Green Fundamentals: SunPower Shines No More

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

SunPower is on the cusp of failure after announcing an end to new customer acquisition

What Happened: On July 17, SunPower announced they would not be supporting new leases or power purchase agreements. This means are not acquiring new customers and possibly not supporting installations that have been delivered but not yet installed. SunPower is laying off 1,000+ employees (~26% of the workforce).

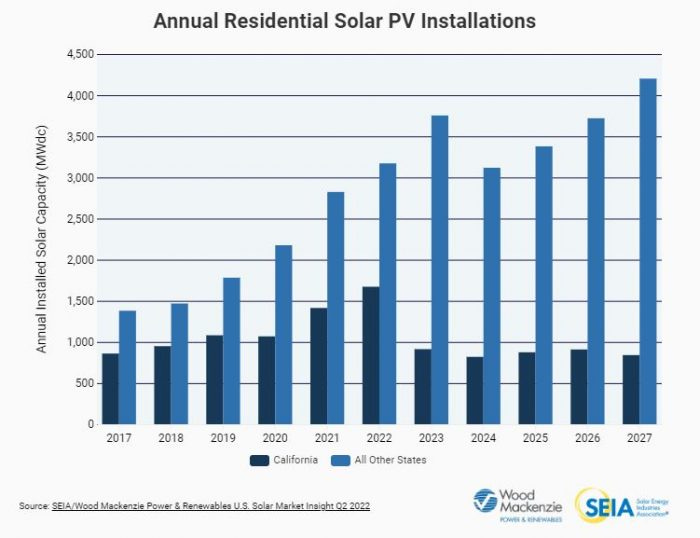

Background: California's net metering policy, “Net Energy Metering (NEM) 3.0”, has had caused a slow-down in the residential solar market. NEM 3.0, which took effect in April 2023, reduces the compensation rates for excess energy exported to the grid by homeowners with solar panels. This change is designed to incentivize energy storage solutions and shift energy consumption to align better with grid demands. However, it has also made solar investments less attractive by lengthening the payback period for new solar installations. Meanwhile, all other states have faced a slow-down (albeit smaller) due to rising interest rates.

Source: Wood Mackenzie

Since these changes in 2023, SunPower has faced turmoil.

December 18, 2023: SunPower announced it might not be able to continue as a going concern due to breaching a key term in a credit agreement.

February 1, 2024: SunPower stated it needed additional time to complete its quarterly financial statement; Nasdaq later informed SunPower it was out of compliance for not filing its forms in a timely fashion.

February 29, 2024: SunPower acknowledged that past financial reports “should no longer be relied upon” due to accounting errors.

June 27, 2024: Ernst and Young, SunPower's independent accounting firm, resigned.

July 3, 2024: SunPower reported the resignation of Ernst and Young, citing a disagreement between the two companies over an audit in later filings.

