Green Fundamentals: Pricing Power

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Electricity Demand is Surging - Here’s Where Smart Investors Are Focusing Next

U.S. electricity demand is shifting dramatically. From a modest 0.1% annual growth from 2005 to 2023, demand is now projected to climb 4.7% annually from 2023 to 2028—a defining challenge for this decade. Identifying who bears the cost and who captures value will reveal the pivotal investments of 2025.

Source: Bain & Company

Take Ohio, where data centers are pushing electricity demand to Manhattan-like levels. These energy-intensive facilities create localized demand spikes that necessitate costly upgrades to the grid—transmission lines, substations, and transformers—to ensure reliable power delivery. In their Q2 2024 earnings call, American Electric Power (AEP) highlighted this challenge:

Regarding data center load, we have commitments from customers for more than 15 gigawatts of incremental load by the end of this decade, mostly driven by large float opportunities. To put this in perspective, AEP system wide peak load at the end of last year was 35 gigawatts. We continue to work with data center customers to meet the increased demand while ensuring contracts and new initiatives are fair and beneficial for all of our customers.

In the fall, we will provide an update on what this large load opportunity means for our capital spend, including generation and transmission investment and on our plan to response with finance this growth initiative. But we certainly encourage innovation when it comes to meeting the energy needs of our customers, data centers included. I want to emphasize that is critically important that costs associated with these large loads are allocated fairly and the right investments are made for the long term success of our grid.

To address these costs, AEP has proposed new rate structures requiring large data centers (25 MW+) and cryptocurrency miners (1 MW+) to pay for 85% of their stated energy needs monthly, regardless of actual usage. Google, Microsoft, Facebook, and Amazon argue these measures are ‘discriminatory’ and ‘unreasonable’, but without them, other electricity consumers often bear the cost through higher rates. Perhaps this will be a precedent for other markets.

Why This Matters Now

Historically, electricity rate increases have been driven by inflation, not demand growth. From 2019 to 2023, U.S. retail electricity prices rose 4.8% annually, tracking inflation, while electricity consumption remained flat.

Source: Lawrence Berkeley National Laboratory

The next five years will be different, with load growth accelerating nationwide:

California: EVs could account for 10% of peak-hour power use by 2035.

North/South Carolina: Mega-projects like EV manufacturing and battery production have increased 2028 load forecasts by 6% (~2 GW).

Georgia: Industrial growth could add 4 GW to winter peak demand.

Arizona: Large commercial projects are driving 20% load growth over five years.

Hydrogen: 3.6 GW of planned projects are yet to be factored into many forecasts.

These shifts demand unprecedented investment in grid infrastructure, storage, and regulatory innovation. Click below to see an in-depth report.

Source: Grid Strategies

Investment Themes for 2025

Grid Modernization: Companies enabling smarter, more resilient grids with technologies like real-time optimization software and advanced transmission upgrades.

Energy Storage Solutions: Long-duration storage (8+ hours) to stabilize grids and integrate renewable energy sources cost-effectively.

Demand-Side Management: Platforms leveraging AI and IoT to optimize energy use, reduce peak demand, and improve efficiency.

DER Aggregation / Virtual Power Plants (VPPs): Solutions aggregating distributed energy resources for grid services and decentralized energy value streams.

Behind-The-Meter Generation: Modular systems enabling energy independence, sustainability, and grid resilience for industrial and commercial users.

As electricity demand surges, the energy sector faces profound challenges—and opportunities. From reimagining grid infrastructure to pioneering financial innovations, investors who act strategically will help shape the future of energy markets while capturing significant value. Whether you’re backing the next grid technology leader or supporting scalable energy storage, this decade’s defining investments are taking shape now.

