Green Fundamentals: Data centers become the center of power demand

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Electricity crisis emerging from data center, EV, & industrial power demand

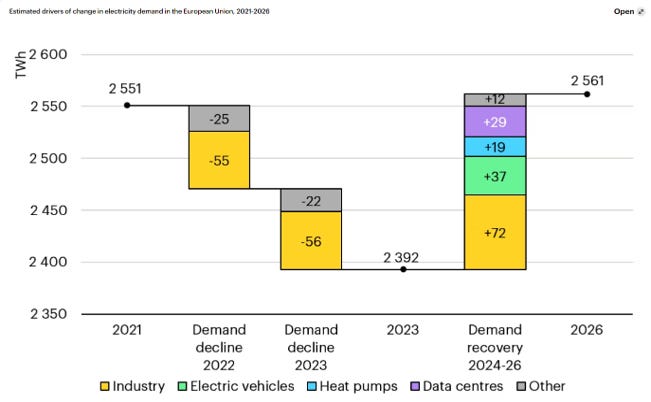

What Happened: Electricity demand from data centers, manufacturing plants, and EV fleets are outpacing capacity growth. For example, in Europe, efficiency gains reduced overall electricity demand 2021-23. But now, the IEA forecasts demand growth in 2023-26 driven by data centers, industry, heat pumps, and EVs.

Source: https://www.iea.org/reports/electricity-2024/executive-summary

Background: Utility forecasts of electricity demand are skyrocketing. FERC increased its load growth forecast by 81%, accelerated by data centers and new manufacturing. Georgia Power increased 2031 forecasted peak winter electricity demand by 17x, largely because of new manufacturing projects. Dominion forecasts Virginia data center power demand to double by 2040. Overall, PJM Interconnection increased 2029 forecasted demand by 2x (equal to ~2 New York Cities worth of electricity).

Take-Away: Energy availability is becoming a limiting factor for industrial growth and data centers for the AI-boom. Industrial applications require 24x7 electricity with near-zero downtime. ‘Base Load’ or ‘Dispatchable’ power is needed to complement intermittent renewables (and it is commanding a premium price as a result).

What Comes Next: Utilities have four difficult options:

Add carbon capture and/or battery storage to make zero-carbon resources dispatchable (and prohibitively expensive with today’s technology)

Deploy nuclear and/or geothermal (risking construction delays, regulatory pushback, failure from unproven technology, and political backlash)

Raise rates and/or reduce demand by slowing down new industrial projects (thereby reducing job growth)

Deploy more natural gas capacity (and fall short of sustainability commitments)

Increasingly, data centers and industrial manufacturing are exploring behind-the-meter-generation (i.e. on-site nuclear, diesel power generators to balance grid load). Dominion Energy, which powers Northern Virginia’s data centers, asked state legislators for 9 GW of additional natural gas generation due to reliability concerns (amid objections).

Further Reading

Technology (Deep Tech, Materials Science)

Green Iron: Electra Launches Pilot Plant to Advance Commercialization of Sustainable Clean Iron Production (Business Wire)

Heat Pumps: In New York City, heat pumps that fit in apartment windows promise big emissions cuts (AP)

Hydrogen: HD Hyundai partners with 3M to insulate liquid hydrogen storage tanks (Offshore Energy)

Private Markets (PE / VC / Real Estate / Infra)

Nuclear: Holtec Gets $1.5B DOE Loan Guarantee to Restart Michigan Nuclear Plant (ENR Midwest)

Nuclear: It’s Official: TerraPower Files Permit to Build Wyoming Nuclear Plant (Cowboy State Daily)

Supply Chain: Uranium is being mined near the Grand Canyon as prices soar and the US pushes for more nuclear power (AP)

Public Markets (Stocks, Bonds)

Electric Vehicles: BYD’s Sales Jump as Investors Await Tesla Delivery Numbers (WSJ)

Electric Vehicles: Tesla’s Quarterly Deliveries Fall for First Time Since 2020 (WSJ)

Supply Chain: Walmart hits ‘Project Gigaton’ goal 6 years early, cutting roughly a Japan’s worth of emissions from its supply chain (Fortune)

