Green Fundamentals: Multi-Day Energy Storage Powers On

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Iron-Air Technology and Emerging Alternatives Set to Transform Multi-Day Energy Storage

What Happened: On August 13, Form Energy announced the successful pilot of their iron-air battery system, a breakthrough in multi-day energy storage technology. This pilot, the first of its kind, marks a significant milestone in addressing the growing need for long-duration energy storage, a crucial component for stabilizing the grid as renewable energy sources like wind and solar become more prevalent. The pilot’s success signals a promising future for iron-air technology, which could become a cornerstone of the energy transition.

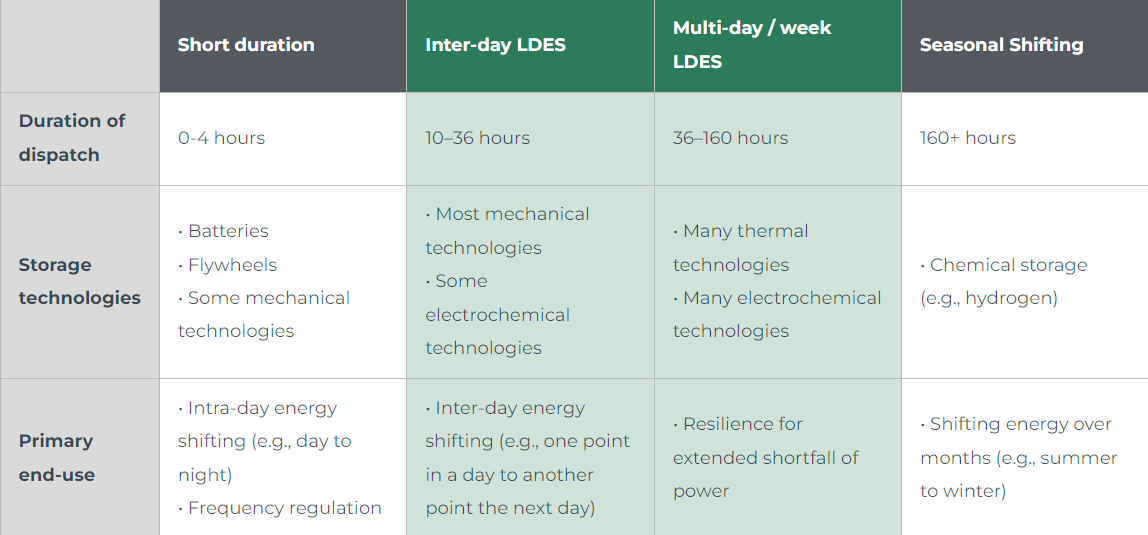

Background: The global energy storage market is facing a critical challenge: how to store renewable energy for extended periods at a low cost. Existing battery technologies, like lithium-ion, are optimized for short-term storage—typically up to four hours—but they become prohibitively expensive and less efficient for longer durations. This limitation hampers the ability to balance the grid when renewable generation is low for multiple days.

