Green Fundamentals: Cash Crunch Looms

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Cash-Short Climate Tech Companies Face Make-or-Break Q3, Offering Opportunity for Alert Investors

What Happened: As Q3 earnings calls approach, cash-strapped companies may face tough news ahead. While the Fed’s recent half-point rate cut has fueled optimism among Climate Tech investors, many companies that are not yet cash flow positive remain under significant financial pressure. Despite the upbeat sentiment around rate cuts, these companies are far from out of the woods. For those still burning cash, liquidity challenges persist as they navigate an increasingly difficult funding environment.

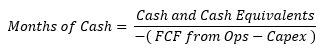

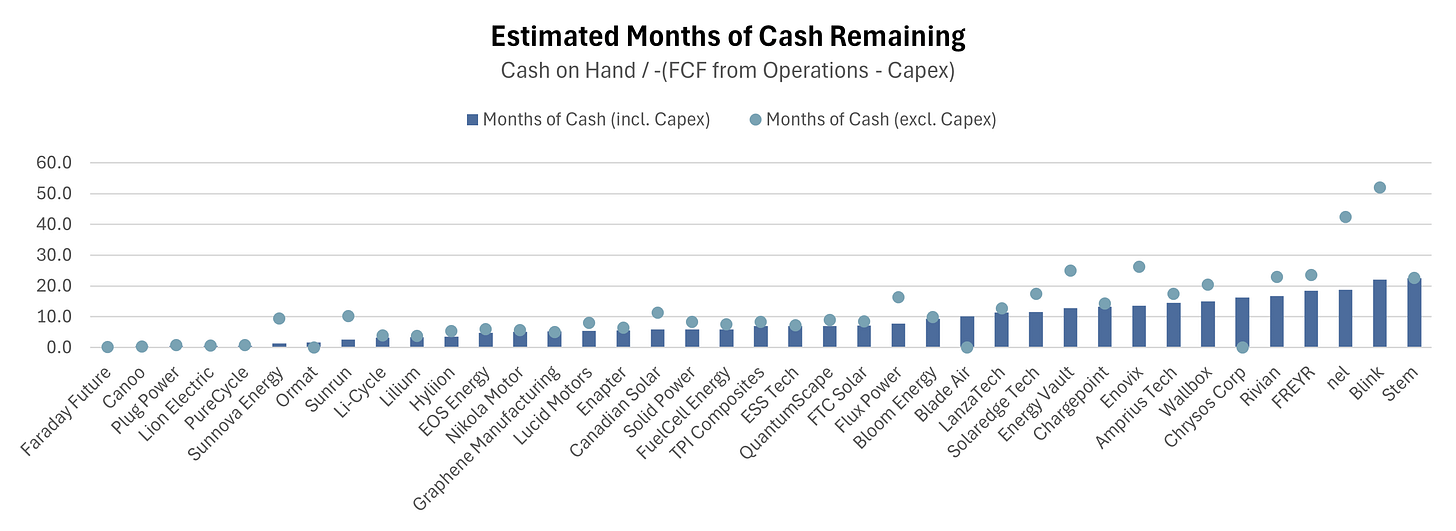

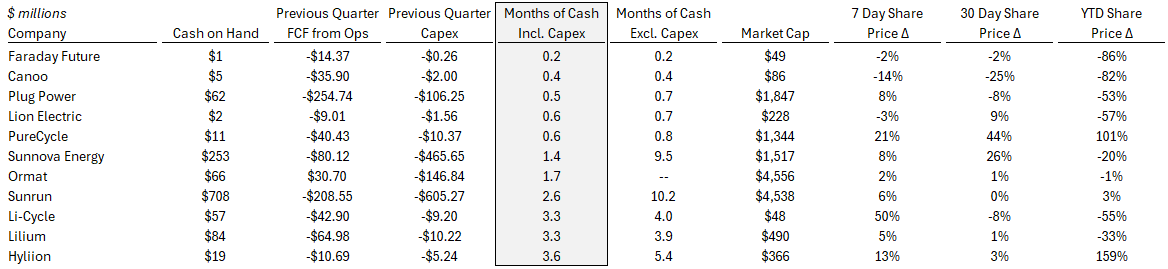

Background: Following Q2 earnings reports, it became clear that many Climate Tech companies are still struggling to achieve positive cash flow. A crucial metric for investors to watch is Months of Cash, which estimates how long a company can continue operating based on its current burn rate and cash on hand. Given the diversity of business models within Climate Tech, comparing companies on an apples-to-apples basis is challenging. However, one useful lens is to analyze cash flow from operations and capital expenditures (Capex), excluding financing and investing cash flows, which can cloud the picture.

