Green Fundamentals: Advanced manufacturing receives advanced tax credits

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

The $10B tax credit every investor in energy and manufacturing should know about

What Happened: The DOE opened applications for the next round of Qualifying Advanced Energy Project Credits (48C). On March 19, the DOE awarded $4B in investment tax credits to ~100 projects. The DOE is authorized by the IRA to award $10B, and many projects have been awaiting their time to apply. This week, the second round has started. Concept papers must be submitted by May 28.

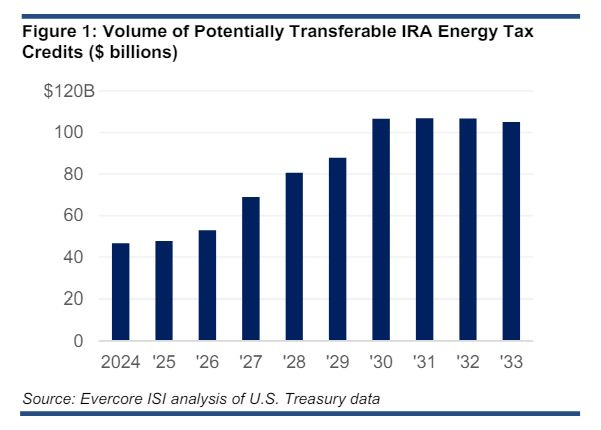

Background: The Qualifying Advanced Energy Project Credit (48C) is designed to catalyze private investment in energy and manufacturing projects with emerging technologies. The investment tax credit is awarded for up to 30% of eligible project costs (improving project equity returns) and can be transferred to anyone (often for 85-94 cents on the dollar). Marketplaces are emerging to enable these transfers and the IRS gave final regulatory guidance on April 25. A major outstanding question is whether lenders will offer debt based on future expected credits (reducing financing costs for construction).

The DOE will likely issue all $10B before election day. The Advanced Energy Tax Credit is awarded at the DOE’s discretion, which a future administration could halt all together. As a result, the full $10B of tax credits will likely be awarded this year for projects coming online in the next 1-3 years. Once awarded, a future administration likely cannot claw back the award.

