Green Fundamentals: Rising Interest in Falling Rates

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

The Jackson Hole Signal Climate Tech Investors Can’t Ignore

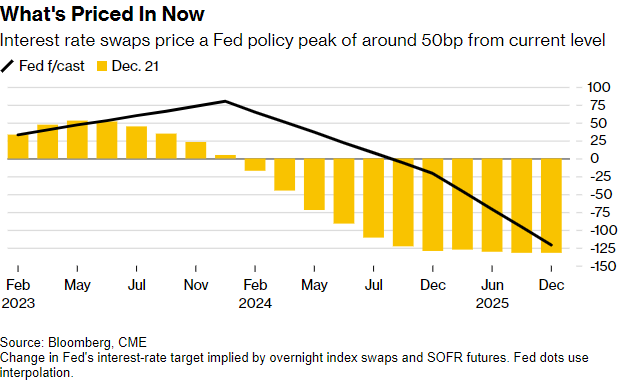

What Happened: At the recent Jackson Hole Economic Symposium, Federal Reserve Chair Jerome Powell hinted at a potential shift in monetary policy that could significantly impact climate tech investing. While the Fed remains cautious, acknowledging that inflation is not yet fully under control, the market is increasingly anticipating rate cuts by the end of 2024. This potential pivot arrives after years of rising interest rates that have already reshaped the investment landscape for climate tech. Investors should be alert: falling rates could unleash a new set of opportunities—and risks—across the sector.

Source: Bloomberg

Background: Climate tech investing has evolved dramatically over the past decade, shaped by both technological advancements and macroeconomic forces. Interest rates, in particular, have played a critical role in directing capital flows, setting valuations, and influencing sector dynamics. Here's how this has unfolded:

Venture Capital: The exuberant valuations of 2021, where early-stage climate tech companies commanded NTM revenue multiples over 30x, have sharply contracted to 10-12x due to rising interest rates. Capital is now more expensive, pushing investors to focus on cash flow breakeven and capital efficiency. VC deployment in climate tech peaked at $65 billion in 2021 but plunged 26% to $48 billion by 2023, marking a severe recalibration in early-stage investment strategies. In 2024, funding is down even further.

Private Equity: Climate tech buyouts have also seen significant recalibration. Debt-to-EBITDA multiples dropped from 7x in 2021 to around 5.5x, reflecting higher debt costs and conservative leverage strategies. Senior secured loans that once traded at LIBOR+300 bps are now priced at SOFR+500 bps or higher, pushing required equity returns into the mid-teens. The focus has shifted to operational improvements and strategic add-ons rather than financial engineering.

