Green Fundamentals: Volkswagen Bails Out Rivian

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Volkswagen plans to invest up to $5B over 3 years, but Rivian’s path to profitability remains challenging

What Happened: Volkswagen Group has announced a substantial investment in Rivian, marking a significant move in the EV market. Volkswagen's initial investment of $1 billion comes in the form of an unsecured convertible note, which will convert into Rivian's common stock after receiving regulatory approvals, no earlier than December 1, 2024. This investment is part of a broader strategy that could see Volkswagen invest up to $5 billion in Rivian through various stages until 2026

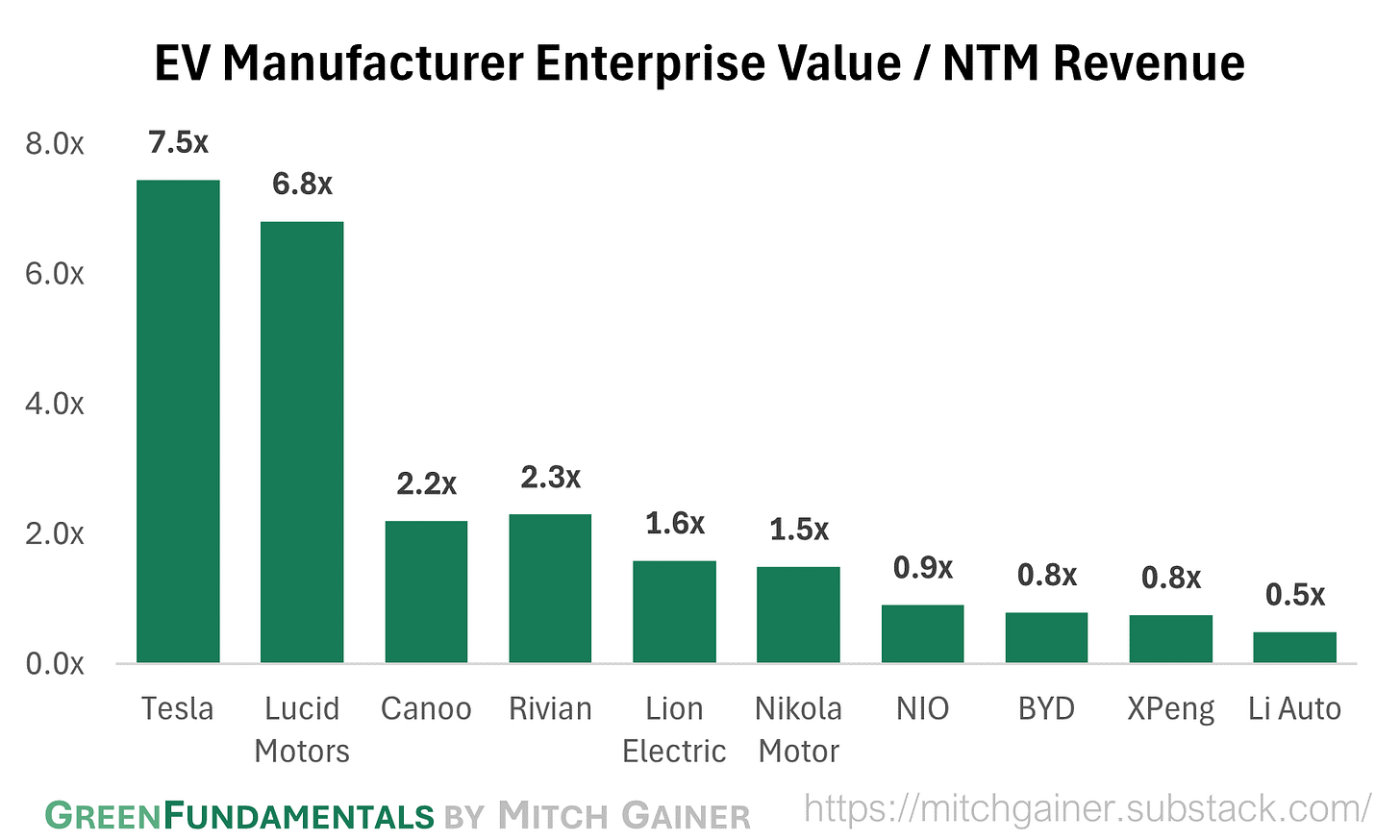

Background: Rivian’s valuation has fallen precipitously since their November 9, 2021 IPO. Rivian’s enterprise value fell from $127B 3 days after IPO to $11B on July 2, 2024. Rivian had secured significant funding to date, including ~$11B pre-IPO and $13.7B in the November 9, 2021 IPO. Today, on a multiple of revenue, Rivian is third highest valued public EV company - but they are dramatically below scale in terms of absolute revenue (Rivian: ~$5B NTM) compared to Tesla ($103B NTM) and BYD ($109B NTM).

