Green Fundamentals: Nuclear's Long, Yet Promising Path Forward

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

U.S. legislation aims to revitalize the nuclear sector, but the journey is perilous

What Happened: On July 9, 2024, President Biden signed into law the ADVANCE Act. This legislation aims to promote the development and deployment of advanced nuclear technologies through regulatory improvements and support for innovation in the nuclear energy sector. This follows Terra Power’s recent start of construction for a 345 MW advanced reactor site in Wyoming, signaling renewed momentum in nuclear development.

Background: Over the past three decades, the U.S. has successfully built only two nuclear reactors. Vogtle Units 3 and 4, part of the existing Georgia Vogtle plants, came online on March 2023 and June 2023 respectively. Initially budgeted for $14 billion over 6 years, the project ended up costing $28 billion over 14 years, leading to a levelized cost of approximately $110 per MWh. Frequent changes in regulatory requirements necessitated extensive modifications during the build process, significantly inflating costs. For example, the average cost of one square yard of concrete is significantly higher for Vogtle than typical construction due to ripping up concrete and re-laying it to comply with regulatory inspections and paperwork.

Completing Vogtle has addressed many uncertainties. Finalized designs, established supply chains, and a trained workforce will potentially lower future costs. However, to be competitive, nuclear power must reduce its cost structure further. This can be achieved through scale, with multiple deployments per design, and expansions of existing plants, which are typically ~30% cheaper than new builds.

