Green Fundamentals: Offshore wind lacks wind in its sails

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Despite setbacks, offshore wind may still deliver… just later than planned and less than promised

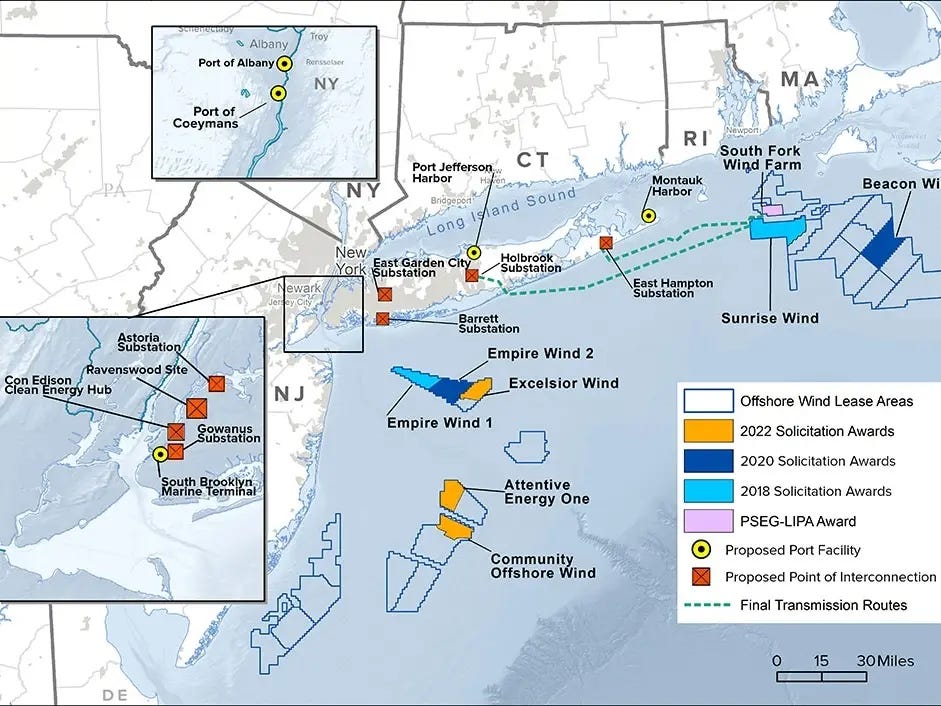

What Happened: New York (NYSERDA) declined to award final contracts to three major offshore wind projects, totaling 4 GW of capacity. GE Vernova, the planned wind turbine manufacturing partner, decided to cancel its plans to make an 18 MW Haliade-X turbine and stick with its current ~16 MW turbine. As a result, New York plans to open another competitive bidding process for the project’s turbines.

Until then, three projects (previously planned to be operational by 2030) will stay in limbo:

Attentive Energy One: 1.4 GW partnering with TotalEnergies, Rise Light & Power, and Macquarie-backed Corio Generation

Community Offshore Wind: 1.3 GW, JV between National Grid & RWE

Excelsior Wind: 1.3 GW owned by Copenhagen Infrastructure Partners

Source: New York State Energy and Research Development Authority

Background: The offshore wind turbine market is in an arms race, which has complicated progress. Bigger turbines produce more power with the same footprint, making projects more productive. However, weight is a limiting factor (to oversimplify: make the turbine too big and it won’t float). Chinese manufacturer Mingyang may be the only company producing 18 MW turbines. Recently, the BASF Chairman called Mingyang’s turbines both “technically better” and “cheaper”.

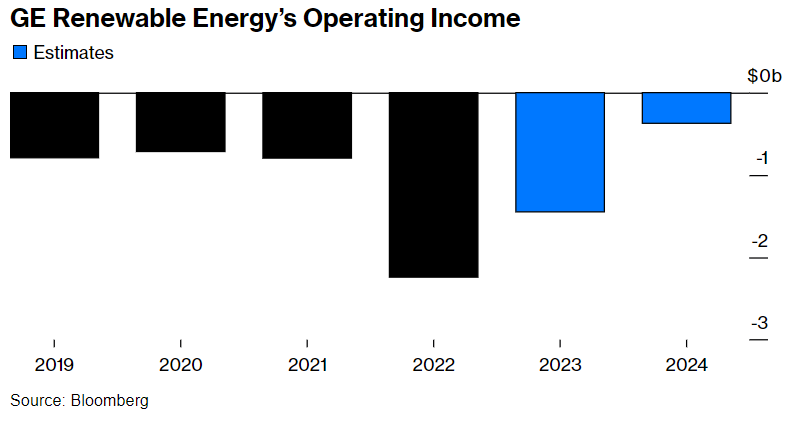

Both GE Vernova and Vestas has announced they will focus production on turbines at the 15-16 MW size. GE had previously submitted project bids with a planned 18 MW turbine before wind turbine manufacturing costs rose. This cancellation may be an opportunity for GE to renegotiate money loosing contracts (as it had been in other recently cancelled projects) and focus on operational efficiencies as well as improving margins, which it desperately needs after spinning out on April 2 (NYSE:GEV).