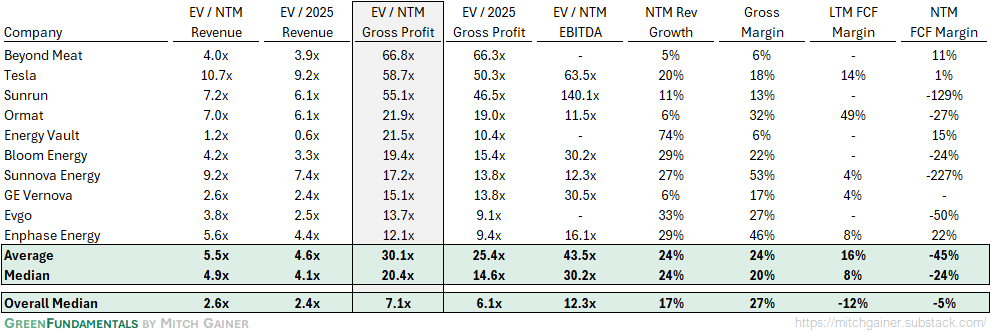

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

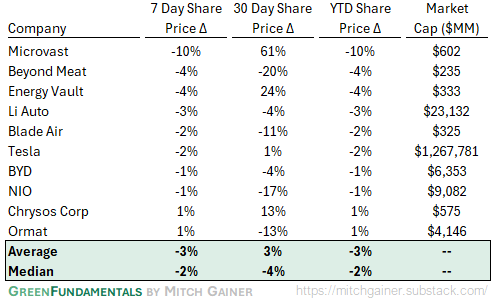

