Green Fundamentals: Fusion Funding Isn't Fizzling

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Smart Money Doubles Down on Fusion Breakthroughs and Commercial Potential Post-2021

What Happened: On October 25, 2024, Pacific Fusion announced a $900M Series A funding round. After a major surge in fusion investment in 2021 (driven by Commonwealth Fusion Systems’ $1.9B Series B), the U.S. market cooled with rising interest rates and well-capitalized leaders. In 2023, China saw a substantial investment year, though some attribute this to geopolitical motives.

Source: Fusion Energy Base

In 2024, fusion has made steady progress:

Marvel Fusion broke ground on their laser facility in Colorado

Zap Energy began demonstrations with its Century reactor

Commonwealth Fusion Systems released further academic studies on the capabilities of their upcoming SPARC reactor

Background: Achieving “Q > 1” (where energy output meets or exceeds energy input) is the top milestone across fusion approaches, as it represents the tipping point from scientific experiment to potential commercial viability. The paths to this milestone include:

Magnetic Confinement Fusion (Tokamak and Stellarator): Uses powerful magnetic fields to confine plasma at extremely high temperatures, enabling sustained fusion reactions. Key challenges include stable plasma confinement, materials that endure extreme conditions, and improving energy efficiency to ensure reactors produce net-positive energy.

Inertial Confinement Fusion: High-powered lasers or ion beams compress tiny fuel pellets to reach fusion conditions, producing intense bursts of energy. This method faces high energy demands, stringent precision requirements for uniform compression, and challenges scaling for continuous energy output.

Magneto-Inertial Fusion: Combines magnetic and inertial principles, aiming to reduce energy requirements through pulsed magnetic fields for efficient plasma confinement and compression. Challenges include balancing magnetic and compression pulses, maintaining efficiency across rapid cycles, and managing wear from operational intensity.

Source: TDK Ventures

Tokamak reactors are the furthest along in fusion development. Decades of research have matured Tokamak design, leading to an advanced understanding of plasma behavior and magnetic field control. Projects like ITER, backed by global cooperation, demonstrate Tokamaks’ progress toward achieving breakeven, positioning them as a leading approach for practical fusion. The data below shows Tokamaks clustered closest to Q>1, reflecting their technical advancement.

Source: Sam Wurzel and Scott Hsu

In December 2022, the National Ignition Facility (NIF) at Lawrence Livermore National Laboratory achieved Q>1 by delivering 2.05 megajoules (MJ) of laser energy to a fuel capsule, resulting in a 3.15 MJ fusion output. This marked the first lab fusion experiment with net-positive energy, yet challenges around energy input, efficiency, and costs keep Inertial Confinement Fusion further from commercialization compared to Tokamaks.

Inertial confinement fusion faces key hurdles that currently limit its commercial viability. It requires massive energy inputs to power high-precision lasers that compress fuel capsules, resulting in low overall efficiency. ICF operates in pulses, which means scaling it for continuous power would need the ability to fire lasers at extremely high frequencies—an area where current tech falls short. Additionally, the intense conditions rapidly wear down equipment, driving up operational costs. While facilities like NIF have demonstrated fusion ignition, the high capital costs and technical demands keep ICF further from near-term commercialization than magnetic confinement approaches like Tokamaks.

Take-Away: Expect fusion to make steady advances in the coming years. While Tokamaks currently lead in sustaining fusion reactions, offering nearer-term commercial potential, other approaches, like inertial and magneto-inertial confinement, also have unique strengths but remain in earlier stages. Investment in diverse fusion technologies can help hedge against risks while capturing potential breakthroughs.

Near-term: Tokamaks will likely attract the most funding due to their technical maturity.

Long-term: Emerging designs in laser-based and hybrid methods may yield significant gains as the fusion landscape evolves.

What Comes Next: There are several upcoming fusion milestones expected over the next three years:

National Ignition Facility (Inertial Confinement Fusion): Following its 2022 ignition milestone, NIF is focused on efficiency improvements for laser-based fusion, with more testing expected.

SPARC by Commonwealth Fusion Systems (Magnetic Confinement, Tokamak): SPARC aims for net-positive energy using high-temperature superconducting magnets, a crucial step toward commercial fusion.

ITER's First Plasma (Magnetic Confinement, Tokamak): ITER’s goal is to achieve first plasma by 2025, a critical milestone for large-scale fusion viability, with sustained reactions targeted for the 2030s.

