Green Fundamentals: Green Cement Builds Momentum

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Decarbonizing cement has a long way to go but could create massive returns for investors

What Happened: Low-carbon cement from Sublime Systems will be used in Amazon's ‘net-zero' Seaport tower. Amazon will be the first commercial application for the cement. Sublime’s drop-in cement replacement for ready-mix aims to replace Portland Cement with their electrified production process.

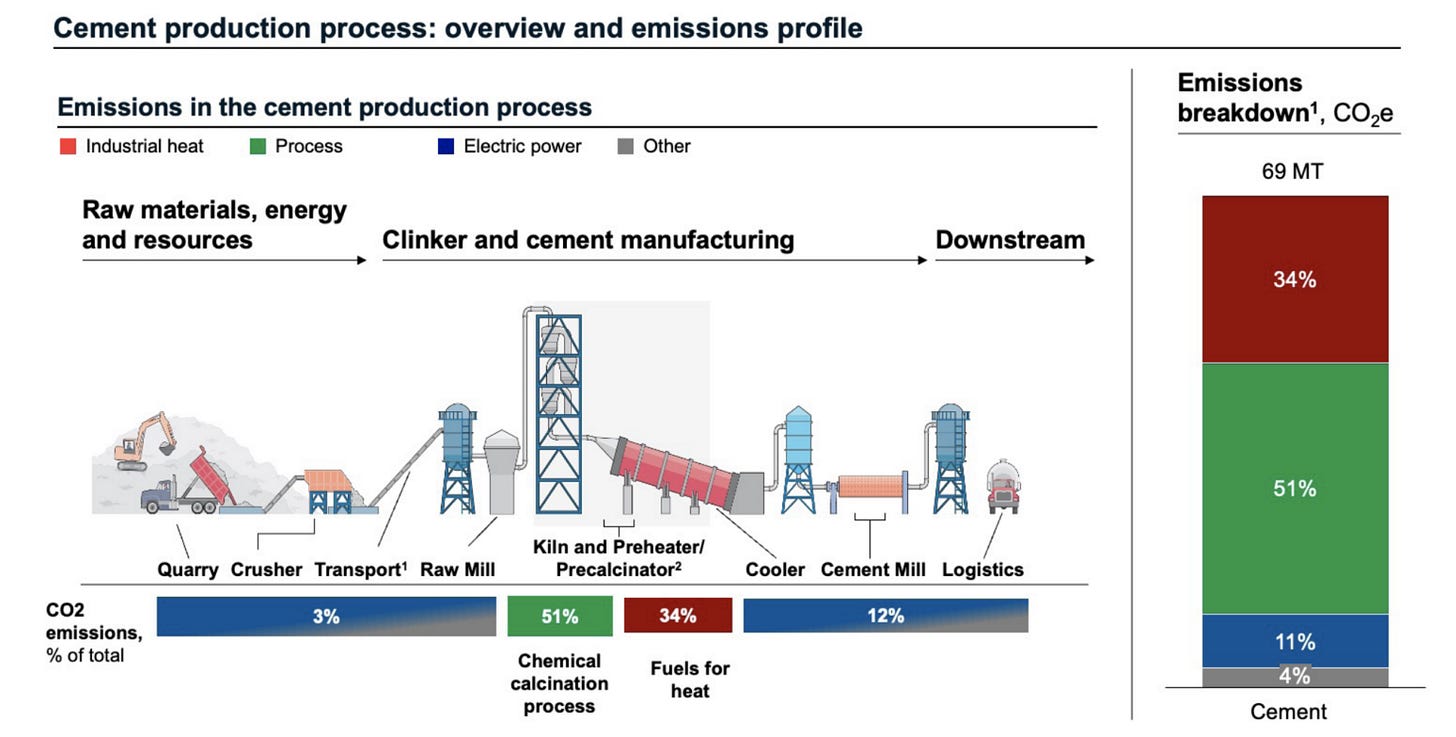

Background: Cement accounts for ~8% of global CO2 emissions. By comparison, all air travel is 2.5% and all shipping is 3%. Most of those emissions (~85%) are inherent in the chemical process of refining limestone to Portland Cement. 51% comes from the chemical calcination processing of Limestone (Calcium Carbonate). 34% comes from the fuels required for high levels of heat (over 1,400C). The global Portland Cement market is ~$4.4B and has not been disrupted for over 100 years.

Source: DOE Low Carbon Cement Commercial Liftoff Report

Synthetic Portland Cement has faced challenges in the past. Blue Planet used captured carbon to create synthetic Portland Cement. It was deployed in the San Francisco Airport in 2016. In 2018, challenges to scaling were surfaced. Still, it has not been deployed at scale.

Decarbonizing cement can take four paths:

Supplemental Cementitious Materials (SCMs): Portland Cement is blended with SCMs (such as Fly Ash / clinker) which historically have been cheaper. One path forward is to increase the amount of SCM that cement is mixed with, resulting in using less carbon-intensive Portland Cement.

Carbon Capture / Carbon Re-use: Portland cement is the most widely used cement and is mentioned specifically in many state and local regulations, which makes replacing it challenging. One path forward is to decarbonize Portland cement, either by making a synthetic (identical) chemical compound or by adding carbon capture to the existing process (both for the chemical calcination process and for the heat used).

Alternatives Binder Chemistries: Some alternatives (like Calcined Clay) are used in small quantities. One path forward is to create a new type of cement that is decarbonized which can become widely trusted and adopted. Solutions like Sublime’s fall in this category.

Alternative Building Materials: Some builders can use other building methods such as prefabricated / modular construction, cross-laminated timber, and design using less cement. One path forward is to more widely adopt these methods, but this may be difficult to require or implement globally.

