Green Fundamentals: Hydrogen's Temporary Uptick

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

This post and the information presented are intended for informational purposes only. They reflect solely the personal opinions of the author in his individual capacity. They do not reflect the views or opinions of any current, past, or future employer, organization, or affiliate.

Nel is Boosted by Samsung’s Buy-in, but the fundamentals remain weak - wait for more order flow before Hydrogen is investible

Nel’s stock has surged 19% over the past week, driven by news of Samsung E&A acquiring a 9.1% stake in the company. This move positions Samsung as Nel’s largest shareholder and underscores its broader strategy to vertically integrate into the hydrogen sector. Rather than just supplying electrolysis technology, Samsung is positioning itself as an EPC (engineering, procurement, and construction) provider of full hydrogen plant solutions. This partnership could help Nel secure larger industrial projects, particularly in Asia, where Samsung has strong market access.

At the same time, Nel’s Q4 2024 earnings call painted a mixed picture: while cost discipline is improving, demand remains uncertain, and macroeconomic headwinds continue to weigh on project development.

Revenue for the quarter stood at NOK 416 million, up slightly from the previous quarter, but EBITDA remained negative at NOK 36 million, despite a 60% reduction in losses compared to 2022.

Order intake was a weak NOK 148 million, and the order backlog declined to NOK 1.6 billion, reflecting a slowdown in project commitments.

Most notably, Nel has temporarily halted production at Heroya and reduced its workforce by 25% to conserve cash, despite a still-strong cash balance of NOK 1.9 billion.

This underscores a key challenge: Nel has successfully improved margins, but it needs significantly stronger demand to justify its existing manufacturing footprint.

Hydrogen Market Check: Caution in the U.S., Measured Optimism in Europe

The broader hydrogen sector remains in a holding pattern. In the U.S., policy uncertainty continues to stymie large-scale investment, with delayed guidance on 45V tax credits and developers hesitant to commit capital without more clarity. Nel itself has put its planned $400M Michigan gigafactory on hold, citing weak near-term demand. The European picture is slightly brighter, with national hydrogen auctions providing some momentum, but electrolyzer manufacturers still face margin compression and tough competition from Chinese suppliers.

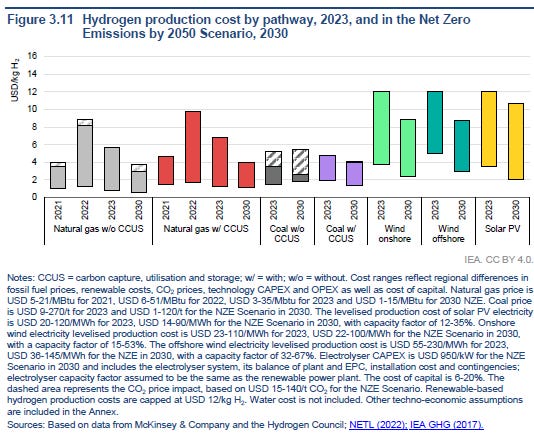

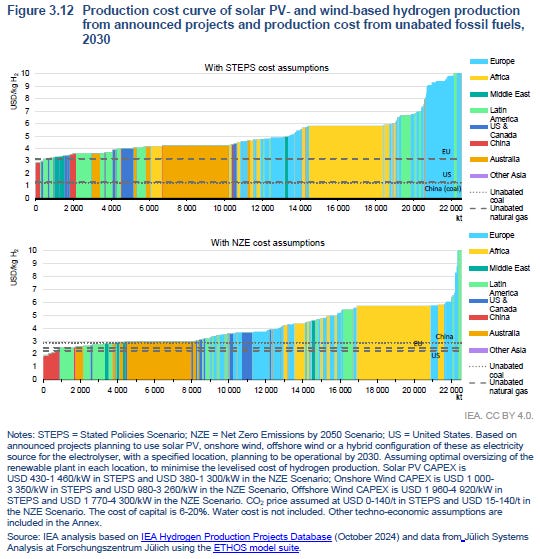

According to the IEA’s 2024 hydrogen report, only 25-30% of announced global hydrogen projects are likely to reach FID by 2030, significantly lower than previously anticipated. While subsidies and funding mechanisms are coming online, they are not yet translating into bankable projects at scale. The most striking data point: green hydrogen production costs remain 2-4 times higher than fossil-based hydrogen in most markets, making it difficult to scale without significant policy support. This cost gap is narrowing but remains a structural issue for the sector.

Source: IEA

The fundamental problem for the hydrogen economy is that battery costs continue to fall while electrolyzer costs are rising. Battery prices have dropped nearly 50% since 2021, while electrolyzer prices have risen by 50% in the same period, according to BloombergNEF and S&P Global. This economic divergence makes direct electrification the more viable solution for many applications, particularly in transportation and grid balancing.

