Green Fundamentals: Wrangling Battery Supply Chains and Herding CATL

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

A battery supply chain revolution unfolds as winners emerge and growth accelerates

What Happened: Chinese battery giant CATL is up 60% year-to-date, establishing itself as a leader in the global battery supply chain. This rise is driven by three key factors:

EV Demand: Automakers like Tesla, BMW, Volkswagen, Mercedes, Stellantis, Honda, Toyota, Hyundai, and NIO rely heavily on CATL for battery supply, ensuring strong and sustained demand.

Innovation: CATL continues to innovate, introducing sodium-ion batteries and super-range hybrids, pushing the technology frontier in both cost and performance.

Market Expansion: Beyond EVs, CATL has aggressively expanded into energy storage systems, growing by 46.8% in 2023, outpacing 32.6% growth for the EV battery business.

Meanwhile, U.S.-based battery supply chains are receiving unprecedented levels of investment and scrutiny, positioning domestic manufacturers to compete more effectively in the global landscape. On October 24, 2024, the Treasury released the final guidelines for 45X, which includes incentives for critical mineral supply chains and U.S. manufacturing incentives. On September 26, 2024, the DOE announced $3B of incentives across 25 projects to strengthen advanced battery capabilities. And on January 29, 2024, the chairs of two U.S. House Committees asked the Biden administration to investigate four Chinese suppliers (including CATL) of Ford Motors’ new Michigan-Based battery manufacturing facility.

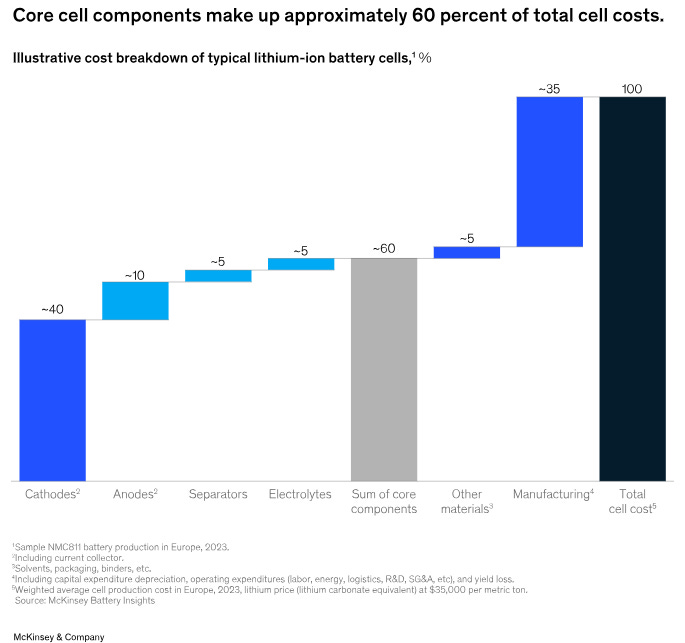

Market: Core cell components make-up 60% of total battery cell costs. The battery component market is expected to grow 2.5x by 2030 (17% CAGR). This growth is fueled by surging demand for electric vehicles and energy storage systems, with key components like cathodes, anodes, and separators in high demand. In particular, the U.S. and Europe are facing a supply-demand imbalance, creating significant investment opportunities in expanding domestic production capabilities and reducing reliance on foreign suppliers.

Source: McKinsey

Historically, batteries have been a tough investment due to shifting chemistry and volatile economics. Raw material costs for key components like cobalt, nickel, and lithium have been highly volatile due to supply chain constraints, geopolitical risks, and fluctuating demand. Cobalt prices, for example, have spiked amid instability in the Democratic Republic of Congo, while lithium prices have surged (and crashed) as demand outpaces supply. Companies pursuing new chemistries have not faired well, such as Cuberg and Ambri.

Technologies: Today, the landscape is different. Technology roadmaps and market applications and become clearer and eagle eyed investors will find superior returns.

NMC (Nickel Manganese Cobalt): With high energy density, NMC is a key choice for premium EVs, especially in the U.S. and Europe, where long-range performance is a priority.

LFP (Lithium Iron Phosphate): LFP offers lower cost, higher safety, and longer cycle life, making it ideal for mass-market EVs and energy storage systems. Its increasing adoption in China and other markets highlights its strength in cost-sensitive applications.

Sodium-Ion: A low-cost alternative to lithium-ion, sodium-ion batteries are emerging for grid storage and low-cost EV applications due to their reliance on abundant materials and competitive price points.

Solid-State Batteries: Though still in development, solid-state batteries promise higher energy density and improved safety, positioning them as a future disruptor for high-performance EVs and electronics by 2030.

