Green Fundamentals: SEC emission disclosures have a major omission

Discussing climate technology, finance, and policy

Every week I’ll provide updates on the latest trends in climate technology companies. Follow along to stay up to date!

In the News

Stories That Caught My Eye

S.E.C. Approves New Climate Rules Far Weaker Than Originally Proposed (NY Times): In March 2022, the Securities and Exchange Commission (S.E.C.) announced they would require publicly traded companies to disclose climate risks and the amount of emissions they produce. On Wednesday, March 13th, the S.E.C. announced rules weaker than originally proposed. Under the new guidelines, companies would need to report emissions from their own operations (Scope 1, Scope 2) but not emissions from their ‘value chain’ (Scope 3). The Fifth Circuit U.S. Appeals Court has temporary halted the climate disclosure rules as they face legal challenge. Still, companies are preparing for them to come into effect by 2026.

Microsoft, Google, Nucor to Collaborate on New Electricity Business Models (Market Watch): 24x7 electricity is vital for large commercial and industrial processes, such as data centers and steel production. Google, Microsoft, and Nucor announced a request for information (RFI) to accelerate the development of first-of-a-kind (FOAK) projects, including advanced nuclear, next-gen geothermal, clean hydrogen, and long duration energy storage. Access to capital is a significant problem for these FOAK projects. Financial investors are wary of the risk and utilities are undercapitalized. Strategic end users may be the key to kick-starting this development ecosystem.

Fossil fuel sector should pay climate finance, EU ministers say (Reuters): World leaders will gather in Baku, Azerbaijan this November for the U.N. Climate Summit. This year’s summit is the deadline to agree on a new global target for how much wealthy nations should pay poorer ones to deal with the most severe impacts of climate change. On Monday, March 18th, a joint statement by EU Member States Foreign Affairs Ministers calls on the fossil fuel sector to pay, as well as emerging countries with high per capital CO2 (i.e. China, Saudi Arabia).

What Else I Read This Week

Companies

Bill Gates’ TerraPower plans to build first US next-generation nuclear plant: Company applies to start constructing sodium-cooled reactor near coal plant in Wyoming in June (FT)

New York Completes Its First Offshore Wind Farm Off Long Island: South Fork Wind is powering 70,000 homes and businesses | Completion marks milestone for industry hit by inflation (Bloomberg)

Form Energy Preparing to Raise $500M for Multi-Day Batteries (Axios Pro)

Flagship climate finance scheme struggles to raise capital: Plan to mobilise vast sums for green transition in developing world ‘long on promise but short on progress’, says foundation (FT)

Market & Policy

A New Surge in Power Use Is Threatening U.S. Climate Goals: A boom in data centers and factories is straining electric grids and propping up fossil fuels. (NY Times)

Is China a climate saint or villain? It is supercharging the green transition—while burning mountains of coal (Economist)

Biden’s EPA Adopts Less-Aggressive Rollout of Vehicle-Emissions Rules: EPA’s rules for tailpipe emissions—while the most stringent ever—give carmakers more time to comply (WSJ)

Biden’s Climate Law Has Created a Growing Market for Green Tax Credits: New Treasury Department data shows companies have registered 45,500 projects for possible sale on a new tax-credit marketplace (NY Times)

Japan Ends the Negative Rate Mistake: The policy didn’t work as advertised, and ending it won’t be easy. (WSJ Opinion)

