Green Fundamentals: Charged Up with Private Cash

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Private investors have poured capital into public EV companies, despite poor performance

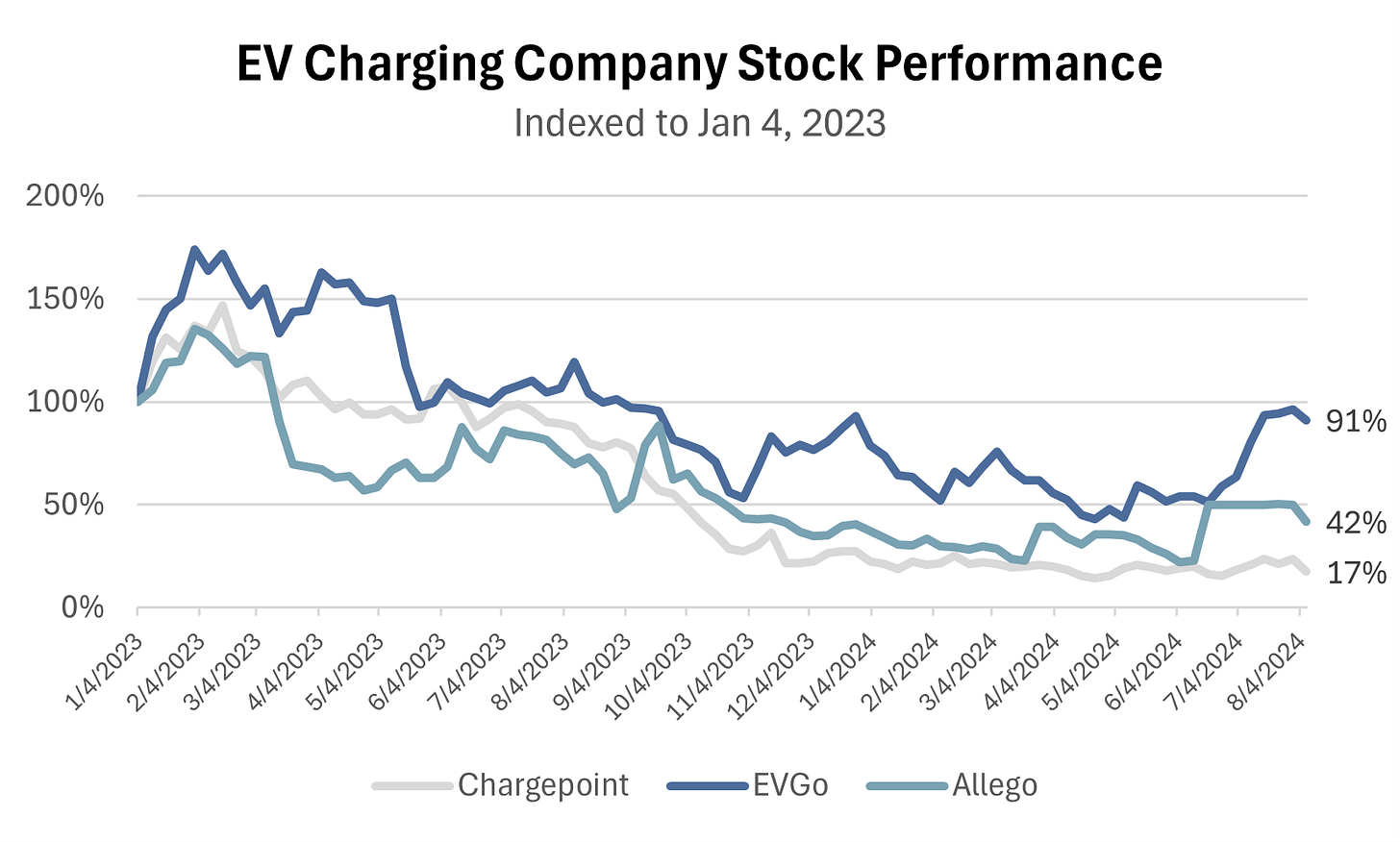

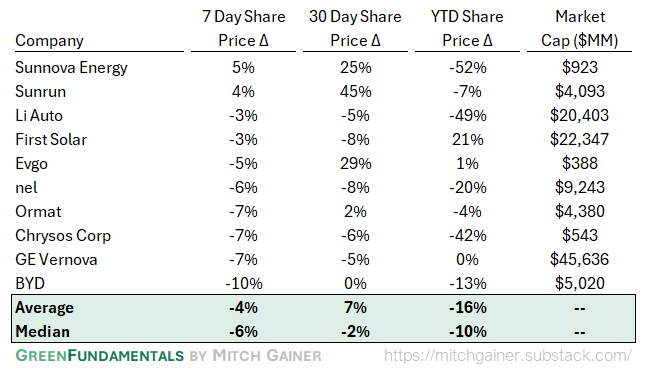

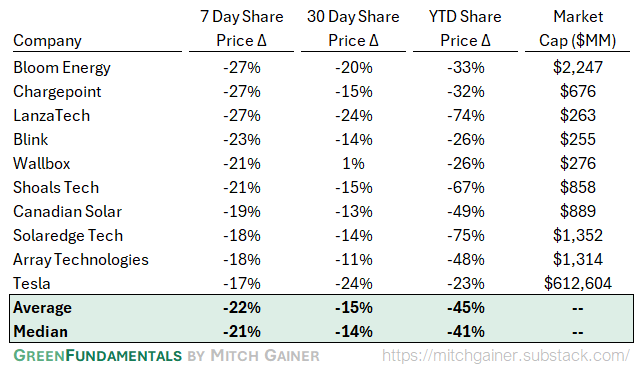

What Happened: In the past few months, stocks of EV charging companies have seen significant swings. Over the last 7 days, three of the top five largest price declines were held by EV charging companies ChargePoint (-27%), Blink (-23%), and Wallbox (-21%). Over the last 8 weeks, substantial increases have been achieved by EVgo (+69%) and Allego (+83%). Still, none of these companies have overcome the significant overall decline for the industry over the past few years.

Source: CapitalIQ

Over the past few months, public EV charging companies have become hotspots for private investors. Recent investments include:

February 2024: ChargePoint secured $232 million through an ATM offering and adjustments to existing convertible notes. This capital will support ChargePoint’s goal of achieving adjusted EBITDA profitability by the fourth fiscal quarter of 2025.

June 2024: Meridiam invested 356 million euros in Allego, facilitating a delisting from the NYSE. This move is aimed at providing more favorable financing options and a more efficient capital structure for Allego.

Background: The EV charging infrastructure market has experienced tremendous growth over the past three years. Globally, the number of public charging points has increased substantially, with major markets like the U.S., Europe, and China leading the charge. This growth is fueled by the rising sales of EVs, which hit a record high in 2023 with nearly 10 million units sold worldwide. Investments from both private and public sectors have poured into the industry, aiming to expand charging networks and improve technology. Still, underutilization of existing charging networks, a mismatch of in-demand fast chargers vs. all others, and slowing EV adoption have presented significant headwinds for the industry.