Of the 87 publicly traded Climate Tech companies tracked in this newsletter, 36 have less than 24 months of cash, and 11 have less than 4 months. This excludes companies with market caps under $40 million, many of which are already facing challenges. These are the companies to watch closely during their upcoming earnings calls.

Source: CapitalIQ

Take-Away: Astute investors will find different ways to capitalize on these conditions, depending on their capital mandates. Hedge funds may uncover compelling multi-strategy opportunities within industries benefiting from strong tailwinds, such as pair trades or intra-sector long-short strategies. Private equity firms and lenders may explore take-private opportunities with significant recapitalization potential. Meanwhile, venture capitalists will seek out emerging leaders that are unburdened by the excesses of 2020-21, positioning themselves to outperform cash-strapped early movers.

What Comes Next: In response to dwindling cash reserves, many companies are taking drastic steps to extend their runway. Investors will notice widespread restructuring efforts, layoffs, recapitalizations, innovative debt strategies (e.g., equipment leasing), and dilutive equity fundraising (risking investor selloff).

Faraday Future appoints new CFO amid restructuring (Investing.com)

Canoo’s chief technology officer is out amid wider reorg (Tech Crunch)

Plug Power Fuels Sales Boom With $150M+ Equipment Leasing Strategy - What's The Benefit? (Yahoo Finance)

Lion Electric announces additional layoffs (Electrive)

PureCycle Technologies: Walking A Tightrope Amidst Execution Challenges (Seeking Alpha)

Sunnova Energy Huddles With Adviser on Balance Sheet Options (Bloomberg)

Ormat Technologies, Inc.'s (NYSE:ORA) Shareholders Might Be Looking For Exit (Simply Wallstreet)

Sunrun eyes USD 365m from new solar-storage securitisation deal (Renewables Now)

Li-Cycle to cut 17% of staff amid battery recycling growing pains (Reuters)

Lilium Secures Loan Guarantee From Bavaria (Aviation Week)

Hyliion spikes powertrain business and lays off 175 employees (Freight Waves)

Look for more difficult news to come in October and November as the cash crunch forces many companies to face the music.