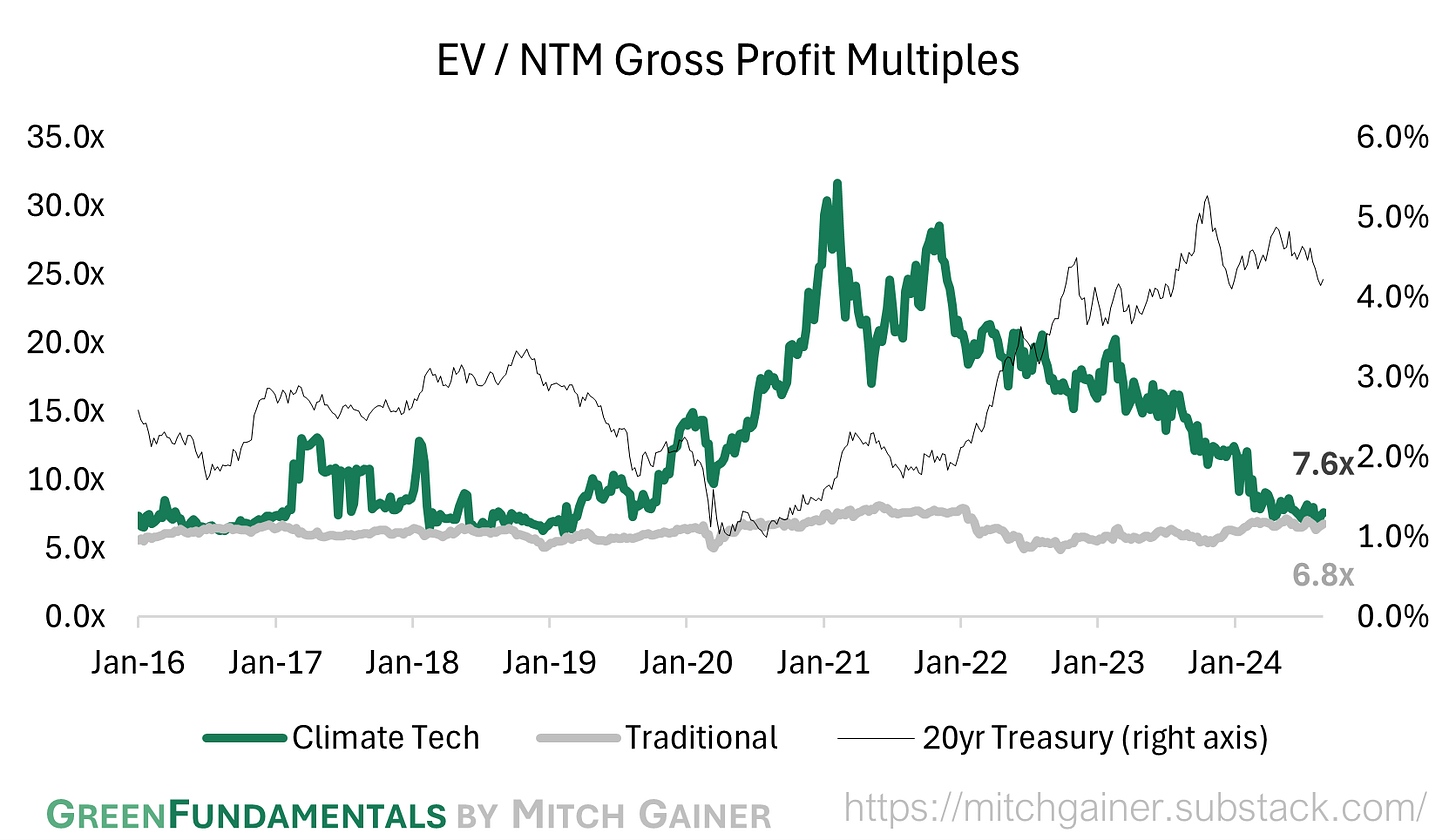

Public Equity: Rising rates have hit public climate tech companies hard, especially those in high-growth, high-burn sectors. Valuations have halved or worse, as the market pivots from growth to value. Investors now demand more mature, cash-generative business models, leaving even solid climate tech companies struggling to maintain interest.

Infrastructure and Project Equity: Rising rates have reshaped infrastructure investments, particularly in renewables. Unlevered project yields have increased from 5-6% in 2021 to 7-8% today, with higher returns demanded for projects with significant risk (as high as 12-15+ unlevered project yields).