Source: McKinsey & Company

Despite the impressive growth, the EV charging infrastructure sector continues to face a ‘chicken and the egg’ problem. High capital expenditure is a significant barrier, as establishing and maintaining a wide network of charging stations requires substantial investment. Regulatory hurdles across different regions add complexity to expansion efforts, with varying standards and requirements that companies must navigate. Additionally, technological standardization remains a critical issue, as compatibility between different EV models and charging stations is essential for seamless operation. The industry has also seen players like Volta, Better Place, and ECOtality fail due to financial mismanagement and an inability to scale efficiently, highlighting the risks associated with the sector.

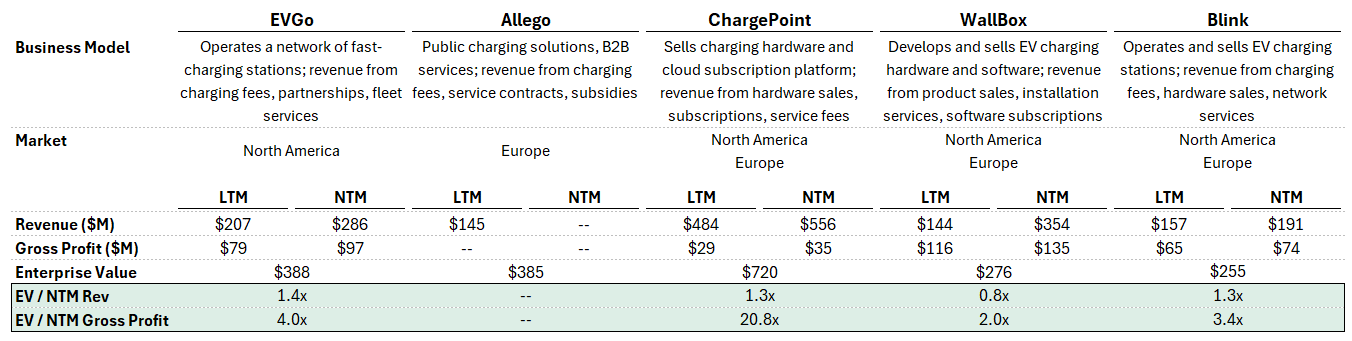

Companies making and operating EV charging infrastructure are taking different approaches across different markets.

ChargePoint has leveraged its first-mover advantage to establish a large network and strategic partnerships, enhancing its market presence.

Allego focuses on the European market, backed by significant private equity investment to drive its expansion.

EVgo has capitalized on its extensive presence in the North American market by building one of the largest fast-charging networks in the U.S., supported by strategic partnerships with major automakers and rideshare companies.

WallBox has rapidly expanded its global footprint with a strong emphasis on innovative home and workplace charging solutions.

