Green Fundamentals: The Power of Deregulated Energy Markets

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

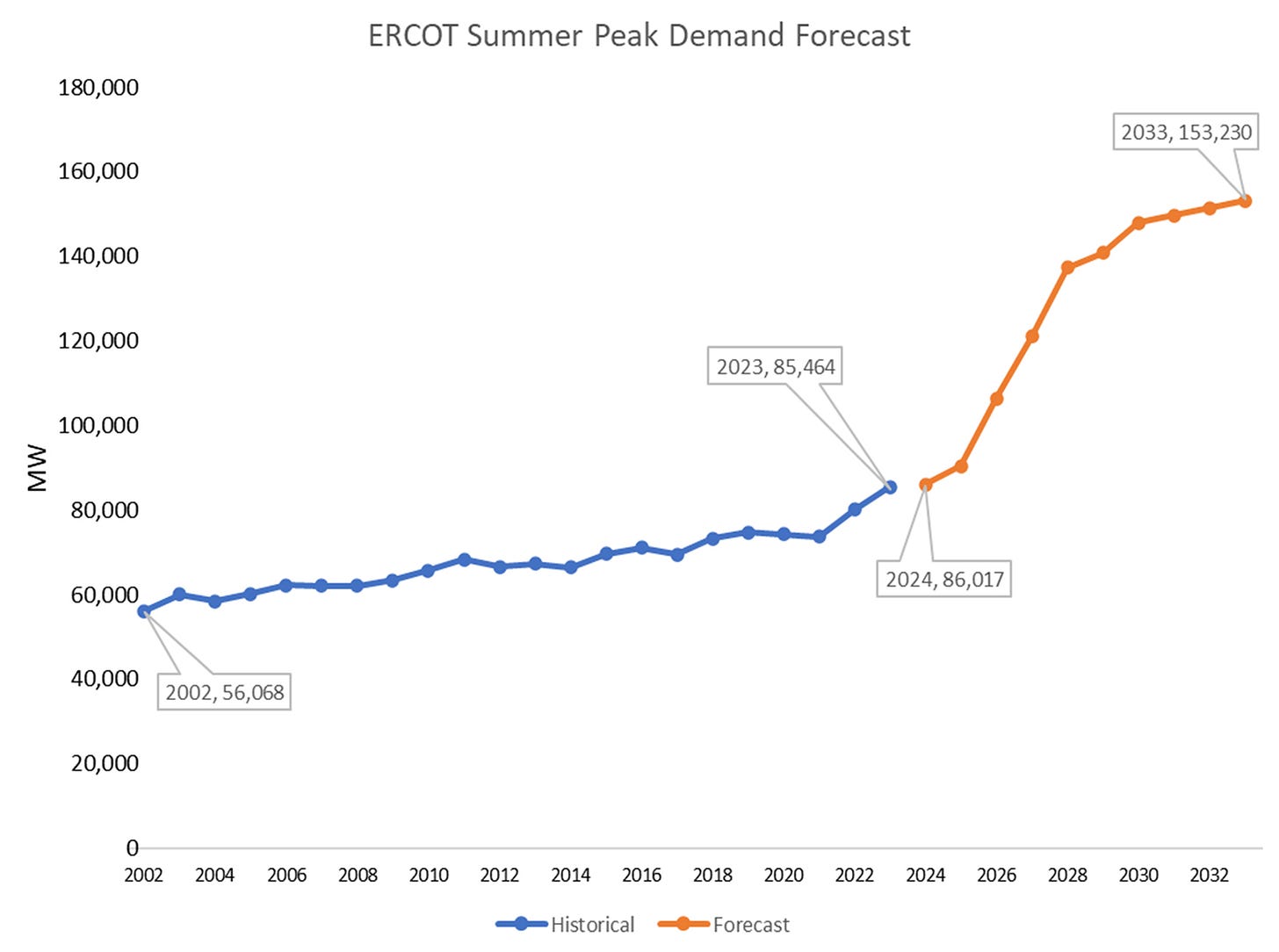

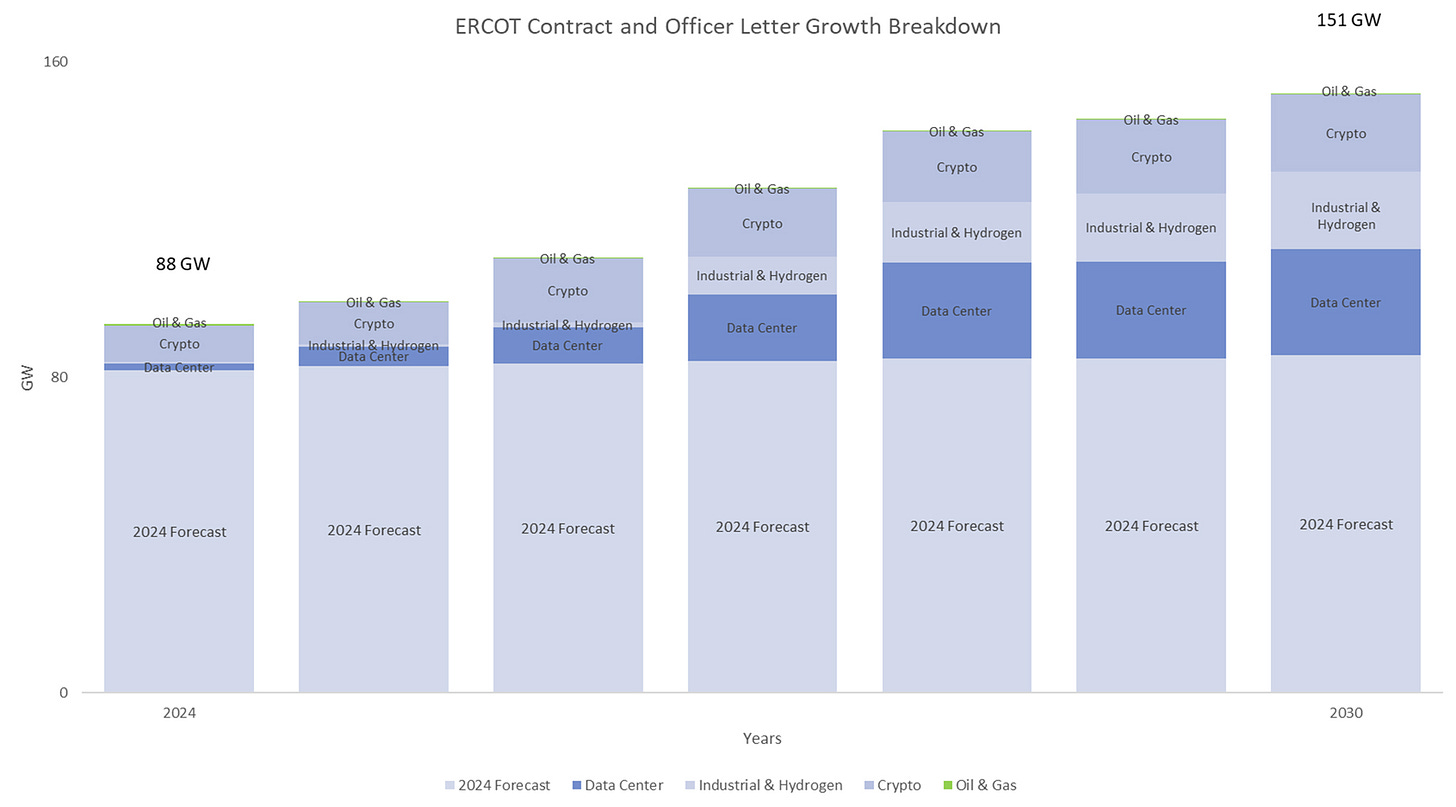

Investors Look to Texas to Lead the Future, Renewables-Driven Grid

What Happened: Plus Power’s Anemoi energy storage project came online in June - adding 650 MW of battery energy storage systems (BESS) to Texas’ grid. The EIA forecasts Texas will add 6.4 GW of utility-scale electric generating capacity in 2024, ahead of California’s 5.2 GW of additions. This expansion underscores Texas’ leadership in adopting and integrating advanced energy solutions into its grid.

Source: EIA

Background: The Electric Reliability Council of Texas (ERCOT) manages the flow of electric power to more than 26 million Texas customers. Representing about 90% of the state's electric load, Texas operates a unique electricity market that is largely separate from the rest of the United States. This separation dates back to the early 20th century when Texas chose to avoid federal regulation by operating its grid independently. ERCOT’s market is deregulated, meaning it separates electricity generation, transmission, and retail. In this energy-only market, generators are paid solely for the electricity they produce and sell, without additional capacity payments. This structure promotes competition among multiple electricity providers, driving innovation and efficiency, leading to better services and prices for consumers.

The deregulated market structure of ERCOT has fostered significant innovation in the energy sector. Some key advancements include:

Battery Energy Storage Systems (BESS): These systems store energy during low-demand periods and release it during high-demand times, providing grid services such as frequency regulation and peak shaving.

Virtual Power Plants (VPPs): VPPs aggregate distributed energy resources to provide grid services, enhancing flexibility and resilience. Texas has been a leader in VPP adoption, despite it being slower than expected nationally.

