Green Fundamentals: Battery Recycling Needs a Jolt

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Li-cycle has faces challenges for the past two years, casting skepticism on an otherwise promising market

What Happened: Publicly traded battery recycler Li-Cycle has seen its stock drop 12% in the last 7 days and 45% over the past 30 days, despite positive news such as a 17% staff reduction in March aimed at streamlining operations. Li-Cycle, Ascend Elements, and Redwood Materials are leading efforts to tackle the growing need for sustainable battery disposal and material recovery. Key developments include:

July 2024: Li-Cycle completed its largest battery recycling facility in Rochester, NY, with a capacity of 25,000 metric tons annually, marking a significant step in their North American hub-and-spoke network.

June 2024: Ascend Elements raised $542 million in Series D funding to scale its Hydro-to-Cathode™ technology, which directly recycles battery materials, reducing waste and carbon emissions.

May 2024: Redwood Materials broke ground on a Nevada facility focused on closed-loop recycling, aiming to recover over 95% of critical metals like lithium, cobalt, and nickel.

Background: The battery recycling market, expected to reach $23 billion by 2030, is driven by the rapid growth of EVs and energy storage systems. However, high recycling costs, regulatory challenges, and complex battery chemistries pose significant barriers. Initially, companies have focused on recycling manufacturing scrap due to its higher purity and profitability. As more end-of-life batteries enter the market, the industry will need to adapt to a more challenging feedstock mix.

Source: McKinsey

Closed-loop contracts have unlocked significant value. These long-term agreements between recyclers, battery manufacturers, and automakers ensure a steady supply of feedstock and recycled materials, reducing supply chain risks and supporting a circular economy. A battery recycler receives a status similar to a ‘preferred vendor’ getting first rights to feedstock at a pre-negotiated price. Securing these contracts is becoming essential for companies aiming to lead the market.

Another significant trend is the focus on producing pre-cathode active materials rather than just black mass. Pre-cathode active material involves recycling battery materials into ready-to-use components for new batteries. This process offers higher margins than producing black mass, the mixed material from shredded batteries that still requires extensive processing to extract valuable metals. By moving further down the value chain, companies like Ascend Elements position themselves to capture more value and become essential partners in the battery manufacturing ecosystem.

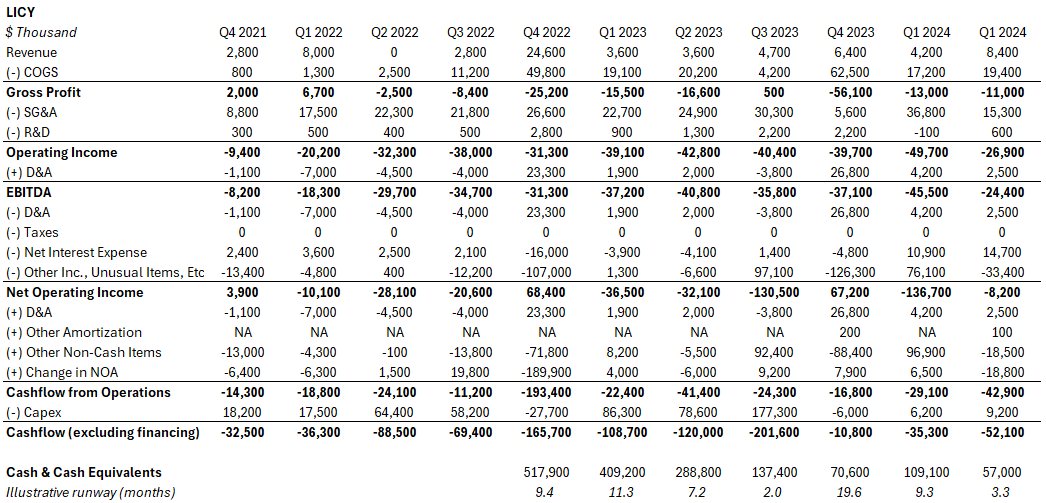

Li-Cycle, disadvantaged on both of these fronts, has been left behind. Li-Cycle's stock is trading lower due to delays in scaling its hub-and-spoke operations and rising costs, which have raised concerns about profitability. Investors are also skeptical about the company's ability to move from black mass production to higher-margin, refined materials. Recent staff cuts, while aimed at cost-saving, have fueled worries about the company's long-term growth and ability to execute its ambitious plans, further dampening investor confidence. Despite significant cost cutting, the company is still not cashflow positive and quickly running out of runway.

