Green Fundamentals: Enphazed and Confused

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

This post and the information presented are intended for informational purposes only. They reflect solely the personal opinions of the author in his individual capacity. They do not reflect the views or opinions of any current, past, or future employer, organization, or affiliate.

Enphase remains best-in-class, but without policy clarity or supply chain relief, the market’s steep discount reflects real risk

On May 22, 2025, Enphase Energy (NASDAQ: ENPH) experienced a significant share price decline of 19.6%, closing at $38.01. This drop followed the U.S. House of Representatives' passage of a tax bill that proposes substantial rollbacks to clean energy tax credits established under the Inflation Reduction Act (IRA).

These developments inject new policy risk into an already fragile operating environment for residential solar. Investors should closely monitor the Senate's response to the House bill, as any modifications could significantly influence the company's financial outlook and stock performance.

What They Do

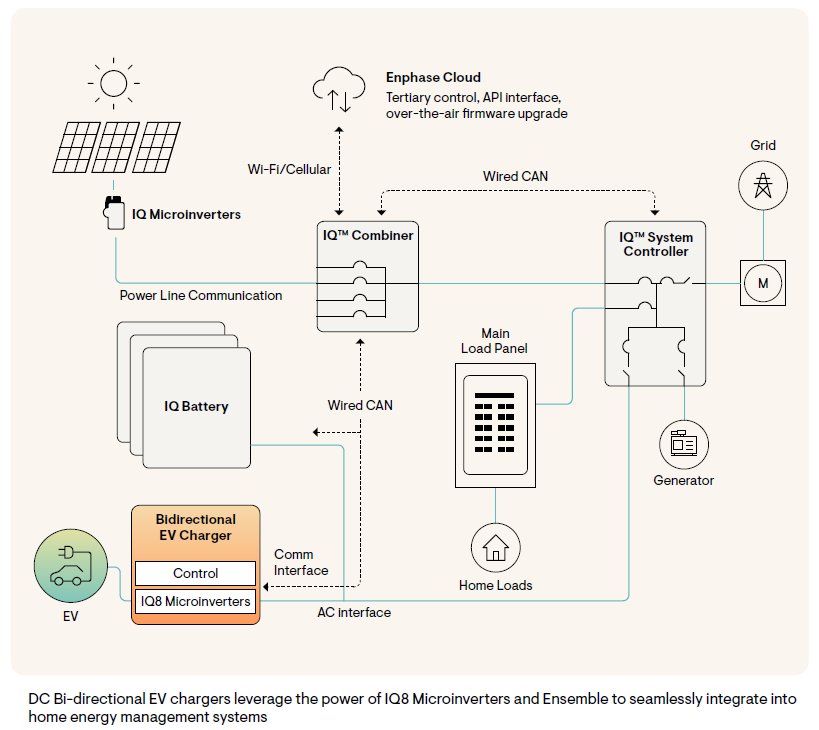

Enphase Energy (NASDAQ: ENPH) makes the “brains” of rooftop solar systems: microinverters that convert DC to AC electricity at the panel level. This architecture is safer, more resilient, and more precise than traditional string inverters, which convert power for an entire array at once. For U.S. residential installers—especially in markets like California and New York—Enphase has become the default premium brand.

Over the past five years, the company has expanded into home energy systems: pairing solar with LFP batteries, EV chargers, and a slick mobile app that lets homeowners monitor and manage their power. Enphase aims to be the one-stop shop for distributed electrification, offering installers a full stack: inverters, storage, software, and service.

That pitch worked brilliantly during the rooftop solar boom. In 2022 and 2023, Enphase posted high-30s EBITDA margins and generated $726 million in adjusted EBITDA on $2.3 billion of revenue. Investors gave the company a premium multiple—and for a while, it looked deserved.

Source: Enphase Annual Report 2024

What’s Changed

Three headwinds have broken the Enphase growth thesis: tariffs, interest rates, and policy risk.

First, Trump-era tariffs on Chinese LFP battery cells have shredded margins in Enphase’s growing storage business. The company sources 95% of its battery cells from China. As of Q2 2025, that exposure is cutting gross margins by 200 basis points, and will climb to 600–800 basis points in Q3. The company has raised prices slightly, but it is eating most of the impact to preserve volume and loyalty.

