Green Fundamentals: Wave of Bankruptcy Crashes

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Bankruptcies highlight common risks, defining the pitfalls that savvy investors will sidestep

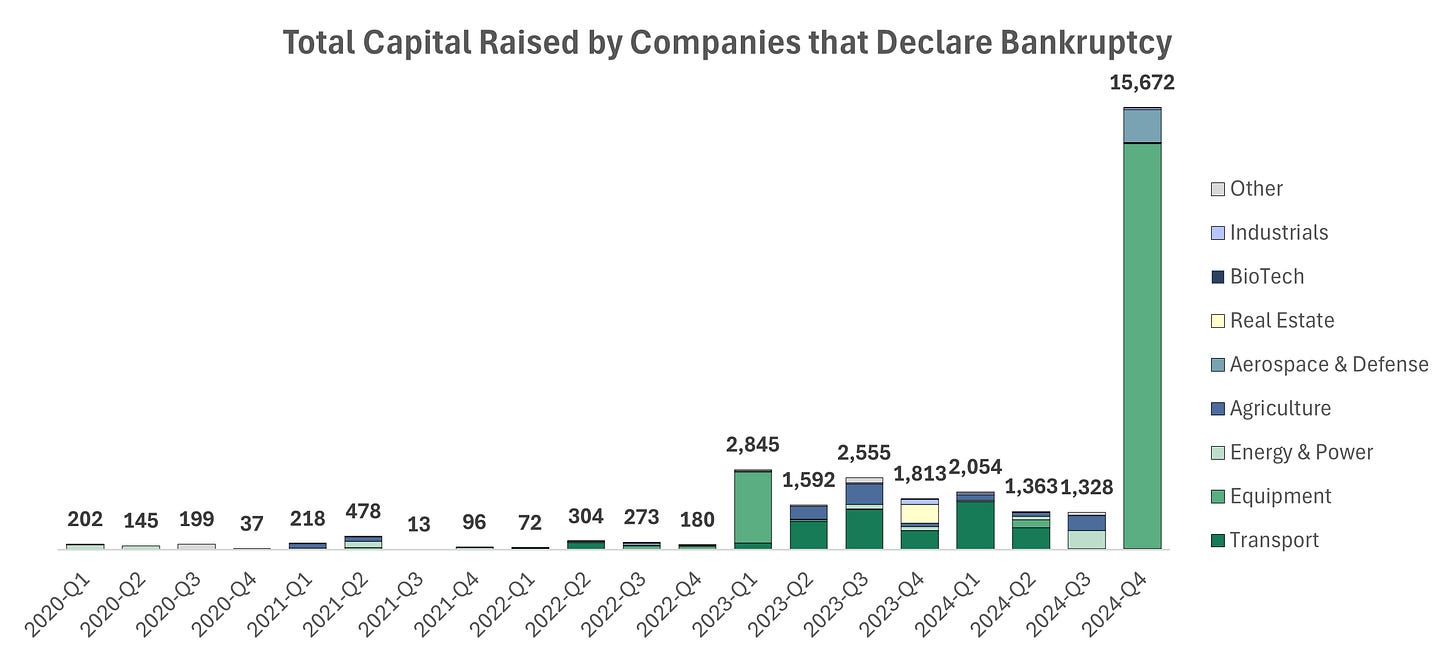

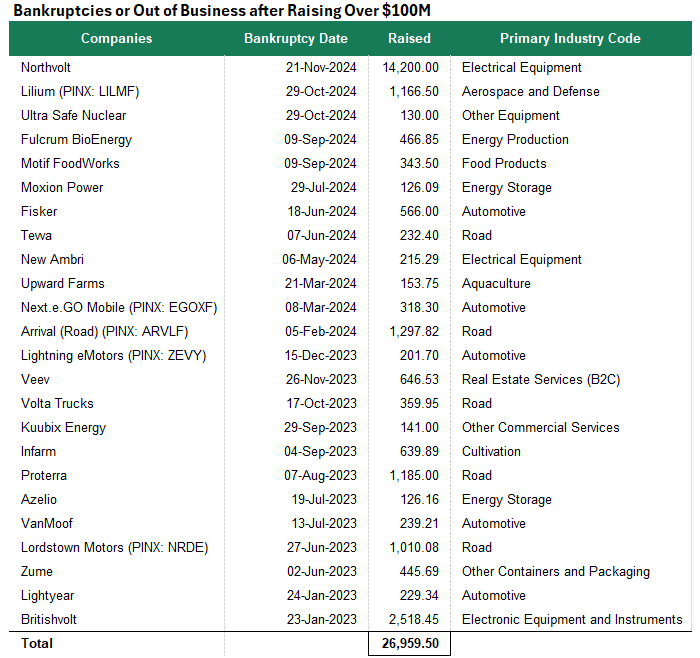

Recent high-profile bankruptcies in climate tech offer a stark reminder of the challenges inherent in scaling transformative technologies. Bankruptcies increased starting in 2023 (as measured by the total capital raised by the company, see below). $27B of capital was invested in companies that have gone bankrupt since 2023. Most notably, the recent bankruptcy by Northvolt ($14B) dwarfs previous failures.

By studying the stories of companies like Northvolt, Moxion, Ambri, SunPower, and Swell Energy, we can uncover critical lessons about what drives success—and what pitfalls to avoid.

