Green Fundamentals: Nuclear rejuvenation sparks debate

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

If new nuclear isn’t being built, the least we can do is keep existing plants going

What Happened: The Palisades Nuclear Plant in Michigan received a $1.8B in federal and state funding to restart. Palisades closed in May 2022 and was bought by Holtec for decommissioning. Michigan Governor Gretchen Whitmer called for it to stay open and was joined by DOE Secretary Jennifer Granholm. On March 27, 2024, the DOE announced a $1.5B loan and the State of Michigan announced $300M of support.

Source: Bloomberg

Background: The U.S. nuclear fleet is aging. The average reactor is 40 years old. Twelve reactors permanently closed between 2012 and 2021. In addition to restarting recently shuttered reactors (like Palisades), operators are looking to extend the life of older reactors. Diablo Canyon (CA) was recently approved to extend for another 20 years. Constellation has applied to operate Dresden (IL) until 2051 and extend Byron’s operations (IL) for another 20 years.

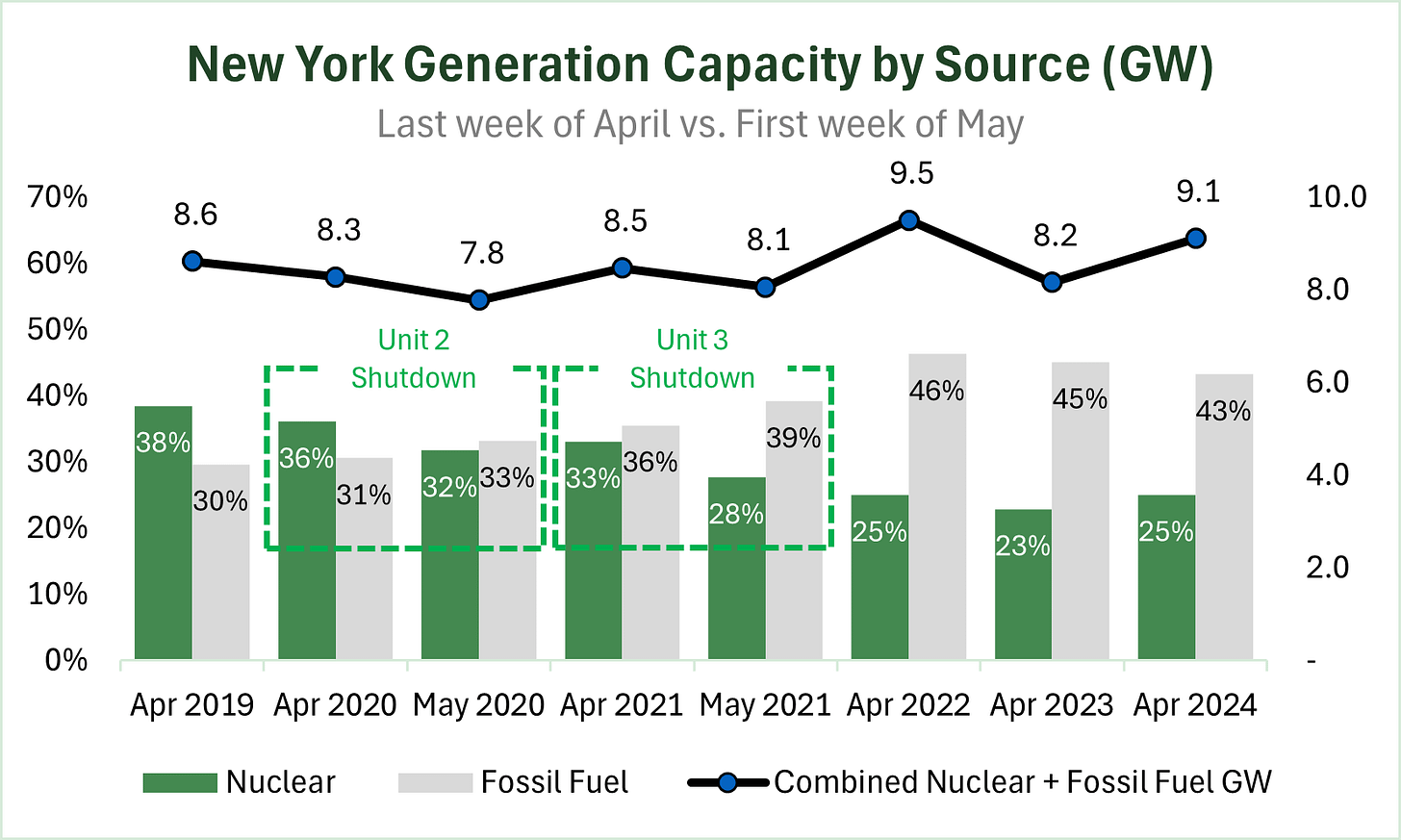

Nearly everywhere nuclear power is shut off, it is replaced by natural gas - not renewables. On April 30, 2021, Indian Point Energy Center (in Buchanan New York) shut down its last operating nuclear reactor (Unit 3). Unit 2 had been shut down the prior year on April 30, 2020. The premature closure of the powerplant removed 2.1 MW of power supply from the grid, or ~25% of New York City’s electricity demand. In the first month after closure, New York’s carbon emissions from in-state generation rose 35%.

Across New York State (NYISO), it is evident fossil fuels replaced nuclear, not renewables. Nuclear fell from 38% of power generation in the last week of April 2019 to 32% in 2020 after Unit 2 shut down. The following year (2021) nuclear’s share fell to 28% after Unit 3 shut down. Fossil fuels (natural gas + dual fuel) increased from 30% in 2019 to 33% in 2020 to 39% in 2021. In the following years, as power demand increased, fossil fuel generation also increased.

Source: New York Independent System Operator; Note: Percentages are of total generation, hydro and other renewables make up the remainder of power generation in New York State.

