Green Fundamentals: Hydrogen Tax Credit - Dead or Alive?

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Hydrogen Tax Credit likely to stay in limbo past Election Day, making fundraising for projects more difficult

What Happened: Several events have cast doubt on the future of the Hydrogen Tax Credit (45V):

December 22, 2023: The Treasury released proposed regulations for the Hydrogen Tax Credit (45V), which were stricter than some anticipated, causing concerns for many projects.

June 28, 2024: The Supreme Court overturned the Chevron doctrine, a 1984 precedent that gives federal agencies wide latitude to interpret laws passed by congress, potentially leading to further lawsuits questioning the legality of the Treasury’s interpretation of 45V and other tax credits.

July 10, 2024: 13 Democratic lawmakers argued that Treasury’s regulations are inconsistent with the IRA. Some groups are considering using the Chevron ruling to overturn these hydrogen regulations.

Background: The clean hydrogen market is in its early stages, with the IRA aiming to test various use cases. There have been many guesses as to how this will shake out (see the Hydrogen Ladder below). McKinsey forecasts significant growth from mobility, heating, and industry (see below).

Source: Liebreich Associates

Source: McKinsey & Company

The Treasury's stricter requirements for the 45V tax credit pose significant challenges for hydrogen production. Increasing electrolyzer utilization (running them 24x7) reduces the cost per kg of hydrogen. But, clean power is not always available. Hydrogen developers wanted to:

Use existing 24x7 power (like hydro)

Sign Power Purchase Agreements (PPAs) for power that can be far away, enabling hydrogen production to be done where most profitable

Consume power when renewables are not be available (i.e., at night) but claim renewable power by ‘matching’ consumption to renewable generation (i.e., pay extra during the day, consume at night)

Instead, 45V is based on 3 pillars that do just the opposite:

Incrementality: Power must come from clean generation that started less than 36 months before the hydrogen facility began operations. As a result, existing hydro power and even much existing renewable power would not qualify. Newly built renewable power is needed (and would be a significant bottleneck).

Deliverability: Power must be generated in the same region as the hydrogen production facility. As a result, hydrogen producers could get forced to build in areas that are better for renewable generation but worse for hydrogen storage, transport, and/or offtake.

Hourly Matching: By year 5, power must correspond to clean energy generated in the same hour as the electricity used for hydrogen production. As a result, hydrogen producers can’t ‘get credit’ for power generated during the day if they consume power at night.

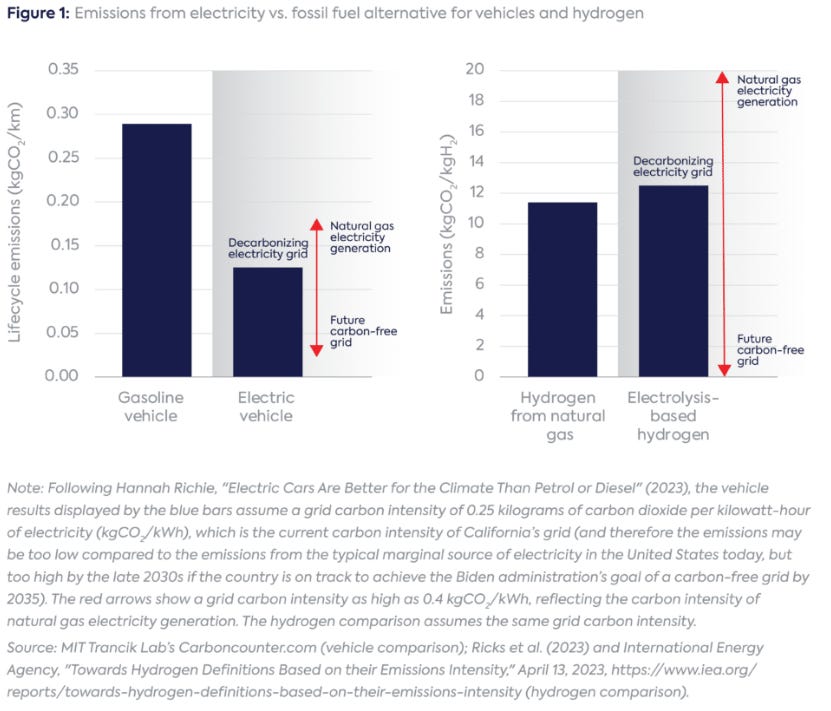

Both environmentalists and the Oil & Gas industry supported strict standards. Environmental advocacy groups wanted stricter standards, hoping it will result in more renewable build-out. They believed hydrogen production could add emissions if made with a ‘dirty’ grid (see below). Oil and gas companies wanted stricter standards (though rarely admitting it publicly), thinking it could slow or even stop the roll-out of a competing source of energy. Publicly they were glad if ‘blue hydrogen’ made with natural gas and carbon capture could qualify or if they could drill for hydrogen.

