Green Fundamentals: New Nuclear Developers, Old Nuclear Problems

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

This post and the information presented are intended for informational purposes only. They reflect solely the personal opinions of the author in his individual capacity. They do not reflect the views or opinions of any current, past, or future employer, organization, or affiliate.

New nuclear developers aren’t betting on reactors — they’re locking up the land, permits, and grid access that hyperscalers and infra funds will pay a premium for

In May, Elementl Power announced plans to develop three advanced nuclear sites—each targeting 600 MW and backed by Google—to serve the surging power needs of AI-driven data centers. It joins The Nuclear Company and others pitching a capital-light, development-first approach to nuclear—one that focuses not on reactor design, but on securing land, permits, and interconnection capacity.

These new entrants aim to solve a pressing market problem: siting clean, firm power fast. Their approach borrows from the early solar developer playbook—just with higher stakes.

The Case for the New Developers

1. Site Control, Not Steel, Is the Scarce Asset. Emerging developers like Elementl and The Nuclear Company are focused on land, permits, and interconnection—not on building reactors. The value they create is in pre-construction development:

Elementl Power partners with Oak Ridge to identify low-conflict sites and has Google as a capital and offtake partner.

The Nuclear Company targets sites with existing NRC permits (COLs or ESPs), reducing regulatory friction and accelerating timelines.

These players are agnostic on reactor tech. Their goal is to deliver de-risked sites to utilities, IPPs, or infrastructure funds. In a queue-constrained, high-demand world, that’s the asset investors need most.

2. These Developers Aren’t Competing with Tech—They’re Enabling It. Unlike earlier nuclear efforts, these firms don’t bet on new reactor designs. Instead, they offer what hyperscalers and utilities need now:

Credible siting and permitting progress

Grid access in high-demand markets

Early-stage offtake discussions with data center operators

Tech is moving aggressively—Microsoft, Amazon, and Google all have nuclear interests—but they don’t want to own reactors. They want clean electrons. Developers who can deliver site certainty are essential partners.

The Incumbent Terrain: Built to Operate, Not Develop

1. OEMs Are Essential but Not Project Creators. Westinghouse, GE Hitachi, and Framatome sell technology—not sites. While they’re critical to project execution, they don’t originate deals or navigate early-stage risk.

2. OEMs with Development Ambitions Face Long Roads. Some are trying, but few are ready to deliver:

NuScale has NRC approval but lost its anchor customer.

Kairos and X-Energy are advancing, but commercial readiness is years away.

TerraPower and Oklo face fuel and scale challenges.

These firms may become builders—but they’re not developers yet.

3. Operators Are Logical Buyers, Not Starters. Legacy operators like Constellation focus on license extensions and PTC monetization, not greenfield builds.

Talen Energy is innovating with AWS at Susquehanna.

Holtec is pursuing a restart at Palisades.

They bring scale—but rarely move fast enough to seize development-stage opportunities.

Developer vs. BOO: Different Risk, Different Returns

BOO Model: Long-Term Value, Long Timelines. Utilities and infra funds that build-own-operate projects capture tax credits and energy revenues—but absorb multi-year development risk. High capex and long lead times make underwriting difficult, especially in volatile rate and policy environments.

Developer Model: Faster to Value, Leaner on Capital. Site developers focus on land, interconnection, permits, and offtake—and then exit. This front-loaded risk model:

Attracts venture capital

Requires less capital

Enables faster monetization

But it needs a credible path to exit—either through offtake or a buyer with build capacity.

Hybrid Plays Are Emerging. Some developers now retain board seats, equity stakes, or co-developer roles post-permit. This aligns incentives and boosts upside while keeping capital exposure low.

A Familiar Playbook: 2010 Solar All Over Again

The solar boom of the early 2010s followed this exact path:

Recurrent Energy and 8minute Solar controlled land, grid access, and offtake—and sold to Sharp, Canadian Solar, and JPM.

First Solar briefly went full-stack, before refocusing on modules.

Institutional capital—Google, Generation IM, Hudson Clean Energy, and Macquarie—backed development-first strategies and won.

The parallel is clear: where solar needed sun and land, nuclear now needs water, permits, and interconnection. The play is the same—own the rights before the money shows up.

