Green Fundamentals: Growth Capital Stages a Comeback

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Growth venture is about to make a come-back while public markets struggle to keep up

Skittish investors fear a bubble burst like ‘Clean Tech 1.0.’ Savvy investors are seeing the growth venture opportunity early. Three factors are converging to set the stage for a new wave of growth venture investment:

Declining interest rates that make growth-oriented assets more attractive

Investors shifting to a 'risk-on' mentality in search of high returns

Limited opportunities in public markets driving capital to private investments

The success stories of Climate Tech 2.0—built on technologies with strong unit economics and a track record of deployment—are creating a foundation for Climate Tech 3.0, where growth-stage investments in emerging technologies will dominate.

Growth Capital: The Linchpin of Climate Tech 3.0

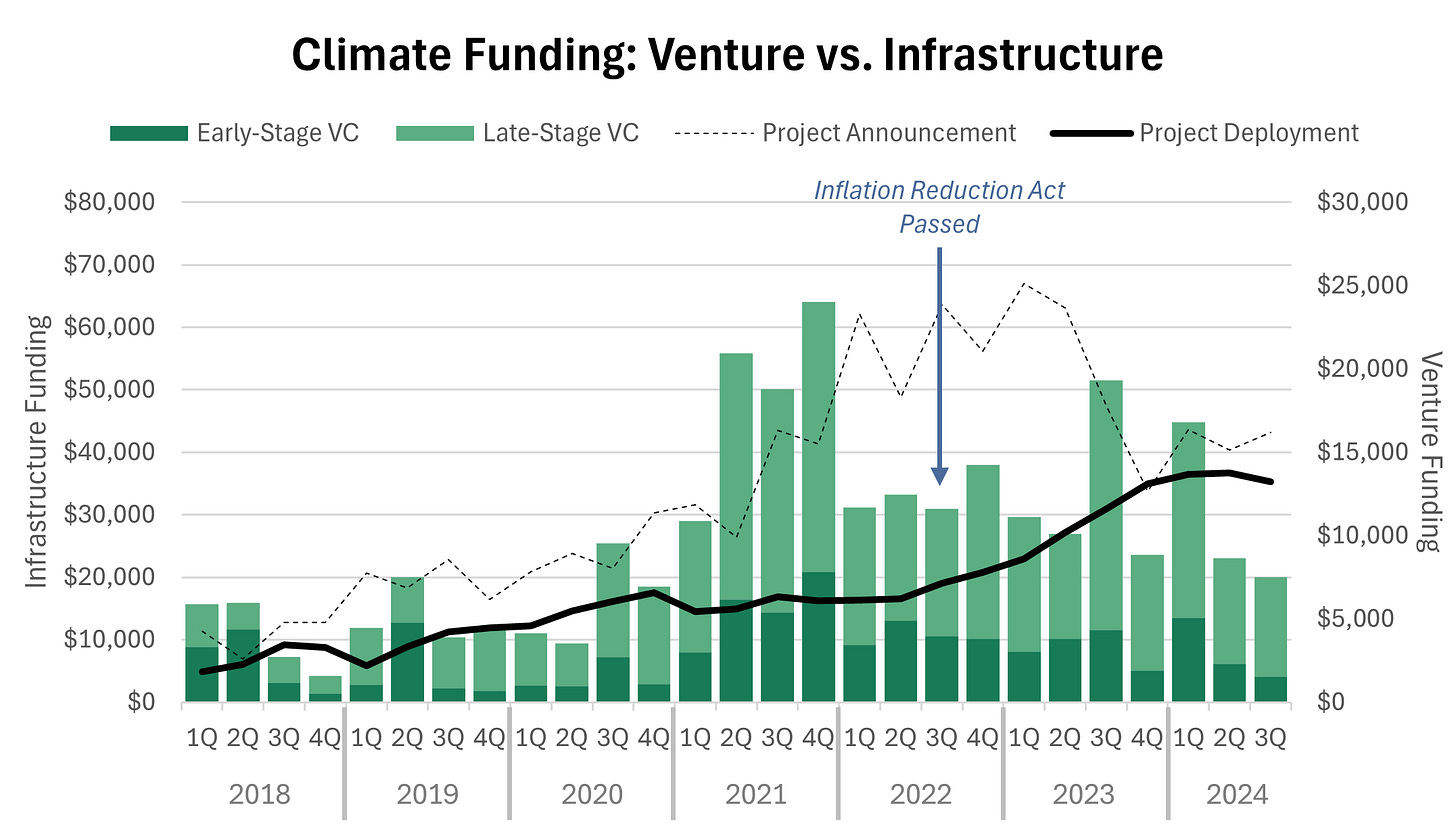

Within Climate Tech, venture investments serve as a leading indicator for major project announcements, which eventually translate into actual deployment. The analysis below highlights trends across early and growth-stage investing, emphasizing their impact on infrastructure development. While early-stage investing has remained relatively stable, late-stage investing has seen significant fluctuations due to both macroeconomic conditions and sector-specific dynamics. These fluctuations reflect more than just interest rate sensitivity; they reveal thematic shifts in climate tech priorities.

On a 12-18 month lag from late-stage venture investing, major projects tend to be announced. These announcements then lead to infrastructure deployments approximately 12 months later. This sequential timeline highlights how venture capital de-risks and incubates innovations before large-scale adoption.

Source: Rhodium Group Clean Investment Monitor, Pitchbook

This pattern holds true across specific investment themes, indicating a consistent relationship between venture capital and deployment. While venture funding peaked during the broader market hype of 2021, its impacts extend beyond coincidental timing. The passage of the Inflation Reduction Act (IRA) provided favorable optics for many project announcements, but the data suggests a deeper, more causal link.

