Green Fundamentals: Tesla faces steep price competition

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Tesla challenged by EV headwinds and low priced competition (for now…)

What Happened: During the Q1 earnings call, Tesla reported a year-over year sales decline for the first time ever. Tesla vehicle sales dropped 8.5% in Q1 2024 over Q1 2023 - the first YoY decline in Tesla history. As a result, Wall Street analysts’ estimated Earnings per Share (EPS) for Tesla dropped more than 13%.

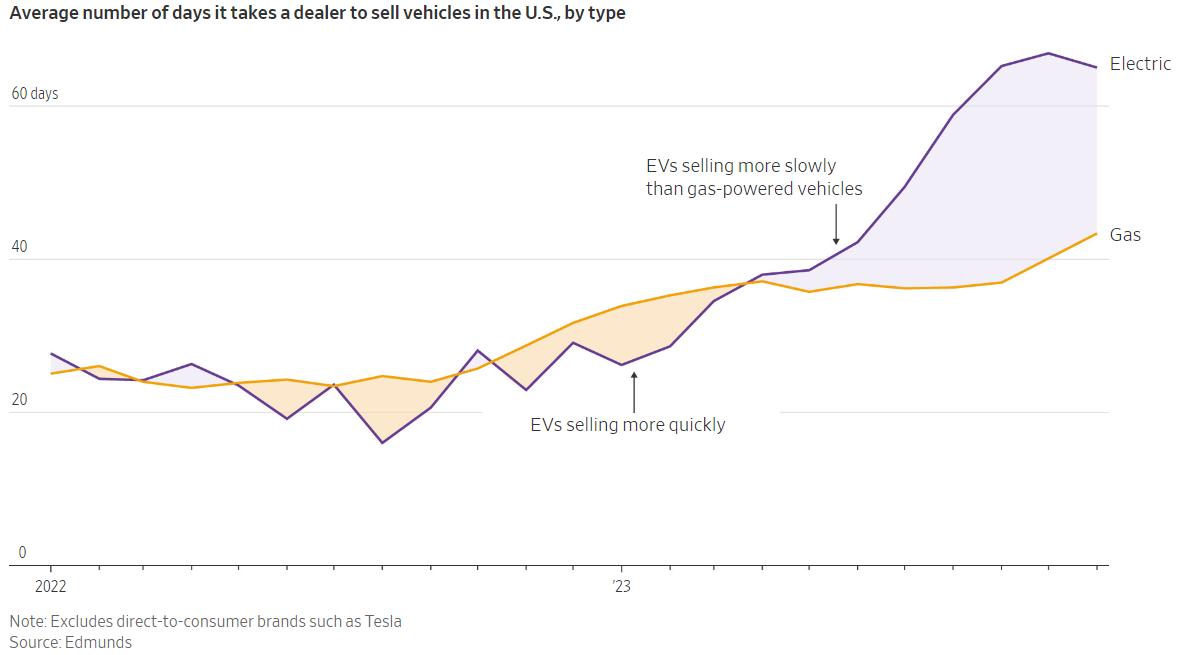

Background: Tesla is pinched between EV headwinds and increased competition at lower price points. Tesla failed to launch a new model in 2022 due to supply chain issues - and now nearly all sales come from two models (~70% of sales come from the Model Y SUV and ~27% from the Model 3). Consumer demand came into question for all EVs at the end of 2023 as inventories significantly increased (see graphic below).