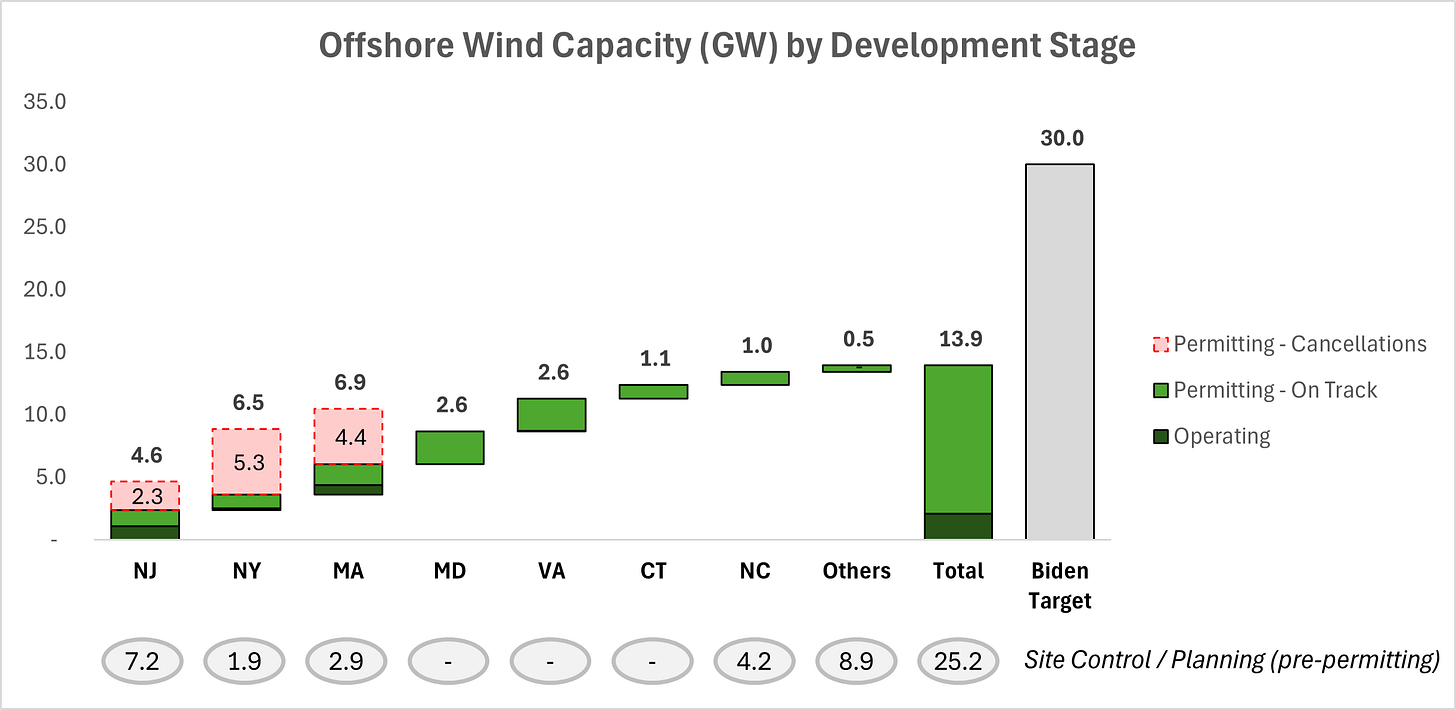

For U.S.-based offshore wind, 2023 was plagued by cancellations despite record growth. In 2023, offshore wind in MA, NY, RI, and VA grew from 42 MW to 240 MW. At the same time, developers canceled contracts for nearly 8 GW, incurring billions of dollars of penalties. The main reasons cited for cancellations were higher interest rates, supply chain issues, and failure to obtain tax credits.

Recent Cancellations (in addition to the recent 4 GW cancellation in NY):

NJ: Ocean Wind 1 & 2 (2,250 MW) was cancelled by Orsted, resulting in a $5.6B write down

NY: Empire Wind 2 (1,260 MW) was cancelled by Equinor and BP, though developers say the project is still alive

MA: South Coast Wind (2,400 MW) owned by Shell ($60M penalties)

MA: Commonwealth Wind (1,232 MW) a unit of Avangrid, a subsidiary of Iberdrola ($48M penalties)

MA: Park City (804 MW), owned by Avangrid ($16M penalties, $1B write-offs)

Recently Operational:

MA: Vineyard Wind 1 (800 MW) delivered first power in February 2024 (operating 5 of planned 62 turbines / 68 GW)

NY: South Fork Wind (132 MW) was commissioned on March 14, 2024 (operating all 12 turbines), owned by GIP / Blackrock, Orsted, and Eversource

Source: Energy.gov

Take-Away: This week’s 4 GW cancellation is devastating to New York’s 9 GW goal by 2035, and makes the White House’s 30 GW national goal by 2030 further out of reach. There is significant capacity still in the planning and site control phase - but these have not even begun to hit the challenges projects have faced in permitting and approval.