Source: Capital IQ

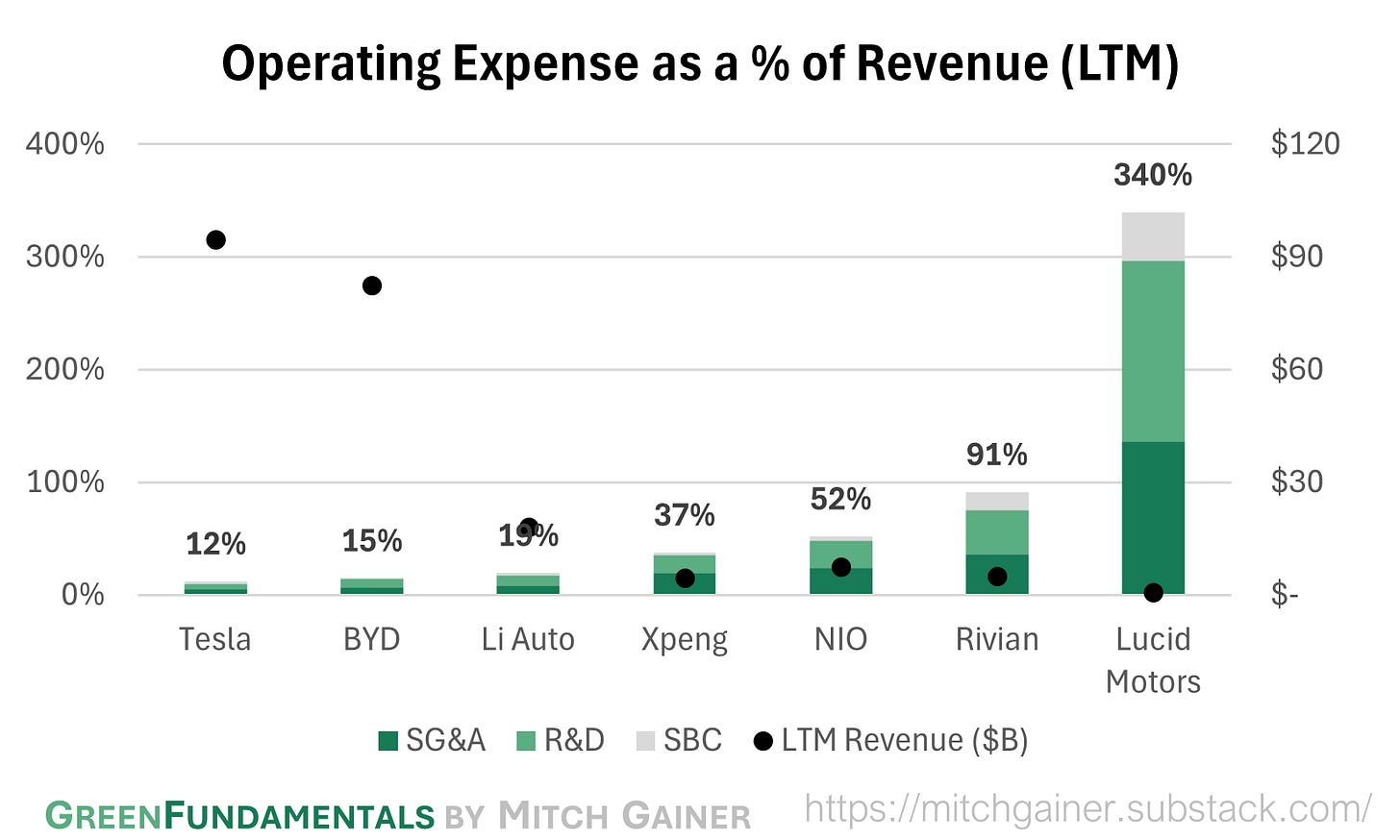

Rivian has faced significant cashflow challenges. In Q1 2024, Rivian had $6B in cash and was burning ~$1.5B per quarter (see analysis below). Rivian's heavy spending on production ramp-up, R&D, and manufacturing expansion has strained its balance sheet. These challenges were highlighted by Elon Musk, who openly criticized Rivian, predicting that the company would run out of cash without a significant increase in production and sales. Musk's comments were underscored by Rivian's quarterly reports showing substantial losses, which raised concerns about the company's long-term viability if it fails to scale up efficiently and control costs.