Take-Away: Closing nuclear plants is more likely to increase use of fossil fuels, even in states with high renewables penetration. Although nuclear is controversial among environmental advocates, historical data suggests nuclear is replaced by fossil fuels, not renewables, because of the need for 24x7 power. Extending nuclear (or restarting where possible) is the quickest path to adding 24x7 power to the grid.

What Comes Next: The barriers to reinstating nuclear power are high once shut down. Interruption of maintenance quickly degrades materials, structures, and components around the plant. For Indian Point, and most other prematurely closed nuclear plants, the technical obstacles to reopening appear insurmountable at this point. The lack of NRC guidance on how an operator might pursue license reinstatement is itself a major hurdle. But reopening is technically feasible for the Palisades plant in Michigan.

Demand for nuclear is likely to heat up as industrial and data center demand increase. On the Hill, a caucus to promote nuclear has formed. Tech leaders are advocating for change. Investors are likely to overestimate nuclear’s impact in the near term (2-5 years) and underestimate in the long term (10+ years).

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Transmission: Can AES rally utility support for dynamic line rating? (Latitude Media)

Battery Recycling: Battery Recycling Shatters the Myth of Electric Vehicle Waste (Bloomberg)

Tidal Power: 2.64 trillion kWh of blue energy in the United States: the largest project in history (EcoNews)

Fusion: New Fusion Record Achieved in Tungsten-Encased Reactor (Gizmodo)

Private Markets (PE / VC / Real Estate / Infra)

Nuclear: Idaho Strategic Announces Memorandum of Understanding with Radiant Industries Frontier Program (Yahoo Finance)

Nuclear: UAE to launch tender for four new nuclear reactors (NEI)

Geothermal: Oil industry could help the Biden administration tap 'invisible' green energy (NPR)

Residential Electrification: Households Wince at the Rising Price of Going Green (WSJ)

Transmission: The Century-Old Transmission Line Is Getting a 21st Century Upgrade (Bloomberg)

Public Markets (Stocks, Bonds)

Data Centers: Meta to build $800m data center in Montgomery, Alabama (Data Center Dynamics)

Nuclear: Surge in New Nuclear Power Completions (Next Big Future)

Electric Vehicles: EV Makers Get Two-Year Reprieve on Tax-Credit Restrictions (WSJ)

Oil & Gas: Ex-Pioneer CEO Barred From Exxon Board for Megadeal to Close (WSJ)