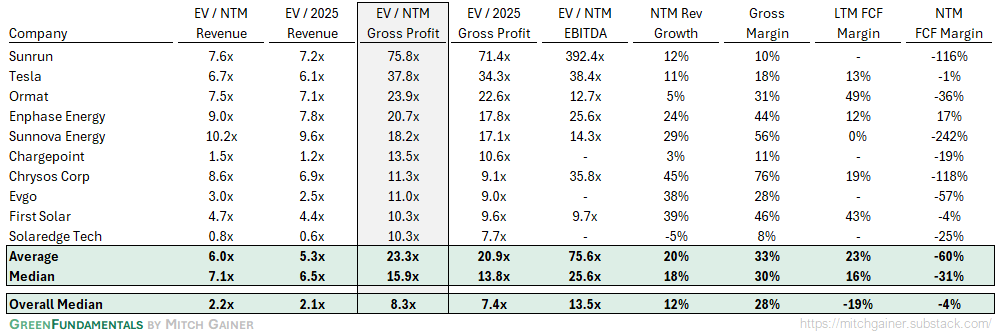

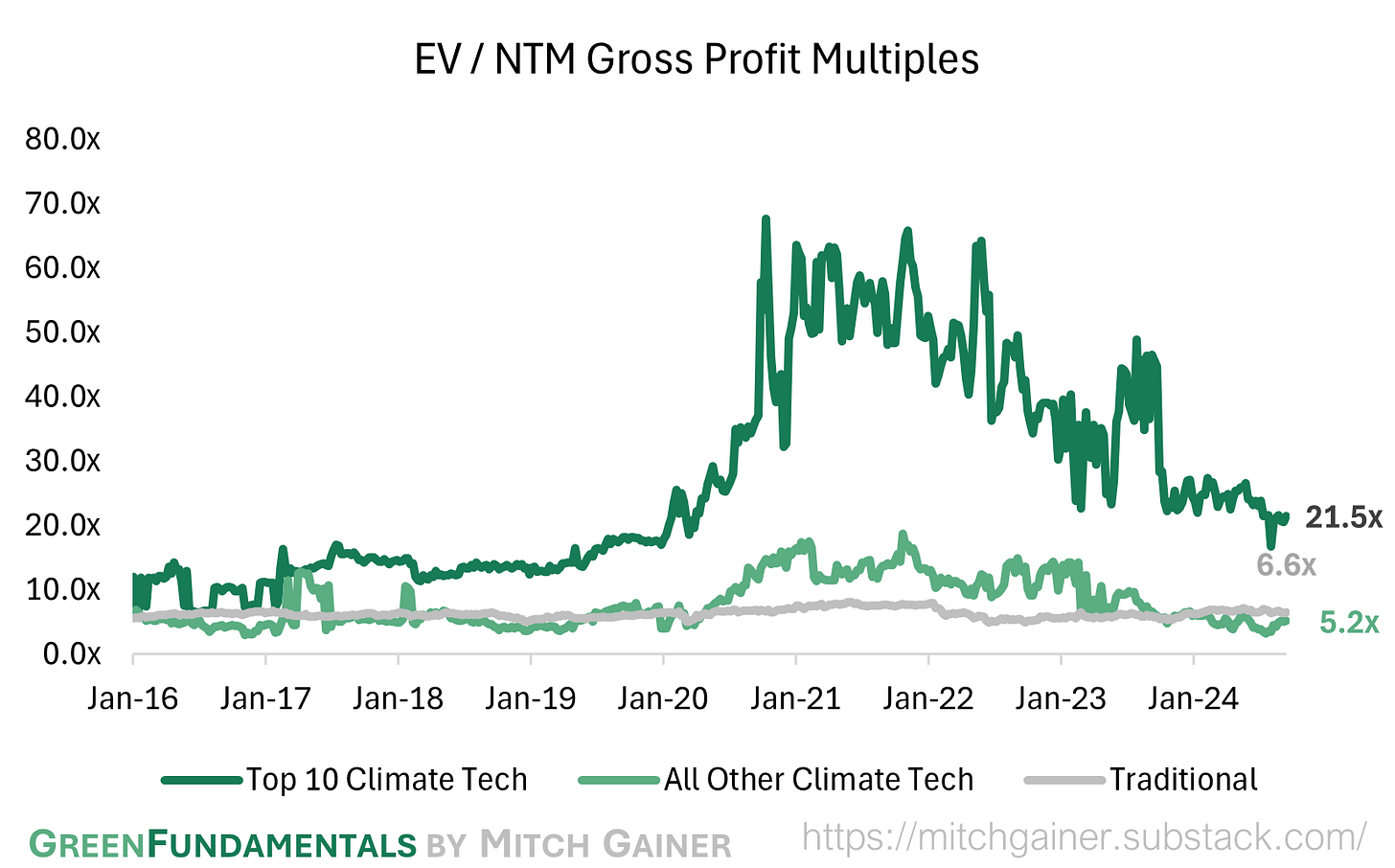

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