Source: Pitchbook (as data available for officially declared bankruptcies or out of business)

Northvolt: Overextended Operational Experience

Market Context: Europe’s EV battery sector is a focal point for reducing dependence on Asian manufacturers. EU subsidies and local policies have driven demand for regional battery production, but competition from established, low-cost Asian suppliers remains intense.

Initial Traction: Northvolt raised over $14 billion from investors, including Volkswagen and Goldman Sachs, positioning itself as a cornerstone of Europe’s EV supply chain. Securing take-or-pay contracts from major automakers seemed to guarantee demand and revenue stability.

Challenge: Northvolt’s ambitious expansion exposed significant operational gaps. At its flagship Swedish facility, production yields fell well below expectations, delaying deliveries and jeopardizing customer contracts. Persistent bottlenecks in scaling operations compounded these issues, as the team lacked the expertise needed to resolve manufacturing inefficiencies.

Result: Unable to meet supply commitments, Northvolt faced cascading financial pressures, forcing it to restructure operations. Delayed expansion plans and strained customer relationships have left the company grappling with its ambitions. This highlights how operational missteps can derail even well-capitalized ventures.

Moxion: Perilous Premature Expansion

Market Context: Demand for mobile battery energy storage is growing, driven by clean alternatives to diesel generators in sectors like construction, events, and disaster response. However, fragmented demand and intense price competition make scaling a risky endeavor.

Initial Traction: With over $120 million in funding and early customer interest, Moxion rapidly expanded operations, leasing a 100,000-square-foot facility to meet anticipated demand. Its innovative technology and strategic partnerships set high expectations.

Challenge: Moxion’s aggressive scaling strategy outpaced its ability to execute. Supply chain disruptions delayed production, while workforce challenges, including layoffs, destabilized operations. Compounding this, speculative market growth failed to materialize, leaving the company reliant on uncertain revenue streams.

Result: Moxion filed for bankruptcy with liabilities estimated between $100 million and $500 million. Its collapse underscores the perils of scaling prematurely without solidifying demand or operational stability.

SunPower: Regulatory Reality Check

Market Context: The residential solar market is increasingly shaped by financing models and regulatory changes. California’s transition to Net Energy Metering (NEM) 3.0 has significantly altered the economics of rooftop solar, setting a precedent for other states.

Initial Traction: SunPower, a veteran in the solar industry, leveraged its strong brand and innovative financing to dominate the residential rooftop market. Its strategy relied heavily on California’s historically favorable policies.

Challenge: The shift to NEM 3.0, which reduced financial incentives for residential solar installations, dramatically weakened the market. Rising interest rates further increased the cost of consumer financing, making rooftop solar less appealing. SunPower’s customer acquisition campaigns, already expensive, became harder to justify under these new conditions.

Result: SunPower implemented significant layoffs (>25% of the workforce) and restructured its residential unit. The dual impact of regulatory shifts and macroeconomic changes revealed the vulnerability of its business model to external shocks.

Swell Energy: Turning Partners into Enemies

Market Context: Distributed energy resources (DERs) are critical for the future of grid resilience, but utilities remain cautious about revenue disruptions from third-party aggregators. Regulatory uncertainty continues to shape collaboration dynamics.

Initial Traction: Swell Energy raised $120 million to develop virtual power plants (VPPs), aggregating residential solar and batteries to provide grid services. Its model promised homeowners new revenue streams and utilities enhanced grid stability.

Challenge: Swell’s approach alienated utilities, positioning itself as a disruptor rather than a collaborator. By challenging traditional utility revenue streams, the company faced resistance from the very partners it needed for success. Regulatory barriers further slowed project approvals, leaving Swell with limited operational progress.

Result: Without utility support, Swell has fired all staff and is pursuing an alternative to bankruptcy. Its adversarial stance with utilities highlights the challenges of navigating heavily regulated industries.

Ambri: Scaling before De-Risking

Market Context: Grid-scale energy storage is essential for decarbonization, with emerging technologies like liquid metal batteries offering alternatives to lithium-ion. However, proving technical and economic viability remains a significant hurdle.

Initial Traction: Backed by over $200 million in funding, Ambri’s liquid metal battery promised safer, longer-lasting, and more cost-effective energy storage. Early prototypes generated investor confidence and industry buzz.

Challenge: Scaling revealed significant technical flaws, including material instability and performance inconsistencies. These issues delayed deployment, drove up costs, and eroded investor confidence. Ambri’s technology had not been sufficiently de-risked during the pilot phase, leading to expensive setbacks.

Result: Ambri restructured, selling assets to lenders and narrowing its focus to validate the technology. Its struggles underscore the risks of advancing to commercial scale without addressing fundamental technical challenges.

Lessons for Investors: The New Era of Growth Capital

Growth capital is evolving into two distinct categories of opportunity:

Asset-Light, High-Growth Software: Technologies like AI align seamlessly with traditional venture capital models, offering scalable growth with relatively low capital intensity.

Asset-Intensive, Industry-Redefining Technologies: Sectors like clean energy infrastructure demand innovative financing strategies, including creative deal structuring and risk-sharing mechanisms, to manage their inherent capital intensity and complexity.

Investors who embrace these shifts will shape the next wave of transformative industries, while those clinging to outdated models will fall behind. Success in asset-intensive sectors requires disciplined, forward-looking strategies centered on:

Proven Operational Expertise: Support teams with a demonstrated ability to scale industrial technologies. Effective operators mitigate risks in production ramp-ups and regulatory hurdles, minimizing delays and financial setbacks.