Blink has diversified its market presence across North America, South America, and Europe, leveraging strategic investments and partnerships with municipalities, healthcare providers, and property developers

Source: Company websites and SEC filings

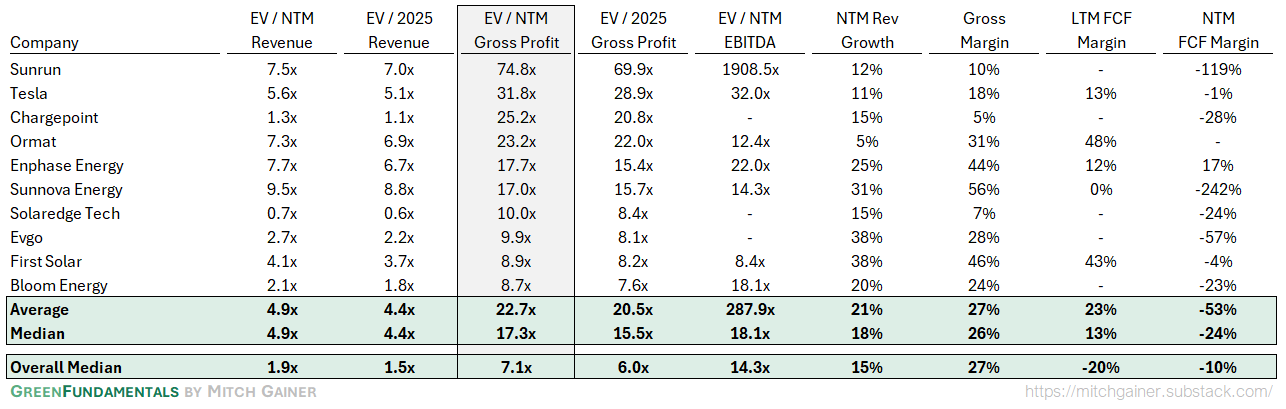

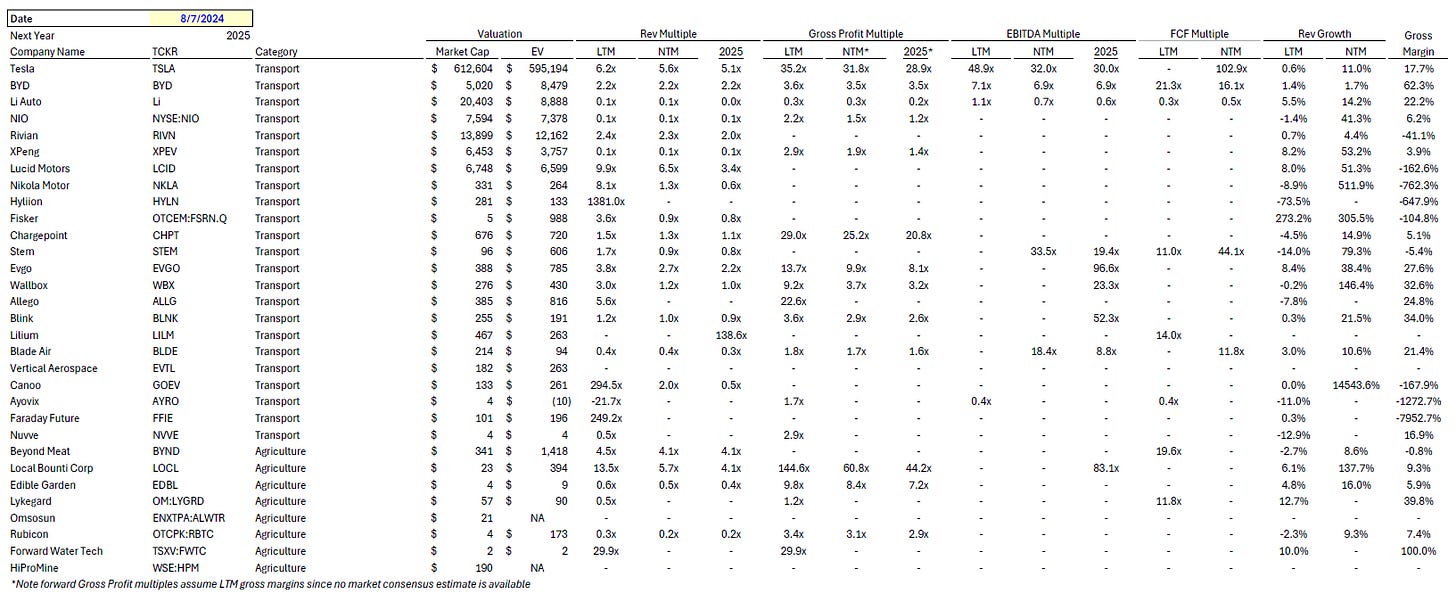

Take-Away: Private capital is playing a crucial role in the expansion and sustainability of EV charging infrastructure. While the market seems to value ChargePoint at a significant premium relative to current growth forecasts (20.8x NTM Gross Profit!), today the valuations of EVgo and Allego are quickly gaining ground (and may have more room to grow for new investors).

What Comes Next: The EV charging sector presents a compelling investment opportunity for private capital. Companies like ChargePoint, Allego, and EVgo are at the forefront of this transformation, poised to benefit from the growing demand for electric mobility and the necessary infrastructure to support it. Investors should anticipate:

Increased Investment: Continued influx of private capital to support the expansion and enhancement of charging networks.

Technological Innovations: Development of faster and more efficient charging solutions, including ultra-fast chargers and wireless charging.

Regulatory Support: Government policies and incentives will play a crucial role in accelerating the deployment of EV charging infrastructure.

Strategic Partnerships: Collaborations between automakers, tech companies, and charging network operators will drive innovation and market penetration.

Gaining one or all of these benefits could determine the overall winner (or winners) of the space. Recent share price volatility underscores that the winner in this space is not yet determined.