Source: Wall Street Journal

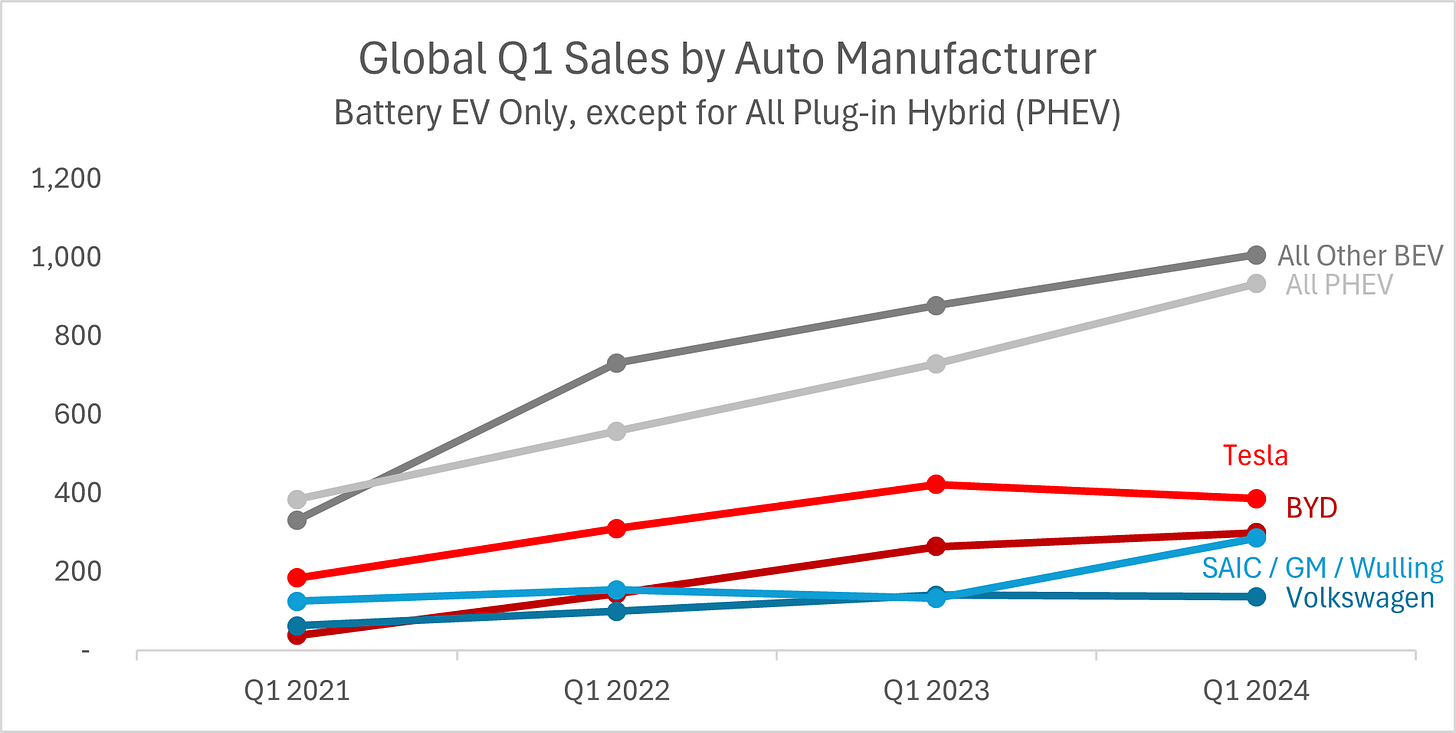

Other EV manufacturers have continued to grow (especially new, smaller entrants at a lower price point). For example, Ford’s Mach-E sales grew significantly after offering discounts on older models. BYD sales had surpassed Tesla in Q4 2023 for the first time (but they too have reported their slowest EV sales growth ever amid competition).

To compete, Tesla cut prices to increase growth. Model Y prices declined from $63K in January 2023 to $50K in January 2024, putting pressure on margins and potentially pulling sales forward leading to a greater uphill battle today.

Note: BEV = “Battery Electric Vehicle”, PHEV = “Plug-in Hybrid Electric Vehicle”

Source: Inside EVs, Electrek, Cox Automotive, Auto News, public filings

Take-Away: For the first time, the question for Tesla is not ‘can they make enough cars’ but ‘will enough people buy them.’ Consumers have more options at lower price points. Tesla’s lineup is stale and may have tapped out the market for their ‘premium’ offering.

What Comes Next: To unlock the next wave of EV drivers, auto manufacturers need to drive down price. Tesla has a narrow road to navigate several difficult options, and the path to success may vary by market:

Continue to lower prices (and squeeze margins)

Maintain prices on current models (and lose market share to low priced competitors)

Launch a lower cost vehicle (and lose focus on resolving supply chain and manufacturing challenges with current models)

Tesla announced a low-cost $25,000 car in 2023. On April 9, Reuters reported that this model was scrapped, though Elon rebuffed this. Analysts will be looking for the new crossover SUV model to refresh the line-up and a price point competitive with new, low-cost competitors.