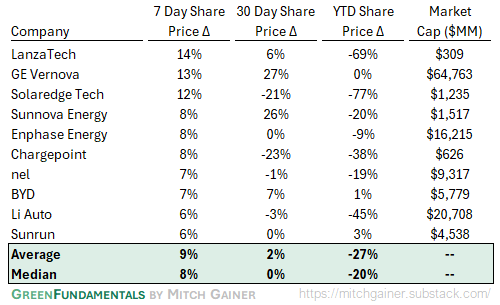

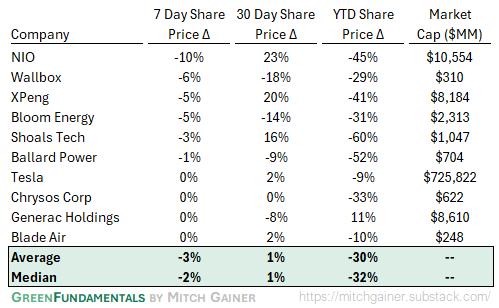

Top 10 and Bottom 10 Weekly Share Price Movement

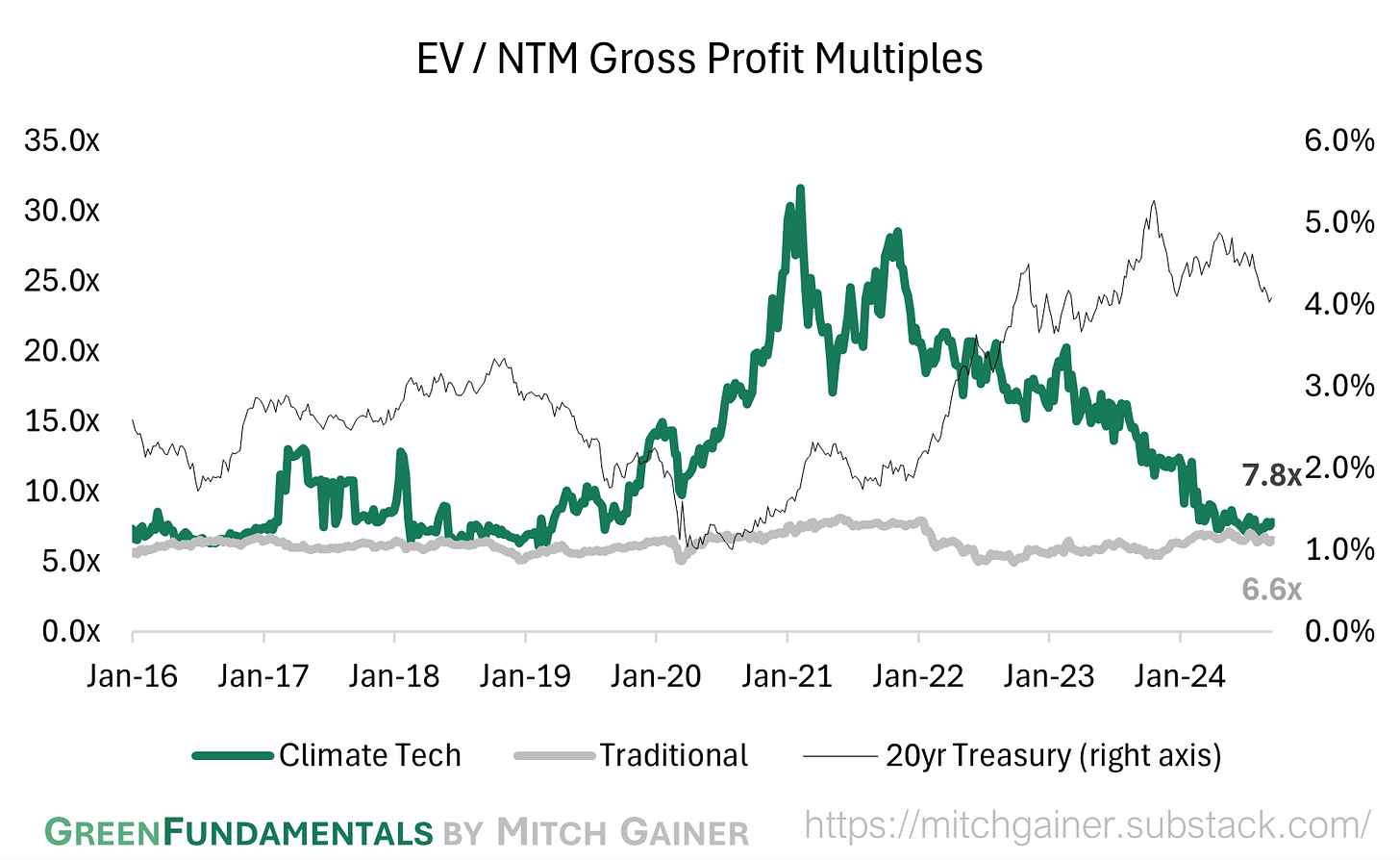

Valuation Multiples over Time