Source: DOE

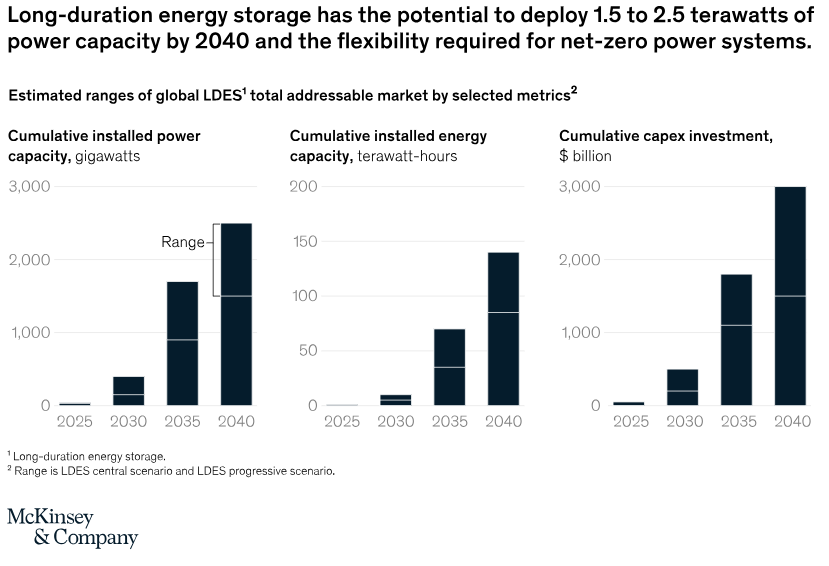

Advancements in materials science and increased investment in research have paved the way for new technologies like iron-air batteries. These technologies promise to deliver multi-day storage at a fraction of the cost. The energy storage market, driven by the urgent need to support renewable energy integration, is expected to grow to a $3.6T market by 2030.

Source: McKinsey

This growth is fueled by declining technology costs, strong policy support, and the global push for decarbonization. With intermittent renewable energy sources providing a growing share of electricity, the ability to store energy for multiple days is essential. Current battery technologies, like lithium-ion, are effective for short-term storage but are costly and less efficient for long-duration applications. Iron-air batteries, which use abundant and inexpensive materials, offer a potential solution by providing cost-effective energy storage over several days.

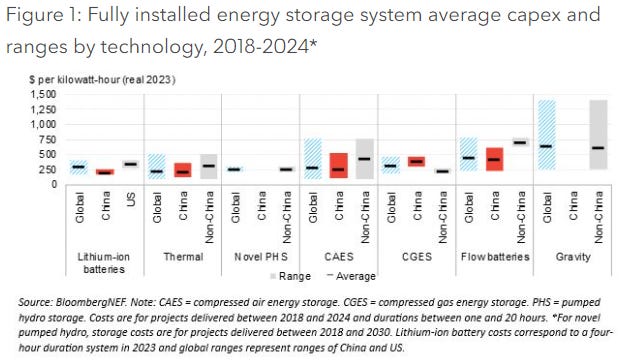

Iron-Air Batteries use iron, a widely available and low-cost material, combined with air to create a reversible chemical reaction that stores and releases energy. Challenges remain, including improving the energy density and cycle life to meet commercial viability. Key companies: Form Energy.

Flow Batteries store energy in liquid electrolytes contained in external tanks. This design allows for flexible scaling of storage capacity and can provide energy over extended periods, making them well-suited for frequent cycling and long discharge times. However, the complexity of the systems and the need for large, specialized infrastructure have limited their deployment. Key companies: ESS Inc., Redflow, Invinity Energy Systems.

Compressed Air Energy Storage (CAES) systems store energy by compressing air into underground caverns or large tanks and then releasing it to drive turbines when electricity is needed, particularly effective for bulk energy storage. The main challenge is the need for suitable geological formations and the high capital costs associated with infrastructure. Key companies: Hydrostor, Siemens Energy.

Compressed Gas Energy Storage (CGES) utilizes existing infrastructure to store energy by compressing gases during low demand periods. CGES is adaptable, leveraging pipelines and storage caverns, and offers a cost-effective alternative to other long-duration storage methods. Key companies: Enerfex, Ecotek Engineering, and Visage Energy.

Pumped Hydro Storage (PHS) uses gravity to store energy by pumping water to a higher elevation during periods of low demand and releasing it to generate electricity when needed. While highly efficient, the environmental impact and the need for specific geographic conditions limit its expansion. Key companies: Voith Hydro, GE Renewable Energy.

Thermal Energy Storage stores energy in the form of heat, typically using molten salts or other materials, and can then be converted back into electricity when needed. The challenge lies in scaling the technology and improving round-trip efficiency. Key companies: EnergyNest, BrightSource Energy, Abengoa, Rondo, Antora.

Source: BloombergNEF

Take-Away: Iron-air batteries and other electrochemical solutions may be about to ‘pull ahead’ competing technologies to become the go-to solution. Iron-air batteries stand out for their potential to deliver cost-effective, multi-day storage, a key requirement for a renewable energy future. Other cost competitive sources, like pumped hydro, have been developed as much as they can be given natural resources. Investors and industry stakeholders should closely monitor developments, as breakthroughs could significantly impact the energy landscape.