The Bottom Line for Investors

These new nuclear developers aren’t building reactors—they’re building options. Their value lies in solving the hardest early-stage problems: securing land, clearing regulatory hurdles, and lining up credible offtake.

They’re already sitting on:

Interconnection queue positions

Engagements with NRC

Letters of intent from data centers and industrial users

Each milestone materially increases project value.

The best returns here may not come from betting on a specific reactor design—but from backing the companies who make those designs possible. Strategic exits to infra funds or utilities are likely. And while these won’t be 10x tech plays, 3–5x returns on early-stage capital are well within reach—especially for firms controlling the chokepoints in a grid-constrained, AI-hungry future.

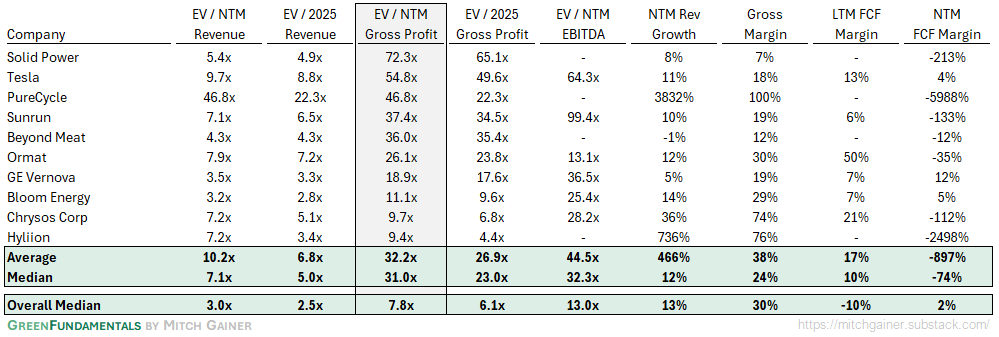

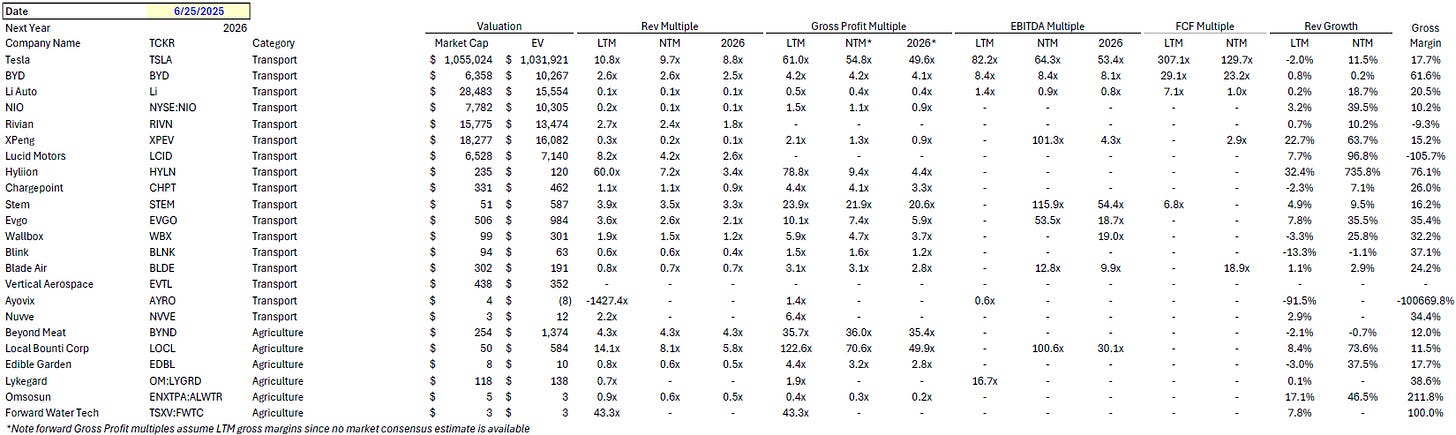

Top 10 EV / NTM Gross Profit Multiples

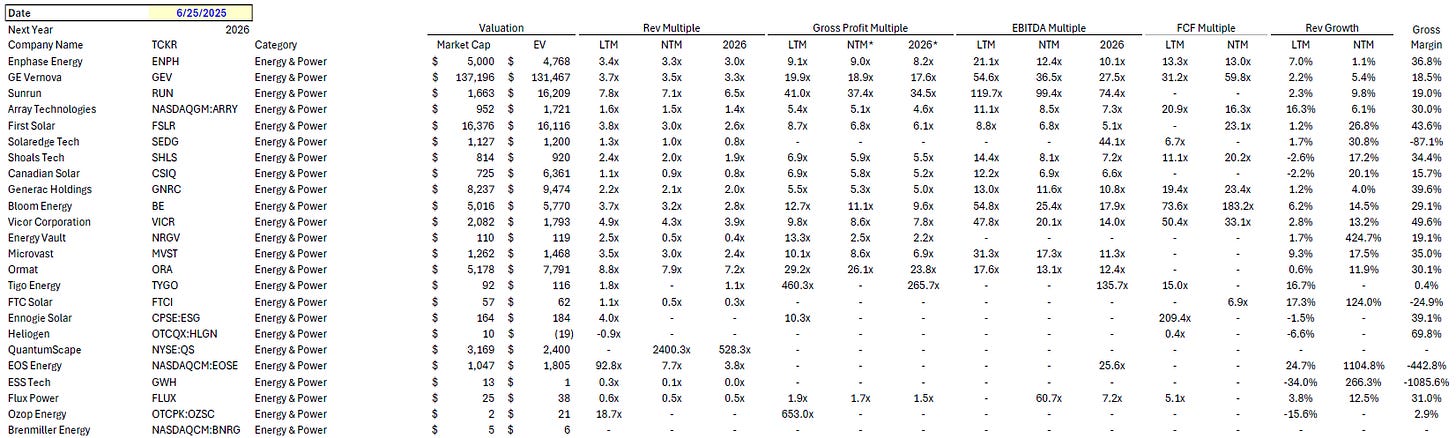

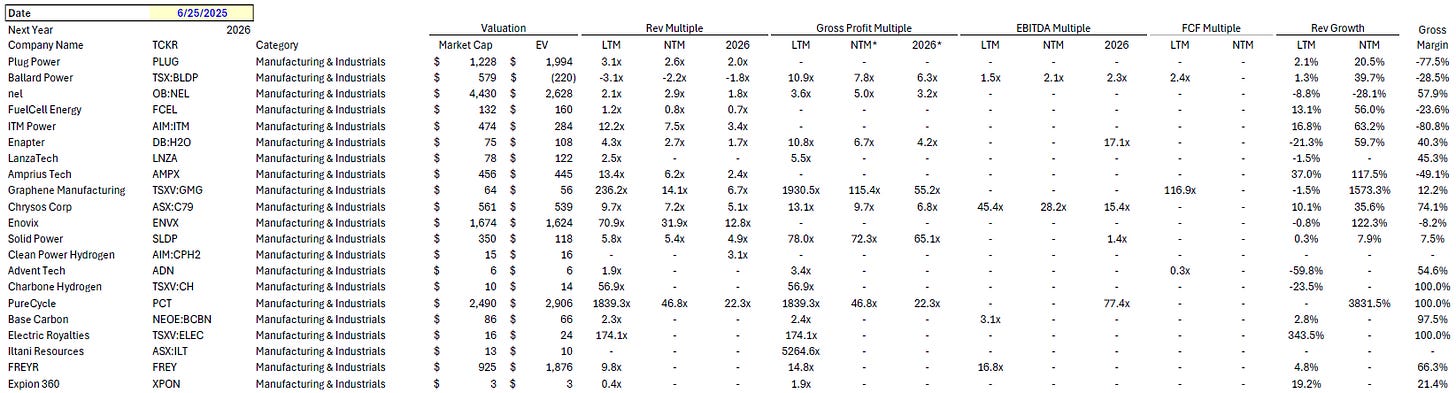