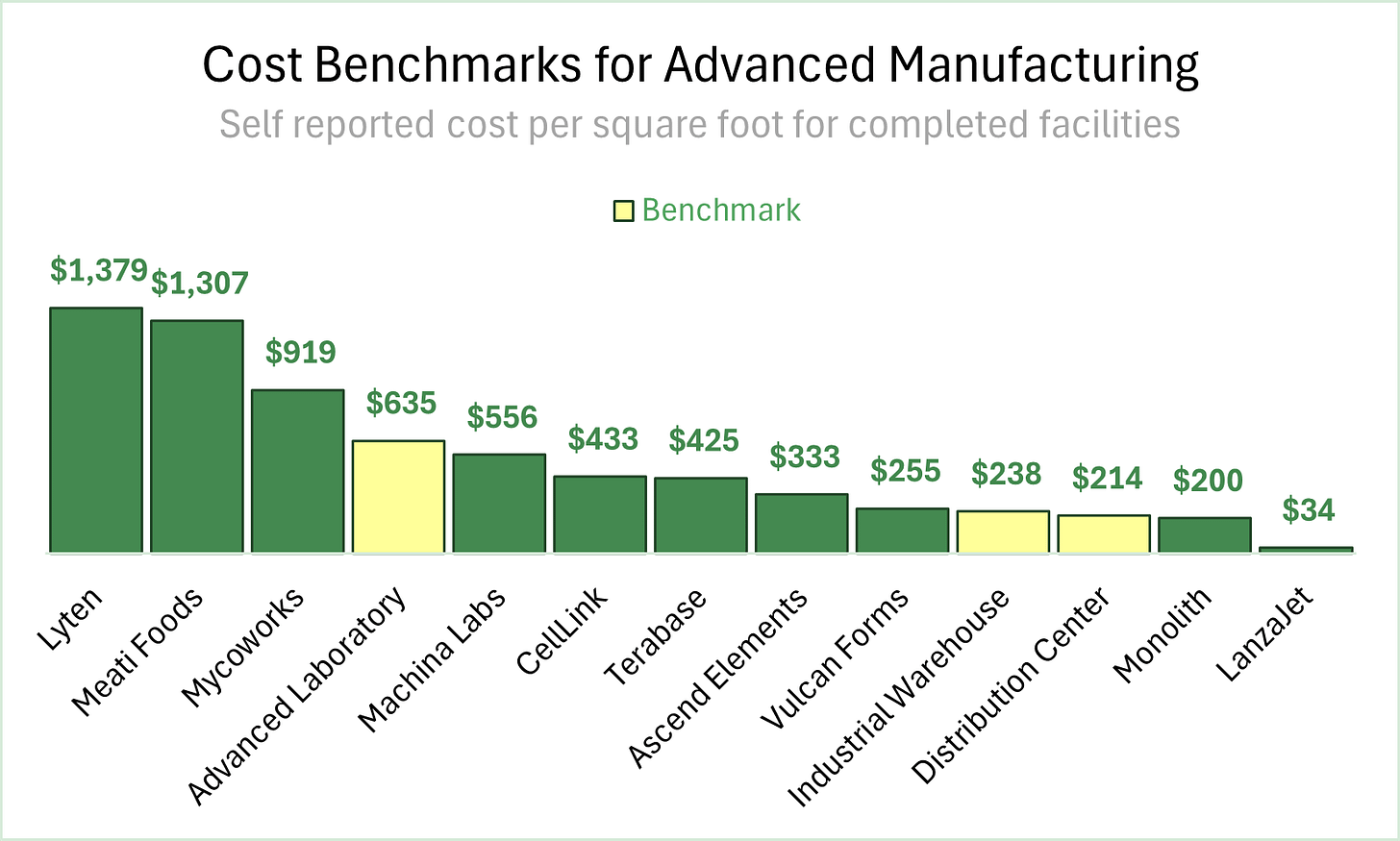

Take-Away: This tax credit will be catalytic for projects that otherwise may not have received funding by significantly enhancing returns. Many emerging advanced manufacturing and energy projects have higher costs (see benchmarking below). These credits will align investor returns with the risk of new infrastructure.

Source: NextGen Industry Council and Cummins

What Comes Next: Savvy investors will look to awardees for outsized returns. Many projects have self-disclosed receipt of their awards (see the list below) while most are not public ($1.9B / 35 projects have self-disclosed, out of $4B / ~100 projects awarded so far). Publicly announced awardees include:

Clean Energy & Vehicle Manufacturing ($1,137M publicly announced)

Highland Materials ($256M)

Entek ($202M)

X Energy ($149M)

e-VAC Magnetics ($112M)

LS GreenLink ($99M)

Solarcycle ($64M)

MP Materials ($59M)

Mobis North America electrified Powertrain ($58M)

Ballard Power Systems ($54M)

JSW Steel ($44M)

GO Lab ($17M)

Nuvera Fuel Cells ($14M)

Voith Hydro ($6M)

Wallbox ($5M)

Critical Minerals & Materials ($420M publicly announced)

ArcelorMittal ($281M)

NOVONIX Anode Materials ($103M)

American Battery ($20M)

Albemarle ($9M)

Nth Cycle ($7M)

Grid Components & Modernization ($63M publicly announced)

Siemens Energy ($18M)

Eaton ($16M)

Eaton ($9M)

Prolec GE ($8M)

Moment Energy ($6M)

Prysmian ($4M)

Eaton ($1M)

Hellenic Cables (<$1M)

Industrial Decarbonization ($313M publicly announced)

Topsoe SOEC Production ($136M)

Nel Hydrogen ($41M)

Middlesex County Utilities ($41M)

John Cockerill Hydrogen ($34M)

Twelve ($29M)

Electric Hydrogen ($18M)

Cummins ($11M)

Covestro ($5M)

Source: Self-Disclosed 48C projects

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Carbon Capture: New electrochemical reactor converts CO2 into usable materials (Interesting Engineering)

Shale Oil: New technology helps US shale oil industry start to rebuild well productivity (Reuters)

Water: Cheap solar gives desalination its moment in the sun (Financial Times)

Hydrogen: Gas companies tell us mixing gas and hydrogen is a climate solution. New research shows it's not (National Observer)

Carbon Capture: Scientists Say New Material Can Suck Carbon Out of Atmosphere Faster Than Trees (Yahoo News)

Fusion: MIT’s superconducting magnets are ready for fusion (MIT Technology Review)

Private Markets (PE / VC / Real Estate / Infra)

Nuclear: Holtec sues New York in federal court over ban on dumping radioactive water into Hudson (Times Union)

Nuclear: California’s Diablo Canyon Plant Shows Nuclear Power’s Aging Problem (Forbes)