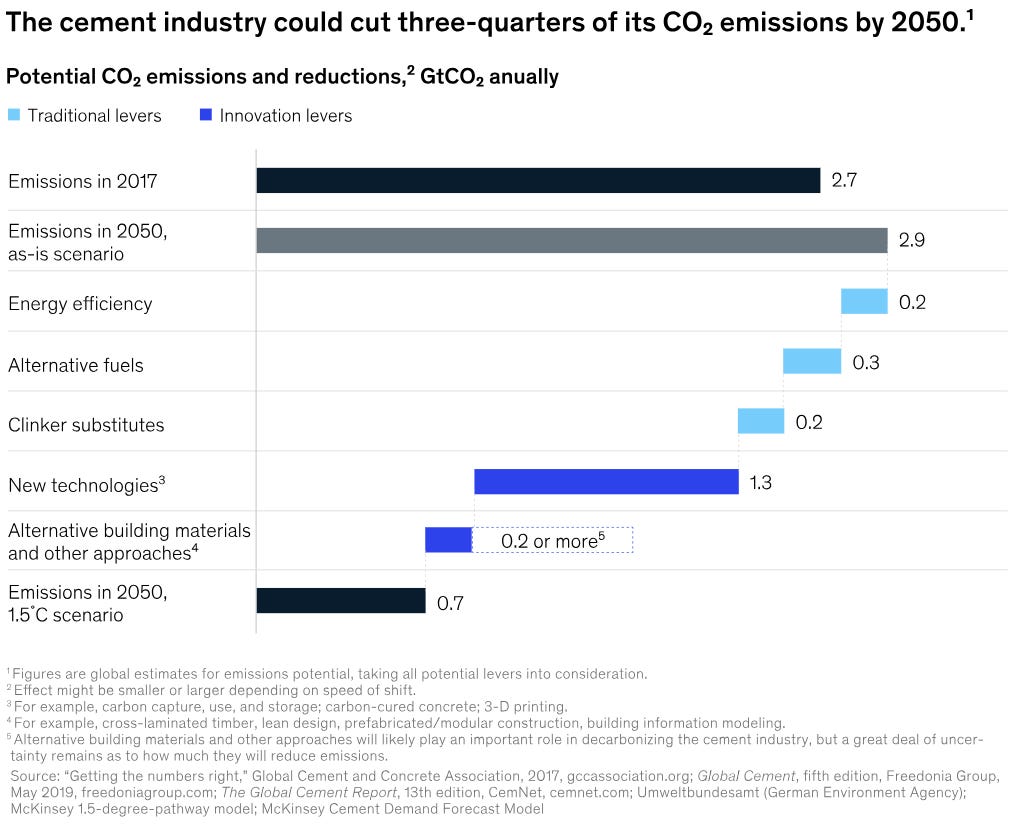

Source: McKinsey

Take-Away: Decarbonized cement still has a long road ahead. Significant testing and a slow roll-out will be required before the major incumbents (i.e., Cemex, Holcim, Rio Tinto) deploy any new material at scale. Further, the roll-out will be very capex intensive and likely require the cooperation / partnership with those incumbents.

What Comes Next: SCMs can decarbonize up to 30% of cement emissions in the next 10 years. Regulation will incentivize carbon capture in some niches in the industry where it becomes economic due to tax benefits. But for long-term decarbonization, a green alternative to Portland Cement is needed.