Source: Publicly Available Financials

Take-Away: The battery recycling industry is at a crucial juncture. While early players like Li-Cycle face challenges, newer entrants like Ascend Elements and Redwood Materials are well-positioned to capitalize on the growing demand for sustainable battery disposal.

Ascend Elements excels with its proven IP in producing pre-cathode active materials, a higher-margin business compared to black mass production. By securing closed-loop contracts, Ascend Elements ensures a stable feedstock supply and cements its role as a key partner in the battery manufacturing process.

Redwood Materials offers a vertically integrated approach with strong partnerships and a focus on scaling infrastructure. If they successfully develop and scale their pre-cathode active material production, they could dominate the market.

What Comes Next: The battery recycling market holds immense potential, but significant hurdles remain:

High Costs: Establishing recycling facilities and processing batteries requires substantial investment.

Regulatory Challenges: Navigating diverse regulatory environments adds complexity to scaling operations.

Technological Barriers: The varying chemistries of batteries make it difficult to create a universal recycling solution.

The race to lead in battery recycling is intensifying. The companies that can overcome these challenges will not only secure a dominant position but also set the standards for sustainable battery management globally.

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Global Temperatures: Part of the Atlantic is cooling at record speed and nobody knows why (New Scientist)

Industrial Electrification: Energy game-changer: 85% efficient green electricity-powered reactor unveiled (Interesting Engineering)

Nuclear Fusion: Nuclear fusion reactor created by school teenager successfully achieved plasma (Interesting Engineering)

Geothermal: Company achieves drilling breakthrough that could transform future of geothermal: 'Uniquely positioned to meet this demand' (TCD)

Nuclear Fission: Molten salt nuclear reactor gets boost with new plasma bubble breakthrough (Interesting Engineering)

Private Markets (PE / VC / Real Estate / Infra)

Transmission: Oh, that’s not good: Energy prices at PJM capacity auction skyrocket 9x (Renewable Energy World)

Battery Storage: Arizona: Tucson Electric Power to build second 200MW/800MWh BESS project (Energy Storage News)

Battery Storage: D. E. Shaw begins construction at 130MW solar, 260MWh storage facility in New Mexico (Energy Storage News)

Battery Storage: Portable battery startup Moxion is bankrupt. What happened? (Latitude Media)

Nuclear: India's second 700 MW nuclear power KAPS-4 plant starts operations at full capacity (The Economic Times)

Hydrogen: German electrolyser maker to open gigafactory at end of September to 'meet future green hydrogen demand'(Hydrogen Insight)

Hydrogen: Hydrogen Hubs Threaten to Drain West Texas of Water (San Angelo Live)

Data Centers: US tech groups’ water consumption soars in ‘data centre alley’ (FT)

Aviation: Clean Fuel Startups Were Supposed to Be the Next Big Thing. Now They Are Collapsing. (WSJ)

Supply Chain: U.S. battery rush spurs $1.4 billion sodium-ion factory in North Carolina (Live Mint)

Public Markets (Stocks, Bonds)

Sustainable Aviation Fuel: LanzaTech, LanzaJet announce project with Wagner Sustainable Fuels in Australia (Ethanol Producer)

Electric Vehicles: Ford Shrinks Its EV Rollout Plans as Demand Lags (WSJ)

Steel: Tata Steel wants to go nuclear for green steel, mulling 200 BSRs (Business Line)

Hydrogen: HydrogenPro’s losses widen as it racks up unexpected costs on US green hydrogen project (Hydrogen Insight)

Fuels: Ørsted scraps flagship European green fuels project (FT)

Government & Policy

Aviation: Biden-Harris Administration Announces Nearly $300 Million in Awards for Sustainable Aviation Fuels and Technologies as part of Investing in America Agenda (FAA)