Despite the cost challenges, next-generation electrolyzers offer some hope—but they remain high-risk investments. Pressurized alkaline and PEM electrolysis continue to improve, and emerging technologies such as solid oxide electrolyzers and anion exchange membrane (AEM) electrolysis are being developed to reduce costs and increase efficiency. However, commercialization timelines are uncertain, and without policy support, private capital alone is unlikely to drive widespread adoption.

While green hydrogen struggles with cost competitiveness, carbon capture and pyrolysis-based hydrogen production are gaining traction as viable alternatives. Carbon capture retrofits for existing hydrogen production facilities provide a near-term way to lower emissions without the high capital expenditures of electrolysis. Meanwhile, methane pyrolysis, which splits methane into hydrogen and solid carbon, avoids the need for carbon storage and can produce low-emission hydrogen at a lower cost than electrolysis.

However, these methods also have limitations. They work best in areas with negative wholesale electricity prices, such as Delta, Utah, where excess wind and solar power can be used cost-effectively. Even so, transport and distribution remain major bottlenecks—without a widespread hydrogen pipeline network or cost-effective storage and transport solutions, local production and consumption will likely be the dominant model, limiting widespread scalability.

Investor Rationale: Betting on Scale vs. Survival

For investors, the fundamental question is whether to bet on Nel’s ability to outlast market stagnation or whether stronger alternatives exist. Nel remains well-capitalized, but its ability to secure new contracts is under pressure. The company’s partnership with Samsung E&A could provide a critical advantage, as Samsung's goal is to integrate Nel’s electrolysis technology into broader EPC offerings. This could make Nel more competitive in securing large industrial contracts compared to standalone electrolyzer manufacturers. However, the extent of Samsung’s strategic commitment remains unclear—whether it sees Nel as a long-term technology partner or just a short-term investment.

Investors should consider two key themes: (1) Europe vs. U.S. exposure—policy clarity in Europe makes the region relatively more attractive, while U.S. uncertainty suggests caution; (2) Tech differentiation—Nel’s next-generation pressurized alkaline electrolyzers could improve competitiveness, but execution on scaling production remains unproven.

Nel is far from the only player in this space, and competition is intensifying.

Biggest Competitors: Siemens Energy and Thyssenkrupp Nucera dominate large-scale hydrogen projects, while ITM Power and Plug Power face operational and financial struggles. Chinese manufacturers are rapidly gaining market share, particularly in low-cost alkaline electrolysis, squeezing margins for Western players.

Upcoming Startups to Watch: Startups like Electric Hydrogen, Hystar, Verdagy, Supercritical, and Ohmium are pushing next-gen electrolyzer technology, but they remain high-risk investments given uncertain adoption timelines and capital needs.

Key Takeaways: What Should Investors Do Next?

The hydrogen sector remains highly uncertain, and investors need to be selective - or even avoid the space entirely. Nel’s stock rally reflects improved investor sentiment, but fundamental demand remains weak. The company’s cash reserves and cost-cutting efforts provide some stability, but its manufacturing footprint is underutilized. Samsung’s investment could be a game-changer, positioning Nel as a key technology supplier for Samsung’s integrated hydrogen projects, but execution risks remain.

Bottom line: Nel has bought itself time, but it must rapidly convert its strategic partnerships into meaningful order flow. Investors should monitor near-term contract wins and execution on cost reductions before assuming this rally has real legs.