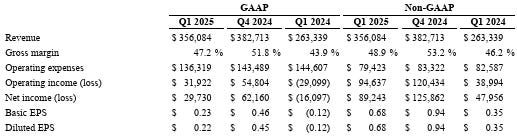

Second, U.S. residential solar demand remains soft. Financing costs are high, installer liquidity is stretched (Sunrun and Sunnova both under pressure), and consumer sensitivity to price is rising. Enphase beat Q1 revenue expectations at $356 million, but still guided flat for Q2, with lower inverter volumes and storage shipments barely offsetting macro weakness.

Finally—and most critically—the U.S. House just passed a bill that would repeal key parts of the Inflation Reduction Act, eliminating the 30% Investment Tax Credit for leased residential solar after 2025. That’s a direct hit to Sunrun and similar players, but Enphase will suffer collateral damage. Why? Because lease providers make up a meaningful share of its customer base—and without the ITC, many third-party systems just won’t pencil.

IRA Repeal: The Real Risk

Investor sentiment around rooftop solar was already fragile amid elevated interest rates, but the House bill introduced a new and material policy shock. Here’s what it does:

Ends ITC eligibility for third-party-owned residential systems (leases and PPAs) after 2025

Accelerates the phaseout of most clean energy credits to 2028

Requires projects to start construction within 60 days of enactment

While the bill still needs to pass the Senate, analysts are already pricing in a material downside. Morningstar expects 25–50% reductions in rooftop solar valuations if the bill becomes law. Enphase would fall on the lower end of that range—but even there, the drop is meaningful.

The broader context is bleak: rooftop solar is inherently harder to finance, deploy, and operate than utility-scale. Policy risk doesn’t just affect tax equity markets—it changes customer paybacks. If a rooftop system loses 30% of its capital subsidy, demand disappears unless pricing adjusts—putting margin pressure on every vendor in the value chain.

Financial Snapshot

Source: Enphase Earnings Call

Enphase has no dividend, minimal capex (~$78M), and a strong balance sheet. But its storage segment, which now makes up ~25% of hardware revenue, is facing intense margin headwinds—just as volumes are ramping.

What the Market Thinks

The market has slashed Enphase’s valuation by over 65% from its peak:

Share price: $47.29 (May 2025), down from $141.63 in late 2023

Fair value: $50 (Morningstar), $50 (HSBC), both cut from $60–75

Price/Fair Value: 0.95 — slightly undervalued, but not capitulated

Stock reaction to House bill: -15%, inline with other rooftop names

This bifurcation highlights a key investor lesson: policy granularity matters. Not all solar is created equal—and when Congress pulls a lever, someone always takes the brunt.

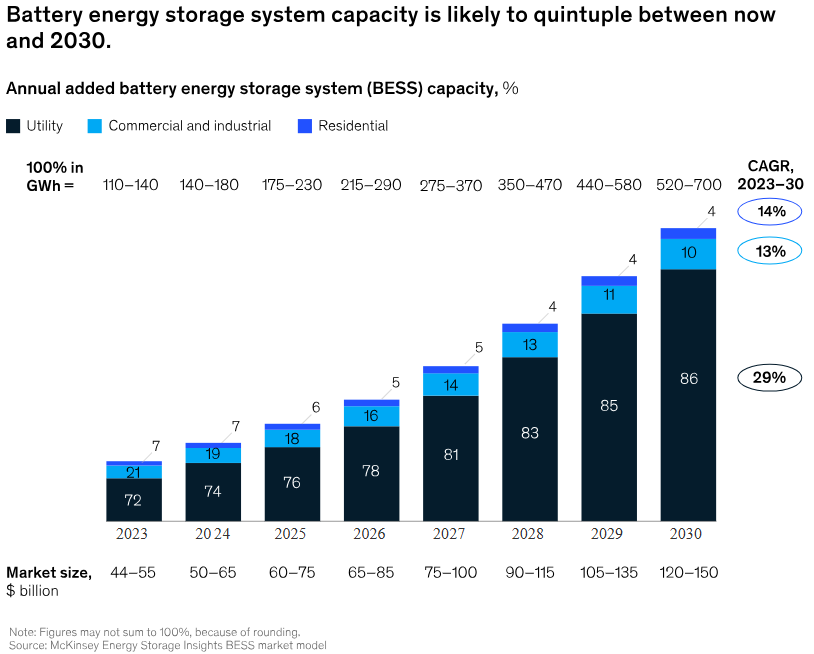

Battery Market Tailwinds—But Not Yet for Enphase

Enphase’s pivot into batteries makes strategic sense. The global residential battery market is growing fast, driven by energy resilience, TOU arbitrage, and the declining cost of LFP cells.