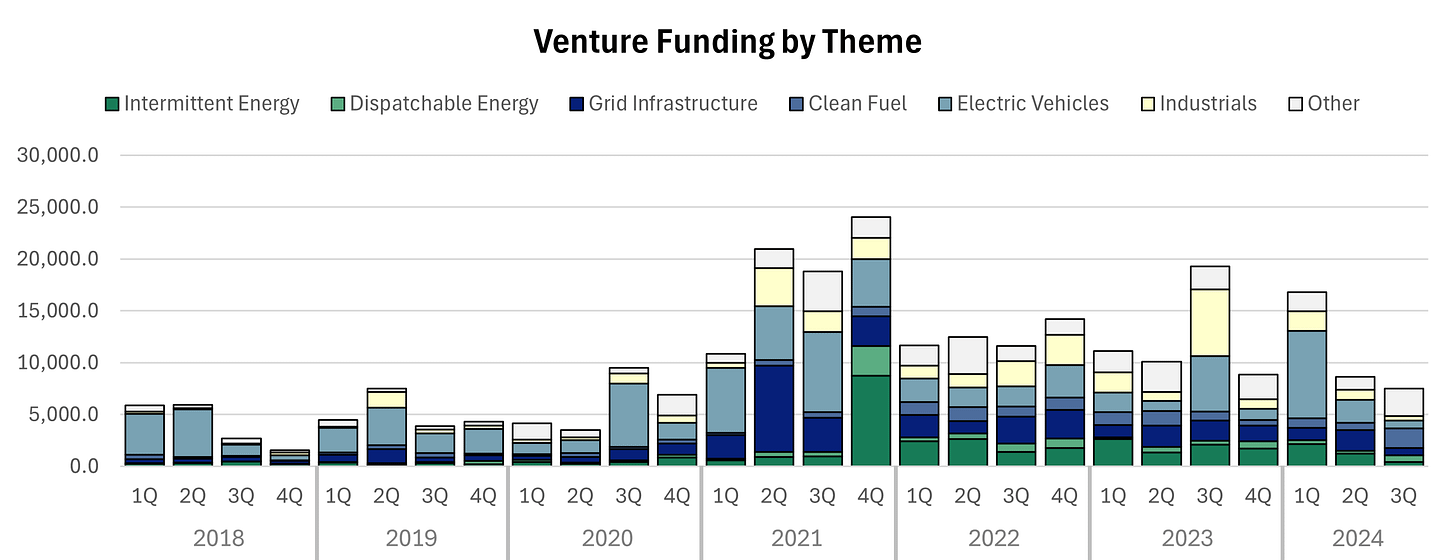

Electric Vehicles & Battery Materials: In 2021, the EV industry attracted record venture and private equity investments, totaling $12.64 billion, alongside substantial commitments from automakers like Ford ($50 billion), GM ($7 billion), and Toyota ($3.4 billion for U.S. projects), primarily for battery production and EV manufacturing. These investments supported significant advancements in battery technology, infrastructure development, and manufacturing capacity. The direct link between venture capital and infrastructure deployment is evident: automaker investments de-risked battery technology, paving the way for mass adoption and infrastructure scaling.

However, this growth also faced challenges. Supply chain bottlenecks for critical minerals like lithium and cobalt, as well as geopolitical uncertainties, slowed deployment timelines. As these bottlenecks are addressed, investments in battery materials—especially recycling and alternatives like solid-state batteries—are emerging as key areas of opportunity.

Grid Infrastructure: The utility-scale battery storage sector also saw transformative investments in 2021. U.S. funding reached approximately $2 billion, a 64% year-over-year increase. This surge led to 4 GW/12 GWh of new battery energy storage systems (BESS) being commissioned in 2022, representing an 80% increase in installed capacity. These systems are critical for stabilizing grids as renewable energy penetration grows.

The link between venture funding and deployment in this sector is particularly strong, as investors de-risked early technologies like long-duration storage and lithium-ion alternatives. However, scalability remains a challenge, with high costs and permitting delays hindering broader deployment. Going forward, opportunities lie in innovations that reduce costs, integrate distributed energy resources, and streamline project timelines.

