Green Fundamentals: Sempra's Masterstroke or Miscalculation

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Sempra’s Growth Story Faces Delays as LNG Timelines Slip and California Regulators Tighten the Screws

The market just gave Sempra Energy (NYSE: SRE) a brutal reality check. After posting disappointing Q4 earnings, the stock plunged nearly 19%, wiping billions off its market cap. The selloff wasn’t just about missing consensus estimates—it was about a credibility gap between Sempra’s long-term growth narrative and the execution risks that investors can no longer ignore.

The company’s five-year capital plan jumped to $56 billion, a 16% increase, but returns on that capital remain uncertain. Management insists this spending spree—especially in Texas and LNG infrastructure—will fuel EPS growth of 9%+ through 2029, but the near-term guidance cut suggests that growth is backloaded. Investors who bought into Sempra’s “decisive decade” of expansion just saw the first cracks appear.

LNG Ambitions vs. Infrastructure Headwinds

Sempra is positioning itself as the backbone of the global LNG trade, with massive projects like Port Arthur LNG (Phase 1 operational in 2028) and ECA LNG (2026). In theory, these assets should deliver highly contracted, stable cash flows for decades. But in practice? Timelines are slipping, construction costs are ballooning, and regulatory hurdles in California could further complicate returns.

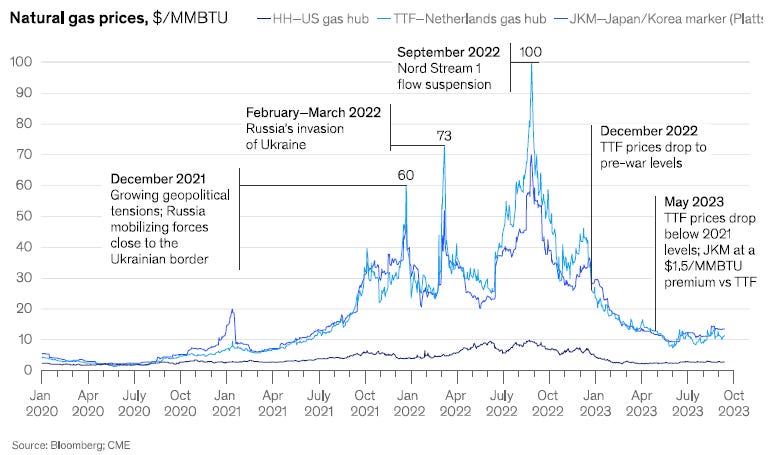

Adding to the uncertainty, the global LNG market is shifting. McKinsey’s 2023 energy outlook projects LNG demand will peak in the 2030s, with pricing pressure intensifying as Qatar, the U.S., and Australia flood the market with supply. The takeaway for investors? Sempra’s LNG cash cow may not be as reliable as management hopes.

Source: McKinsey & Company

California: A Regulatory Quagmire

If Texas is Sempra’s engine of growth, California is its Achilles’ heel. The state’s latest general rate case (GRC) decision came in weaker than expected, leading to downward revisions in earnings forecasts. Worse, the Federal Energy Regulatory Commission (FERC) just scrapped a key incentive for California utilities, dealing yet another blow to Sempra’s regulated returns.

Meanwhile, the wildfire liability crisis looms large. California’s $21 billion wildfire fund was supposed to stabilize investor-owned utilities, but there’s no plan yet to replenish it. Without a backstop, Sempra’s exposure to catastrophic wildfire risk could increase, putting pressure on the stock’s multiple.

Oncor: The Texas Growth Story Comes at a Cost

Sempra’s $36 billion investment in Oncor (Texas’ largest transmission and distribution company) is a big bet on electrification. Load growth in West Texas is surging, driven by data centers, industrial demand, and the Permian Basin’s grid expansion. On paper, this looks like a rock-solid growth story—until you dig into the details.

To finance this expansion, Sempra needs to push through rate increases. But filing for a base rate review earlier than expected in Texas means near-term earnings pressure in 2025. Investors who expected steady, compounding EPS growth will now have to wait until 2026 or beyond for those benefits to materialize.

Investor Takeaways: What to Watch

Earnings inflection won’t come before 2026. Sempra’s management is asking investors to wait as it builds out infrastructure. If you’re holding the stock, be prepared for near-term volatility.

Regulatory risks in California aren’t going away. If the wildfire fund isn’t replenished—or if regulators continue pressuring utility ROEs—Sempra’s earnings could take another hit.

LNG growth isn’t a free pass. Investors should watch for cost overruns and delays in Port Arthur and ECA LNG. A tightening global LNG market could mean lower returns than initially projected.

Texas is the real wildcard. Oncor’s growth is undeniable, but rate case outcomes and cost recovery mechanisms will determine whether it’s the tailwind Sempra is counting on.

Sempra’s infrastructure-heavy growth strategy could still deliver big returns—but patience is required. The company is doubling down on Texas transmission and LNG, betting that long-term demand will offset near-term execution risks. Investors, however, need to decide: Is this a multi-year buying opportunity or a classic case of overpromising and underdelivering?

See footnote for detailed valuation methodology and explanation.1

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.