Wind: Wind Is Dominating the UK Power Grid, Pushing Out Fossil Fuels (Bloomberg)

Storage: Clean energy developer to transform former mine into massive clean energy storage project: 'Will help ensure people have energy when they need it' (TCD)

Storage: Nevada put big battery energy storage where a coal plant used to be (Electrek)

Critical Minerals: Miners struggle to finance projects even amid surging battery metal demand, IEA says in forecast (The Northern Miner)

Batteries: Global battery rollout doubled last year – but needs to be six times faster, says IEA (Guardian)

Public Markets (Stocks, Bonds)

Data Centers: Microsoft to power data centres with big Brookfield renewables deal (FT)

Data Centers: Carlyle sees a cash cow in AI electricity boom (Semafor)

Oil & Gas: Exxon and Chevron Earnings Fall Back to Earth (WSJ)

Electric Vehicles: Insight: Why BYD's EV exports sell for twice the China price (Reuters)

Electric Vehicles: EU’s unwinnable price war with Chinese EVs summed up: BYD cars are 11-fold more profitable in Europe vs. China (Fortune)

Government & Policy

EPA: The Biden EPA’s Plan to Ration Electricity (WSJ Opinion)

FERC: The most important climate agency you’ve never heard of (The Economist)

DOE: DOE sets 2-year deadline for federal transmission permitting, cutting average timelines in half (Utility Dive)

NRC: NRC approves streamlined environmental review for advanced nuclear (E&E News)

China: Musk Wins China’s Backing for Tesla’s Driver-Assistance Service (WSJ)

G7: G7 to target sixfold expansion of electricity storage (Financial Times)