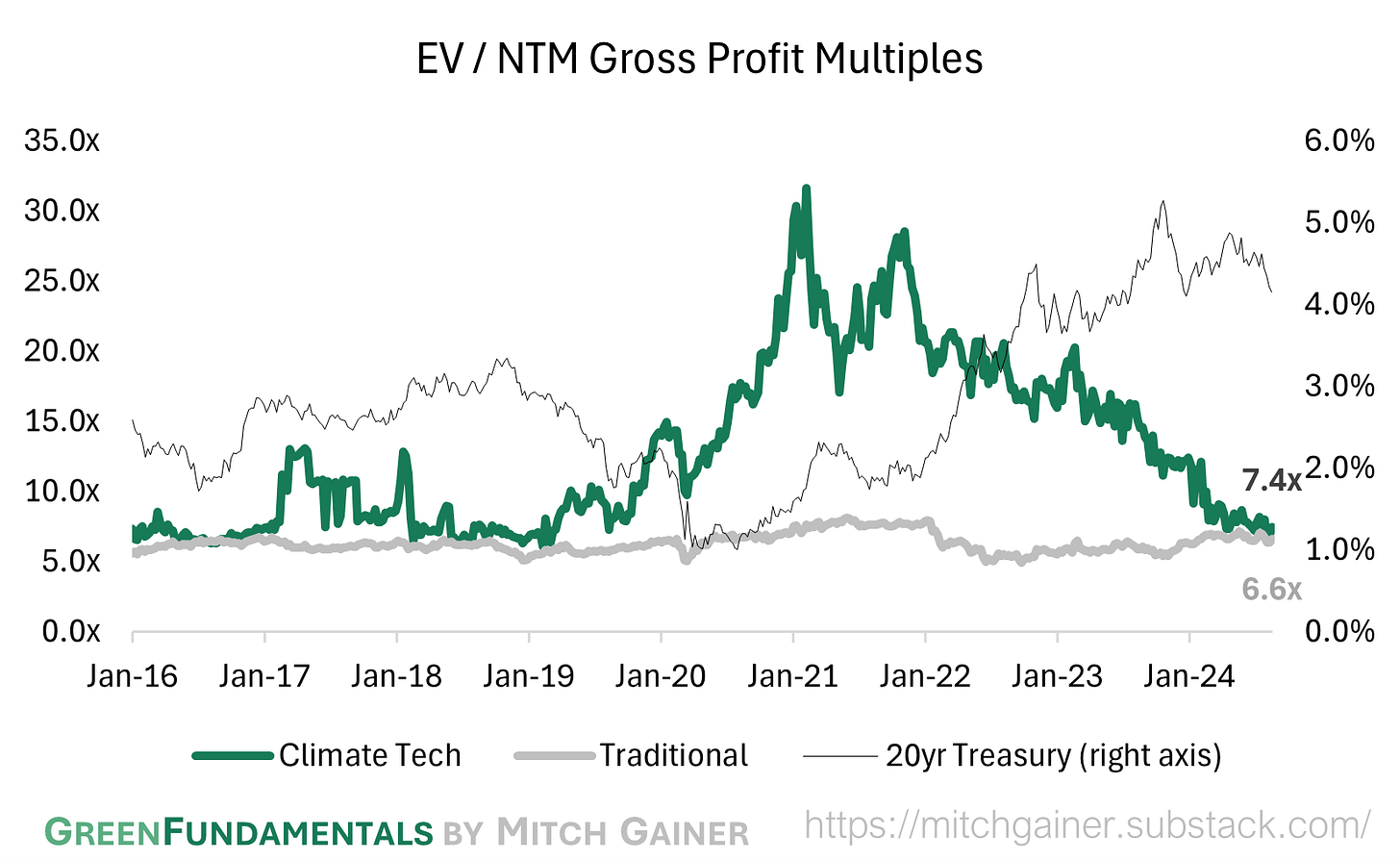

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