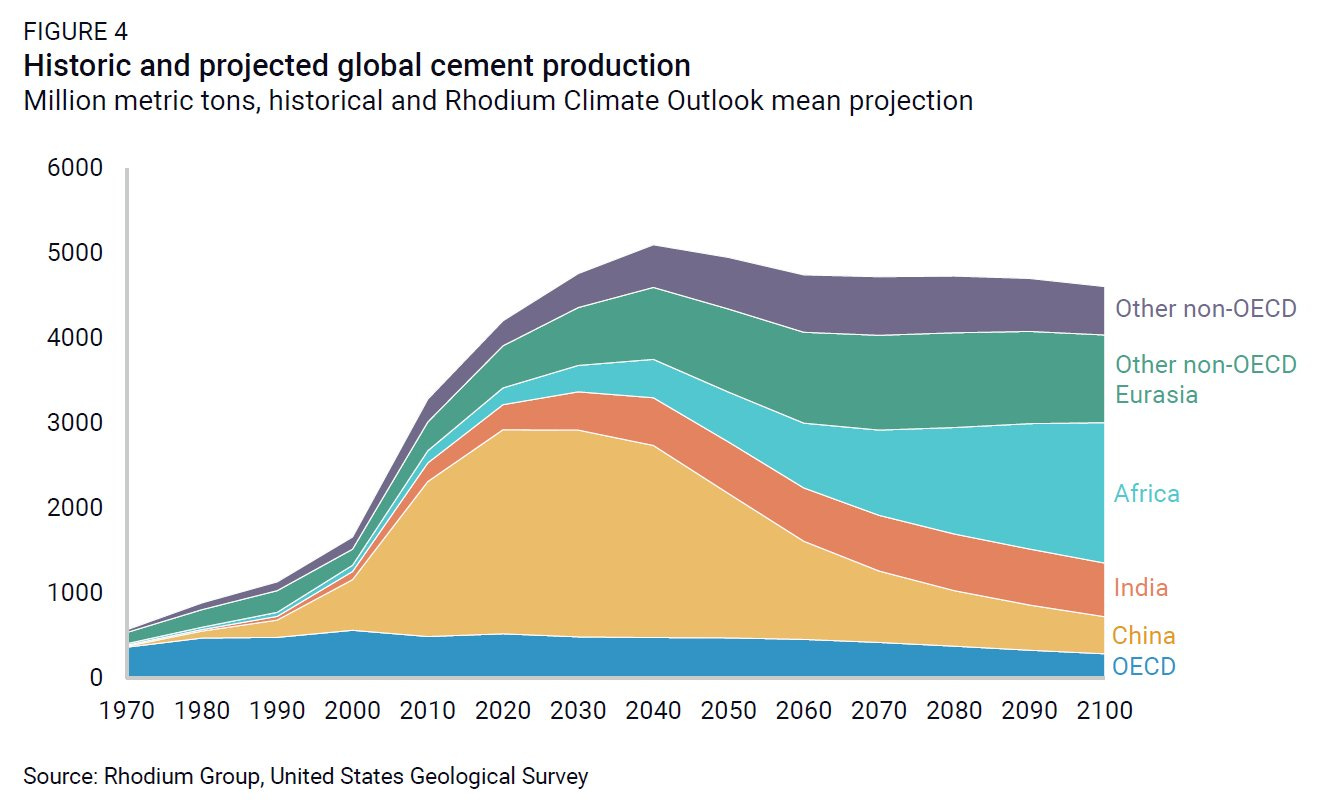

The true prize for innovation in the U.S. is to be exported to the world. Nigeria’s demand for cement will triple by 2050. China contributes the majority of cement demand today. American technology has a responsibility not just to American emissions, but to the world as cement production is a global challenge.

Source: Rhodium Group

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Batteries: Solid-state battery from US cell maker hits new milestone (New Atlas)

Batteries: TDK Claims Solid State Battery With 100X Energy Density (Hackday)

Data Centers: Data Centers Projected To Consume Over 6% Of All U.S. Electricity By 2028 (Bisnow)

Utilities: Wild Weather Is Roiling Electricity Prices. This Startup Is Looking to Help. (WSJ)

Methane: ‘Blindspot’ over methane emissions puts dairy and beef sectors at risk, say investors (Reuters)

Private Markets (PE / VC / Real Estate / Infra)

Wind: The Long-Term Costs of Wind Turbines (Harvard Business Review)

Solar: Private firms are driving a revolution in solar power in Africa (The Economist)

EV Charging: Ionna, the EV charging company backed by seven automakers, is beginning to take shape (The Verge)

Geothermal: Google to Buy Clean Power From Buffett’s Nevada Utility (Bloomberg)

Nuclear: French Power Slumps as Surging Renewables Push Out Atomic Plants (Bloomberg)

Data Centers: Desperate for AI companies look for nuclear option (Forbes)

Data Centers: Google to invest $2.3B in central Ohio data centers; executives address power grid concerns (10tv)

Utilities: How [Google is] working with utilities to create a new model for clean energy (Google)

Utilities: PJM is dispatching coal-fired power less frequently (Power Engineering)

Financing: How D-SAFES can help climate tech startups get projects off the ground (Impact Alpha)

Food: Why Jeff Bezos’ Climate Fund just invested $30 million to build ‘sustainable protein’ in North Carolina' (Fast Company)

Public Markets (Stocks, Bonds)

Electric Vehicles: DHL on Track to Become Rivian’s Electric Van Client (Electric Vehicles)

Electric Vehicles: Musk Says Future $20,000 Tesla Model Y Would Be Affordable Car ‘Game Changer’ (Forbes)

Electric Vehicles: Electric-Vehicle Startup Fisker Files for Bankruptcy (WSJ)

EV Charging: Allego Shares Take Flight Premarket on Deal to Go Private (Market Watch)

EV Charging: Why is Allego stock up 128% today? (Investor Place)

Metals Recycling: Follow the Money in Metals Recycling - Why the Big Miners Are Jumping In (Financial Content)

Carbon Credits: Microsoft to buy 8 million carbon credits from BTG Pactual in largest-ever sale (Reuters)

Government & Policy

Nuclear: U.S. Senate passes bill to support advanced nuclear energy deployment (Reuters)

Nuclear: DOE floats $900M to build advanced reactors (E&E News)

Landfills: White House Announces Strategy to Keep Edible Food Out of Landfills (NY Times)

