Green Fundamentals: Battery Storage Supercharges 24x7 Power Users

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Opportunistic investors will strike as battery costs decline (driven by materials) and demand surges (driven by renewables)

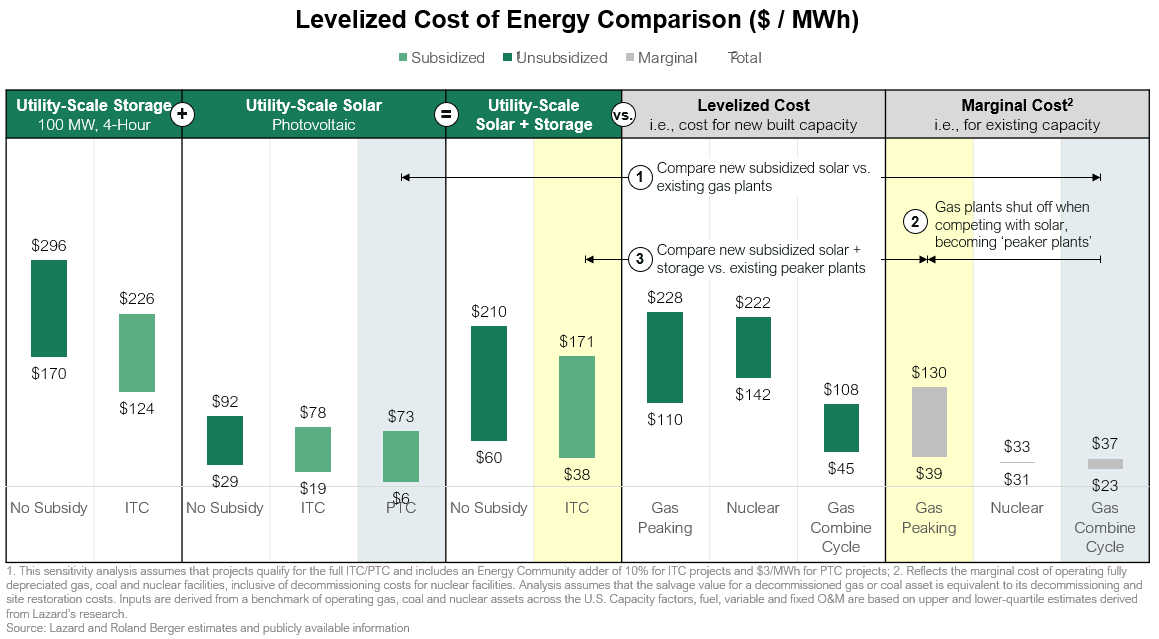

What Happened: Last week, Lazard released their annual LCOE report, which includes estimates that the cost of utility-scale battery energy storage systems (BESS) has fallen to as low as $124 / MWh with IRA benefits. Every year, Lazard releases their levelized cost report, which becomes the industry standard among investors. Previously, the high cost of battery storage has prevented significant roll-out to make use of low-priced intermittent renewables. But now BESS can compete with Gas Peaker Plants (see below for an explanation), bringing BESS investments within striking distance for investors.

Source: Lazard

Background: Low cost solar has been out competing natural gas when the sun is shining (see #1 above comparing the blue columns). California is an example market where solar can contribute over 100% of power demand in the middle of the day. As a result, gas plants are shutting down and only operating when needed (i.e., at night or in the winter when solar is less productive).

Using a gas plant less increases the levelized cost of power for that plant (see #2 above). A gas plant fully utilized is a typical combined cycle plant. When it is used for ‘peak demand’ (i.e., turning it on only when solar isn’t generating enough) it is a ‘Peaker Plant’. The utility uses this to ensure supply can always meet demand, and they are willing to pay more for this capability. This dynamic has caused policy makers and investors to question the impact of solar. Though solar can be cheaper when the sun is shining, if power becomes more costly the rest of the time then the overall cost of electricity could be higher for some power consumers.

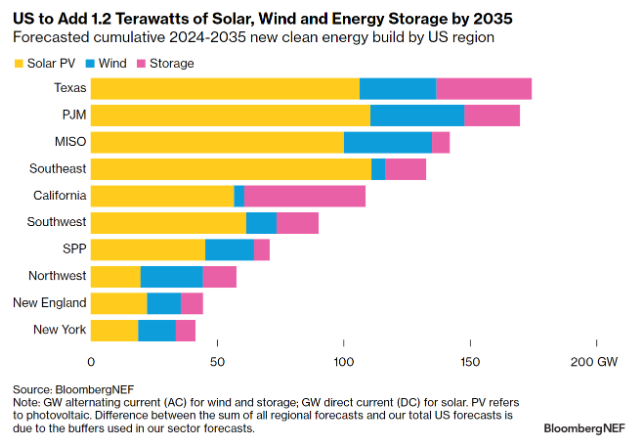

Battery storage is becoming cheap enough to store low cost solar and deploy it later in the day (see #3 above comparing the yellow columns). Significant demand for battery storage is emerging as intermittent renewables are rolled out - especially in Texas, PJM (the Mid-Atlantic), and California.