General Fusion’s Demonstration Plant (Magneto-Inertial Fusion): General Fusion seeks breakeven through magneto-inertial fusion, leveraging mechanical pistons and magnetic fields for cost-effective plasma compression.

KSTAR's Extended Operation (Magnetic Confinement, Tokamak): South Korea’s KSTAR aims to sustain a 300-second plasma reaction by 2026, providing insights into continuous magnetic confinement.

Keep in mind that ITER is a government-backed initiative that has been in development since the 1980s, with formal agreements finalized in 2006. If a venture-backed company reaches Q>1 before ITER, especially if it proves more quickly viable for commercialization, expect headlines like ‘Capitalism Beats Government to Fusion’.

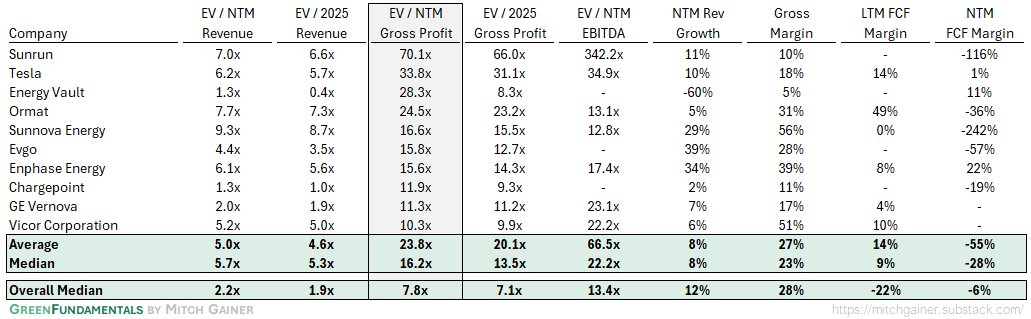

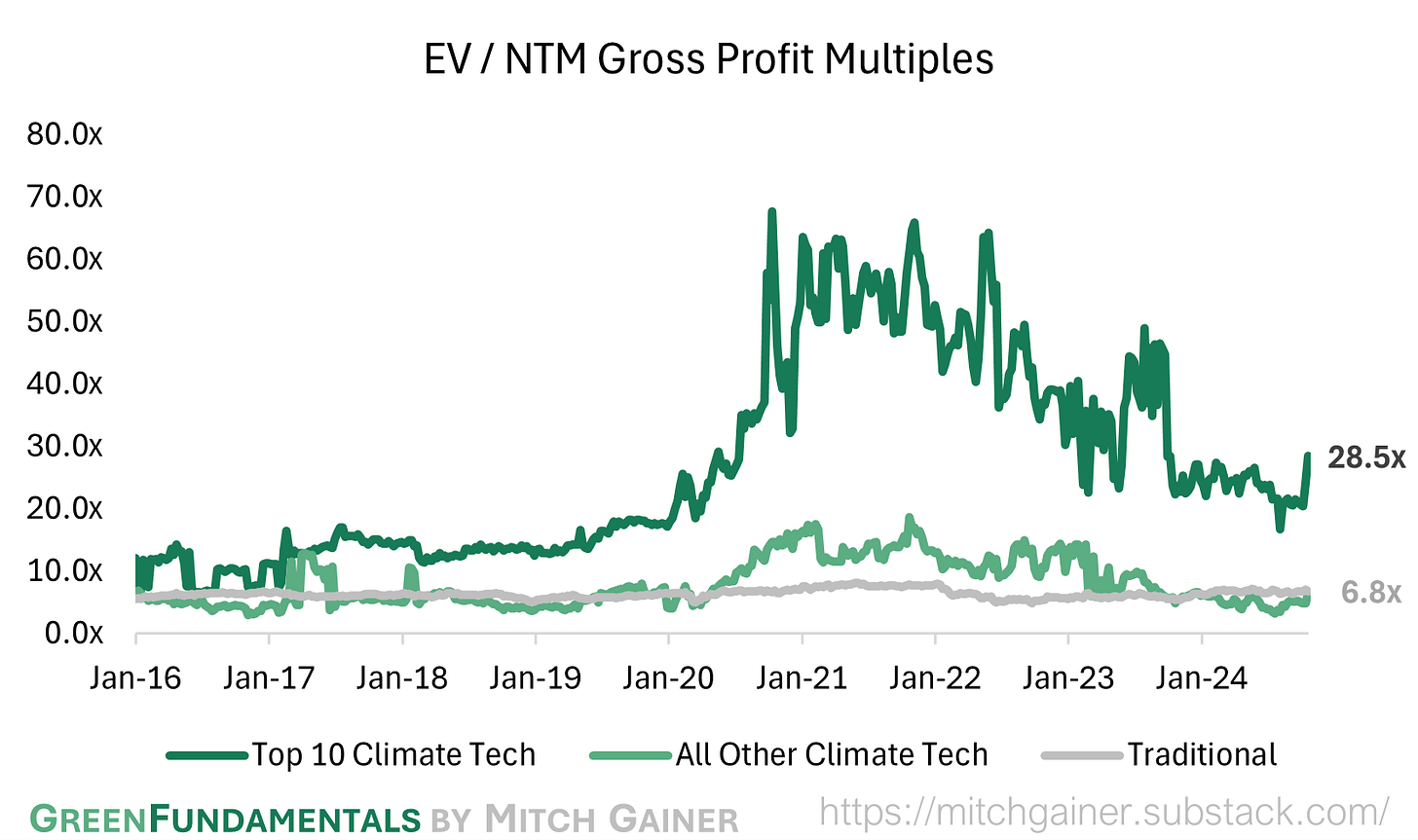