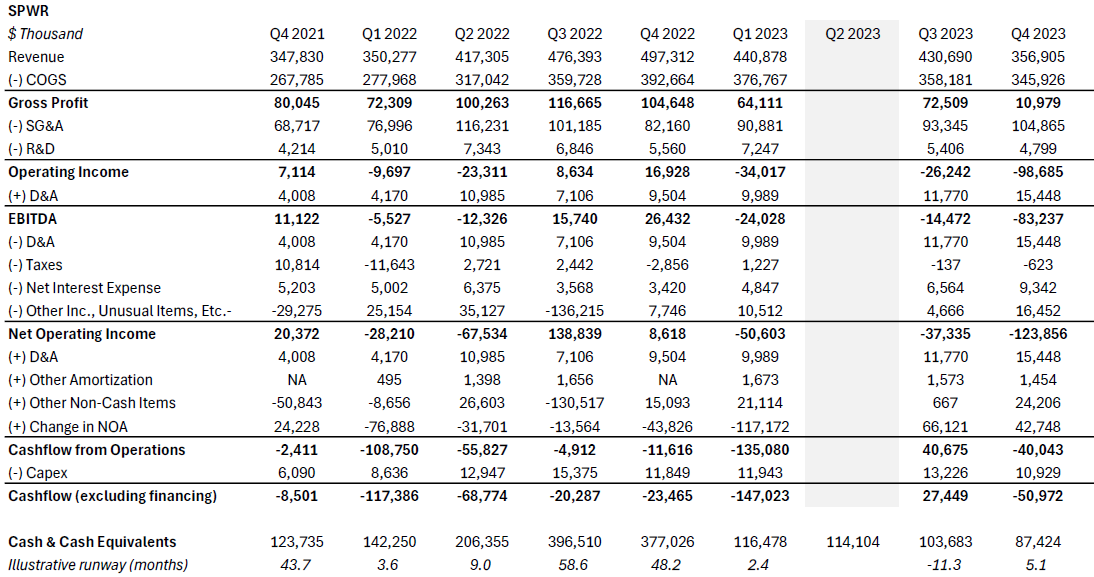

In Q4 2024, SunPower reported a significant increase in cash burn - suggesting as little as five months runway. Revenue declined 17% due to a slow down in customer demand from high interest rates and changes to California’s net metering policy. Further, SunPower faced significant cost over-runs due to higher-than-expected install costs. The sales slowdown was exacerbated by delays receiving low-income investment tax credit ‘adders’. Overall, gross margins declined from 17% to 3% QoQ.

Source: Public SEC Filings

Take-Away: SunPower’s recent announcement underscores the importance of financial resilience and operational flexibility. The volatility driven by high interest rates and shifting policies, such as California's new net metering rules, has amplified the risks in the market. Investments in companies with clear, straightforward business models and transparent revenue streams are crucial. Financial innovation can indeed unlock significant potential, but complexity and opacity in how a company makes money can increase the risk of being adversely affected by sudden market shifts. SunPower’s experience serves as a cautionary tale about the dangers of overreliance on optimistic growth projections without a robust financial foundation to weather market fluctuations.

What Comes Next: SunPower’s immediate focus will be on aggressive restructuring and cost-cutting to extend its cash runway. The company will need to secure new financing, likely through asset sales or partnerships, to stabilize its finances. Analysts expect a shift toward a low fixed-cost model, emphasizing its dealer network and installation partners. SunPower will continue to invest in its New Homes business and maintain service for existing customers. This restructuring aims to ensure future viability amid a slower market recovery and tighter financial controls.