According to McKinsey:

Global BESS deployments will grow 15–20x by 2040

Residential storage is projected to 5x by 2030

LFP dominates due to safety and low cost

Margins improve as supply chains diversify

Enphase is well-positioned to ride this wave—but not yet. Until it shifts battery sourcing out of China (target: Q2 2026), tariffs will suppress contribution margin and FCF.

Source: McKinsey and Company

Investor Perspective: High-Quality Business, Low-Visibility Moment

Enphase remains a leader in U.S. residential solar with strong brand loyalty, solid fundamentals, and long-term alignment with electrification trends. Its expansion into batteries and software enhances its strategic position—but near-term headwinds are significant.

The combination of IRA repeal risk, tariff-driven margin pressure, and weak installer demand makes this a low-visibility moment. Margins are set to compress further through 2025, and recovery depends on two key variables:

Policy clarity—whether the Senate softens the House’s proposed repeal of residential solar incentives.

Supply chain execution—how quickly Enphase can shift battery sourcing away from China to avoid sustained tariff impacts.

Enphase offers asymmetric upside if these resolve favorably, but until then, investors should stay patient. The business is sound—but the investment case hinges on external catalysts.

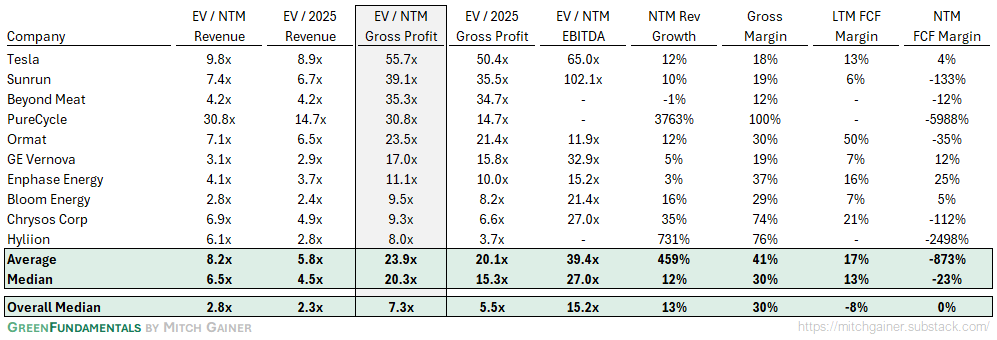

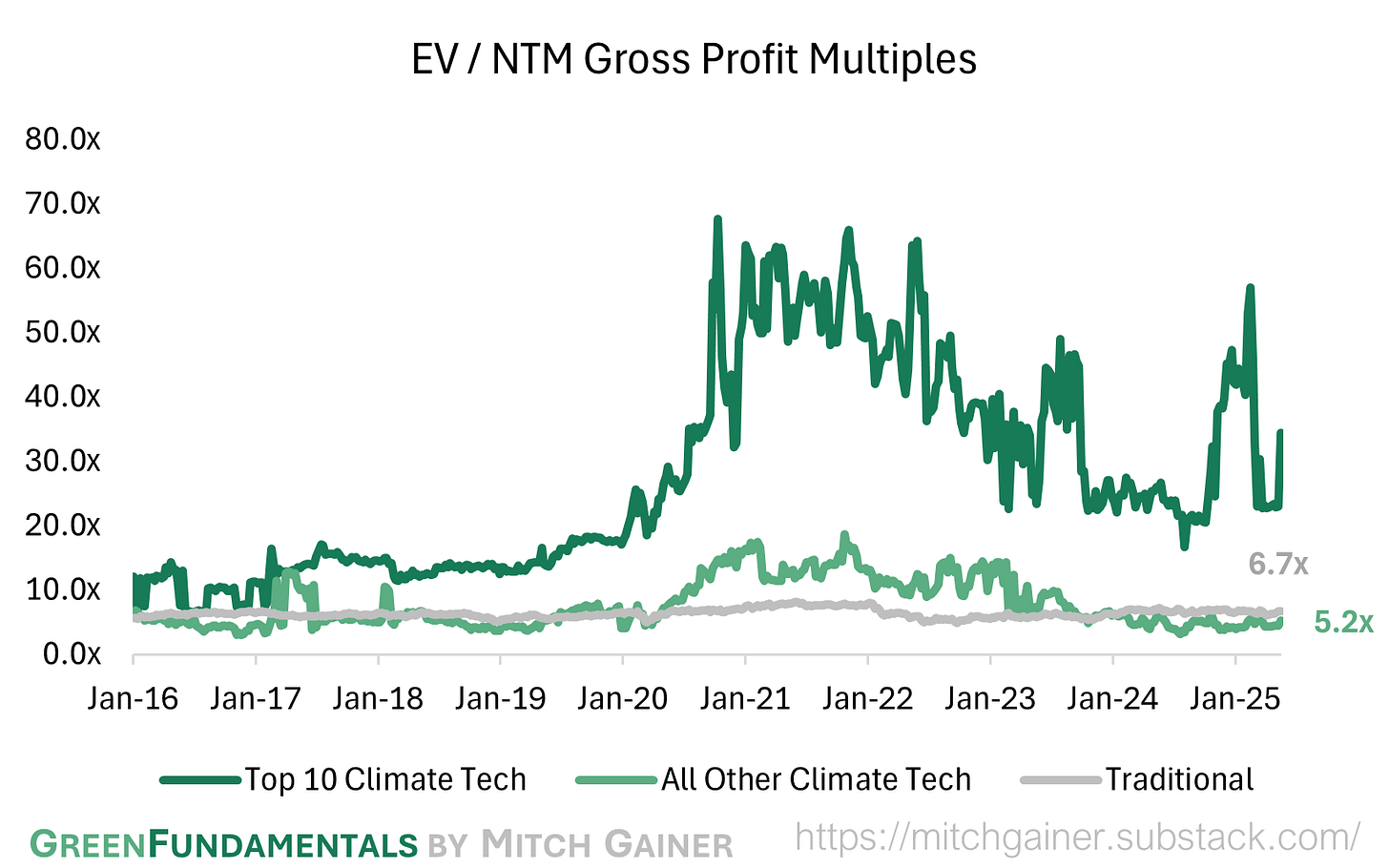

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

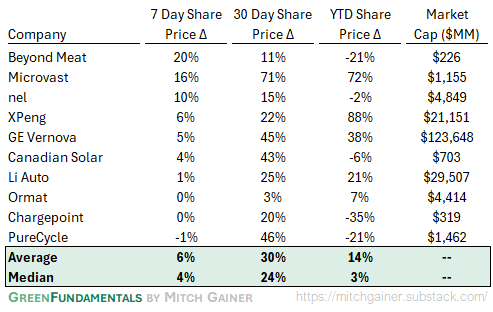

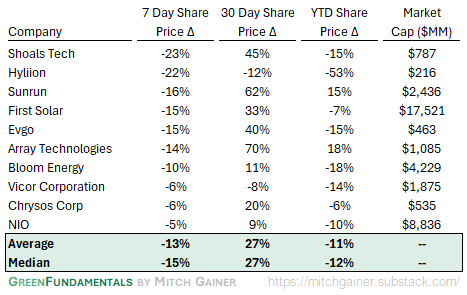