Source: BloombergNEF

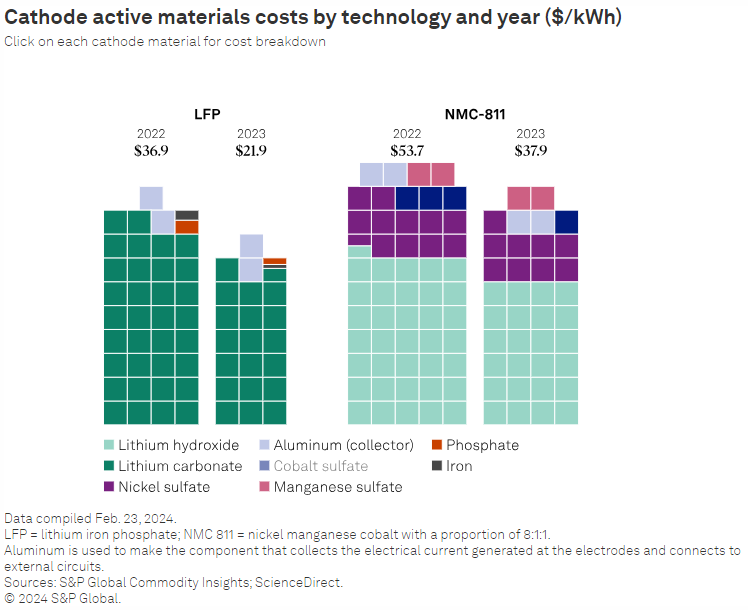

Battery prices have declined in part because of a decline in raw material prices. Lithium Ion (Li-Ion) batteries use Nickle, Manganese, and Cobalt (NMC) as their Cathode (in addition to the Lithium anode). Lithium Iron Phosphate (LFP) batteries use Lithium Carbonate, Phosphate, and Iron (in addition to the Lithium anode). Metals prices have significantly declined this year, reducing costs.

Source: S&P Global

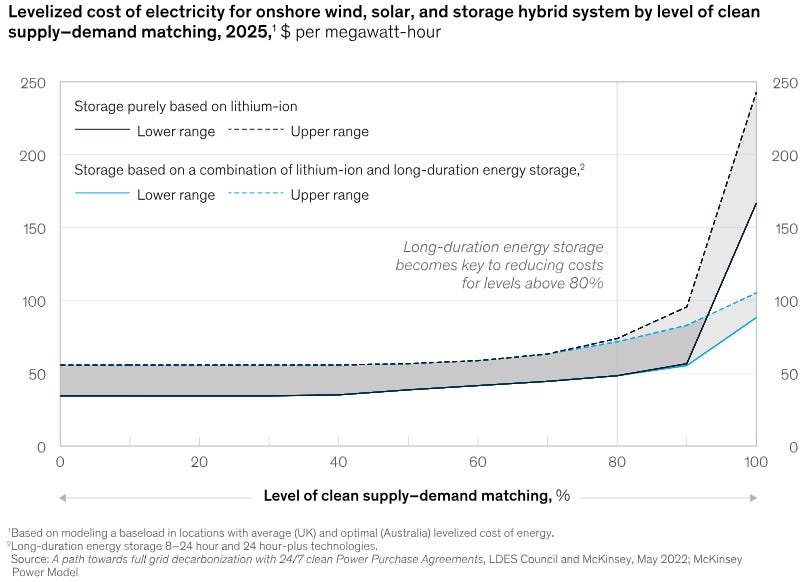

Decarbonizing the final 20% of hours in the day is the hardest. Storing low cost solar for the night (‘short duration’ ~4 hours of storage) and for ‘less sunny’ seasons (‘long duration’ several months of storage) has been prohibitively expensive. As a result, consumers of 24x7 power (i.e., data centers, industrial processes) are willing to pay significantly more for clean 24x7 power.