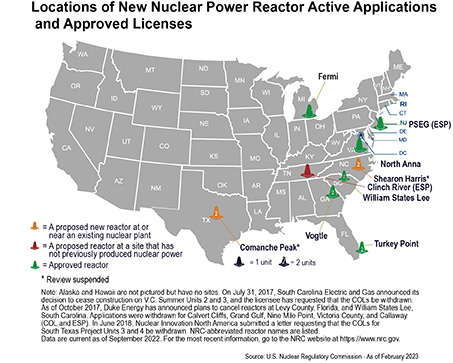

Source: Nuclear Regulatory Commission

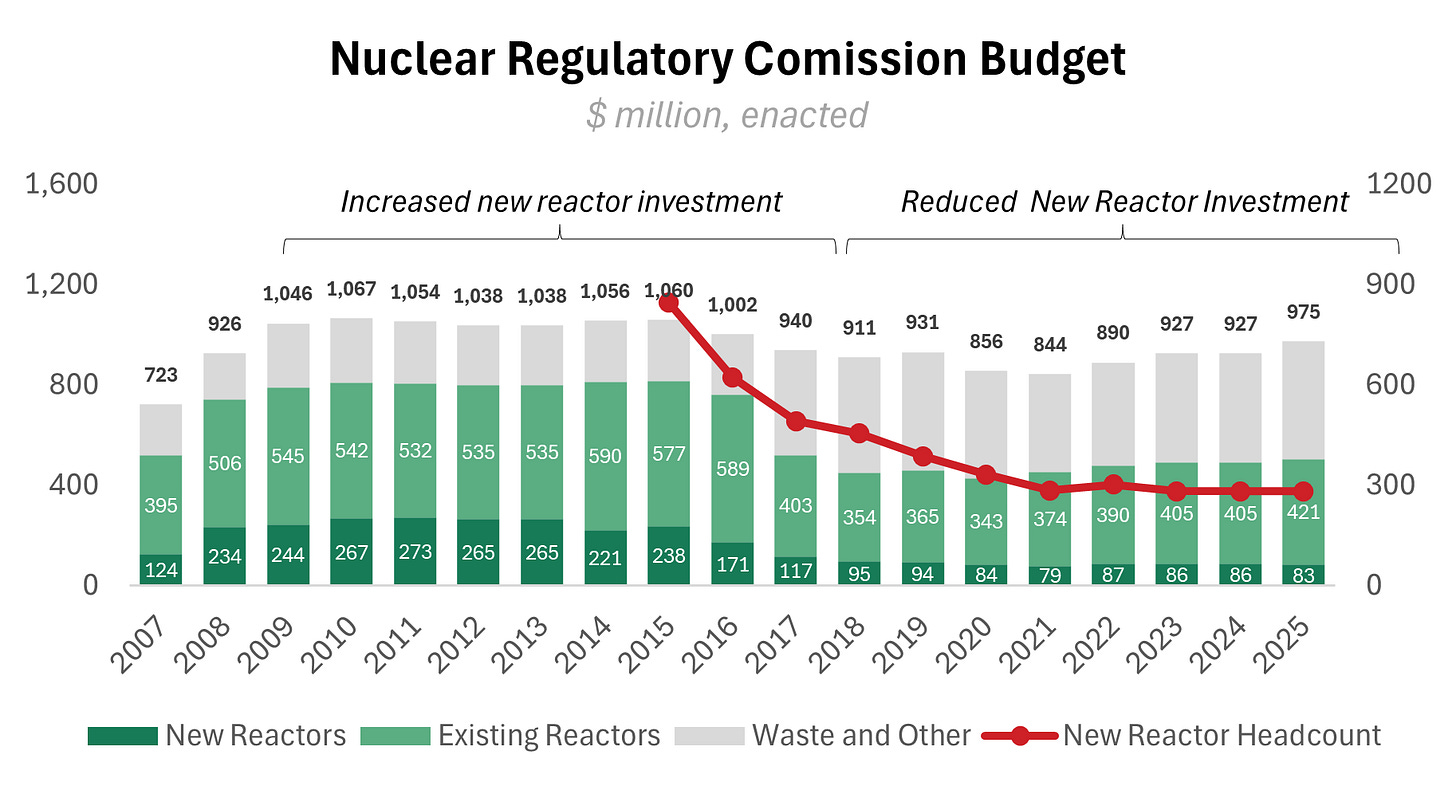

Reforms to the NRC have burned investors in the past. The Bush administration passed the Energy Policy Act in August 2005, which increased funding to the NRC. However, the applications for new nuclear sites took too long and fewer came than expected. As a result, during the Obama years, NRC budgets were slashed to eliminate ‘government waste’. This history fosters caution among regulators regarding increasing the NRC budget without clear market interest and new applications.

Source: Nuclear Regulatory Commission

Take-Away: The ADVANCE Act is designed to reignite the U.S. nuclear construction economy. Key provisions include:

Streamline licensing processes: Simplifies regulatory procedures by revising the Nuclear Regulatory Commission's (NRC) licensing process to reduce unnecessary burdens and expedite reviews (Section 103).

Support public-private partnerships: Provides funding and frameworks for joint ventures and cooperative agreements (Section 201).

Promote investment in R&D: Provides incentives and support for research and development, including grants, tax incentives, and loan guarantees for R&D projects (Section 305).

Encourage non-electric applications: Advocates for the use of advanced nuclear reactors beyond electricity generation, such as in industrial processes and hydrogen production, with funding for demonstration projects and pilot programs (Section 401).

Improve workforce development: Includes measures to enhance training and education programs for the nuclear industry workforce. The act funds educational grants and apprenticeship programs (Section 503).

Ensure safe nuclear waste management: Calls for the development of advanced waste management technologies and improved storage solutions (Section 601).

This bill has the potential to transform the nuclear sector, reversing its long-term decline. However, the pace of implementation and the long-term impact remain uncertain. For investors in climate tech and the broader energy sector, nuclear offers intriguing opportunities, especially within the supply chain that benefit from increased construction.

What Comes Next: The realization of new nuclear power generation is on a 7-10 year horizon, not 3-5 years. This timeline presents challenges for those seeking quick returns, especially for new data centers requiring power in under five years. Even current projects, like Terra Power’s Wyoming plant, are not expected to generate power until after 2030. The extended duration of nuclear assets (50-70 years) compared to traditional infrastructure (10-30 years) poses additional challenges attracting capital.

Many projects are making progress and investors should look out for them:

Terra Power broke ground last month on their ARDP project, and the NRC accepted their construction permit application for review

Kairos Power’s second NRC construction permit application is under review

X-energy and Dow are working towards submitting their NRC construction permit application (after a failed SPAC in October)

Oklo went public via SPAC in May (with a mixed market response)

These projects will take time. Any investment thesis anticipating significant build-out within the next five years should be approached with caution, given historical precedents.

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Batteries: World’s biggest sodium-ion battery switches on, able to power 12,000 homes (The Information)

Fusion: Giant international fusion project is in big trouble: ITER operations delayed to 2034, with energy-producing reactions expected 5 years later (Science)

Fusion: Fusion Sparks an Energy Revolution: After hitting a power-output milestone, fusion technology is ready to graduate from small-scale lab experiment to full-sized power plant. (Wired)

Private Markets (PE / VC / Real Estate / Infra)

Utilities: Temasek to prioritise US deals and stay cautious on China (FT)

FOAK: Climate and infrastructure startups are leaning into modularity — and investors are paying attention (Business Insider)

Funding: Investment Drops in a Crucial Part of the Climate Tech Ecosystem (Bloomberg)

Funding: Climate Tech Is No Longer Weathering Venture’s Slump (WSJ)

Public Markets (Stocks, Bonds)