Government & Policy

Geothermal: We Can’t Drill These Holes Fast Enough: The U.S. just made permitting easier for geothermal, but industry and lawmakers say we should be going farther. (Heat Map)

Transmission: Looming power grid rules could make or break the US energy transition (Canary Media)

Capital: The $9tn question: how to pay for the green transition (FT)

Tax Credits: Tax credit transfer deals ‘not simple’ and carry different benefits, risk and downsides – ITC seller (Energy Storage News)

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

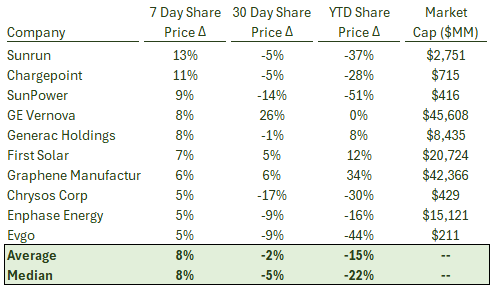

Top 10 Weekly Share Price Movement

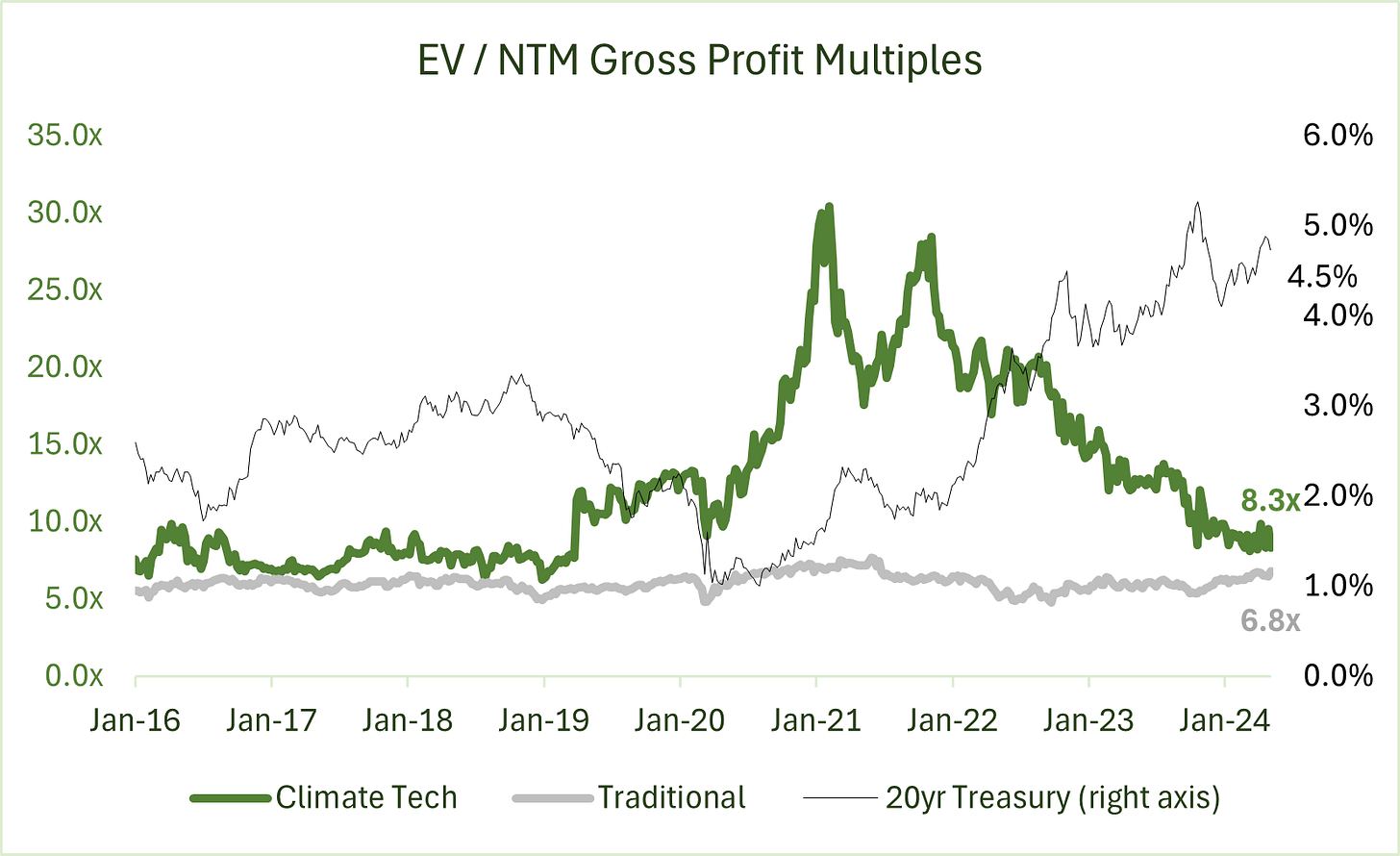

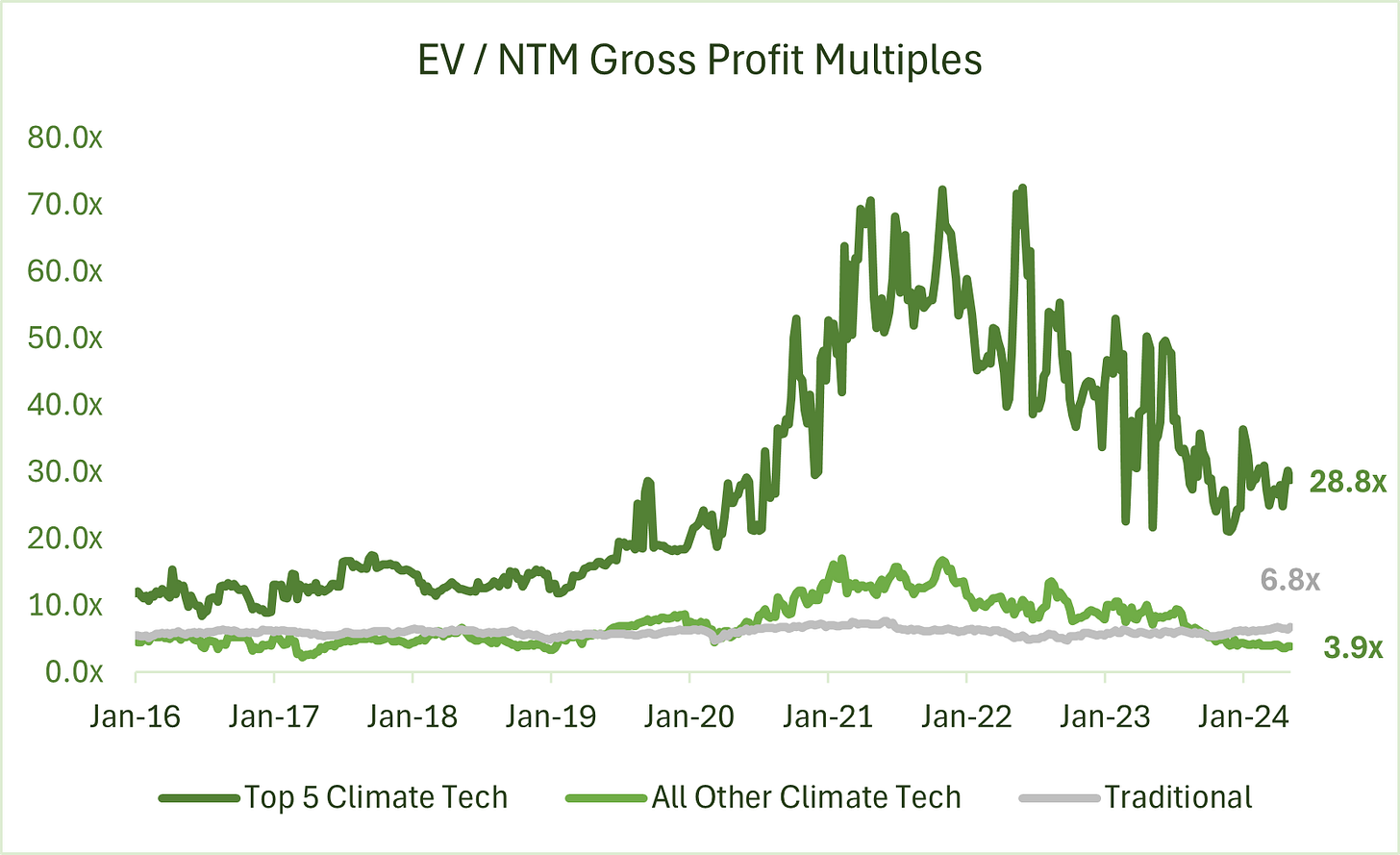