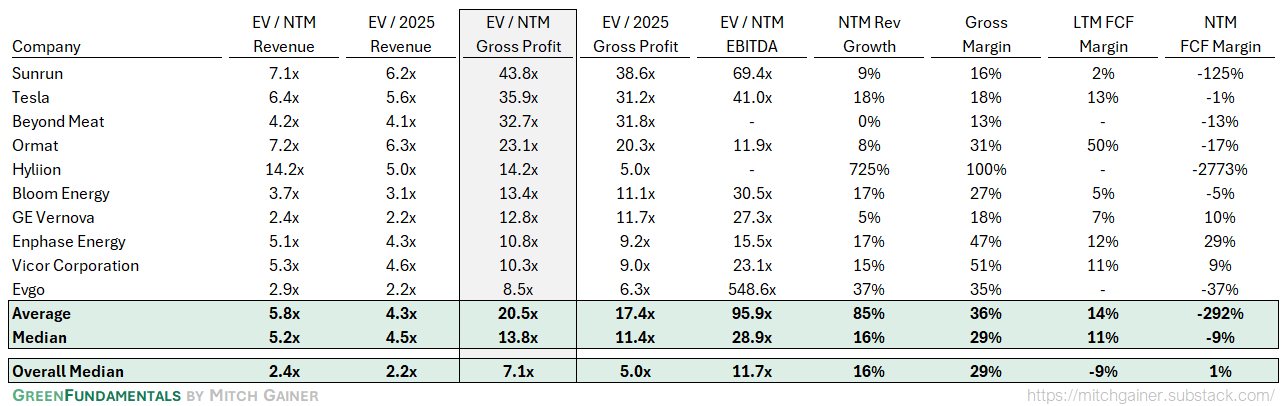

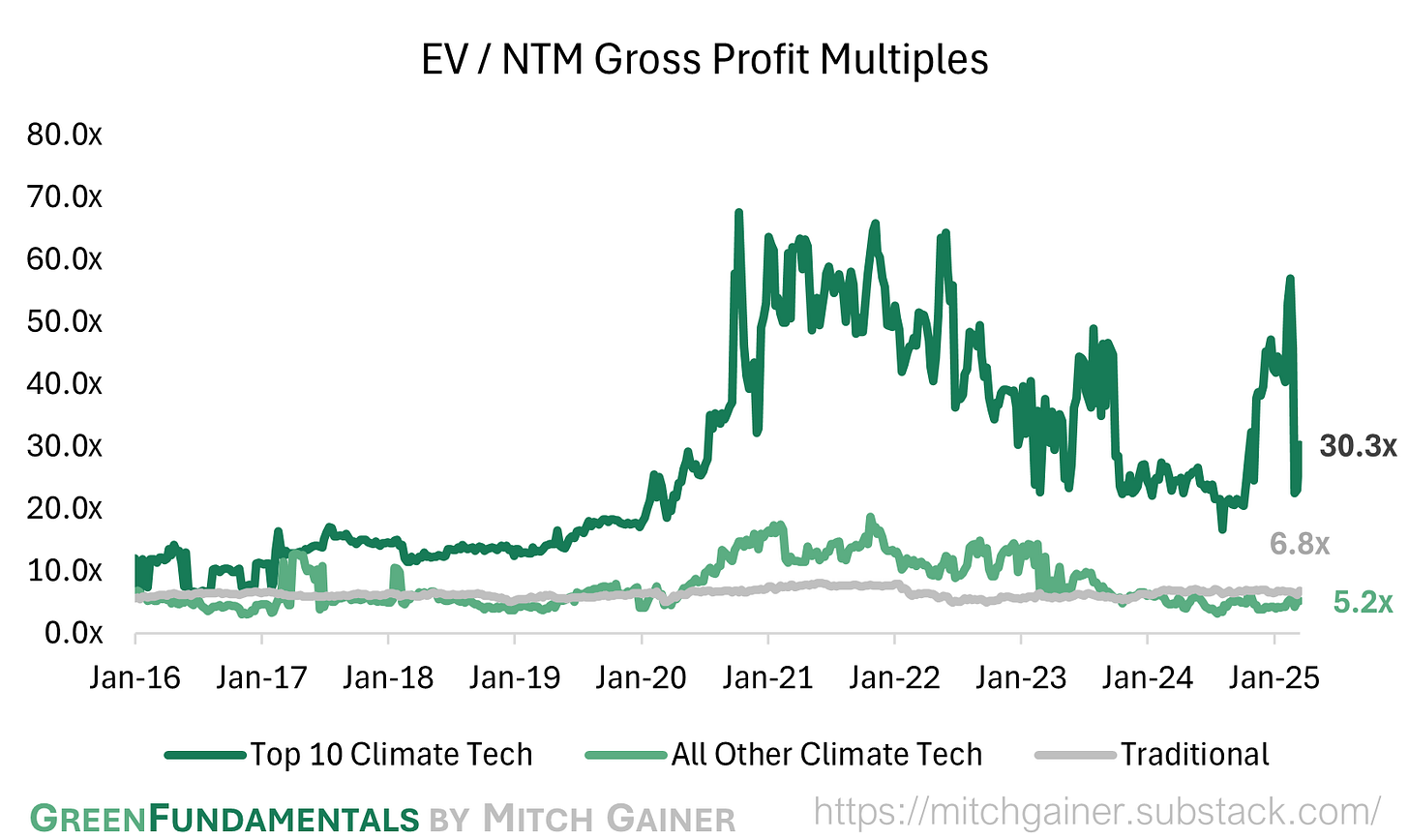

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

