Green Fundamentals: The Bull Case for eSAF

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Investors look to a narrow take-off window for some eSAF projects, despite legitimate broader skepticism

What Happened: In the past month, Infinium and Twelve raised a total of $1.7B for Sustainable Aviation Fuel (SAF) production from Brookfield and TPG.

TPG Rise Climate led a $645 million funding round for Twelve, of which $400 million is project equity to develop additional SAF facilities including the first facility in Washington.

Brookfield Asset Management has committed up to $1.1 billion to Infinium, of which $200 million for Infinium’s Project Roadrunner in West Texas and $650M for additional project capital for global SAF projects.

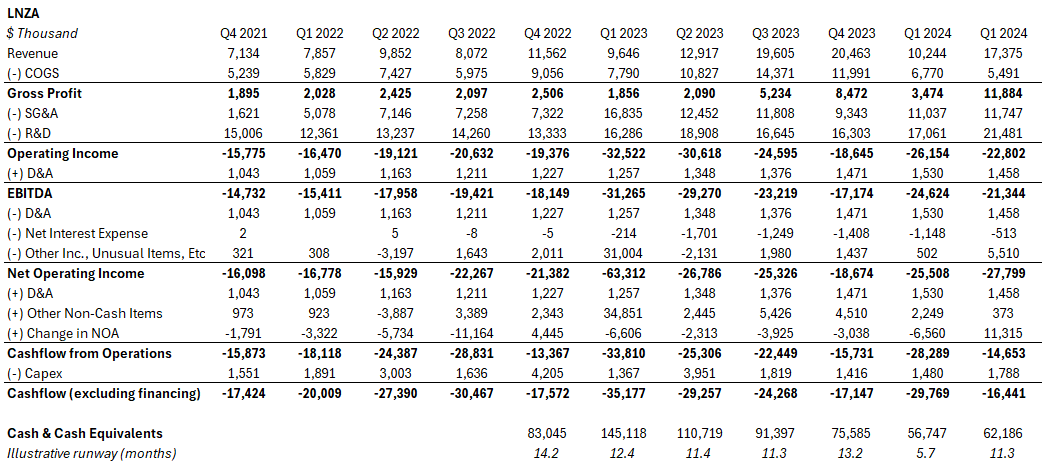

Yet the SAF industry continues to grapple with setbacks and challenges. Some companies are struggling to stay afloat, while others are failing to meet their production goals. Another Brookfield-backed company, LanzaJet, is grappling with supply chain disruptions and fluctuations in the availability of feedstocks. LanzaTech, which owns 36% of LanzaJet, has seen their market cap fell precipitously since their March 2022 SPAC at $1.8B, down today to under $400M, with under 12 months runway. For now, LanzaJet is buying time with outside investment (such as from MUFG’s latest investment).

Source: CapitalIQ

Background: eSAF is emerging as the leading drop-in solution for decarbonizing aviation. While aviation accounts for 2.5% of global CO2 emissions, its total climate impact is closer to 3.5% due to high-altitude emissions. Decarbonization is challenging because planes need high energy density fuels for long flights, and alternatives like batteries and hydrogen face significant weight and infrastructure hurdles for large aircraft.

eSAF is produced through power-to-liquid (PtL) technologies, where renewable electricity is used to generate green hydrogen via electrolysis, which is then combined with CO2 to produce synthetic aviation fuel. Key companies: Twelve, Infinium, Synhelion, HIF Global.

Legacy SAF solutions are primarily bio-based, produced from feedstocks such as used cooking oils, agricultural residues, and municipal waste. These fuels rely on biological materials and processes like hydroprocessing or fermentation to create sustainable aviation fuels and are supply constrained. Key companies: Neste, LanzaJet, Fulcrum Bioenergy.

Liquid hydrogen (LH2) is hydrogen stored at cryogenic temperatures (-253°C), making it compact enough to use as a fuel in modified aircraft engines. It offers zero CO2 emissions when burned, but requires significant modifications to aircraft and airport infrastructure due to its low energy density by volume and the need for specialized storage and handling systems. Key companies: ZeroAvia, Universal Hydrogen.

The skeptic’s strongest argument against SAF is the green premium. As of 2024, the price per gallon of bio-based SAF is often 3-5 times higher than Jet A. Jet A currently averages around $3 per gallon, while SAF ranges from $6 to $9 per gallon depending on the feedstock and production process. New entrants (like Twelve, Infinium, and others) argue they can reduce the green premium, but probably not eliminate it.

High feedstock costs are a significant contributor to this green premium. Green hydrogen, produced using renewable electricity via electrolysis, is significantly more expensive than conventional (fossil-fuel-based) hydrogen. As of 2024, green hydrogen costs between $4 to $6 per kilogram, far higher than the $1-$2 per kilogram for conventional hydrogen. Similarly, capturing CO2 from industrial processes or the atmosphere requires energy-intensive and costly technologies.