Source: McKinsey

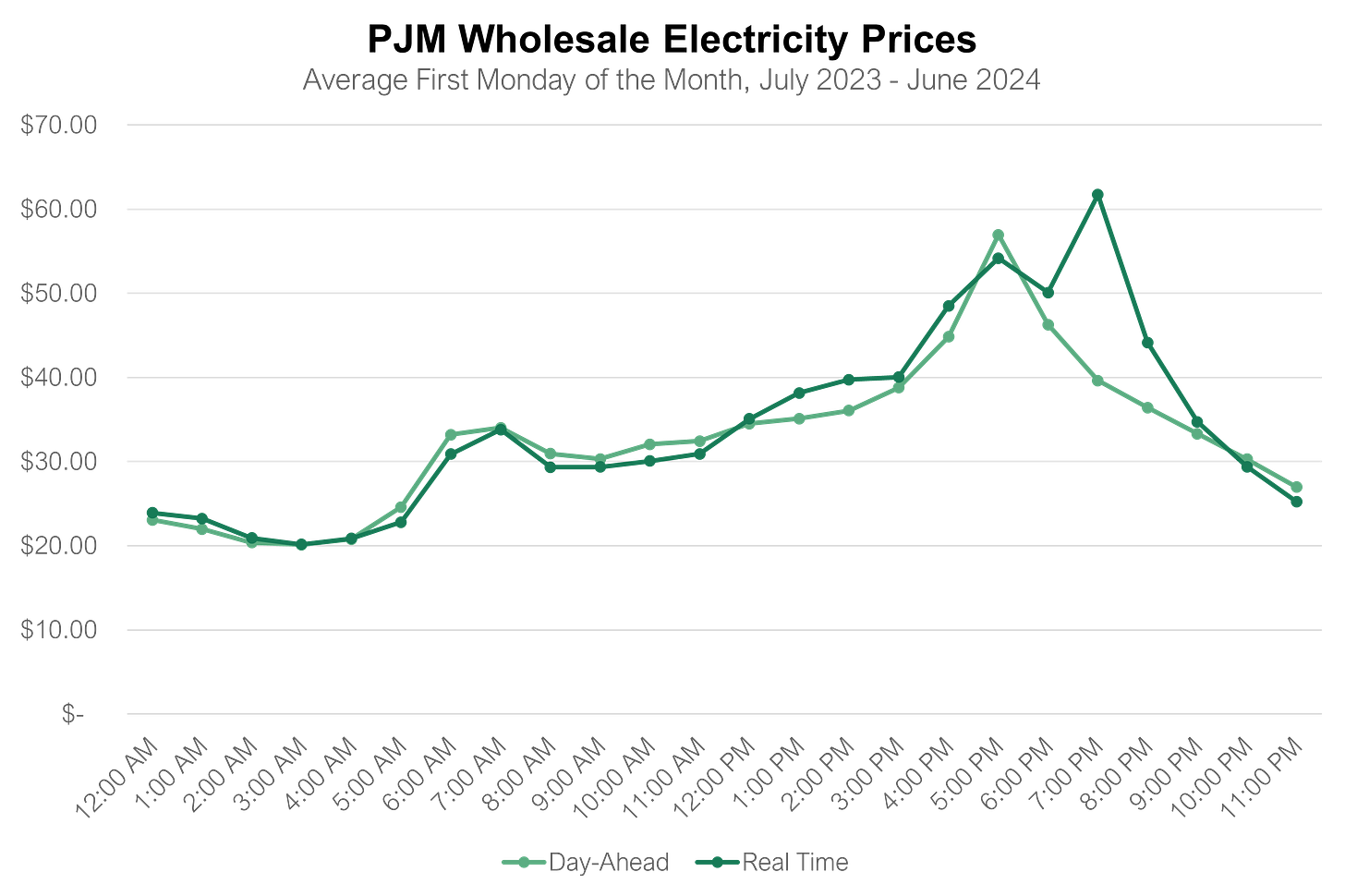

Take-Away: There is no longer one electricity price, rather different prices for intermittent vs. dispatchable. Consumers that can use power when it is cheap and abundant (i.e., when the sun is shining) can take advantage of low rates. But consumers that need 24x7 power (like data centers and industrial processes) will need to pay more for dispatchable power. See the average real time rates for PJM below, where data centers are a major consumer.

Source: PJM, PPL Electric Utilities

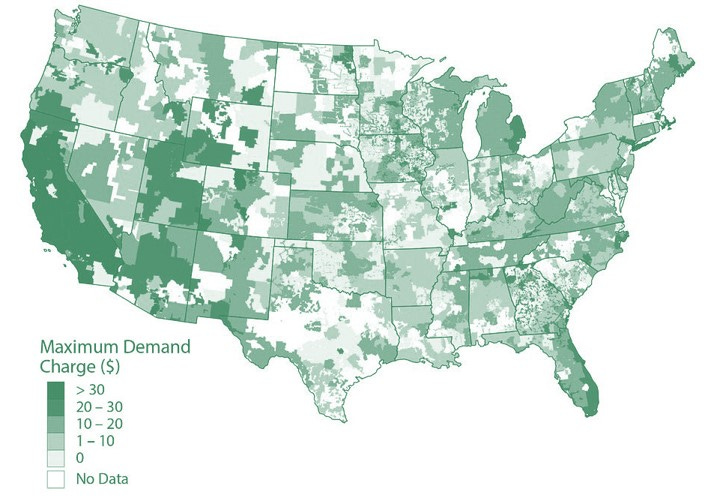

In some geographies, batteries are now competitive. Storage makes the most sense where they can reduce large peaks in power demand where power rates are highest. Additional opportunities can exist to arbitrage power prices with the grid. Investment returns are even more attractive with lucrative investment tax credits and other government incentives.

Source: NREL

What Comes Next: 24x7 consumers will look to new solutions during peak pricing hours. Data centers and industrial processes will look to virtual power plants (VPPs), alternative rate tariffs, new base-load capable generation (like geothermal), and utility-scale battery solutions to reduce carbon intensity at these higher priced hours. Defining the value proposition vs. natural gas for these end users is about to get much more nuanced. $60-80 per MWh is no longer the benchmark for every hour of the day. Investors that understand how to navigate that will see opportunities others miss.