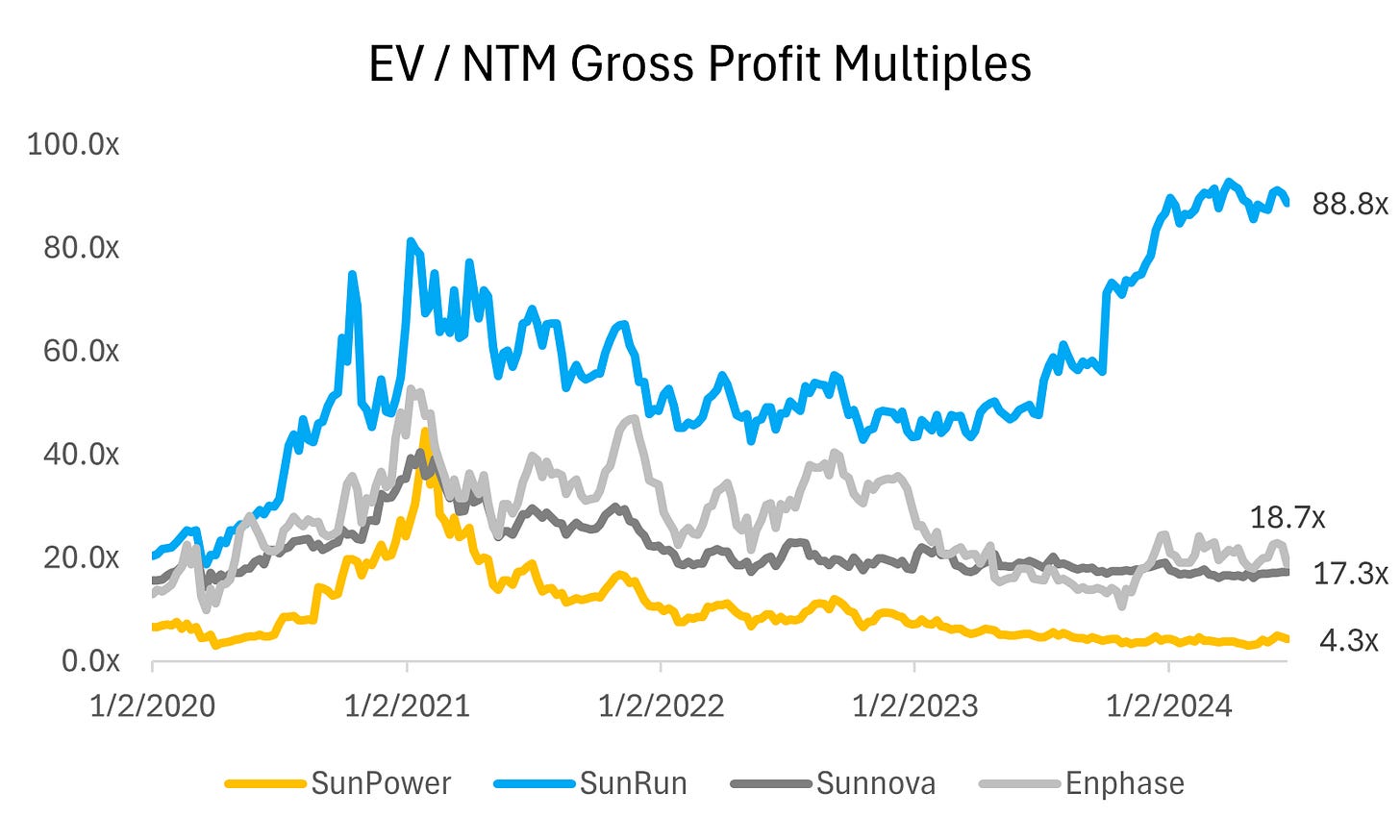

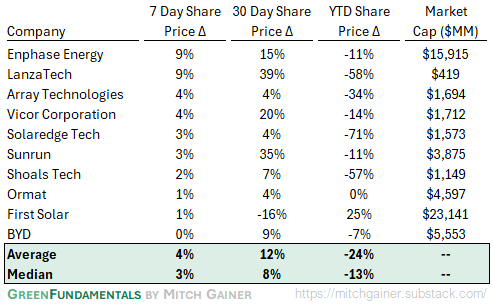

SunPower’s loss could be a competitor’s gain. Competitors in the residential solar market could seize the opportunity to attract SunPower's disaffected customers and leverage the situation to emphasize their stability and reliability. Companies like Tesla Solar and Sunrun may increase marketing efforts and offer incentives to capture a larger share of the residential solar market. The market seems to be optimistic about Sunrun’s growth potential in particular (see below).

For the renewables sector, SunPower's situation underscores the importance of robust financial management and the potential impacts of regulatory changes. Companies must remain agile and prepared to adapt to policy shifts and market fluctuations. The broader industry might also advocate for more stable and supportive regulatory environments to mitigate similar risks in the future.

Source: CapitalIQ

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Fusion: 'Tungsten wall' leads to nuclear fusion breakthrough (Quartz)

Climate Data: Google AI predicts long-term climate trends and weather — in minutes (Nature)

Carbon Capture: Scientists Make Breakthrough in Replicating the Enzyme That Captures Carbon (Technology Network)

Private Markets (PE / VC / Real Estate / Infra)

Battery Storage: Utility offtake agreement signed for gigawatt-hour scale BESS project in Arizona (Energy Storage)

Battery Storage: Clean energy company strikes $837M in deals to add capacity in Texas (Chron)

Data Centers: Blackstone has $70bn in prospective data center pipeline, on top of $55bn portfolio (Data Center Dynamics)

Nuclear: N.B. Power facing $71M bill for generator troubles at idle nuclear plant (CBC News)

Coal: Ramaco Resources Preparing To Build Plant To Transform Coal (Cowboy State Daily)

Funding: Venture capital has an exit problem (FT)

Public Markets (Stocks, Bonds)

Solar: First Solar opens Ohio R&D centre, sets new CdTe cell efficiency record (PV Tech)

EV Charging: Mercedes-Benz is putting its EV chargers at 100 Starbucks locations (Fast Company)

Electric Vehicles: Chinese electric vehicles are more of an opportunity than a threat (FT)

Electric Vehicles: Japanese carmakers ‘very scared’ by China’s rapid EV development (FT)

Government & Policy

Buildings: GSA and DOE select emerging technologies to accelerate the path to net-zero federal buildings (GSA)

Politics: The Populist Revolt Against Climate Policy (Foreign Affairs)

Ohio: Upcoming Ohio Supreme Court decisions could make it even harder to develop solar power in the state (Energy News)

Hydrogen: California first state to get federal funds for hydrogen energy hub to help replace fossil fuels (AP News)