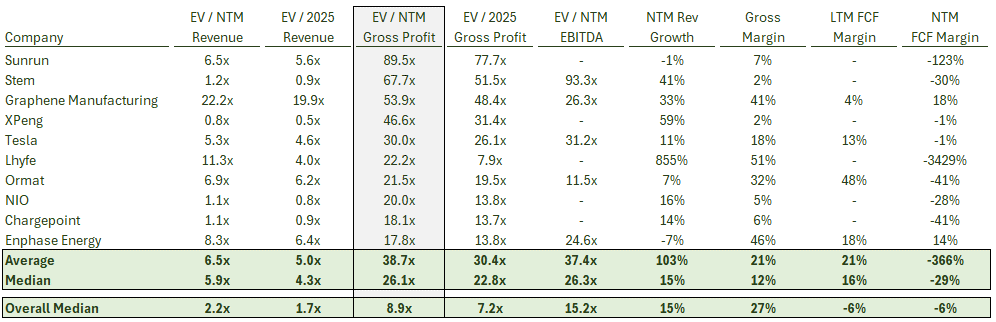

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

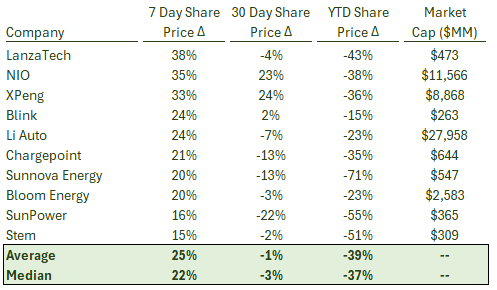

Top 10 Weekly Share Price Movement

