Green Fundamentals: Bright Spots in 2024's Climate Tech Storm

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

The final newsletter of the year will include predictions for major events in 2025. Please participate by submitting your predictions below, which will be anonymized and used in next week’s post!

Operational Excellence, Market Fit, and Profitability Defined 2024’s Public Climate Tech Winners

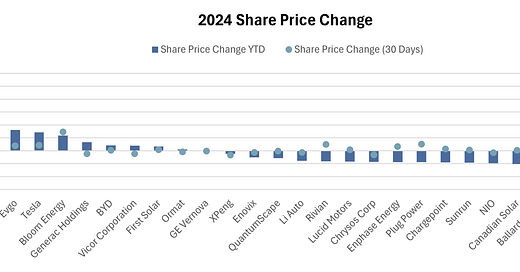

Very few Climate Tech companies outperformed the S&P this year. This newsletter tracks 87 publicly traded Climate Tech companies. 7 companies were acquired or went bankrupt this year. Only 16 companies currently have a market capitalization higher than at the start of the year - and only 8 outperformed the S&P 500.

Below, we dive into lessons learned from three standout winners with a market cap over $1B — PureCycle, Bloom Energy, and Generac Holdings—drawing insights for investors navigating the climate tech space. Tesla is in the top as well, but is excluded here because they are well covered elsewhere.

Source: CapitalIQ

PureCycle: Closing the Loop in Plastics

Market Context: The global polypropylene (PP) market is vast, with annual demand exceeding 170 billion pounds and projected to grow at a 3.5% CAGR through 2027. Despite PP’s ubiquity in products ranging from food packaging to textiles, less than 5% is recycled annually due to technical challenges in removing contaminants.

Technology: PureCycle Technologies (PCT) addresses this gap with patented solvent-based purification technology, offering ultra-pure recycled resin (UPR) as a viable alternative to virgin polypropylene. However, operational consistency remains critical to capturing this underserved market.

What Worked: Despite earlier delays, PCT has made tangible progress at its flagship Ironton facility, including:

Achieving a continuous run rate of 6,500 pounds per hour, a fourfold increase from early 2024.

FDA approval for food packaging applications, unlocking a lucrative market.

Demonstrating commercial applications with partners like Beverly Knits (for fiber production) and consumer products (e.g., fully circular stadium cups).

Exploring additional revenue streams from co-products, previously destined for landfills, now gaining interest from industrial buyers.

These advances reflect a significant leap toward commercial-scale operations, but consistent execution remains essential.

2025 Challenges: PureCycle faces operational and financial hurdles. Ironton’s inconsistent production and bottlenecks must be resolved to scale throughput and achieve profitability. With $25M in cash, a $39M quarterly burn, and significant facility upgrade costs, liquidity remains tight. While market demand for UPR is strong, revenue generation and cost competitiveness are unproven. Management’s history of missed timelines has strained investor confidence, making execution and transparency critical.

Bloom Energy: 24x7 Fuel Cells Blossom

Market Context: The rise of hyperscale data centers and industrial users is driving surging demand for 24/7 reliable power. Traditional power sources face scalability and environmental challenges, creating opportunities for Bloom Energy’s stationary solid oxide fuel cells (SOFCs), which run on natural gas, biogas, and hydrogen.

Technology: Bloom Energy Servers deliver low-emission, flexible power solutions, with a roadmap to increase biogas and hydrogen use. The company is also exploring long-term opportunities in green hydrogen production with solid oxide electrolyzers and marine applications.

What Worked: Bloom’s agreement with American Electric Power (AEP) for up to 1 GW of SOFCs validates its scalability for large energy users. Key achievements include:

Delivering an initial 100 MW order, with further expansion expected in 2025.

Cutting product costs by over 10% annually, expanding accessibility.

Growing international sales, led by South Korea.

These advances set the stage for revenue growth but underline operational and market challenges.

2025 Challenges: U.S. sales are geographically concentrated, and South Korea remains a critical market vulnerable to policy risks. The potential expiration of the fuel cell ITC in 2024 adds regulatory uncertainty. Financially, Bloom’s $1.1 billion in recourse debt and negative cash flow constrain further capital expansion. Success depends on diversifying the customer base, scaling production, and improving profitability through operating leverage.

Generac Holdings: Repowering a Legacy Business

Market Context: Generac is leveraging rising grid instability and climate-driven outages to strengthen its leadership in home standby (HSB) generators. Recent hurricanes have driven record power outages, boosting demand and awareness of energy security, positioning Generac to benefit from the shift toward distributed energy solutions.

Technology: Generac’s portfolio includes reliable and scalable HSB and portable generators. Its expansion into clean energy includes next-generation battery storage (PWRcell 2), microgrid controllers through Ageto, and EV charging integration via its Wallbox partnership, building a holistic energy technology ecosystem.

What Worked: Generac’s 2024 highlights include:

Residential Growth: HSB sales grew over 20%, driving a 28% year-over-year increase in residential sales.