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Hydrogen: New nanomaterials could boost hydrogen production for clean energy (PhysOrg)

Cow Methane: Pioneering Cattle Methane Vaccine Project Launched with $9.4M Grant from Bezos Earth Fund (Bezos Earth Fund)

Lithium: World’s biggest lithium producer urges state help to compete with China (FT)

Private Markets (PE / VC / Real Estate / Infra)

Solar & Wind: Solar and wind overtake fossil fuels in ‘historic’ first for Europe (The Independent)

Wind: New England’s Offshore Wind Resource Is A Winter Powerhouse (Clean Technica)

Energy Storage: Sineng Electric to supply energy storage solutions for sodium-ion BESS project (Energy Storage News)

Energy Storage: Arevon puts 800MWh California BESS into operation (Energy Storage News)

Public Markets (Stocks, Bonds)

Energy: Carlyle to sell power producer Cogentrix Energy in $3bn deal (FT)

Solar: Sunrun sees market opportunity after SunPower files for bankruptcy, company's shares surge (CNBC)

Electric Vehicles: No longer propelled by Tesla, the EV industry retreats faster (The Information)

Government & Policy

DOE: Georgia’s first-of-its-kind solar plant getting $1.45B federal loan (Atlantic Journal Constitution)

DOE: Biden admin announces $2.2B in grants to boost US power grid (Canary Media)

EPA: EPA announces nearly $160M to cut construction emissions (Construction Dive)

California: Why Californians Have Some of the Highest Power Bills in the U.S. (WSJ)

China: China Is Rapidly Building Nuclear Power Plants as the Rest of the World Stalls (Bloomberg)