Top 10 and Bottom 10 Weekly Share Price Movement

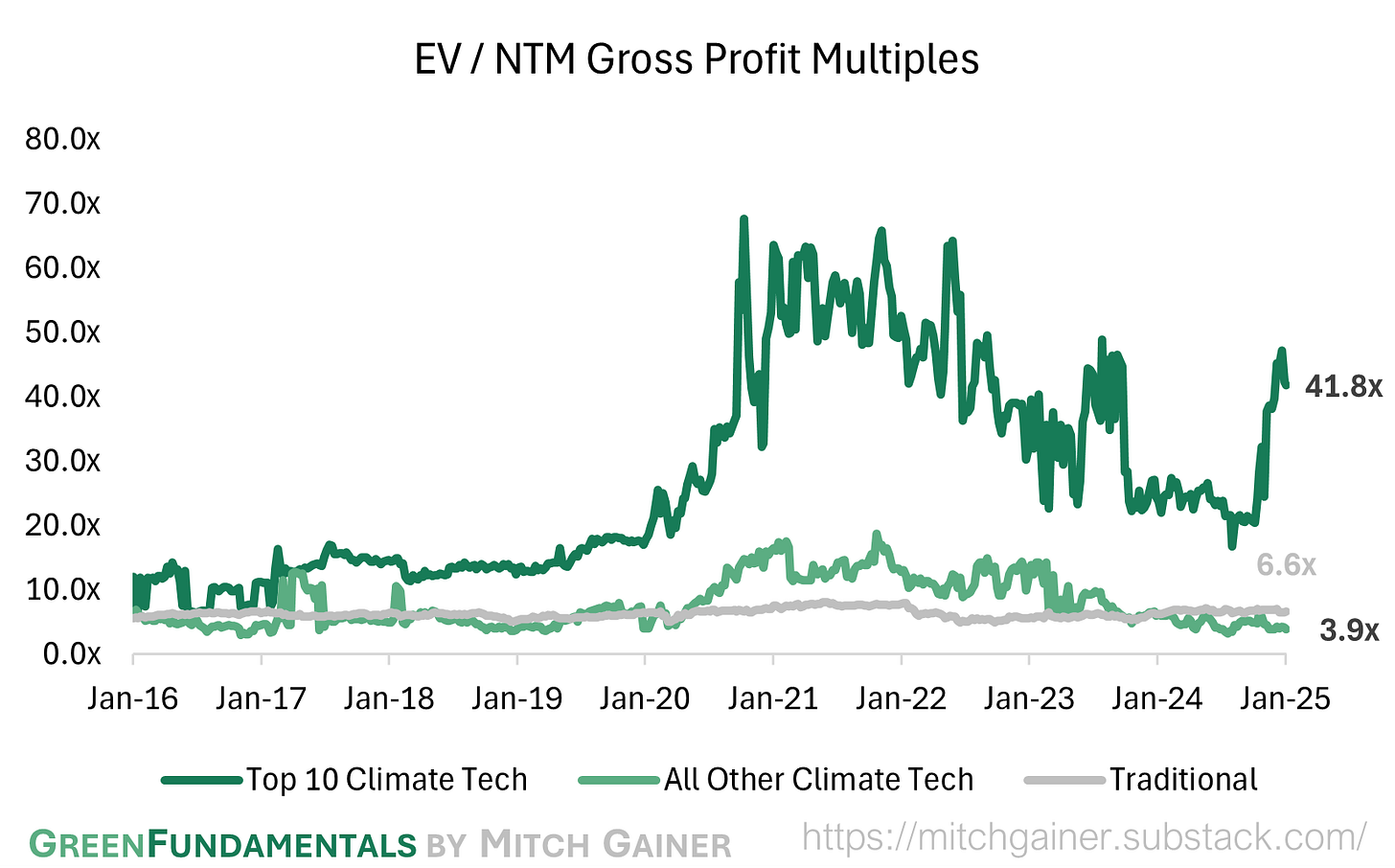

Valuation Multiples over Time

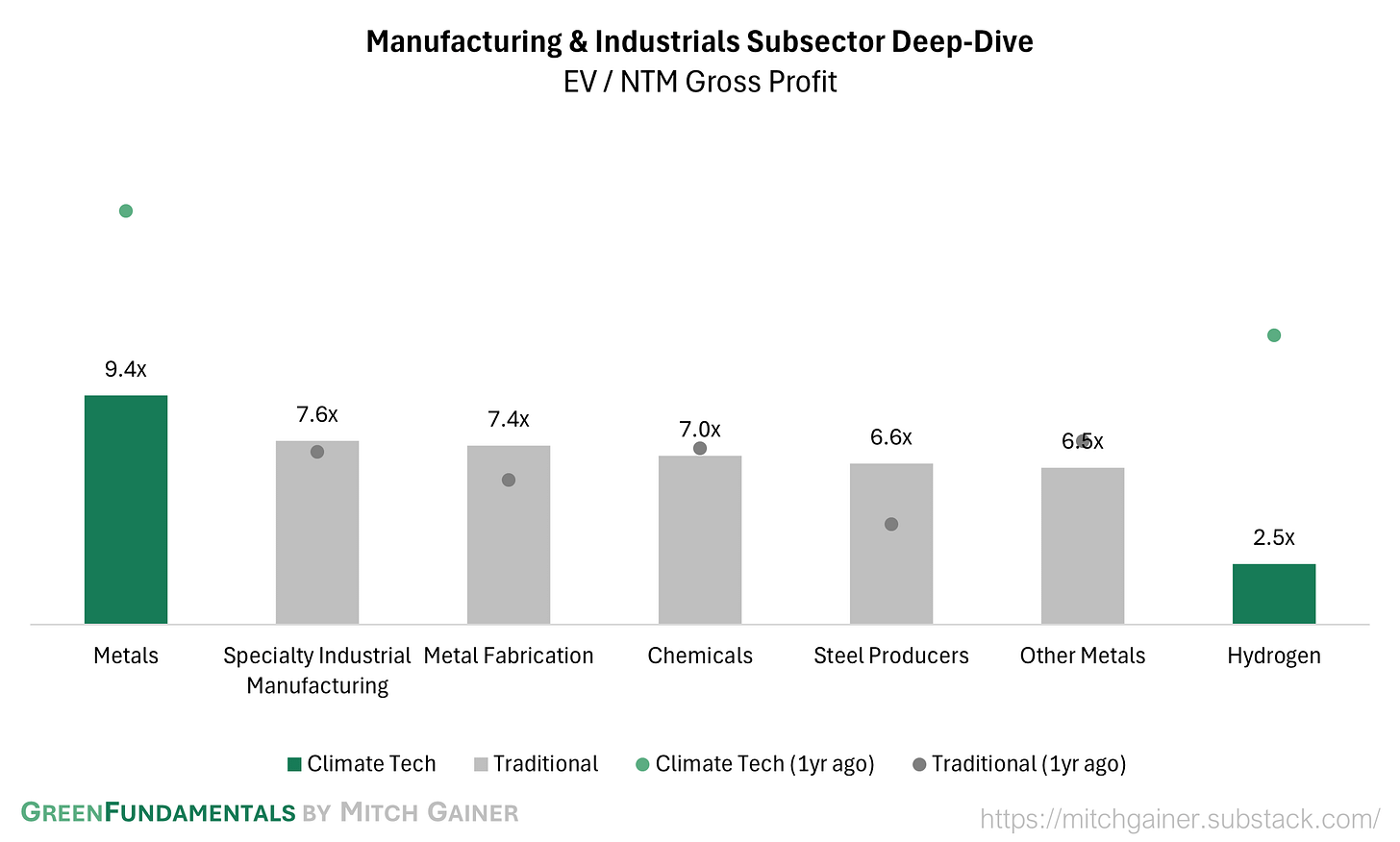