What Comes Next: 10-15 GW of Offshore Wind could come to final investment decision (FID) in the coming years and be operational by 2030. Developers, regulators, and investors will need a few things to ‘go right’ to achieve this, including:

New contracts negotiated for recent cancellations (developers believe projects are still alive despite recently cancelled contracts)

Resolution of significant questions on transmission and operating costs for the projects

Added political pressure to accelerate earlier-stage projects in the site control and planning phase (especially in California, which has a very large but very early pipeline of projects)

Improved margins for turbine manufacturers (like GE Vernova) in light of new pressures as an independently traded company so they can continue to expand off-shore wind production

Politicians make headlines announcing large amounts of planned capacity for offshore wind before many of the challenging details are worked out. Project development and permitting is where the war will be won.

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Fusion: ‘Cheap and simple’ Bill Gates-backed fusion concept surpasses heat of the Sun in milestone moment (Recharge)

EV Charging: A Highway in Indiana Could One Day Charge Your EV While You’re Driving It (Inside Climate News)

Private Markets (PE / VC / Real Estate / Infra)

Rare Earth Minerals: The rare earths mine becoming a bellwether for US minerals policy (FT)

Hydro: The $6 billion project to power 1 million NY homes with clean energy is the first of its kind (Business Insider)

Wind: America's first large-scale offshore wind project impresses with full-power grid delivery: 'This marks a turning point' (TCD)

Grid: Wind and solar in limbo: Long waitlists to get on the grid are a ‘leading barrier’ (Chicago Tribune)

Grid: FERC to unveil US power grid reform on May 13 (Reuters)

FOAK: Prime Coalition Announces Trellis Climate to Accelerate Deployment of FOAK Projects (Prime Coalition)

Public Markets (Stocks, Bonds)

EV Charging: Tritium DCFC Limited (DCFC) enters insolvency, is seeking buyers (Electrek)

Transformers: Hitachi Energy invests $1.5B to make more transformers for grid upgrades (Electrek)

Electric Vehicles: Here’s When These 16 Automakers Will Switch To Tesla’s Charging Network (Autoweek)

Electric Vehicles: Tesla, Li Auto Cut Prices in China as EV Competition Heats Up (WSJ)

Electric Vehicles: A cheaper Tesla is back on the menu: Tesla is planning to put new models into production in the second half of 2025 — including more affordable models that were previously reported to be canceled. (The Verge)

Wind: What is LM Wind Power’s future in GE Vernova? (Tamarindo)

Government & Policy

Battery Materials: Chinese Exports of Battery Material Graphite Plunge on Controls (Bloomberg)

Solar: EPA Announces $7 Billion in Solar for All Awards (NRDC)

Tax Credits: Biden-Harris Administration Announces First Projects Receiving Clean Energy Manufacturing Investments in America's Industrial and Energy Communities (DOE)