Implications for Private Market Investors

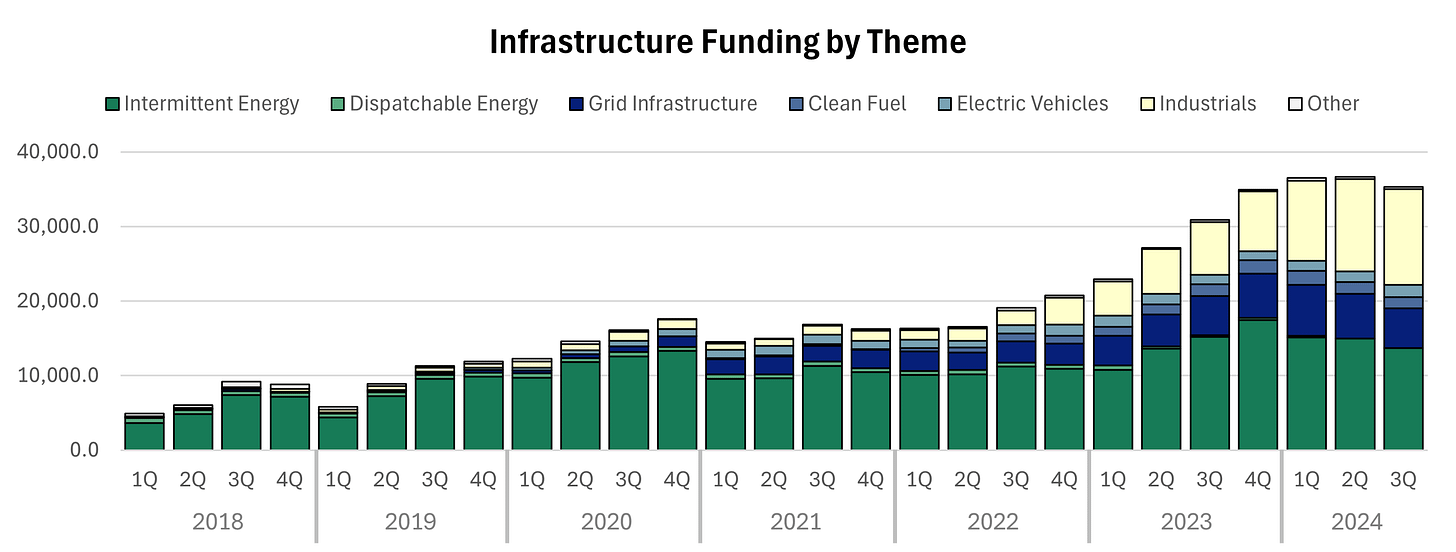

Based on recent venture capital trends, infrastructure investors should focus on battery materials and industrial applications. These areas are primed for growth-stage investments and project funding as early-stage innovations mature. While intermittent renewable energy and traditional grid infrastructure may be reaching saturation, emerging technologies in long-duration storage, industrial decarbonization, and supply chain localization are poised for significant expansion.

It’s also worth noting that private capital in climate infrastructure appears resilient. The growth of this market pre-dated the IRA and is likely to persist despite potential policy shifts. Challenges such as permitting reform and workforce availability may act as headwinds, but these are unlikely to derail overall growth.

Creative financing structures that blend project and growth equity are emerging as key differentiators in climate tech. With unprecedented talent driving commercialization of material science breakthroughs, the market is ripe for innovation. However, traditional venture capital often falls short for capital-intensive infrastructure projects, leaving room for novel financial solutions. These approaches—such as hybrid equity-debt models or development capital—are well-positioned to unlock asymmetric returns by bridging the gap between high-risk innovation and long-term infrastructure investment.