Advanced Demand Response Programs: These programs incentivize consumers to reduce their electricity use during peak periods, helping to balance supply and demand.

Renewable Energy Integration: Texas leads the nation in wind power capacity and is rapidly expanding its solar power infrastructure, supported by policies that encourage renewable energy development.

Microgrids and Distributed Generation: These systems provide localized energy solutions that can operate independently of the main grid, enhancing reliability during outages.

As Texas continues to add renewable generation capacity, the grid faces challenges such as maintaining reliability during extreme weather events and balancing intermittent renewable energy sources. The integration of large amounts of wind and solar power requires advanced grid management techniques and robust energy storage solutions. Compared to markets like the California Independent System Operator (CAISO), which also faces high renewable penetration, Texas benefits from its competitive market structure that encourages rapid adaptation and innovation. However, both regions must address similar issues, including grid stability, energy storage, and maintaining a reliable supply of electricity as they transition to cleaner energy sources.

Source: ERCOT

Source: ERCOT

Take-Away: The addition of Plus Power’s Anemoi energy storage project is a testament to the effectiveness of Texas’ deregulated market in integrating advanced energy solutions. By enabling competitive market dynamics, ERCOT fosters innovation and efficiency, essential for meeting rising electricity demands and enhancing grid reliability. Texas' market structure allows for rapid adaptation to new technologies and solutions, such as BESS and VPPs. These systems not only provide essential services like frequency regulation and peak shaving but also support the integration of renewable energy sources, ensuring a stable and sustainable power supply.