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

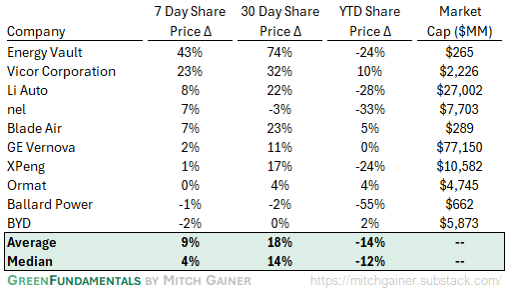

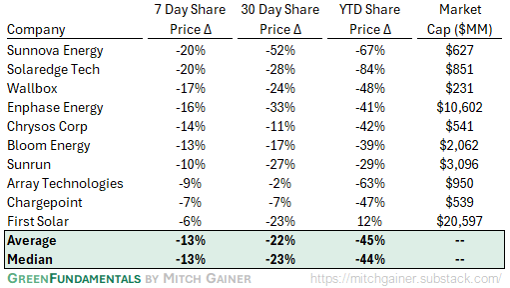

Top 10 and Bottom 10 Weekly Share Price Movement

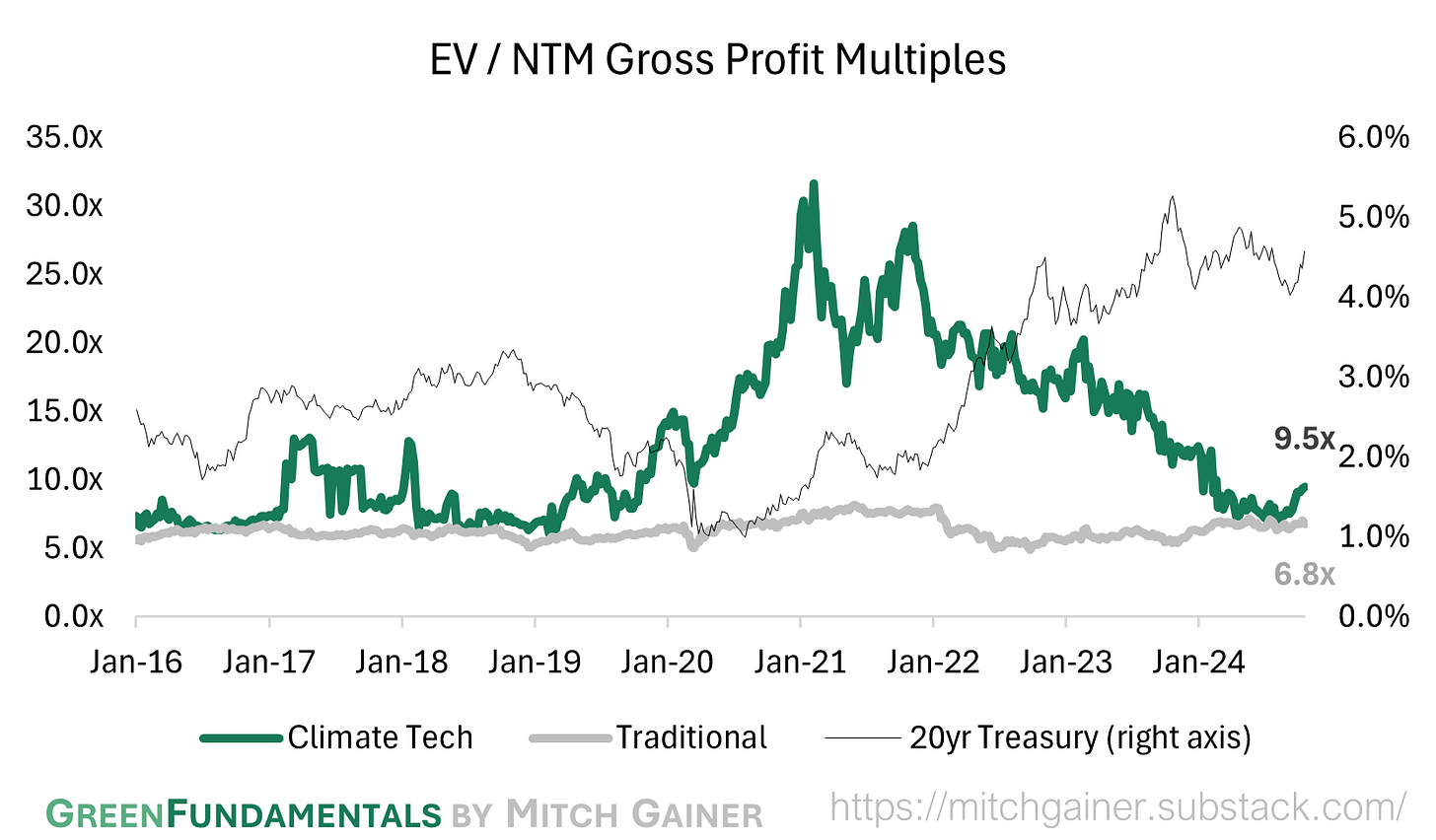