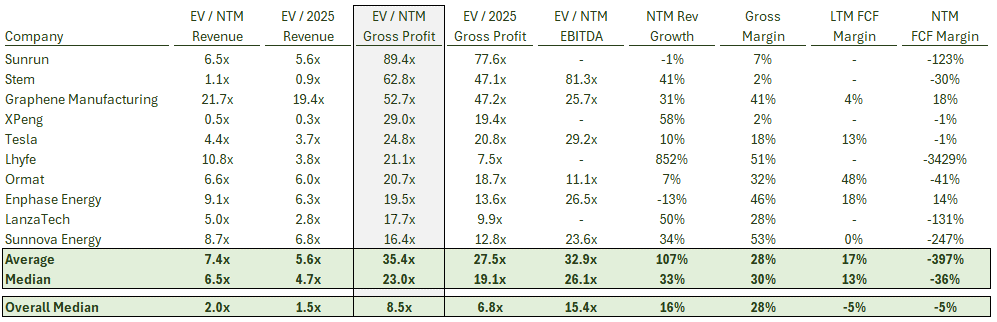

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

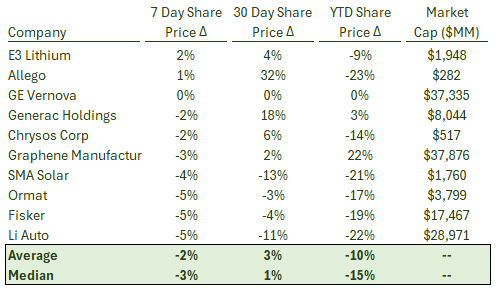

Top 10 Weekly Share Price Movement