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

Top 10 and Bottom 10 Weekly Share Price Movement

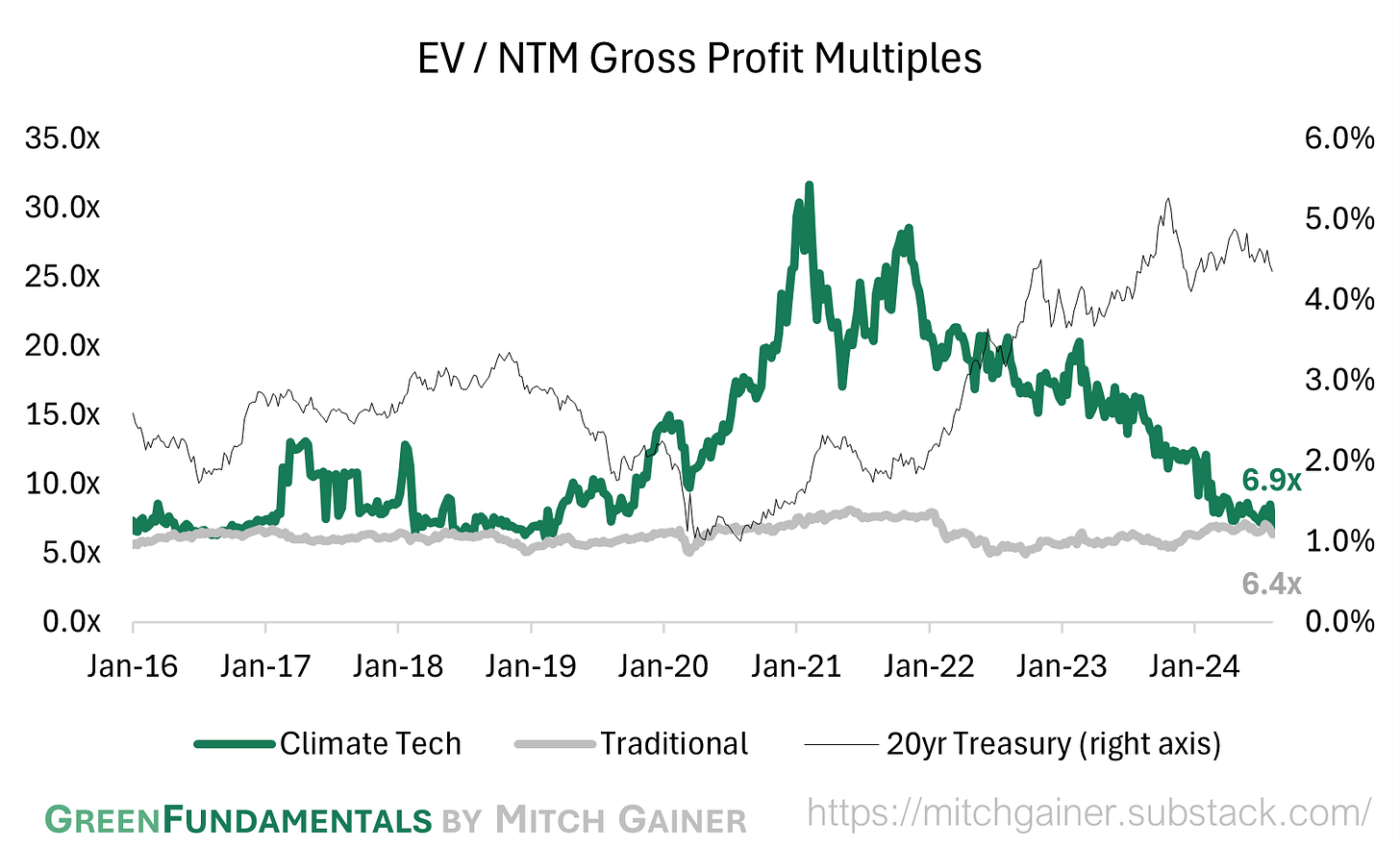