Valuation Multiples over Time

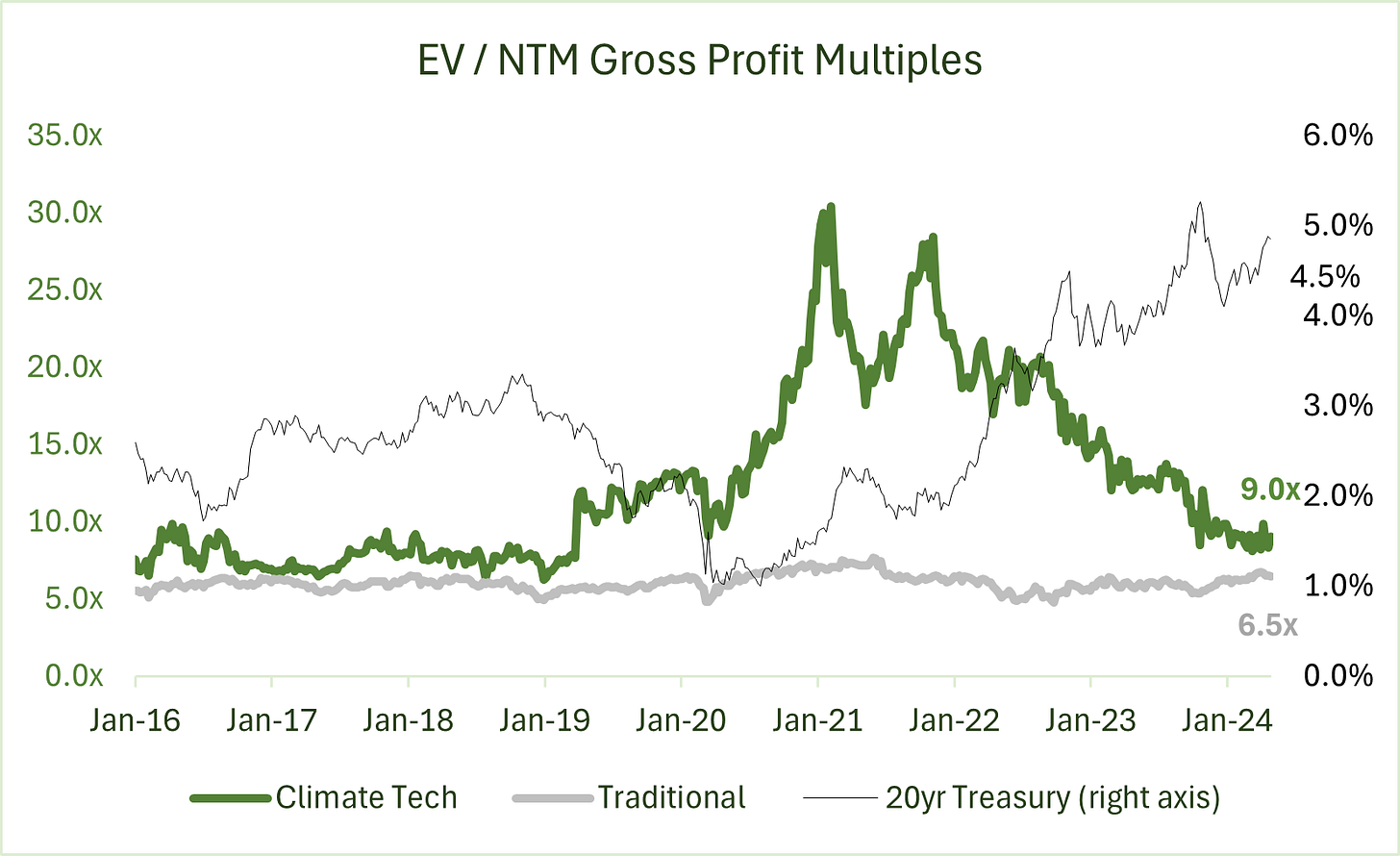

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

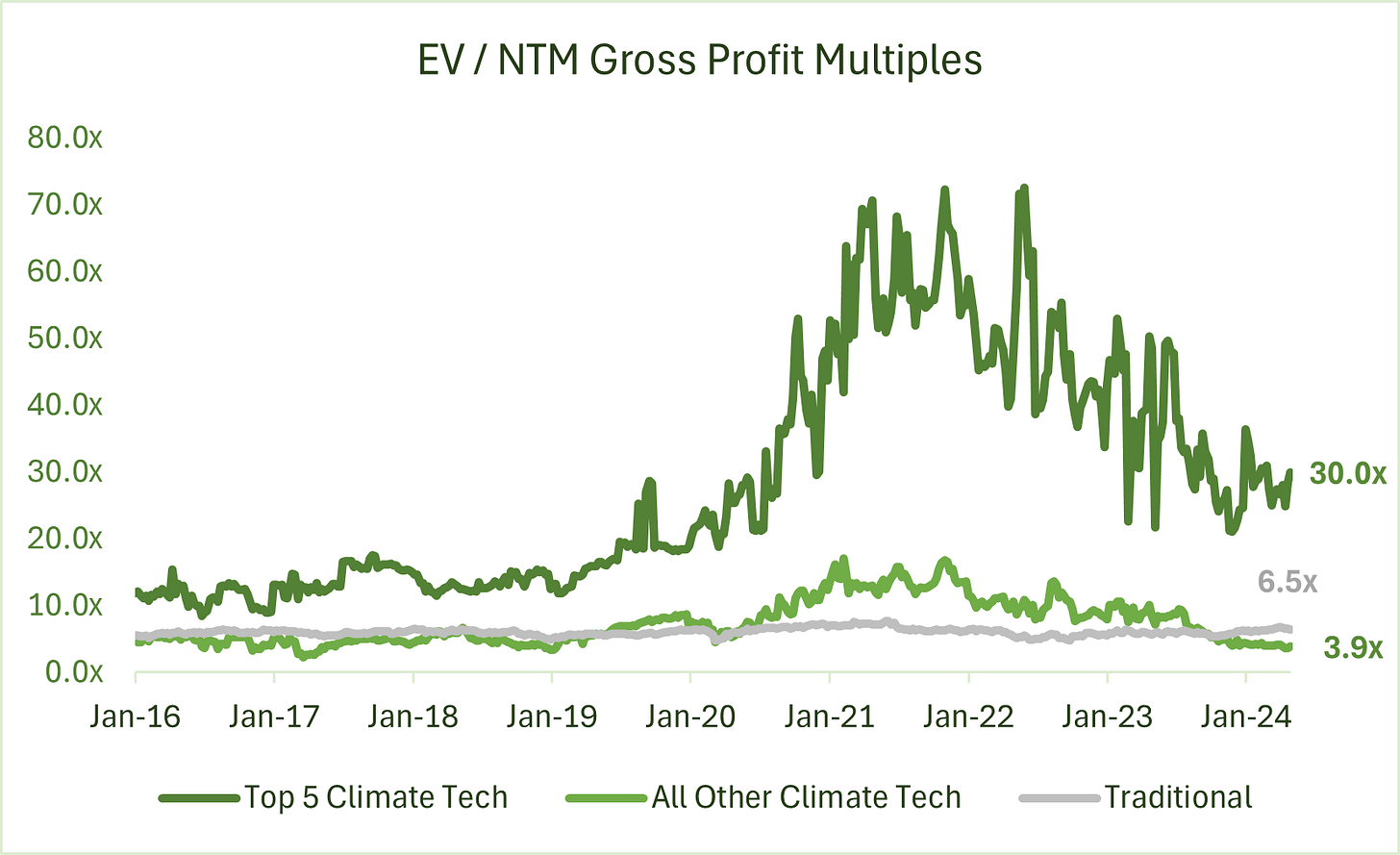

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