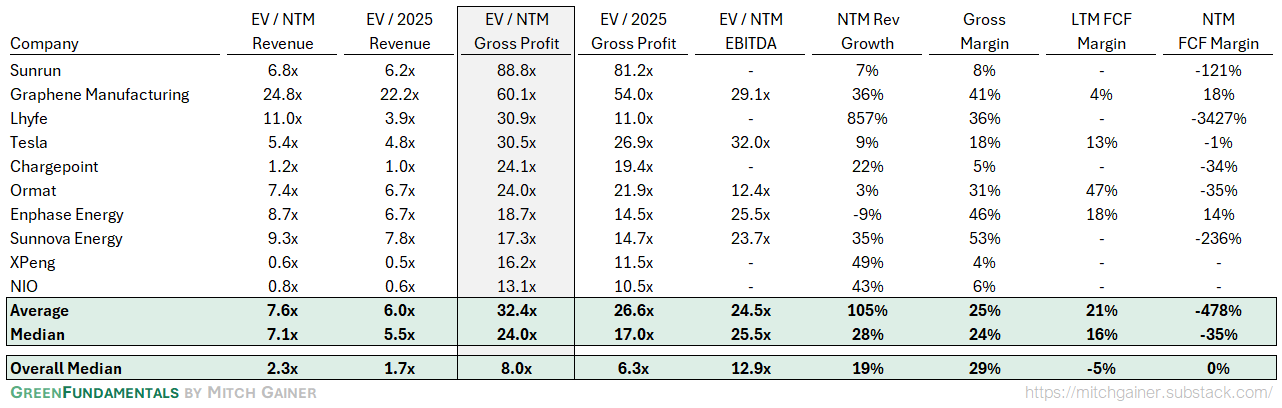

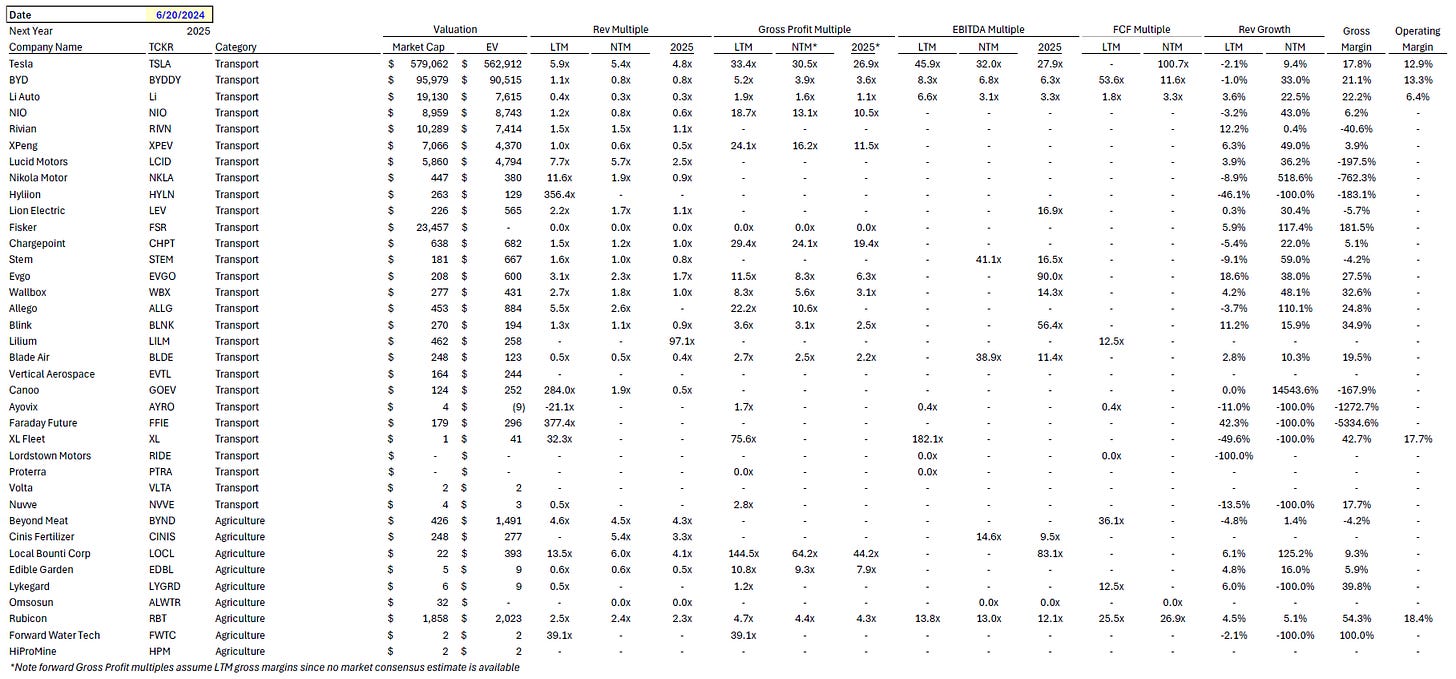

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

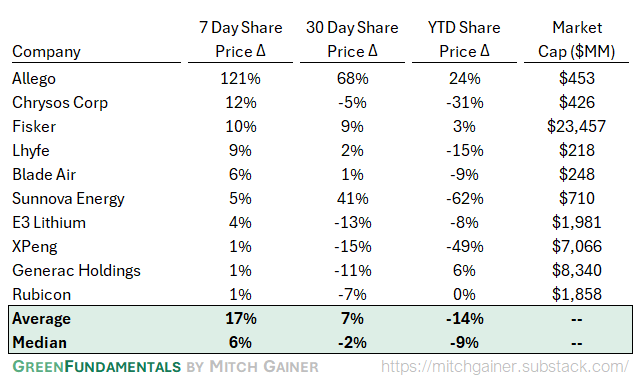