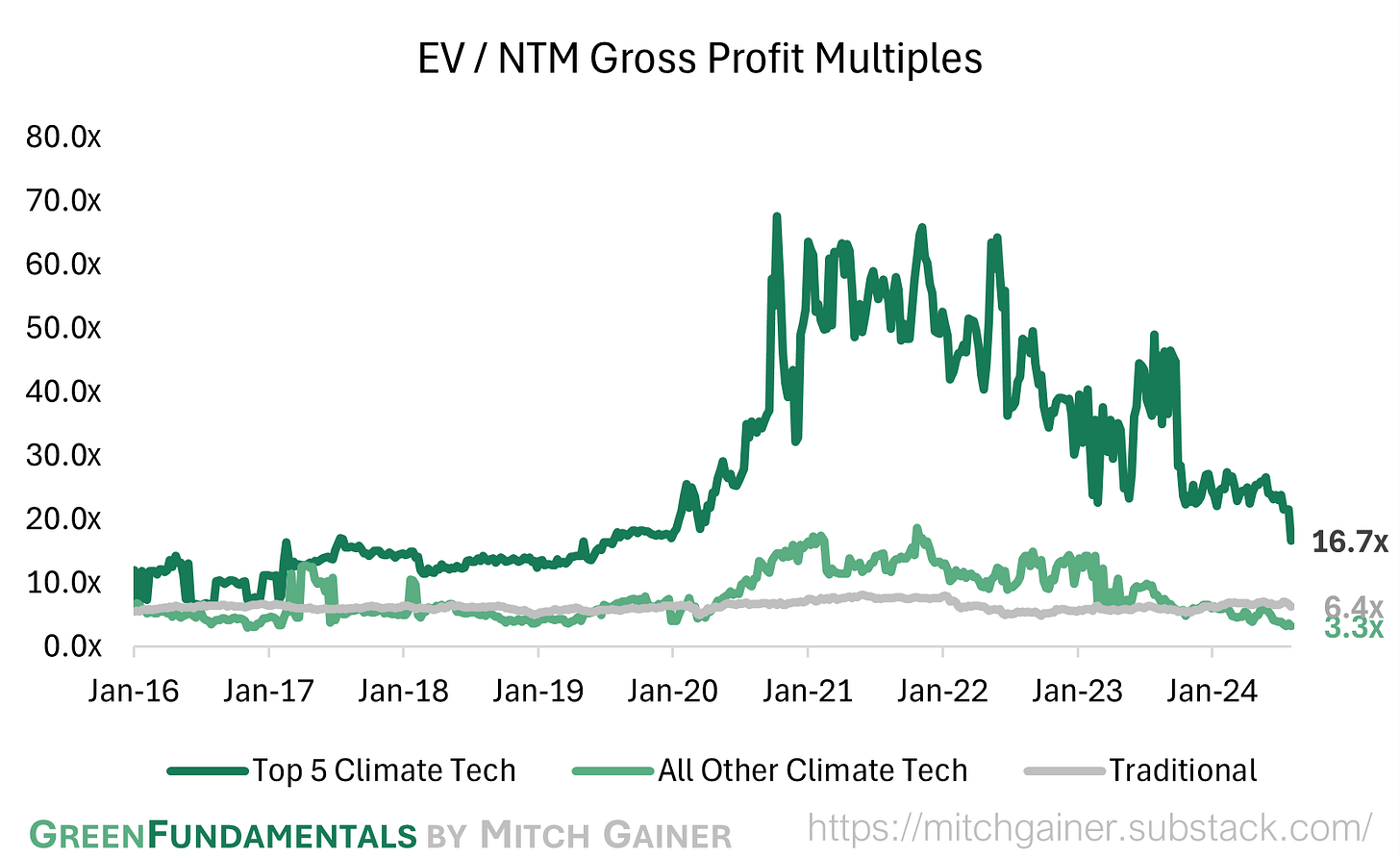

Valuation Multiples over Time

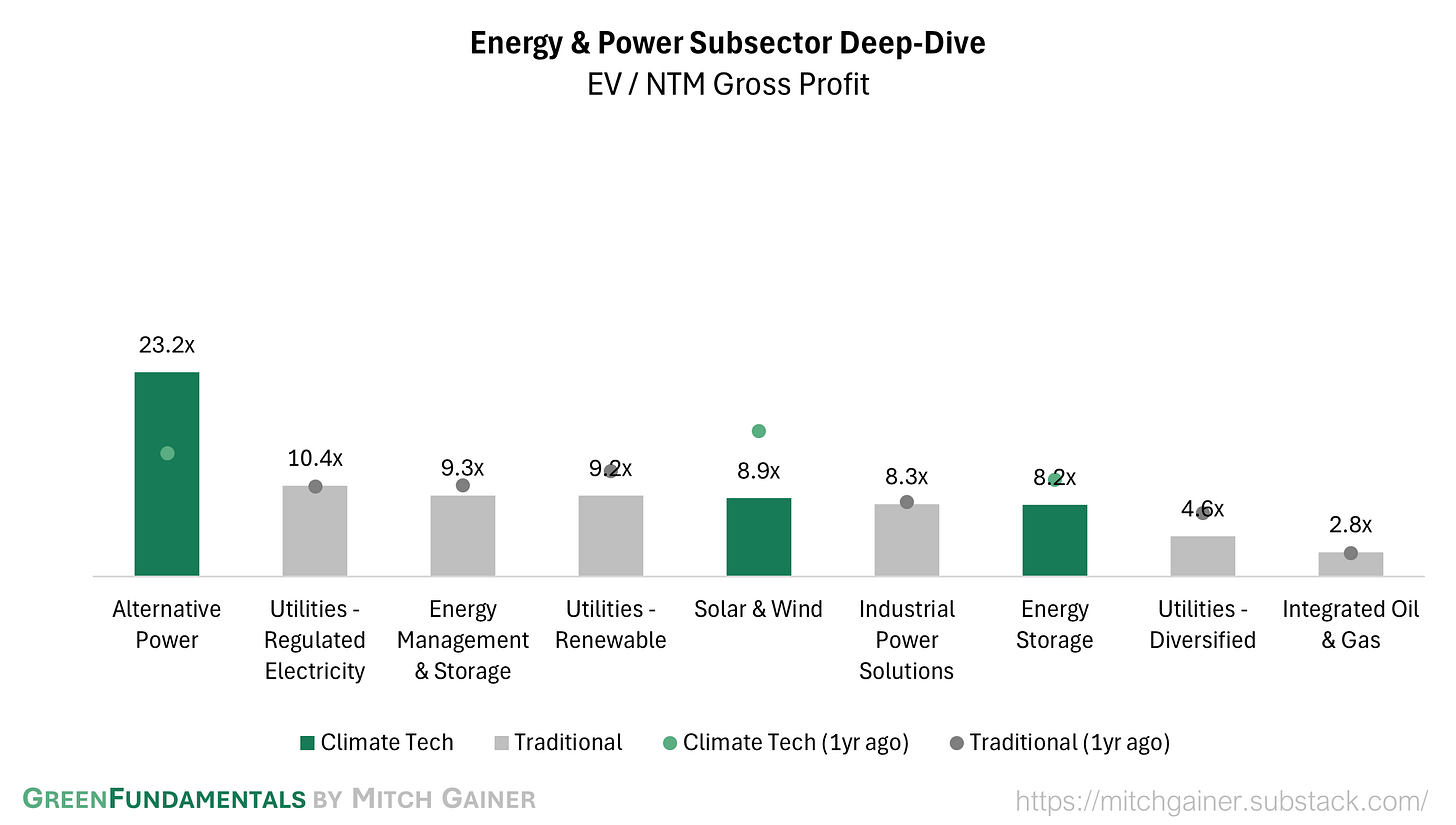