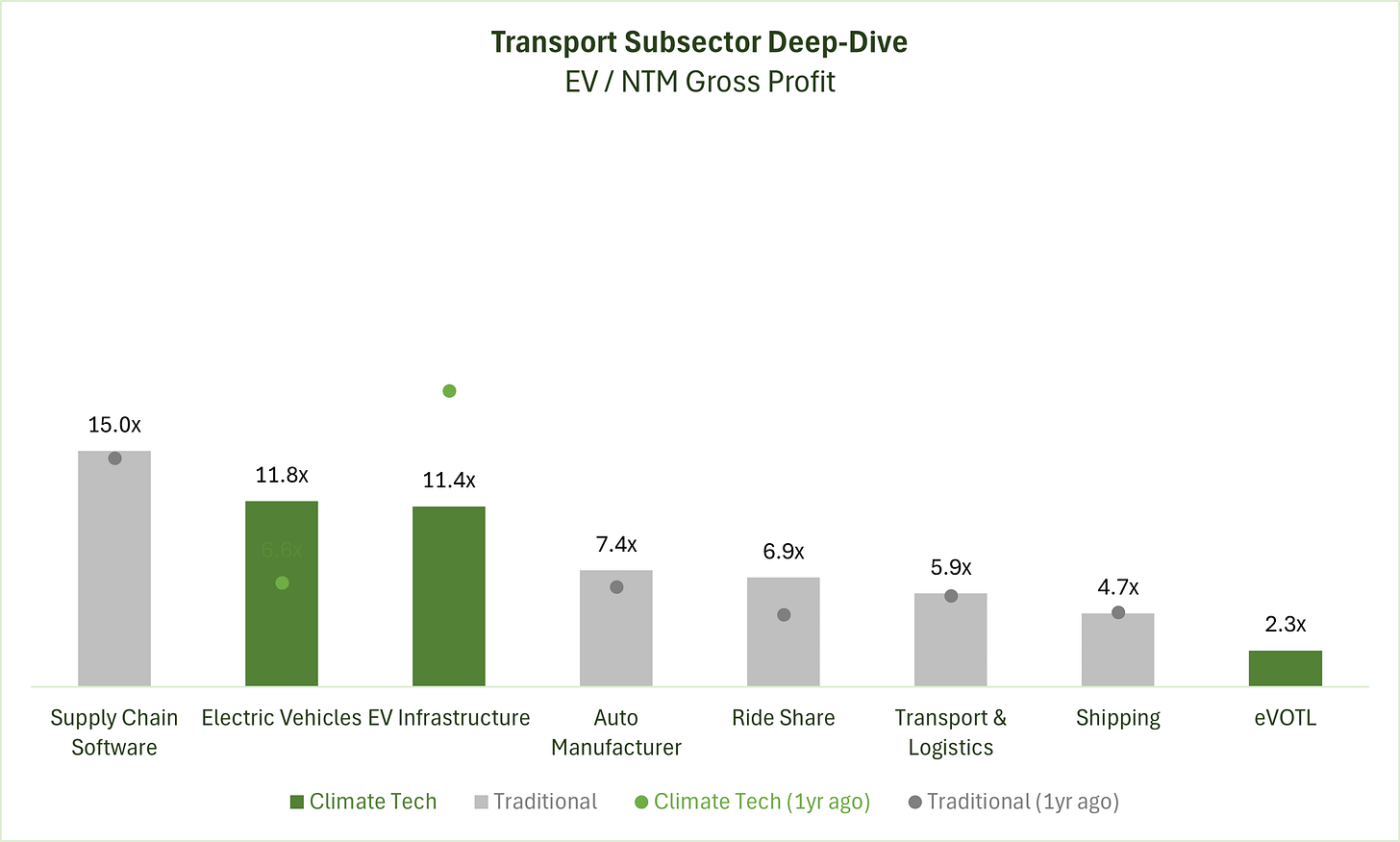

Deep-Dive by Subsector

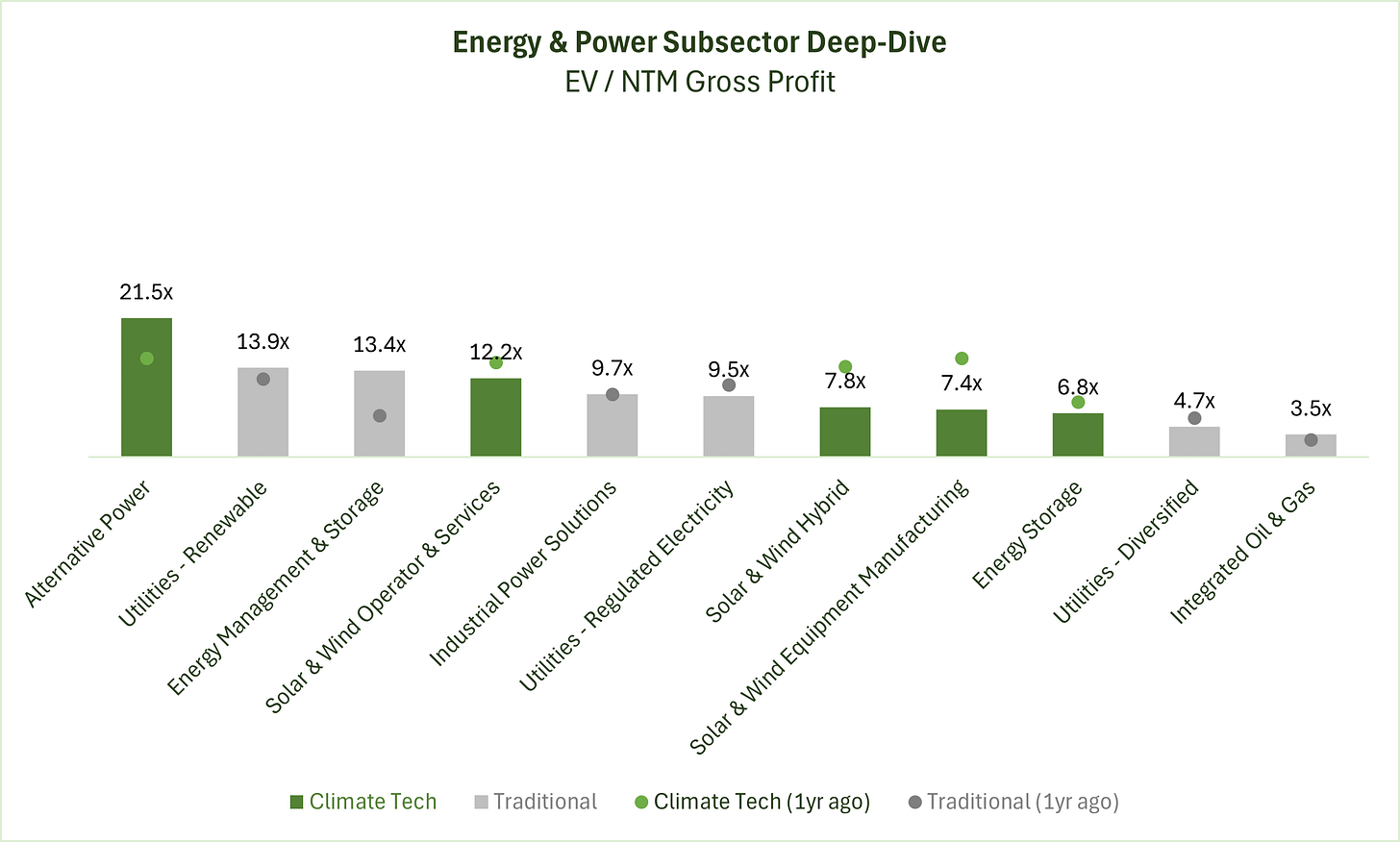

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium, while more speculative (storage) has less; the market is more skeptical on solar & wind manufacturing and hybrid business models (combining manufacturing with services or operations).