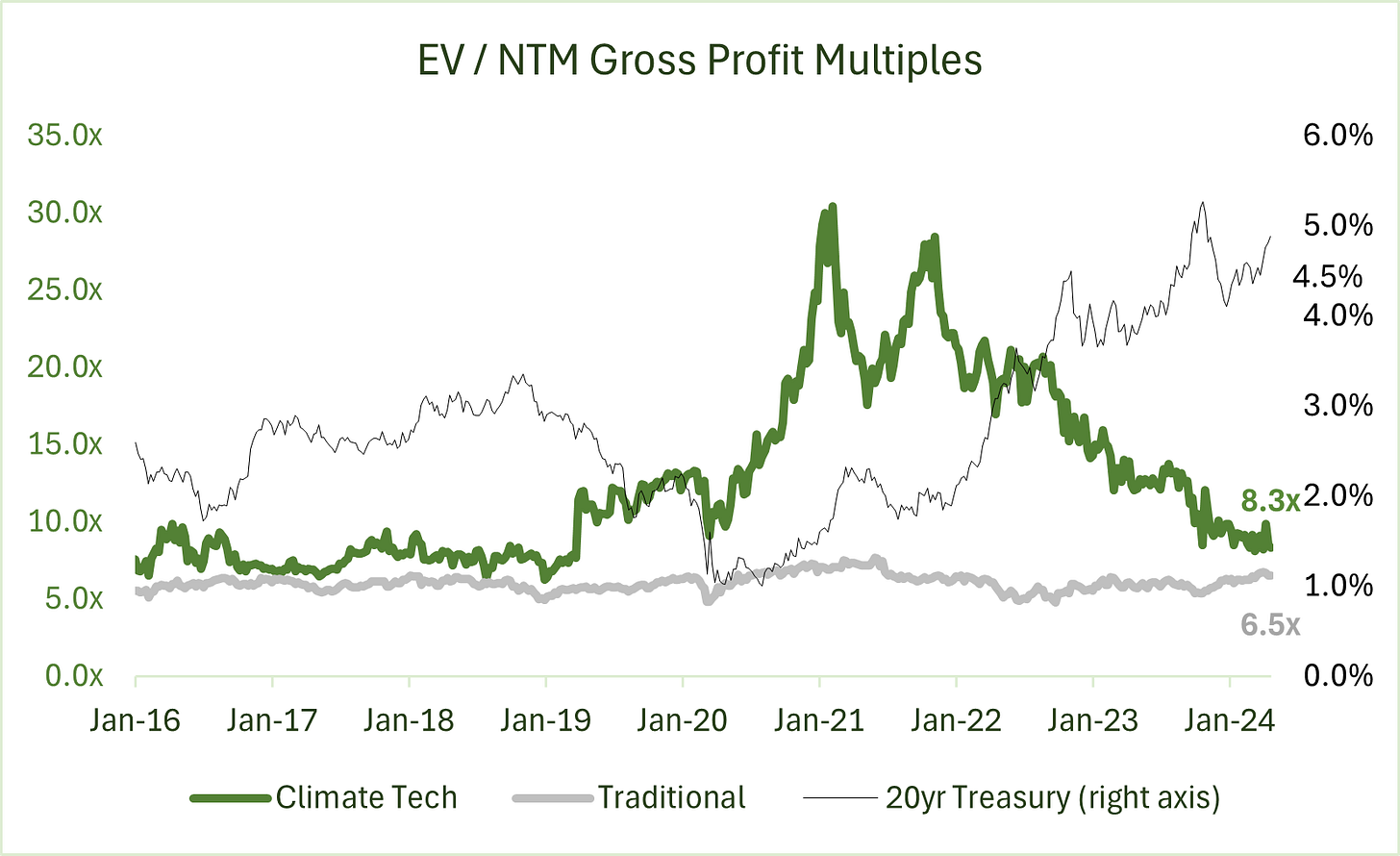

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

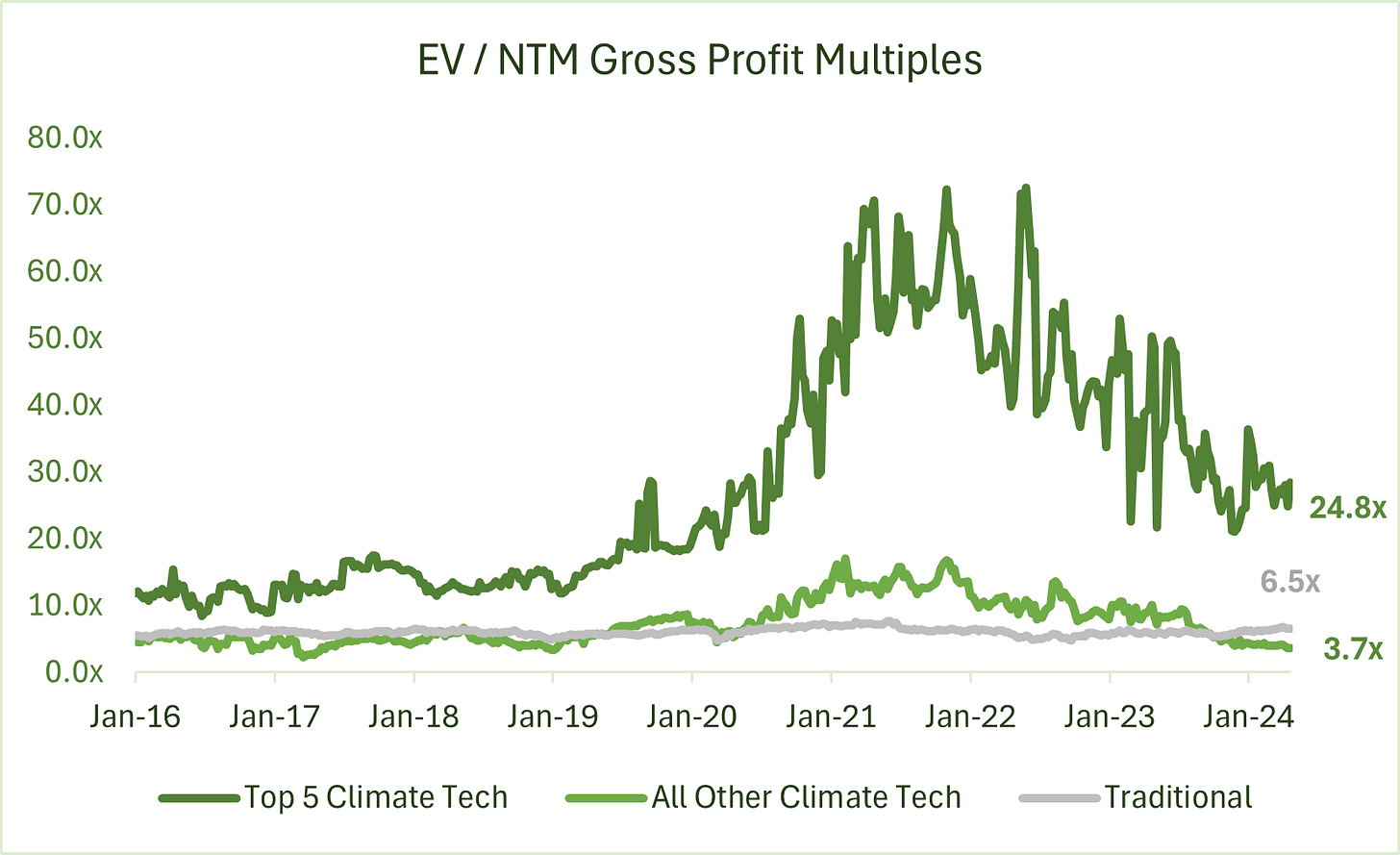