Top 10 Weekly Share Price Movement

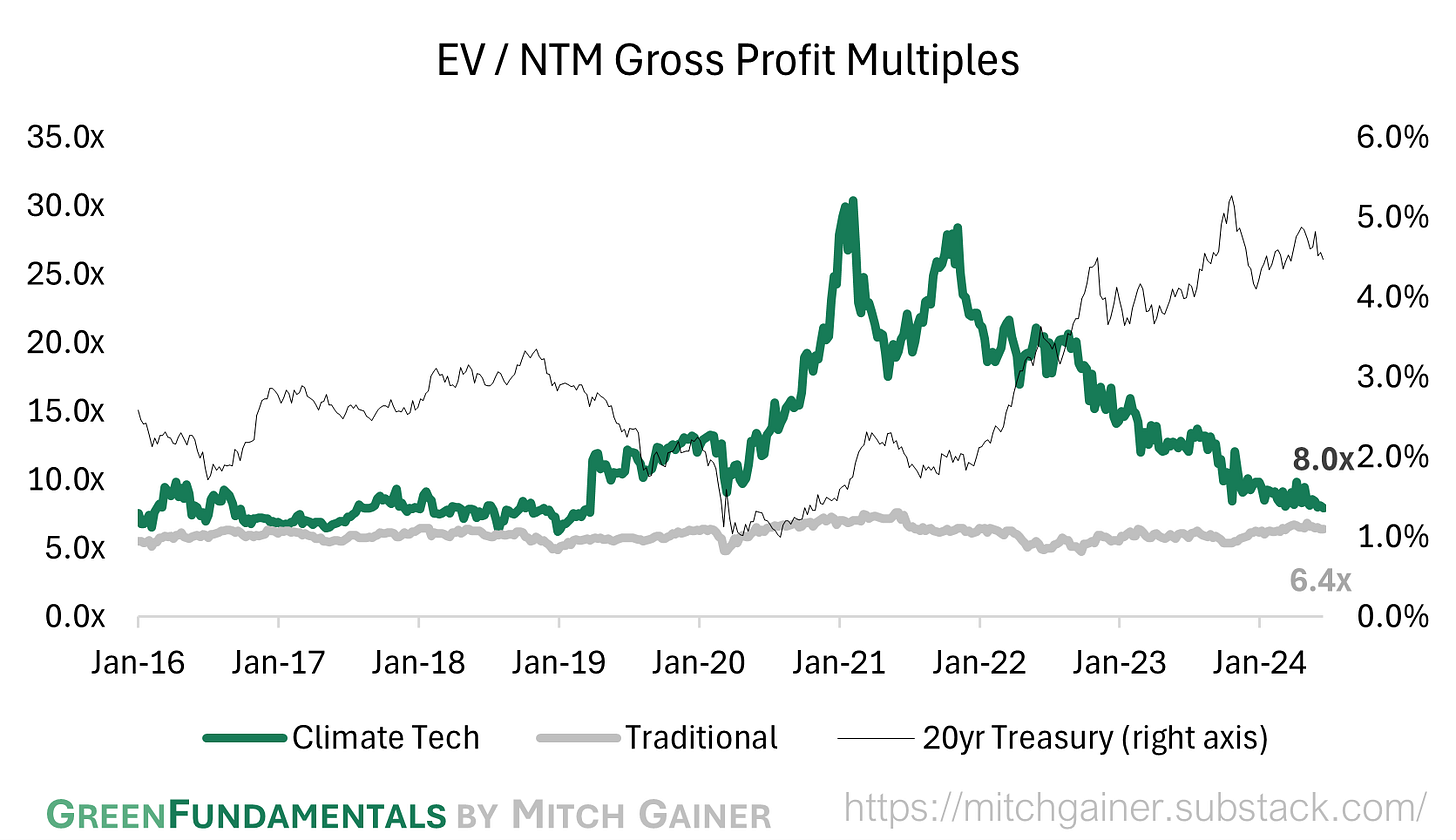

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

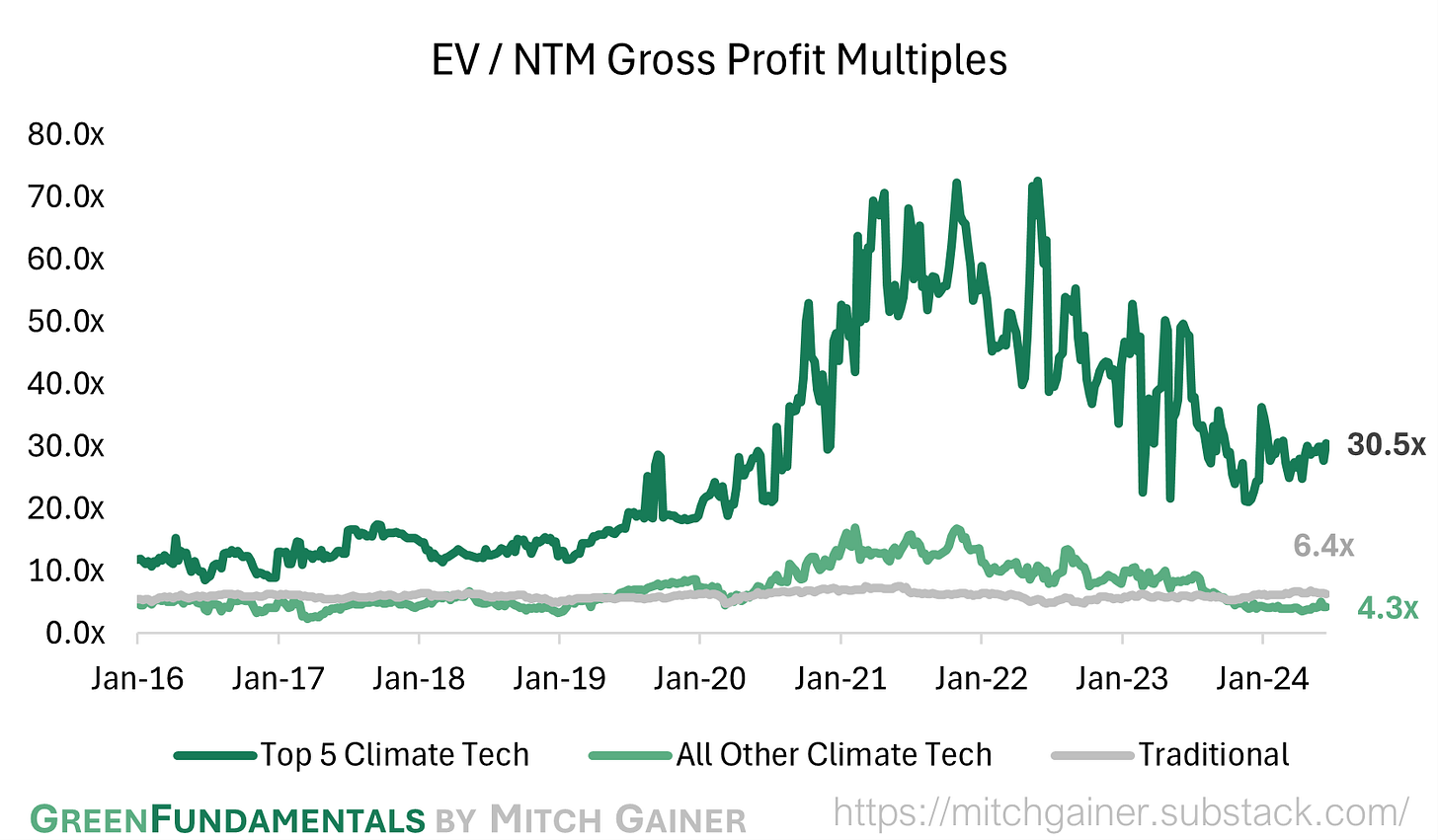