Valuation Multiples over Time

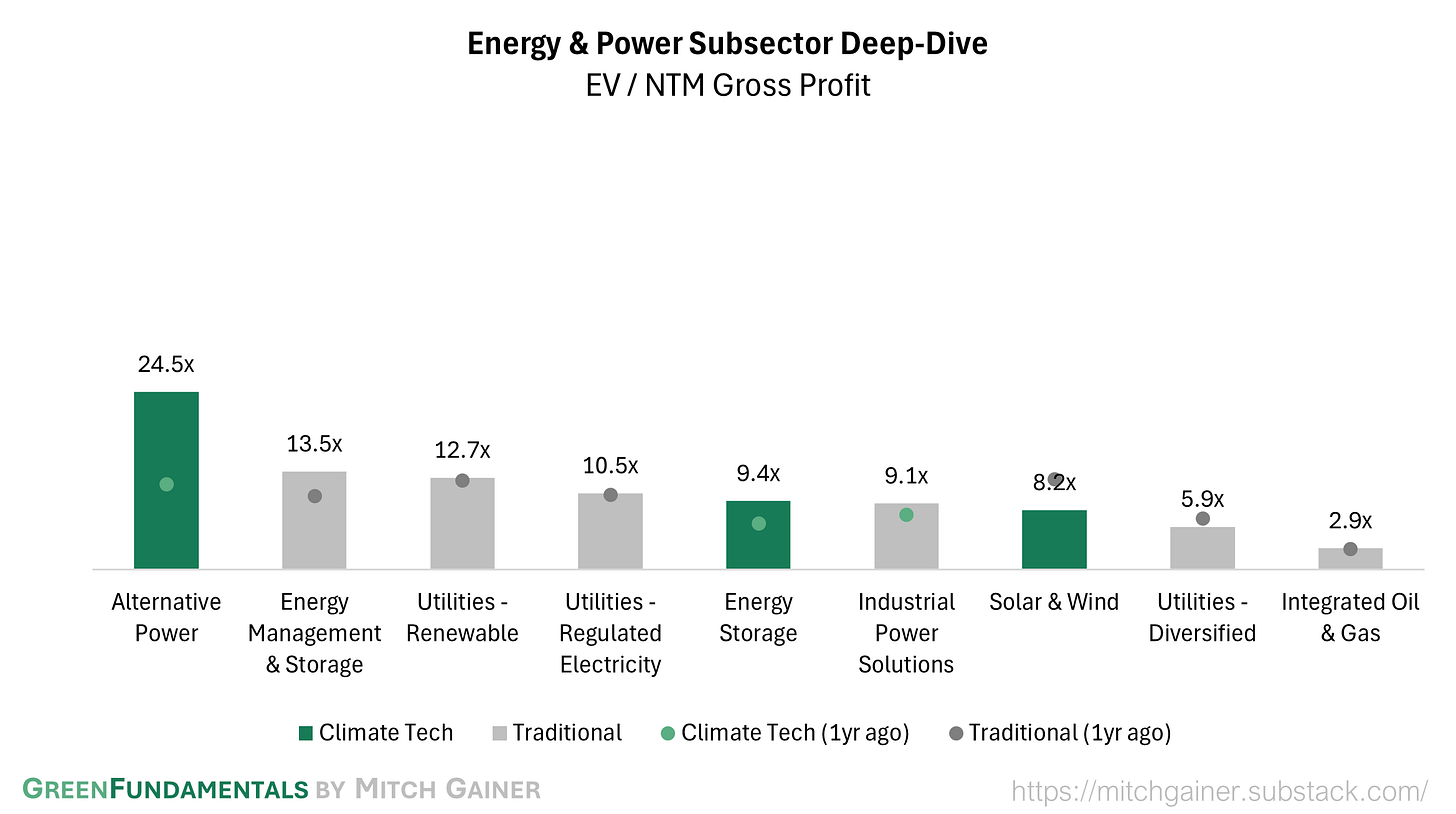

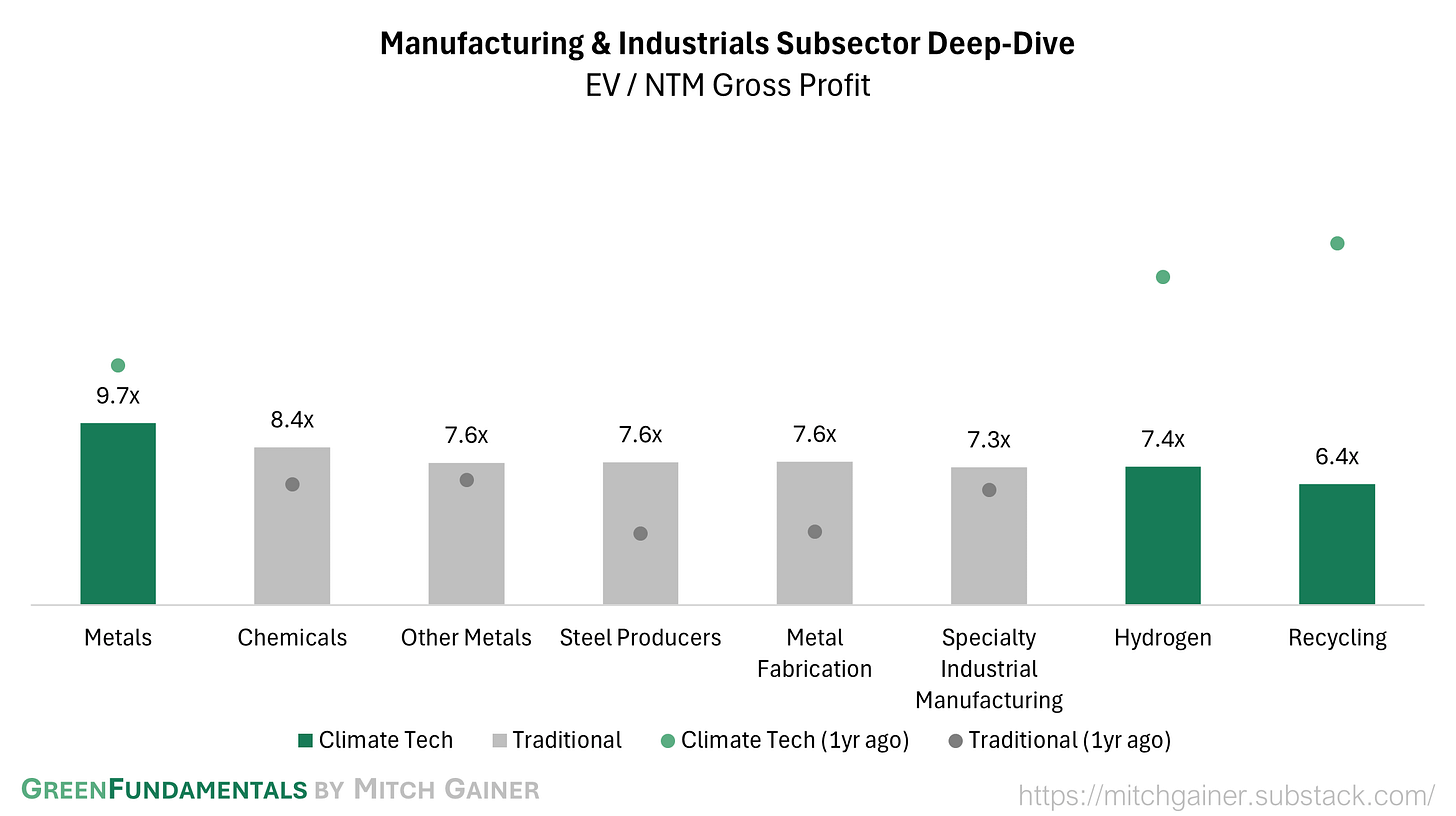

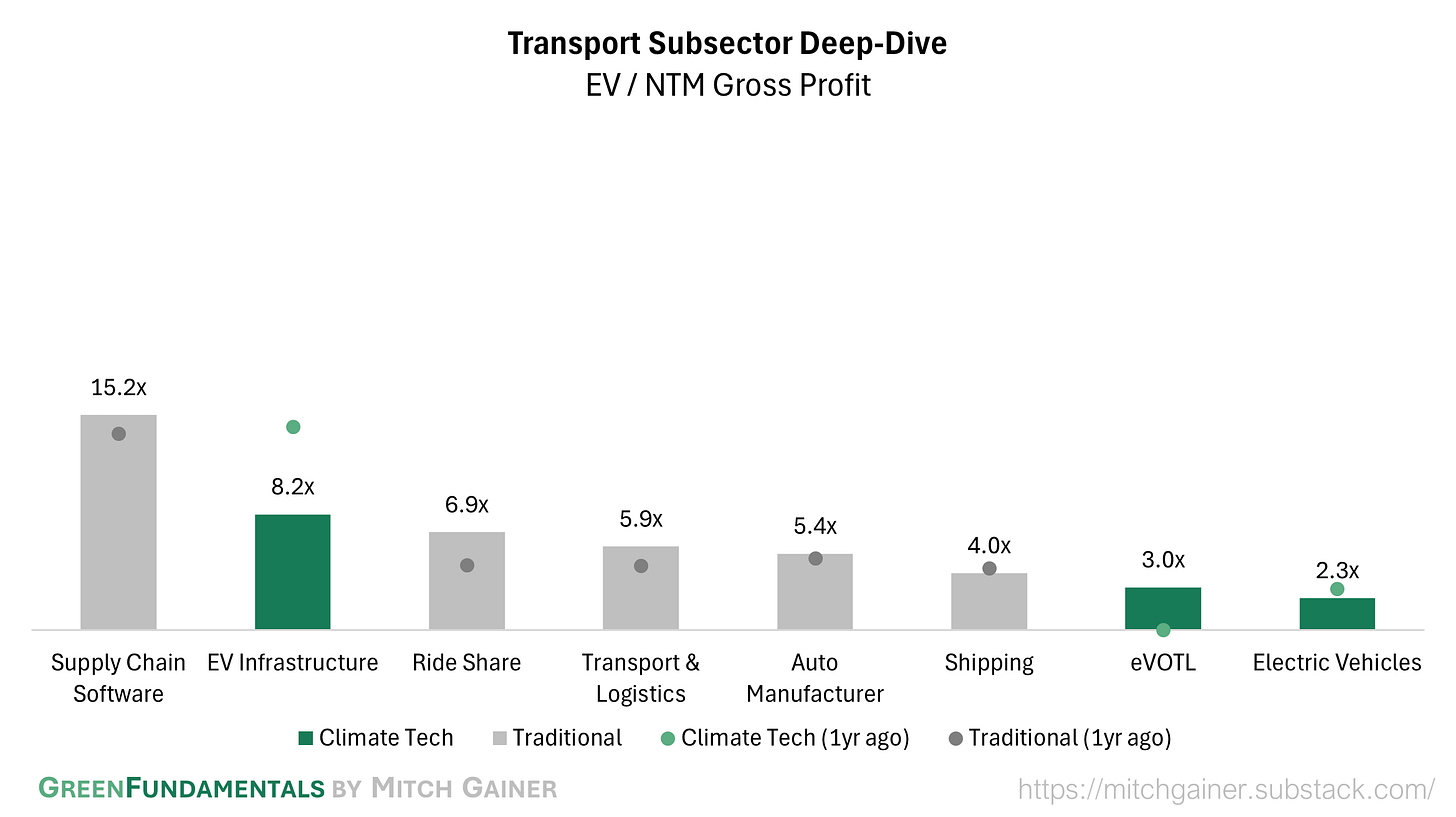

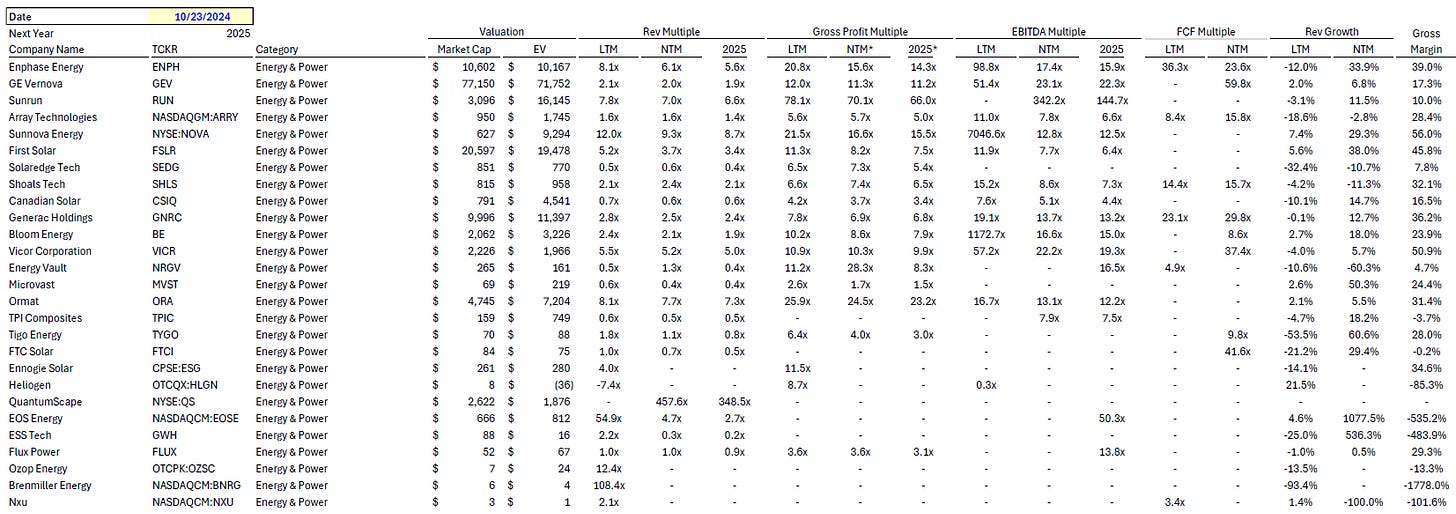