CCUS: The future of Drax, Britain’s largest power plant: From coal to wood to carbon capture and storage? (The Economist)

Government & Policy

Tax Credits: US grants US$4 billion in tax credits, including US$2.7 billion for energy manufacturing and recycling, under 48C scheme (PV Tech)

Grants: Biden admin doles out $20B in "green bank" funding (Axios)

Regulations: New Pollution Rules Aim to Lift Sales of Electric Trucks: The latest in a string of ambitious climate regulations aims to clean up the heaviest polluters on the road. But truckers are worried (NYT)

Trade: Yellen heads to China to fight a green trade war the U.S. may not win: Some economists say subsidy competitions may leave everyone poorer (Market Watch)

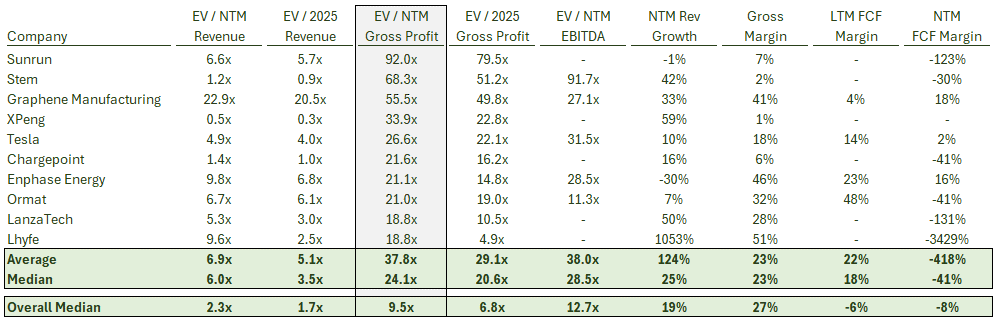

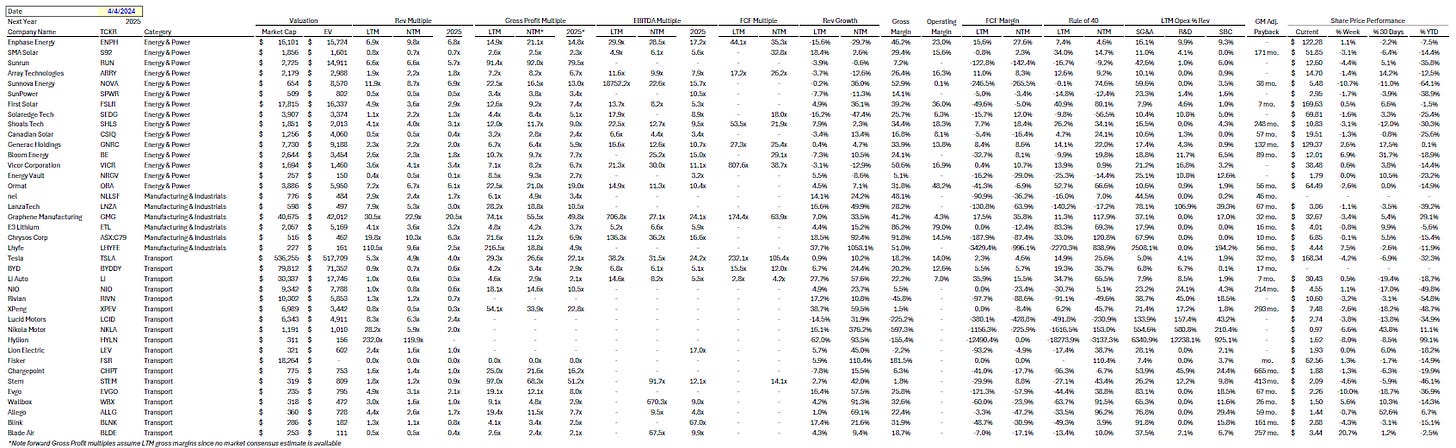

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

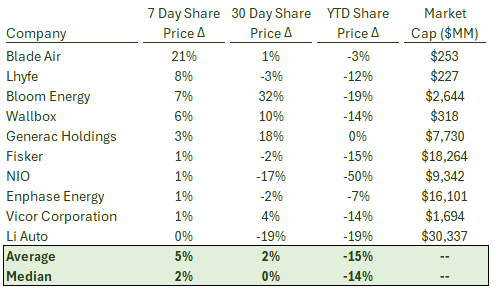