What Comes Next: ERCOT's proactive stance and the state’s deregulated market structure will continue to drive the adoption of advanced energy technologies. As the EIA forecasts significant capacity additions in Texas, we can expect further investments in renewable energy and storage solutions.

Other markets can be plagued with issues:

Regulatory Complexity: Operating across various states with different rules can slow down the adoption of new technologies and increase costs. For example, PJM operates across 13 states and the District of Columbia, creating a patchwork of regulations that complicate and slow down technology implementation.

Limited Flexibility: Heavy reliance on long-term contracts and inflexible market designs can hinder adaptation to changing conditions. In California, long-term power purchase agreements (PPAs) for capacity and renewable projects can delay the integration of new energy storage solutions and innovative technologies.

Slow Approval Processes: Lengthy regulatory oversight can delay new projects and increase costs. California's extensive regulatory reviews and NYISO's bureaucratic procedures slow down the deployment of new technologies and infrastructure upgrades.

Investment Uncertainty: Complex regulatory landscapes create financial risks and market volatility, discouraging long-term investments. In PJM, frequent changes in market rules and regulatory interventions create uncertainty for investors.

Operational Challenges: Strict resource adequacy requirements can lead to over-procurement and underutilization of resources, reducing market efficiency. CAISO mandates that entities procure enough capacity to meet peak demand plus a reserve margin, often leading to inefficiencies and complicating grid management.

Investors and industry stakeholders should look to Texas as one of the first markets to deploy new energy assets. The ongoing advancements in battery storage technology and the growing emphasis on renewable energy integration highlight the critical role of these systems in our transition to a more sustainable energy landscape.

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Green Steel: US Steel and Bill Gates-backed start-up announce pilot clean steel project with integrated turquoise hydrogen production (Hydrogen Insight)

Electric Vehicle: Charging An Electric Vehicle Is Cheaper Than Filling A Gas Tank Everywhere In America (Forbes)

Private Markets (PE / VC / Real Estate / Infra)

Data Centers: Global Power Demand Is Surging on AI and Aircon, IEA Says (Bloomberg)

Nuclear: Another Fourth-Generation Nuclear Reactor Begins Construction in the U.S. (Power Magazine)

Ports: The Energy Transition Is Setting Ports on a Greener Route (Infrastructure Investor)

Public Markets (Stocks, Bonds)

Self Driving: The Hidden Autopilot Data That Reveals Why Teslas Crash (WSJ)

Vehicle-to-Home: Sunrun Launches Nation’s First Vehicle-To-Home Grid Support In Maryland Using Ford F-150 Lightning Trucks (SunRun)

Nuclear: NuScale Power Comments on Short-Seller Report (Business Wire)

Government & Policy

Interest Rates: A Fed Rate Cut Is Finally Within View (WSJ)

Loan Program Office: Government loan promise gives Erie's International Recycling Group $182 million boost (Go Erie)

DOE: Biden-Harris Administration Announces $24 Million to Further Expand America's Clean Energy Workforce and Enhance Manufacturing Efficiency (DOE)