Strategic, Measured Scaling: Target companies scaling in phases, with validated demand and sustainable capital structures. Avoid those chasing speculative growth or relying on unbalanced debt loads.

Regulatory Resilience: Invest in businesses with adaptable models that align with long-term regulatory trends. Companies that anticipate and respond to policy shifts will outlast those dependent on static incentives.

Post-ZIRP Financial Discipline: In today’s higher interest rate environment, prioritize ventures with lean financial models, clear profitability milestones, and minimal reliance on speculative future growth.

By adapting to these principles, investors can navigate the unique challenges of asset-intensive industries while capturing the outsized returns that come with reshaping foundational sectors.

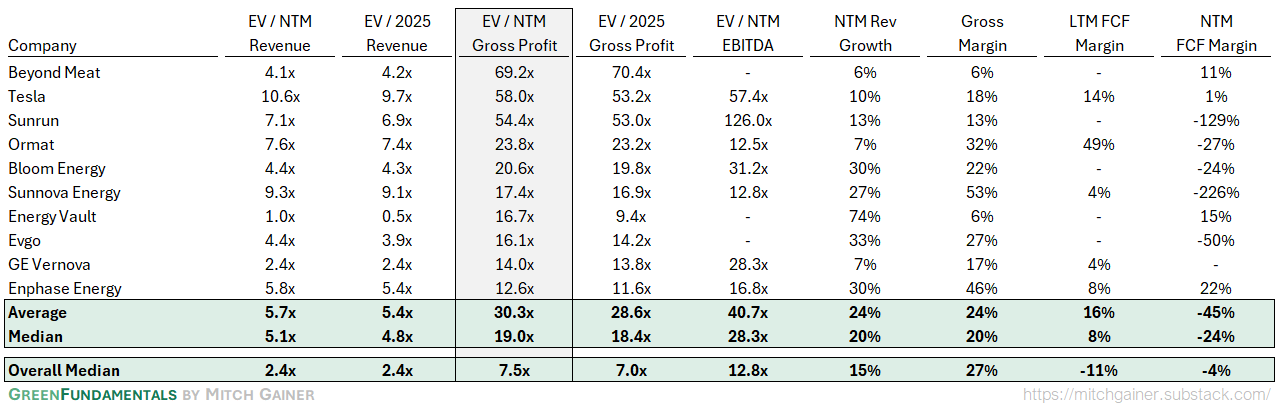