Wind: Dominion Energy Announces Agreement to Acquire Offshore Wind Lease From Avangrid For Potential Future Regulated Generation Development (PR Newswire)

Utilities: Talen urges FERC to reject AEP-Exelon protest over interconnection pact for Amazon data center (Utility Dive)

Electric Vehicles: Rivian's Brand-New LFP Battery Pack Gets Tested at a DC Fast Charger (Auto Revolution)

Carbon Credits: Microsoft and Occidental sign carbon credit deal to help offset AI energy surge (FT)

Government & Policy

LPO: Biden admin offers $1.2B loan to expand US battery supply chain (Canary Media)

Supreme Court: EPA lost big at the Supreme Court this term. There’s more to come. (E&E News)

Electric Vehicles: US Department of the Treasury makes significant last-minute change to vehicle tax credit rules: 'Fair and logical' (TCD)

China: Gridlock in China: huge spending on network in shift to green energy (FT)

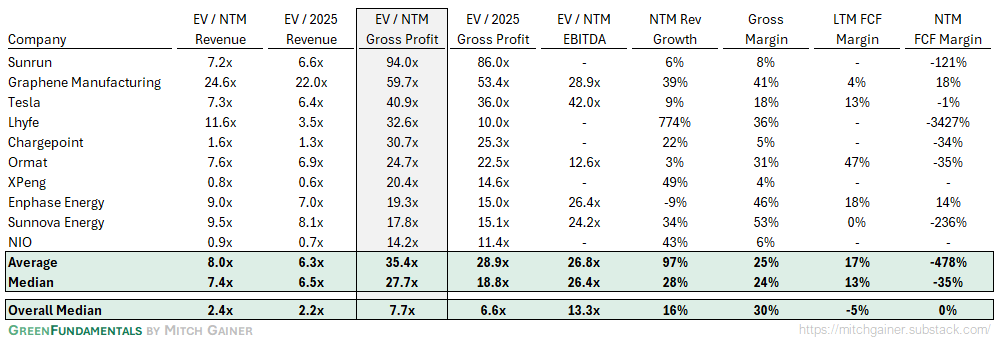

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

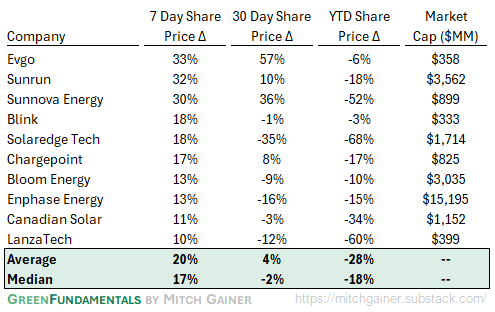

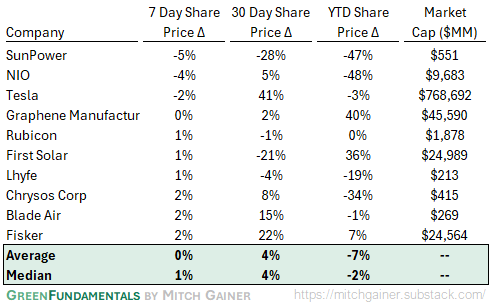

Top 10 and Bottom 10 Weekly Share Price Movement