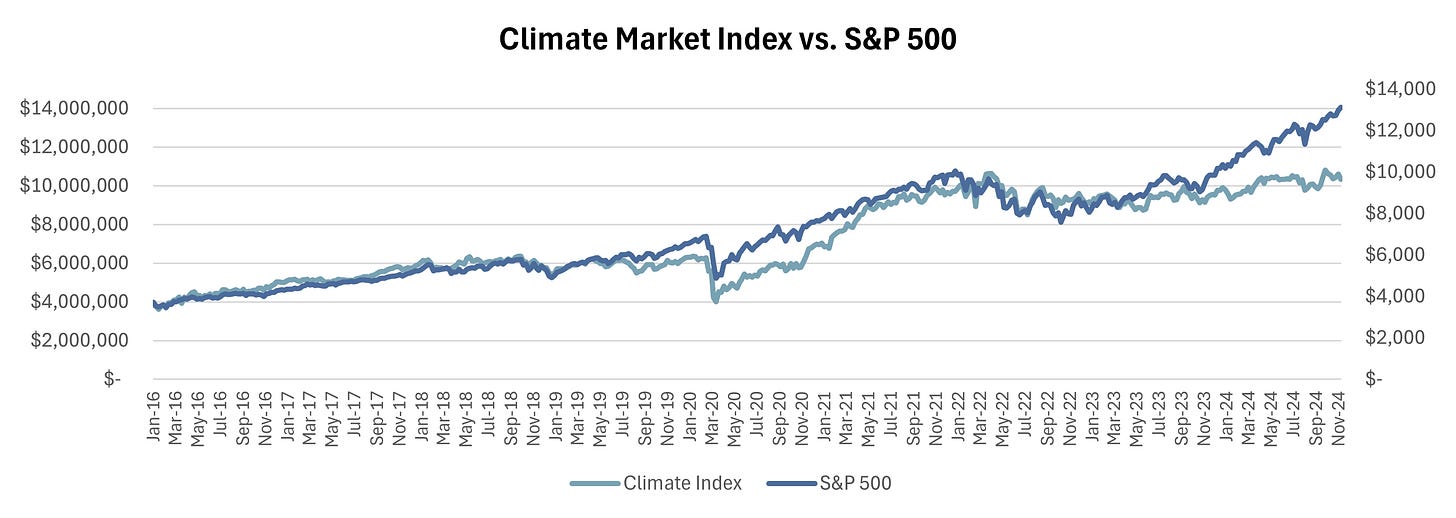

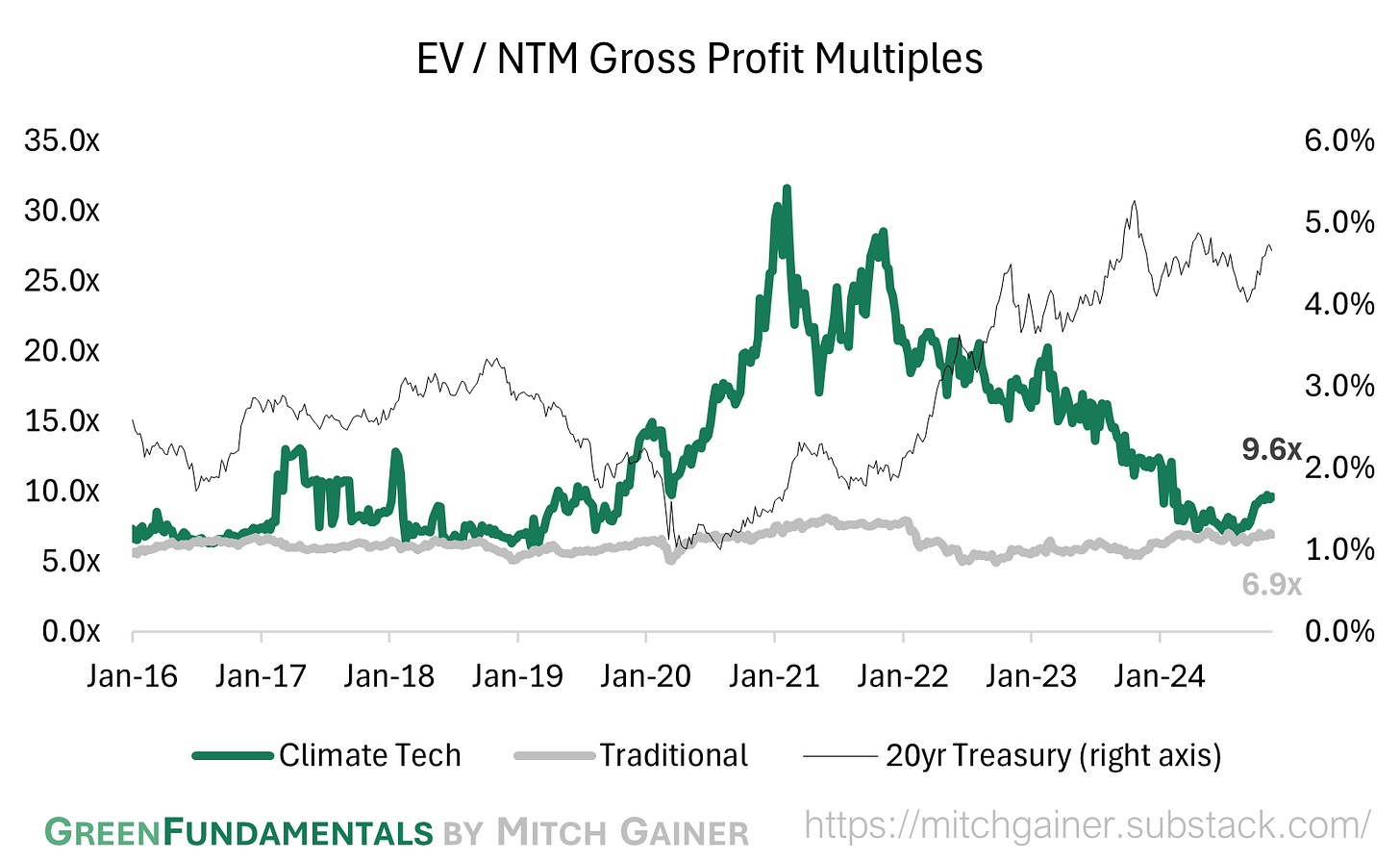

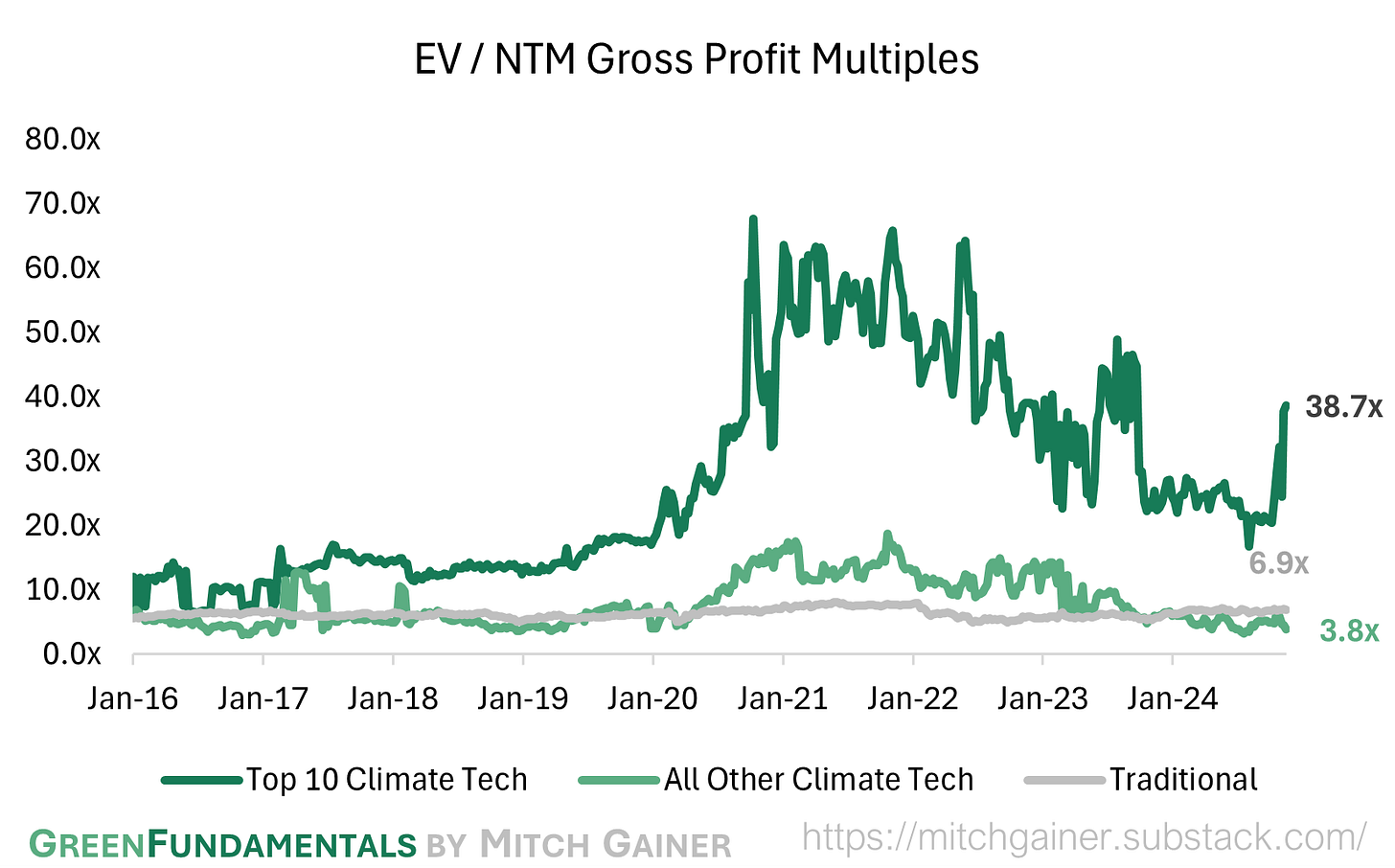

Public Markets: A Different Story

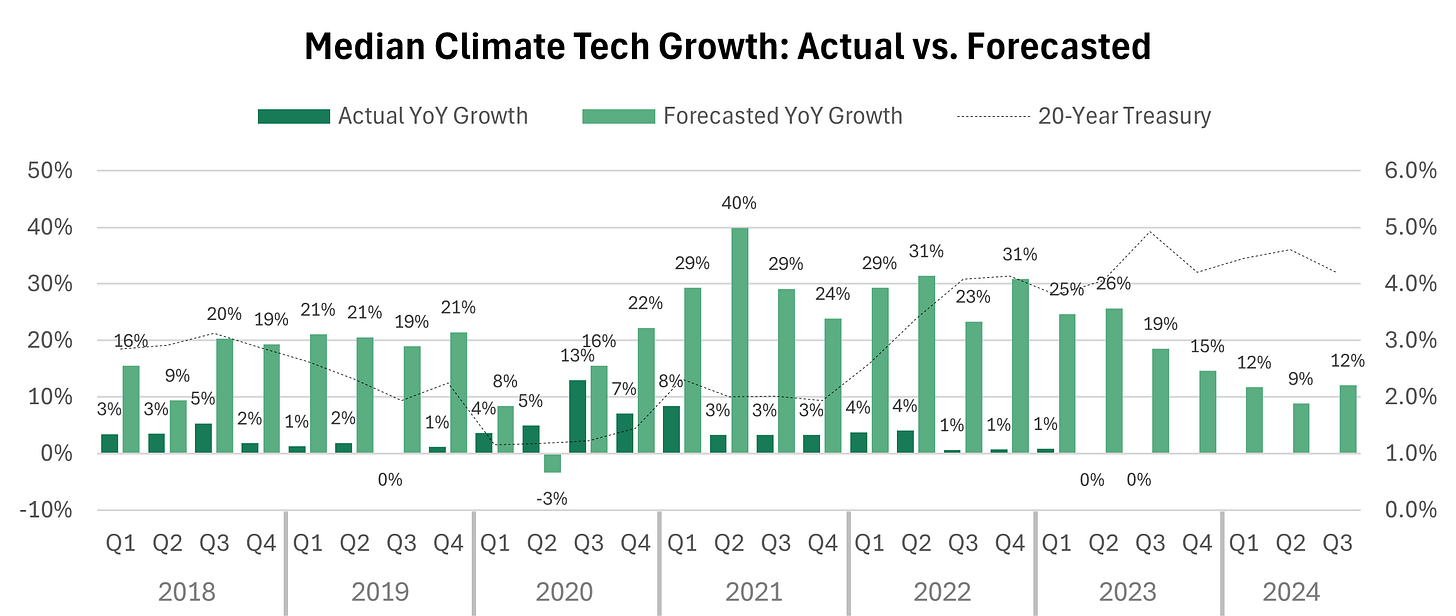

Public climate companies continue to struggle despite improving macroeconomic conditions. The 10- and 20-year Treasury yields have not declined significantly, and public market performance remains concentrated in a few dominant players like Tesla. Broader public climate tech companies have consistently underperformed consensus growth expectations. This reflects both execution challenges and a mismatch between investor expectations and market realities.

Source: CapitalIQ

Unlocking capital for public climate companies will require consistent year-over-year growth that meets or exceeds expectations. Stronger earnings, improved operational efficiency, and clarity around government policy impacts are essential to rebuilding investor confidence in this sector.

Over the past few years, public climate tech companies have significantly underperformed the consensus growth expectations. Actual YoY growth will need to pick up and meet consensus before capital will unlock for these public companies.

Source: CapitalIQ

Take-Away

The cycle of venture investments, project announcements, and infrastructure deployment underscores private capital’s pivotal role in driving climate tech innovation. While public markets face headwinds, private investments are charting a durable growth trajectory, creating fertile ground for transformative advancements. The next wave of opportunities lies in battery materials, industrial decarbonization, and grid integration—sectors fueled by recent venture activity and ripe for scaling.

Climate Tech 3.0 is emerging, marked by disciplined growth and technological maturity. Savvy investors are seizing this moment, leveraging a perfect storm of declining interest rates, risk-on capital flows, and novel financing models to accelerate the deployment of decarbonized infrastructure. Those who act now will not only capture outsized returns but also help shape the infrastructure of a sustainable future.