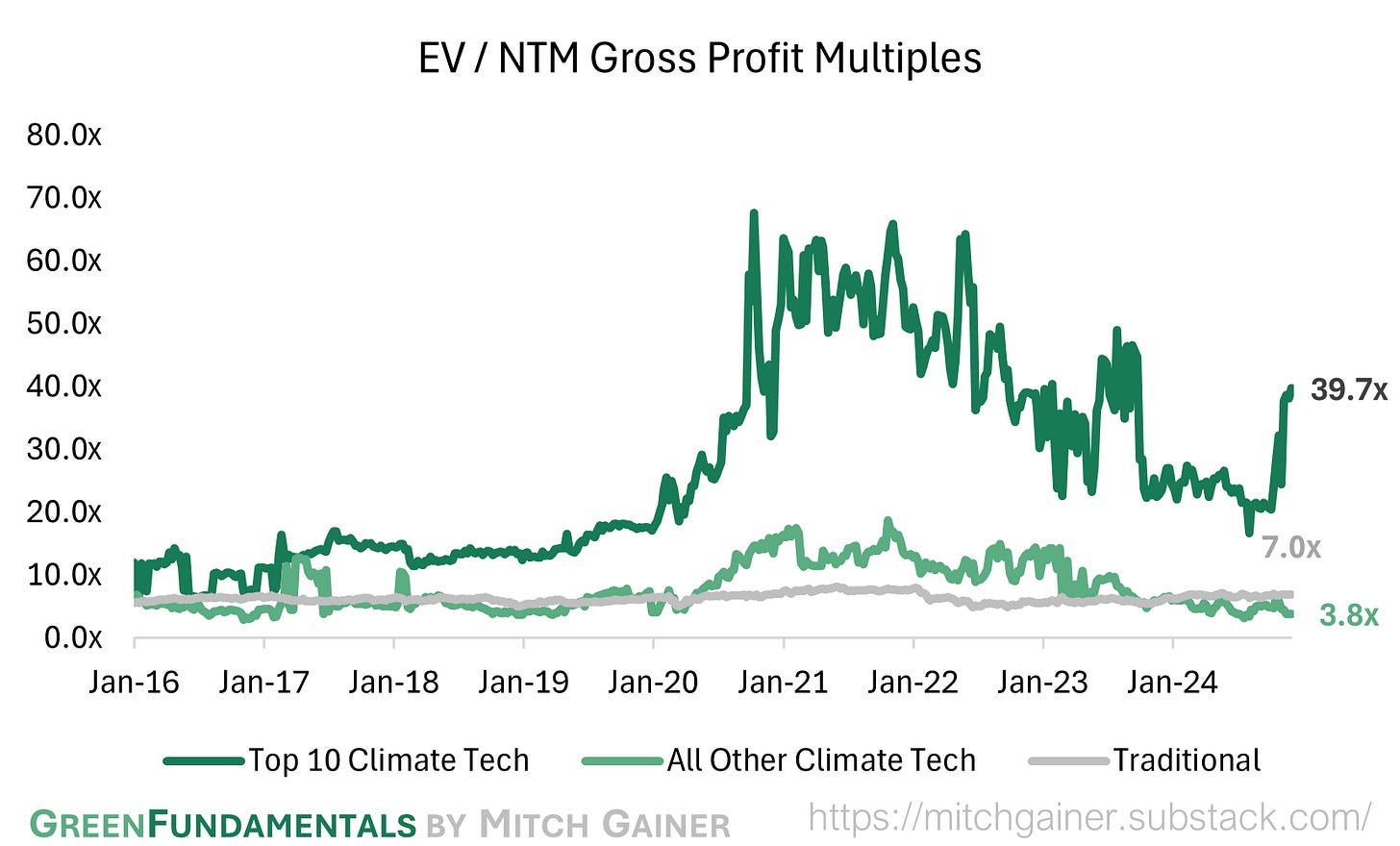

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

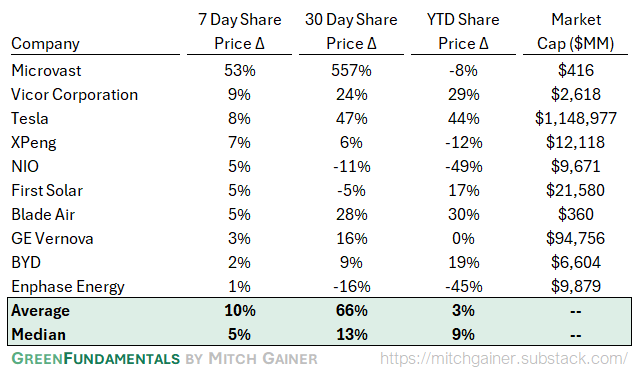

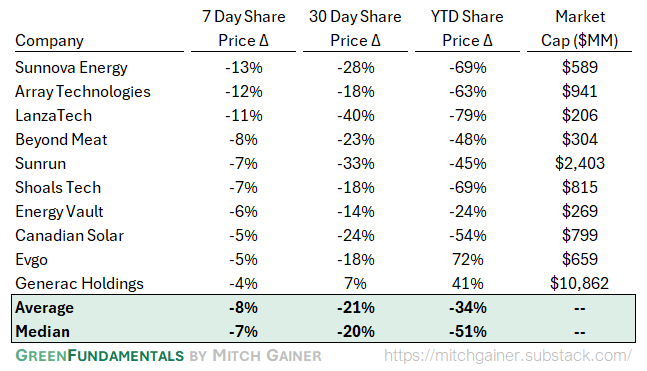

Top 10 and Bottom 10 Weekly Share Price Movement

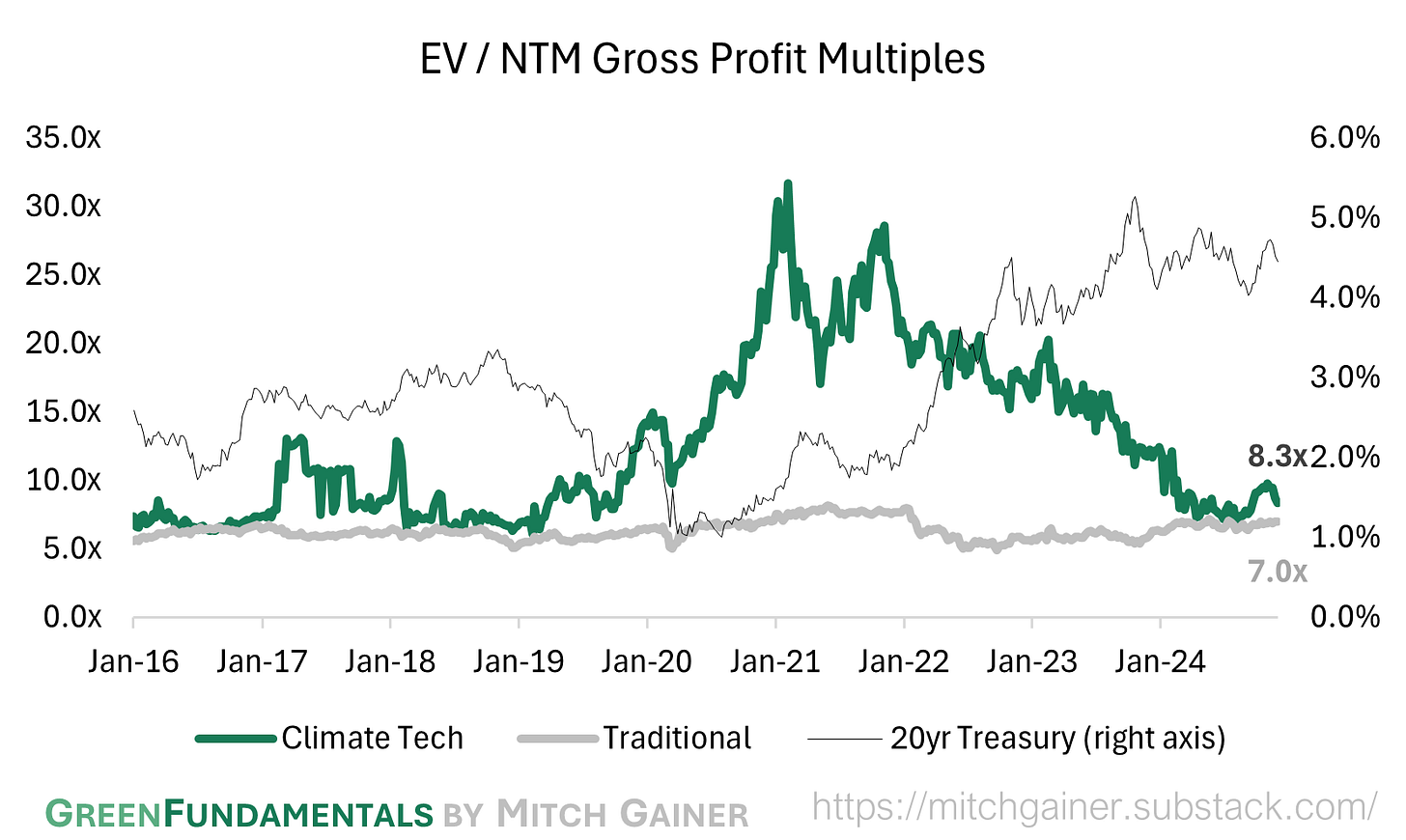