Airlines are low margin businesses, and even a 50% increase in fuel costs would bankrupt most airline businesses. Airlines operate on thin margins, with fuel typically making up 20-30% of their expenses. Airlines have limited ability to pass these costs to price-sensitive customers. Historically, fuel price volatility, such as during the 2008 oil crisis, pushed many airlines to the edge of bankruptcy. With slim operating margins and high debt, even small cost increases can severely impact profitability, straining both cash flow and liquidity.

The Bull Case for eSAF

Despite the 300% green premium, the aviation biofuels market is huge today. Existing aviation biofuels were a $100B market in 2022, forecasted to increase to over $300B by 2031. So there must be some demand curve even at higher price points.

Demand driven by regulation will grow. By 2030, the European Union will require airlines to blend at least 5% sustainable aviation fuel (SAF) into their fuel consumption, increasing to 63% by 2050 under the "ReFuelEU Aviation" initiative. Countries like France and Germany have also set their own mandates, intensifying the need to scale SAF production to meet these targets.

Demand driven by voluntary participation will grow. There have been over 20 million tons per year in voluntary airline commitments. By entering into SAF purchase agreements or offsetting programs, these companies can help airlines cover the higher costs of SAF production.

Airlines (with corporate partners) are willing to sign major offtake agreements. For instance, United Airlines has pledged to purchase 3 billion gallons of SAF by 2030, and Delta has signed multi-year agreements to secure 250 million gallons.

Blending expensive SAF into 5% of airline fuels by 2030 is a much smaller cost increase, palatable to airlines. Airlines can still primarily consume Jet A fuel while purchasing relatively small amounts of higher cost SAF. Corporate partners can partially offset costs, making the agreement easier for all parties.

Capturing just a 5% eSAF blend is enough for great project returns and incredible start-up exit opportunities. eSAF projects can contractually lock-in an attractive margin and return. Projects have long-term offtake agreements, long-term feedstock agreements (H2, CO2), and a healthy contracted margin based on the technology risk. SAF demand will far exceed supply by 2030, providing a long project runway to new SAF producers. Investors can deploy billions across several projects with outsized returns far before mass adoption takes place.

Source: McKinsey & Company

Take-Away: A good SAF investment does not require 100% SAF anytime soon. Long term, mass adoption will require an alternative at parity to Jet A, which is not yet on the horizon. But, many projects will be very profitable while airlines blend a novel eSAF solution with low cost Jet A (and offload the risk to corporate partners with a higher willingness to pay).

What Comes Next: Legacy SAF players that scaled before 2021 will continue to struggle due to reliance on less efficient, more expensive first-generation biofuels. Many are constrained by outdated infrastructure, making it harder to compete with newer entrants using advanced carbon capture and hydrogen-based technologies. As regulations tighten and newer players achieve economies of scale, legacy producers may face increasing challenges in meeting sustainability targets and reducing costs.

Investors should prioritize eSAF projects with contracted offtake agreements, stable feedstock prices, and sales in markets backed by strong regulatory support. Caution is still necessary in this evolving sector, with attention focused on key developments that could reshape the market:

Feedstock Innovations: Any breakthrough that significantly boosts the availability of sustainable, affordable feedstocks could dramatically shift the landscape, making SAF production more viable and scalable.

Cost Efficiency: Companies that streamline production or lower costs will hold a clear competitive edge, positioning themselves as market leaders in an increasingly crowded field.

Policy Shifts: Government actions, such as enhanced subsidies or stricter mandates, could accelerate SAF adoption, though the timing and extent of such support remain uncertain and vary by region.

While the SAF sector offers potential, it remains high-risk. Investors must be selective, focusing on companies with strong technological capabilities, solid partnerships, and a clear strategy for overcoming the industry's significant hurdles. For now, SAF is a long-term, high-stakes investment, suitable for those prepared for the challenges ahead.