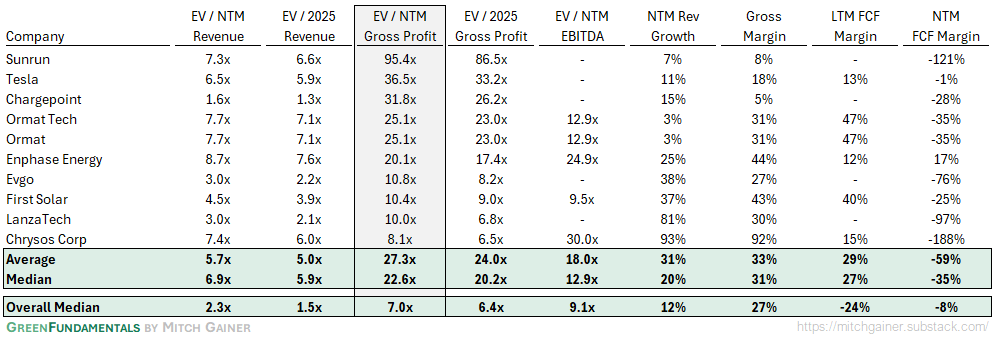

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

Top 10 and Bottom 10 Weekly Share Price Movement

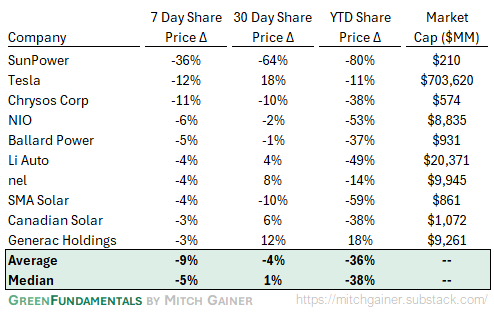

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

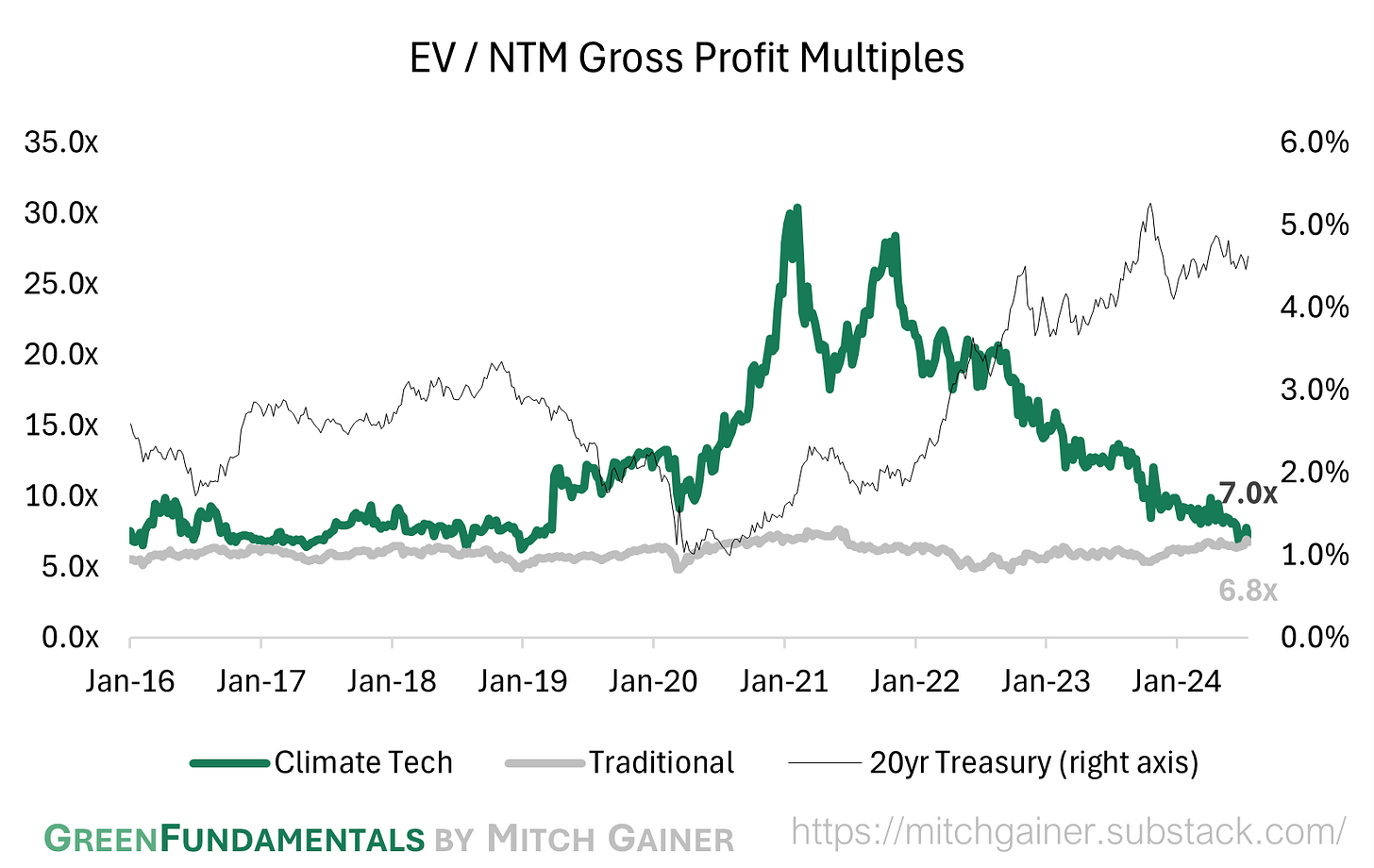