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

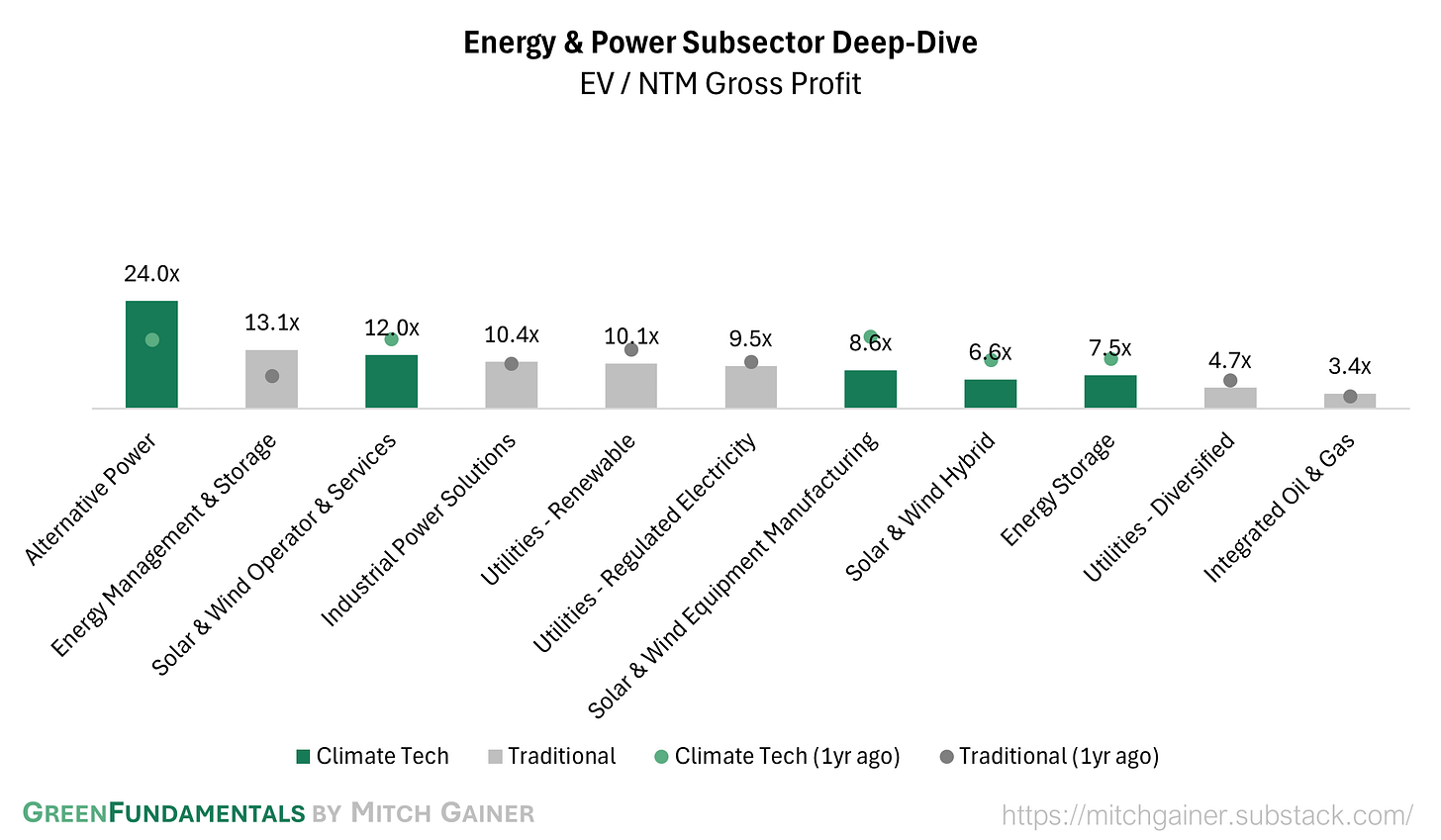

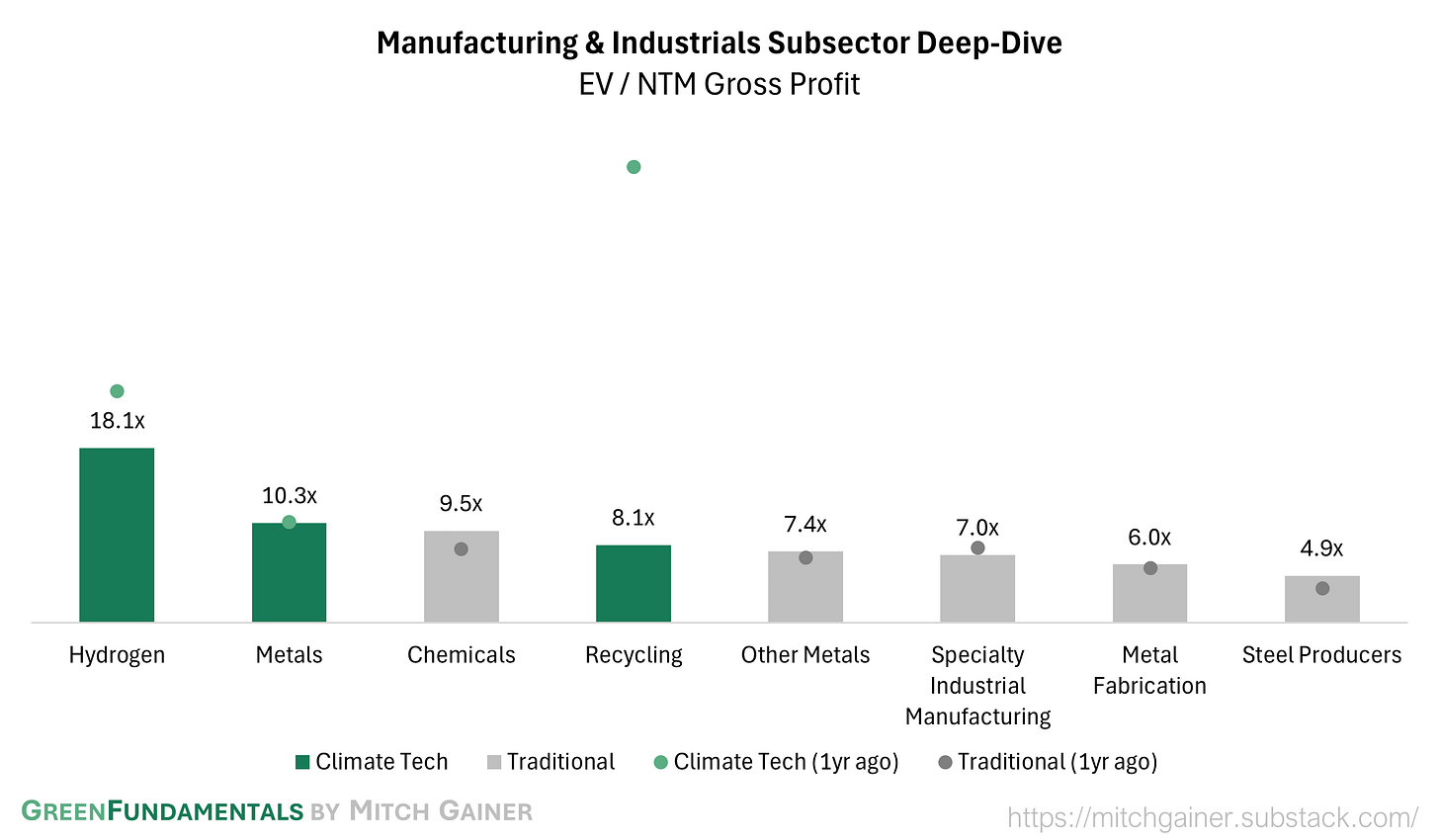

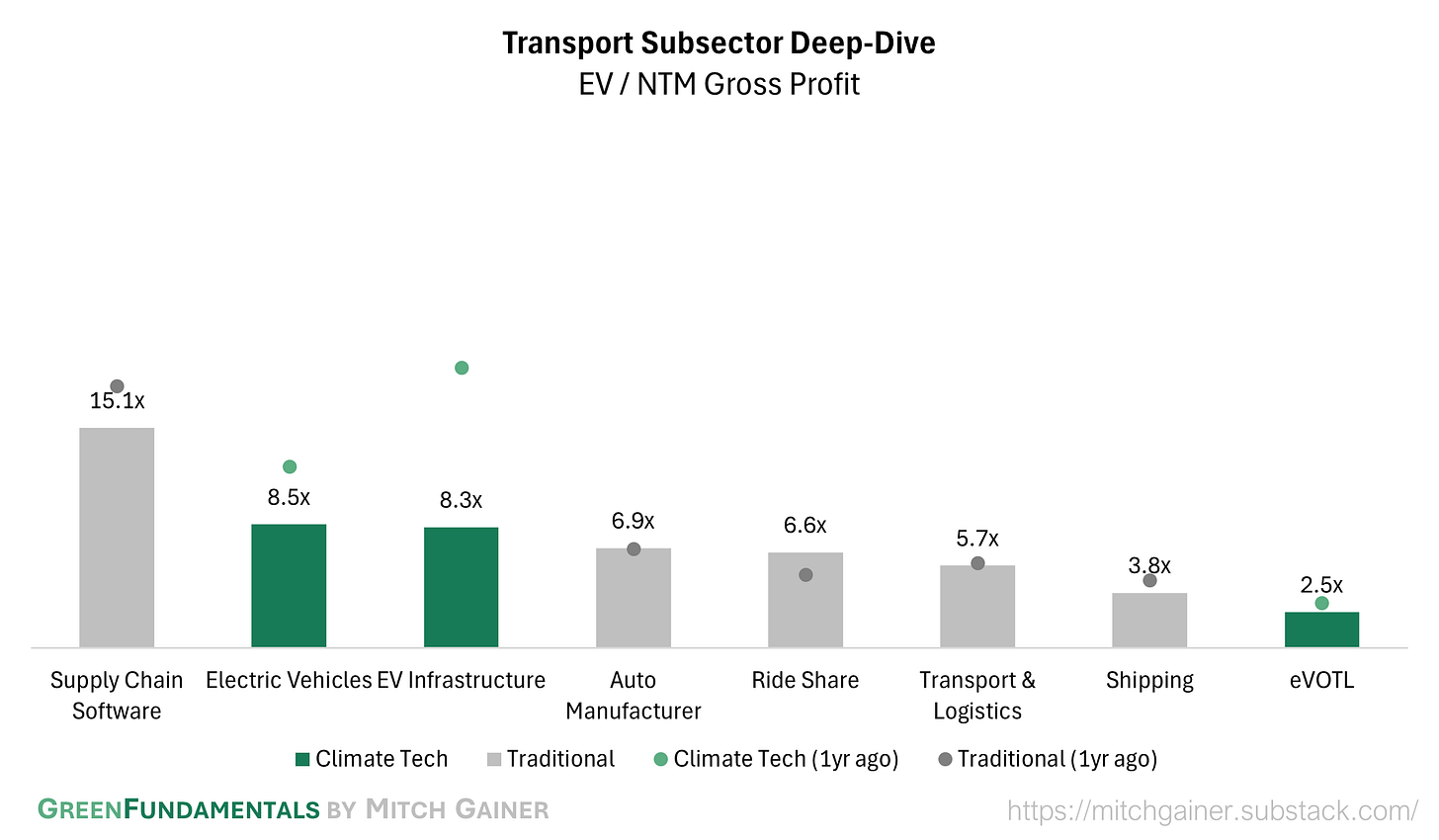

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium while energy management systems have increased in value; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