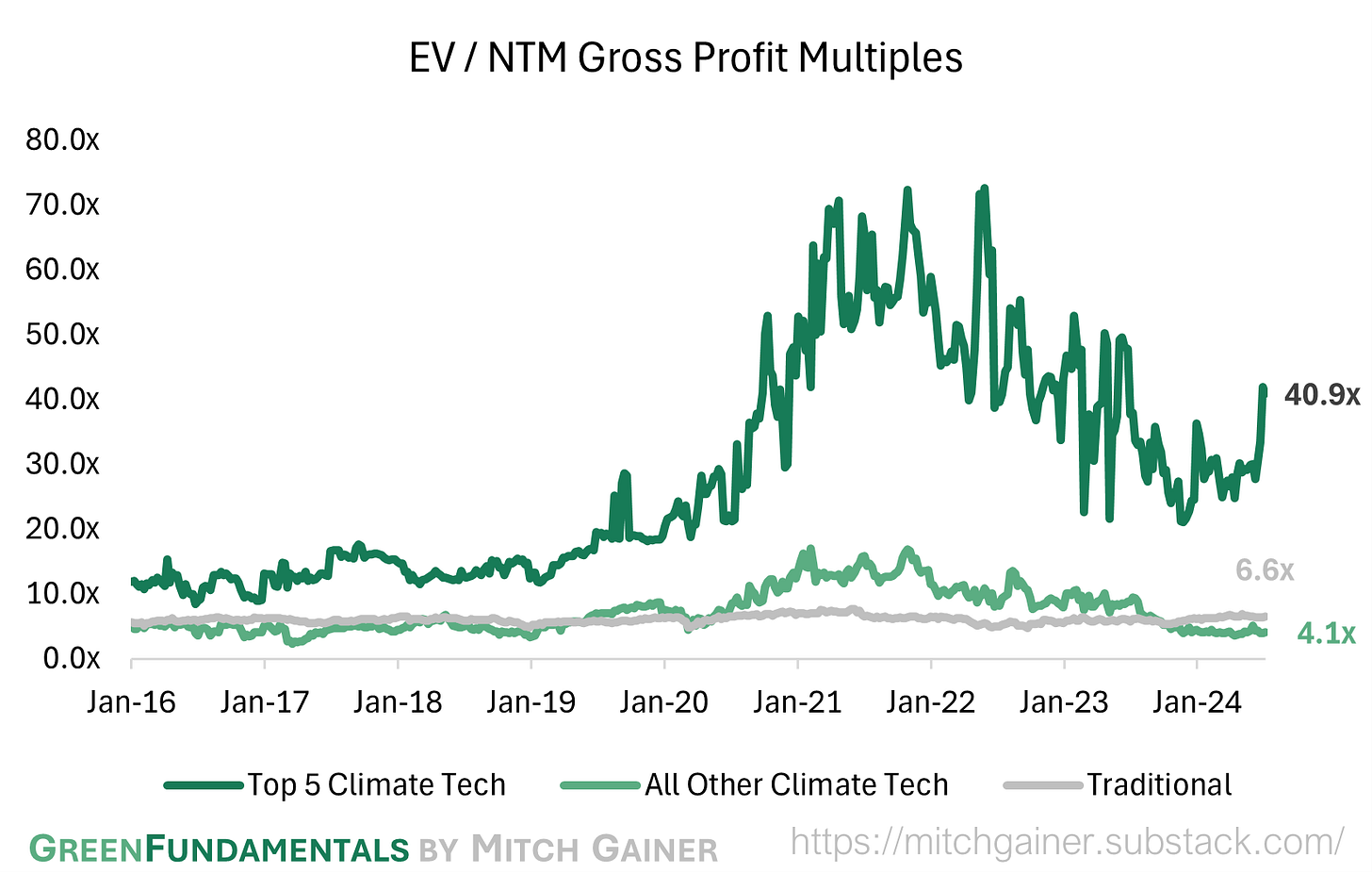

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

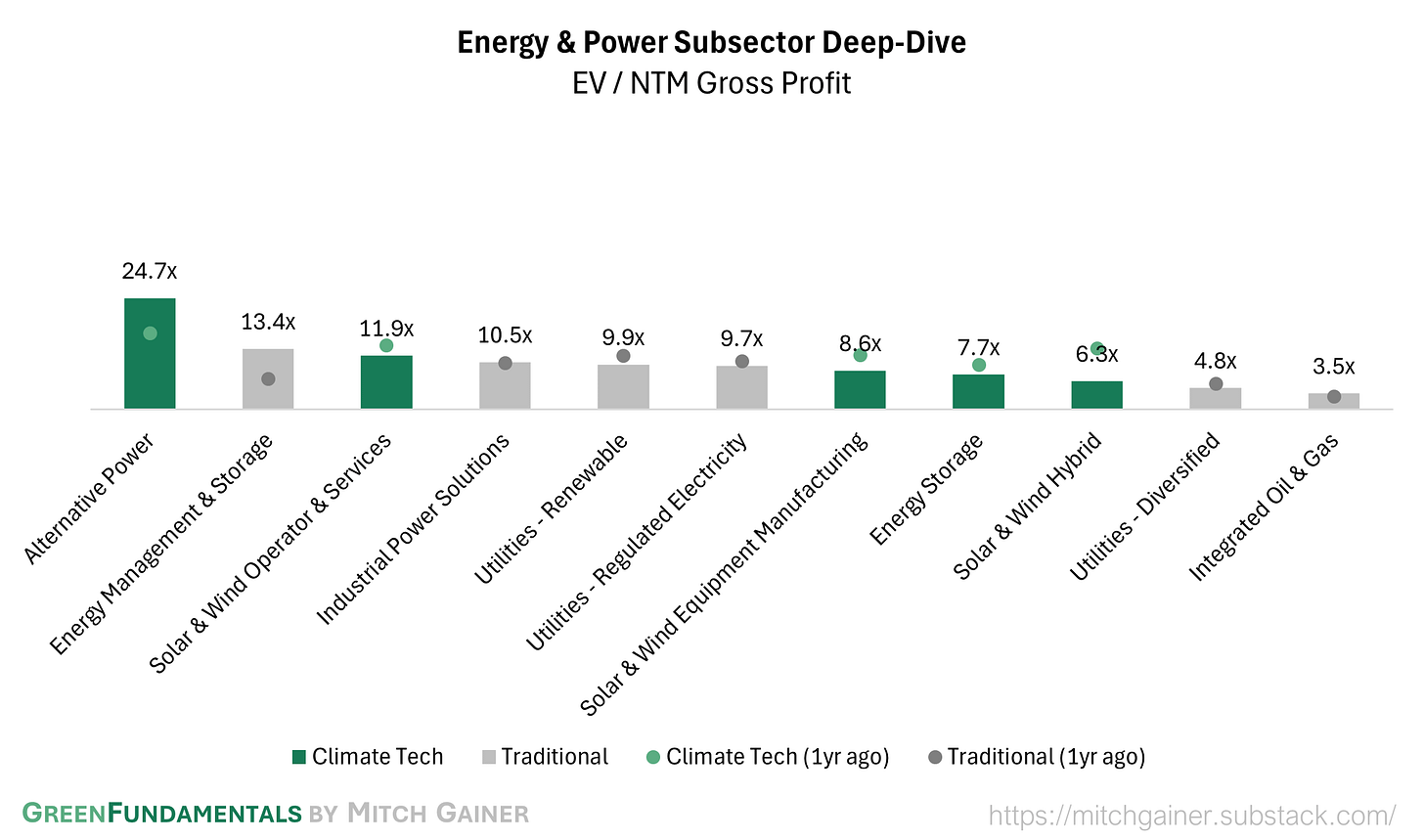

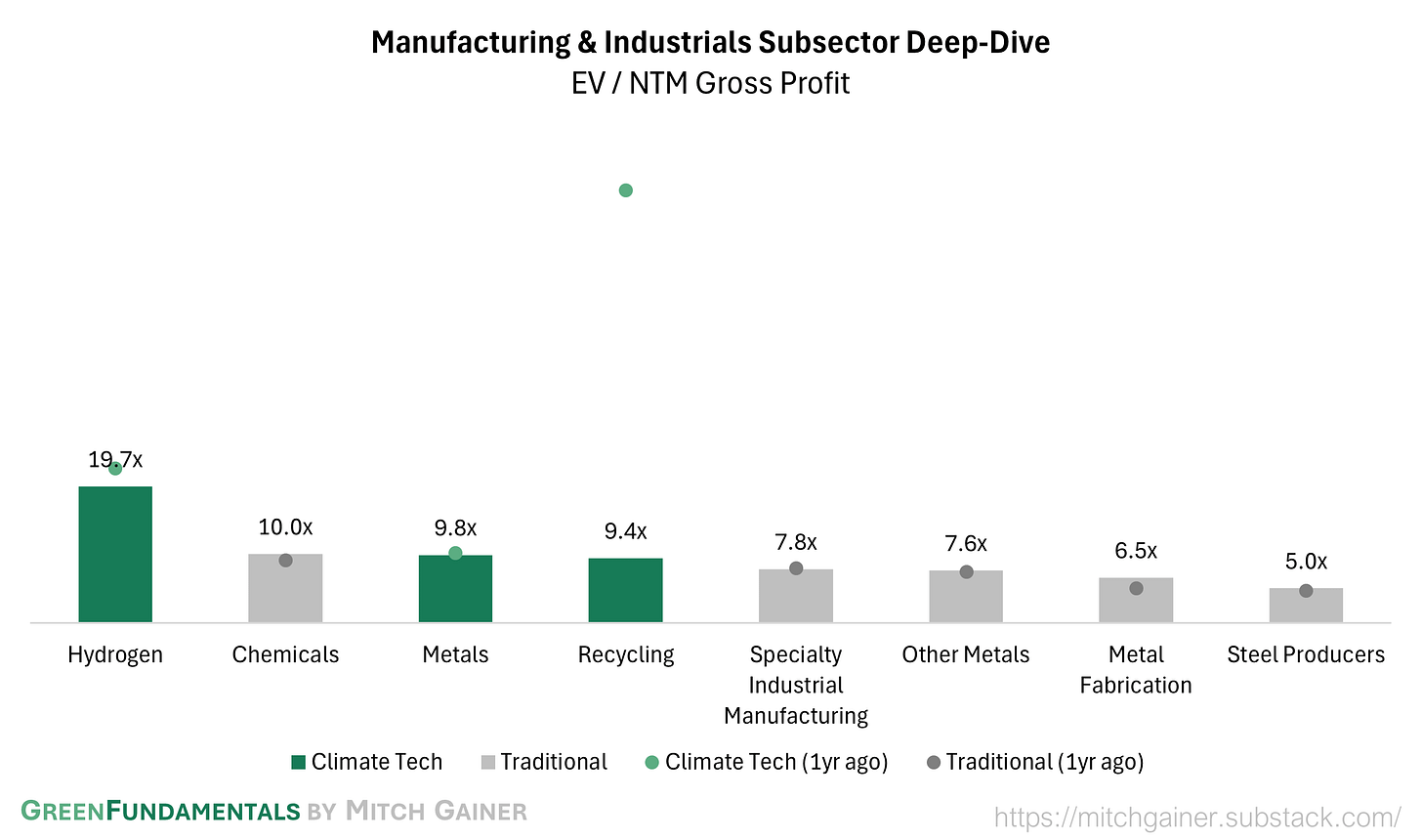

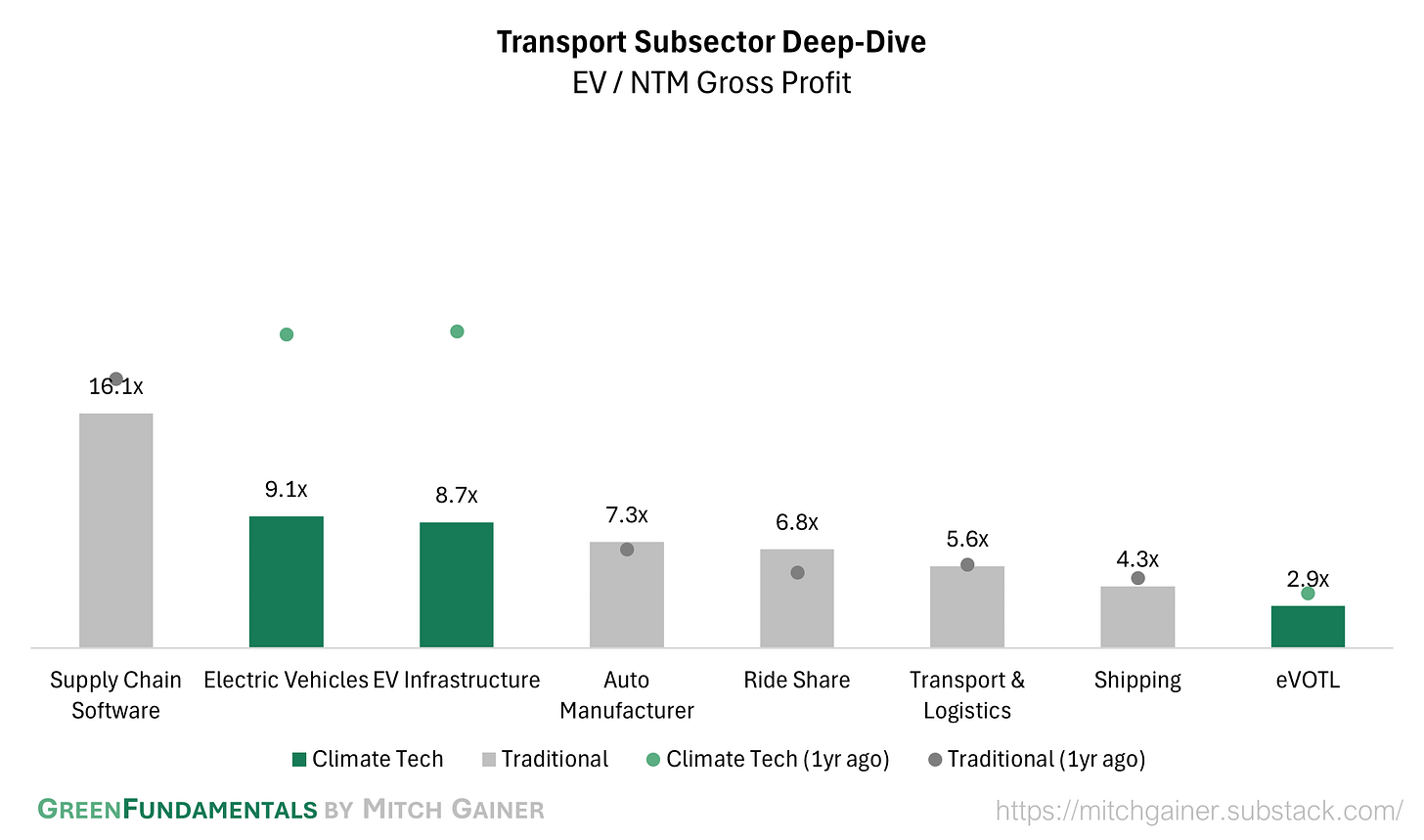

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium while energy management systems have increased in value; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