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

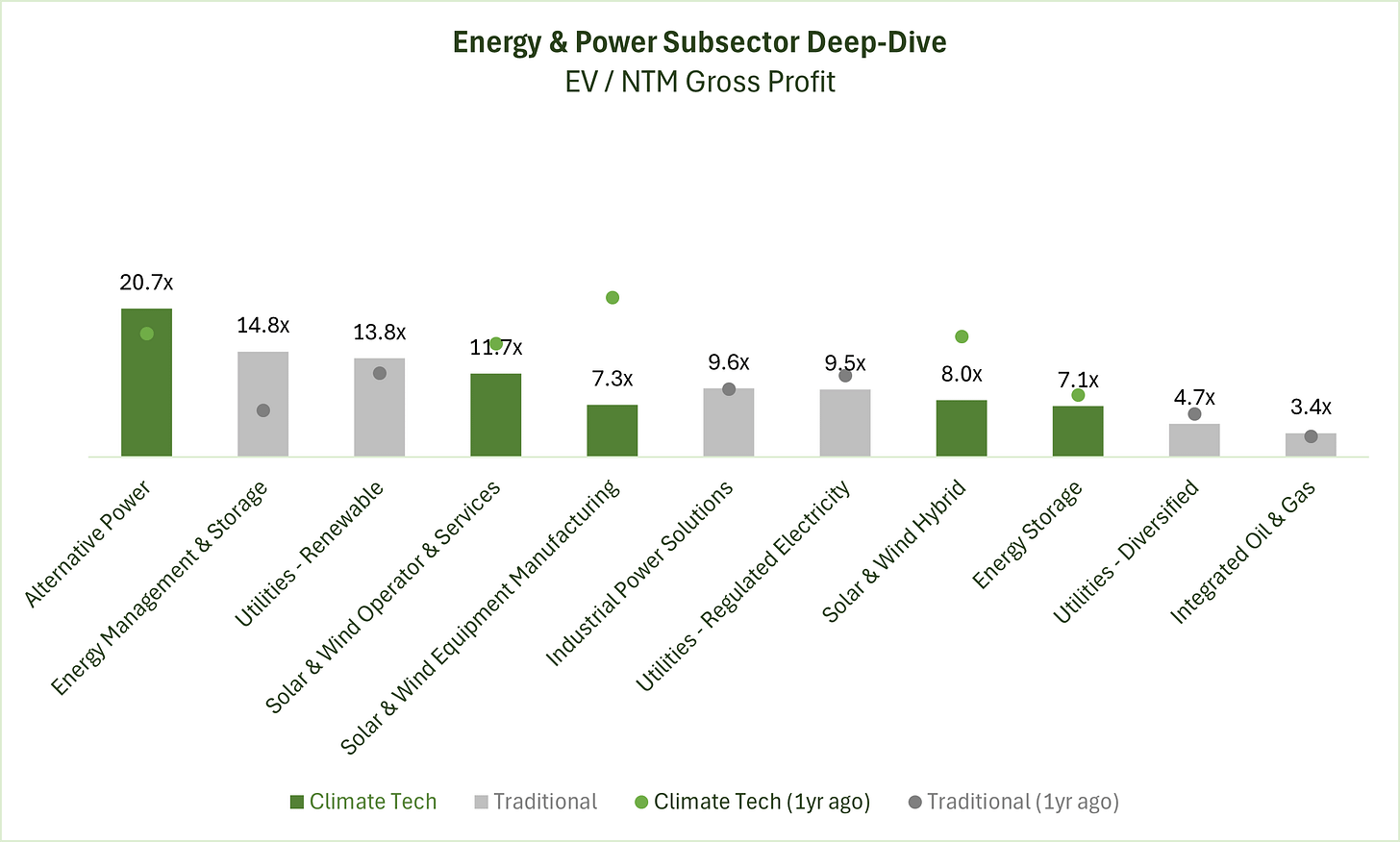

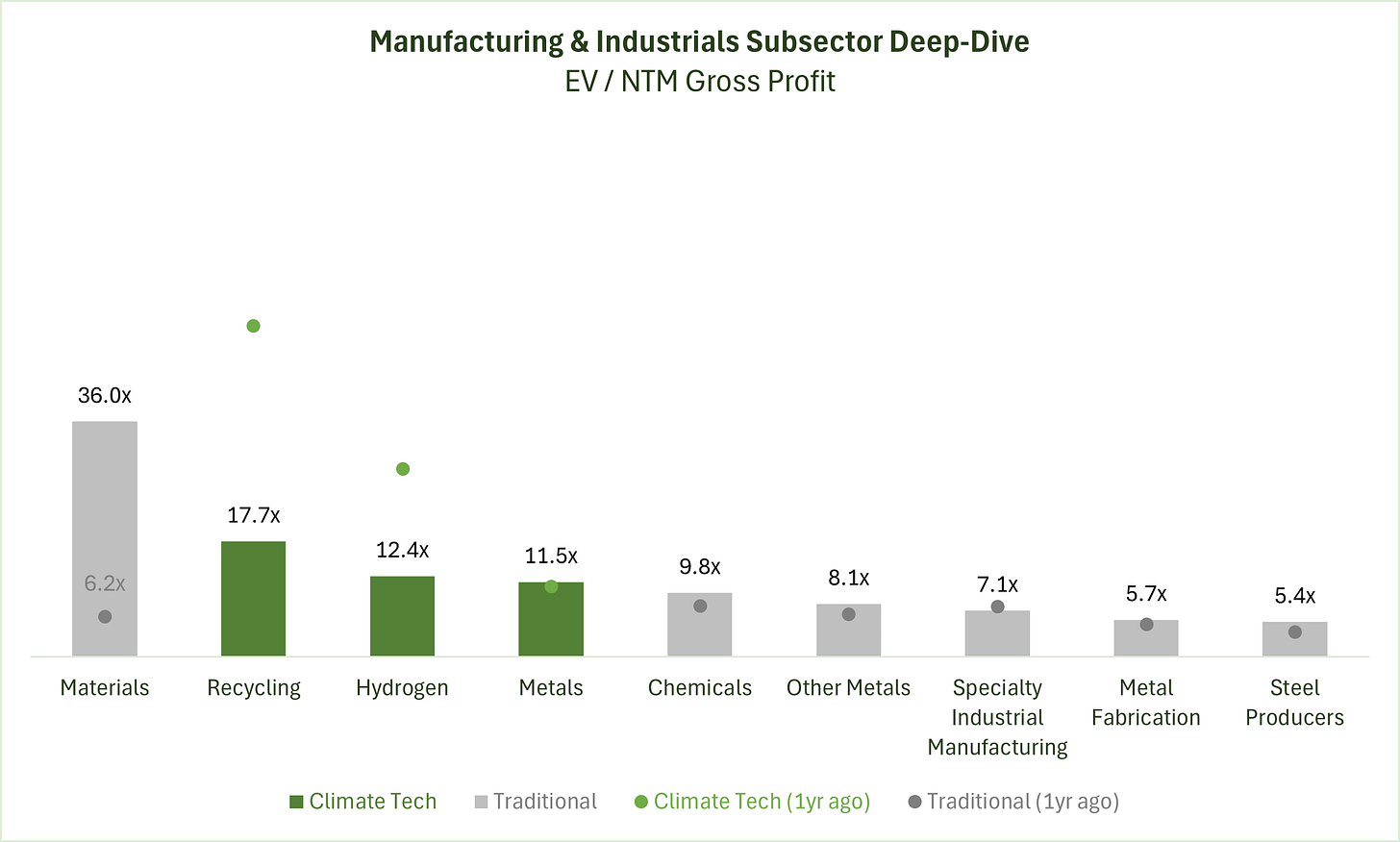

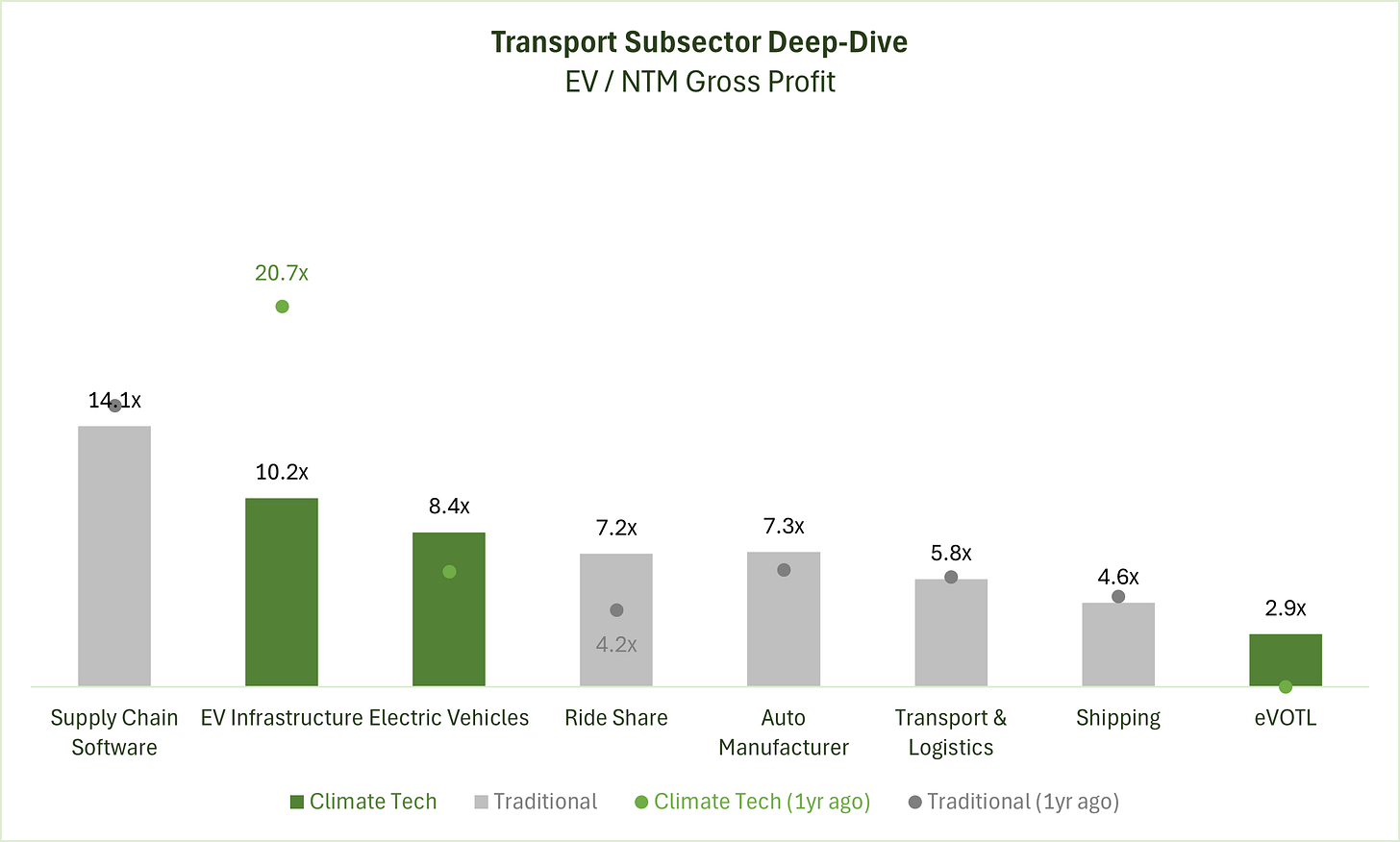

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium, while more speculative (storage) has less; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