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium while energy management systems have increased in value; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

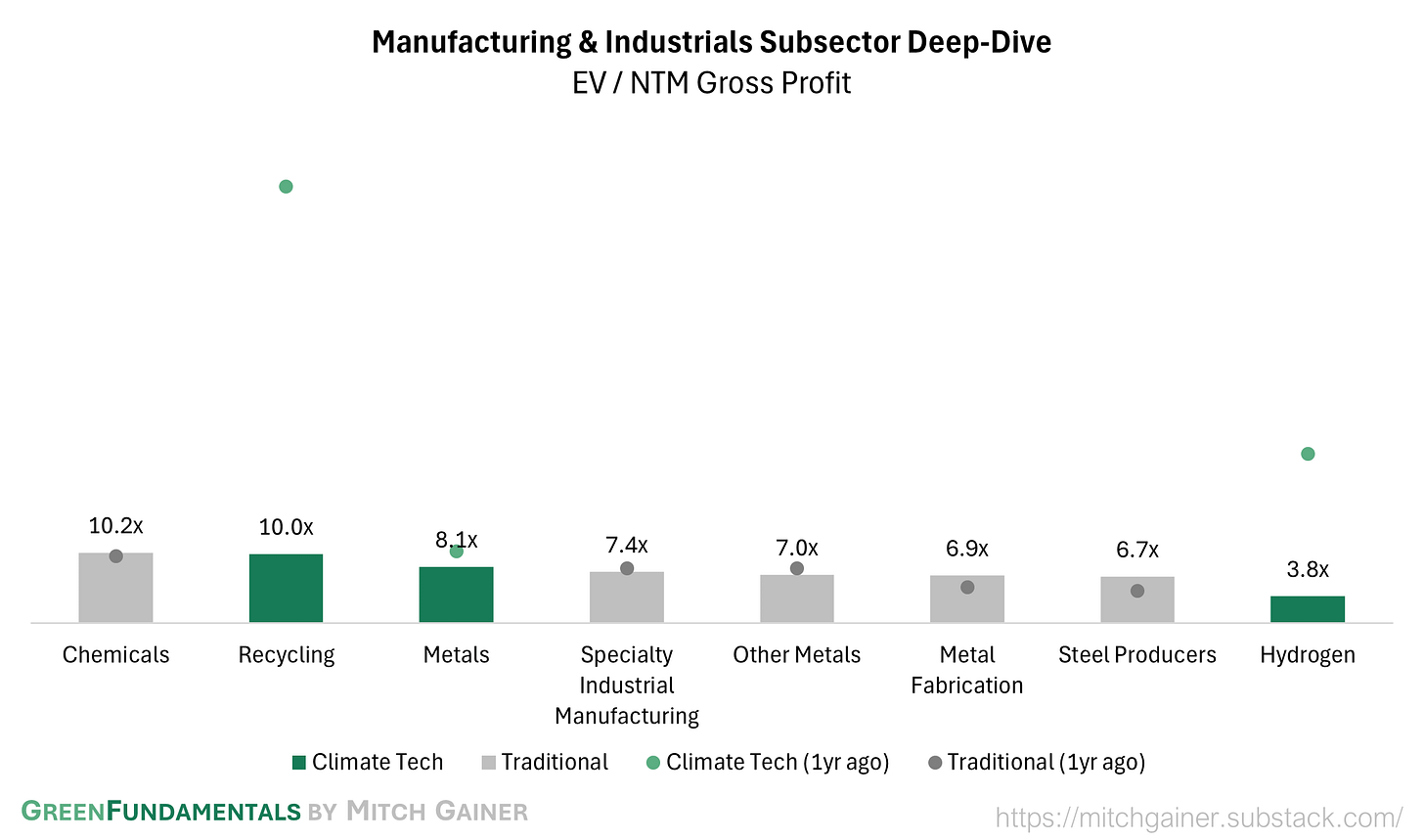

Manufacturing & Industrials: Hydrogen and recycling investments are commanding a premium again, though neither are trading nearly as high as they were a year ago.

