Green Fundamentals: A unicorn's collapse is a warning to FOAK investors

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Fulcrum Bioenergy’s waste-to-fuel may have been a waste of capital, even for lower risk bond holders

What Happened: On Friday, May 17, Fulcrum Bioenergy laid off nearly all of its 100 staff and is now facing bankruptcy. Fulcrum raised over $450M of venture capital, most recently at a $1B valuation. They also raised over $500M of debt financing for their projects (including capital in escrow).

Background: Fulcrum aimed to convert plastic waste into ‘Net Zero’ jet fuel. Fulcrum partnered with waste management facilities to divert plastic trash from landfills. Fulcrum facilities would sort, process, and shred the trash so it could undergo gasification (heating at 700-1,000C) to break it down into syngas. Cleaned syngas would then undergo Fischer-Tropsch synthesis, catalytically converting it into hydrocarbons. Further hydro-processing, refining, and distillation would result in jet fuel that can be blended with conventional fuels or used directly. Fulcrum had one operational project in Nevada, with planned facilities in Indiana, Texas, and the UK.

Source: Fulcrum Bioenergy and Inside Climate News

Warning signs emerged in 2023 as Fulcrum defaulted on bonds they had issued in Nevada. Fulcrum’s first facility in McCarran, Nevada started operations in 2022, financed with $290M of environmental improvement revenue bonds (EIRBs) issued between 2017 and 2020 through the Nevada Department of Business and Industry. The bond issuance is facilitated by the state and the bonds are purchased by investors (often, the interest is tax exempt, providing outsized after-tax returns). EIRBs are secured by the revenue generated from the project they finance. Unlike general obligation bonds, revenue bonds do not obligate the state to repay bond holders in the case of default. For Fulcrum, the revenues from the Nevada project were not enough to cover the cost of the bonds.

Waste-to-fuel projects uniquely face significant risks, making them challenging investments for infrastructure investors. Unfortunately, nearly all of these plagued Fulcrum’s Nevada facility:

Scale-up Risk: Transitioning from pilot-scale to commercial-scale is especially challenging for biofuels. Fischer-Tropsch synthesis often works in smaller, more controlled settings but at scale any deviation can lead to inefficiencies (and lower yield) or complete process failure.

Feedstock Consistency: Municipal waste can vary significantly. As different plastic types are used (with different ‘chain lengths’), the output will be inconsistent and therefore less reliable. Further, if the supply of feedstock is interrupted, the plant lays dormant and unproductive.

Cost Over-Runs: First-of-a-kind projects often have significant cost over-runs (over 50% on average). Once operational in 2022, the plant unexpectedly created nitric acid, eating through the facility’s equipment and causing millions in damages as well as months in delays. In 2023, after increasing production the plant began building up a cement-like material in the gasification system, causing the plant to shut down again.

Financial Constraints: Large projects take substantial upfront investment and, if unproven, demand a high cost of capital. EIRBs were meant to help solve this, but the debt service coverage was too high relative to the variability of cost-over-runs and process productivity.

Environmental Concerns: Large industrial processes can be less environmentally friendly at scale than expected. In May 2022, Nevada environmental regulators reported the facility created a plume of nitrogen oxide emissions. Further, the EPA warns that biofuels made from plastics may increase cancer risk.

The Nevada plant bond default on October 17, 2023, also caused Fulcrum to pause a $500M bond issuance for the second plant in Gary, Indiana. Investor appetite for the bonds evaporated, seeing the challenges in Nevada. Environmental advocates in Gary, Indiana filed a petition asking that the air permit issued to Fulcrum should be revoked due to incomplete information and unsupported emissions calculations in the permit application. On October 27, 2023, Six Senate Democrats sent a letter to the head of the IRS, urging the tax industry to prohibit companies that make fuels from plastics and other petroleum products from qualifying form IRA tax credits. On April 30, 2024, Kent announced they secured the FEED contract for Fulcrum’s UK facility - though this now seems unlikely.

Take-Away: Fulcrum is a lesson in the risks for First-of-a-Kind facilities. While announcements of major projects and eye popping valuations had been making headlines since 2018, the real challenges were only revealed when shovels went in the ground. In the words of Mike Tyson, “Everybody has a plan until they get punched in the face.” More important now than ever are partners that have experience in the fight to build new infrastructure.

