Green Fundamentals: Hard to abate sectors just got a little easier

Data-driven discussion of climate technology, finance, and policy

I provide climate tech news from a finance perspective and data-driven market analysis. Follow along to stay up to date!

One of these might be the next Tesla… or Solyndra

What Happened: The DOE announced $6B in funding across 33 projects and 20 states in hard to abate industrial sectors (see list of projects here). Many of these projects are first-of-a-kind plants or are testing new technologies at commercial scale.

Background: Hard to abate sectors account for significant portions of global GhG and require new technologies (many of which are still unproven) at scale; sectors include: Iron and Steel (7-9% global GhG), Cement and Concrete (5-8%), Aluminum and Metals (2%+), Chemicals (4%), Process Heat (5%), and others. These are significant contributors - compare these to shipping (3%) and commercial aviation (2%).

Take-Away: The next Solyndra could be in this group, but so could the next Tesla. The private sector has been hesitant to capitalize projects like these because often they have ‘venture risk’ (high) with ‘infrastructure returns’ (low). The government is needed to catalyze early adoption in these hard to abate industries, but only the private sector has enough capital (‘trillions’ not ‘billions’) to decarbonize these industries at scale once the technology is proven.

What Comes Next: This initial $6B government investment will catalyze $14B+ in immediate private sector investment. The companies that unlock ‘bankable’, ‘Wall Street’ financing will have successful projects that (1) quickly navigate procurement, (2) avoid construction delays, and (3) deliver quality product to customers on time.

Further Reading

Technology (Deep Tech, Materials Science)

Solid-State batteries are probably still far away despite the hype, though green metals may be closer than you think and more critical than we acknowledge.

China’s ‘battery king’ dismisses solid-state EV commercialisation as years away: CATL chief Robin Zeng says much-vaunted tech for electric vehicles is impractical and unsafe (Financial Times)

Gates-Backed Startup Hits Milestone, Races Ahead on Green Steel: Electra, which makes iron at a low temperature using renewable energy, is scouting sites for its factory. (Bloomberg)

The Dark Side of the Lithium Boom (OilPrice.com)

Private Markets (PE / VC / Real Estate / Infra)

‘Traditional’ energy and infrastructure players are helping deliver slow and steady progress - investors should welcome them as they help the ecosystem mature (and uncover practical challenges).

Pennsylvania’s largest solar farm will replace its largest coal plant (Electrek)

Texas will add more grid batteries than any other state in 2024: With cheap land and a competitive market irresistible to energy storage developers, the Lone Star State will even overtake California in battery deployments this year. (Canary Media)

Southeastern Utilities Block Transmission Necessary for Decarbonization (Energy and Policy Institute)

Why Bill Gates Reckons Houston May Become The ‘Silicon Valley Of Energy’ (Forbes)

The Oil and Gas Industry Wants ‘Energy Transition’ to Mean More Fossil Fuels (Time)

Public Markets (Stocks, Bonds)

Strategic corporate partners are emerging as an important partner for early adoption, especially as government help may wane in the face of bond market pressure on debt and spending.

Big Tech’s Latest Obsession Is Finding Enough Energy: The AI boom is fueling an insatiable appetite for electricity, which is creating risks to the grid and the transition to cleaner energy sources (WSJ)

Ford partners with Allego to bring ultra-fast charging up to 400 kW to dealerships around Europe (Electrek)

The $27 Trillion Treasury Market Is Only Getting Bigger: More debt, different buyers and increased regulation pose challenges (WSJ)

Government & Policy

In addition to investment, governments have work to do unlocking regulatory red tape and enabling access from global markets, despite political headwinds.

Energy Dept. Awards $6 Billion for Green Steel, Cement and Even Macaroni Factories: Industries produce 25 percent of America’s planet-warming emissions but so far have proved very hard to clean up. The Biden administration is trying. (NY Times)

Palisades nuclear plant gets $1.5B federal loan in bid to reopen, a national first (The Detroit News)

Homes need to electrify. New building codes will make that harder: A nonprofit group that sets U.S. building codes has nixed rules to make new homes ready for EVs and heat pumps. Climate advocates blame fossil gas lobbyists. (Canary Media)

The hidden costs of Biden’s steel protectionism: Uncertain political benefits do not justify the president’s vetoing a Japanese takeover of US Steel (Economist)

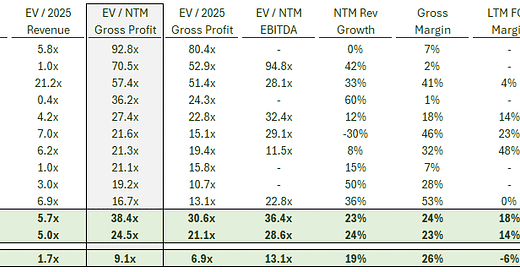

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

Top 10 Weekly Share Price Movement

Allego announced a partnership with Ford to bring ultra-fast charging to dealerships in Europe, resulting in +70% share price increase in the last 7 days.

Valuation Multiples over Time

As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium, while more speculative (storage) has less; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

Manufacturing & Industrials: Both traditional and emerging companies around critical minerals supply command a premium; the market has grown skeptical on hydrogen.

Transport: EV growth is priced in to climate tech and traditional companies; the market is skeptical on eVOTL.

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.