Top 10 and Bottom 10 Weekly Share Price Movement

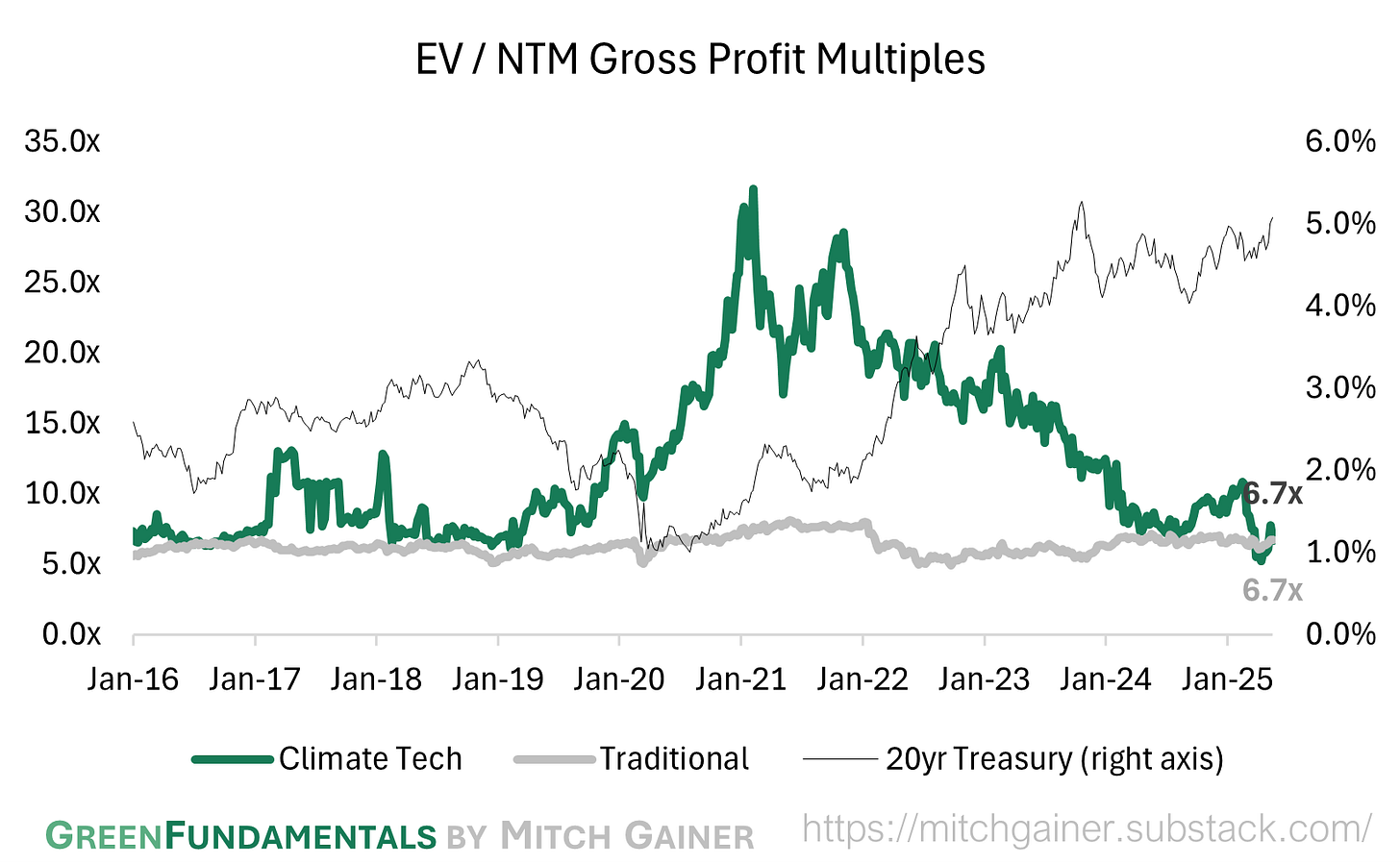

Valuation Multiples over Time

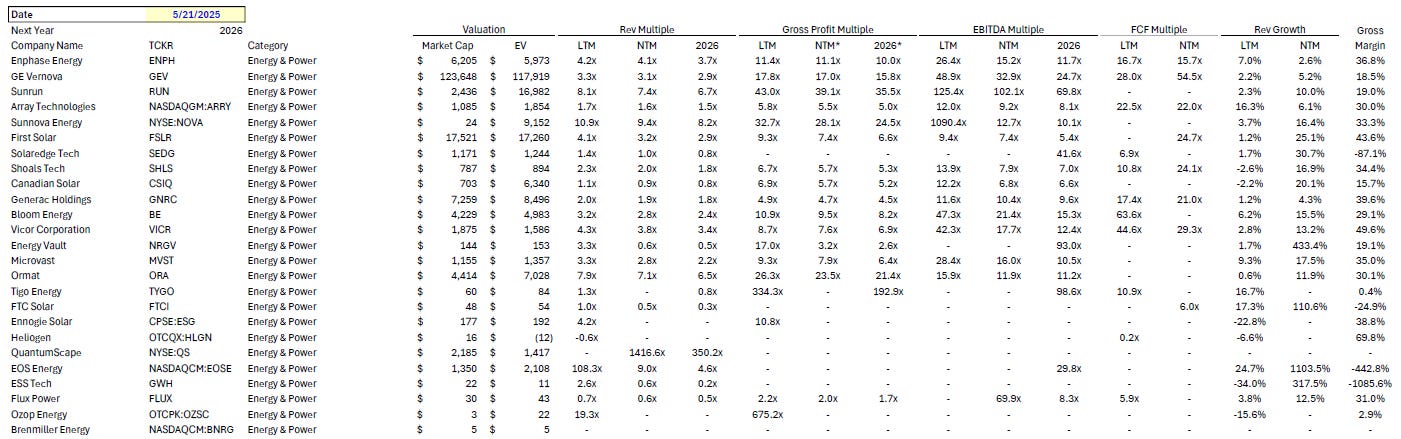

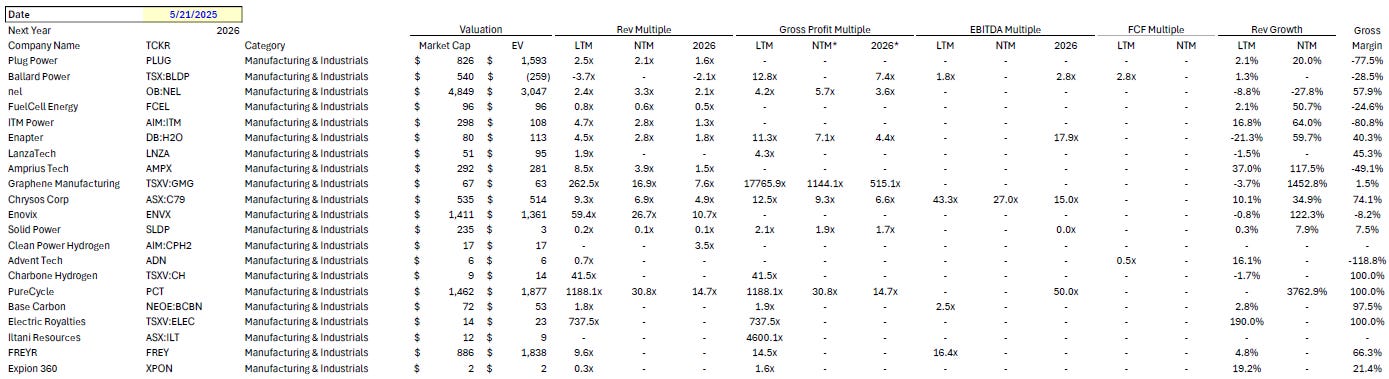

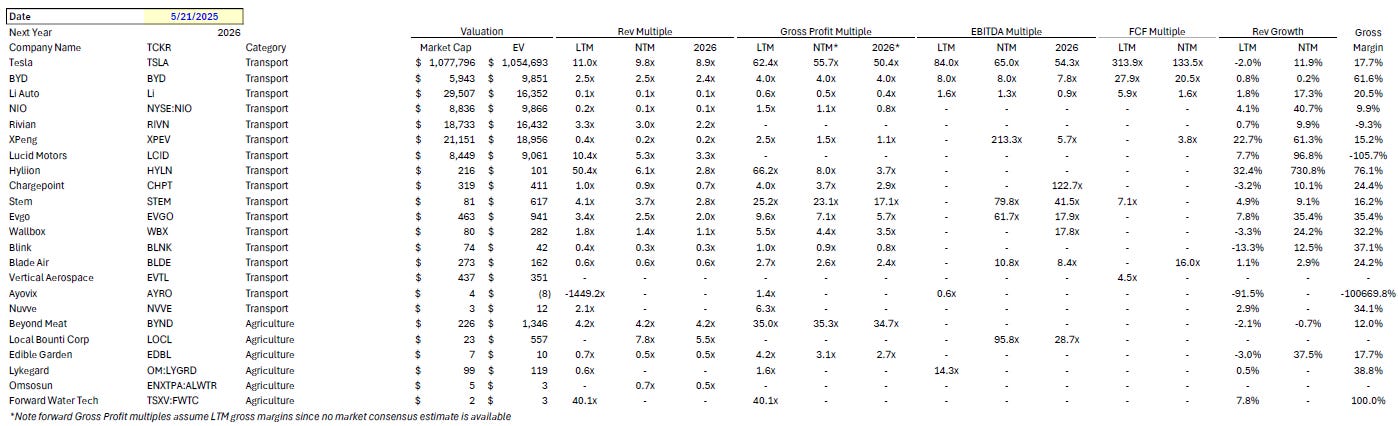

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. They reflect solely the personal opinions of the author in his individual capacity. They do not reflect the views or opinions of any current, past, or future employer, organization, or affiliate. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.