What Comes Next: Investors should look to these investment characteristics when assessing emerging infrastructure:

Demonstration at Scale / Modularity: Raising a multi-$100M facility that is unproven is too risky. Either the process needs to be modular (with limited scale-up risk) or small incremental steps need to be taken. Unfortunately, lower scale can often mean worse economics.

Quality of Feedstock: Across many industries (including recycling and reuse), the quality of feedstock is most important. Investors should ensure there is consistent supply of high quality feedstock with limited risk of variability. Companies that can secure this have a meaningful, differentiated moat.

Quality of Offtake: Often headline making ‘agreements’ are nothing more than unenforceable expressions of interest. Enforceable take-or-pay contracts are necessary to secure lower cost financing.

Financing Sensitivity to Delays and Process Yield: Any emerging infrastructure investment needs to be robust to (or at least plan for) a downside scenario with 50% cost over-runs (or more) and 20%+ lower productivity once operational. Some insurance can mitigate this risk (such as performance guarantees), but rarely will a first- or even fifth-of-a-kind project not see these challenges.

Debt Service Coverage: For many of these projects, the limit to debt is not the balance sheet (i.e. 50% of overall capex), it is the debt service coverage ratio (project net operating income divided by interest payments). 1.2-2.0x is a common benchmark (depending on the type of project). Projects with emerging technologies should be able to meet these even in a ‘downside’ scenario with lower yields. Otherwise, they should take less debt (which will lower returns to equity holders).

Very few waste-to-X processes meet these requirements. While there has always been interest in low cost feedstock, often you get what you pay for. There may be rare outliers, but they are the exception, not the rule.

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Shipping: Ridiculously simple idea cuts cargo ship emissions by 17.3% in first trials (New Atlas)

Shipping: Ships could store their CO2 emissions in the ocean (New Scientist)

Batteries: In numbers: America’s dramatic shift from gas power plants to batteries (The Progress Playbook)

Batteries: China’s Iron-Based Batteries Are Even Cheaper Than We Thought (The Information)

Batteries: Korean researchers develop battery that could eliminate major issue with electric cars: 'A new era where rapid charging becomes a reality' (TCD)

Nuclear Waste: Technology for slashing nuclear power plant waste wins Swiss backing (FT)

Private Markets (PE / VC / Real Estate / Infra)

Utilities: The Next Front in the War Against Climate Change: Clean-energy investment in America is off the charts—but it still isn’t translating into enough electricity that people can actually use (The Atlantic)

Transmission: National Grid plans 5-year, $35B investment in New York, Massachusetts (Utility Dive)

Industrials: Industrial emissions aren’t falling fast enough to meet US climate goals (Canary Media)

Insurance: Why insurance is key to speeding up the energy transition (FT)

Electric Vehicles: Ethiopia Shows Us Just How Fast The Transition To Electric Mobility Can Happen In Africa (Clean Technica)

Data Centers: Virginia’s data center boom takes Central Va. by storm with recent large-scale project approvals (ABC)

Public Markets (Stocks, Bonds)

Bonds: The $280 Billion Climate Bond Market That Isn’t Working (Bloomberg)

Utilities: Responding to growing demand, Duke Energy, Amazon, Google, Microsoft and Nucor execute agreements to accelerate clean energy options (PR Newswire)

Solar: Strength Seen in Sunnova Energy (NOVA): Can Its 13.7% Jump Turn into More Strength? (Zach’s Equity Research)

Solar: What’s Next For Sunrun Stock After 25% Gains In A Month? (Forbes)

Solar: SunPower now selling Tesla Powerwall 3 via loans or leases (Solar Builder)

Government & Policy

Investment Tax Credits: Tech-Neutral Tax Credits: The Foundation of US Electric Power Decarbonization (Rhodium Group)

Texas: How red Texas became a model for green energy (FT)

Maine: A trust fund for Portland’s climate progress (The Maine Monitor)

Michigan: Michigan launches program to help connect large clean energy projects to federal funding (Michigan Advance)