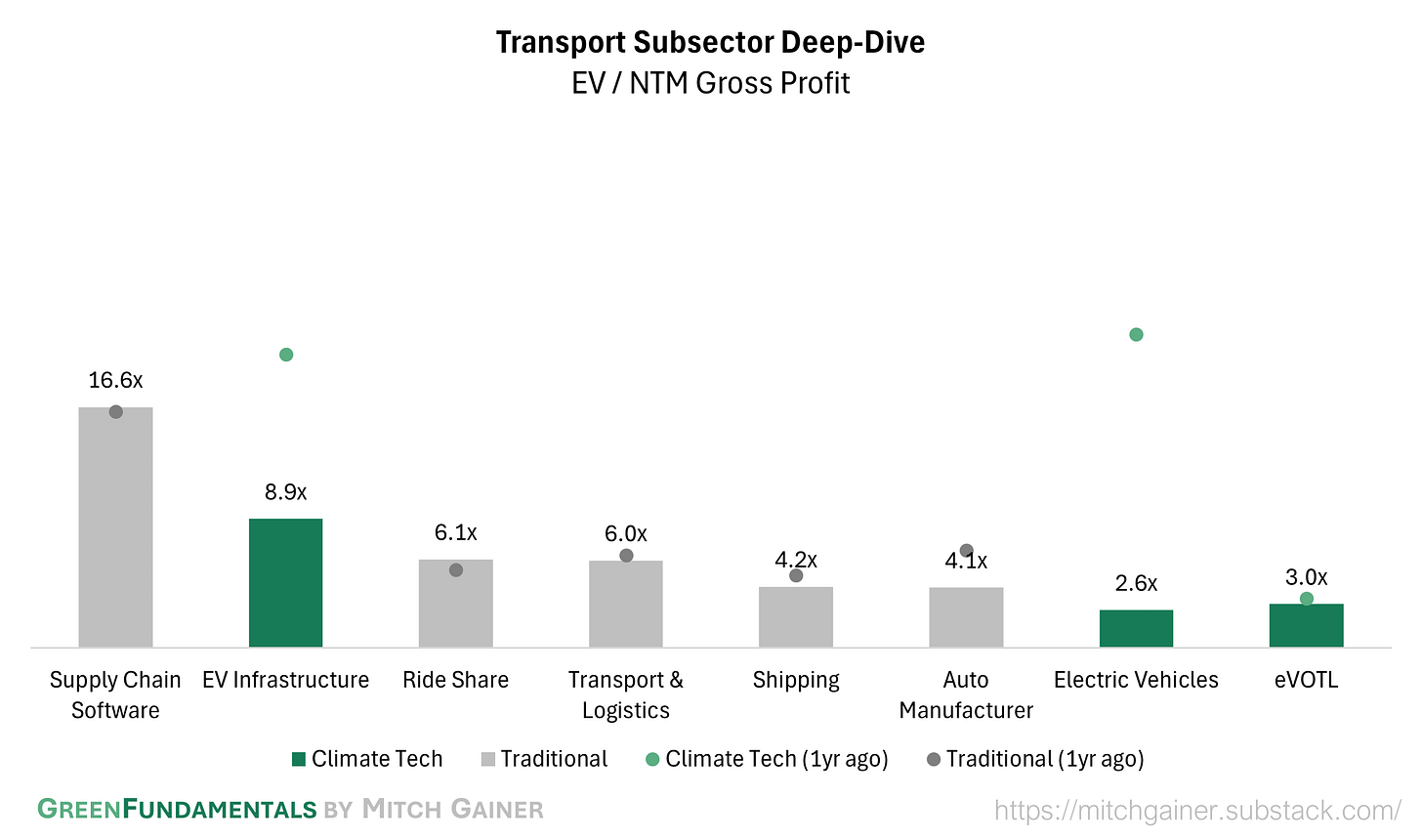

Transport: EV growth is priced in to climate tech and traditional companies - though they have declined over the past year; the market is skeptical on eVOTL.

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.