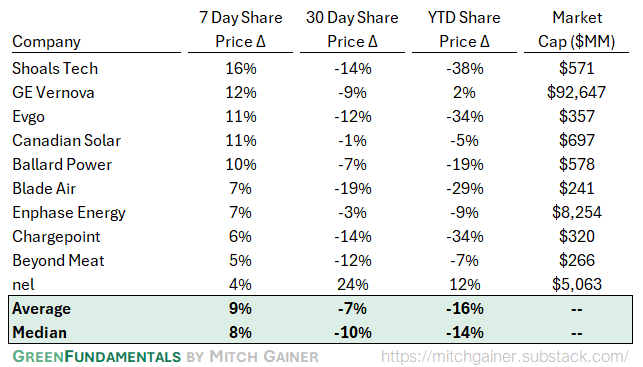

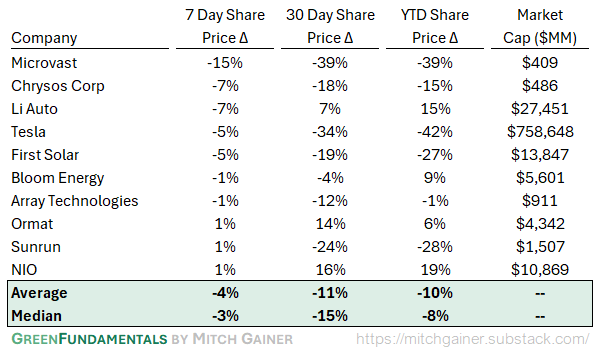

Top 10 and Bottom 10 Weekly Share Price Movement

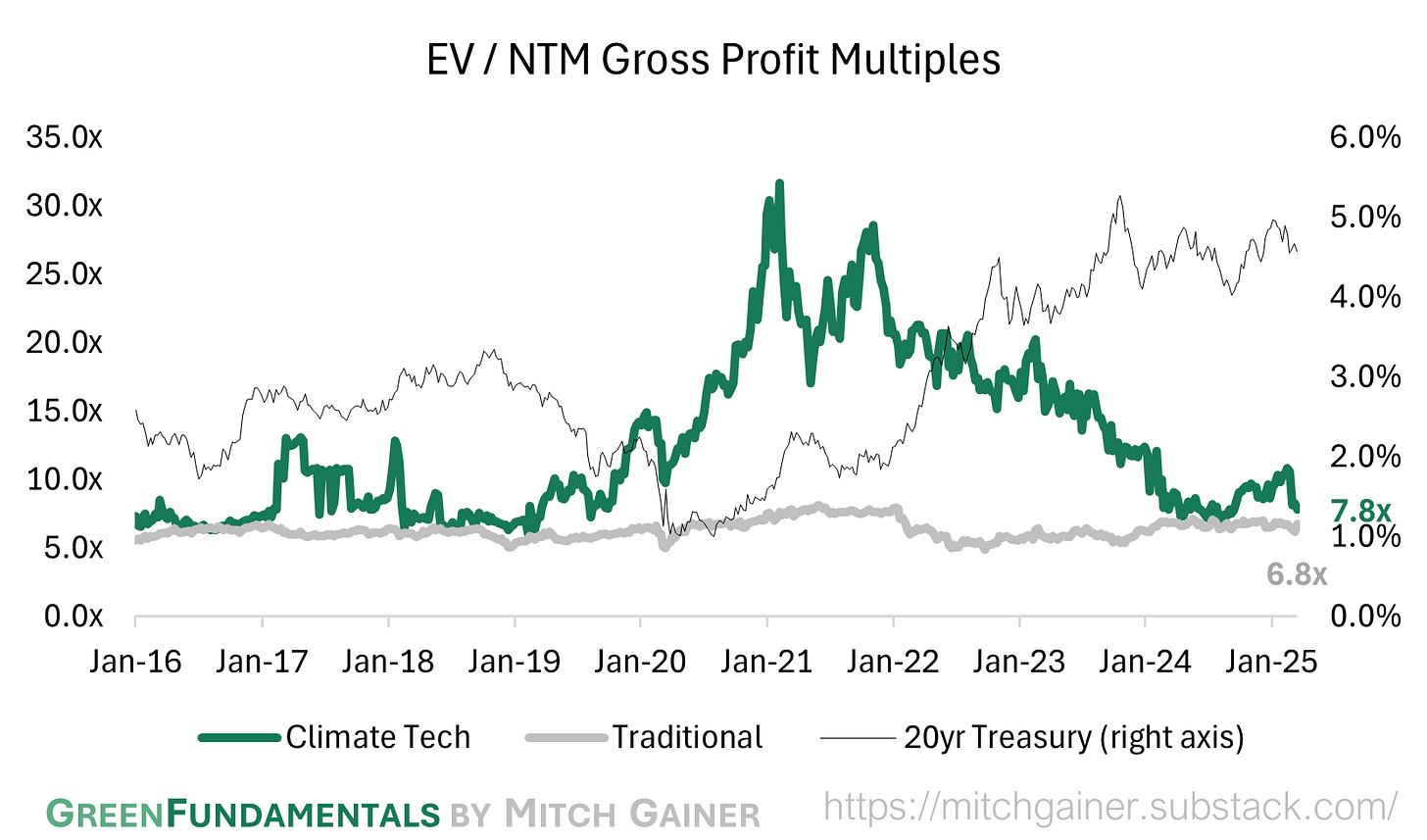