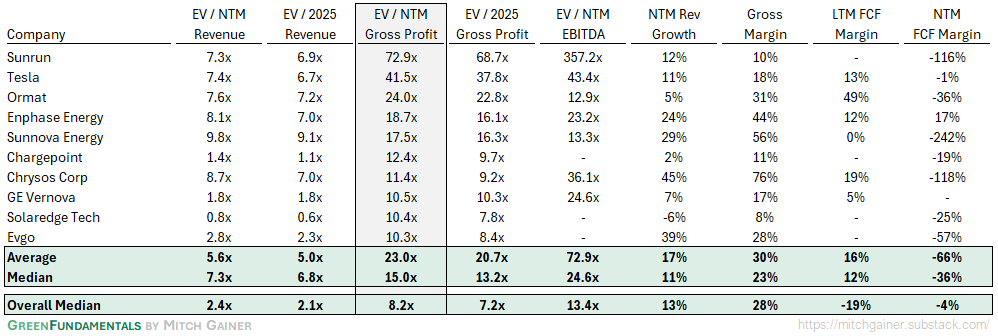

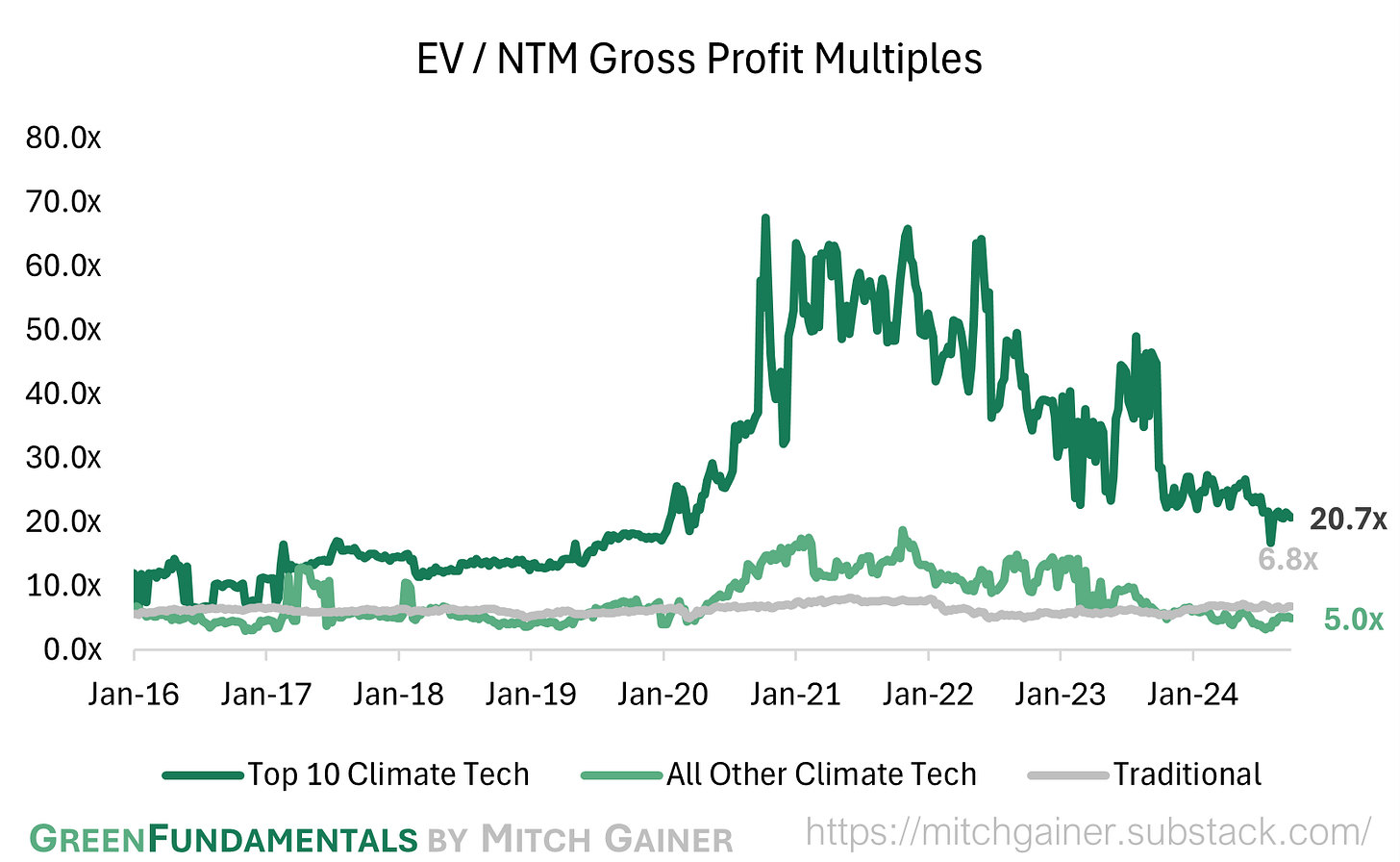

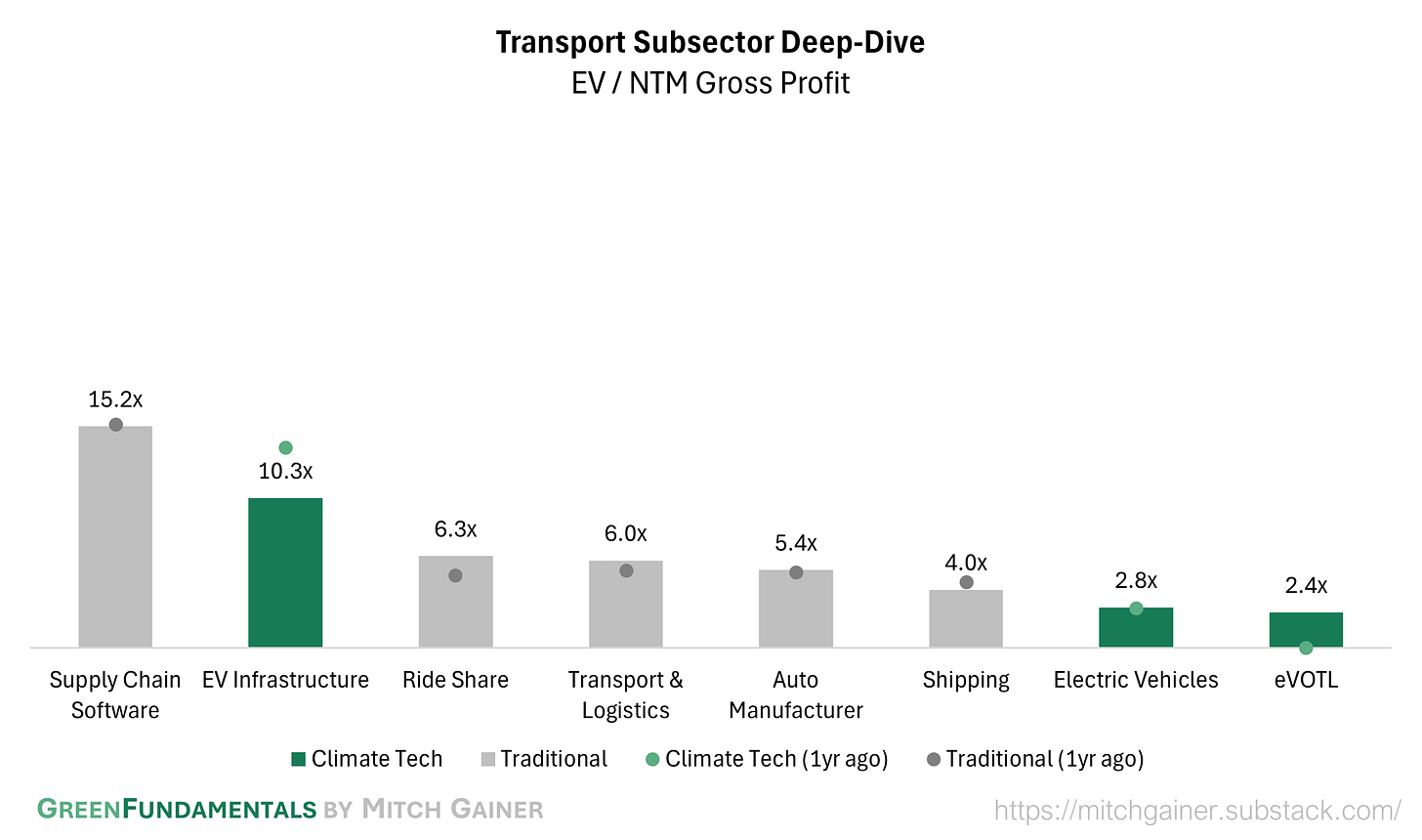