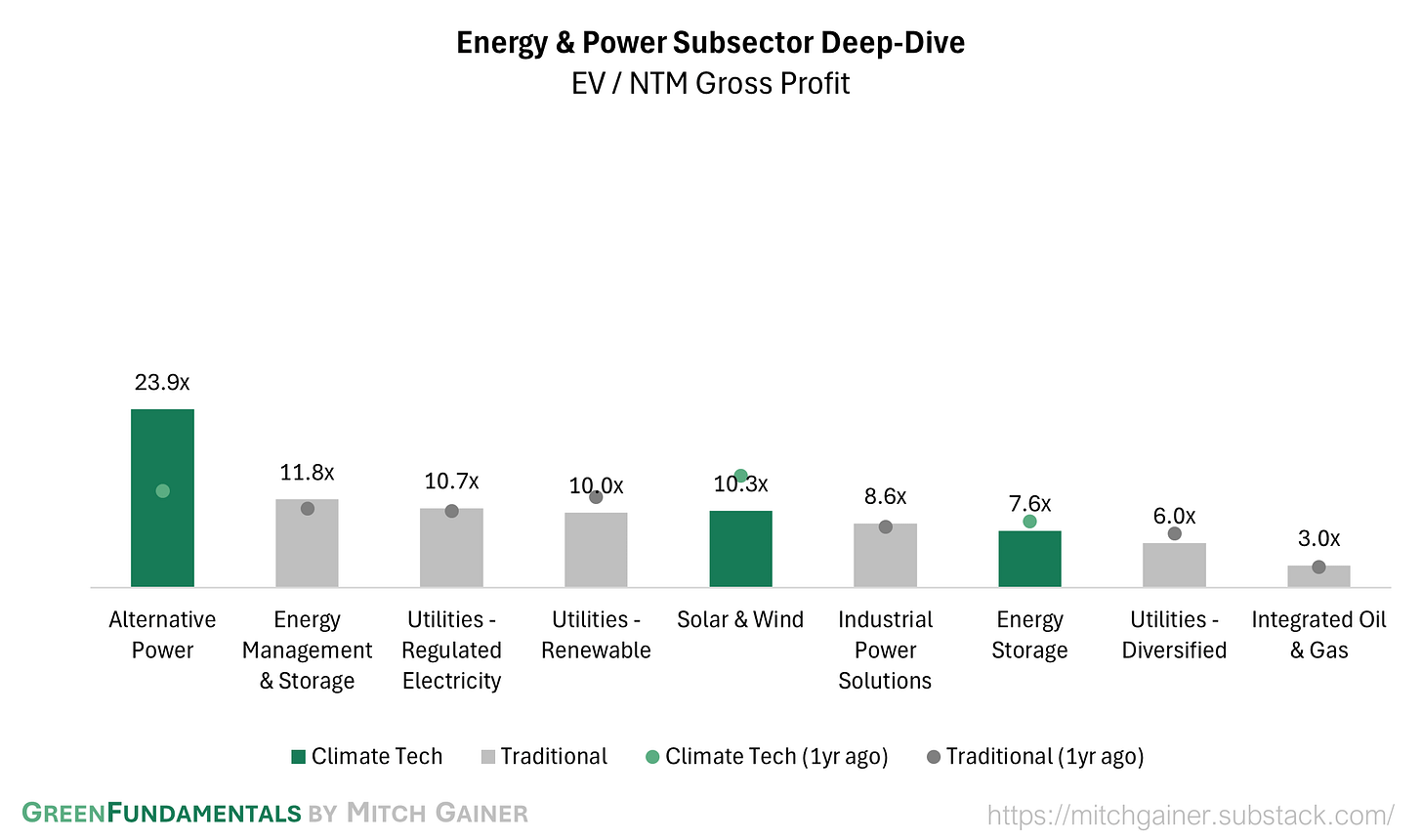

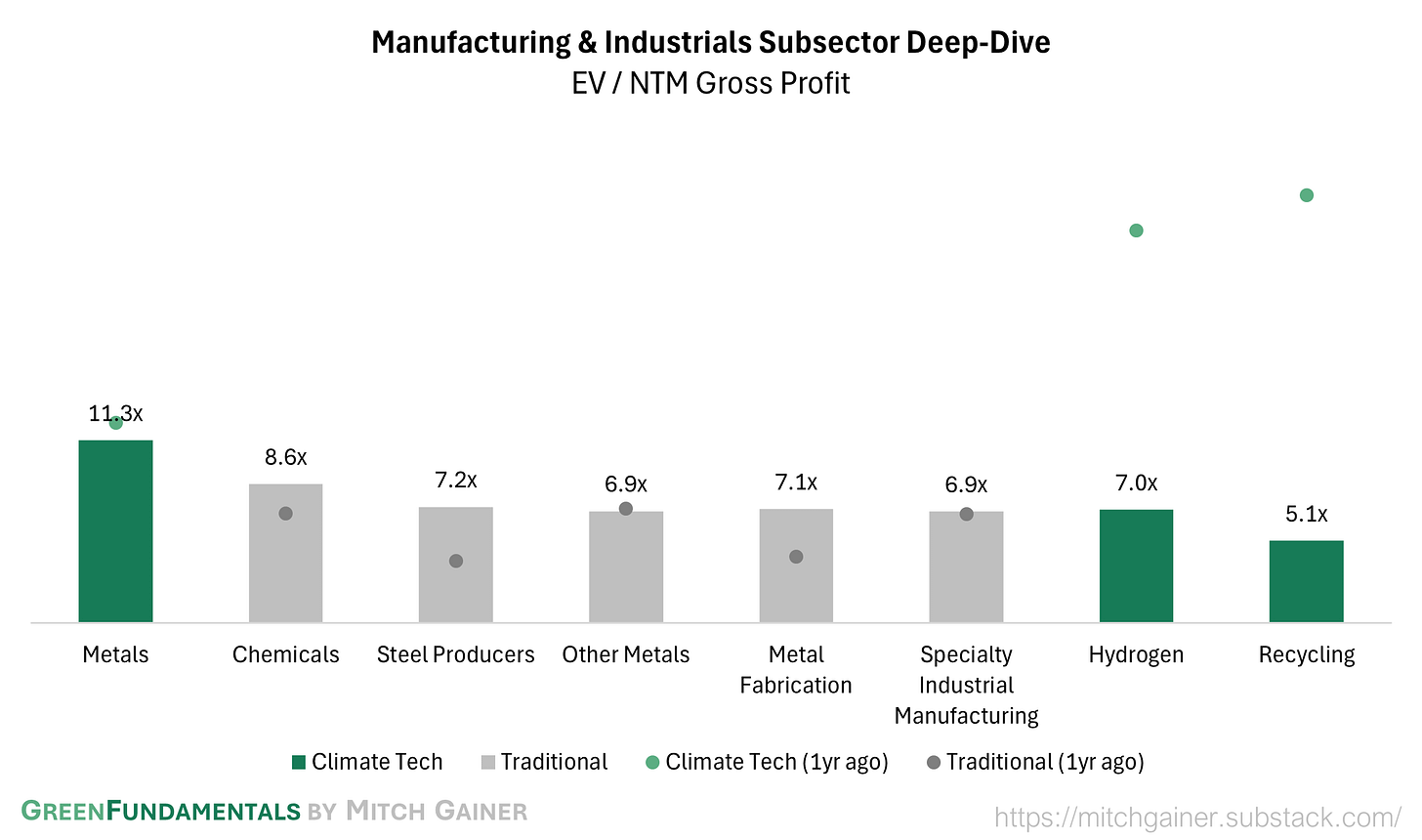

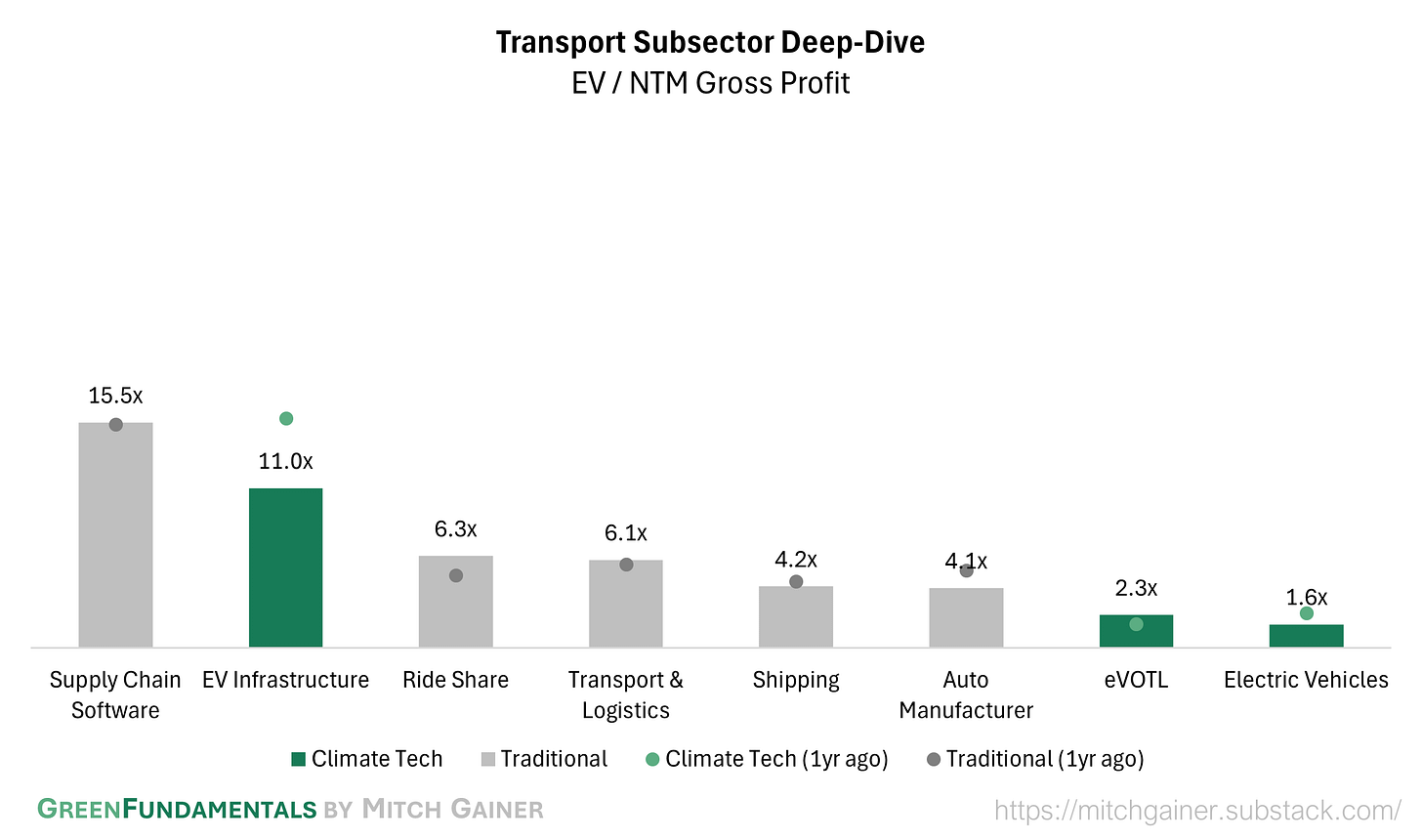