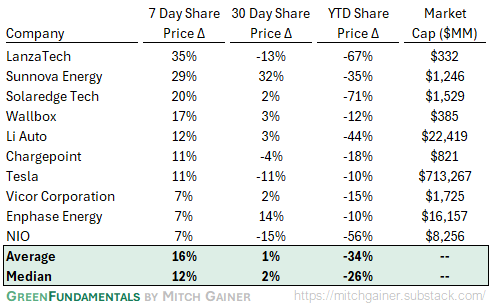

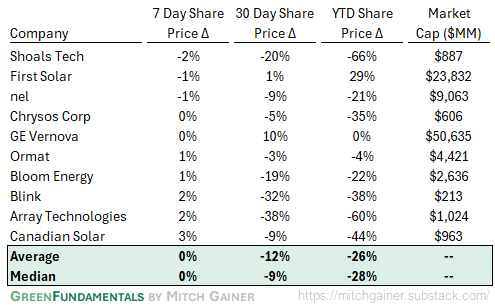

Top 10 and Bottom 10 Weekly Share Price Movement

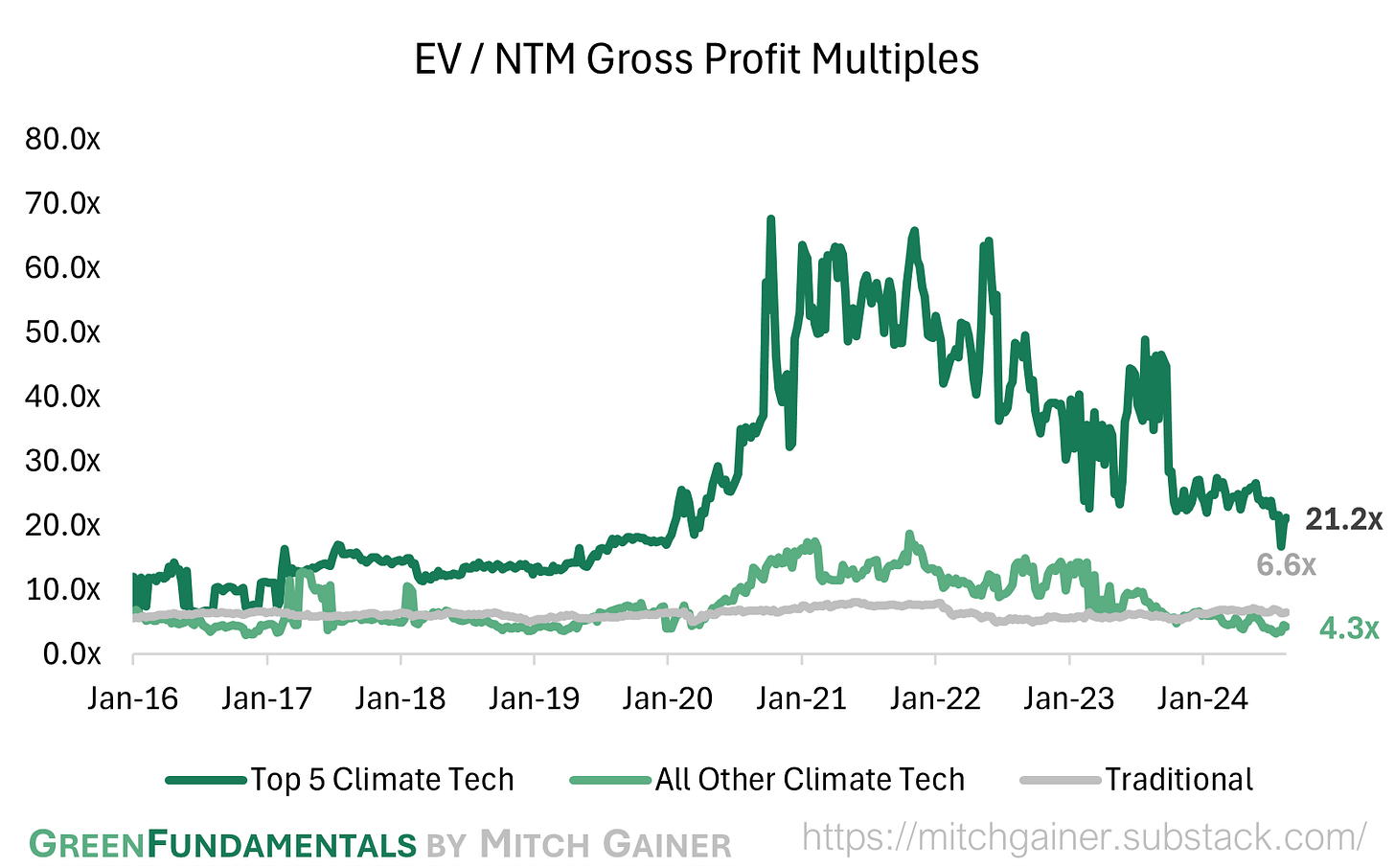

Valuation Multiples over Time