Valuation Multiples over Time

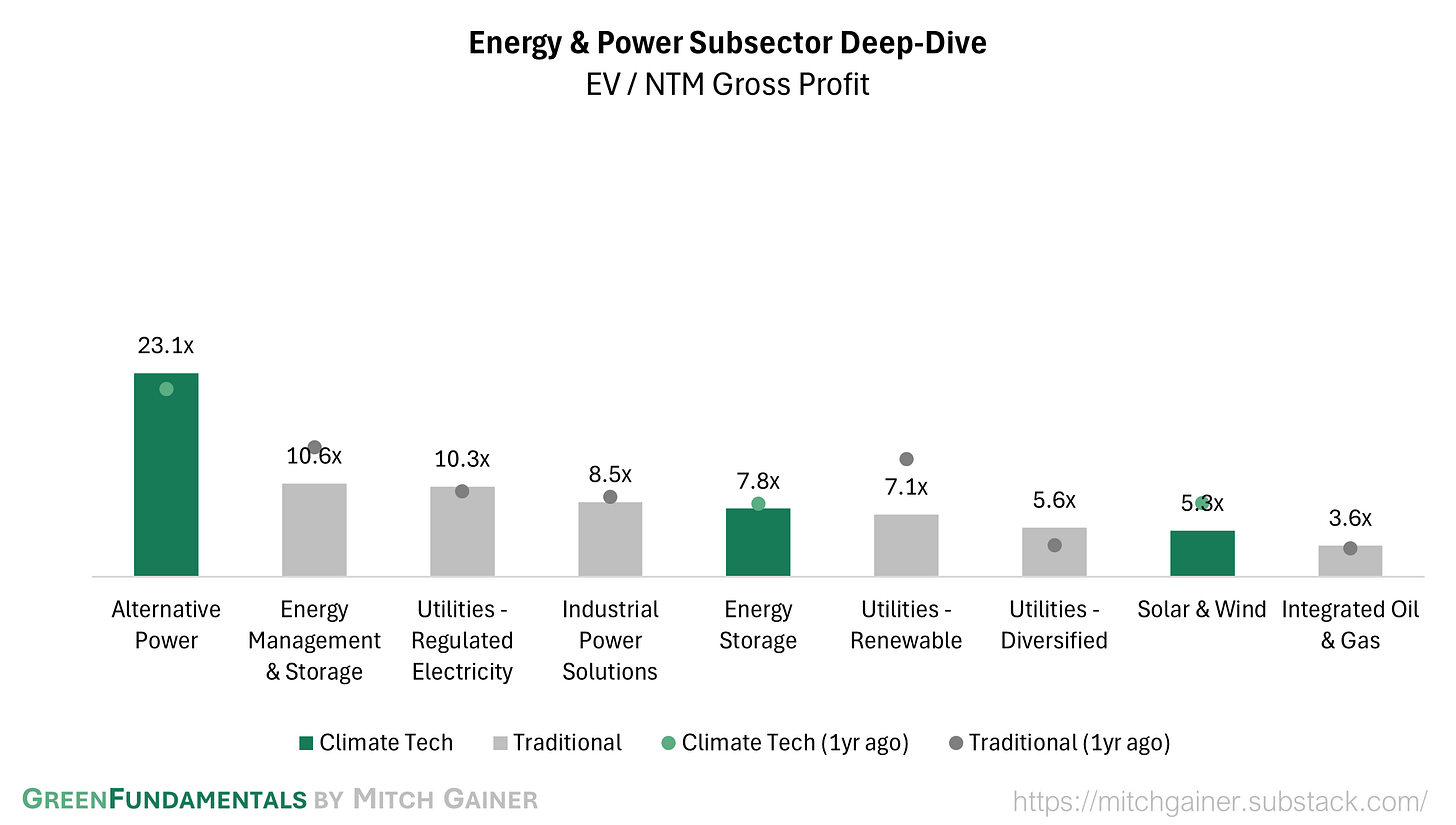

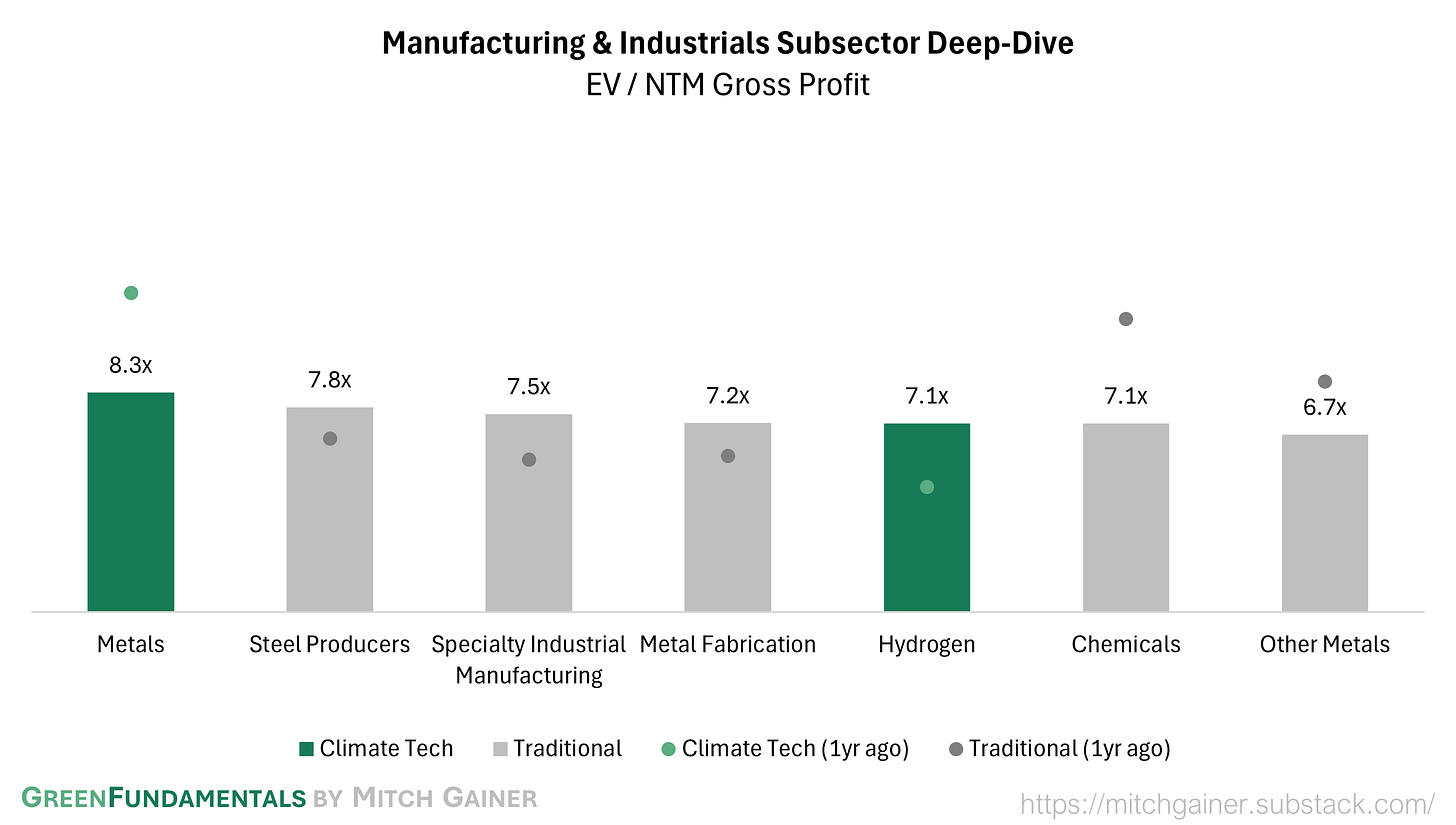

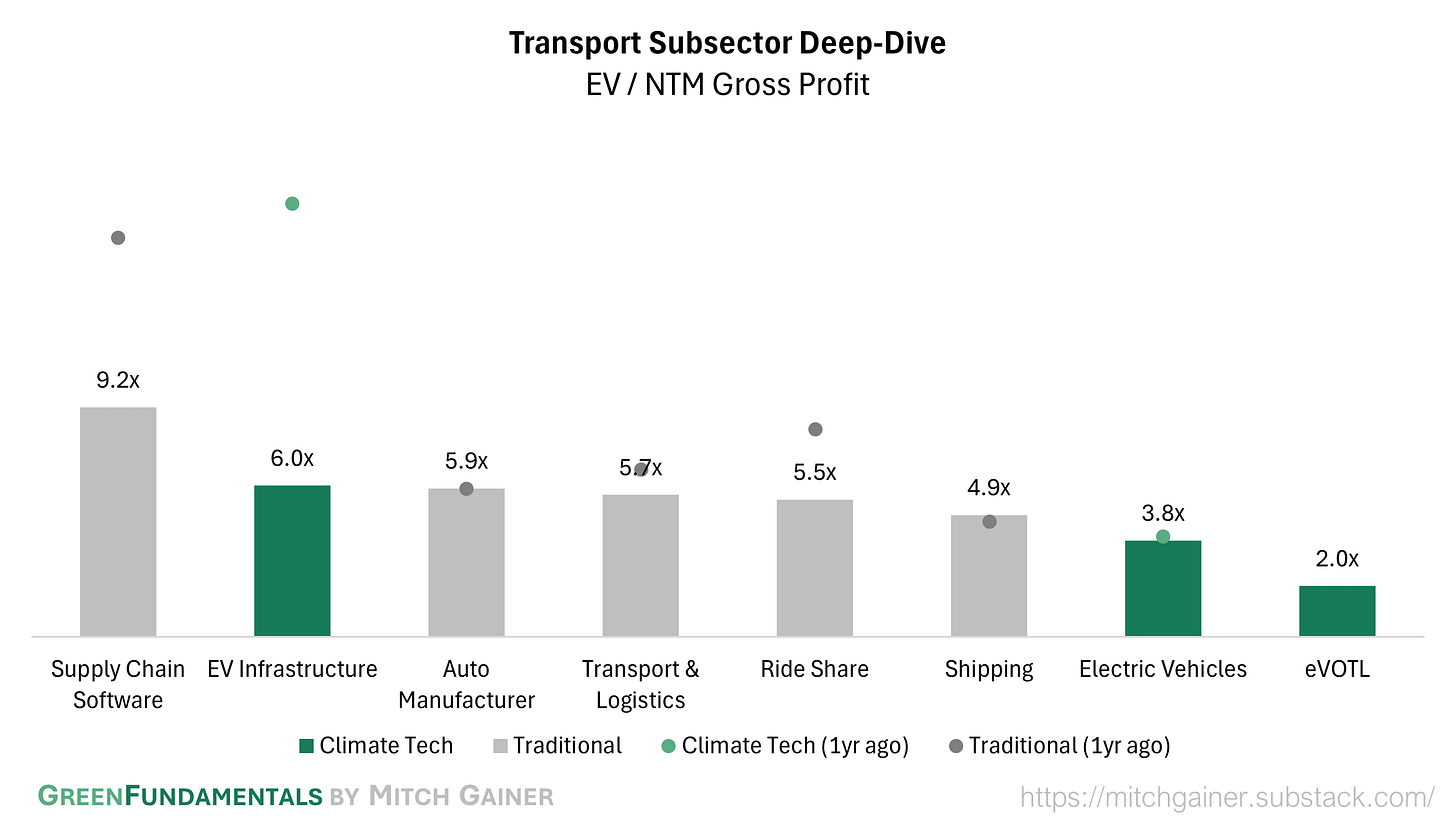