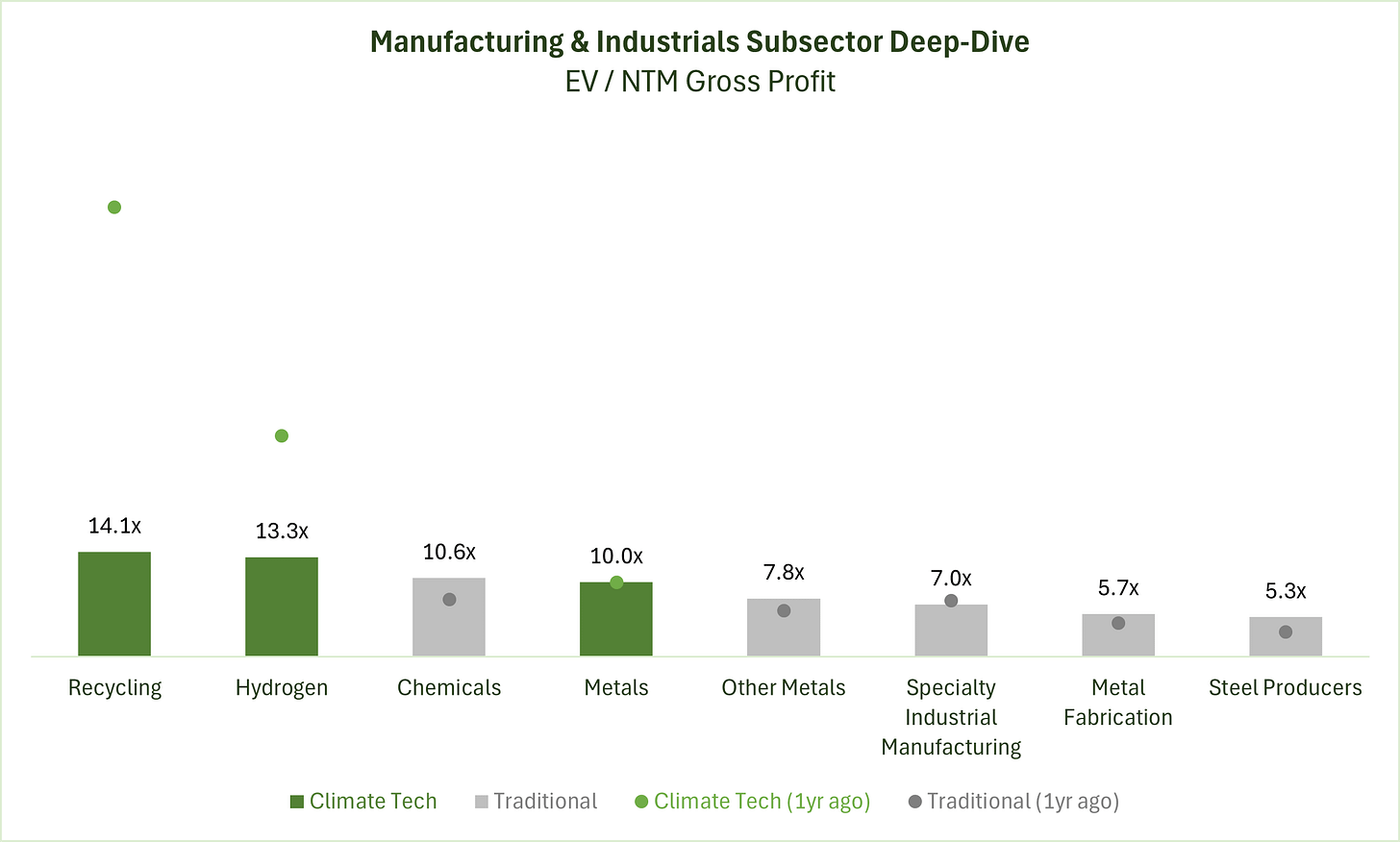

Manufacturing & Industrials: Recycling and hydrogen companies are rewarded for potential future growth, but they remain far below where they traded one year ago.

Transport: EV growth is priced in to climate tech and traditional companies; the market is skeptical on eVOTL.

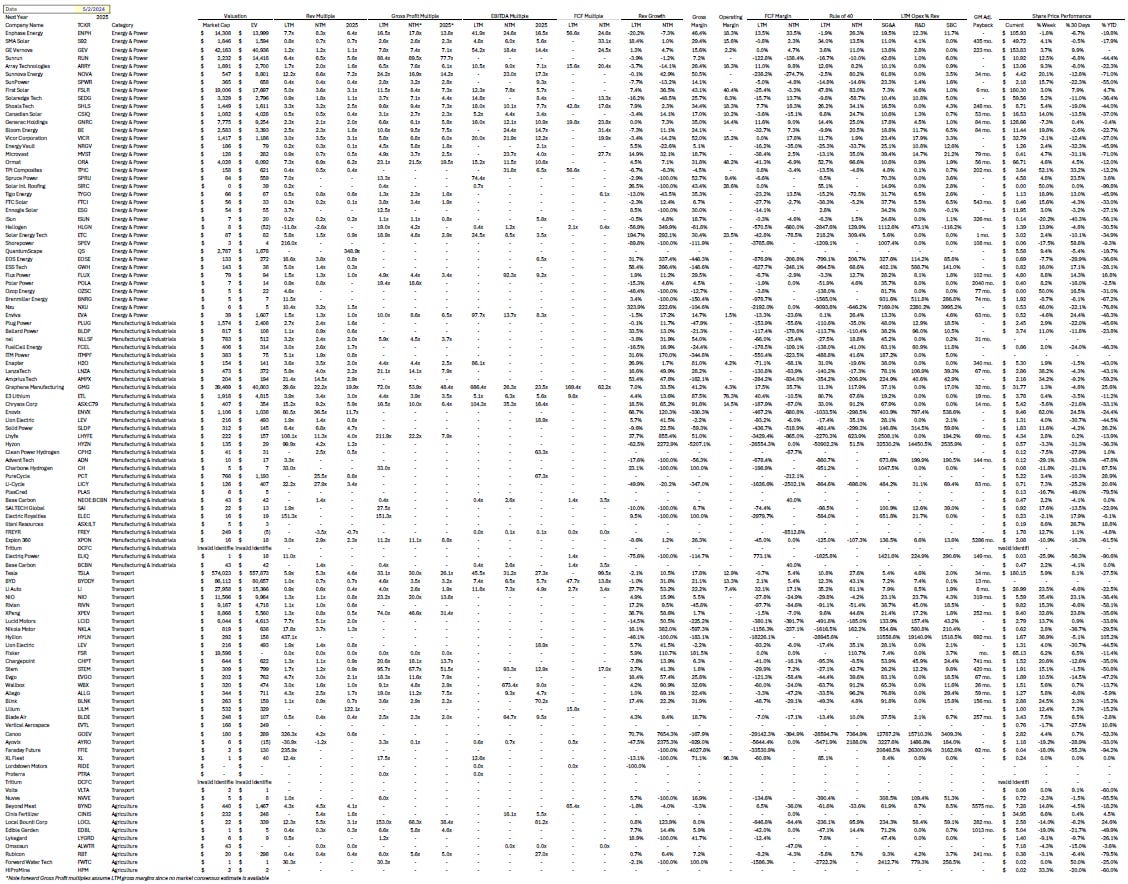

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.