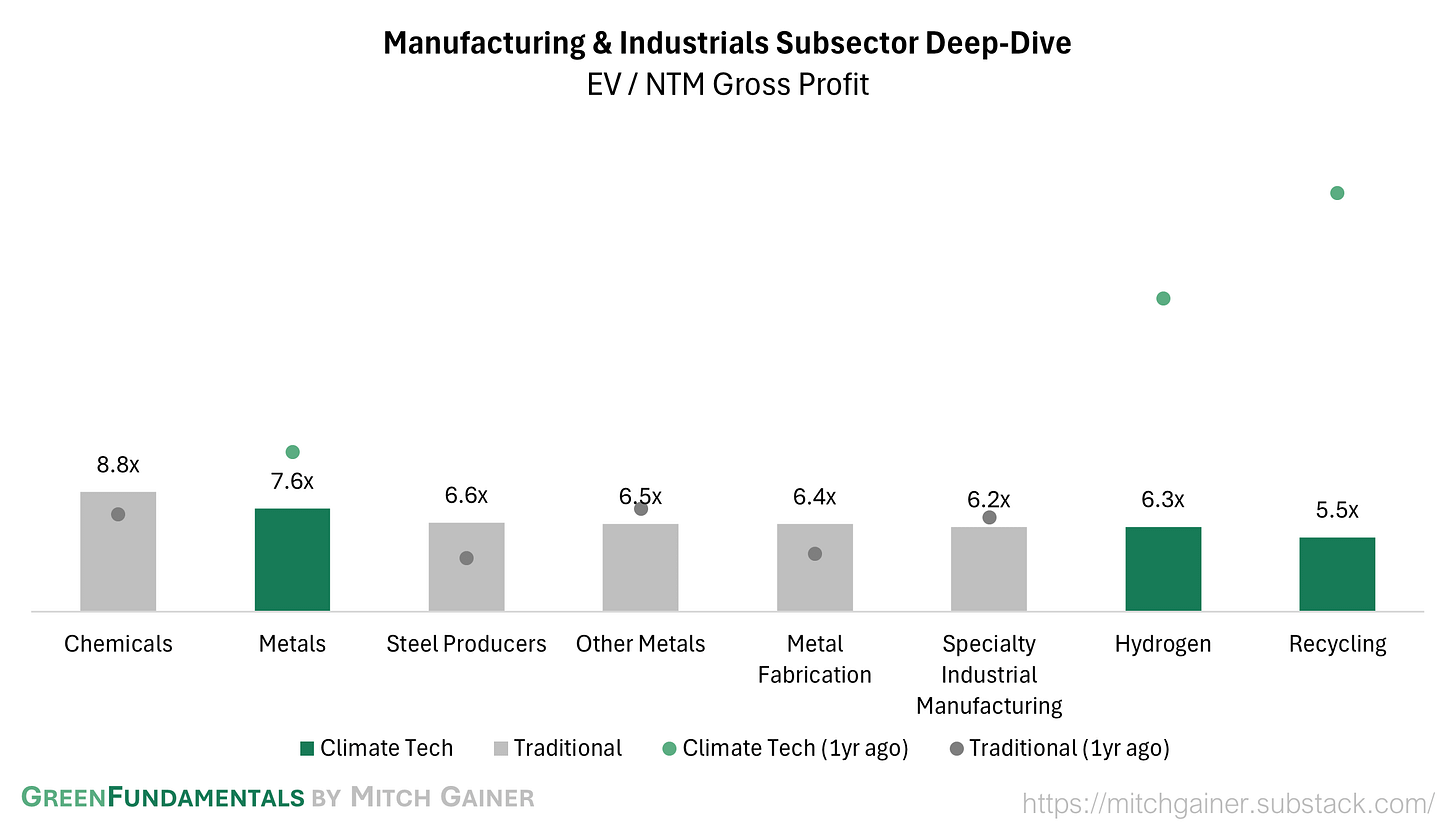

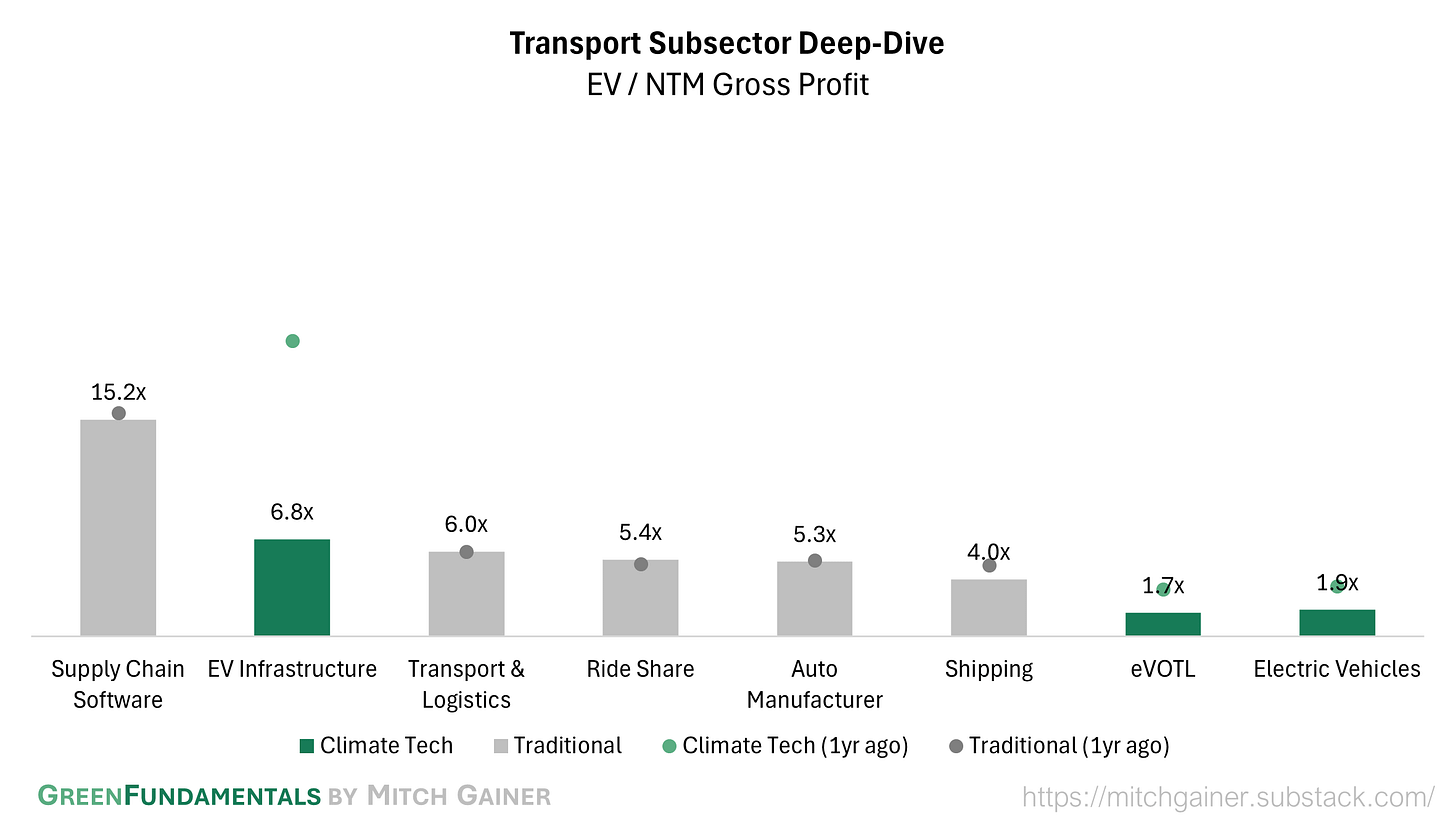

Deep-Dive by Subsector