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

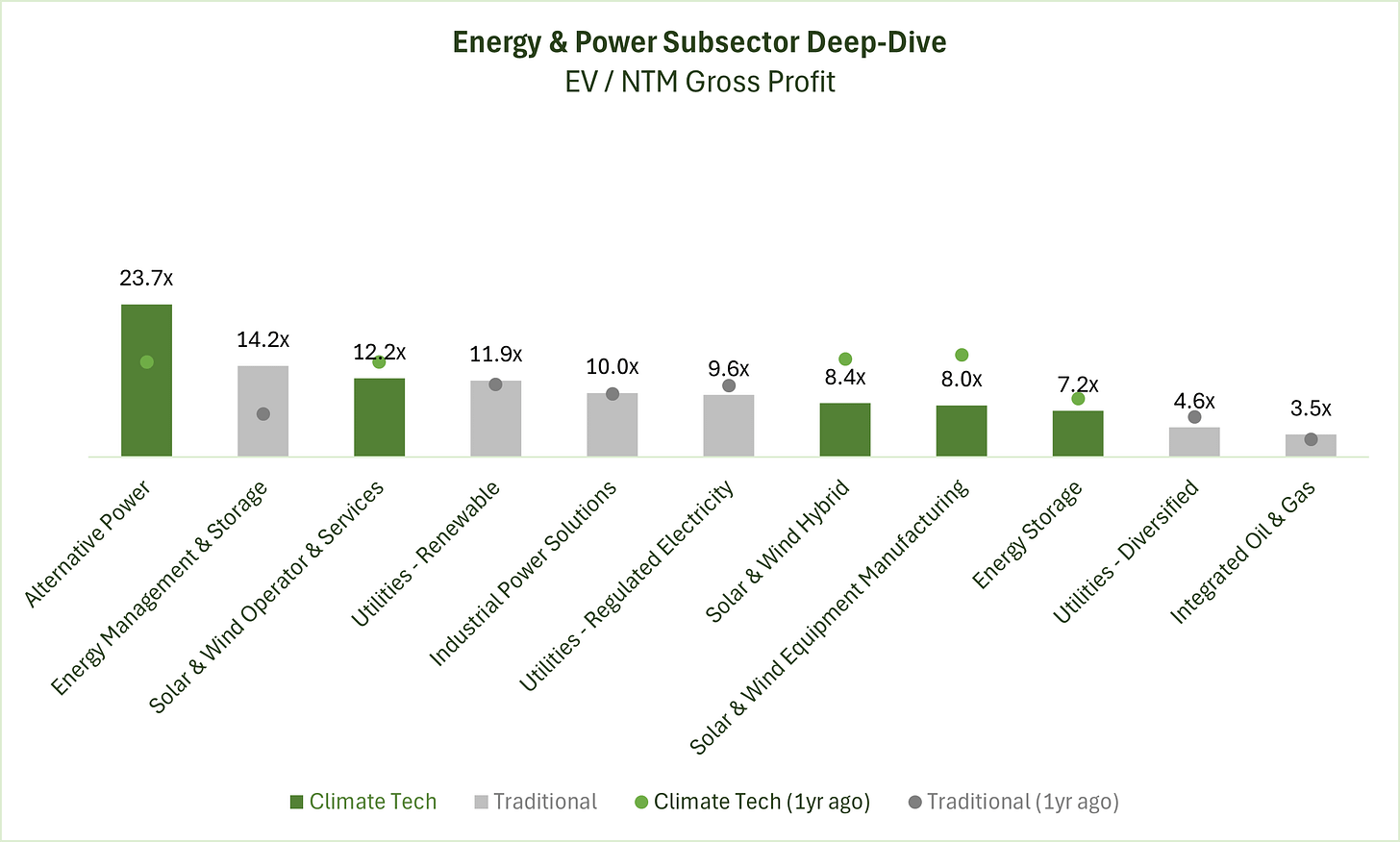

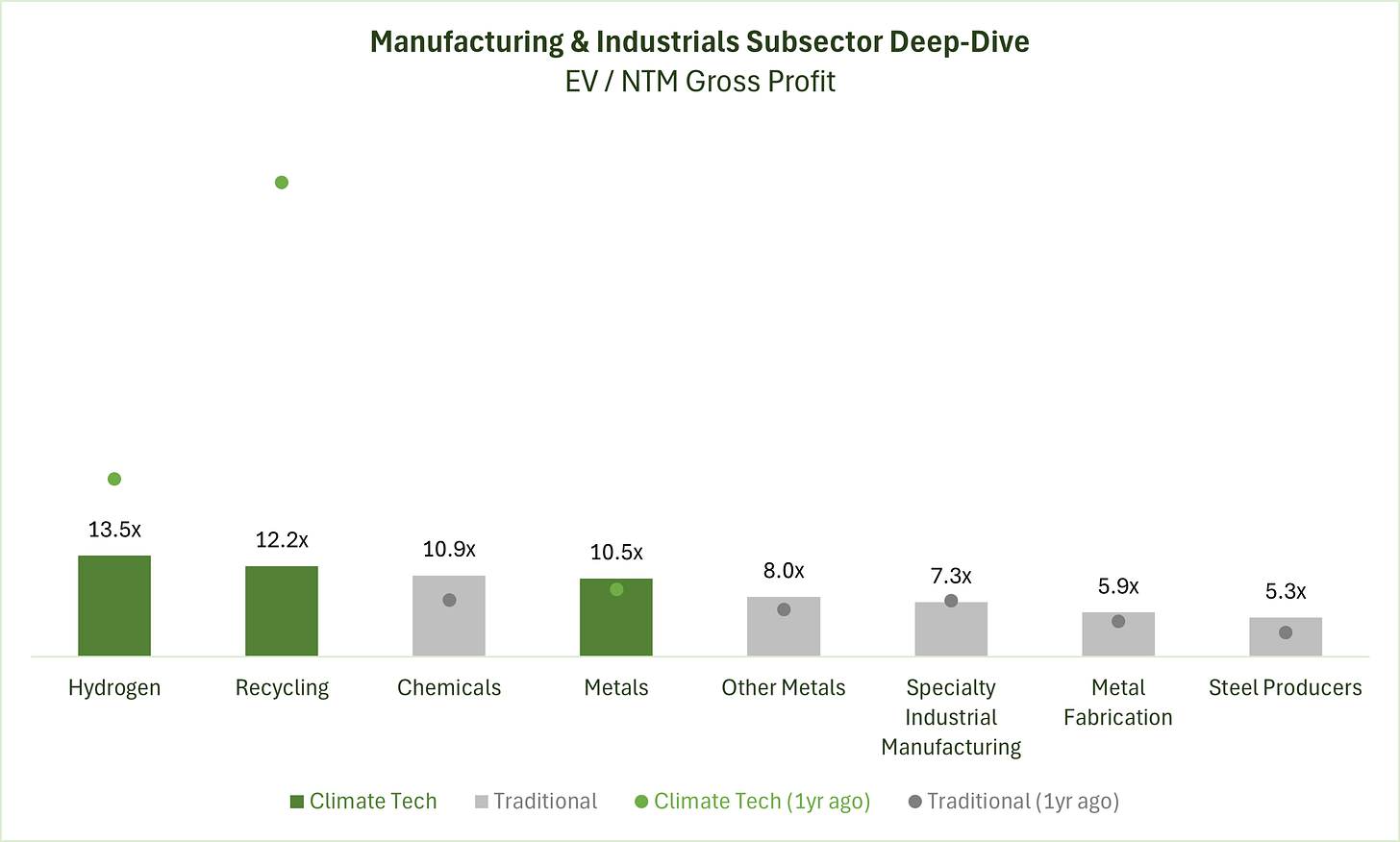

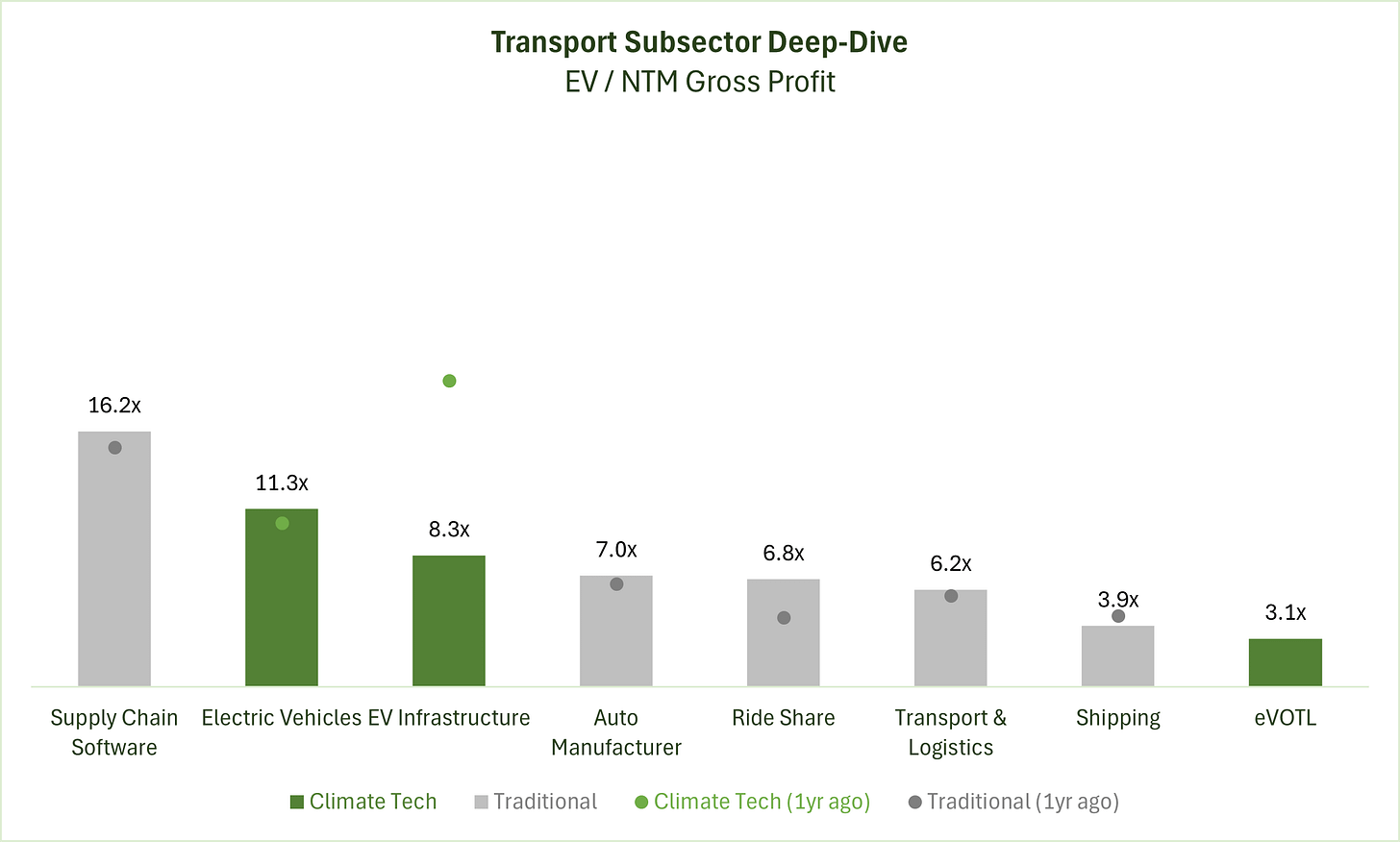

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium, while more speculative (storage) has less; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

Manufacturing & Industrials: Both traditional and emerging companies around critical minerals supply command a premium.