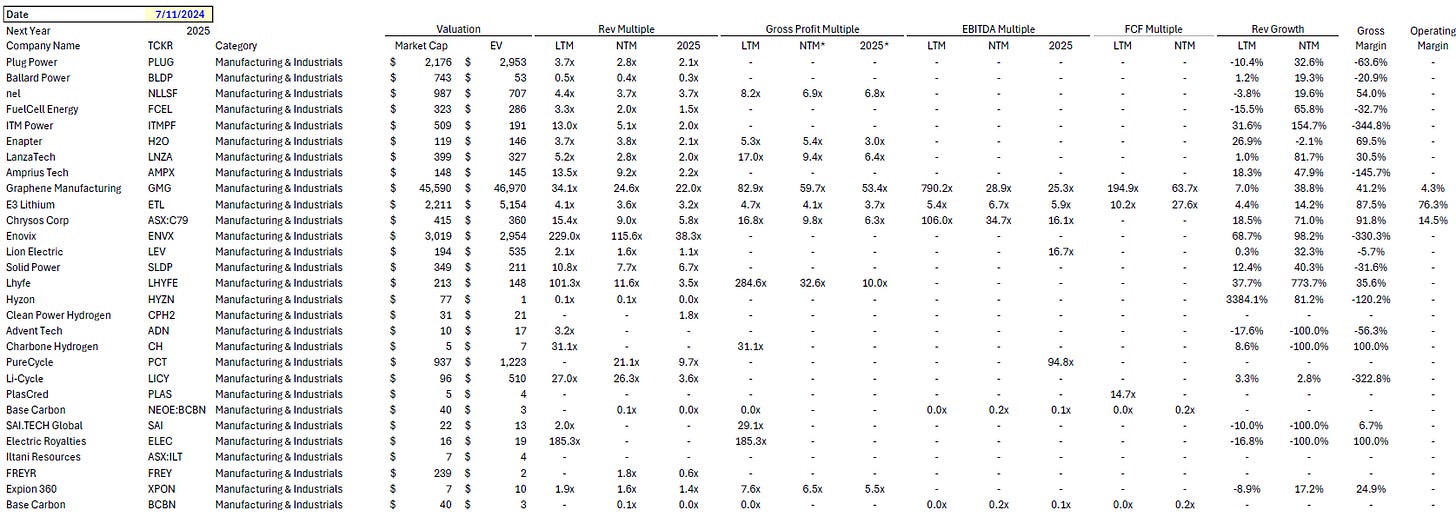

Manufacturing & Industrials: Recycling has fallen significantly over the past year, and hydrogen is trading back to where it was last time due to lower trading companies falling out of the comp set.