Valuation Multiples over Time

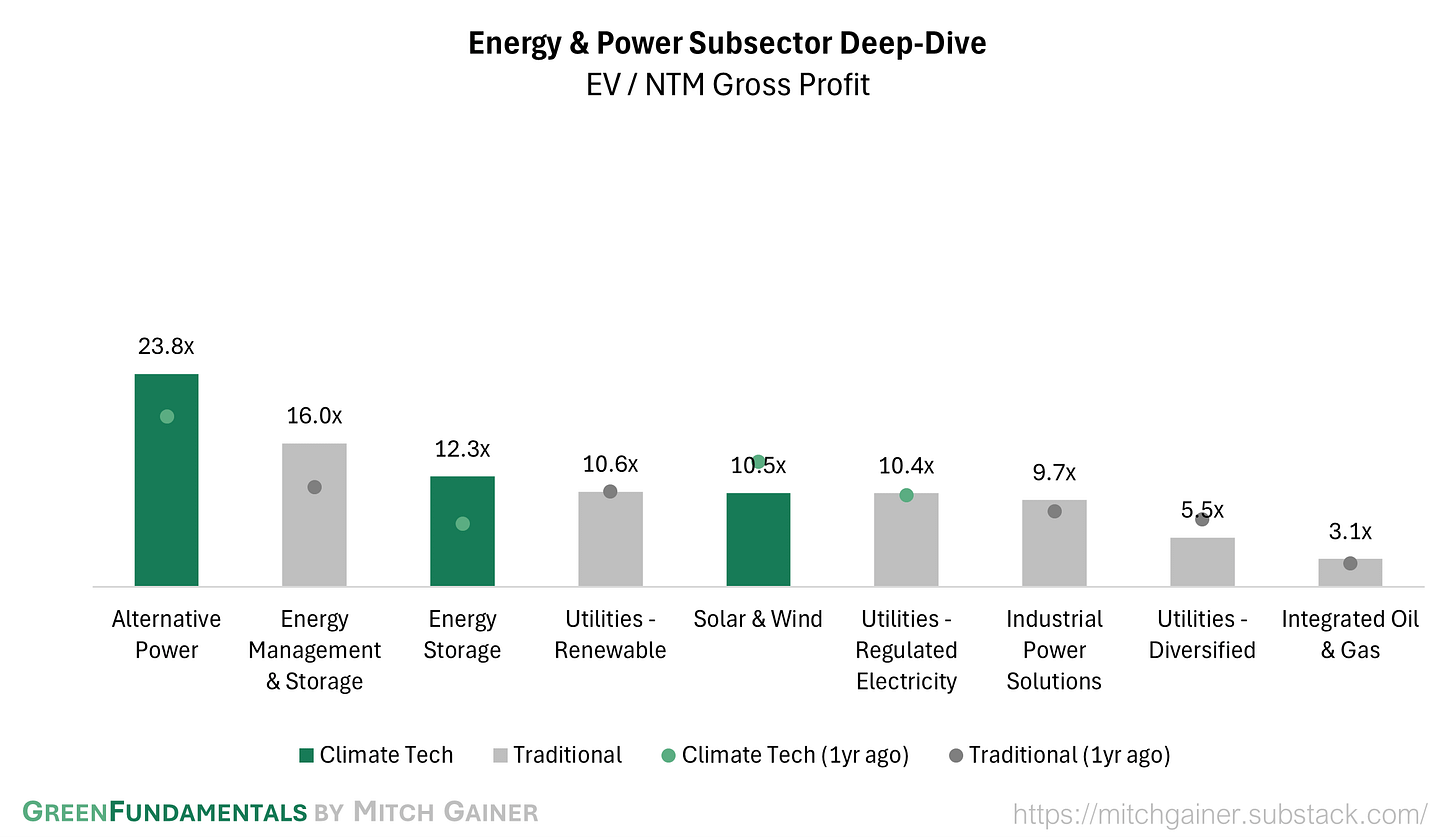

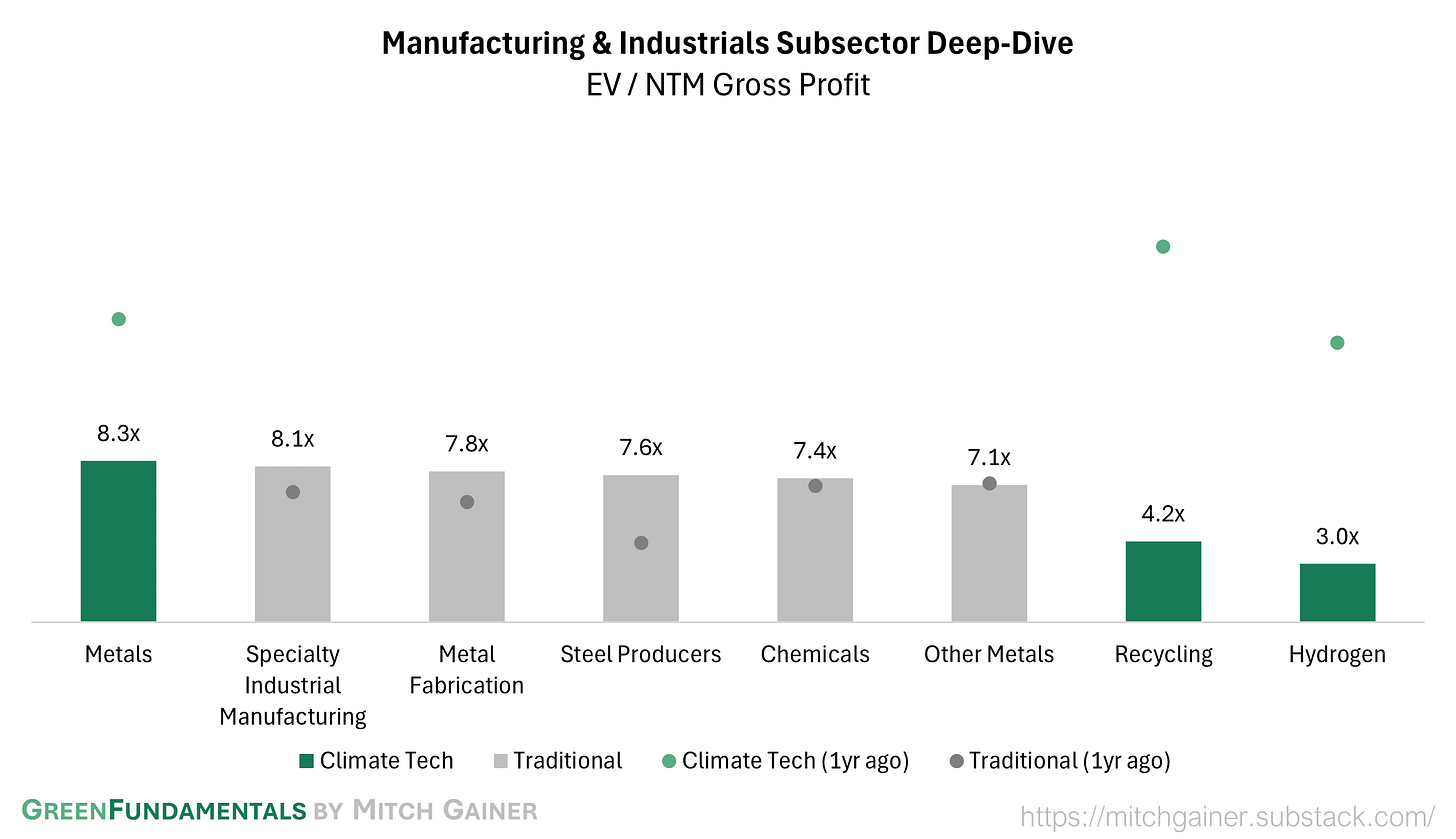

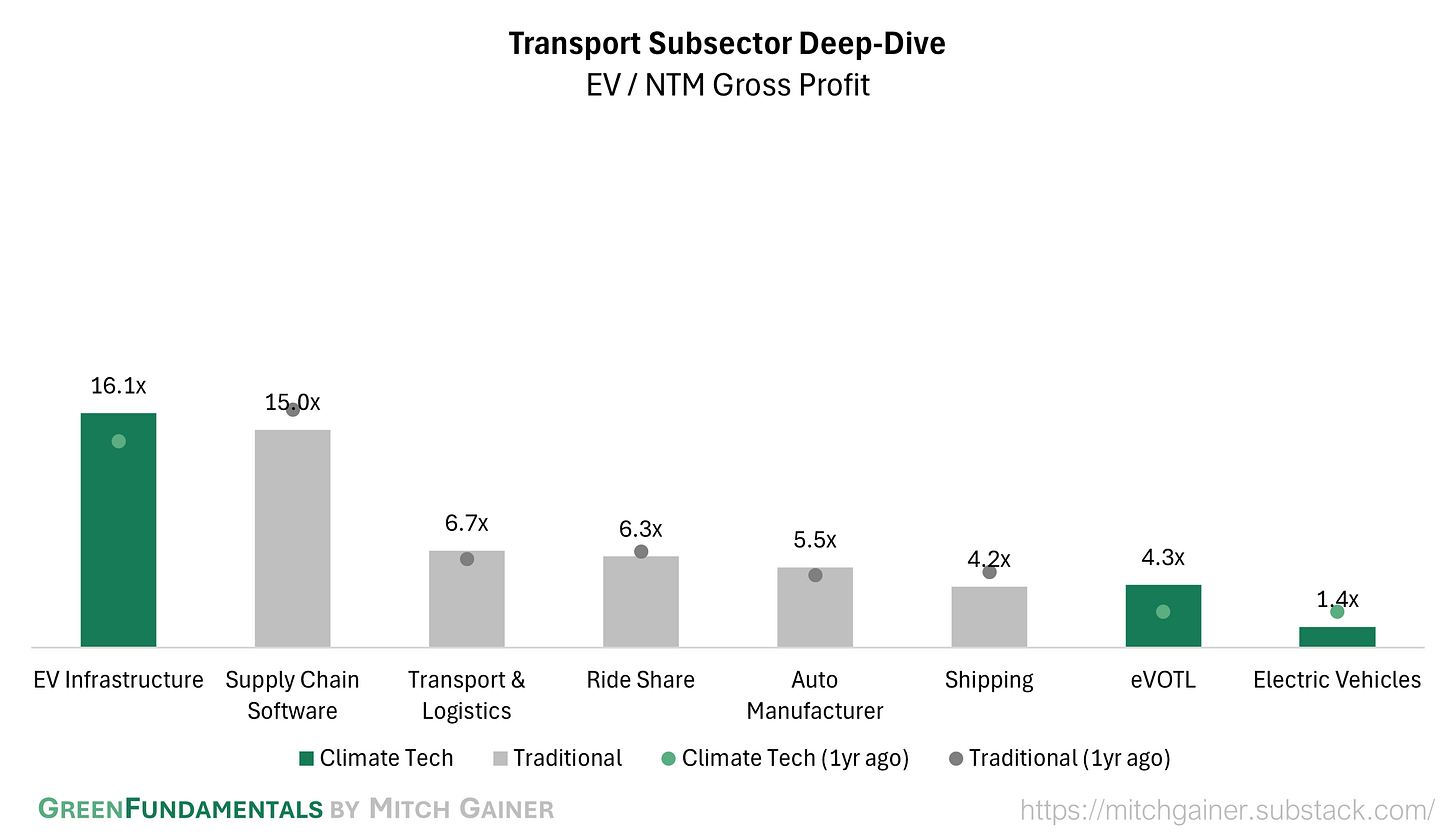

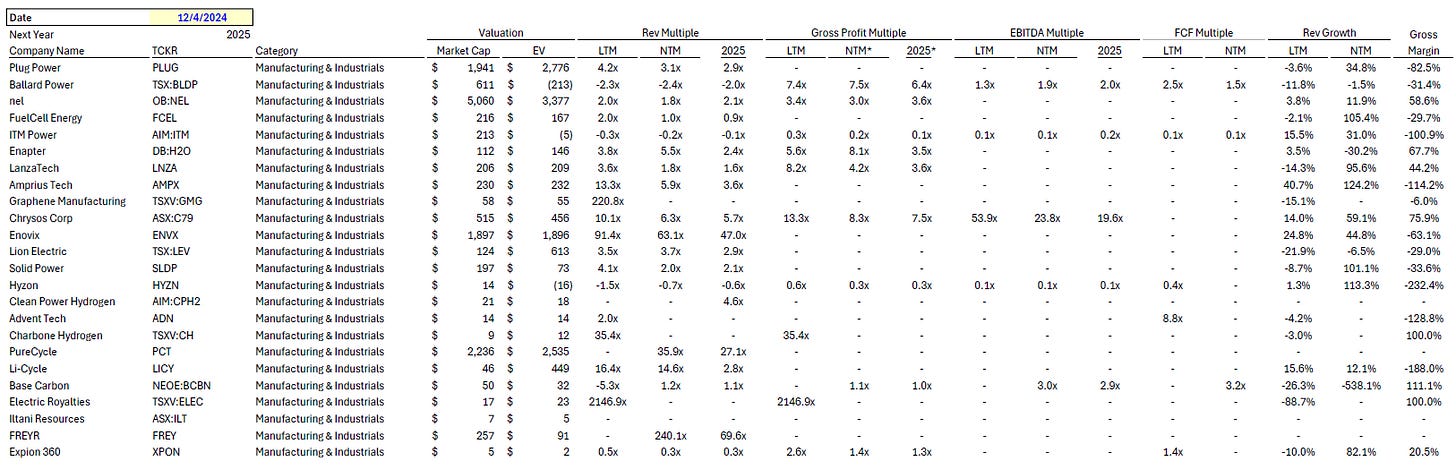

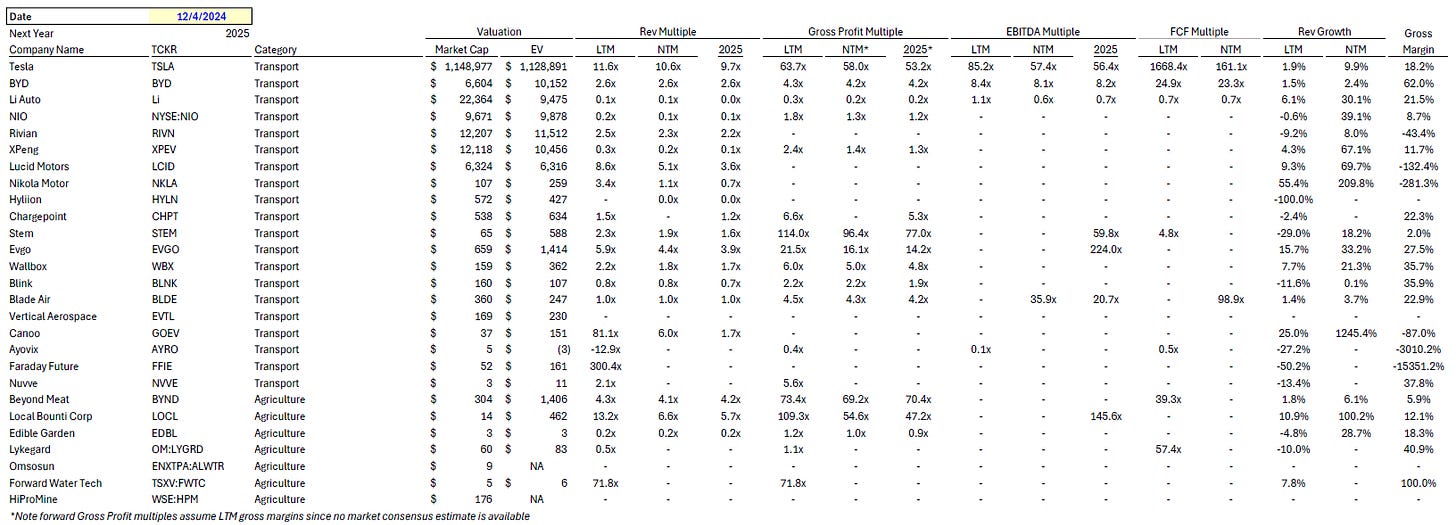

Deep-Dive by Subsector

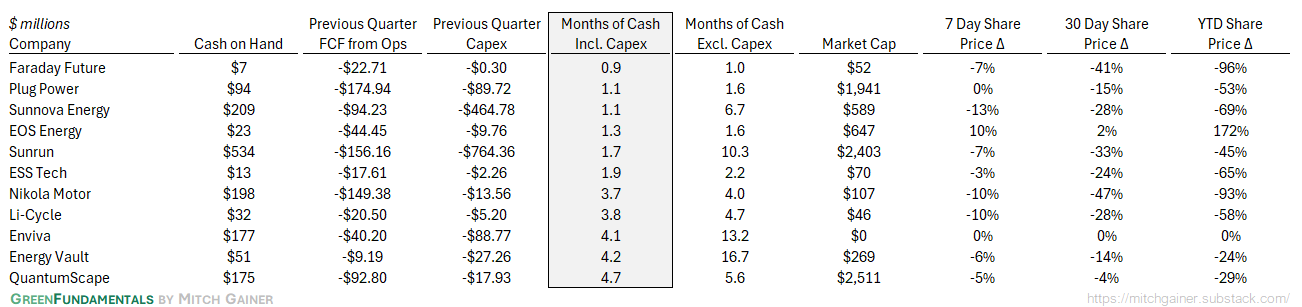