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

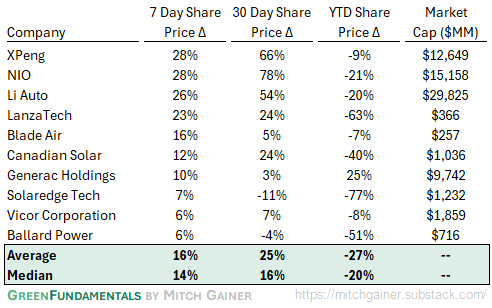

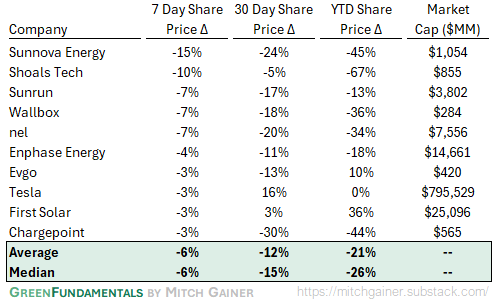

Top 10 and Bottom 10 Weekly Share Price Movement

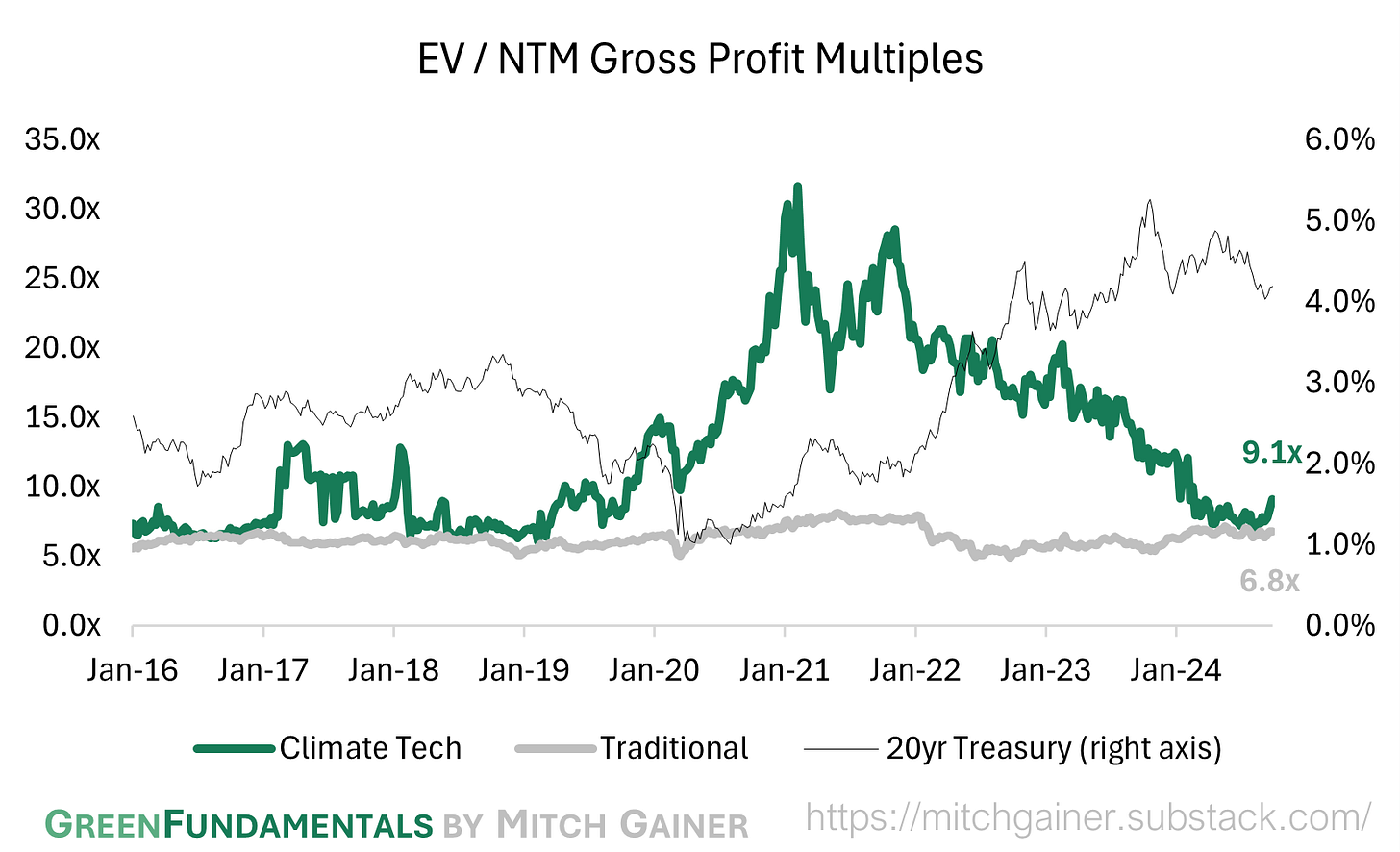