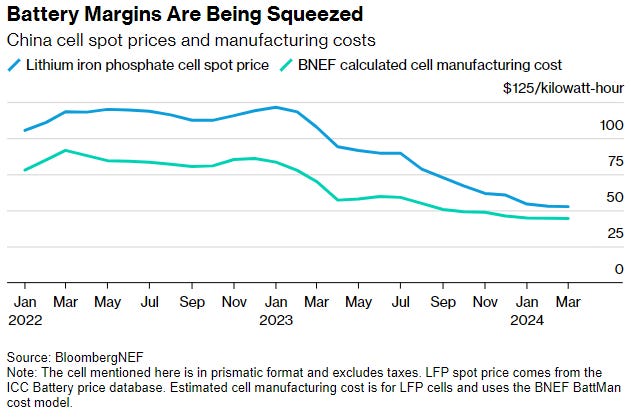

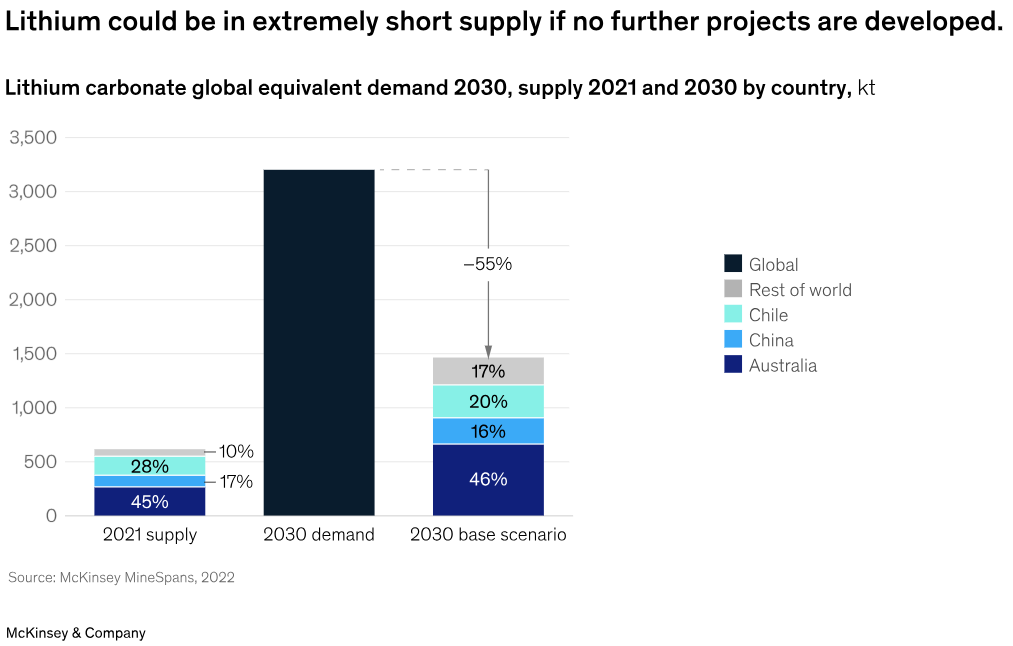

Economics: Battery prices continue to decline, driven by advancements in manufacturing automation and higher production yields, particularly in China. CATL and other Chinese manufacturers maintain a lead in efficiency, keeping spot prices at historical lows, even if these prices are not fully reflected in the U.S. market. However, challenges loom, especially with projected lithium shortages by 2030, which could reverse the current trend of declining prices and squeeze margins further.

Source: Bloomberg NEF

Source: McKinsey

Take-Away: The battery supply chain is undergoing a profound transformation, with established players like CATL capitalizing on strong EV demand, pioneering innovations, and expanding into energy storage. U.S. and European investments in domestic production are gaining momentum, but the risk of raw material shortages—especially lithium—underscores the importance of securing stable, scalable technologies. Strategic investments in NMC, LFP, sodium-ion, and future solid-state batteries can offer substantial returns as the market grows and supply chain disruptions become more manageable.

What Comes Next: Investors can expect rapid growth in the battery market, as more applications become economically feasible amid lower prices. NMC will likely dominate premium EVs, while LFP and sodium-ion will capture cost-conscious EV and energy storage markets. Solid-state batteries could disrupt the industry by 2030, but scaling them remains a challenge.

In the U.S., manufacturers will need to focus on productivity and operational execution to capture opportunities and build competitive advantages. Competing with China’s established efficiency will require mastering high production yields and ensuring that U.S. partners capture sufficient value in joint ventures. The U.S. battery market’s competitiveness will depend on its ability to adopt cost-effective technologies like LFP while scaling domestic production efficiently.

Two questions will persist:

Can the U.S. execute on managing the plants we build (i.e., can we learn enough and hire enough talent to have high production yields)?

Can the U.S. do this without foreign partners capturing too much of the value?