Top 10 Weekly Share Price Movement

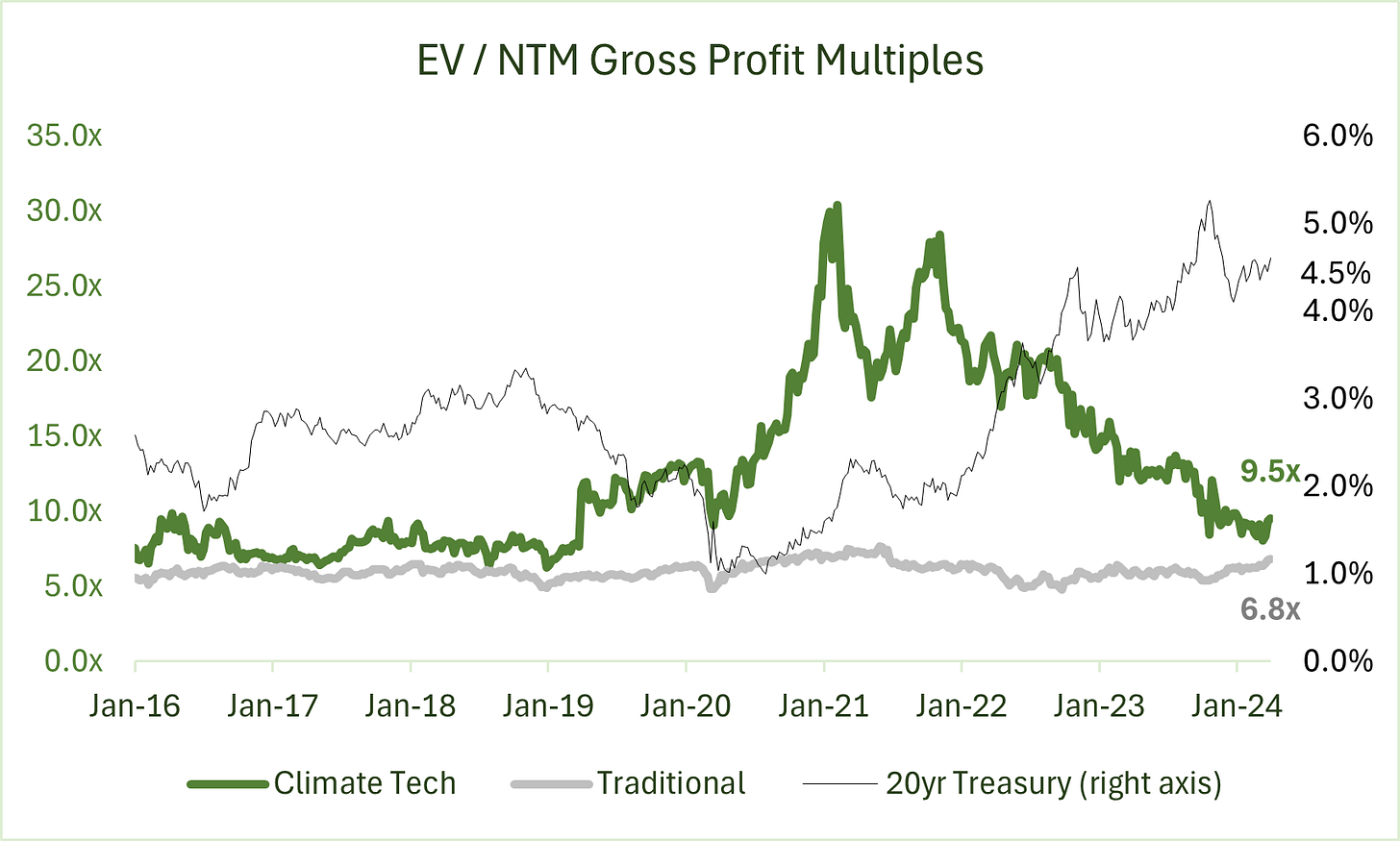

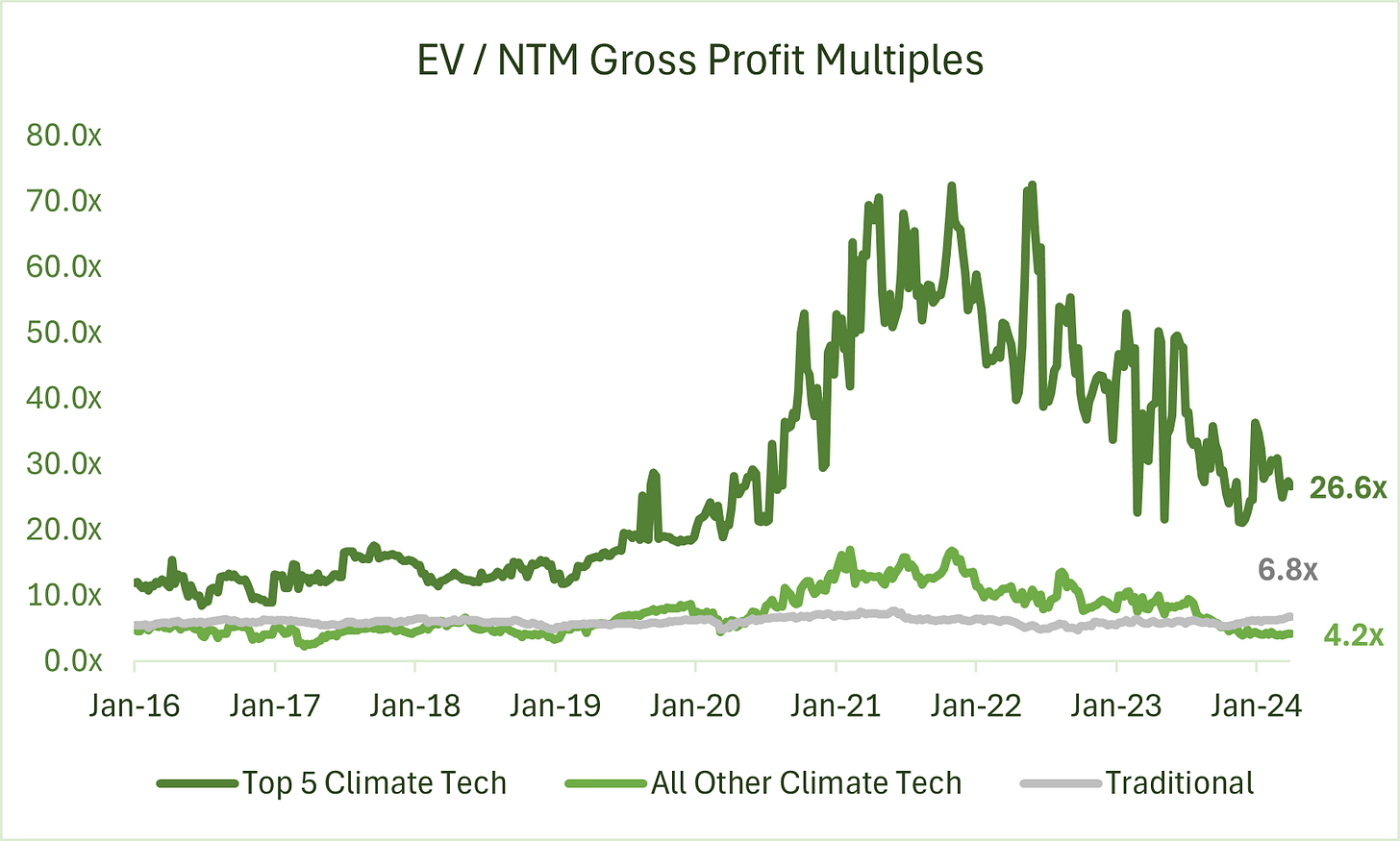

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

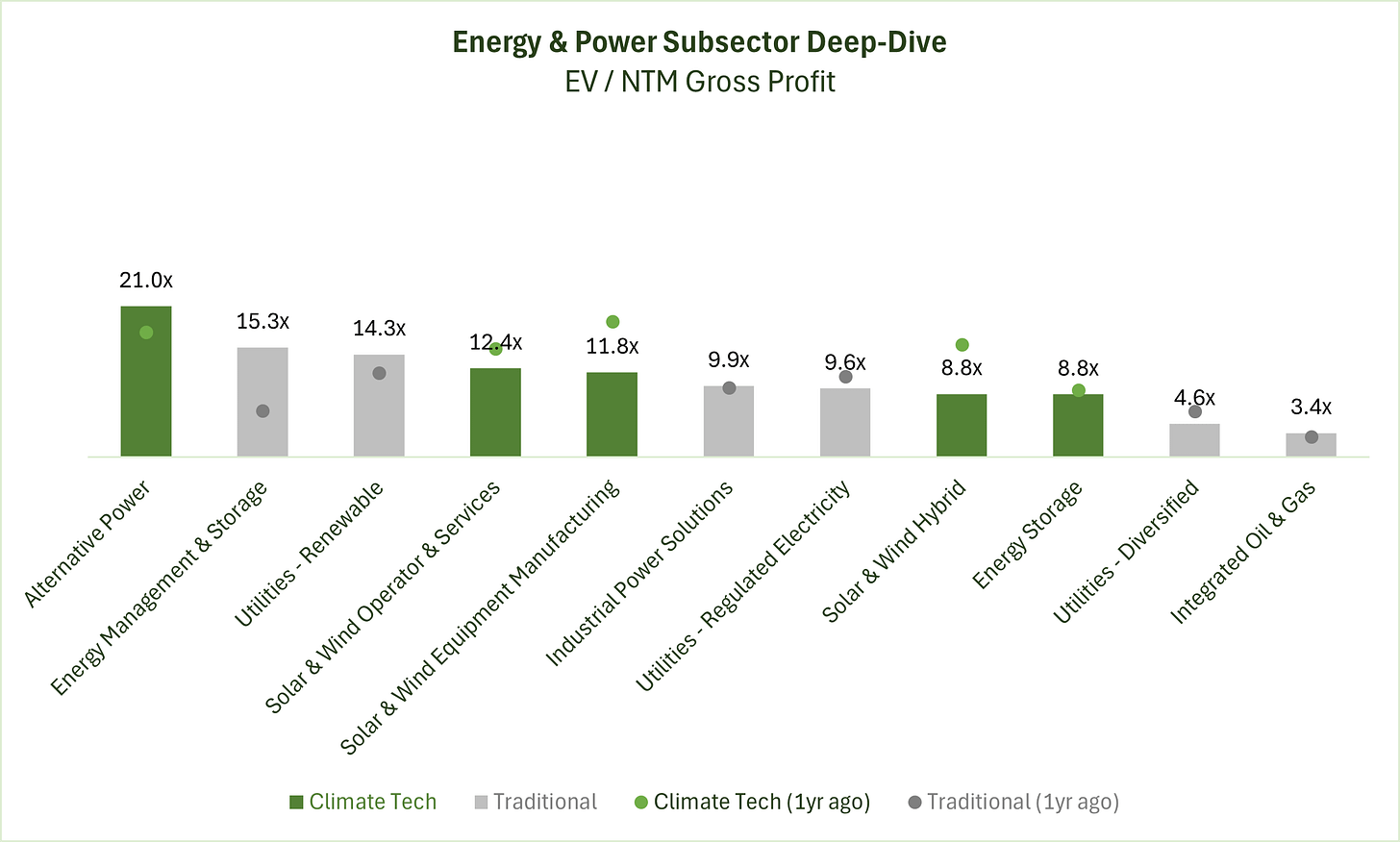

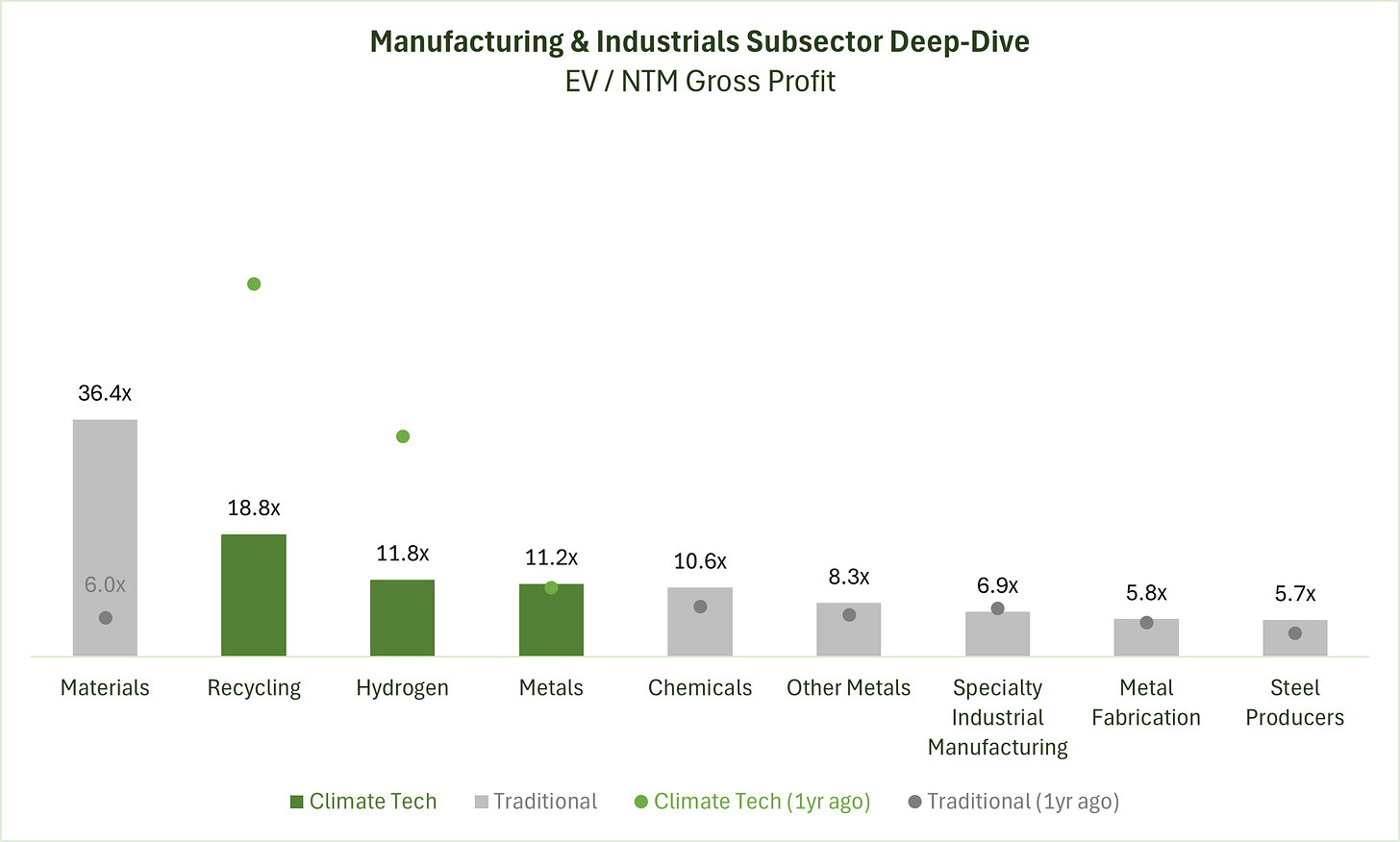

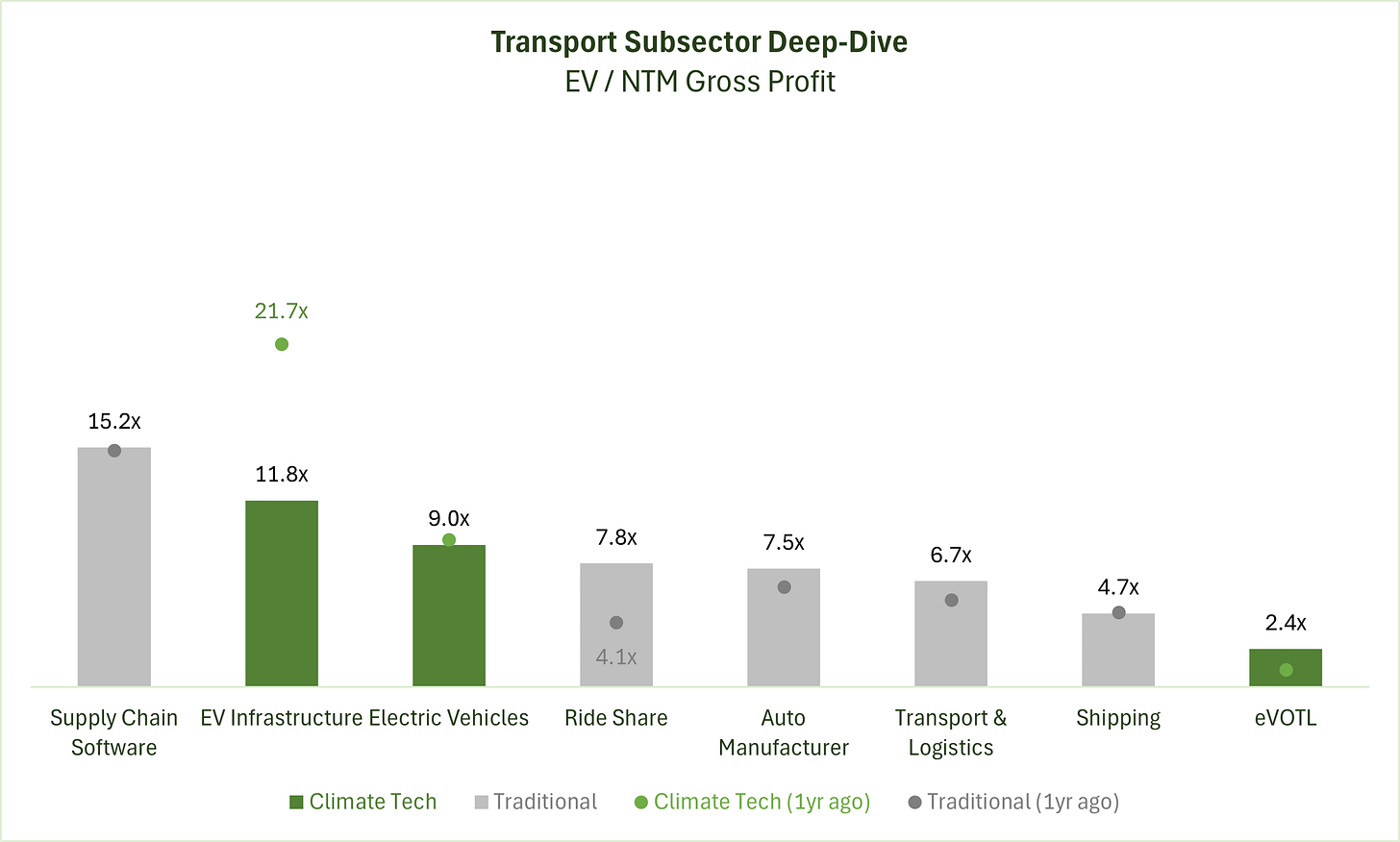

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium, while more speculative (storage) has less; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

Manufacturing & Industrials: Both traditional and emerging companies around critical minerals supply command a premium. Several hydrogen companies have dropped from the comp set due to negative gross profits.

Transport: EV growth is priced in to climate tech and traditional companies; the market is skeptical on eVOTL. Many EV manufacturers are forecasting negative gross profits next year.

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.