Source: Center on Global Energy Policy at Colombia

Hydrogen project developers and investors are concerned about the viability of future projects. For example, hydrogen produced with natural gas is key to seven of the hydrogen hubs winners (a Bipartisan Infrastructure Law hydrogen policy). Some companies insist the regulations will change, but time will tell.

The Supreme Court’s Chevron ruling adds yet another complicating factor. The Supreme Court has been slowly setting precedent to overturn Chevron, a precedent that gave the executive branch wide latitude to interpret law passed by Congress. These decisions collectively signal a move toward stricter judicial oversight of federal agency actions.

On January 13, 2022, the Court limited the EPA's power to enforce a mask mandate on planes without explicit congressional authorization.

On June 30, 2023, the Court struck down the Biden administration's student loan cancellation plan, emphasizing the need for clear legislative approval for such broad actions.

On June 28, 2024, the Court's ruling in Loper Bright Enterprises v. Raimondo overturned the Chevron precedent all together, continuing the trend of scrutinizing and limiting the power of federal agencies.

Take-Away: The Supreme Court ruling on Chevron may have a cooling effect on hydrogen investment. The 45V hydrogen tax credit is set to undergo significant legal and regulatory uncertainty, with final Treasury guidance unlikely before Election Day. This ruling could lead to stricter judicial review of the Treasury's guidelines and methodologies.

What Comes Next: Regulatory uncertainty for investors in hydrogen may be enough to stop investment all together. Constellation plans to file for 45V credits and challenge regulators in court. Even post-Election Day guidance may not be investible for years as legal challenges progress.

More of the IRA might be at risk. Democratic lawmakers have pushed for interpretations that could be overturned, including anti-competitive regulations, avoiding support for factory farming, and blocking plastic-based fuels. Senate Republicans may use the congressional review act to nullify regulations coming from Treasury.

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Carbon Sequestration: Sam Altman-Backed Startup Scaling Technology to Store CO2 in Rocks (Bloomberg)

Battery Energy Storage: Is BESS commoditising? Industry converges to 20-foot, 5MWh products (Energy Storage News)

Batteries: Solid-state batteries with a range of 1,000 kilometers are coming, but we can’t afford them. (Blog Post on LinkedIn)

Private Markets (PE / VC / Real Estate / Infra)

Solar: US renewables electricity output overtaking nuclear (Reuters)

Nuclear: The Nuclear Company Announces Plans to Develop Fleet-Scale Nuclear Power in the U.S. (Business Wire)

Nuclear: Problem at Point Lepreau nuclear plant could prolong 3-month outage, drive up costs (CNBC News)

Nuclear: Three Mile Island considers nuclear restart as Pa. lawmakers look to new tech to meet demand (State Impact Pennsylvania)

Wind: US offshore wind farm shut down after turbine debris fouls beaches (Reuters)

Mining: Cumbria project will be ‘net zero’, coalmine firm tells high court (The Guadrian)

First-of-a-Kind: Building Billion-Dollar Industrial Strategies for the Energy Transition: From Tesla to Twelve with Andy Stevenson (NextGen Industry Group)

Utilities: California’s grid passed the reliability test this heat wave. It’s all about giant batteries (The Sacramento Bee)

Batteries: The U.S. battery supply chain has entered phase two (Latitude Media)

Public Markets (Stocks, Bonds)

Solar: SunPower Plunges After Halting Solar Installs and Shipments (Yahoo)

Data Centers: Google cuts on-site carbon emissions but struggles to contain data center electricity use (Utility Dive)

Utilities: NextEra Energy Resources reaches final permitting stage for 3GW BESS in Fresno County, California (Energy Storage News)

Hydrogen: Bloom Energy and CoreWeave Partner to Revolutionize AI Data Center Power Solutions (Business Wire)

Electric Vehicles: This Is When Hyundai's Rivian R1S Rival Will Arrive (Carbuz)

Electric Vehicles: Rivian Announces FIVE New Vehicles (247 Wall St)

EV Charging: EVgo stock roars to life after Benchmark raises price target (Yahoo)

Government & Policy

EU: Europe’s battery problems show the governments need to up their game (FT)

WTO: China requests WTO to establish panel regarding dispute over US Inflation Reduction Act (Shine)