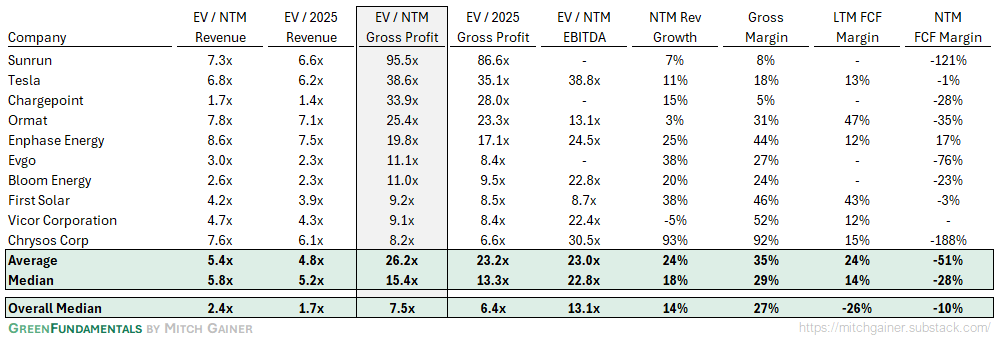

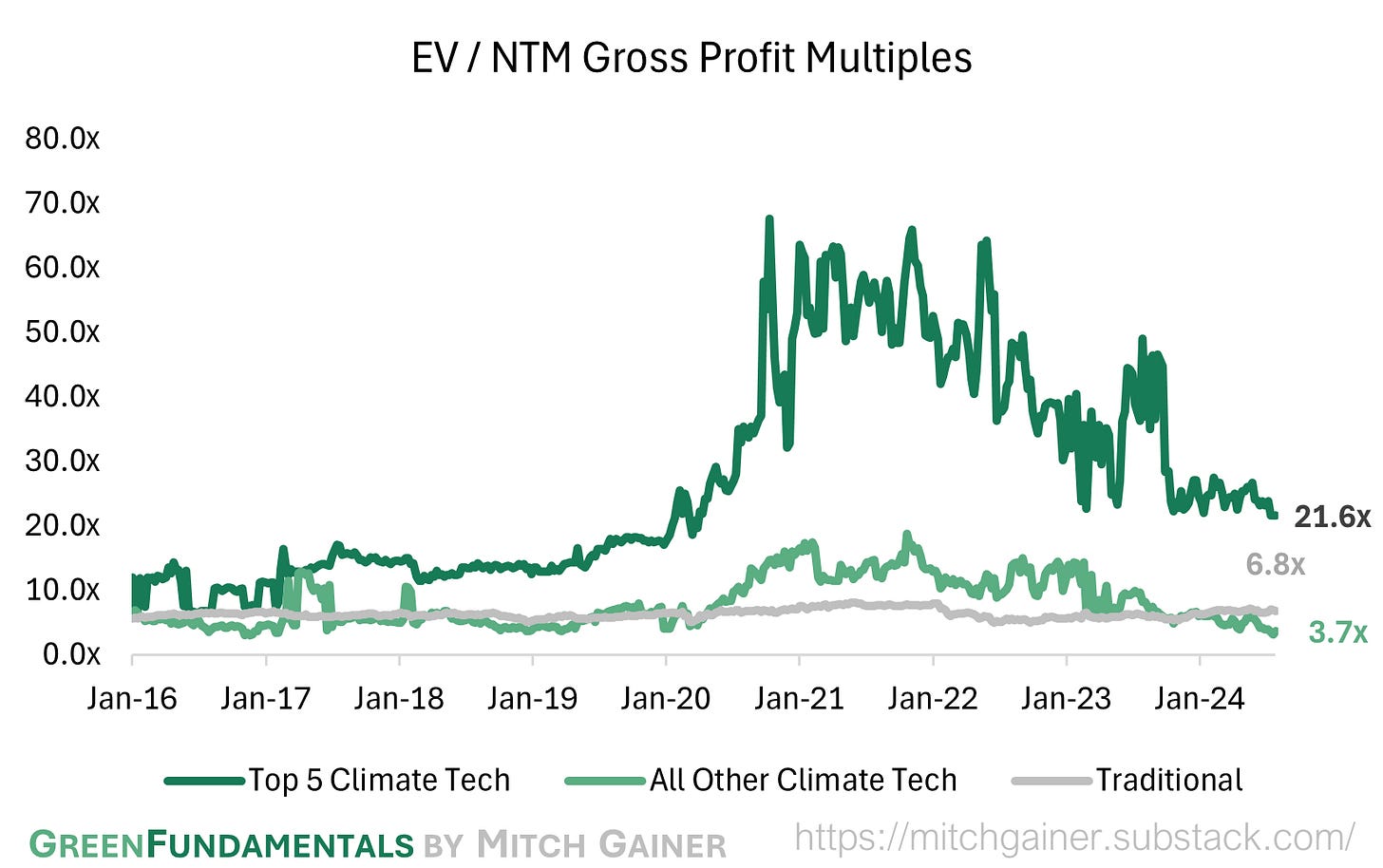

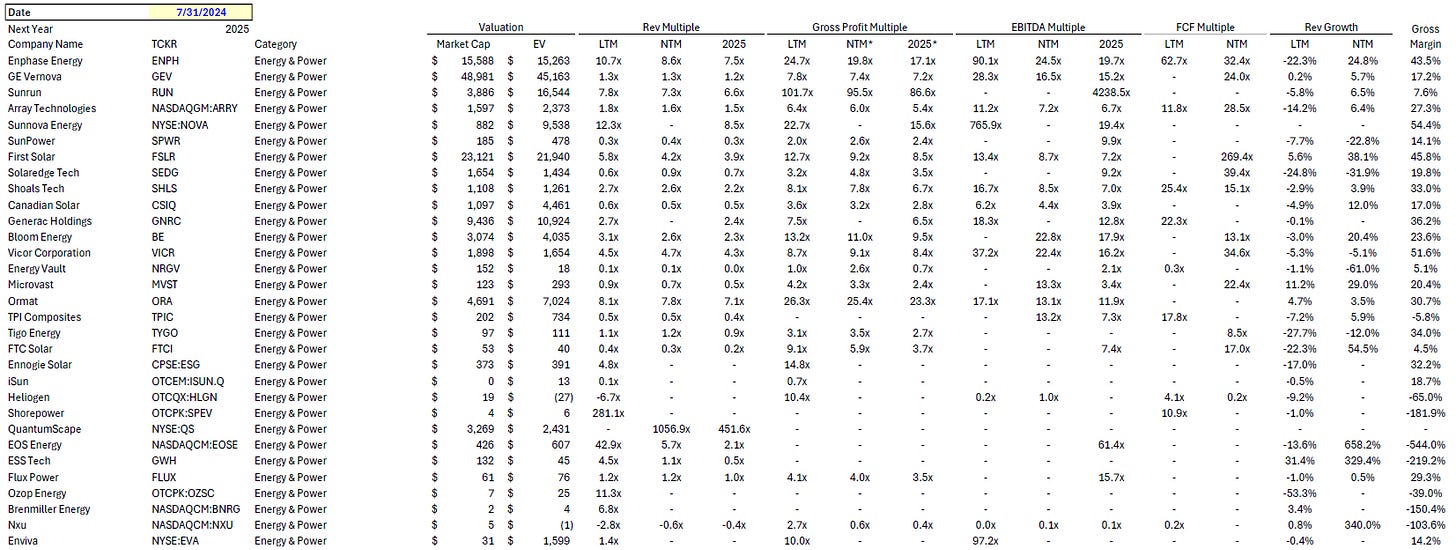