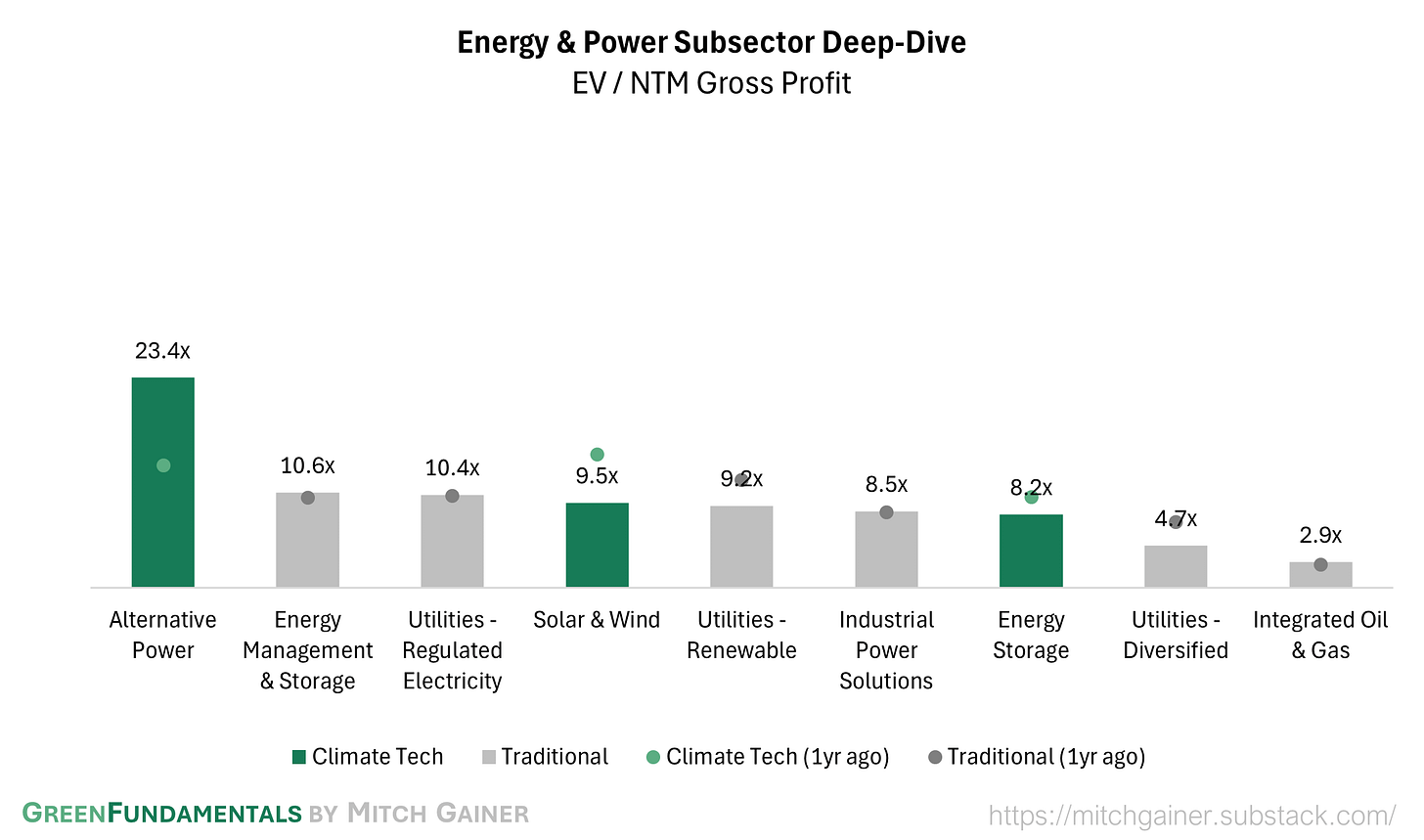

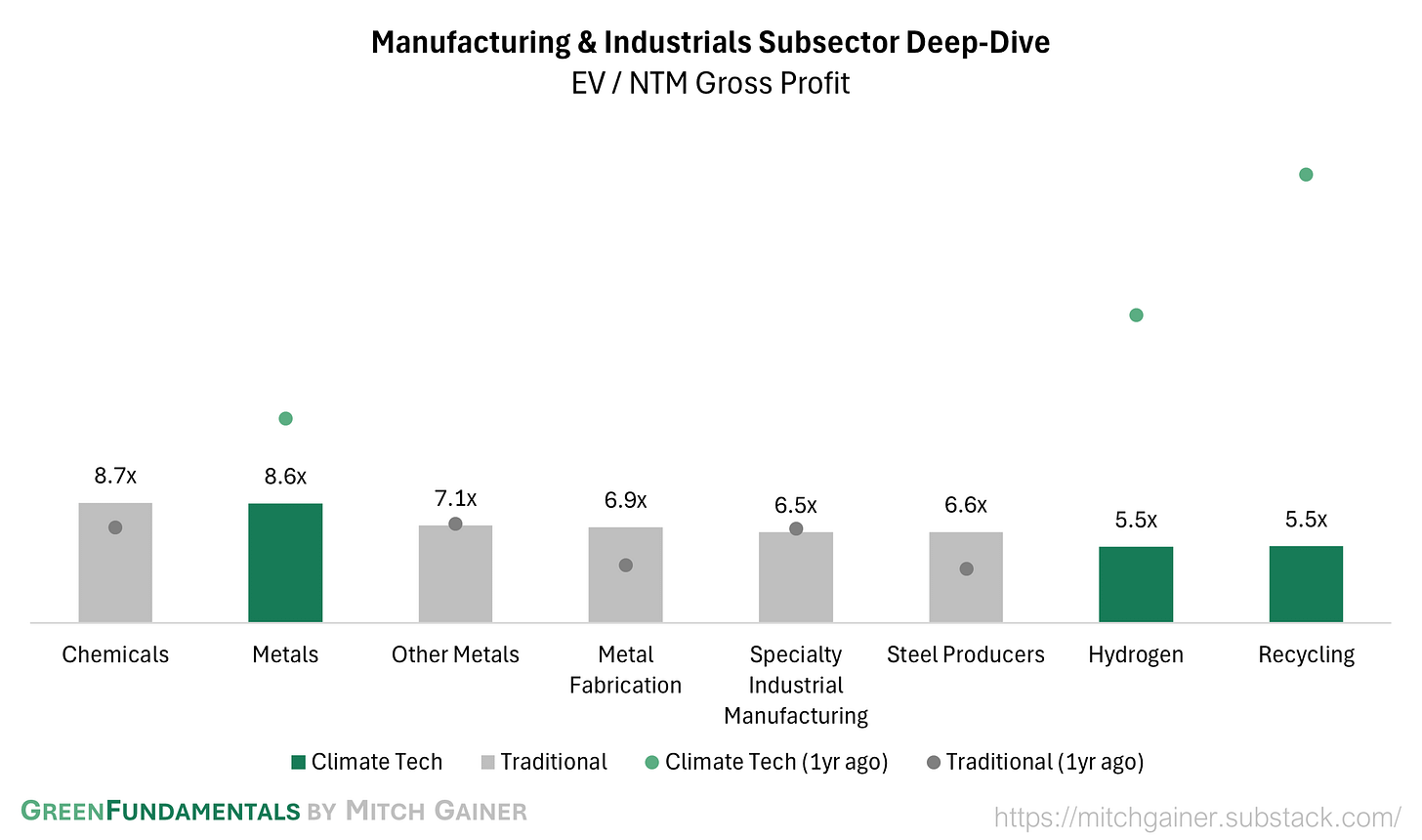

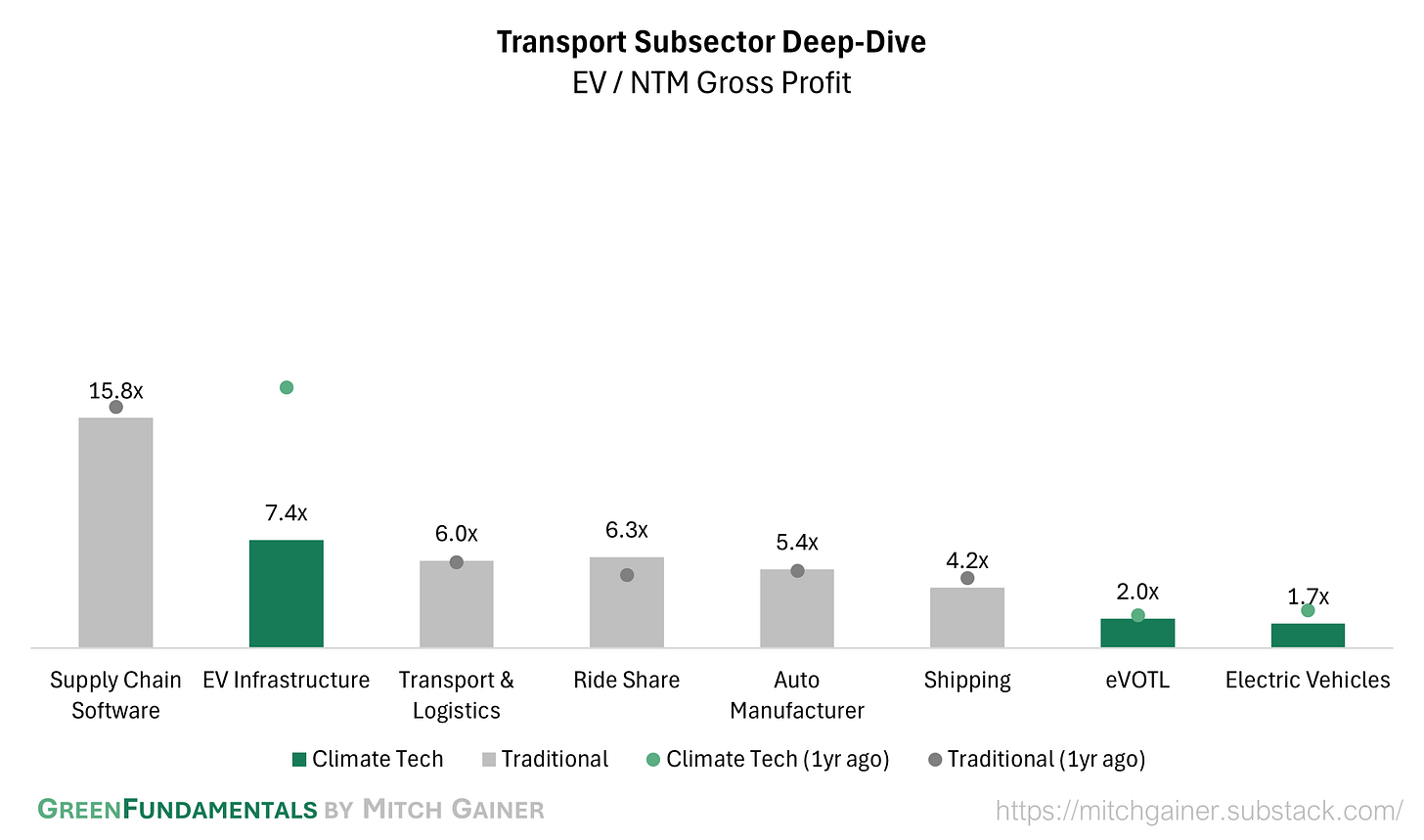