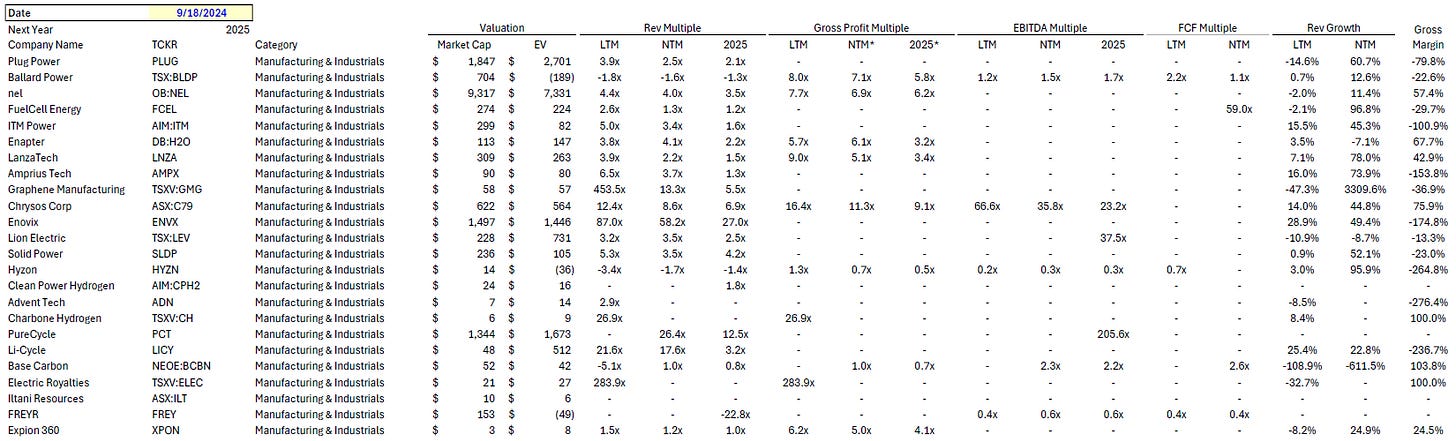

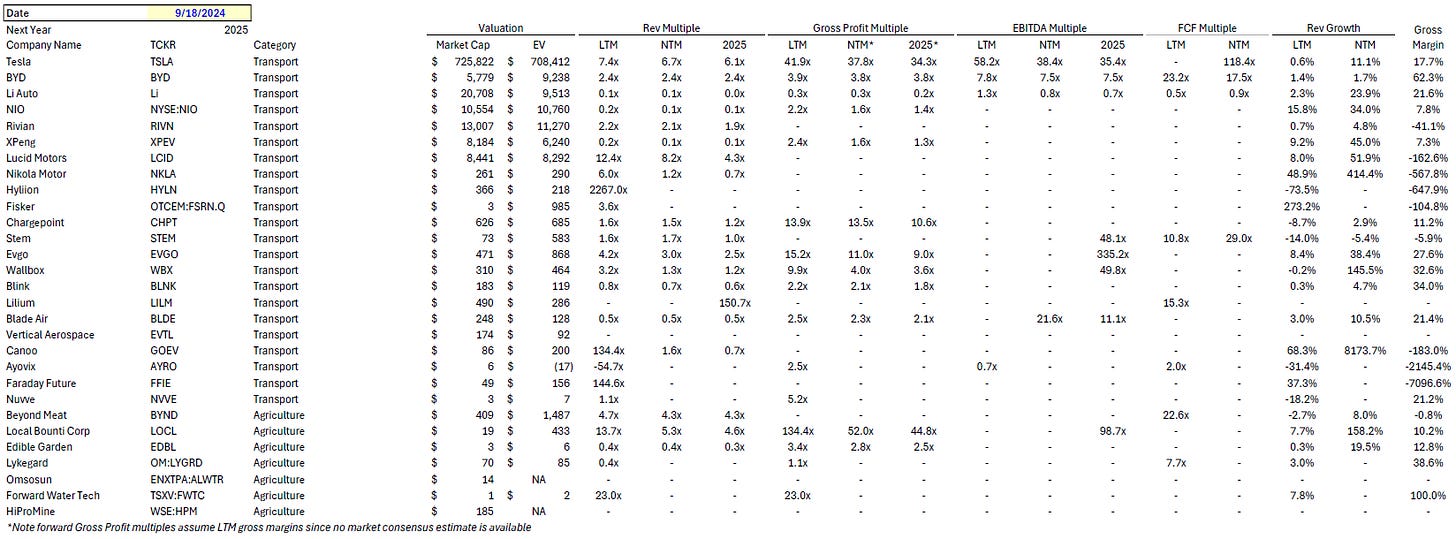