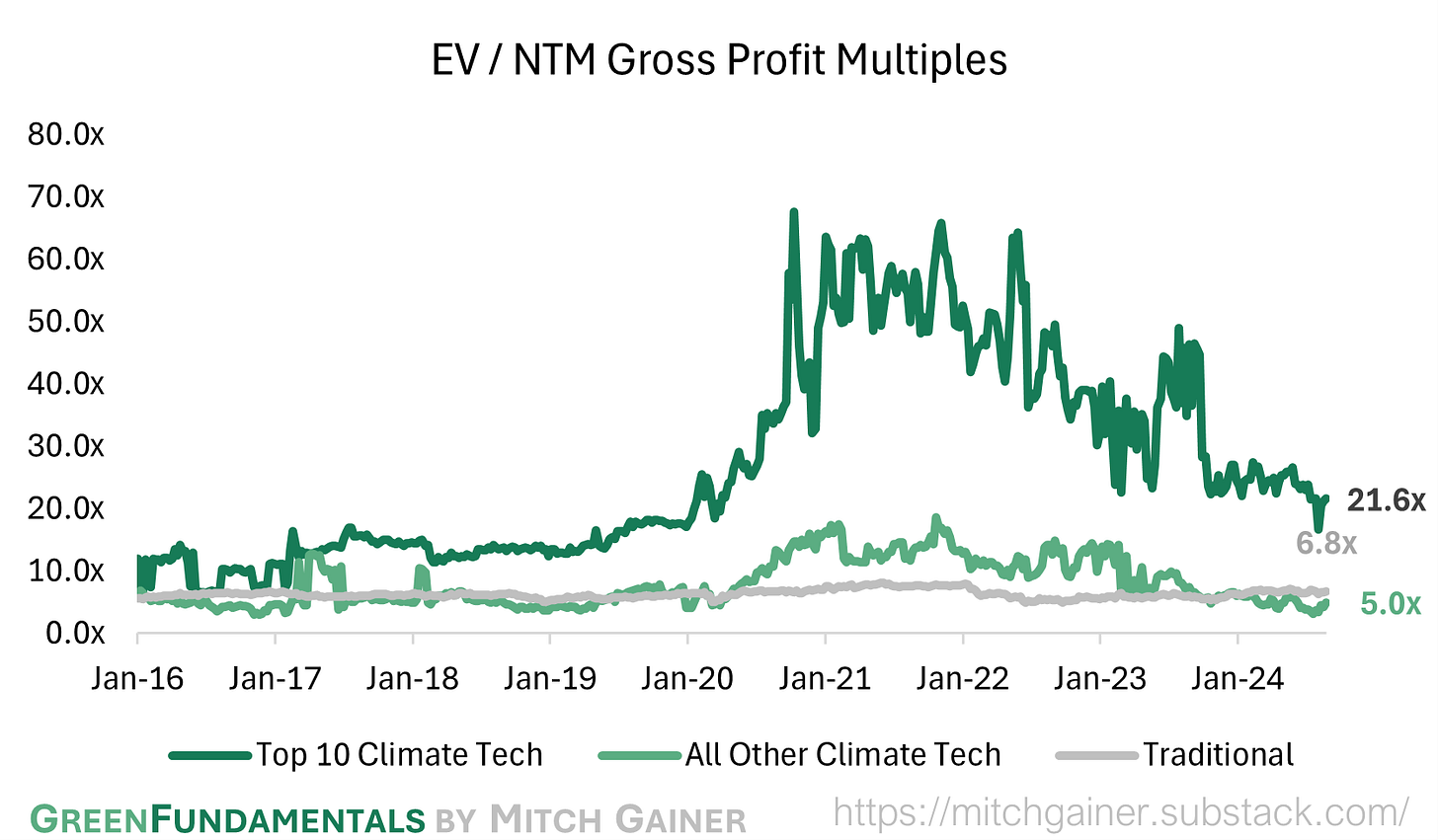

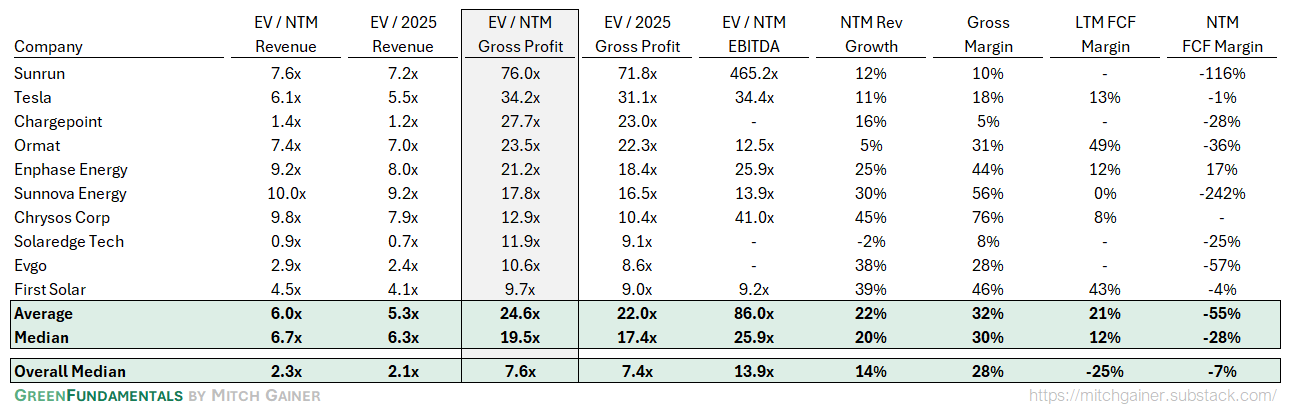

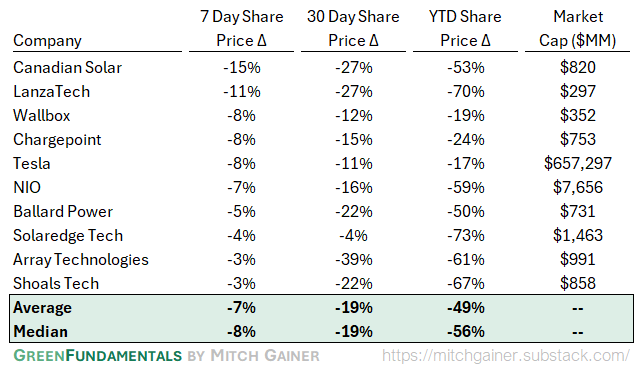

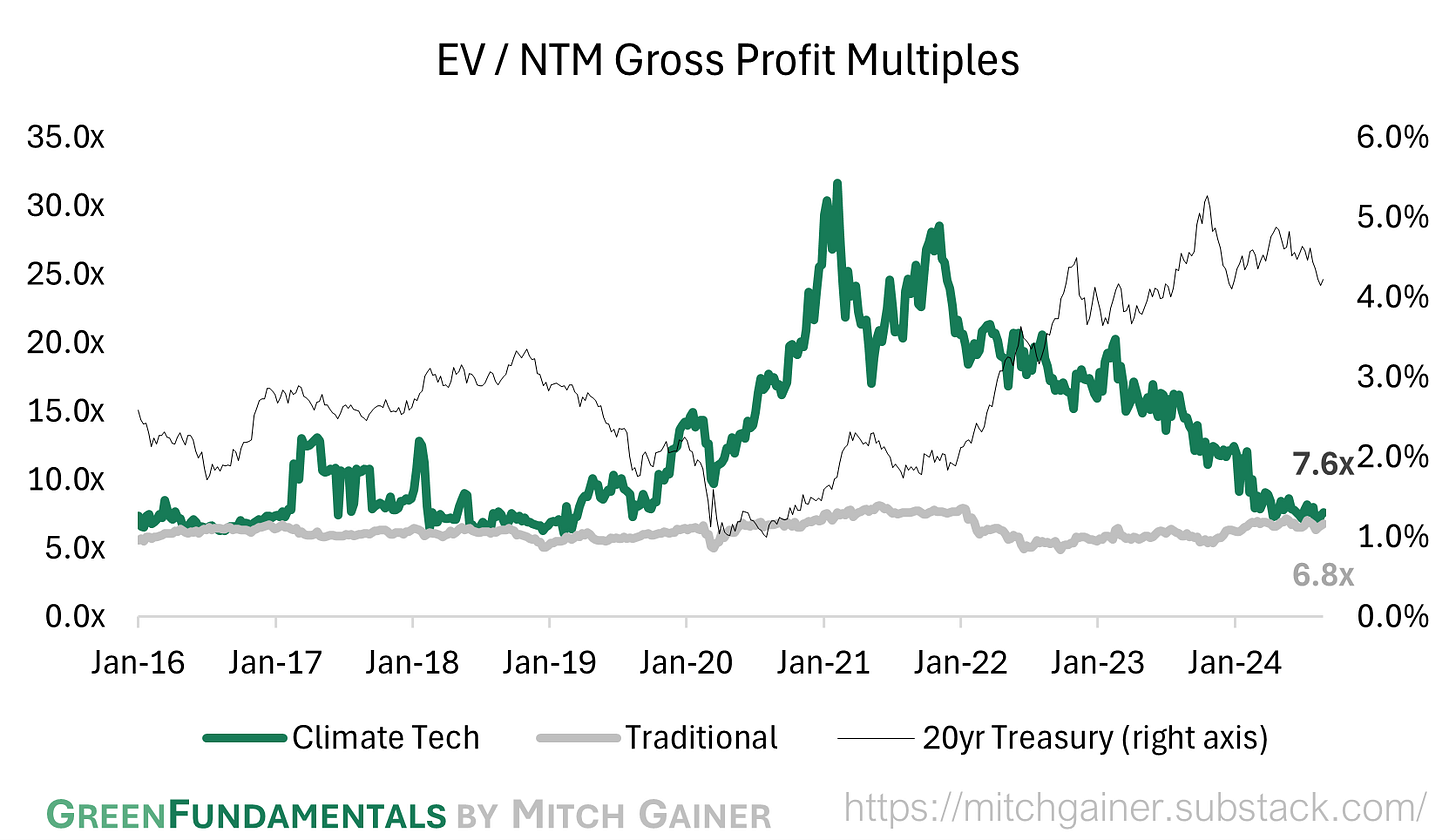

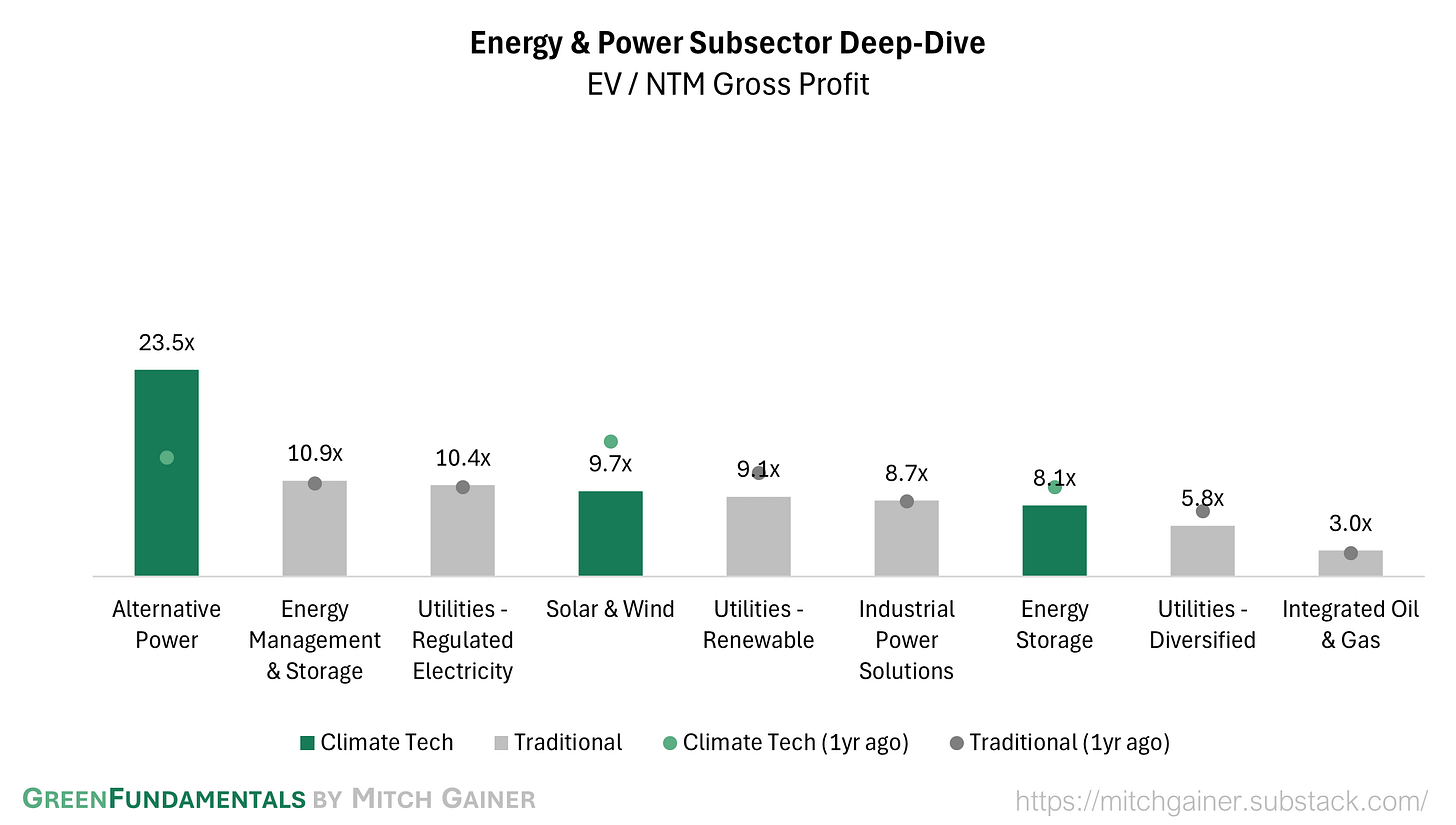

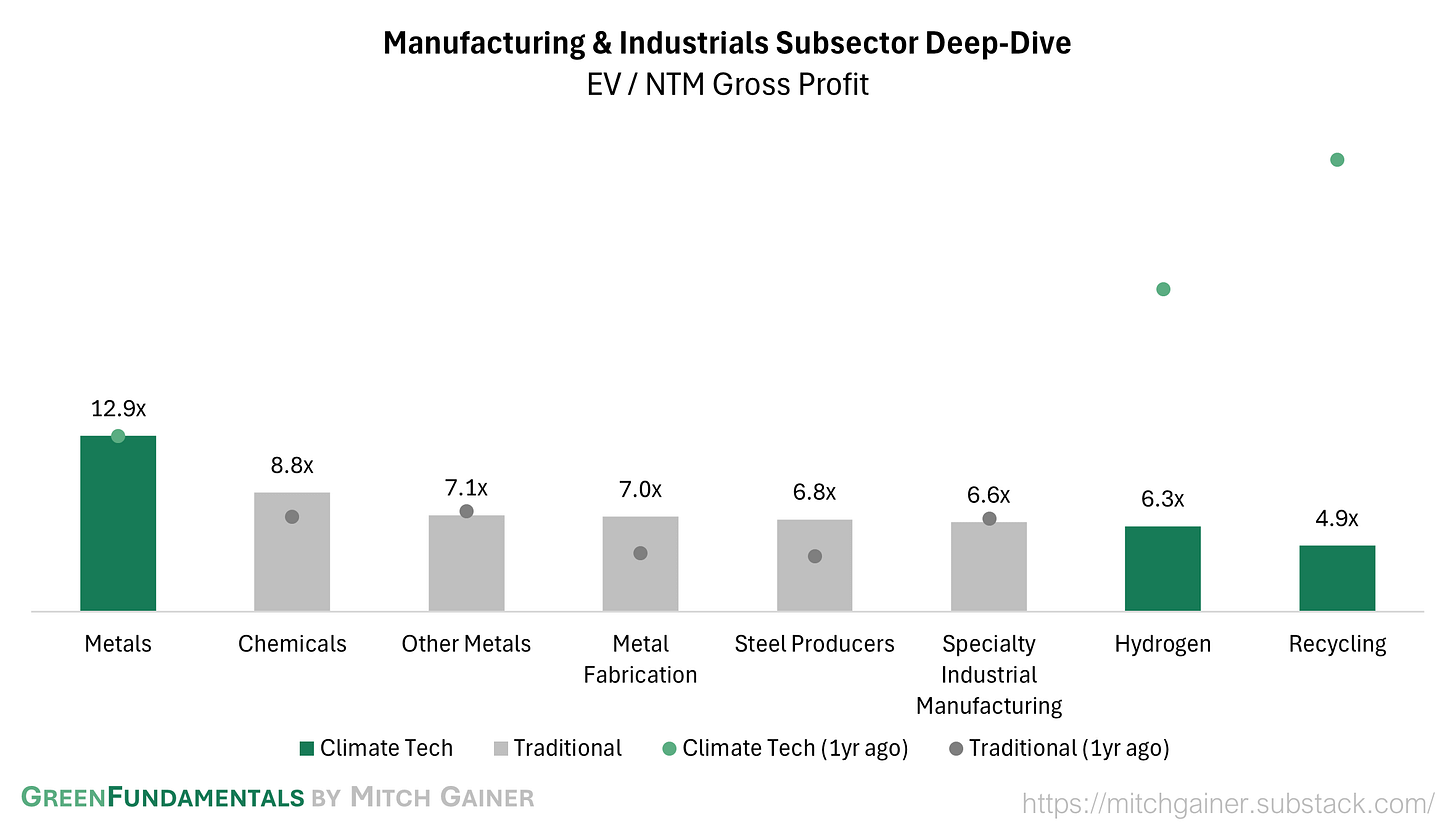