What Comes Next: Other novel technologies are likely to emerge on the the success of Form Energy's iron-air battery pilot - the news may catalyze a wave of new projects in the long-duration energy storage space. As the technology proves its commercial viability, a surge in project financing is expected, with early investors poised to capture higher returns. Companies and governments will increasingly commit capital to deploy these systems at scale, driven by the need for reliable, low-cost storage to support renewable energy. This capital rush could lead to significant advancements in storage technology, offering substantial opportunities for those who act quickly.

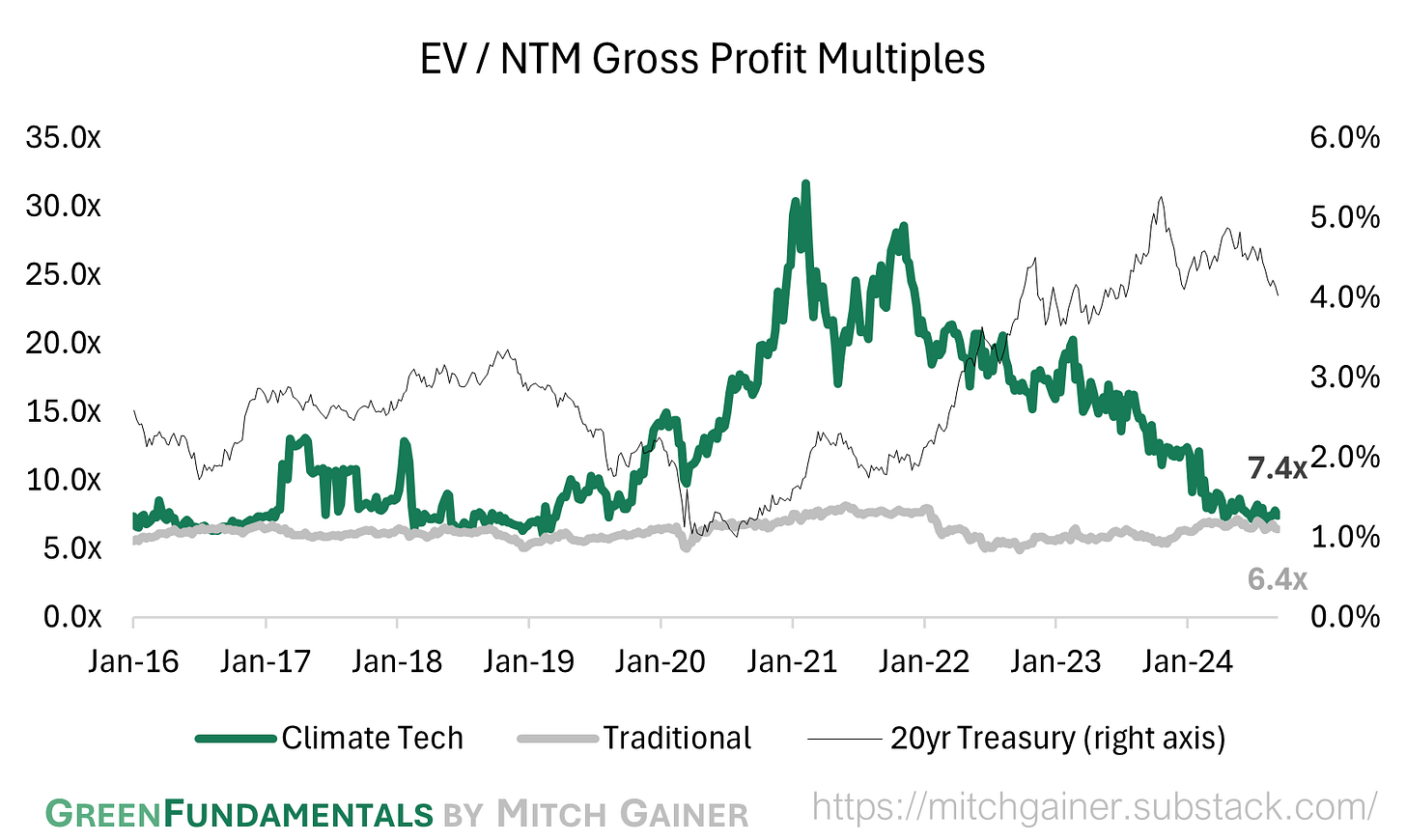

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

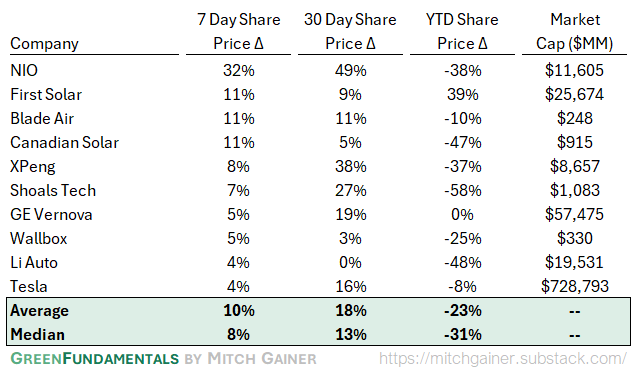

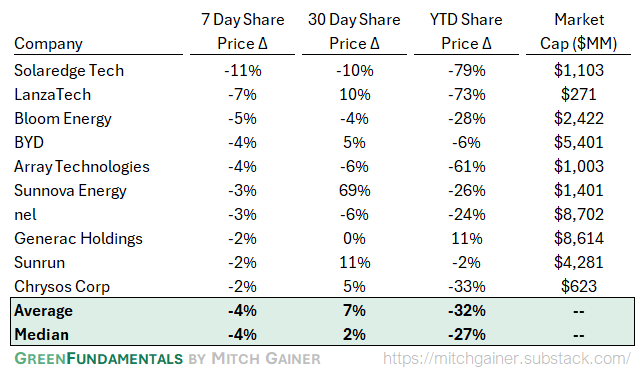

Top 10 and Bottom 10 Weekly Share Price Movement

Valuation Multiples over Time

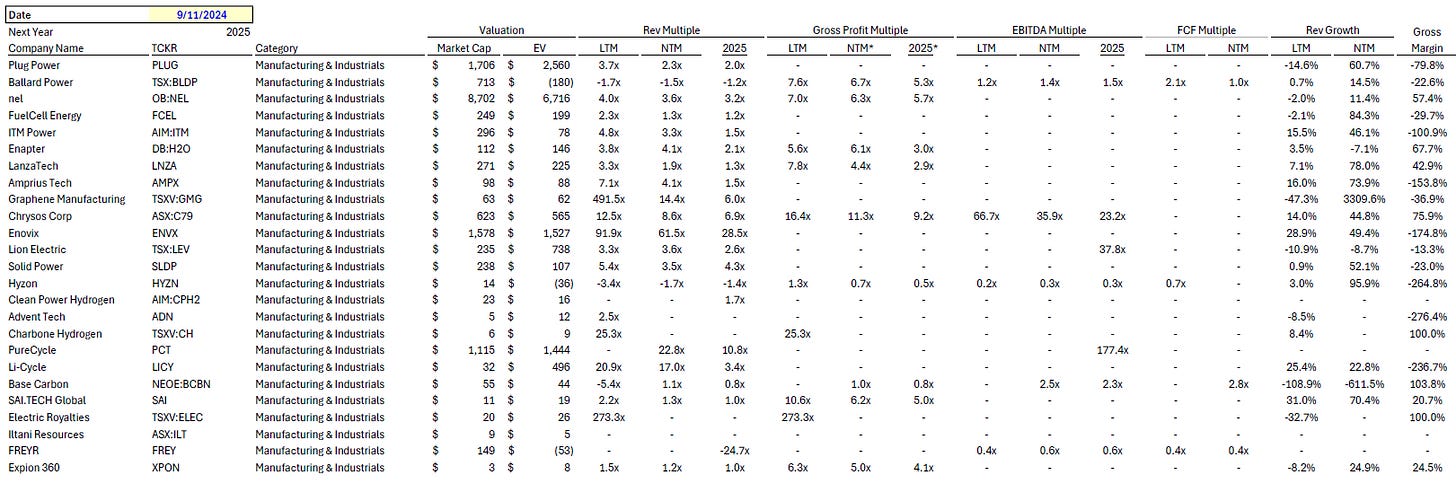

Deep-Dive by Subsector

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.