Deep-Dive by Subsector

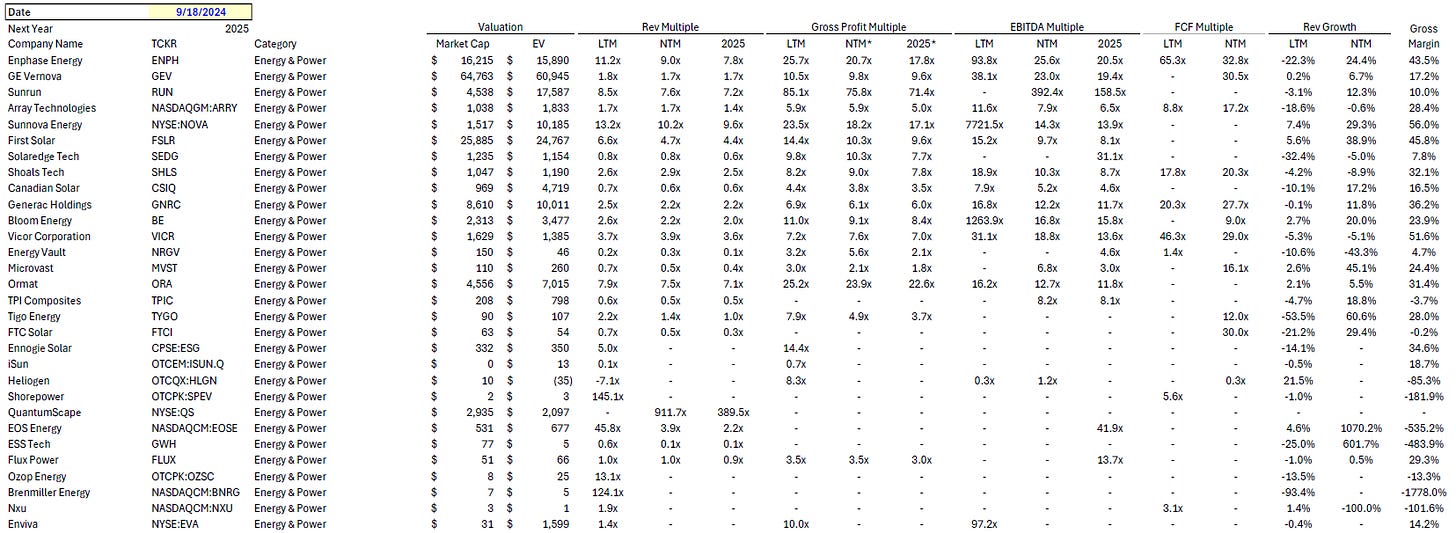

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.