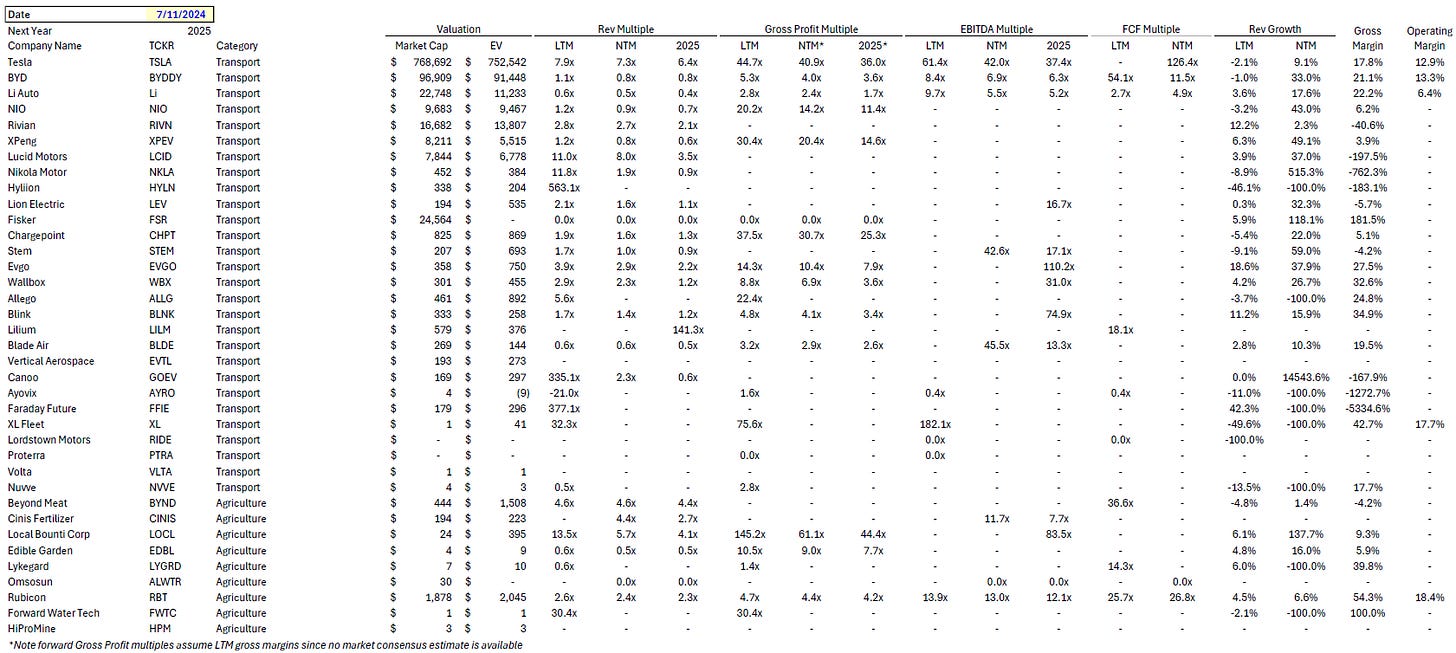

Transport: EV growth is priced in to climate tech and traditional companies - though they have declined over the past year; the market is skeptical on eVOTL.

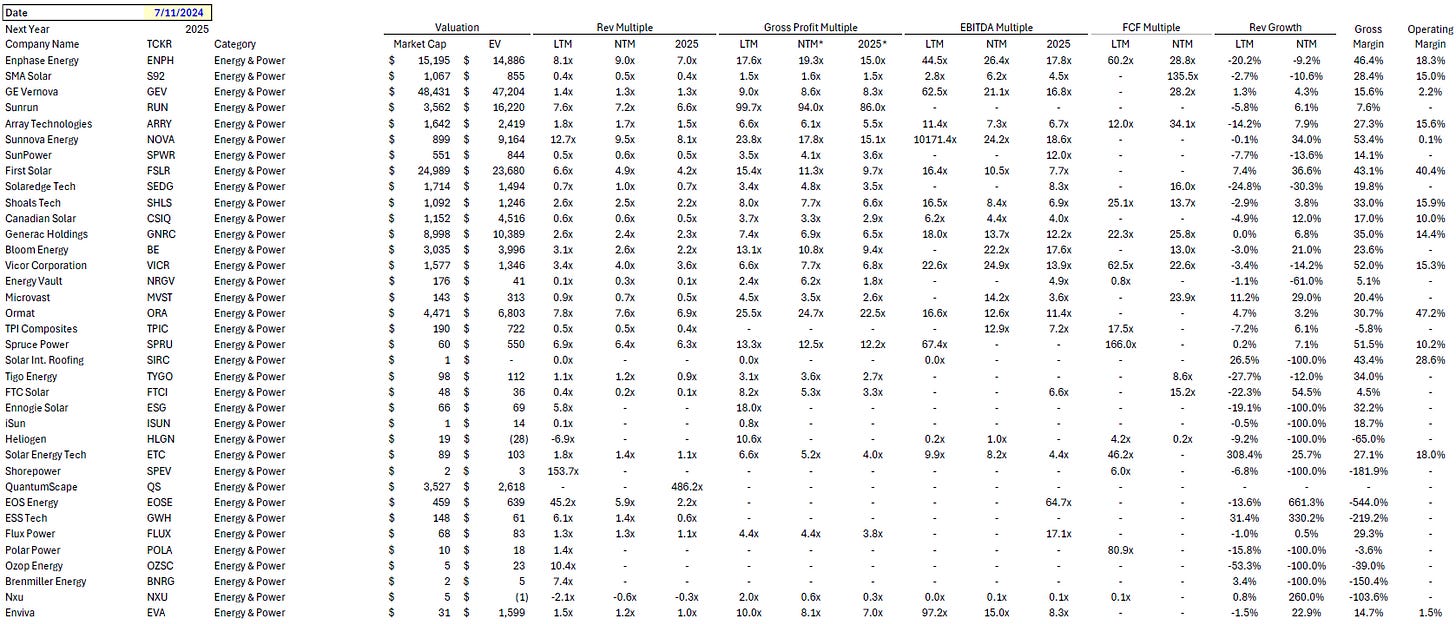

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.