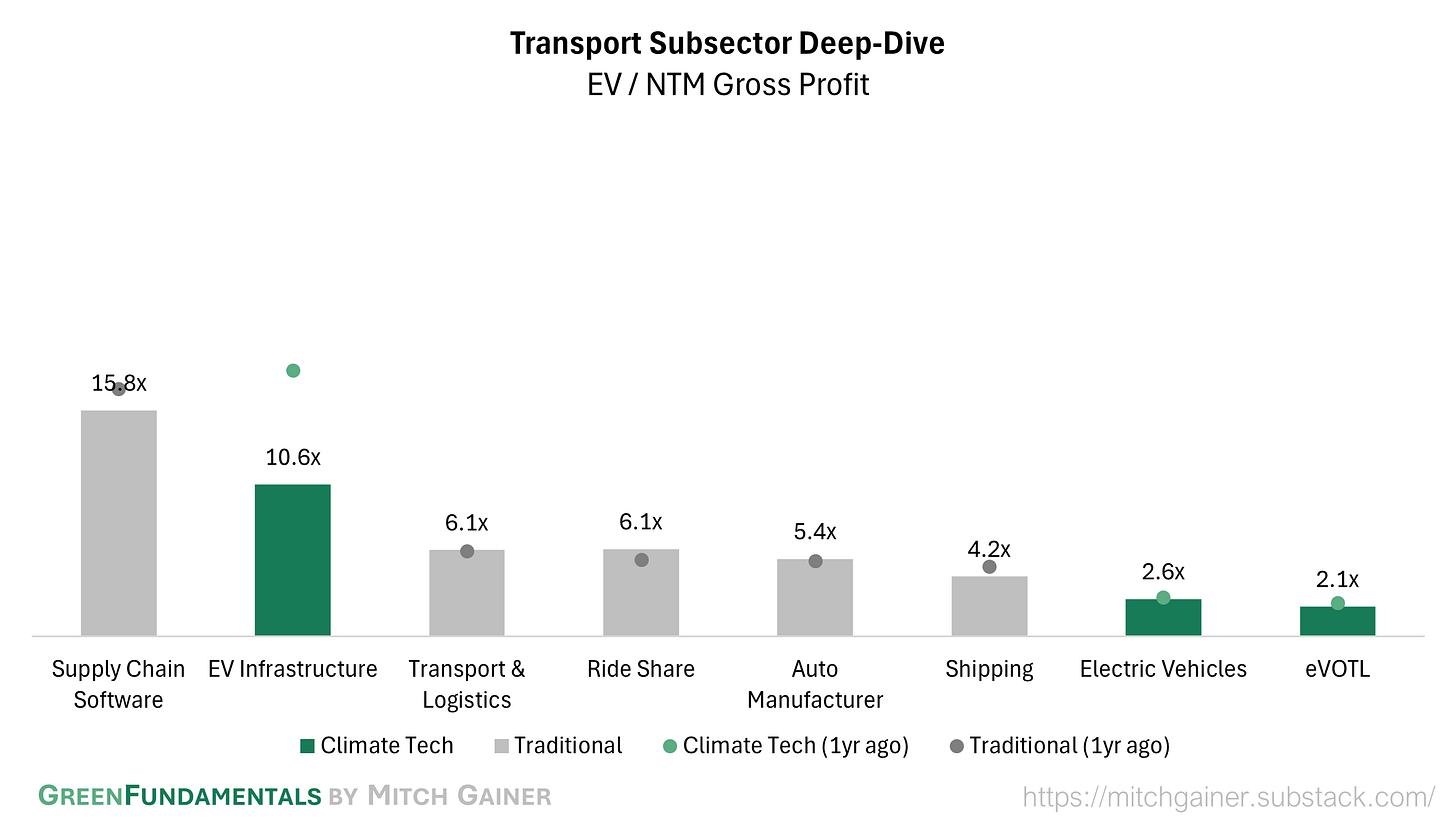

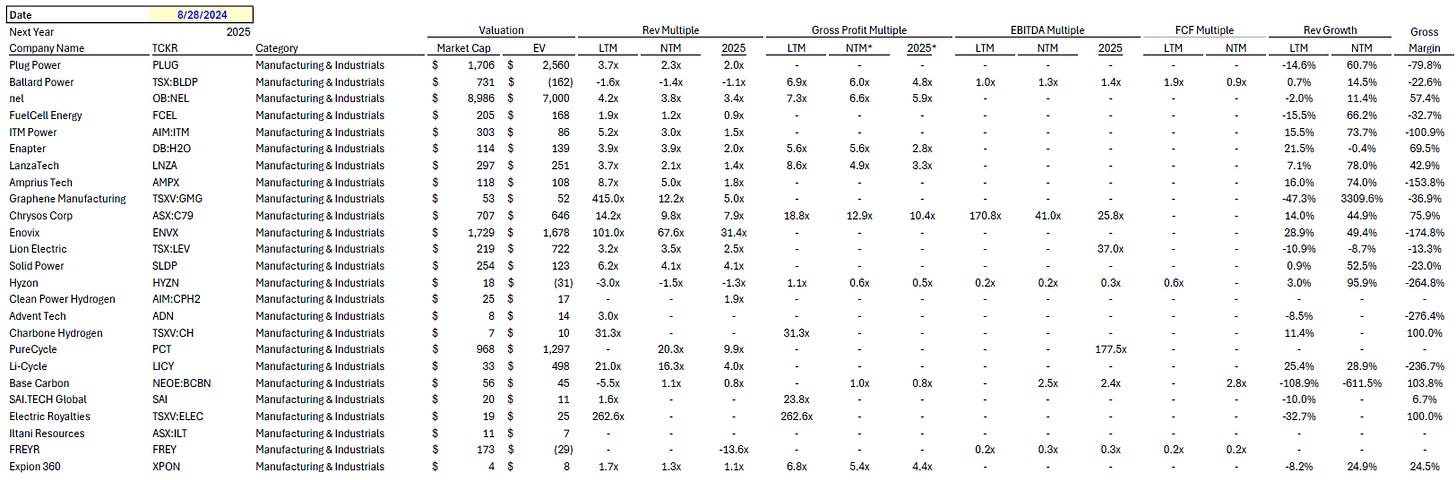

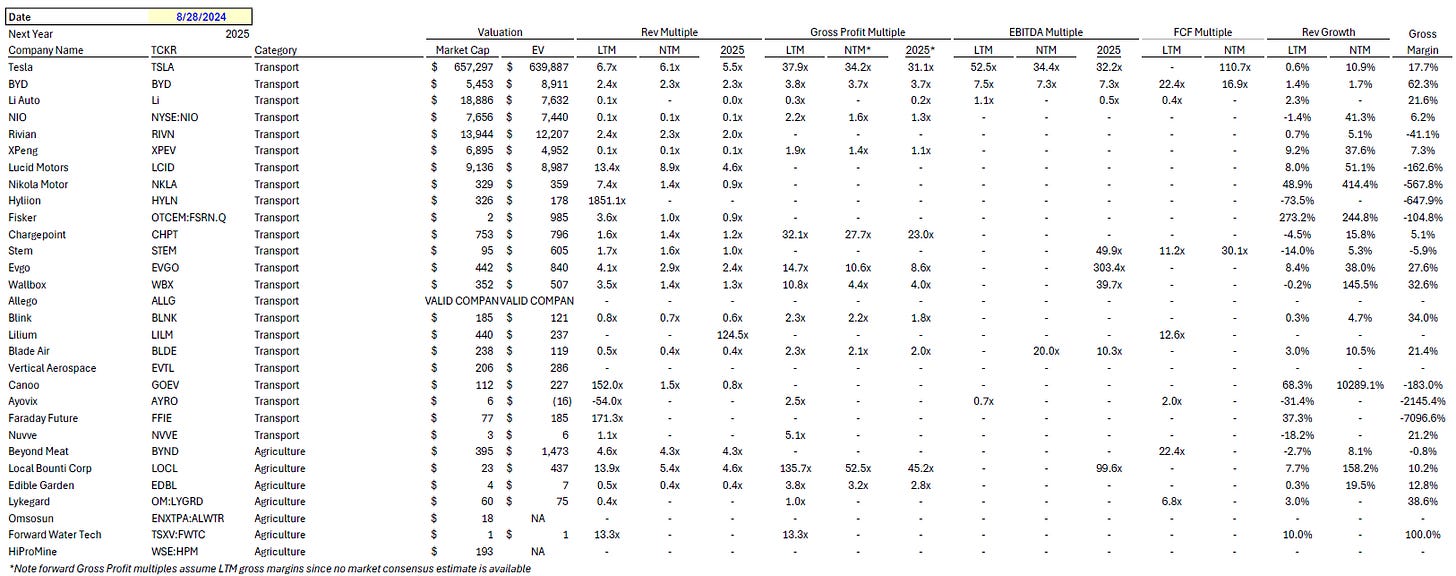

This newsletter’s market multiple analysis has been tracking this as it unfolds. We track forecasted NTM multiples based on Gross Profit (to account for significantly varying business models in Climate Tech). Not only have Climate Tech public multiples converges to their traditional industry counterparts as interest rates increased - but ten companies account for nearly all of the small premium that remains. Exclude the ten highest multiple companies and the ‘premium’ for emerging Climate Technology businesses goes away compared to the traditional industry counterparts.