Transport: EV growth is priced in to climate tech and traditional companies; the market is skeptical on eVOTL.

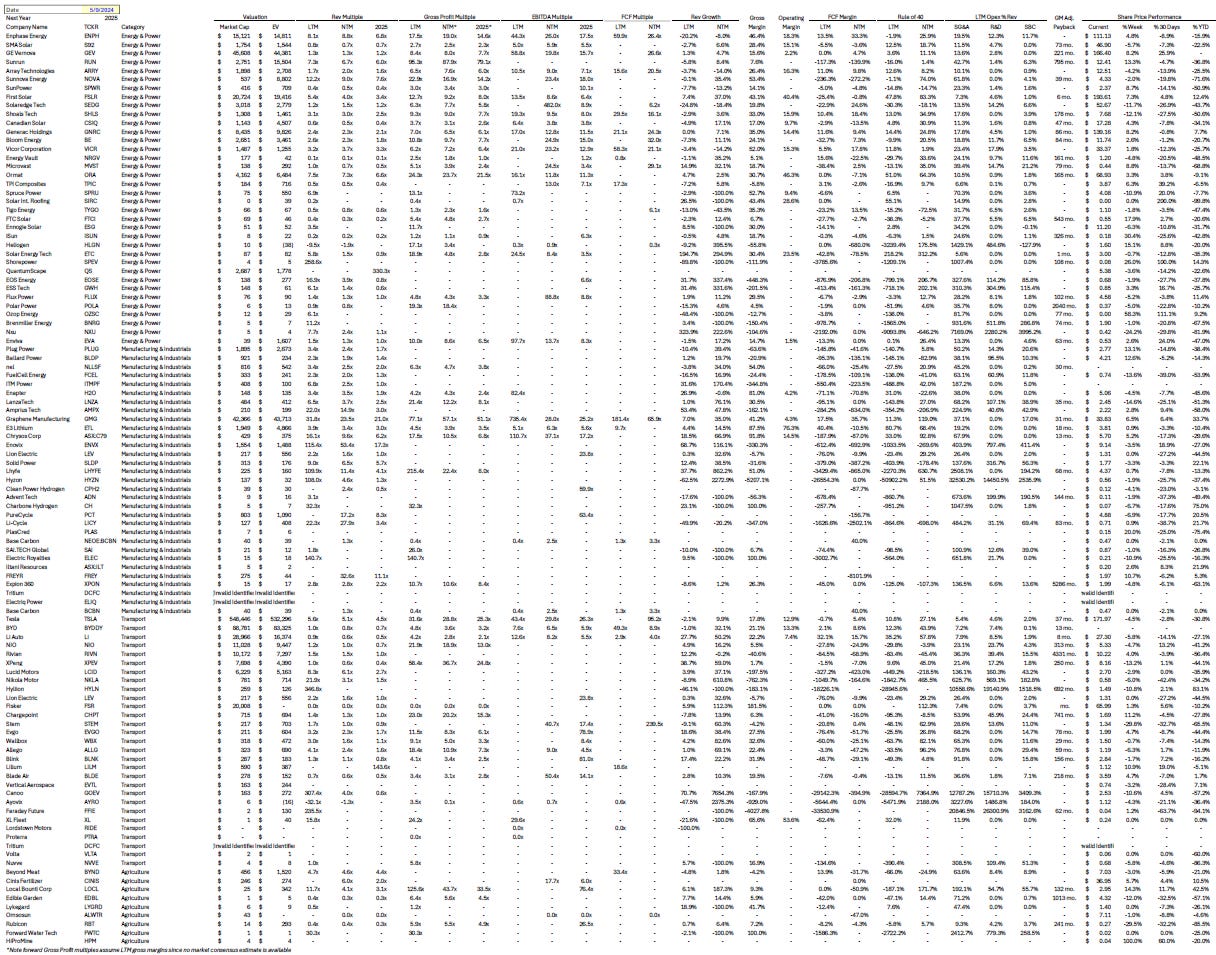

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.