Margin Expansion: Gross margins hit 40%, supported by favorable pricing and cost efficiencies.

Clean Energy Investments: PWRcell 2’s launch and a $120M DOE grant for Puerto Rico energy storage demonstrate clean energy progress.

These factors contributed to a revenue guidance increase to 7% for 2024, with continued growth expected into 2025.

2025 Challenges: Generac’s portfolio remains heavily reliant on residential generators, while commercial and industrial (C&I) sales are projected to decline by high single digits. The clean energy segment continues to weigh on margins, though improvements are anticipated with new product launches in 2025. Revenue is also highly sensitive to the frequency and severity of weather events. Despite these challenges, Generac’s core generator business underpins its profitability, positioning the company for market outperformance as it transitions into a broader energy technology leader with strong EBITDA and earnings growth expected.

Lessons for Investors: What Makes a Winner?

2024’s success stories illustrate the evolving criteria for investment in climate tech:

Solve Customer Pain Points: Address urgent challenges like 24x7 power reliability or decarbonizing hard-to-abate sectors with measurable solutions that drive demand.

Execute at Scale: Transition efficiently from pilots to full-scale production while maintaining operational reliability to build trust and competitive advantage.

Align with Macro Trends: Tap into structural growth drivers like data centers, distributed energy, and circular economies for long-term relevance.

Optimize Costs and Profitability: Achieve cost reductions and scalability to ensure financial sustainability, even without subsidies.

Adapt to Policy Shifts: Build resilient models that thrive with or without regulatory support to mitigate external risks.

By focusing on these principles, investors can identify and support the next wave of climate tech winners while mitigating risks inherent in high-growth, asset-intensive sectors.

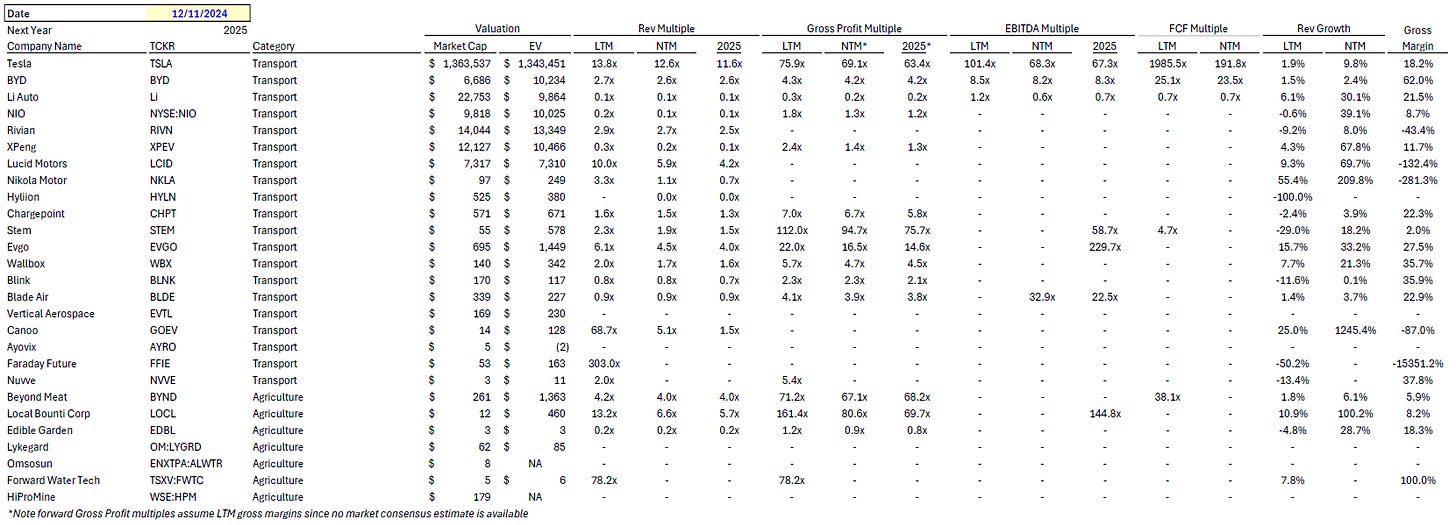

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

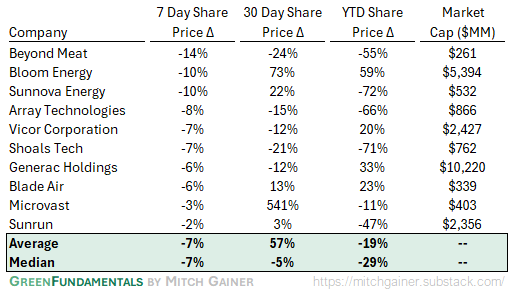

Top 10 and Bottom 10 Weekly Share Price Movement

Valuation Multiples over Time

Deep-Dive by Subsector

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.