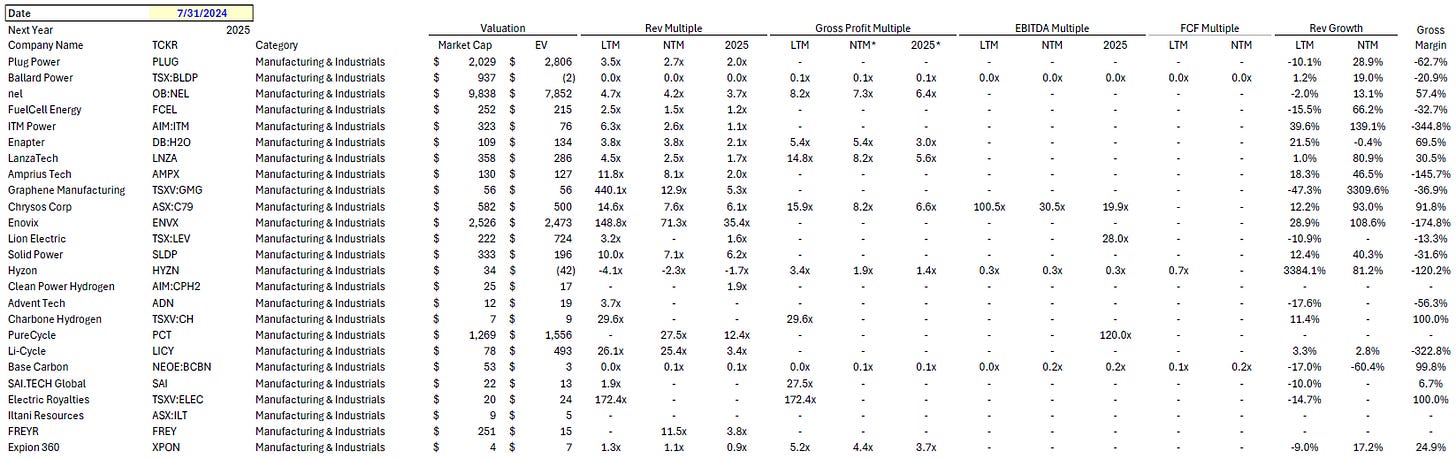

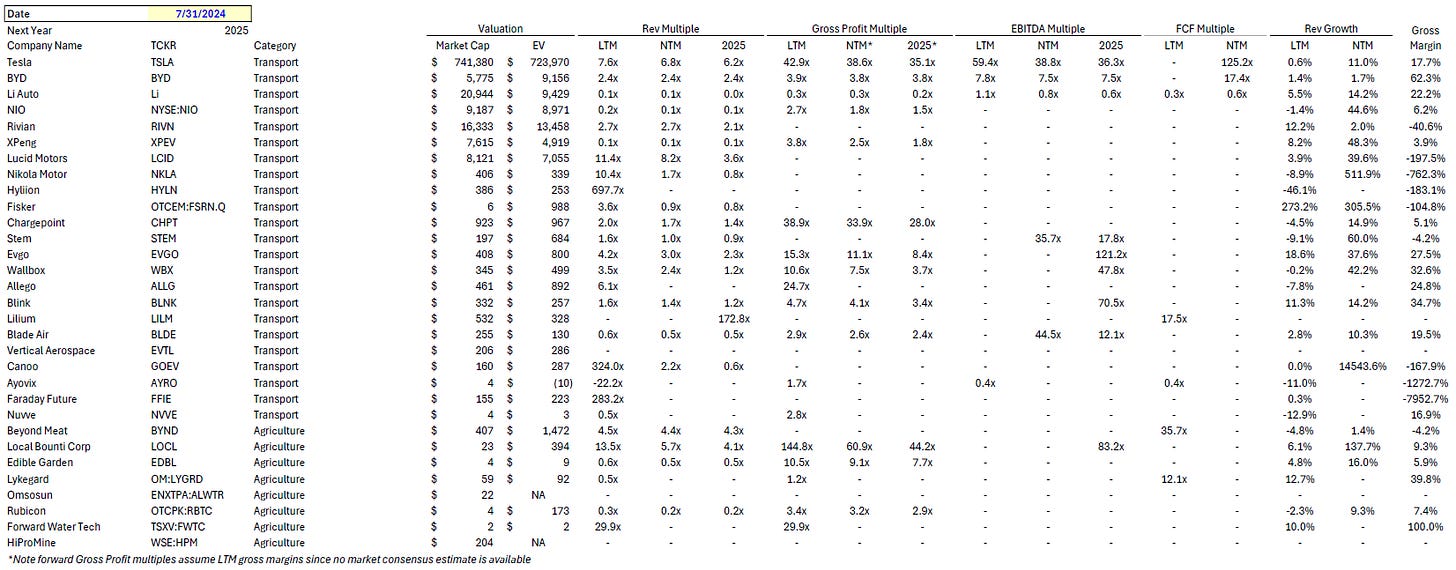

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