Source: CapitalIQ

Take-Away: The market is currently pricing in a 50-75 bps reduction in interest rates by Q4 2024, but the outcomes remain uncertain. Let’s explore the potential scenarios:

Soft Landing: If the Fed successfully engineers a soft landing, with inflation gradually subsiding, here’s what we might see:

Venture Capital: NTM revenue multiples could modestly expand as the cost of capital decreases, but private multiples may lag public multiples. This would likely reignite interest in growth-stage investments, which have been on pause as public markets have cooled. Investment will flow to the best companies, at a premium valuation, as companies without a path fall to ‘zombie’ status. Capital flows could rebound by 20-30% over the next year or two.

Private Equity: Cheaper debt could drive debt-to-EBITDA multiples back to 6x or higher. However, LPs are likely to demand more from their investments, scrutinizing ESG mandates and seeking platform plays that consolidate fragmented markets (e.g., EV infrastructure).

Infrastructure and Project Equity: Unlevered project yields might compress slightly to 6-7%, as lower rates make long-duration assets more attractive. However, the price premium for the riskiest assets will likely remain. The full return of cheap debt financing is unlikely until inflation is decisively beaten. Expect a resurgence in greenfield projects, albeit with stricter return hurdles.

Hard Landing: If the economy tips into recession with sticky inflation, the dynamics will look quite different:

Venture Capital: NTM revenue multiples might remain stuck in the 10-12x range, or even decline further if growth capital becomes more scarce. VCs will likely prioritize follow-on investments in their strongest portfolio companies, with new deals becoming increasingly selective. Even great companies may find it difficult to raise, providing an opportunity for shrewd investors that do deep diligence.

Private Equity: A continued focus on defensive sectors within climate tech, such as energy efficiency or sustainable food, is likely. Deal volumes might contract further as firms become even more cautious in deploying capital. Tight debt terms and wide spreads could push required equity IRRs into the high teens, reflecting the elevated risk environment.

Infrastructure and Project Equity: In a hard landing scenario, unlevered project yields could rise to 8-9%, particularly for projects with high commodity price or regulatory risks. The project finance market could seize up, slowing down new builds significantly, as investors demand higher premiums for long-duration risk.

What Comes Next: Given these potential outcomes, it’s clear that investors need to be both proactive and reactive. Here’s how to think about positioning:

For Venture Capitalists: Maintain dry powder and focus on companies with strong unit economics and clear paths to profitability. Consider co-investment opportunities where risk can be shared, and returns are asymmetric.

For Private Equity Investors: Emphasize operational improvements in portfolio companies to mitigate the impact of higher debt costs. Look for opportunities to buy at distressed valuations, but be wary of overleveraging in a volatile rate environment.

For Public Equity Investors: Many companies in the first crop of Climate Tech investments are now facing distress. Recent bankruptcies and take-privates show an opportunity for acquirers who can identify the deep value stranded in these assets. Hedge funds can take advantage of the spread between emerging winners and nearly bankrupt competitors even within the same sector.

For Infrastructure and Project Equity Investors: Prioritize projects with secure, long-term offtake agreements, and consider increasing exposure to brownfield assets with immediate cash flows. Stay cautious on greenfield developments until there’s more clarity on the rate path.

As we transition into this next phase of the interest rate cycle, the most astute investors will be those who can navigate the intricacies of a shifting macro environment. Climate tech continues to offer compelling long-term opportunities, but capturing them will require precision, discipline, and a deep understanding of how macro forces interact with sector dynamics.

Now is not the time to be complacent—now is the time to be strategic.