Further Reading

Technology (Deep Tech, Materials Science)

Grid: The U.S. Urgently Needs a Bigger Grid. Here’s a Fast Solution. (NY Times)

Batteries: Researchers make new breakthrough with 50-year-old battery technology: 'I didn't know they were still around' (TCD)

Batteries: ‘Good Enough’ Batteries Threaten Lithium Metal Start-ups (The Information)

Natural Gas: Is Synthetic Natural Gas Any Better Than the Real Thing? (Financial Times)

Private Markets (PE / VC / Real Estate / Infra)

Oil & Gas: Opinion: Investing in oil and gas doesn’t make sense anymore (oped by Tom Steyer at CNN)

Utilities: Xcel Energy to cut power to 55K people along Colorado's front range amid wildfire risk on Saturday (CBS News)

Bike Share: IPO hopeful Lime avoids share bike graveyard (Financial Review)

Carbon Capture: Jim Bridger Targeted for Carbon Capture Tech (Sweet Water Now)

Coal: New England's last coal plants set to shutter, ushering in era of green energy (Fox News)

Public Markets (Stocks, Bonds)

Electric Vehicles: Kia’s affordable EV3 is coming soon… and it’s getting a sporty GT Line model (Electrek)

Electric Vehicles: Mercedes-Benz Delays Its EV Plans, Will Keep Making Combustion Engines (Inside EVs)

Electric Vehicles: Ford Slashes Mustang Mach-E Prices, Sales Soar—Proof People Crave Cheaper EVs (Carscoops)

Nuclear: Equinix signs deal to procure up to 500MW of nuclear power from Oklo reactors – makes $25m pre-payment (Data Center Dynamics)

Government & Policy

EPA: America’s new high-risk, high-reward $20 billion climate push (Washington Post)

EPA: California carbon capture facility scrapped after federal agency digs into details (Court House News)

UK: UK plans fleet of 40 Xe-100 small nuclear reactors to meet energy needs (Interesting Engineering)

Australia: Australia set to join global clean energy subsidy race with new green fund, AFR reports (Reuters)