Valuation Multiples over Time

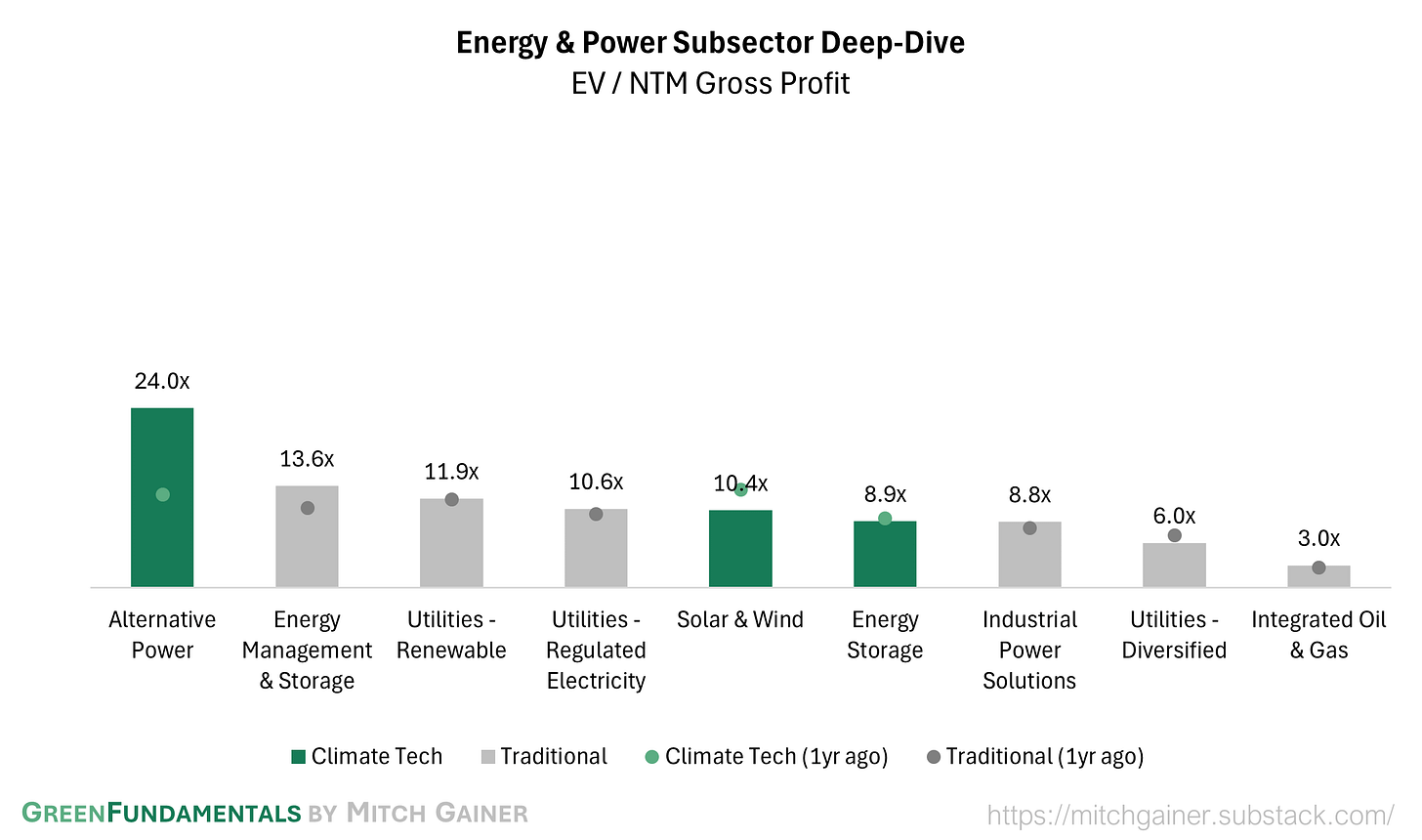

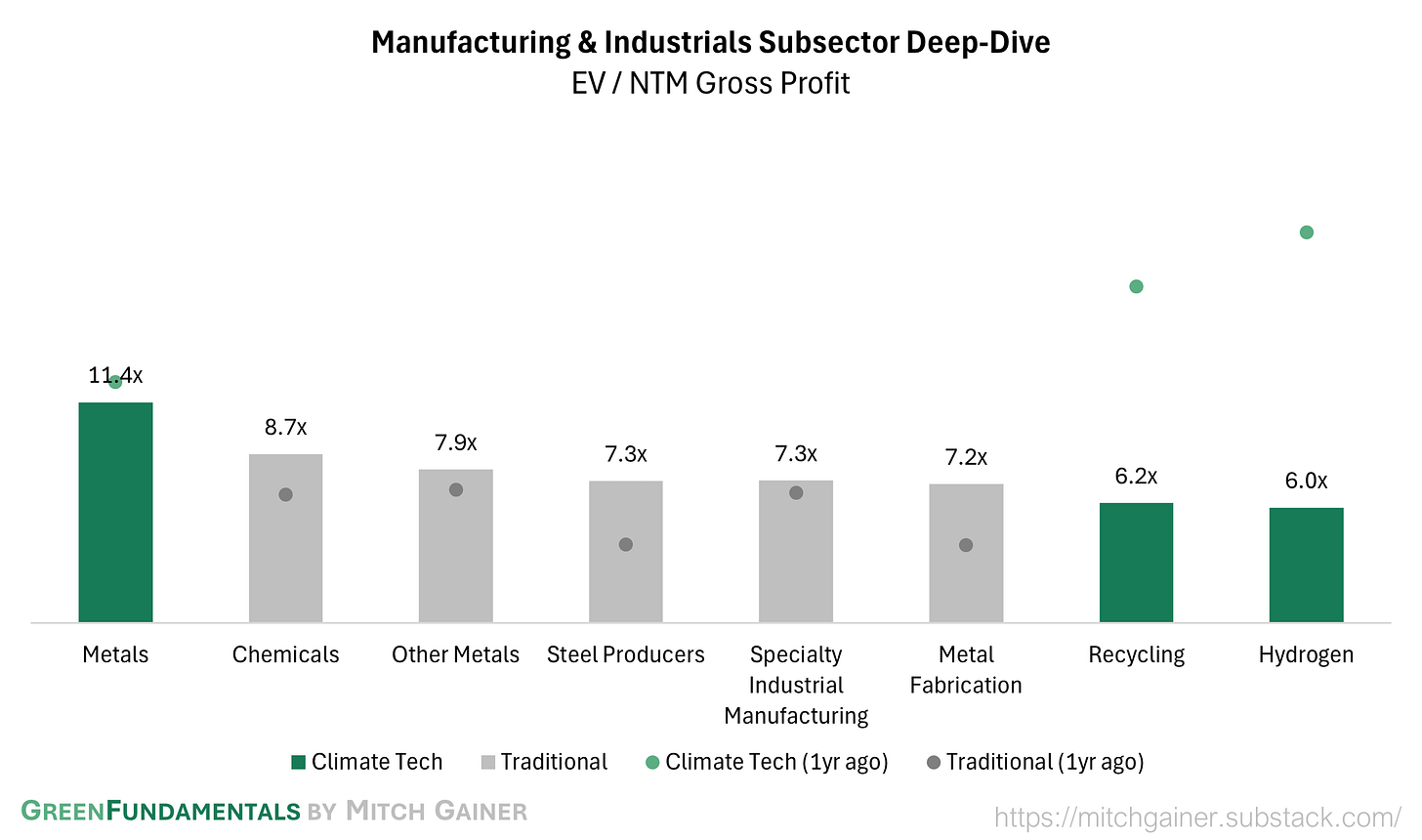

Deep-Dive by Subsector