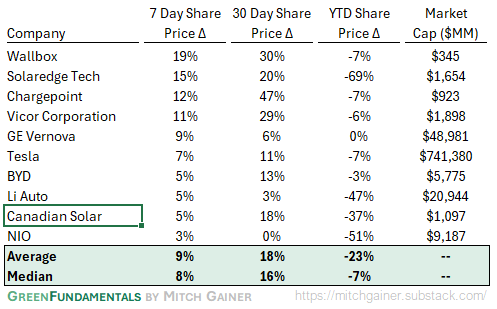

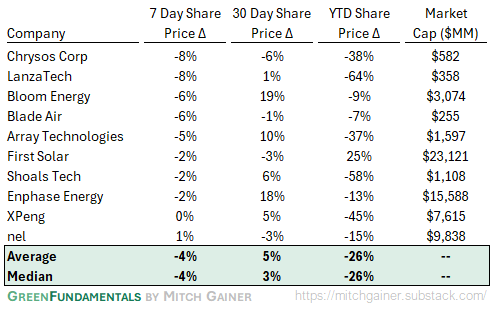

Top 10 and Bottom 10 Weekly Share Price Movement

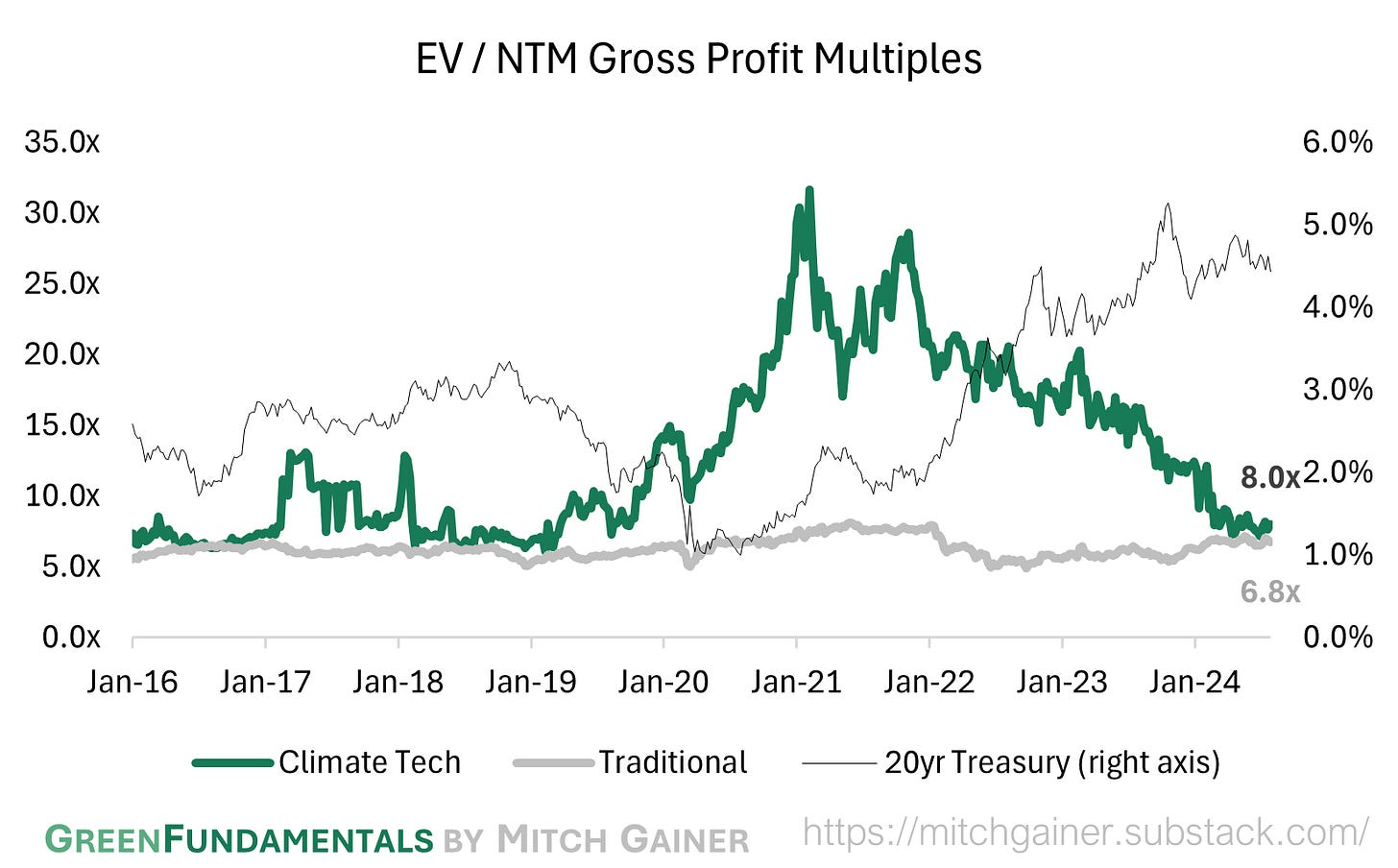

Valuation Multiples over Time

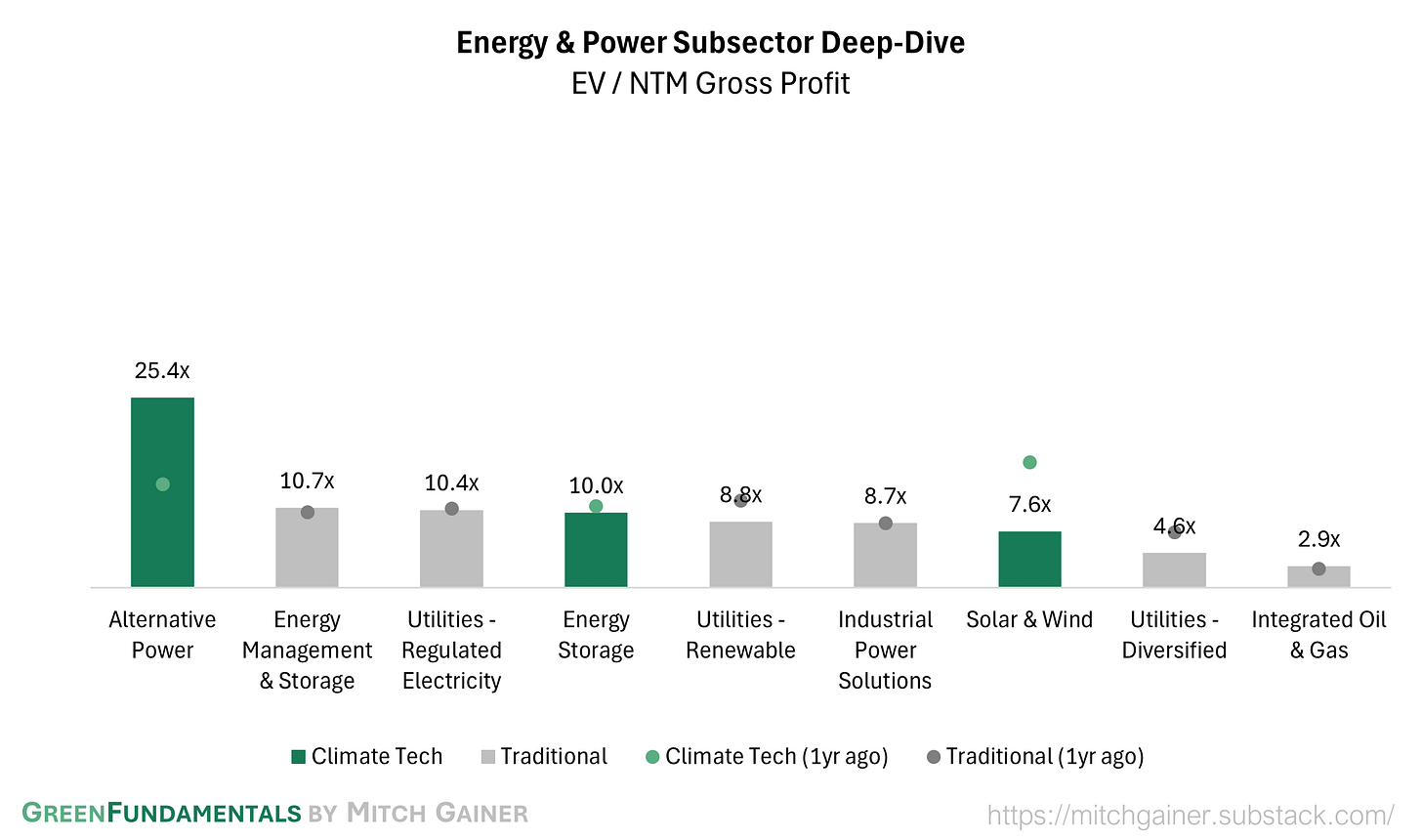

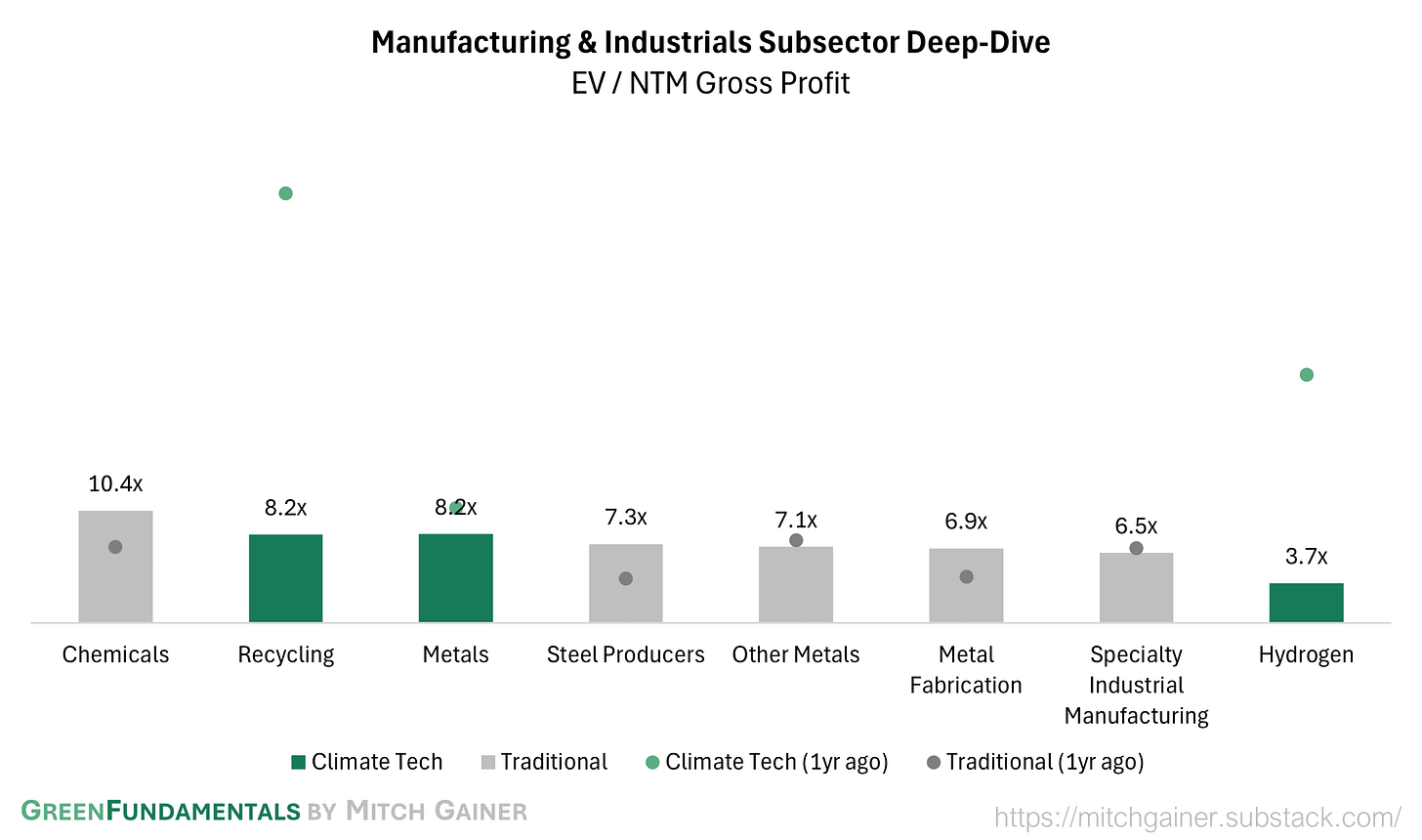