Hydrogen Hub: California’s hydrogen hub becomes first in US to formally receive federal funding, with $12.6bn of public and private finance secured (Hydrogen Insight)

Interest Rates: Fed sends clearest signals yet that it will soon cut interest rates (FT)

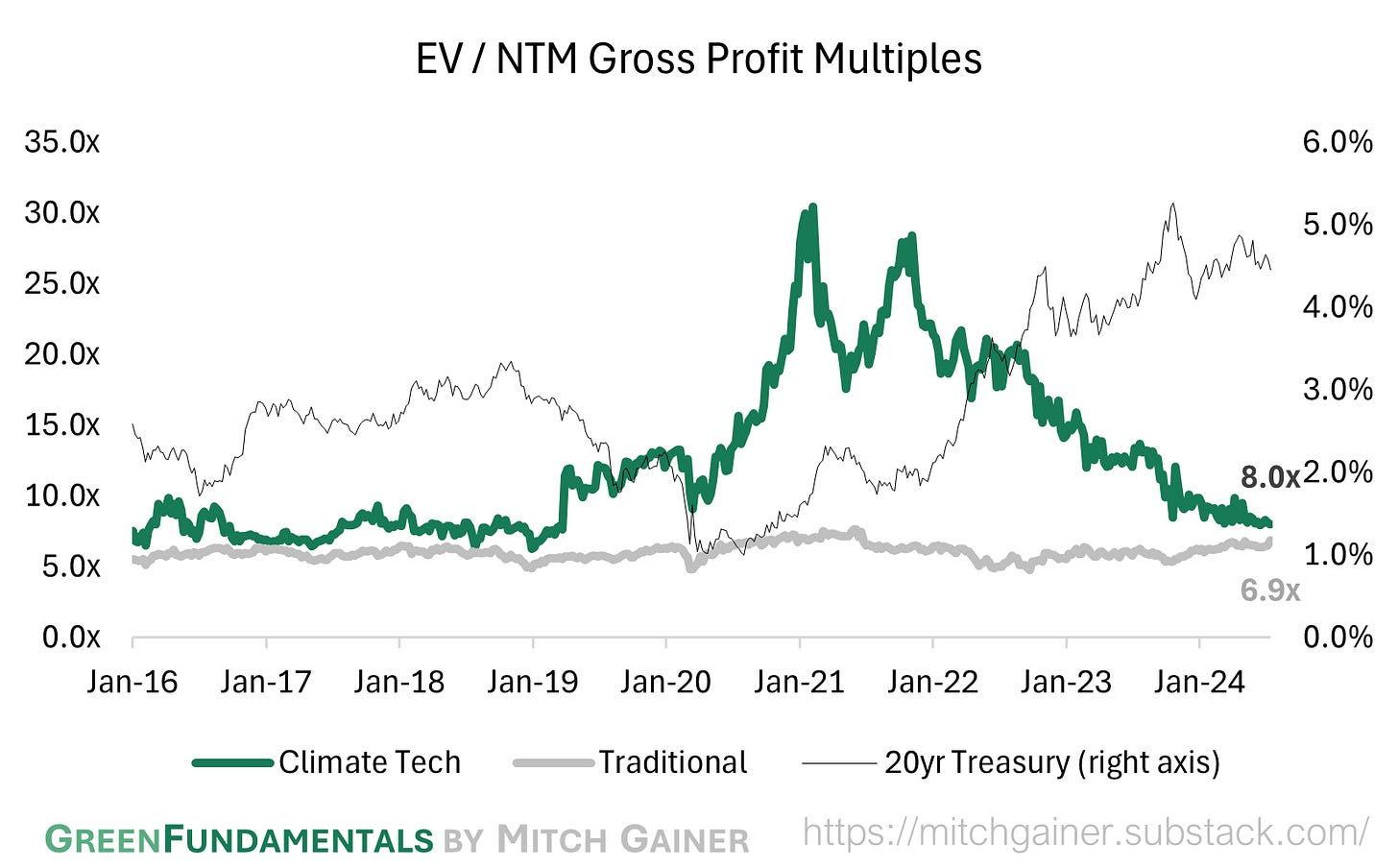

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

Top 10 and Bottom 10 Weekly Share Price Movement

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium while energy management systems have increased in value; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

Manufacturing & Industrials: Hydrogen and recycling investments are commanding a premium again, though neither are trading nearly as high as they were a year ago.

Transport: EV growth is priced in to climate tech and traditional companies - though they have declined over the past year; the market is skeptical on eVOTL.

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.