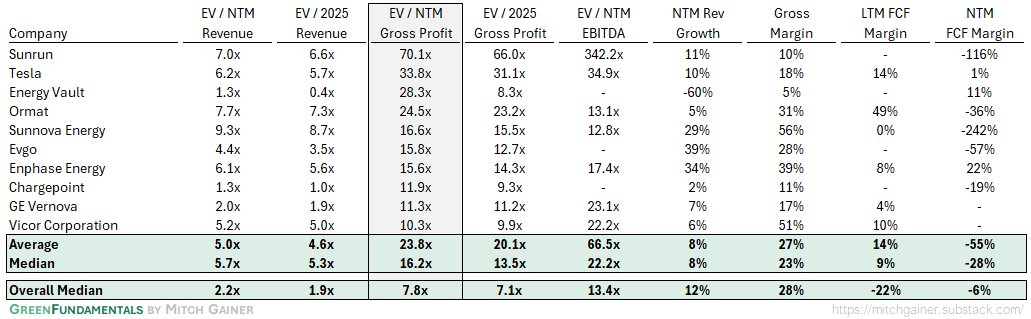

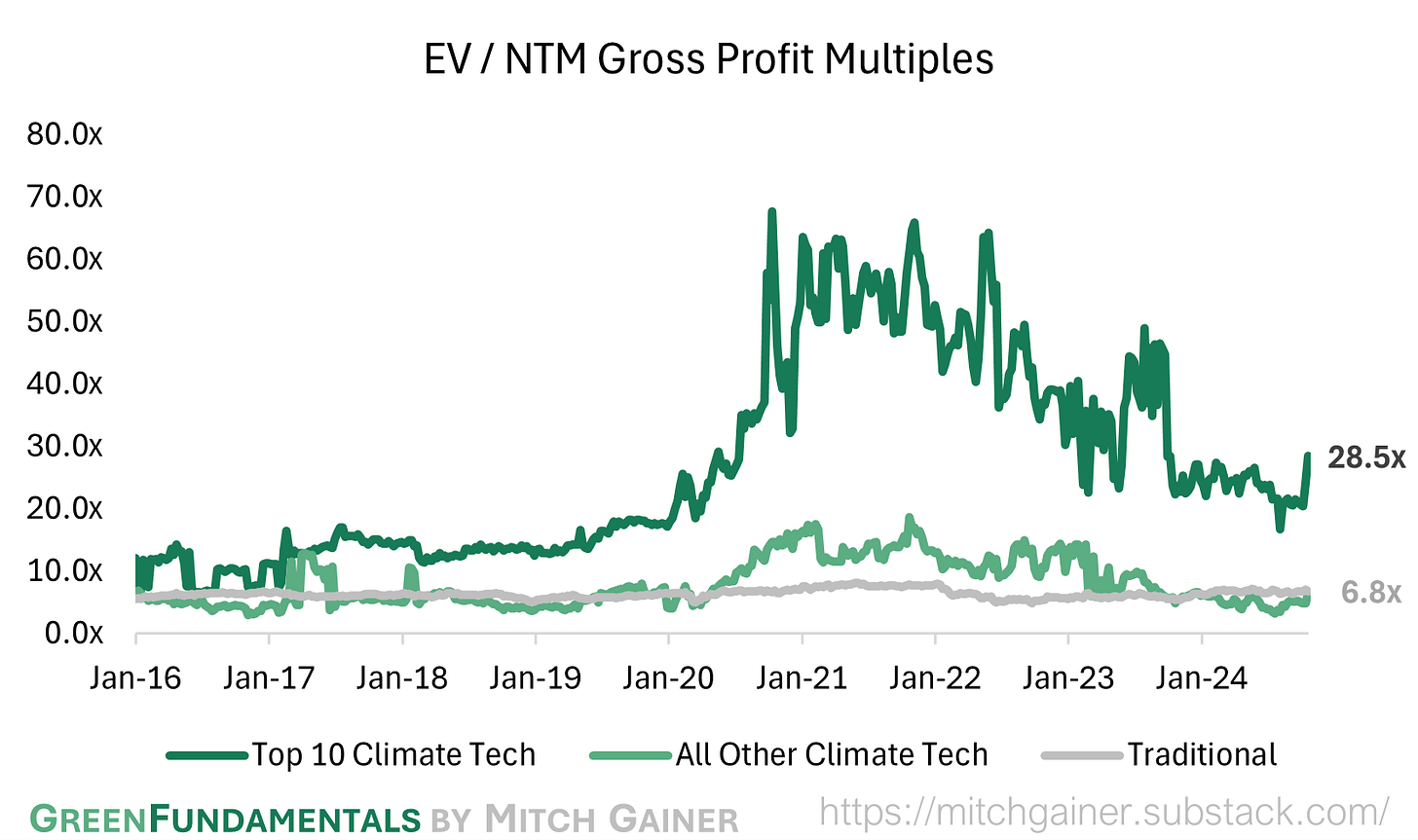

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