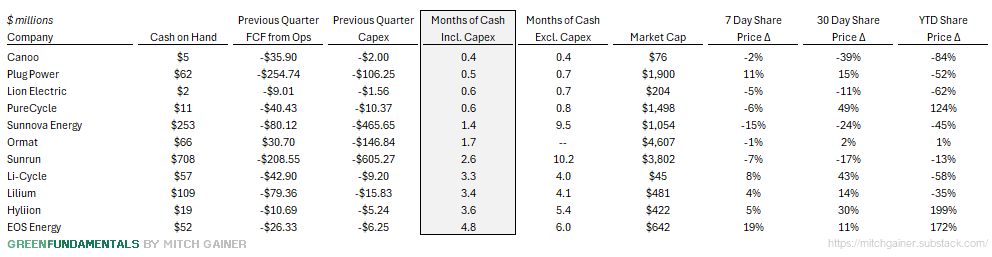

Months of Cash

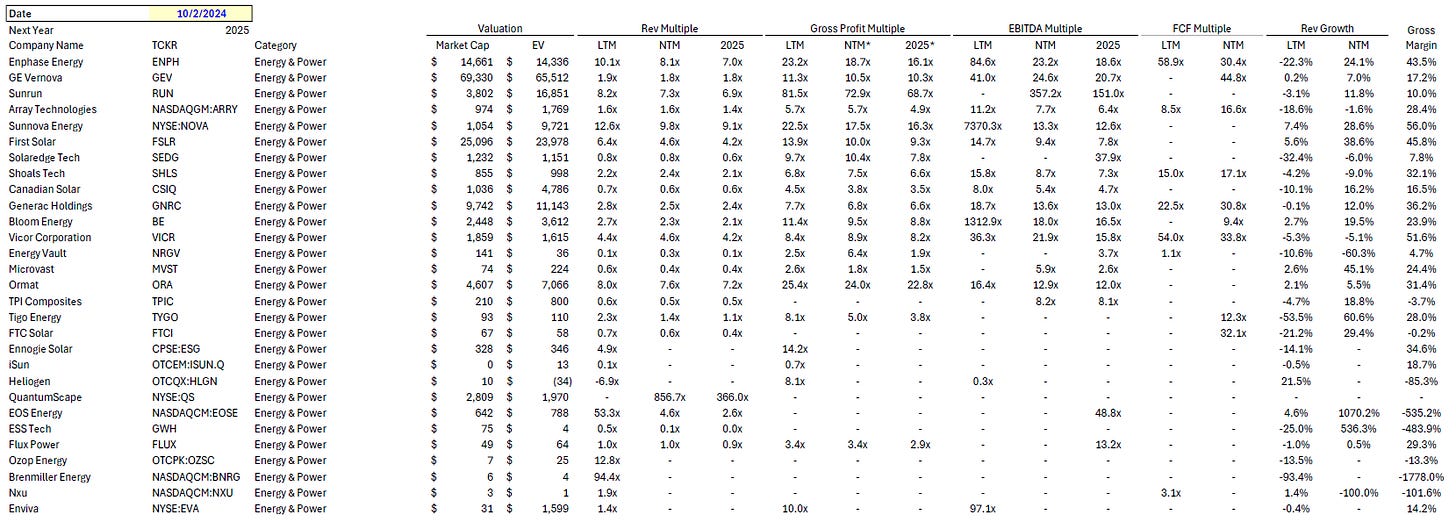