Source: Capital IQ

Source: Public SEC Filings

The EV market slowdown has prompted Rivian and other major automakers to reassess their strategies and seek partnerships to stay competitive. As the automotive industry shifts towards electrification, the importance of software and advanced electronic systems has become increasingly apparent. Modern EVs rely heavily on software for everything from battery management and autonomous driving to user interface and connectivity features. This reliance on sophisticated software has created opportunities for traditional automakers to partner with emerging startups.

Source: Rivian Investor Presentation

Volkswagen and Rivian plan to establish a joint venture focused on developing next-generation electrical and electronic architecture for vehicles. This collaboration aims to integrate Rivian's advanced software and electrical systems into Volkswagen's global vehicle lineup, leveraging both companies' strengths to accelerate technological advancements and reduce costs. The joint venture is expected to be finalized by the fourth quarter of 2024.

Integration of advanced electronic architecture in vehicles is crucial for several reasons.

Scalability: Supports future technological advancements like over-the-air updates and increased vehicle autonomy.

Efficiency: Reduces vehicle weight and complexity by consolidating electronic control units (ECUs), improving performance.

Seamless Experience: Enables efficient communication among vehicle systems, enhancing user experience.

Flexibility: Provides a more adaptable platform for integrating new technologies and features as they develop.

Innovation: Drives technological advancement and operational efficiency through streamlined system integration.

Source: McKinsey & Company

Take-Away: EV manufacturers should look to partnerships like this to extend runway and potentially add new revenue streams. This strategic partnership underscores the growing importance of software and electrical architecture in the automotive industry. For Rivian, the collaboration provides significant capital and a broader market for its technology.

Rivian’s cash runway is secured, for now. Rivian has announced the investment structure and partnership goals for the next two years:

Investment Structure: The initial $1 billion investment by Volkswagen is through a convertible note. Additional investments include $2 billion in Rivian’s common stock in two tranches ($1 billion each in 2025 and 2026), and $2 billion for the joint venture, split between initial payments and a loan in 2026

Strategic Goals: This partnership is designed to enhance Volkswagen's software capabilities and competitiveness in the EV market. By combining Rivian's innovative technology with Volkswagen's manufacturing and global reach, both companies aim to lead the development of future automotive technologies

What Comes Next: The CEO seems focused on new revenue streams rather than cost cutting. On the back of this investment, Rivian plans to launch five more models including less expensive models. Further, they may pursue alternative paths to monetizing their software (such as other partnerships similar to Volkswagen). More models can lead to more sales (which is needed) but at the cost of operational efficiency.

Rivian is kicking the can down the road, betting on the profitability of new models and potentially more partnerships. Rivian is still gross profit negative and, for the car business to be profitable, should focus on scale and operational efficiencies (as Elon Musk suggested in his tweet). It seems the CEO is not pursuing this path and instead focusing on investing in partnerships to expand revenues. Rivian is making the bet that becoming a software partner to OEMs is a shorter path to profitability than scaling operations (like Tesla or BYD). This would be a major pivot, but perhaps the least bad option for a company challenged to achieve profitability.

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Fusion: World’s largest nuclear reactor to make magnetic field 250,000x stronger than Earth’s (Interesting Engineering)

Solar: Solar panel achieves world record with ‘miracle material’ (Independent)

Global Temperatures: Heat deaths to mount as world risks warmest summer on record (FT)

Private Markets (PE / VC / Real Estate / Infra)

Nuclear: France's EDF to redraft small modular reactor design amid cost, technology concerns (Reuters)

Solar: Mining the Sun: Some in the Wyoming Epicenter of the Coal Industry Hope to Sustain Its Economy With Renewables (Inside Climate News)

Hydrogen: Universal Hydrogen, pioneer of hydrogen-powered flight, goes bust (The Seattle Times)

Public Markets (Stocks, Bonds)

Solar: Sunnova Energy International Inc. (NOVA): Hedge Funds Are Shorting This Stock Right Now (Insider Monkey)