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Global Temperature: What you need to know about record-breaking heat in the Atlantic (Yale Climate Connections)

Electronic Components: Why DOE is funding a wiring company you've never heard of (Latitude Media)

Shipping: Ships could store their CO2 emissions in the ocean (New Scientist)

Transport: It’s a bird, it’s a plane…it’s a Chinese flying car (The Economist)

Green Steel: A New Way to Make Green Steel: To meet demand from automakers and builders, startups are processing iron ore without using fossil fuels (WSJ)

Private Markets (PE / VC / Real Estate / Infra)

Solar: Big solar projects launch in Idaho as US nuclear test sites go green (Reuters)

Solar: Increasing use of renewable energy in US yields billions of dollars of benefits (The Guardian)

Wind: In a world first, China installs an 18 MW offshore wind turbine (Electrek)

Shipping: First Hydrogen-Fueled Vessel in the US Receives US Coast Guard Approval to Enter Commercial Service (Business Wire)

Nuclear: US Nuclear Industry Fetes Rare New Reactors as Retrofits to Dominate (Bloomberg)

Grid: NV Energy opts to join CAISO-developed day-ahead market over SPP alternative (Utility Dive)

Grid: ERCOT says Texas could face rolling blackouts in August, as Houston officials announce cooling centers (Houston Public Media)

Public Markets (Stocks, Bonds)

Batteries: Novel battery manufacturer EnerVenue is raising $515M, per filing (TechCrunch)

Batteries: Ford Advances Training, Sustainability and Community Engagement as Blueoval City Construction Progresses (Ford)

Batteries: Battery specialist Umicore warns on electric vehicle slowdown (FT)

Electric Vehicles: Rivian’s path to survival is now remarkably clear (TechCrunch)

Government & Policy

Congestion Charging: Why New York scrapped congestion charging (The Economist)

Batteries: How America Can Win the Coming Battery War (Foreign Affairs)

Nuclear: US DOE approves safety design for Kaleidos microreactor (NEI)

Trade: EU to hit Chinese electric cars with tariffs of up to 48% (FT)