Deep-Dive by Subsector

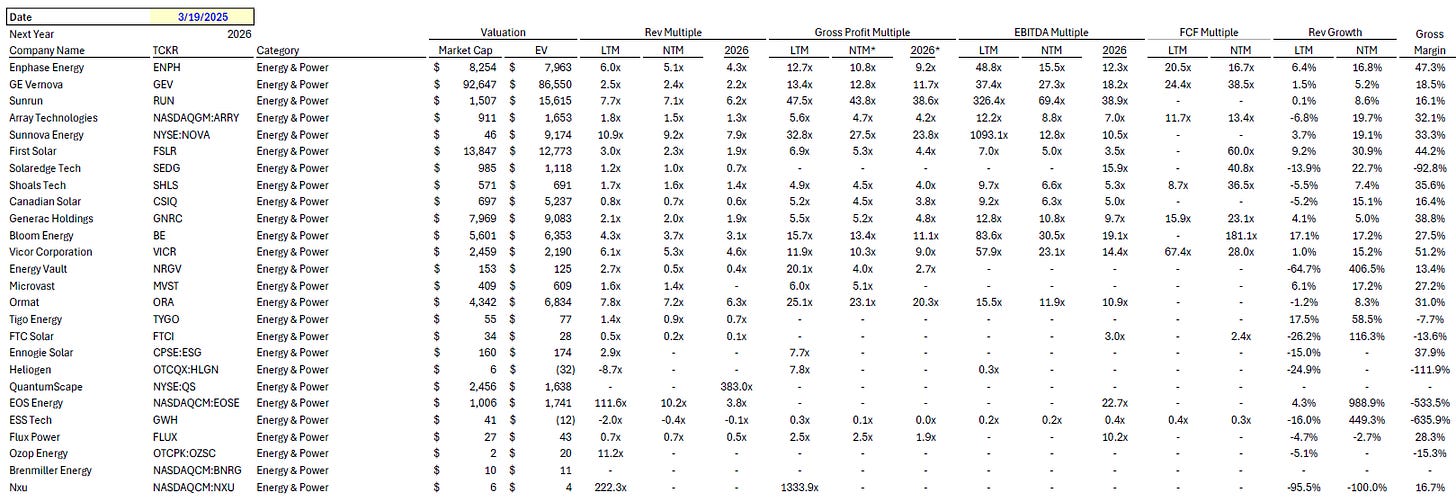

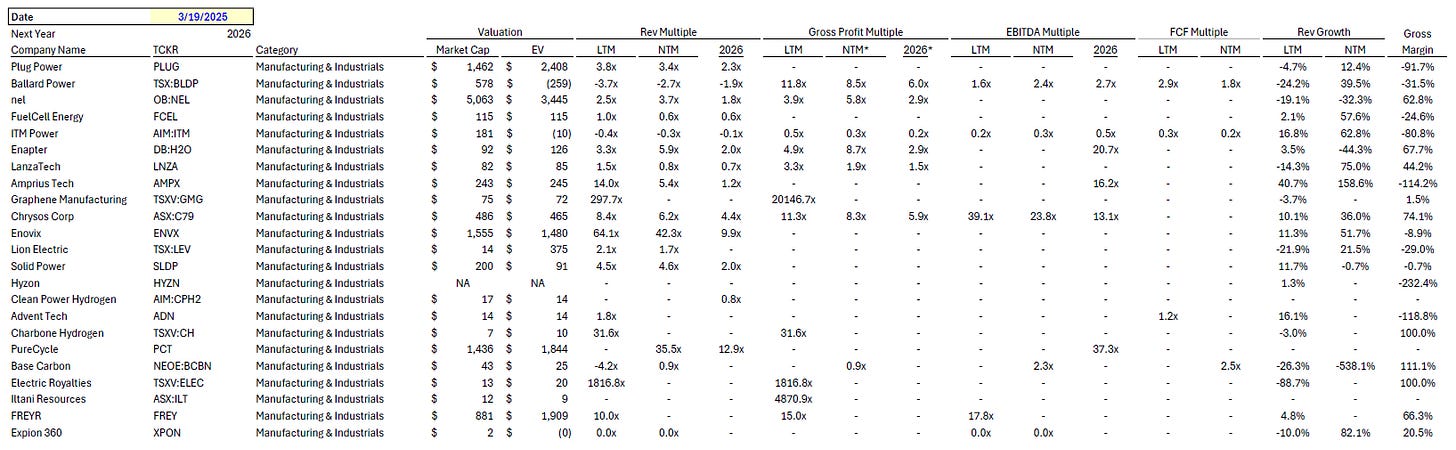

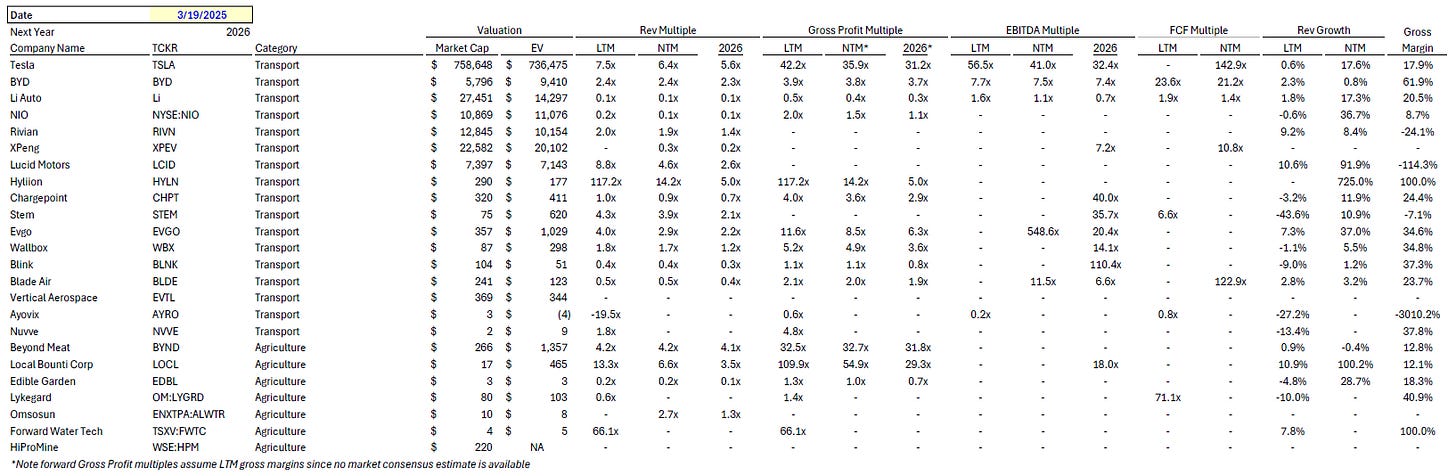

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. They reflect solely the personal opinions of the author in his individual capacity. They do not reflect the views or opinions of any current, past, or future employer, organization, or affiliate. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.