Manufacturing & Industrials: Both traditional and emerging companies around critical minerals supply command a premium; the market has grown skeptical on hydrogen.

Transport: EV growth is priced in to climate tech and traditional companies; the market is skeptical on eVOTL.

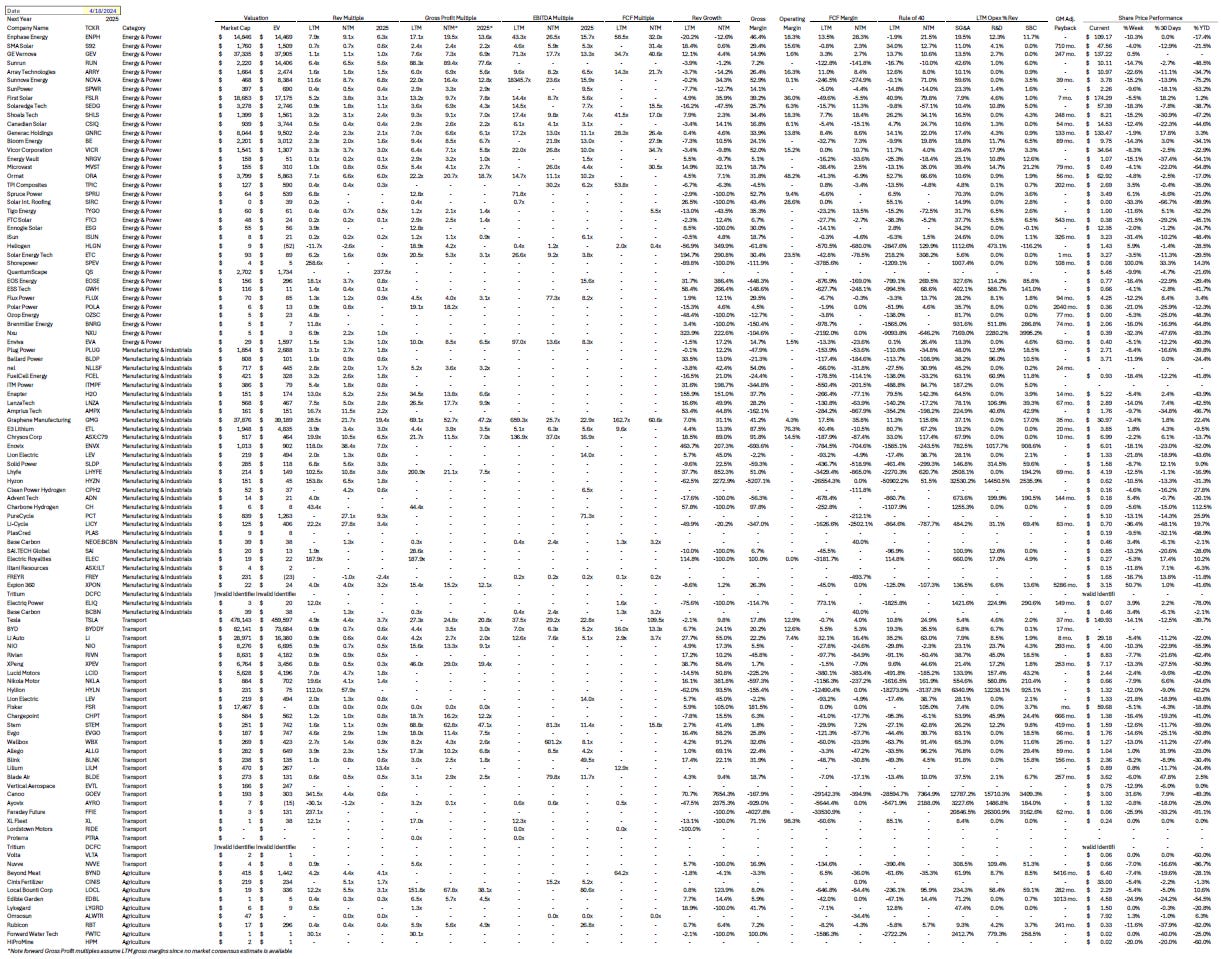

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.