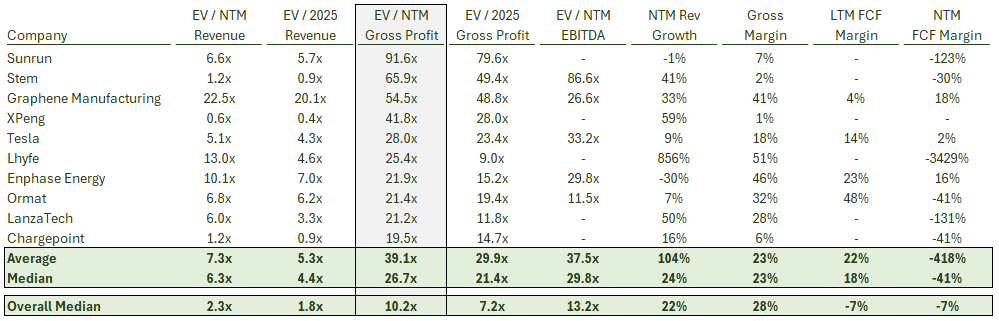

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

Top 10 Weekly Share Price Movement

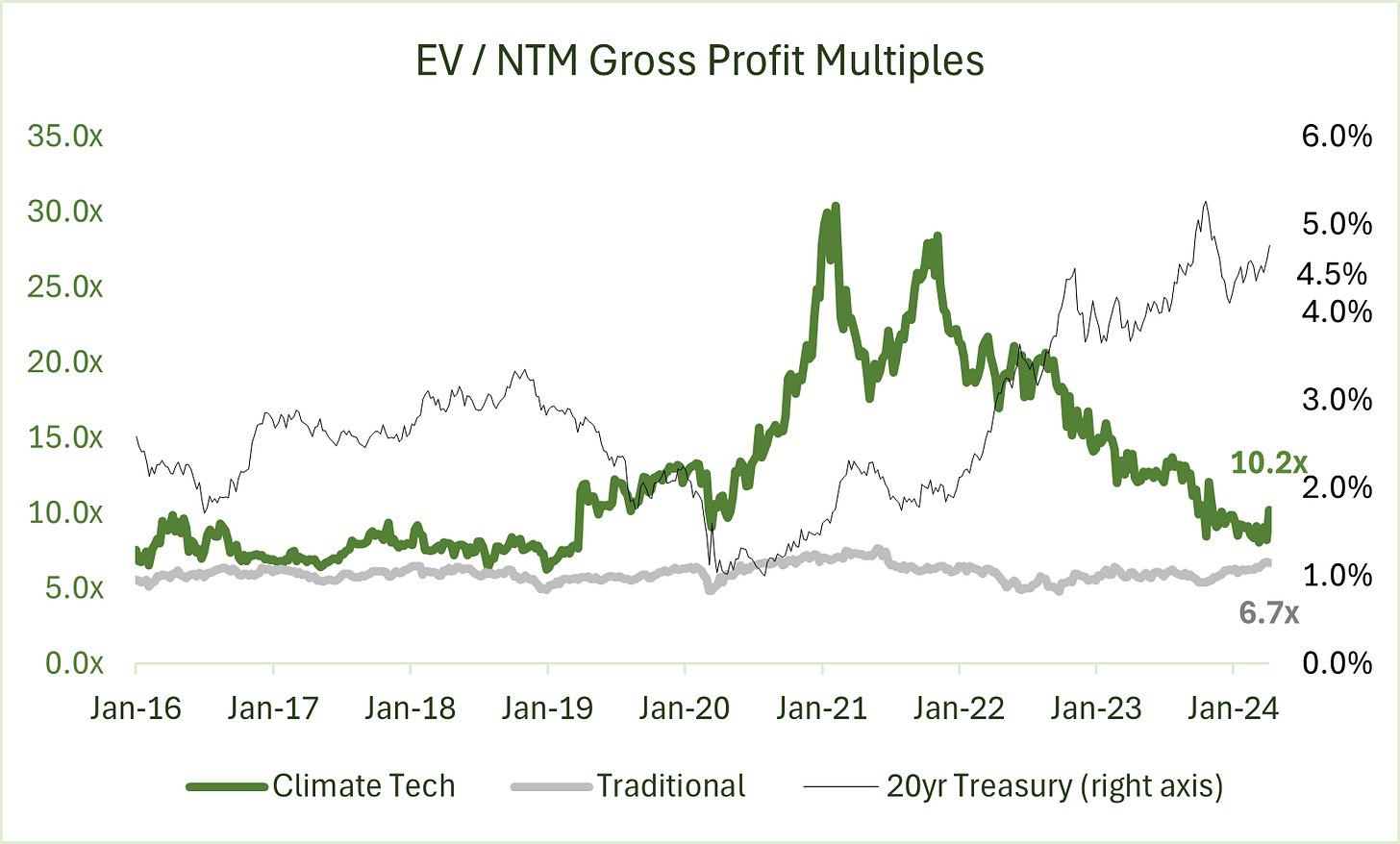