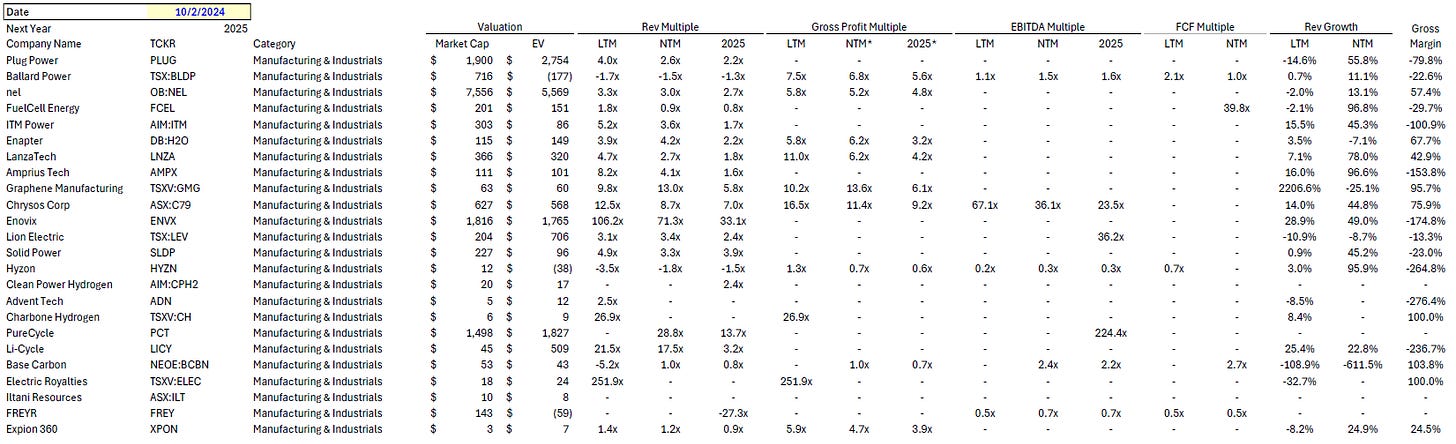

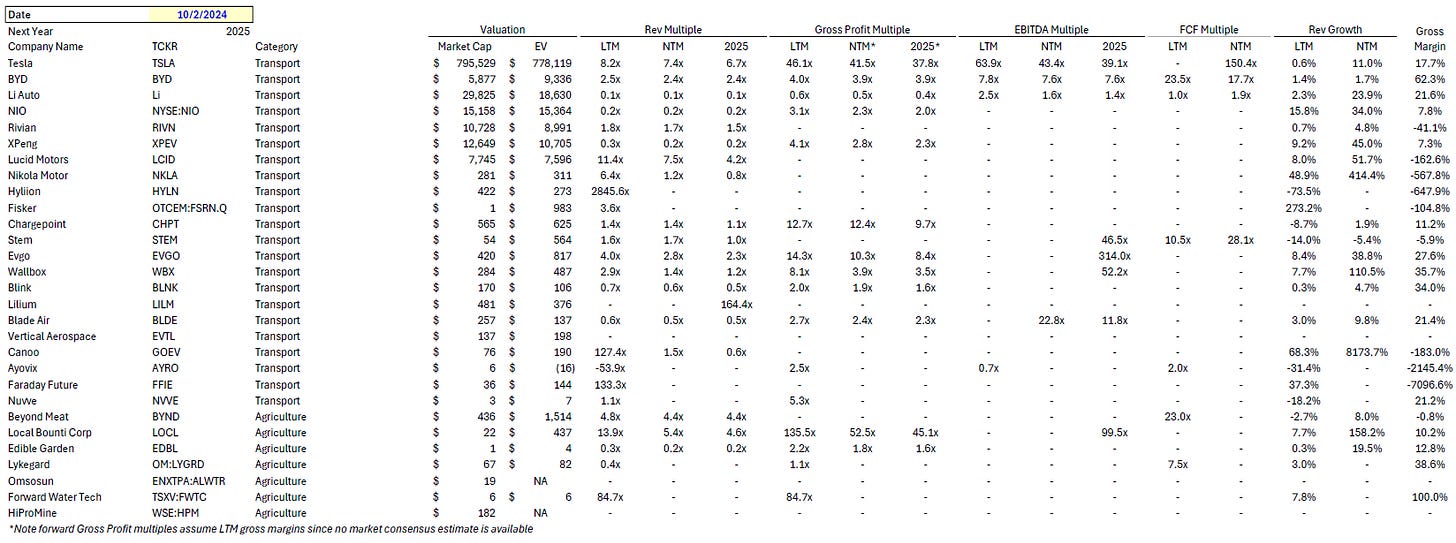

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.