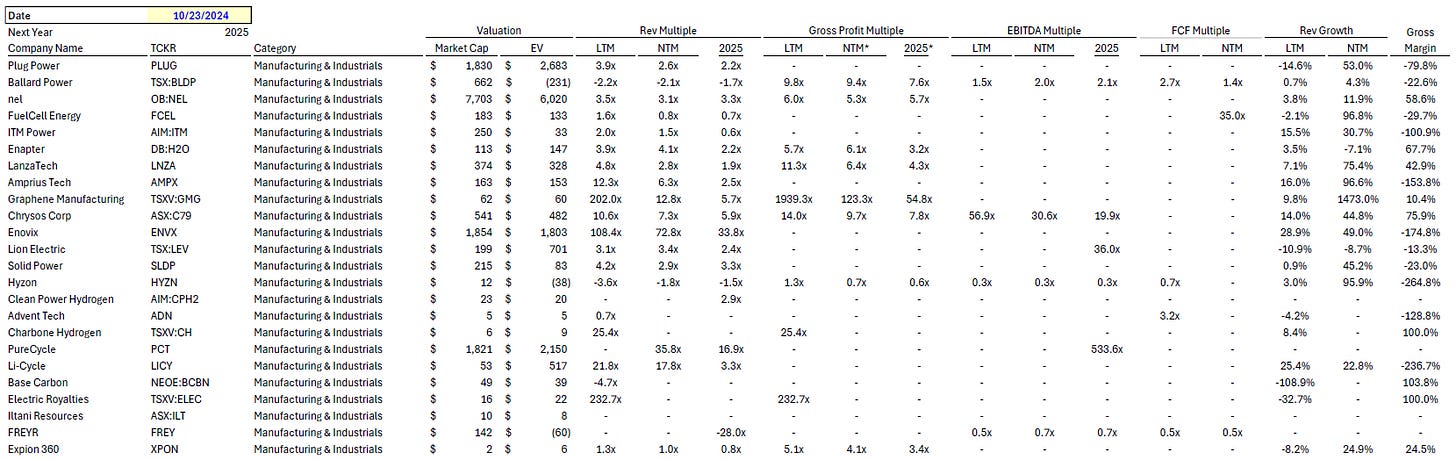

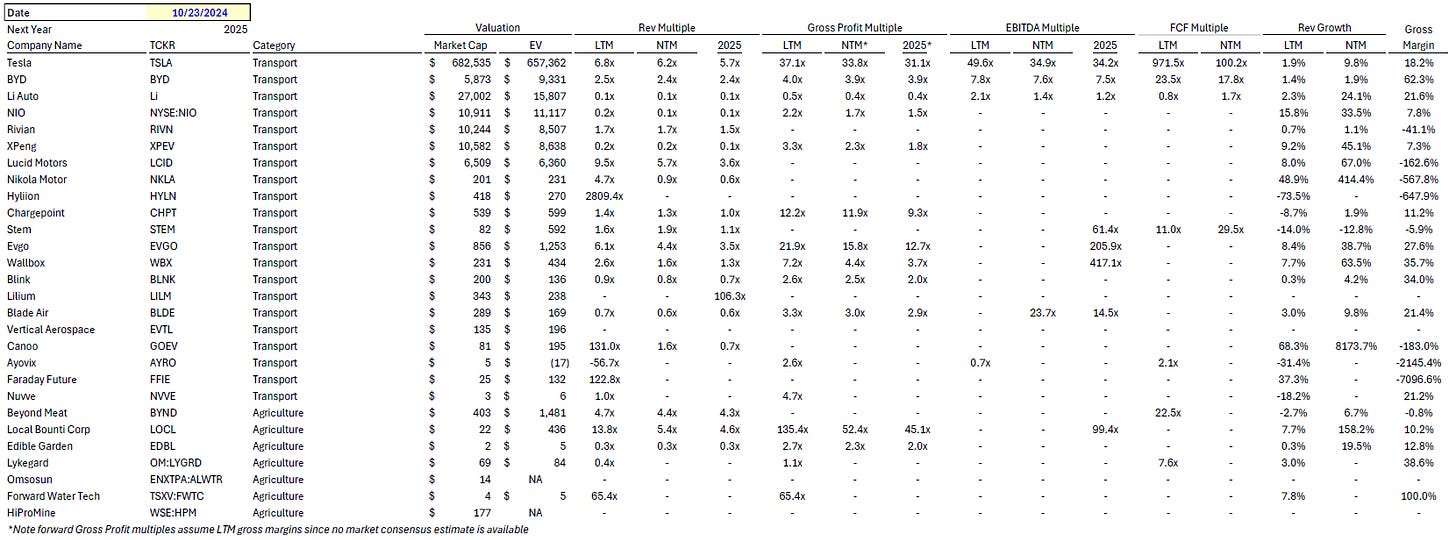

Deep-Dive by Subsector

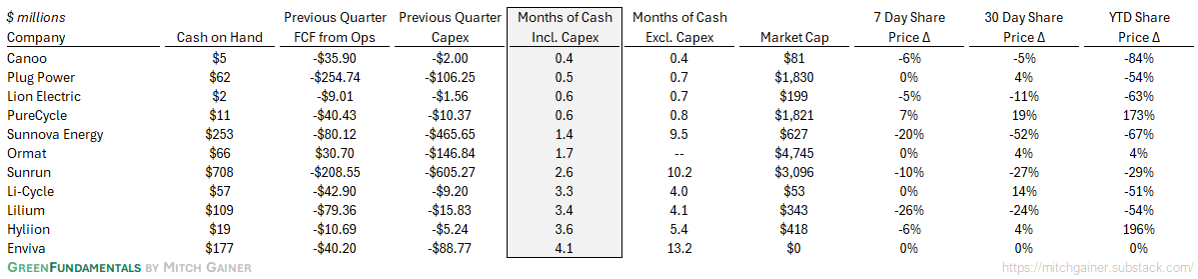

Months of Cash

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.