See footnote for detailed valuation methodology and explanation.1

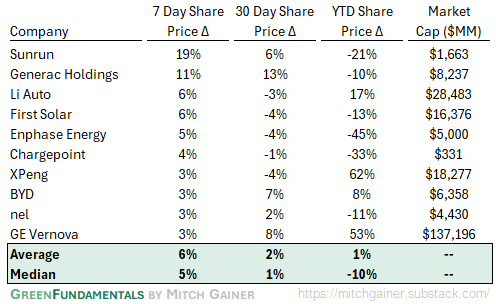

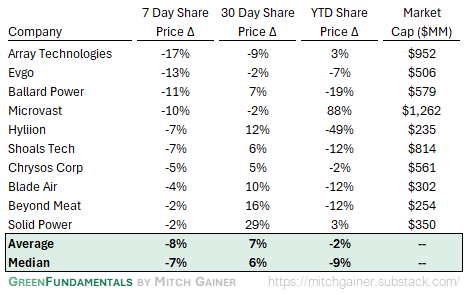

Top 10 and Bottom 10 Weekly Share Price Movement

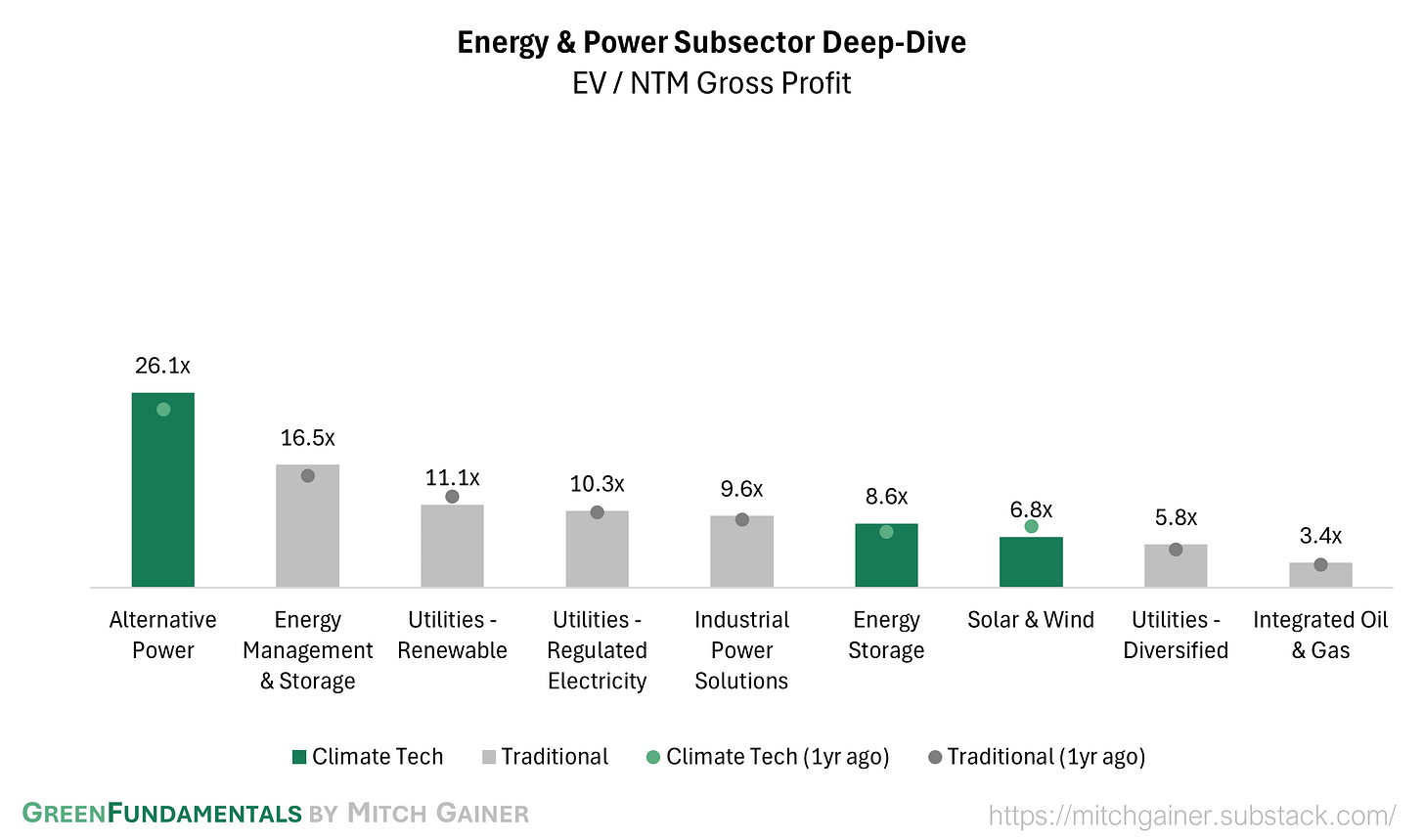

Valuation Multiples over Time

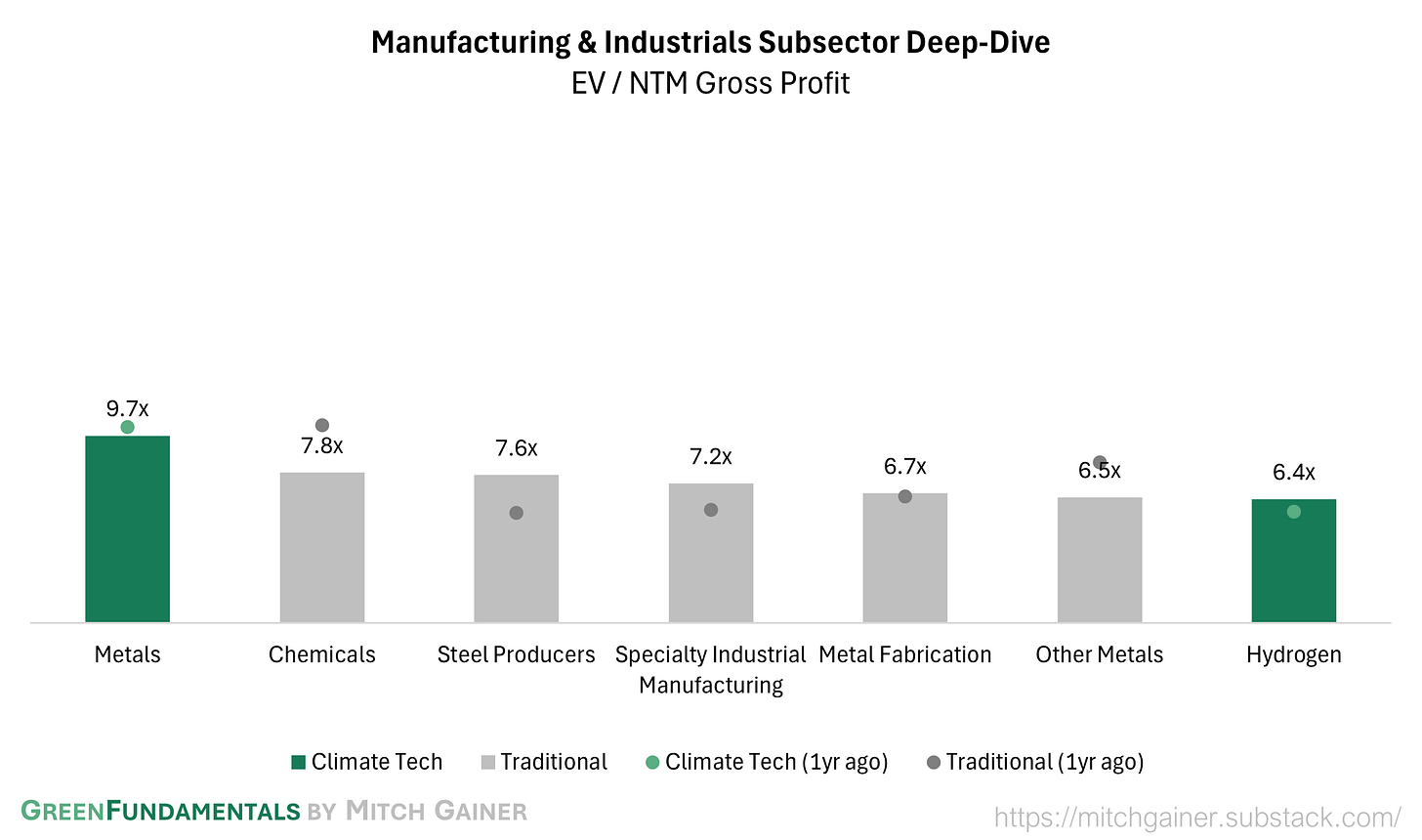

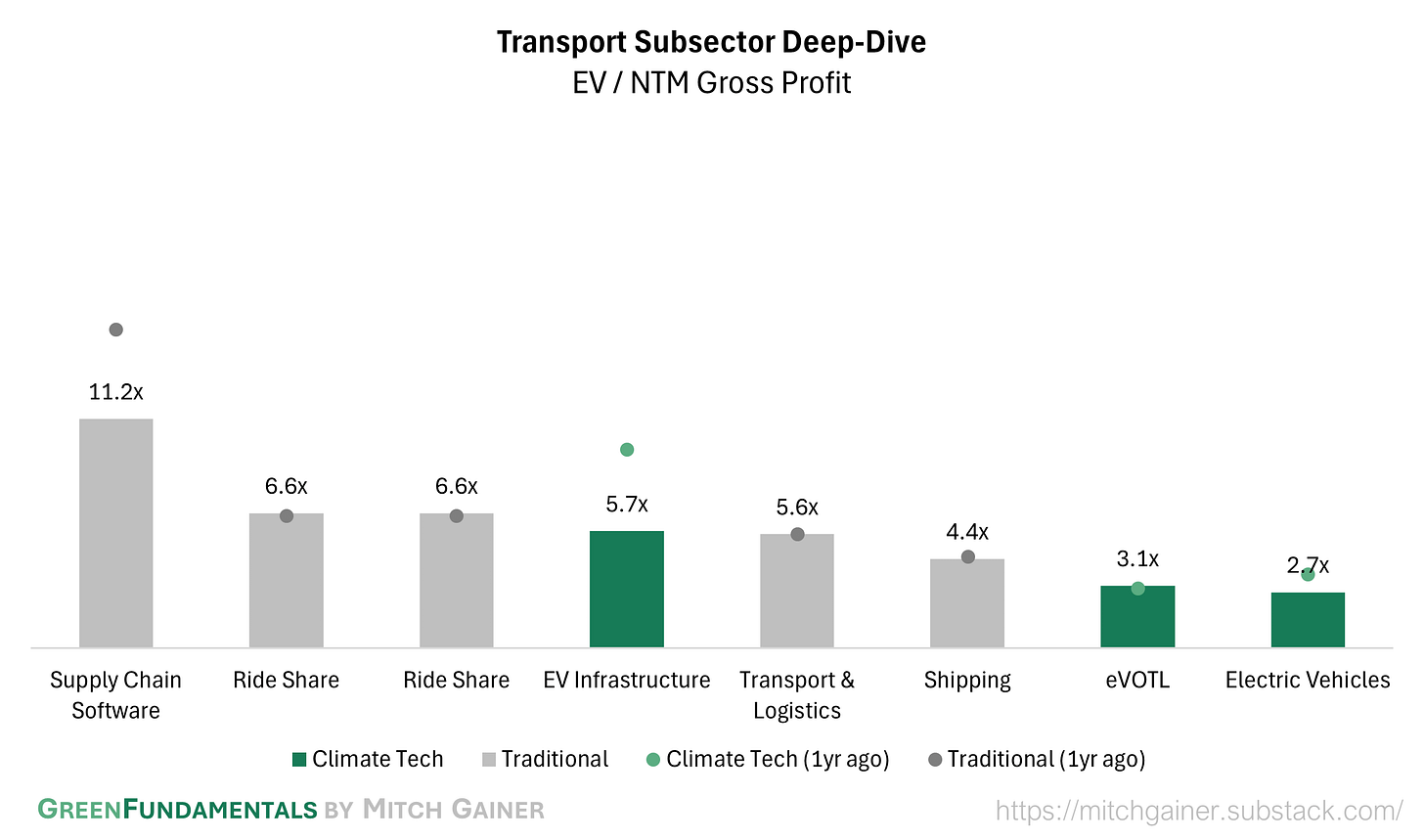

Deep-Dive by Subsector

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. They reflect solely the personal opinions of the author in his individual capacity. They do not reflect the views or opinions of any current, past, or future employer, organization, or affiliate. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.