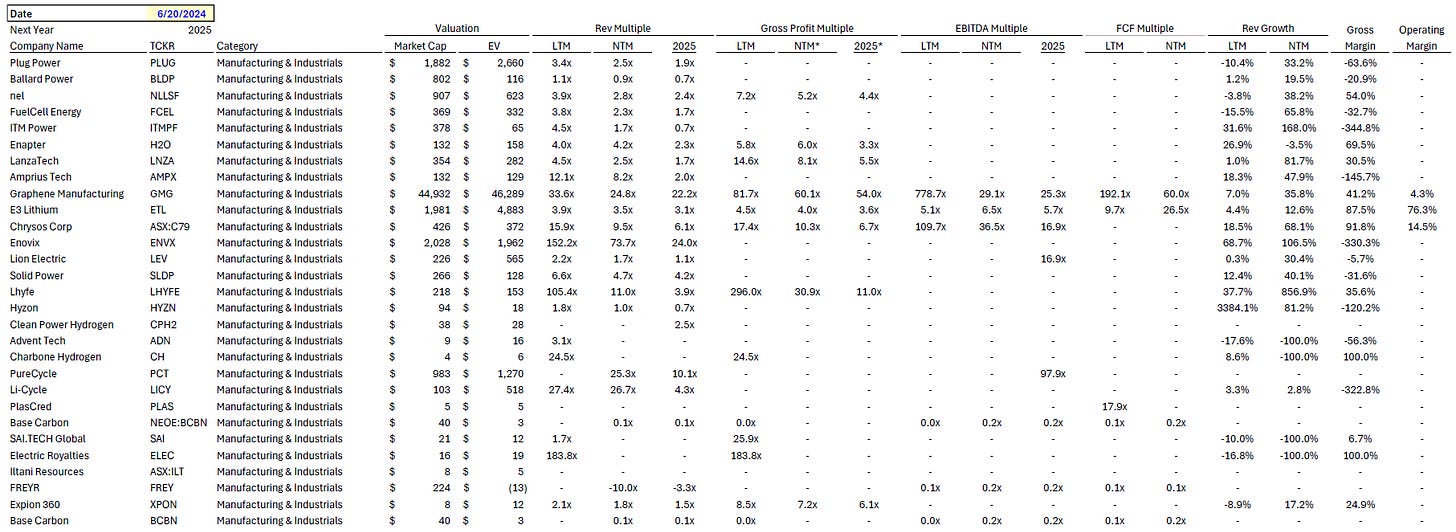

Manufacturing & Industrials: Hydrogen and recycling investments are commanding a premium again, though neither are trading nearly as high as they were a year ago.

Transport: EV growth is priced in to climate tech and traditional companies - though they have declined over the past year; the market is skeptical on eVOTL.

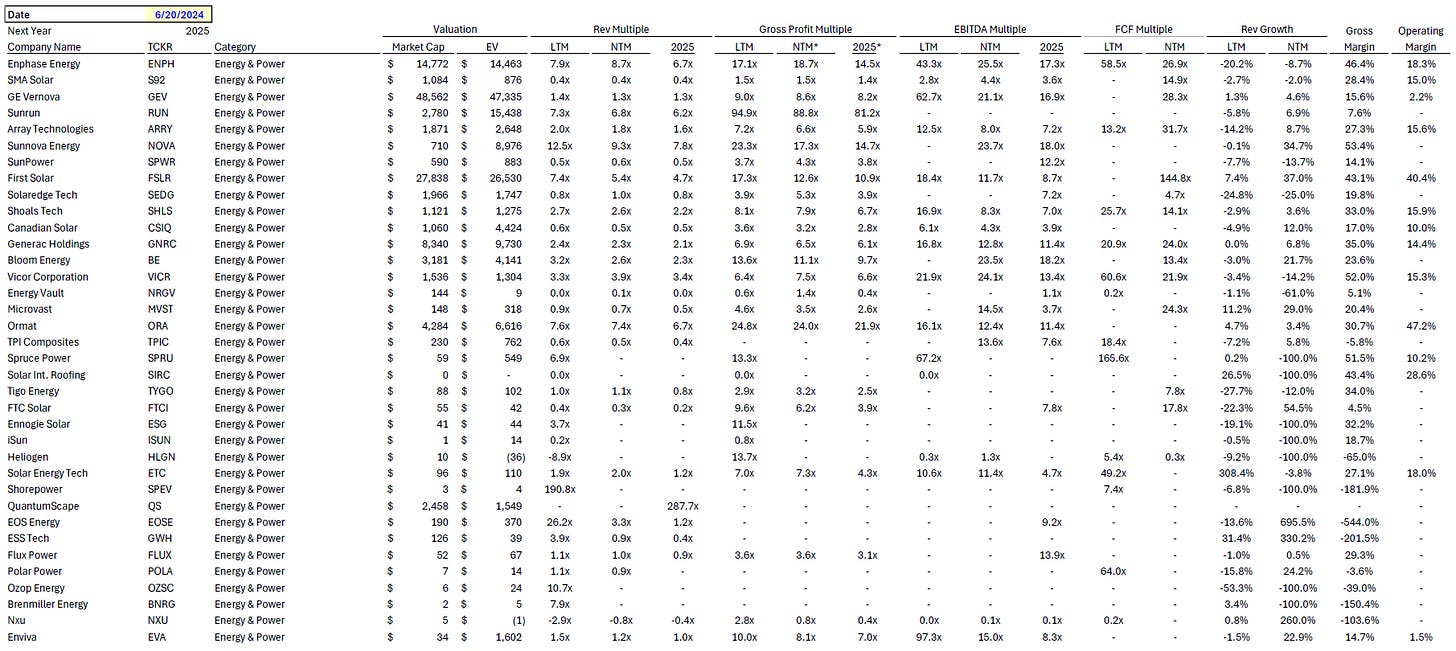

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.