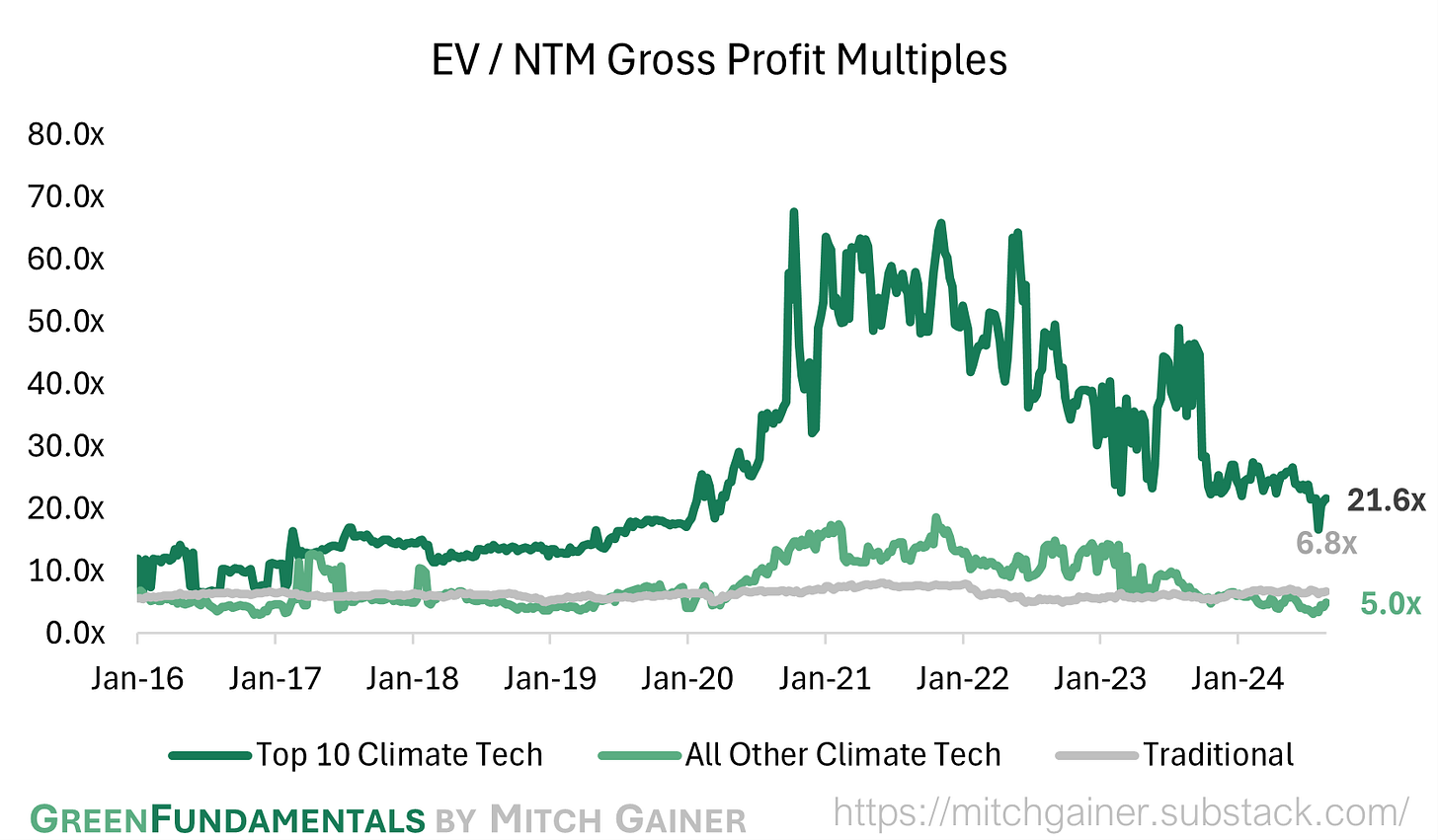

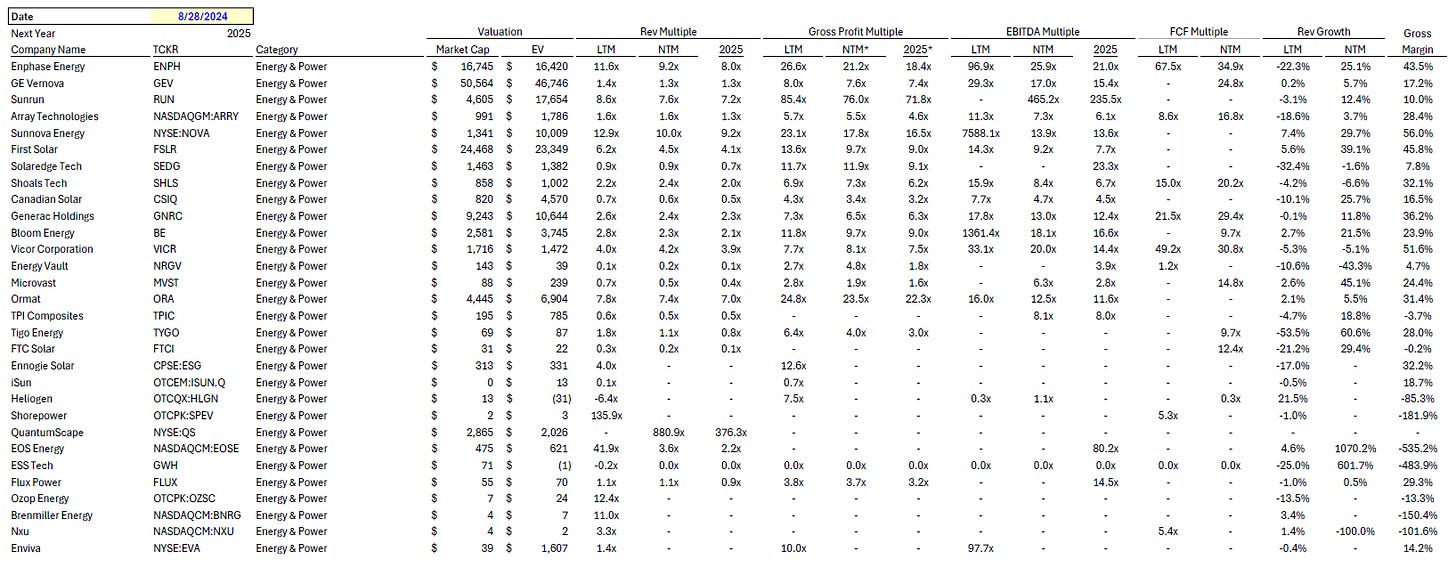

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

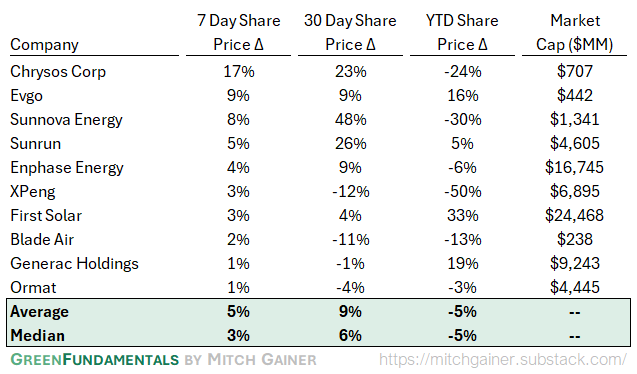

Top 10 and Bottom 10 Weekly Share Price Movement

Valuation Multiples over Time

Deep-Dive by Subsector

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.