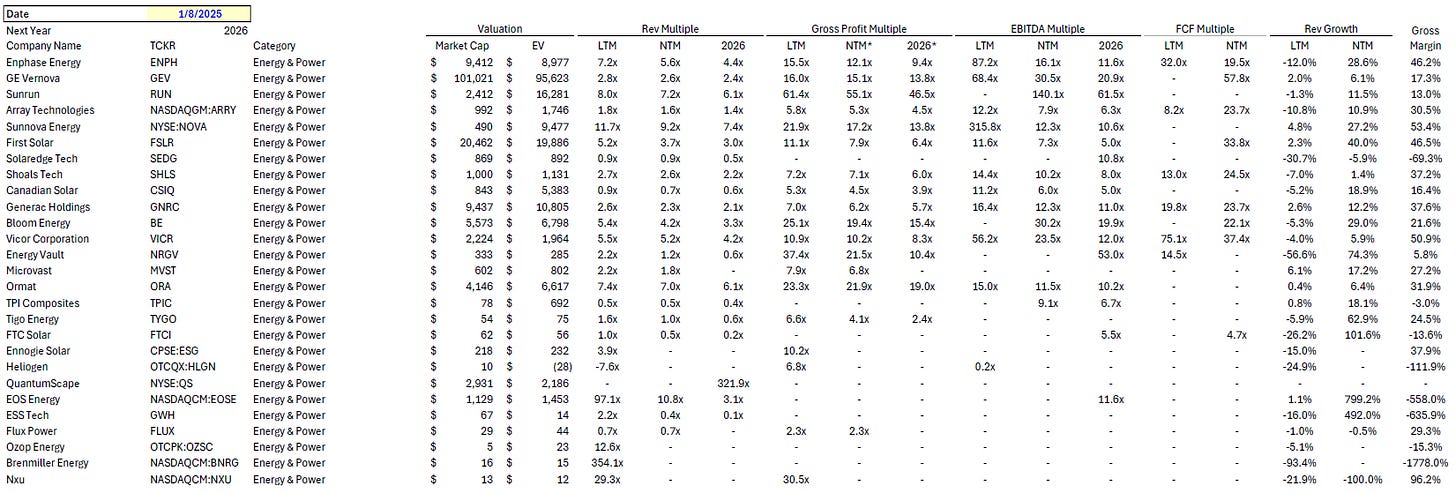

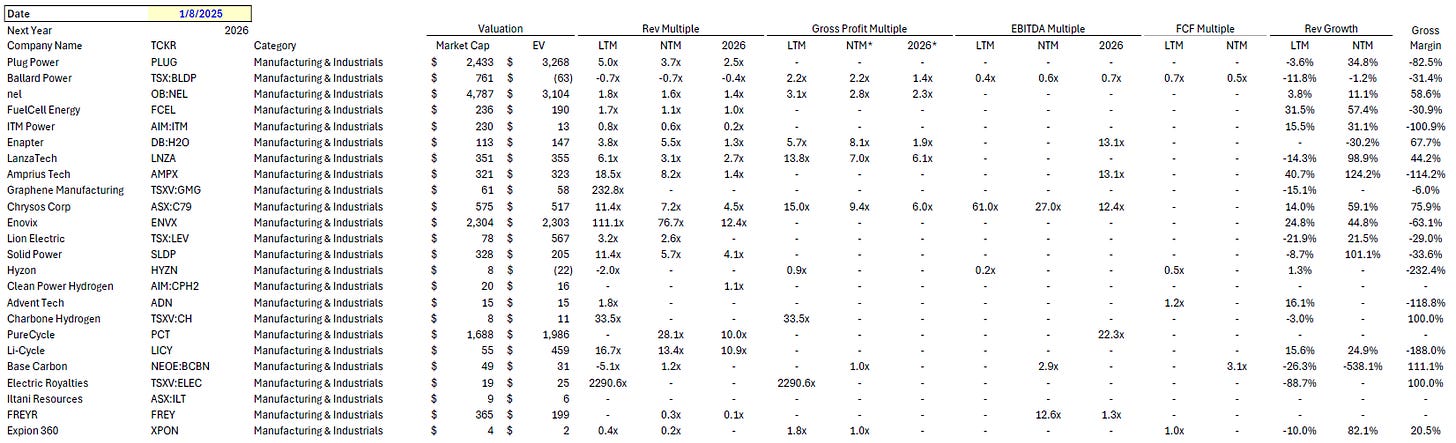

Deep-Dive by Subsector

Months of Cash

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.