Electric Vehicles: Tesla’s Vehicle Deliveries Slump for Second Straight Quarter (WSJ)

Electric Vehicles: Tesla stock surges as quarterly vehicle deliveries beat Wall Street estimates (Yahoo)

Data Centers: Tech Industry Wants to Lock Up Nuclear Power for AI (WSJ)

Data Centers: Microsoft to invest $7.16 bln in new data centres in northeastern Spain (Reuters)

Hydrogen: Bloom Energy surges on hydrogen electrolyzer tech deal with Shell (Seeking Alpha)

Government & Policy

National Security: Green Peace: How the Fight Against Climate Change Can Overcome Geopolitical Discord (Foreign Affairs)

Uranium: DOE issues $2.7B RFP for low-enriched uranium in bid to grow domestic nuclear supply chain (Utility Dive)

Batteries: DOE Poised To Dole Out $400 Million to Energy Company on Brink of Financial Collapse—After Evading Tariffs on Chinese Imports (Free Beacon)

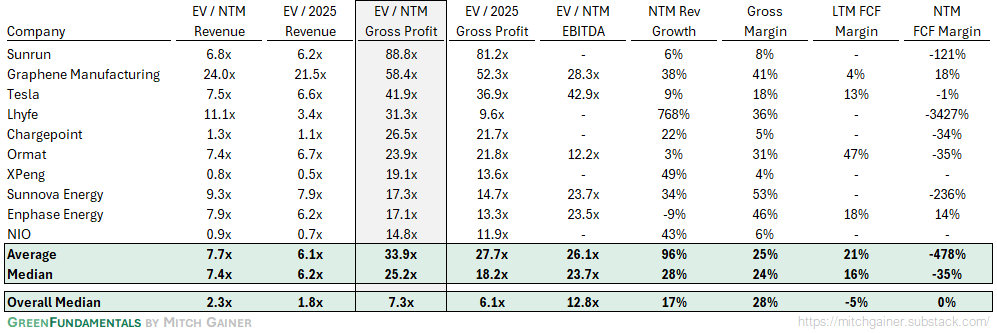

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

Top 10 and Bottom 10 Weekly Share Price Movement

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

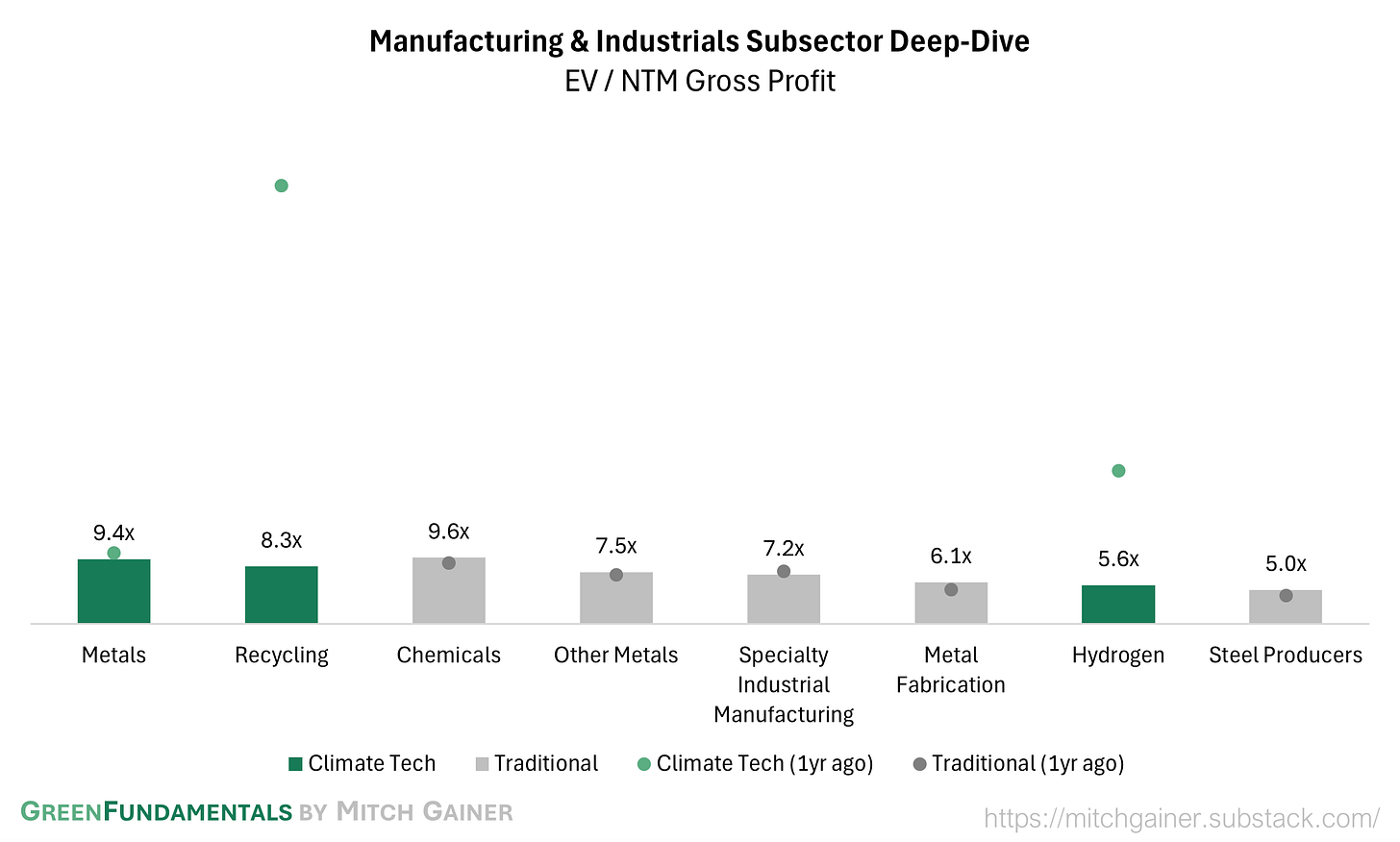

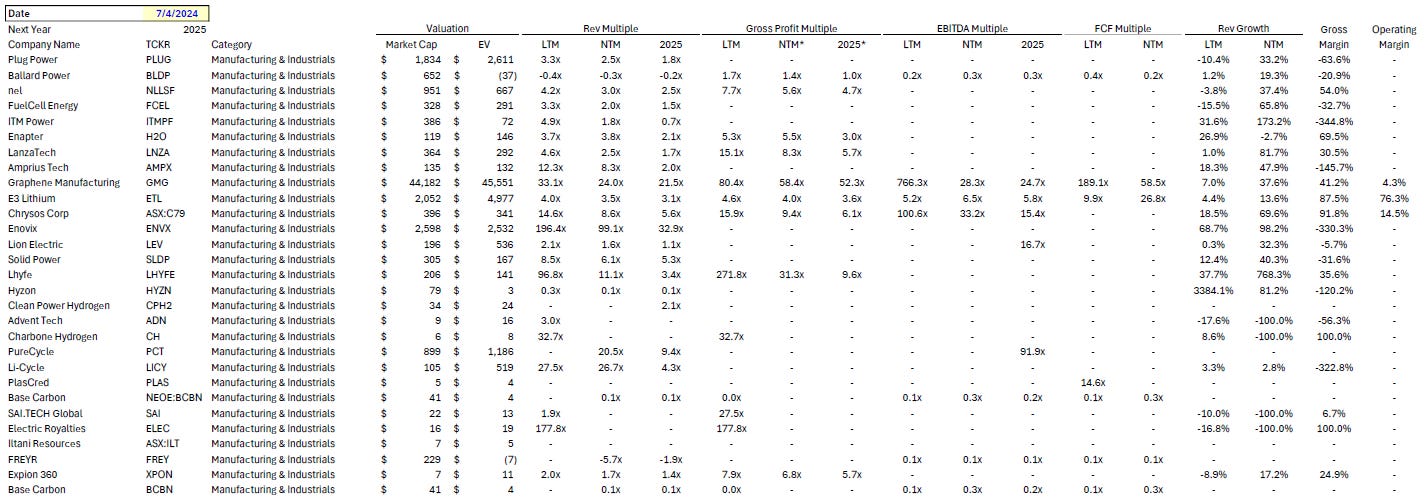

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind, alt. power) commands a higher premium while energy management systems have increased in value; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

Manufacturing & Industrials: Hydrogen and recycling investments are commanding a premium again, though neither are trading nearly as high as they were a year ago.

Transport: EV growth is priced in to climate tech and traditional companies - though they have declined over the past year; the market is skeptical on eVOTL.

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.