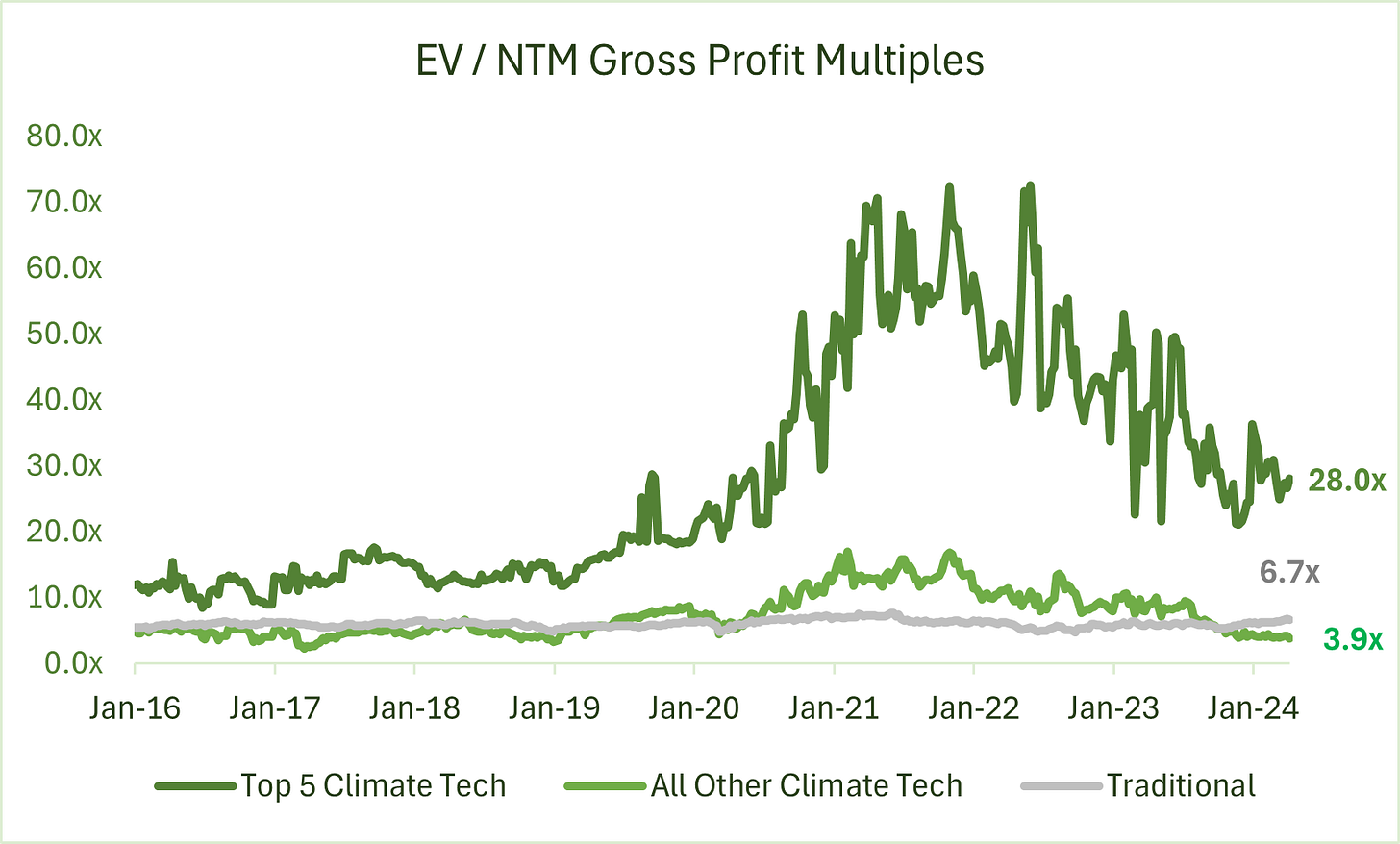

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

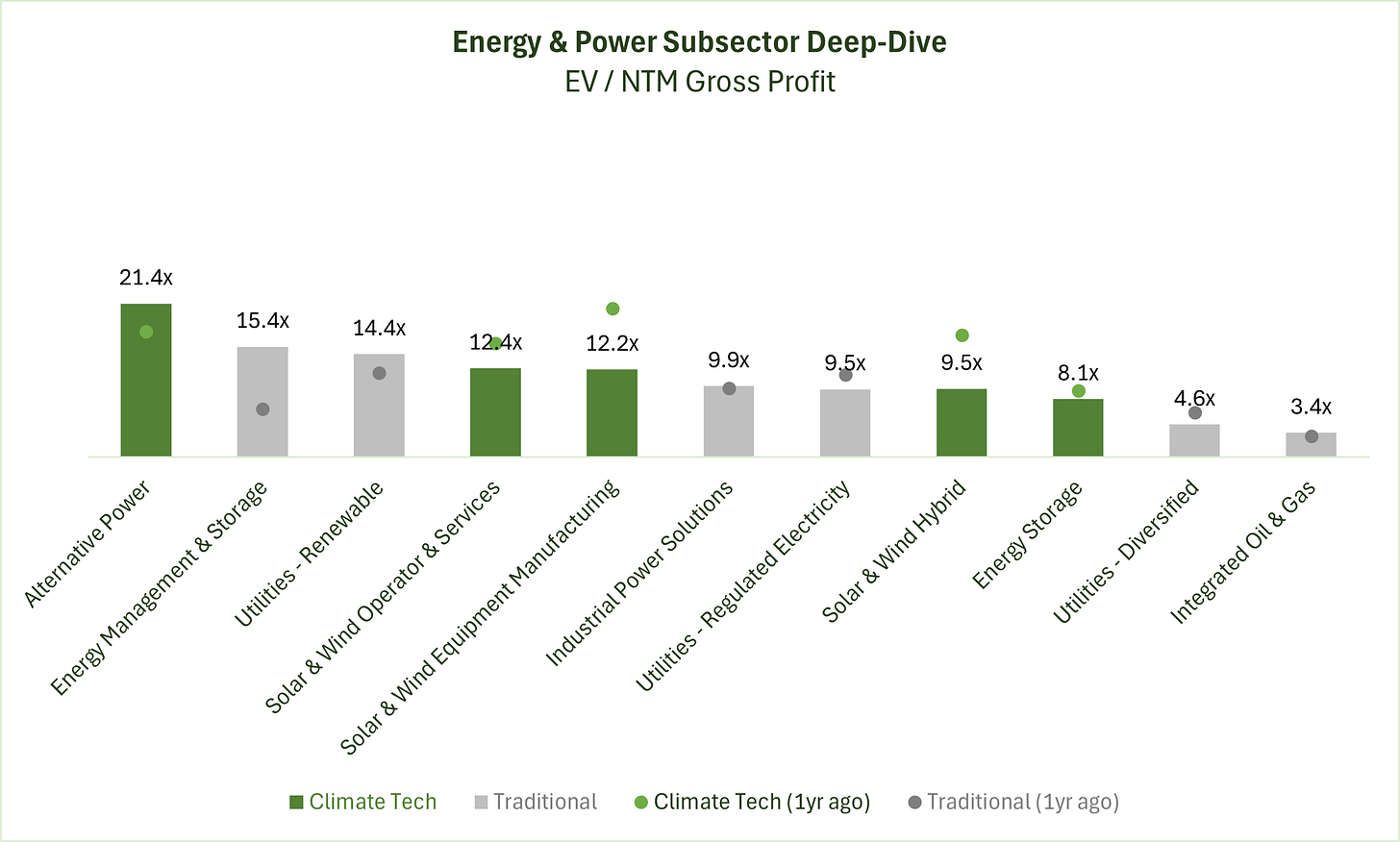

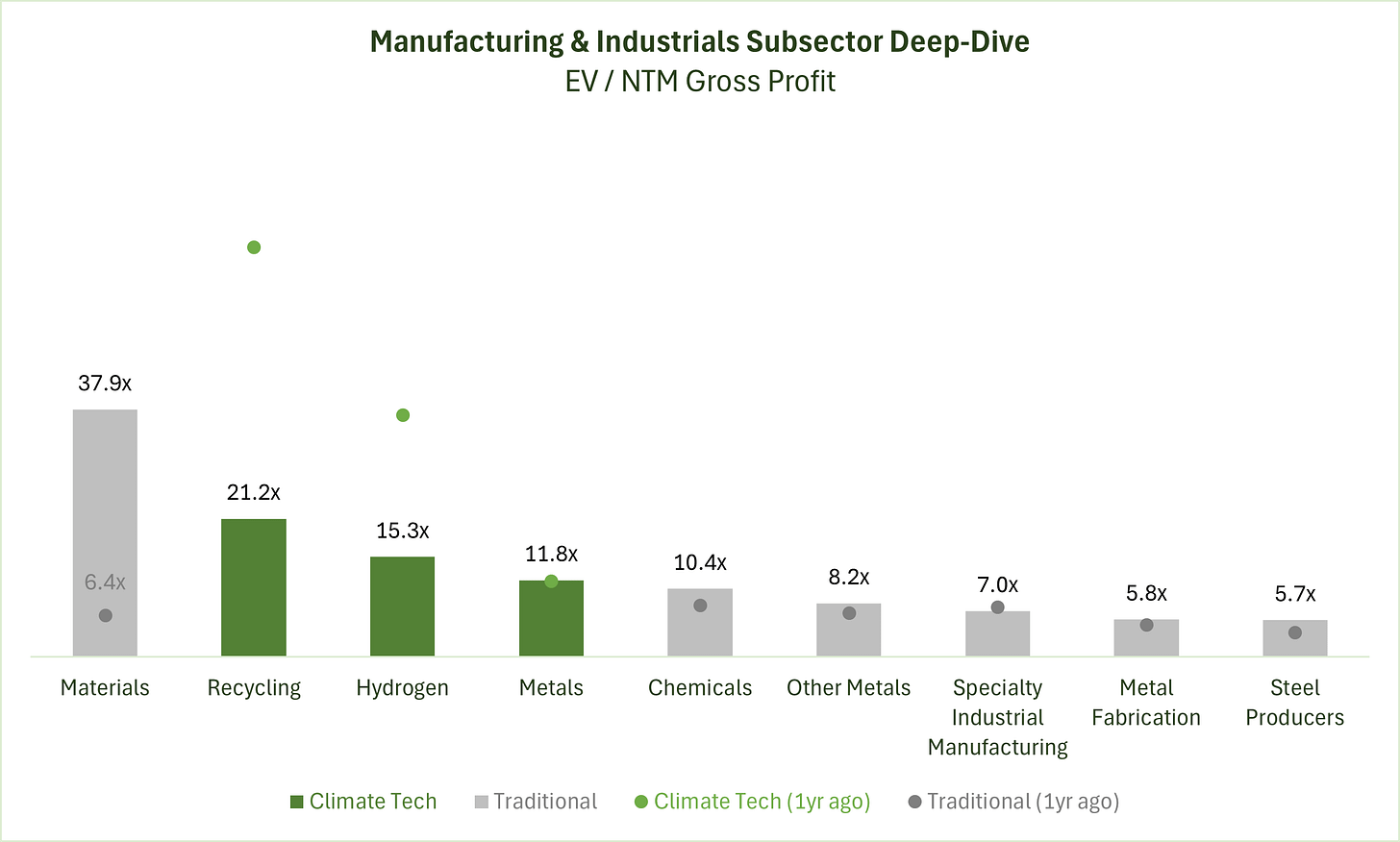

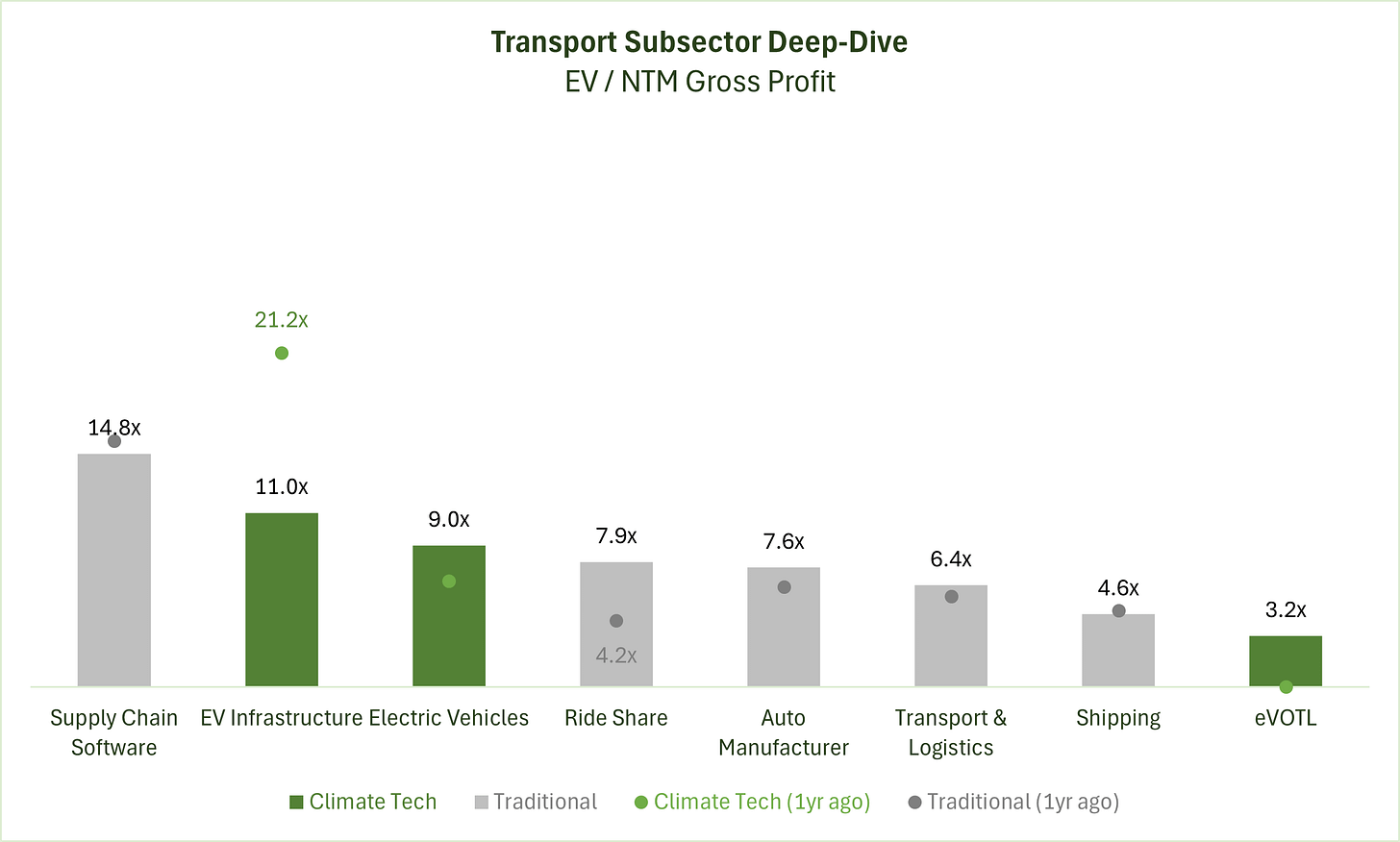