Market Analysis

Top Take-Aways

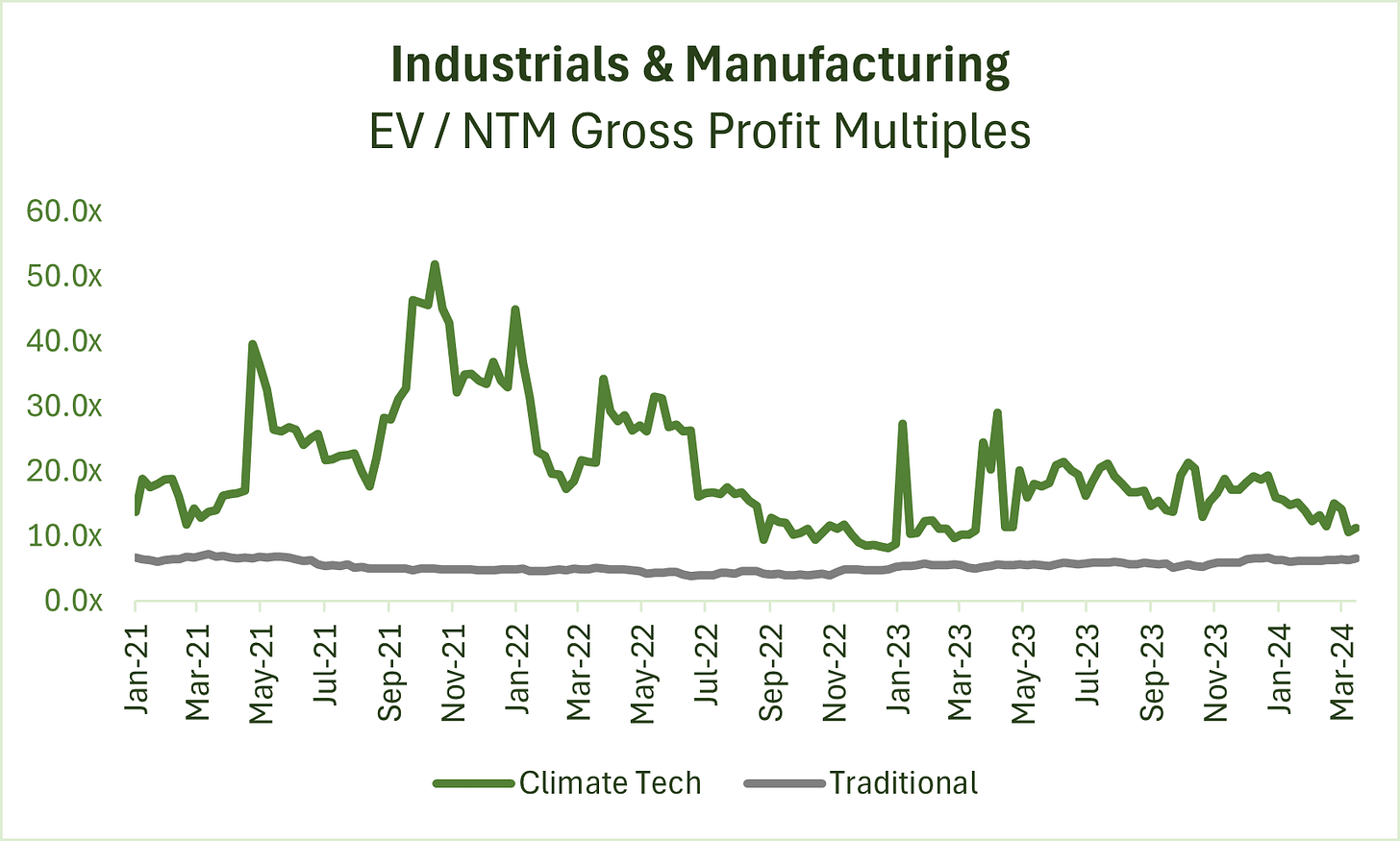

Two years ago, publicly traded climate tech valuations significantly outpaced traditional industry. As interest rates rose, valuations have come down to a slight premium (~30%) over their traditional industry counterparts.

The top 5 publicly traded climate tech companies account for nearly all of the premium to traditional industry (with the remaining companies trading at a discount).

Top 10 EV / NTM Gross Profit Multiples

Notes on Valuation Approach

Valuation multiples are a shorthand valuation framework, and an imperfect one at that. Finding a consistent market valuation methodology across emerging and traditional climate technology businesses is challenging. While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA.

Due to the varied business models across climate technology, and the fact that many of the companies are not yet EBITDA positive, valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit. The intent is to account for various business models (high vs. low margin) and future business growth (market consensus next twelve month growth) while comparing the widest range of possible companies (including those not yet EBITDA positive).

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Valuation Multiples & Index

The “Climate Tech” comparison set includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit.

The “Traditional” benchmark is a comparison set of legacy market participants in relevant sectors (energy, power, transport, industrials, manufacturing). See below for a detailed subsector breakdown.

Climate Tech: 8.4x (28% premium)

Traditional: 6.6x

Top 5: 26.7x

All Others: 4.1x

Sector Specific Valuation Multiples & Index

Energy & Power

Climate Tech include solar & wind equipment manufacturers, solar & wind operators / servicers, energy storage, alternative power providers, and electrified C&I.

Traditional includes integrated oil & gas, regulated utilities, diversified utilities, energy management & storage, and industrial power solutions.

Climate Tech: 8.3x (13% premium)

Traditional: 7.3x

Note: Data begins once there are at least 8 companies in the comparison set.

Industrials & Manufacturing

Climate Tech includes hydrogen, recycling, metals, and battery manufacturing.

Traditional includes specialty industrial manufacturing, steel and other metals producers, metals fabrication, advanced materials, and chemicals.

Climate Tech: 11.3x (72% premium)

Traditional: 6.6x

Note: Data begins once there are at least 6 companies in the comparison set.

Transportation

Climate Tech includes electric vehicles, EV infrastructure, and eVOTL.

Traditional includes auto manufacturers, transport & logistics, shipping, and supply chain software.

Climate Tech: 11.0x (48% premium)

Traditional: 7.4x

Note: Data begins once there are at least 6 companies in the comparison set.

Comps Output

Sources used in this post include news articles cited (above) and publicly available SEC filings.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.