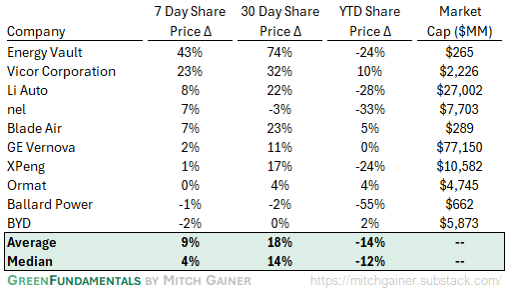

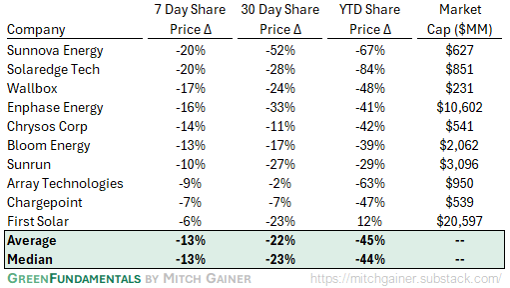

Top 10 and Bottom 10 Weekly Share Price Movement

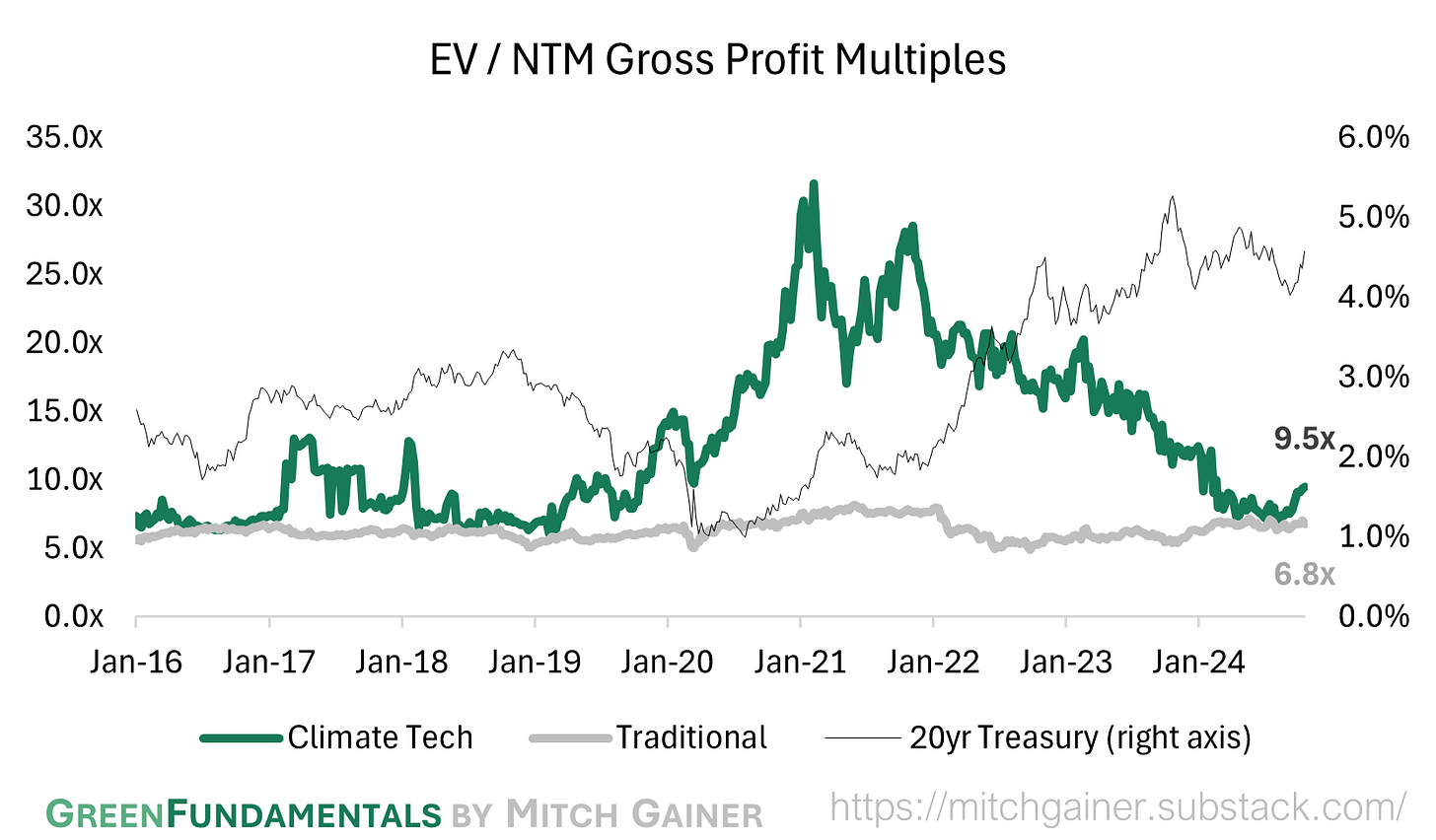

Valuation Multiples over Time

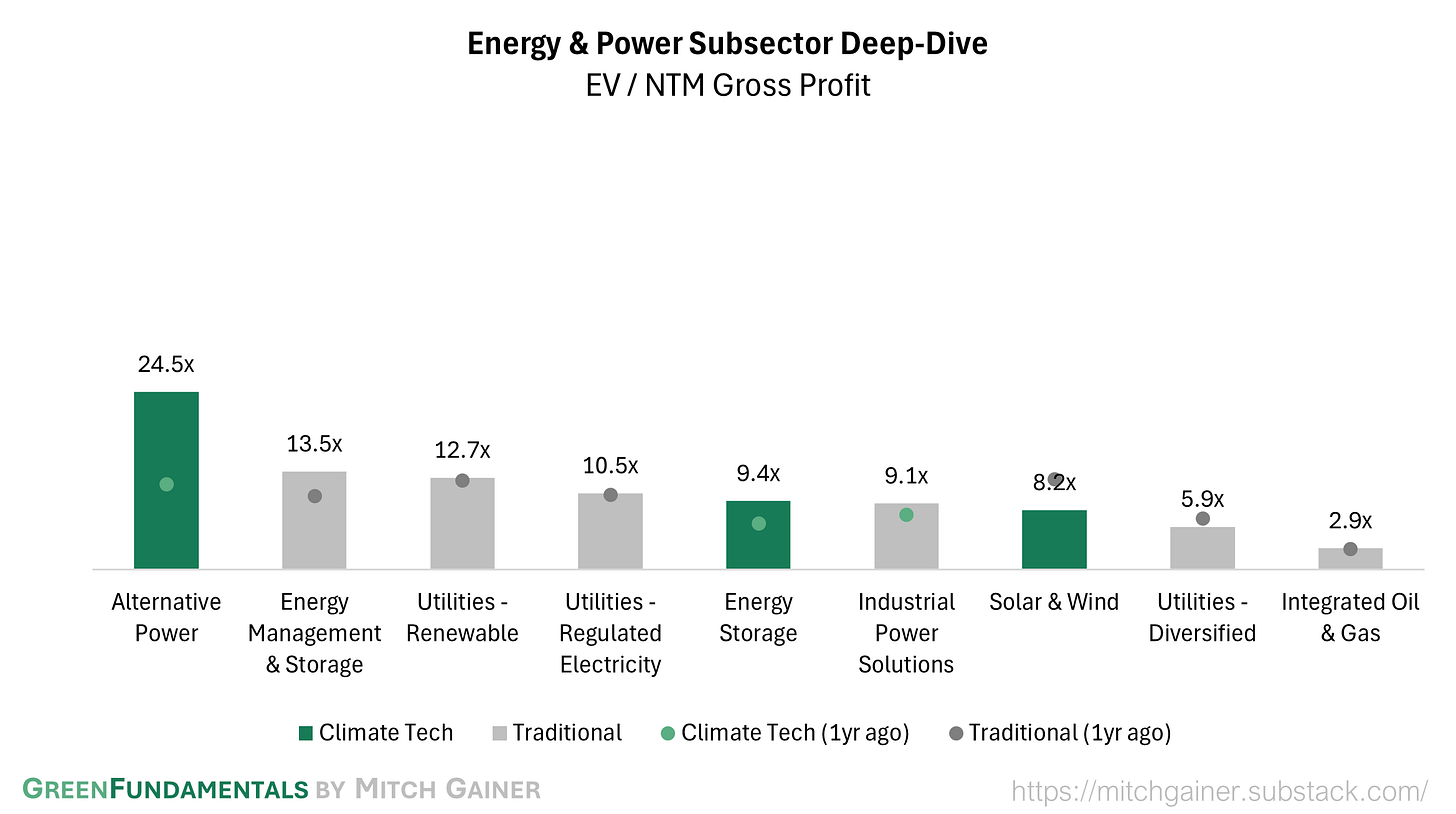