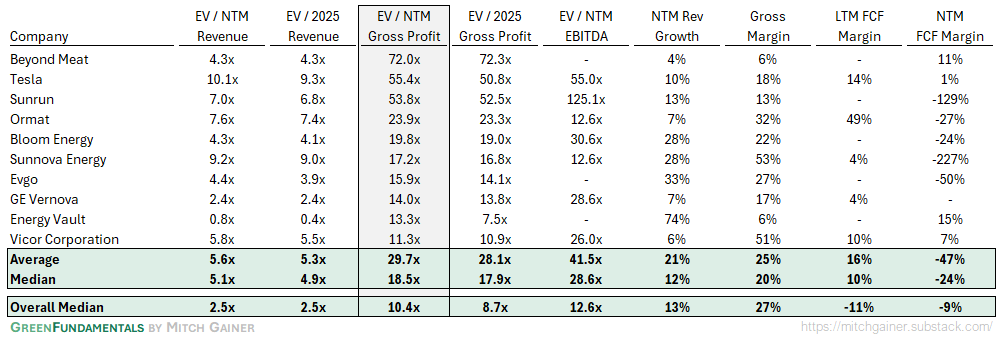

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

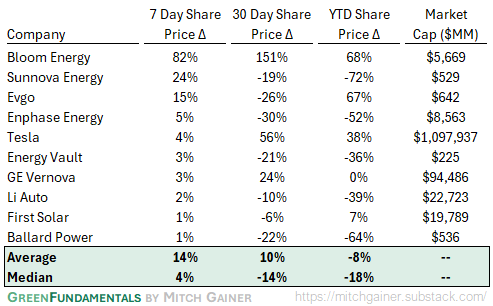

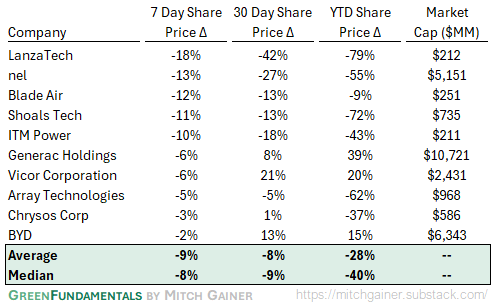