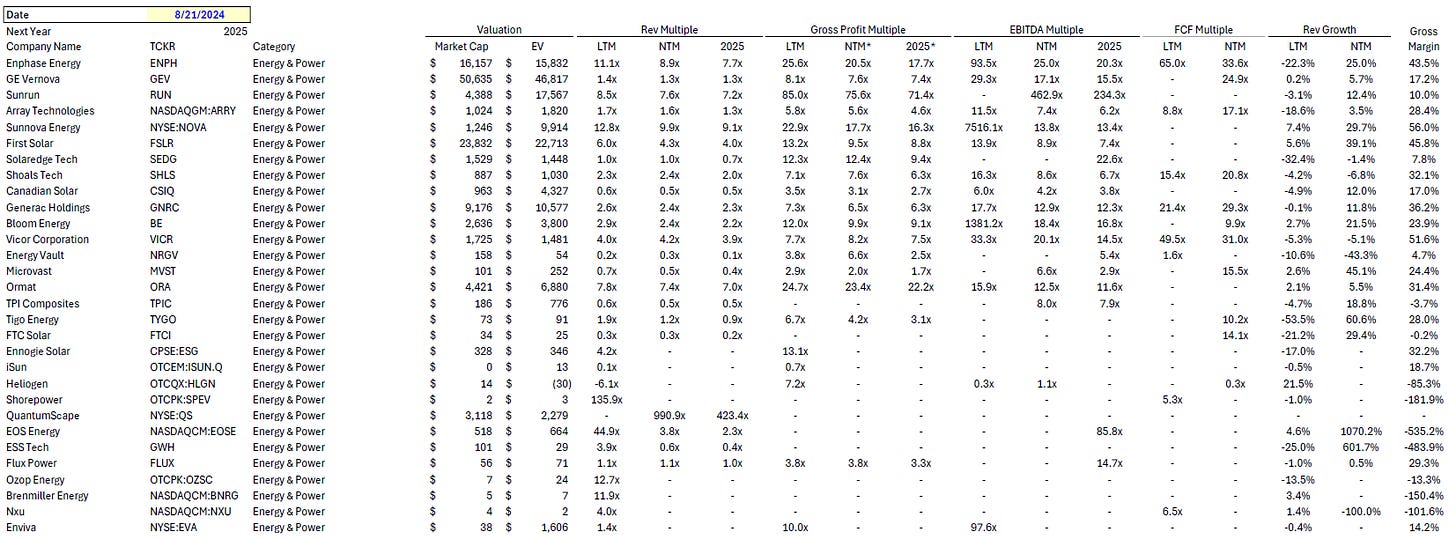

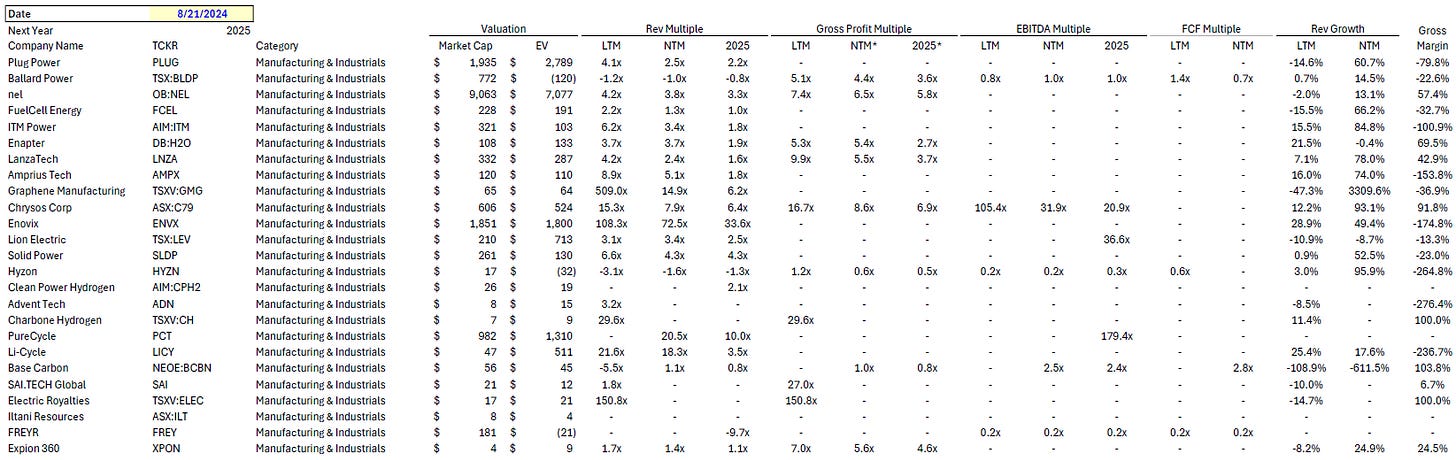