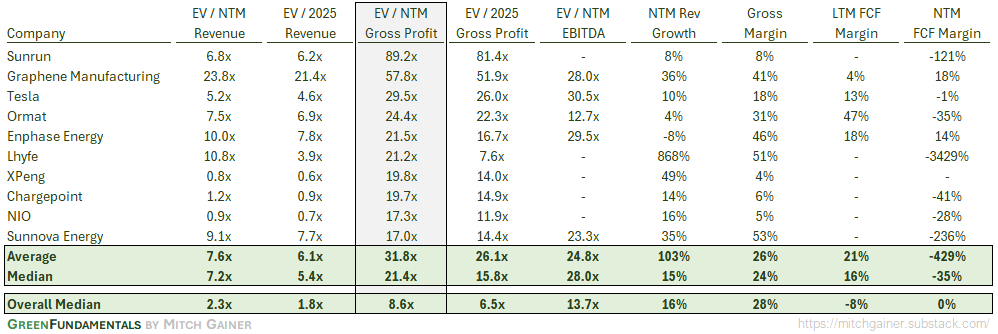

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

Top 10 Weekly Share Price Movement

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

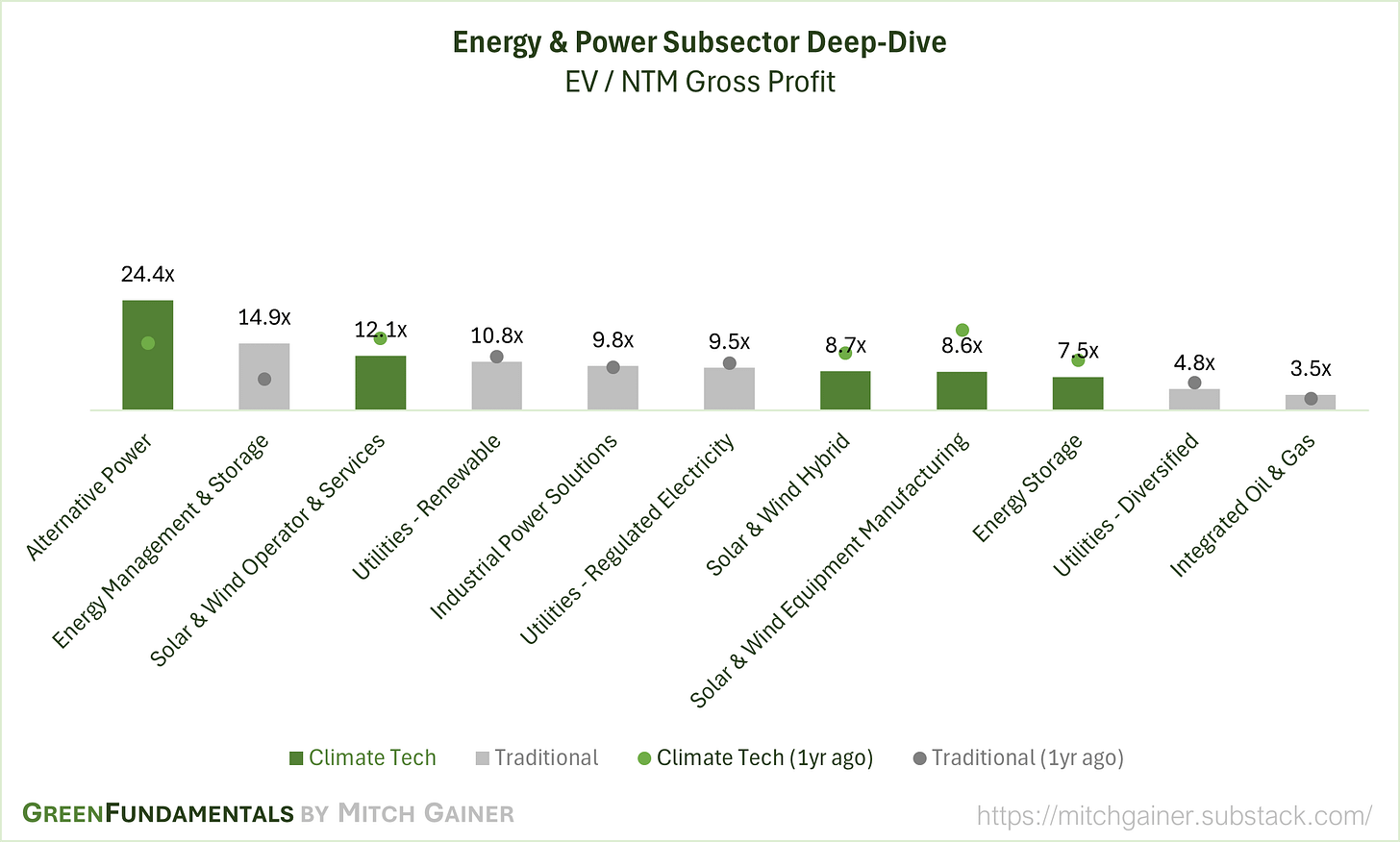

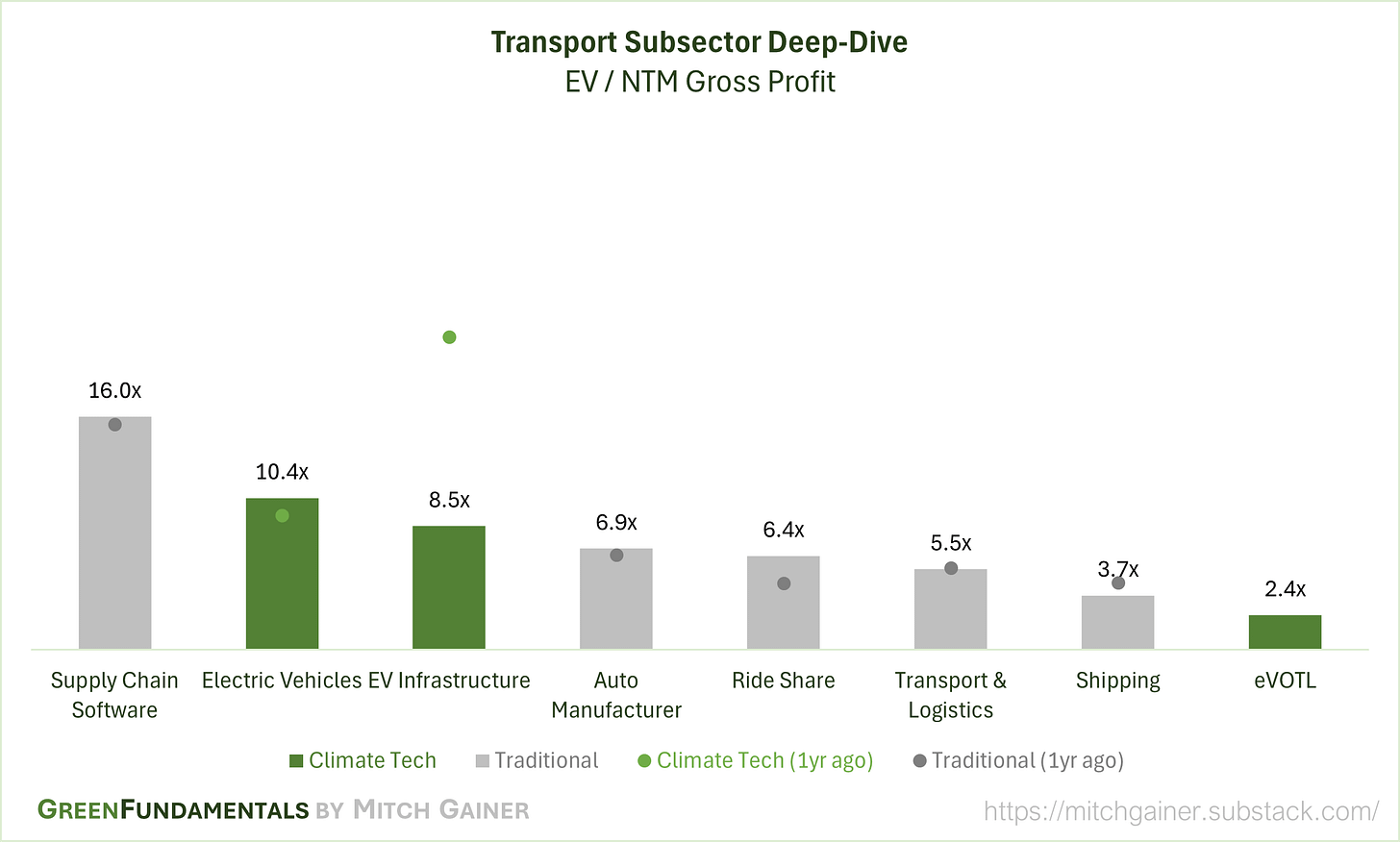

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium, while more speculative (storage) has less; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

Manufacturing & Industrials: Both traditional and emerging companies around critical minerals supply command a premium.

Transport: EV growth is priced in to climate tech and traditional companies; the market is skeptical on eVOTL.

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.