Top 10 and Bottom 10 Weekly Share Price Movement

Valuation Multiples over Time

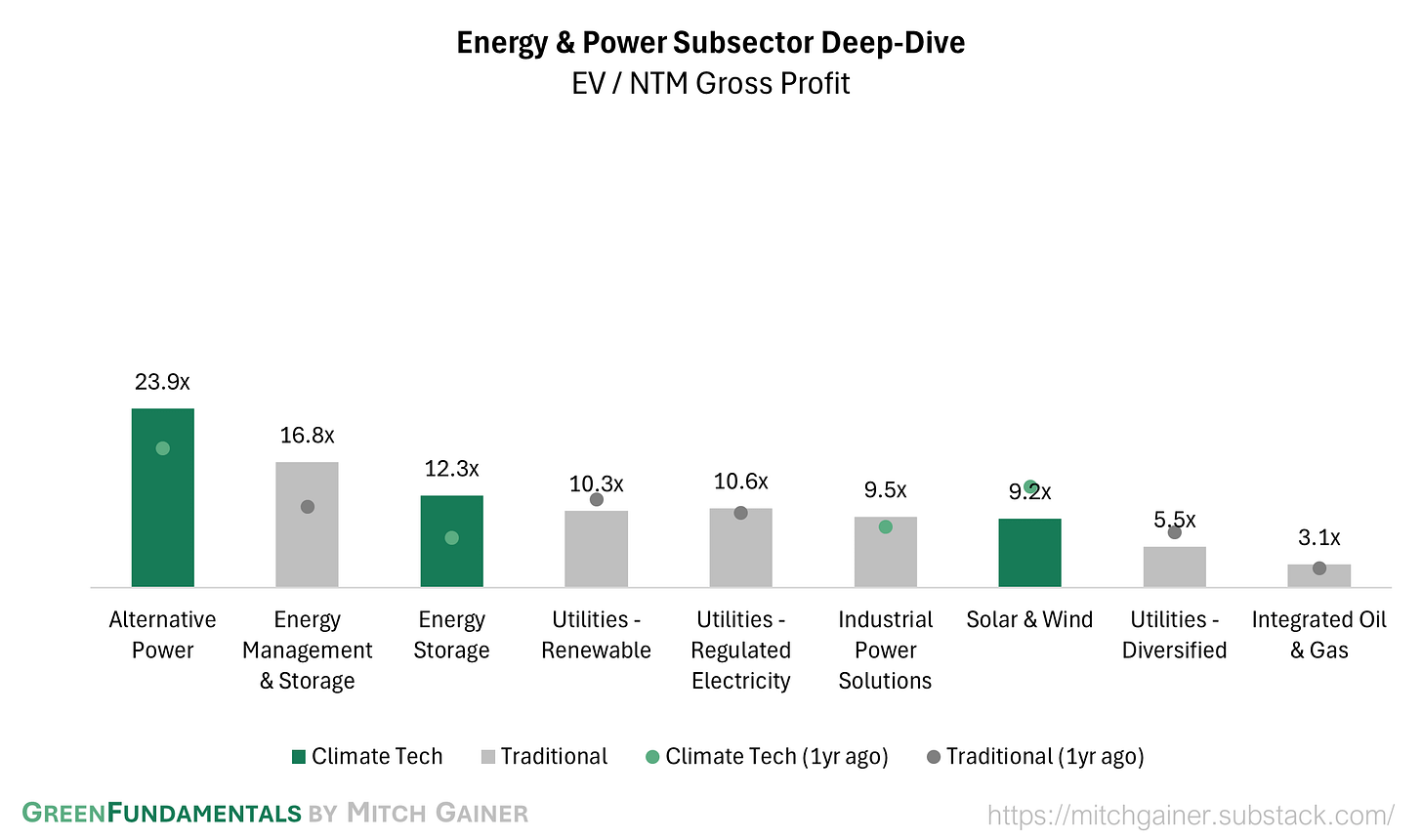

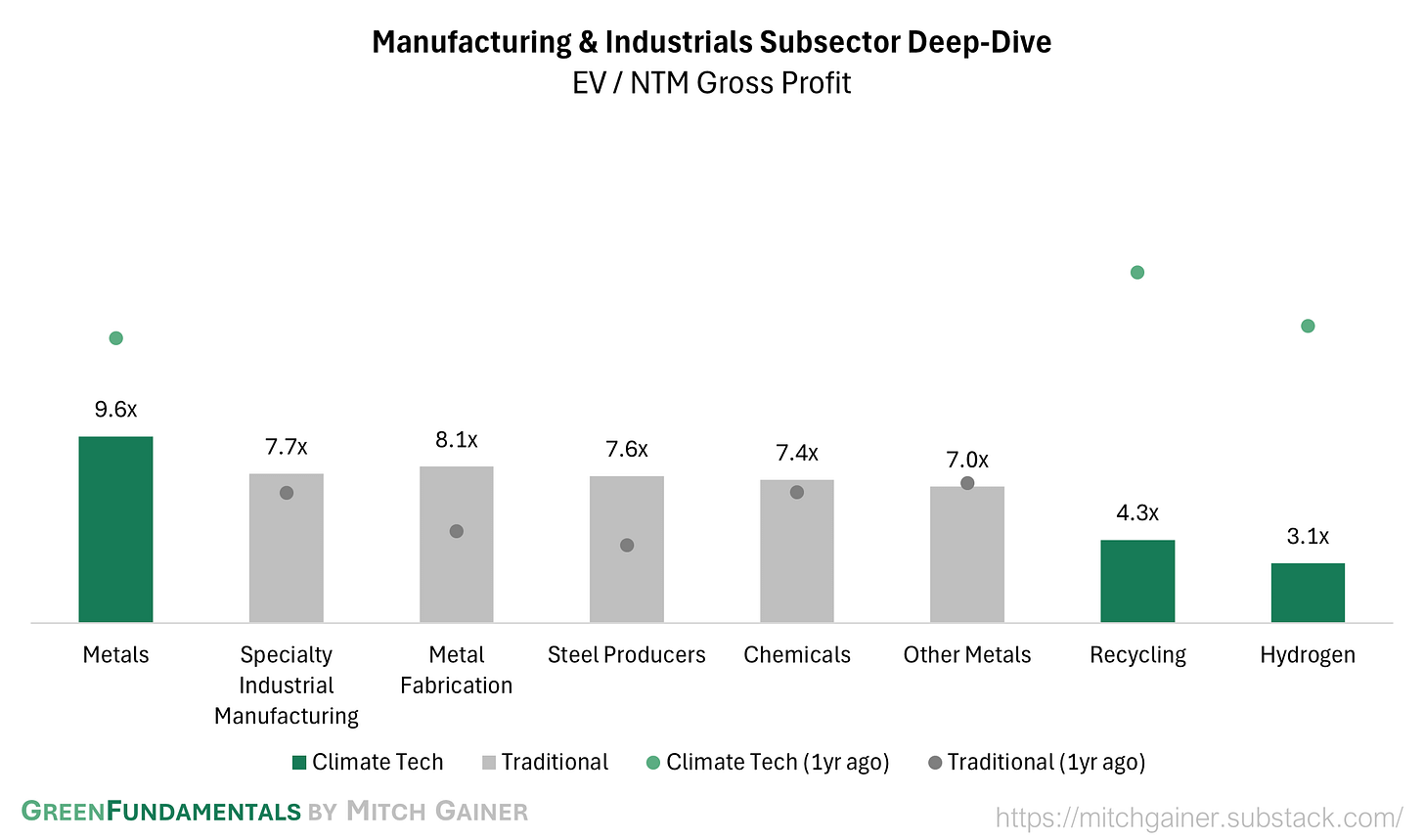

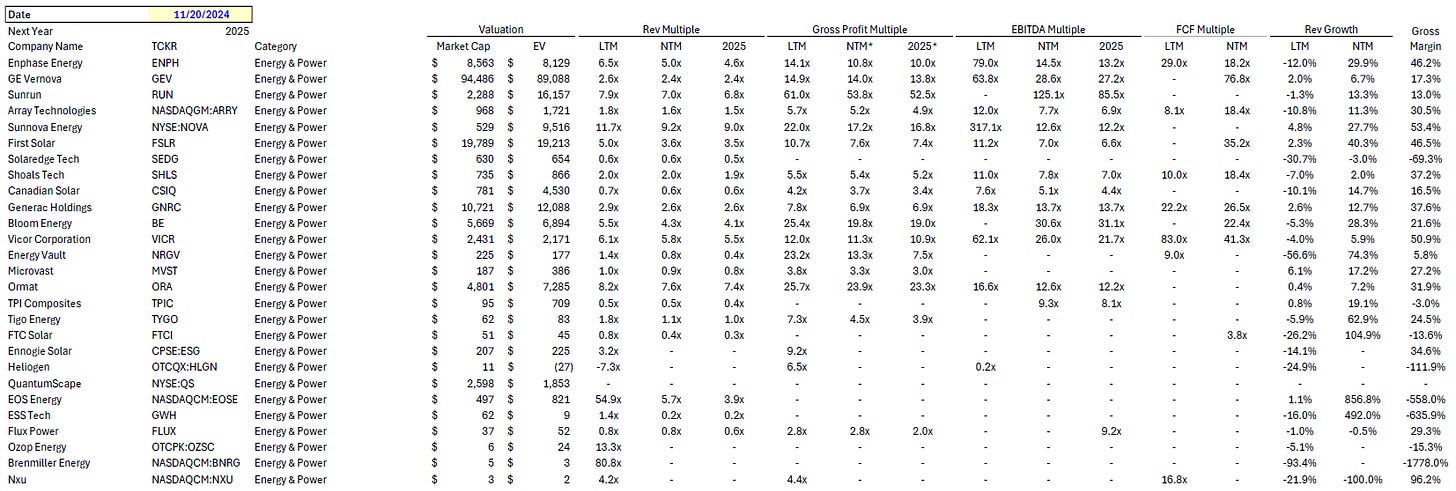