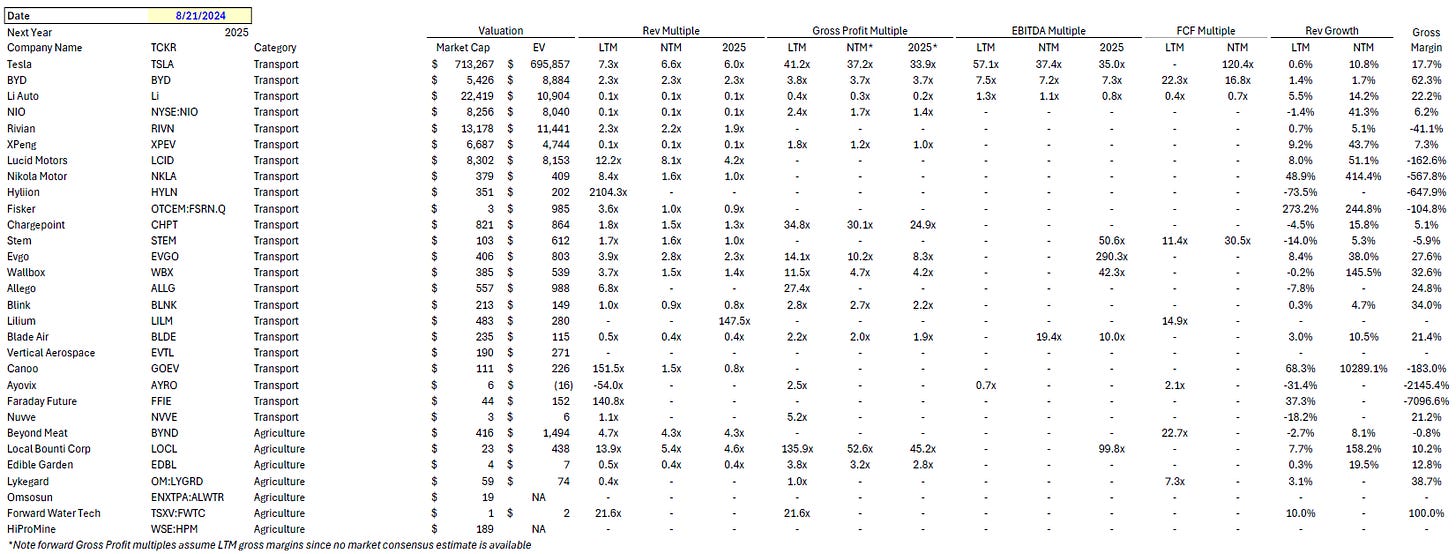

Deep-Dive by Subsector

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.