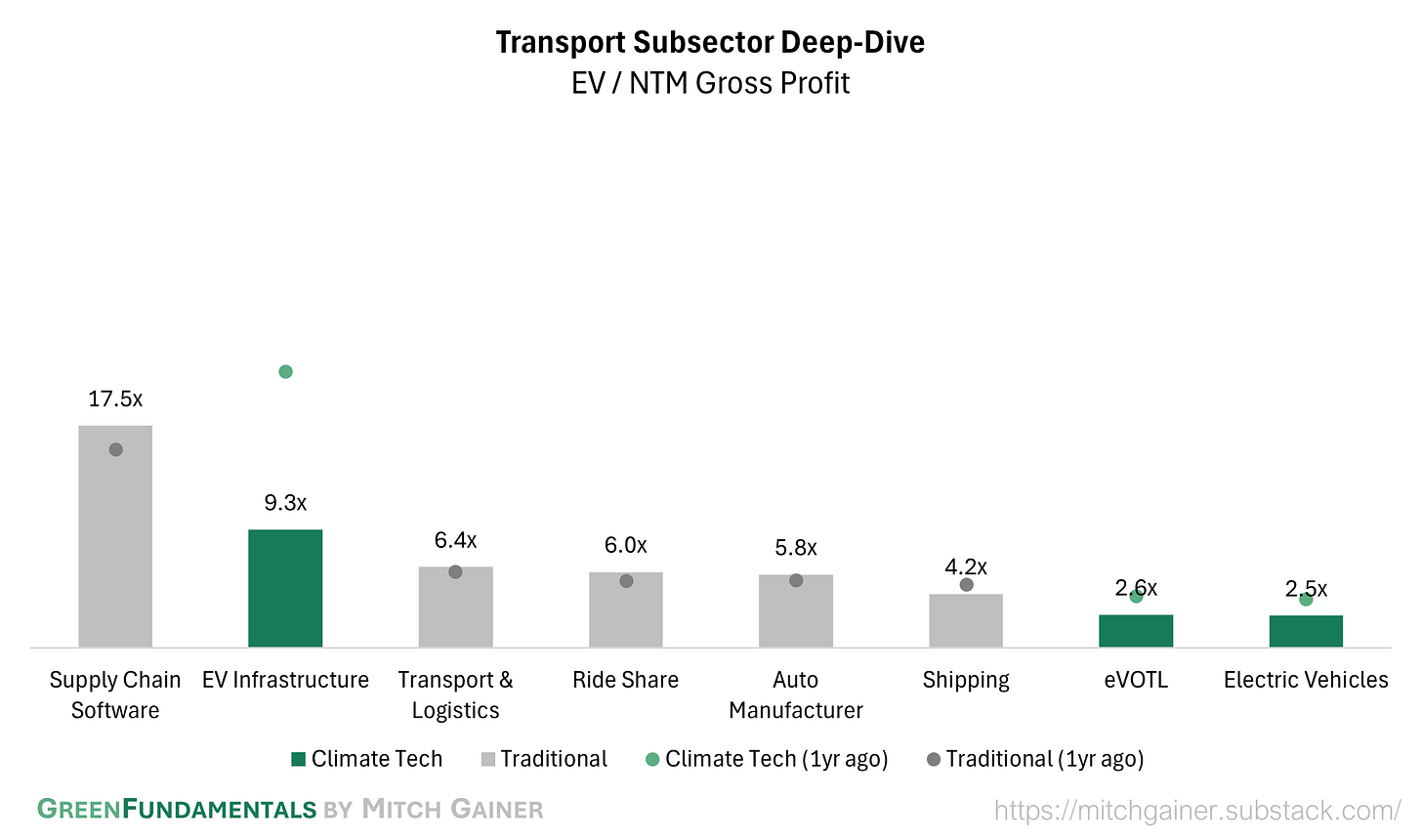

Deep-Dive by Subsector

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.