Months of Cash

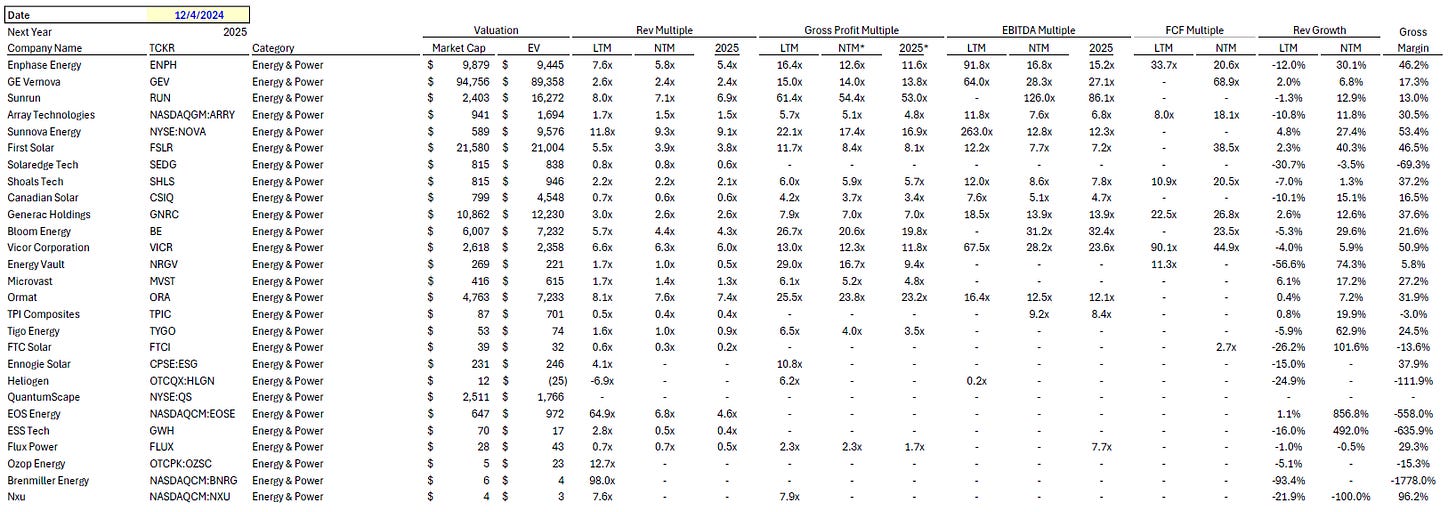

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Wow, highly insightful..The article perfectly resonates with my views on Kior's bankruptcy while the company was pursuing certification of pyrolysis to jet fuel track..