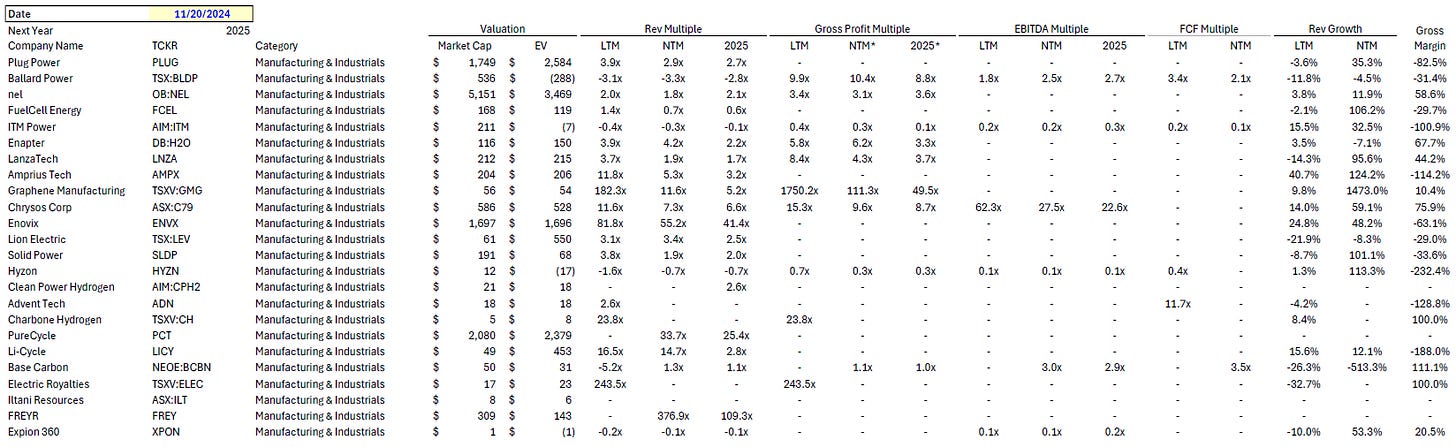

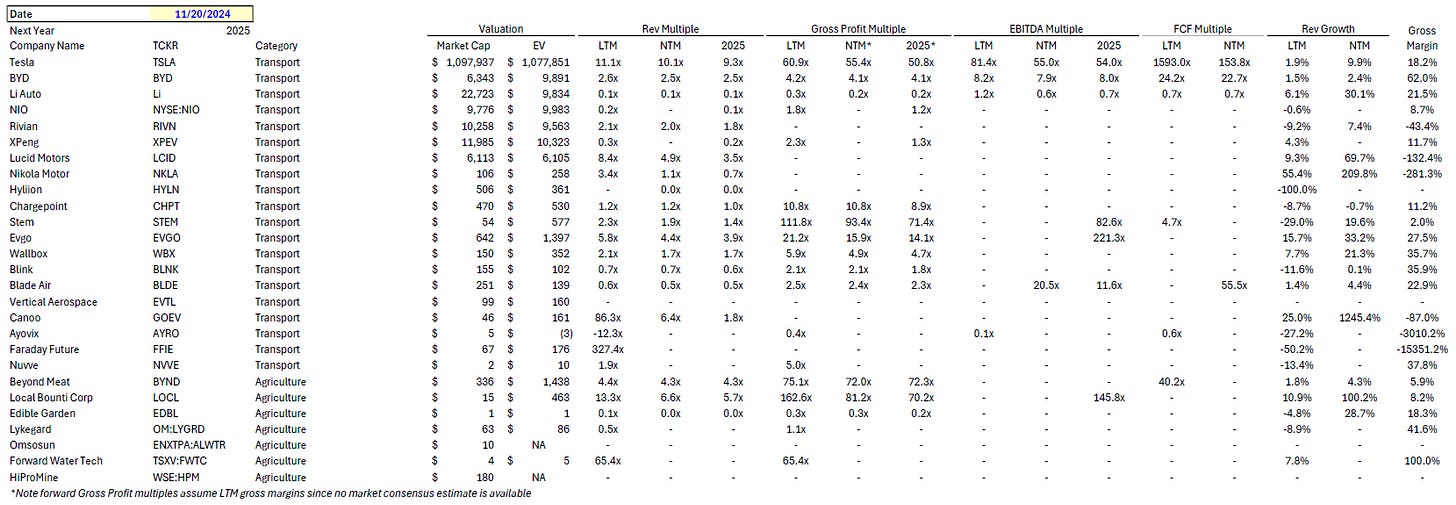

Deep-Dive by Subsector

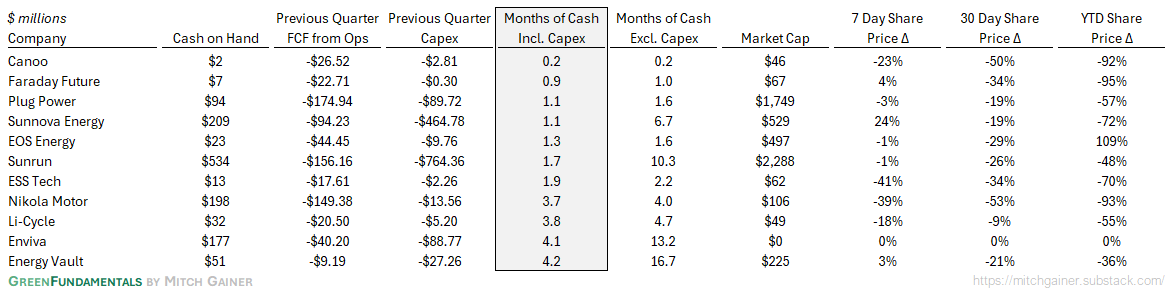

Months of Cash

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.