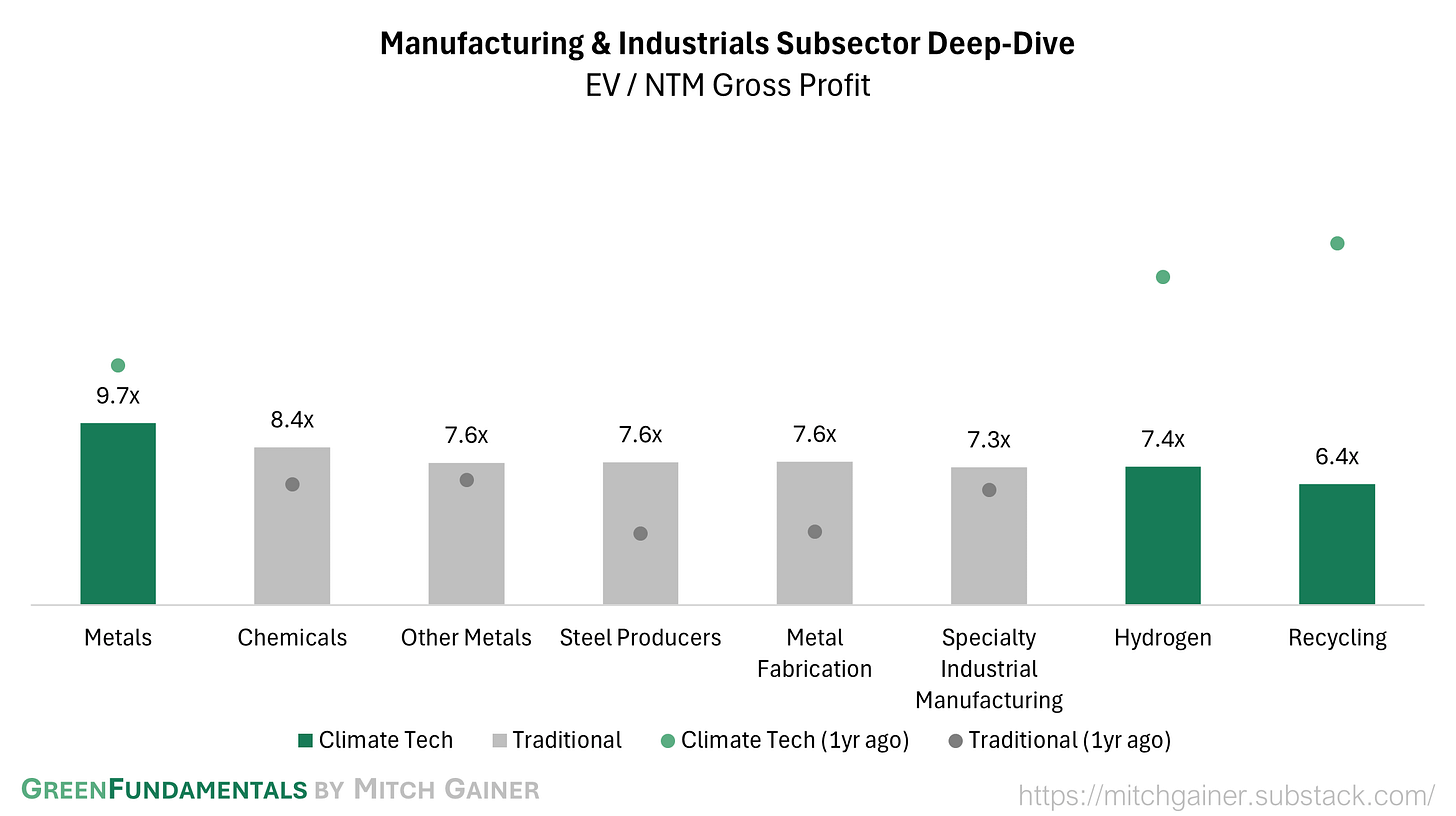

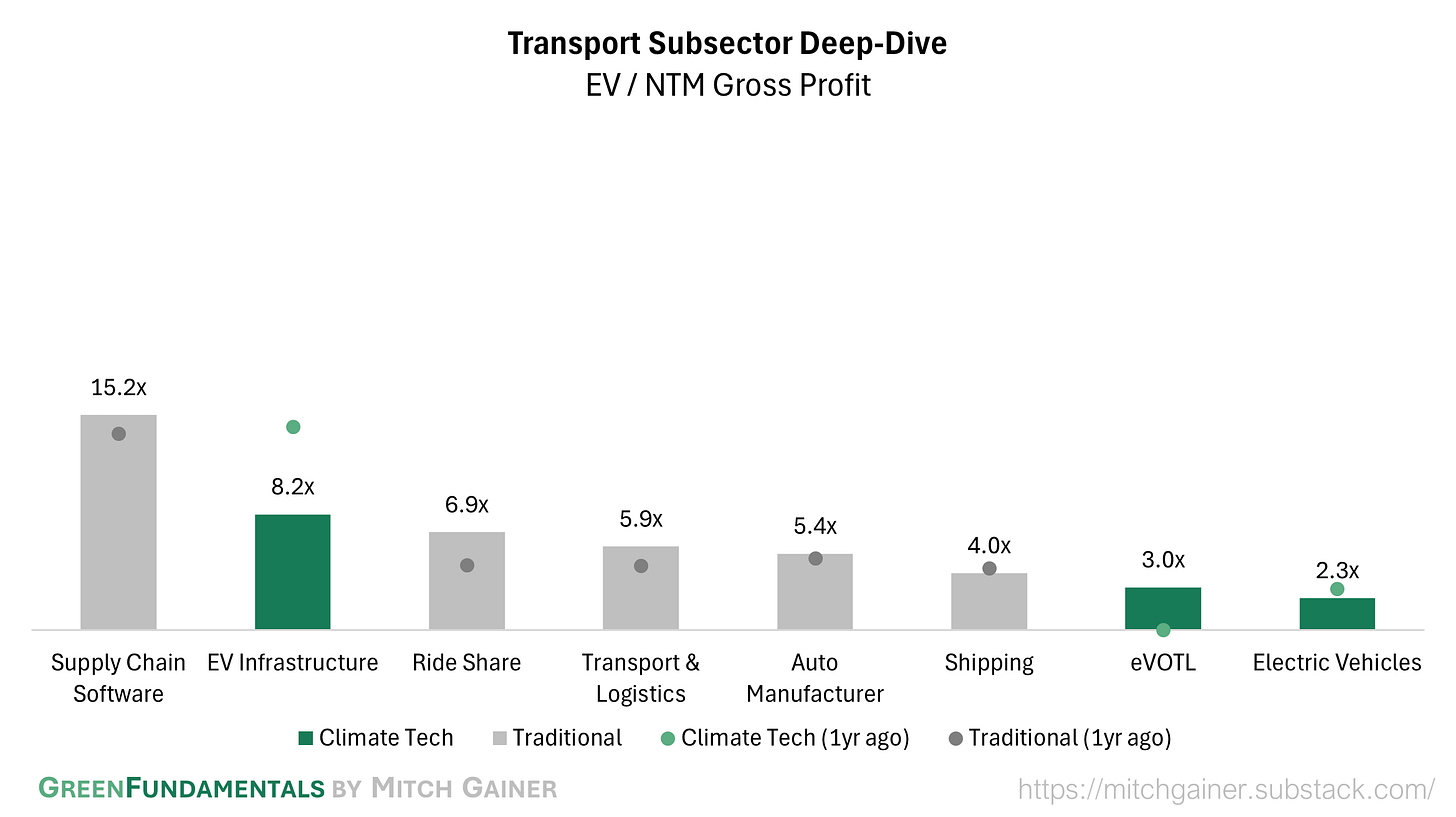