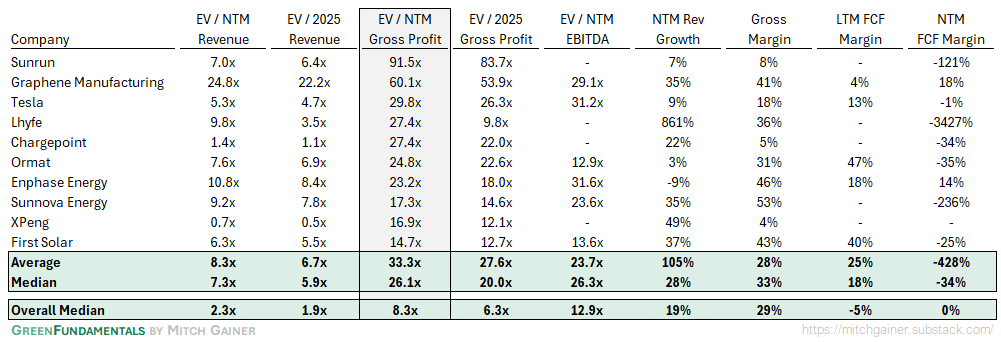

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

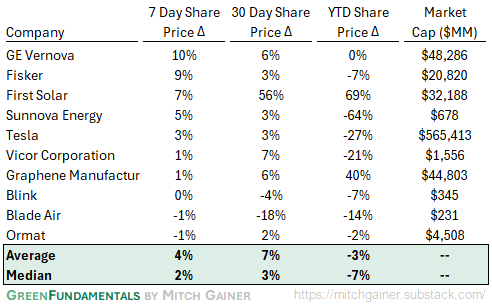

Top 10 Weekly Share Price Movement

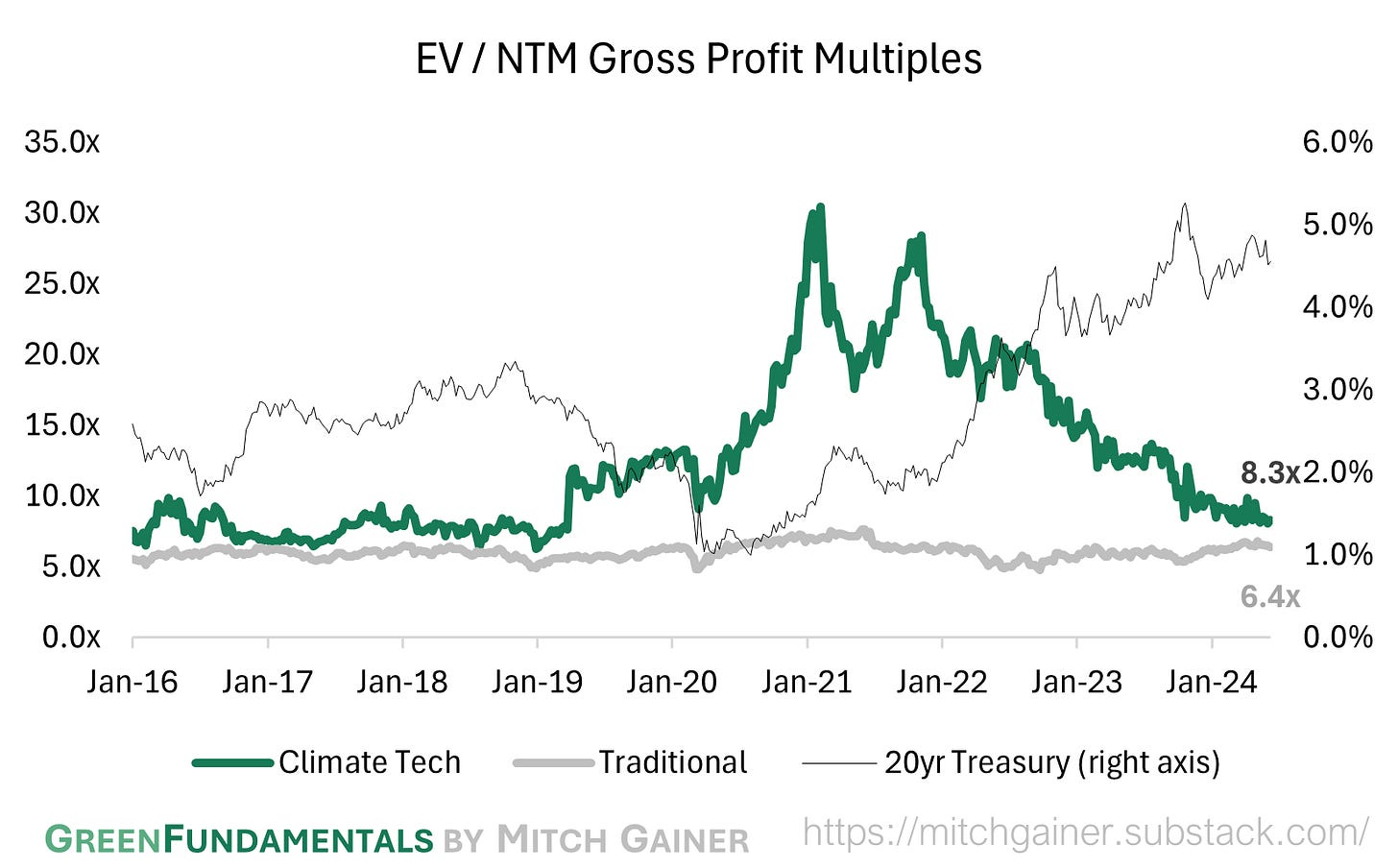

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