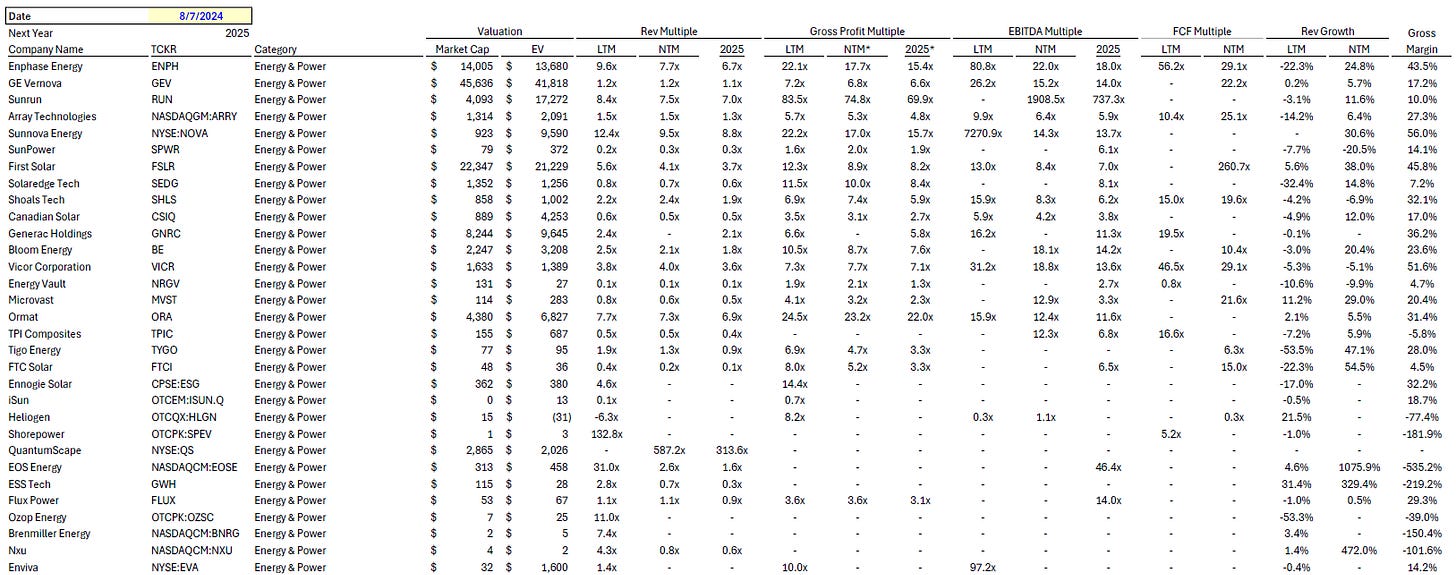

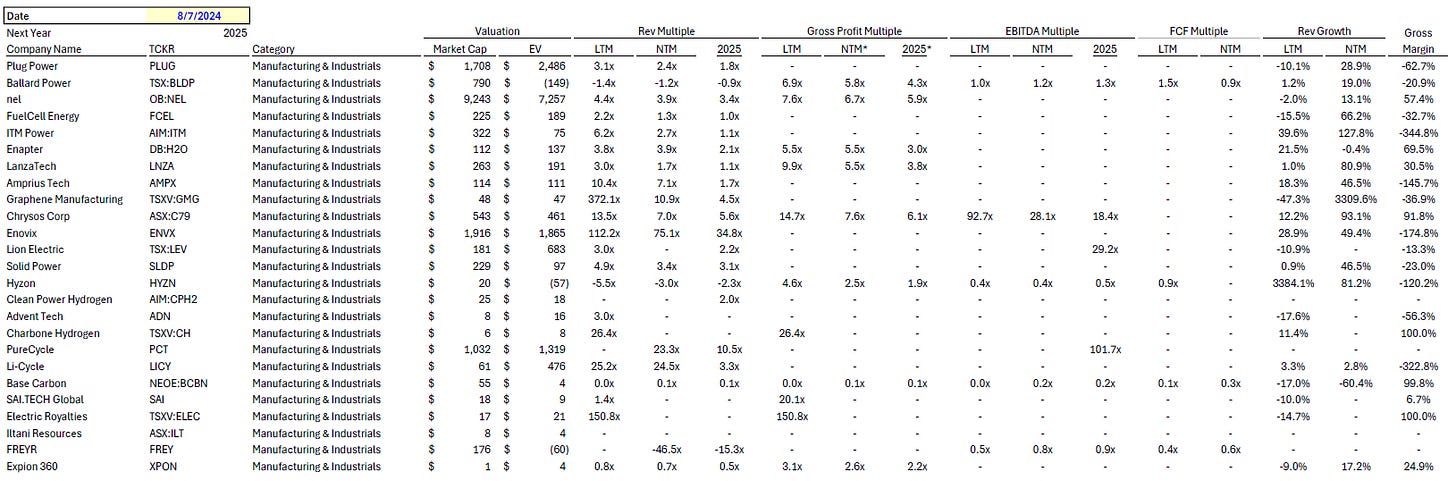

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.