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium, while more speculative (storage) has less; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

Manufacturing & Industrials: Both traditional and emerging companies around critical minerals supply command a premium, both recycling and hydrogen have fallen significantly from a year ago.

Transport: EV growth is priced in to climate tech and traditional companies; the market is skeptical on eVOTL.

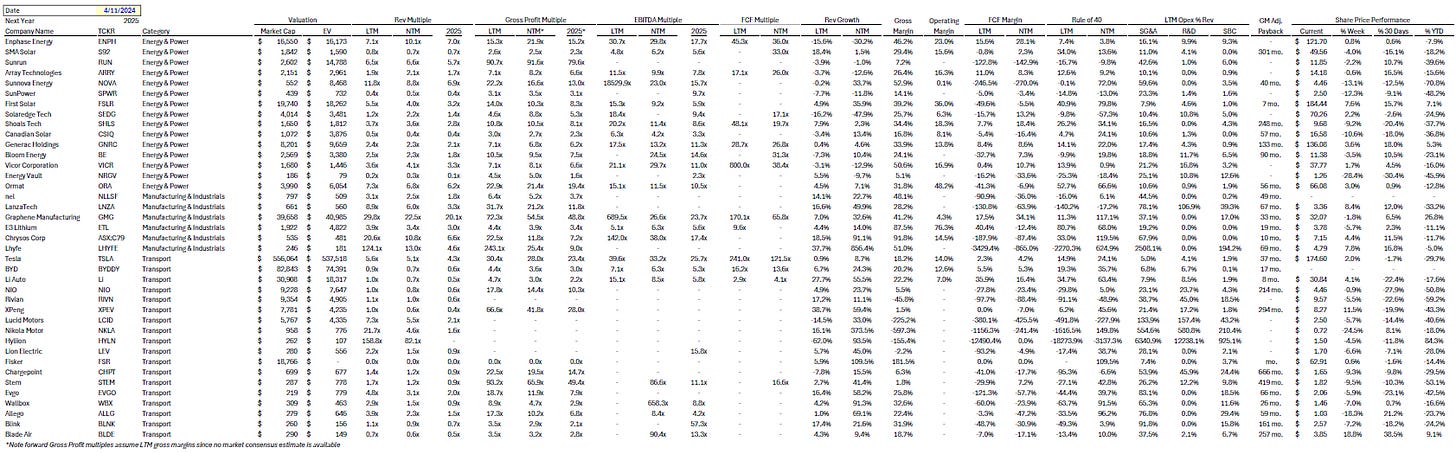

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.