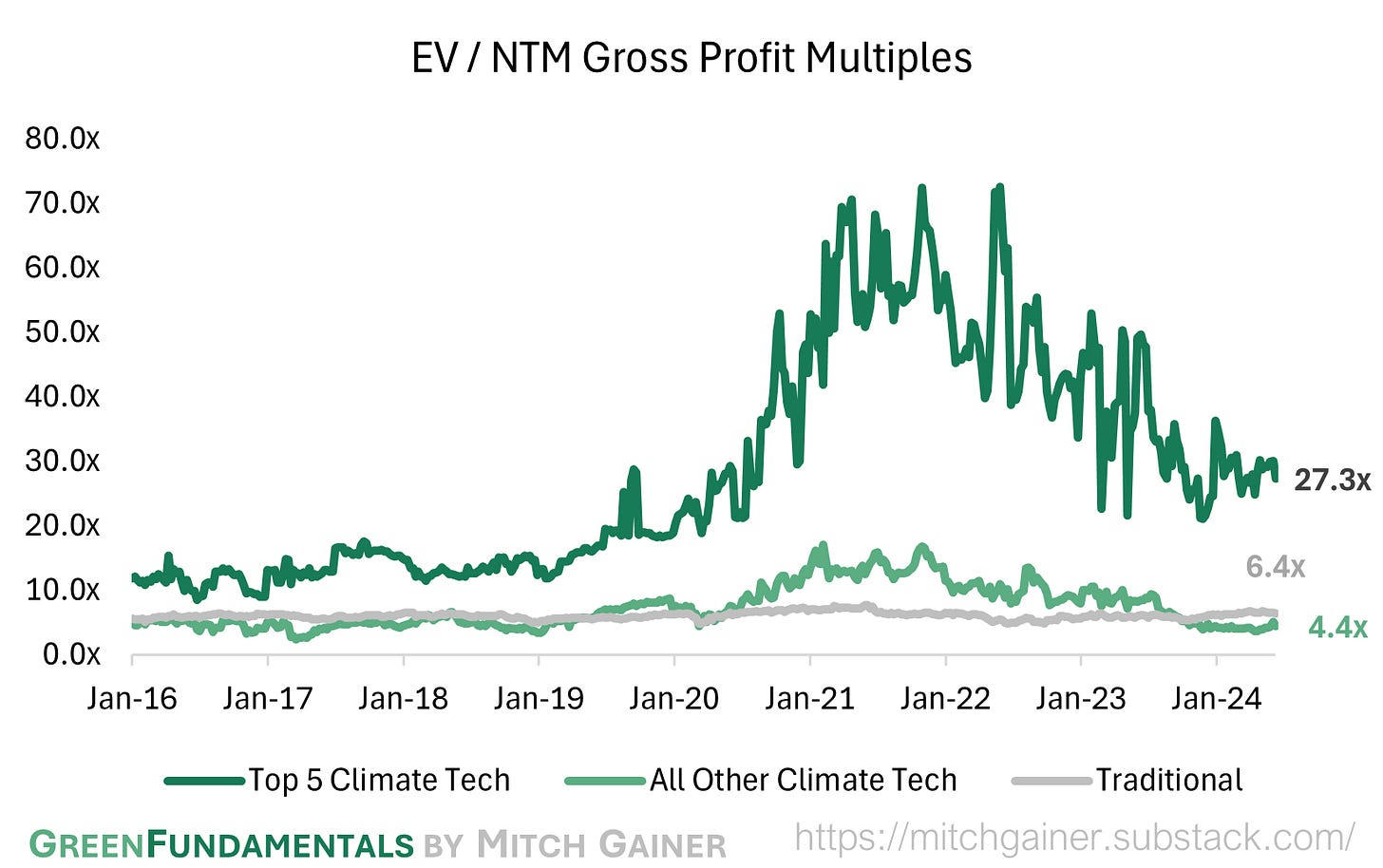

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

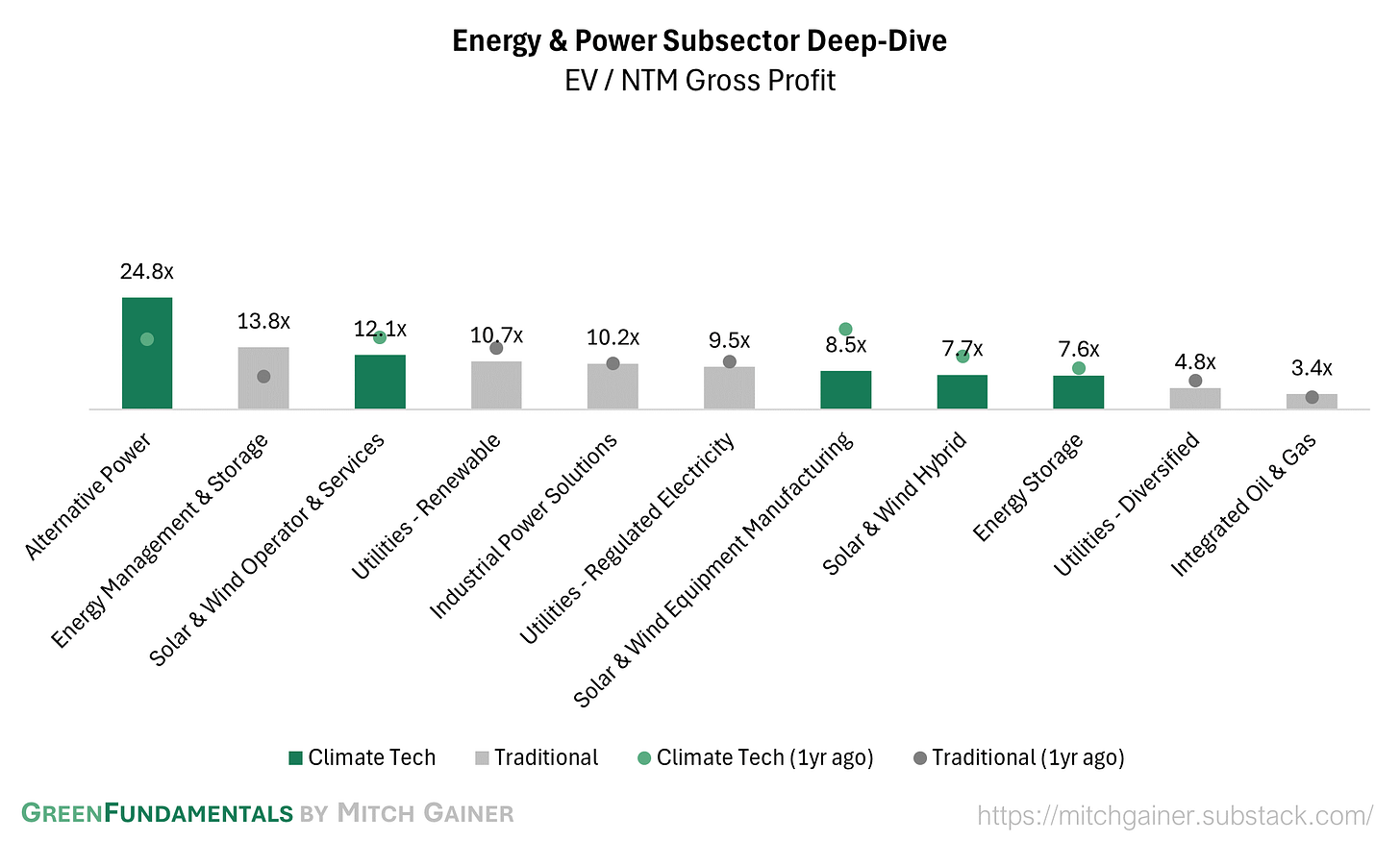

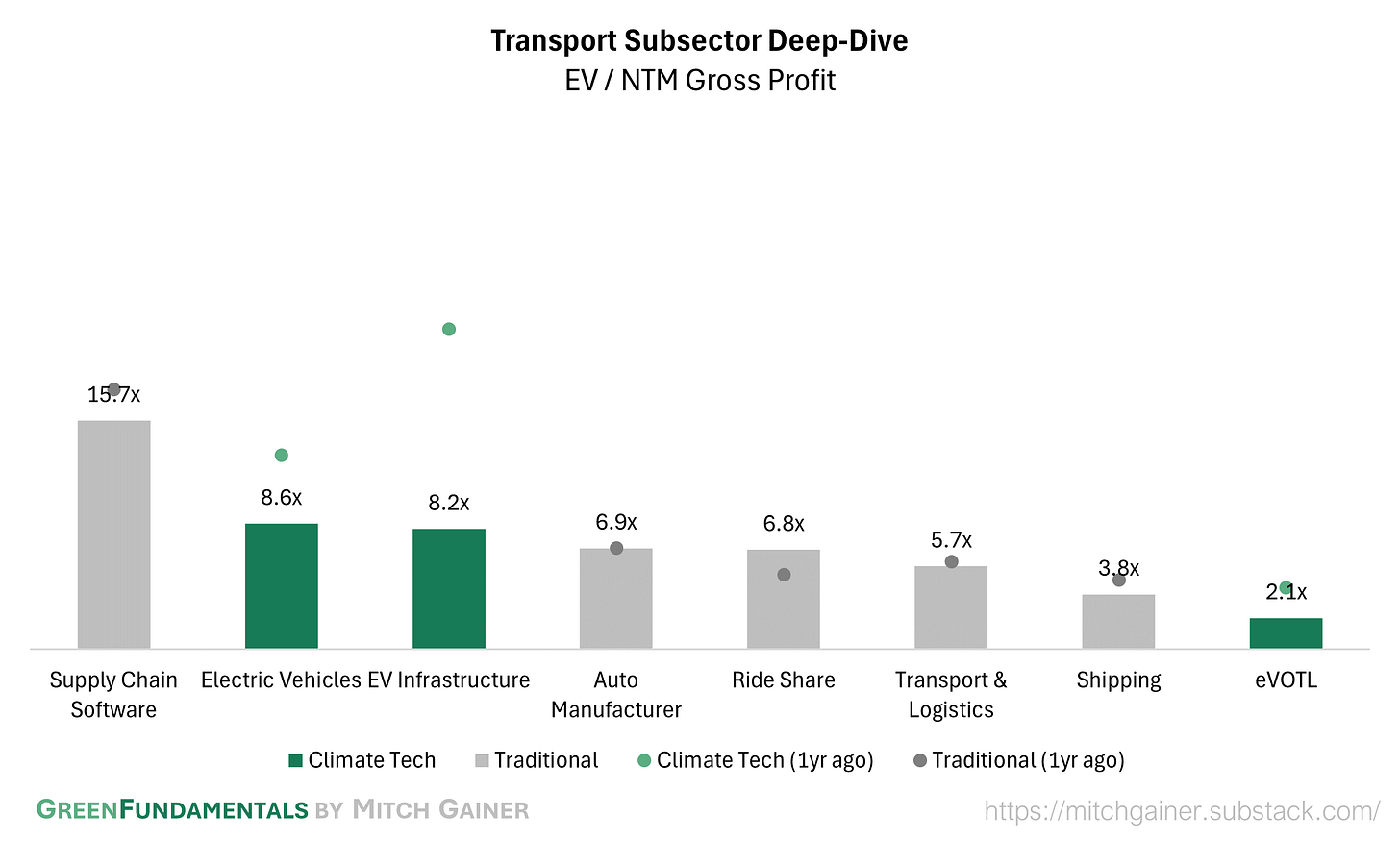

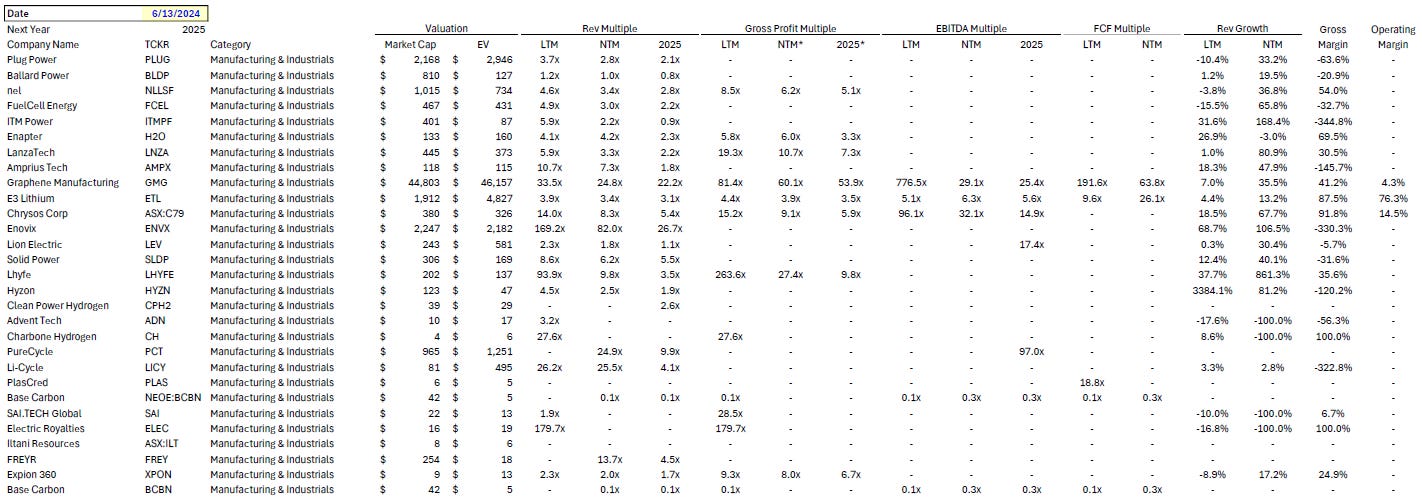

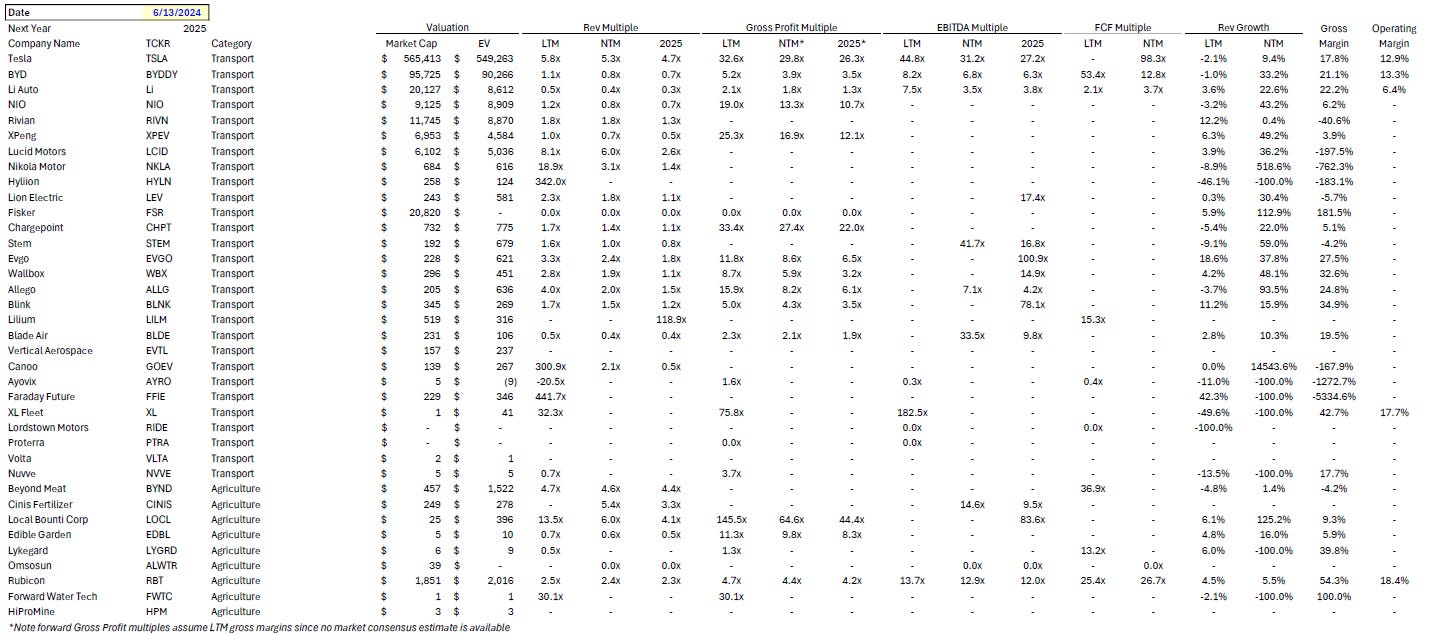

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium while energy management systems have increased in value; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

Manufacturing & Industrials: Hydrogen and recycling investments are commanding a premium again, though neither are trading nearly as high as they were a year ago.

Transport: EV growth is priced in to climate tech and traditional companies - though they have declined over the past year; the market is skeptical on eVOTL.

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.