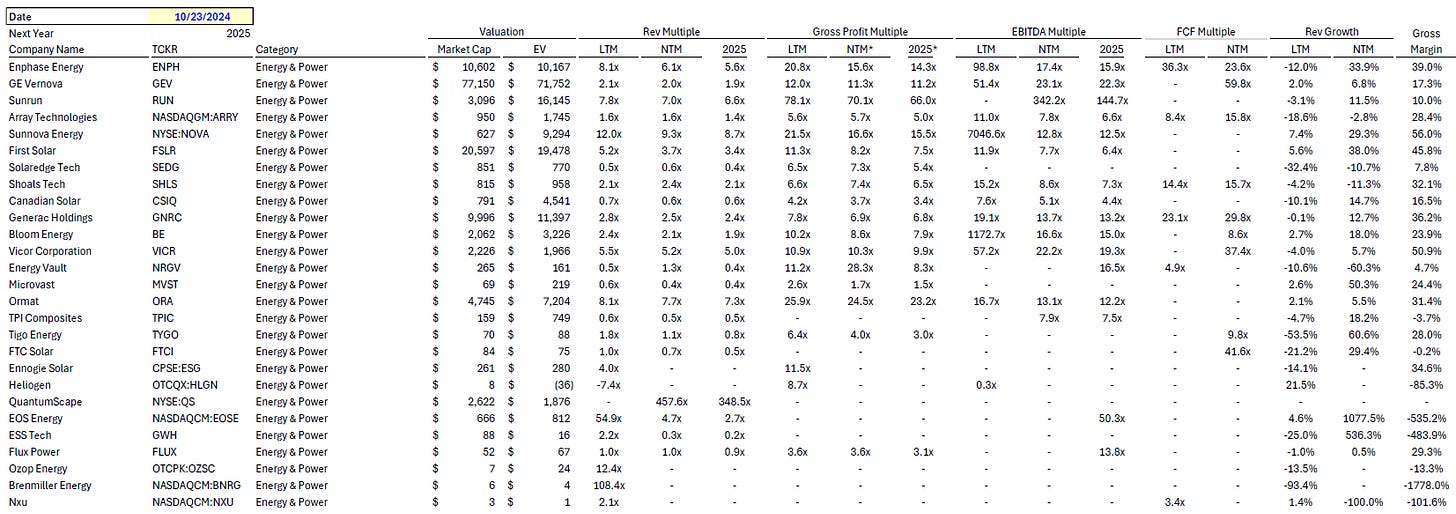

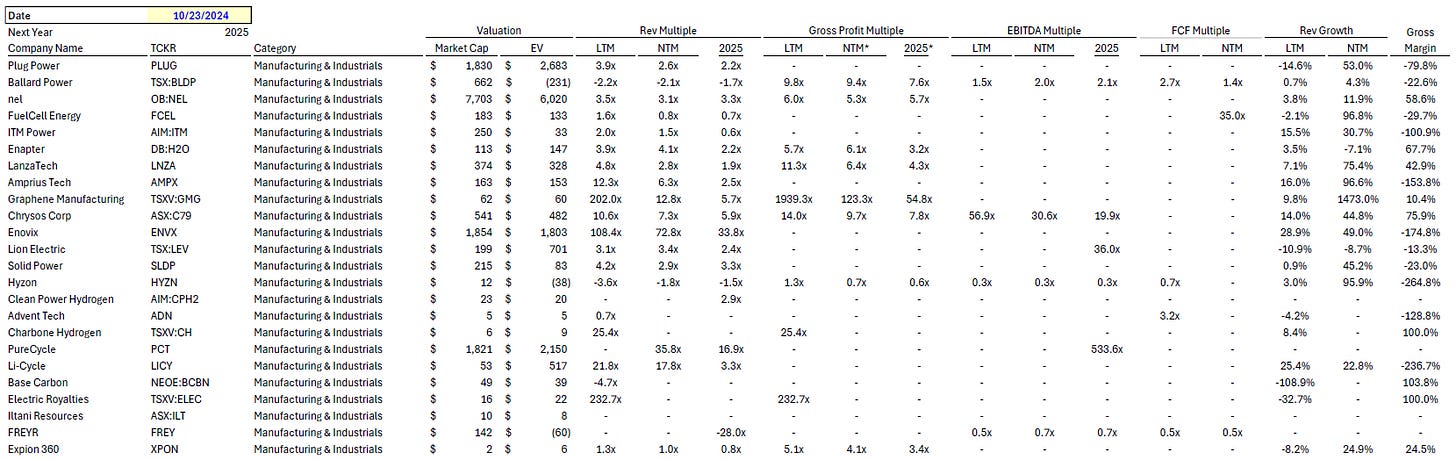

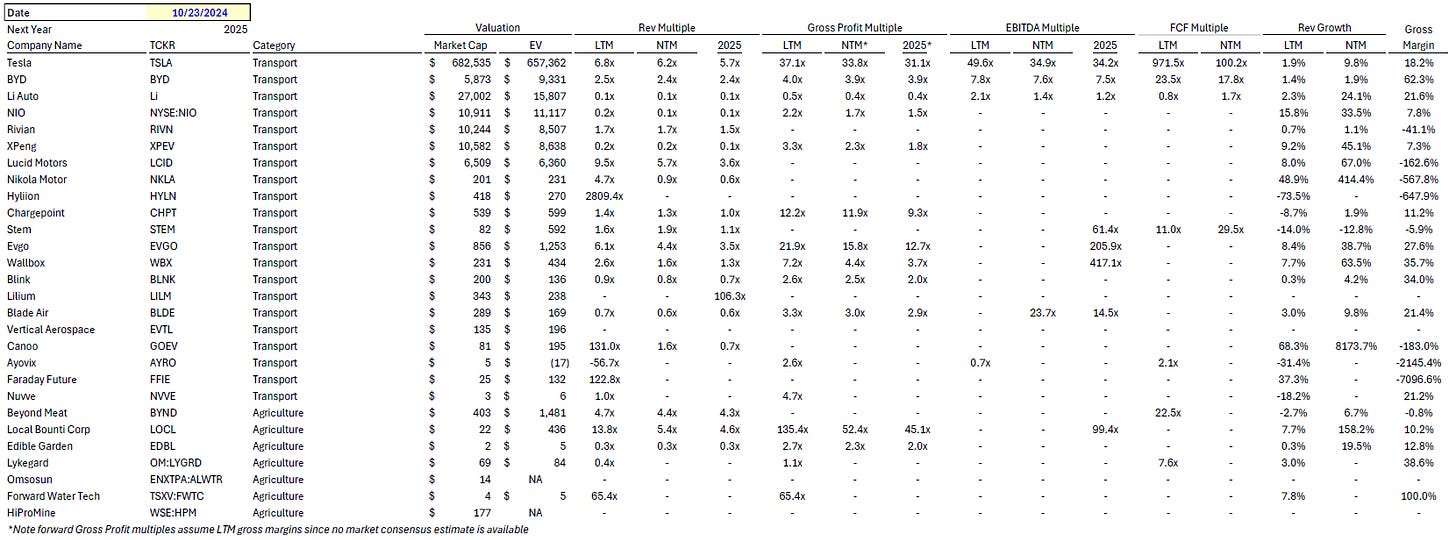

Deep-Dive by Subsector

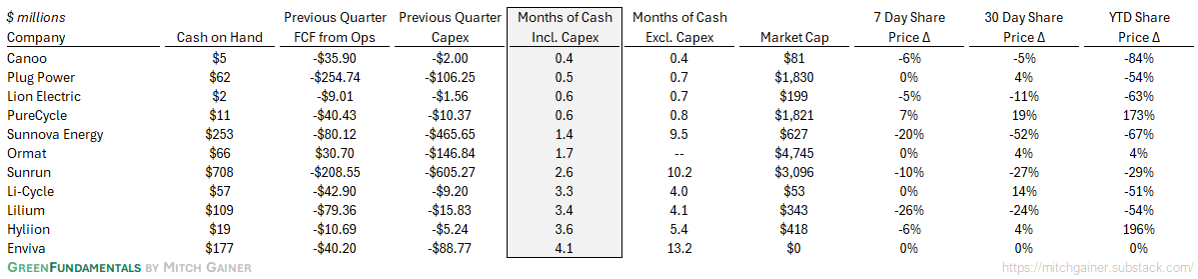

Months of Cash

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.