Green Fundamentals: Climate Policy Under Trump

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Nuclear Revives, Carbon Capture Thrives, the LPO and EPA May Not Survive – Still, the 10 Year Horizon Stays Bright

Based on over a dozen conversations in the past week with policymakers, advocates, lobbyists, non-profits, and several news sources (MIT, Brookings, Policy Center, etc.). I’ve formed an early perspective on how climate policy and the IRA may change under the next administration. This is subject to change and will be greatly determined by the future Treasury and DOE secretaries. If you are interested in a webinar discussing this further, please express interest in the link below!

Trump is prioritizing “energy dominance” and “domestic manufacturing”. The incoming administration understands the challenges presented by load growth from data centers and AI. They are also unlikely to distinguish “clean firm power” from just “firm power” and “all of the above”. Expect major benefits for nuclear, geothermal, natural gas, and carbon capture and sequestration.

Winners and losers are taking form with early signals from the new administration. The exact nuances of how the administration will enact these changes are complicated (and laid out below). Here is an early take on where different policy provisions stand:

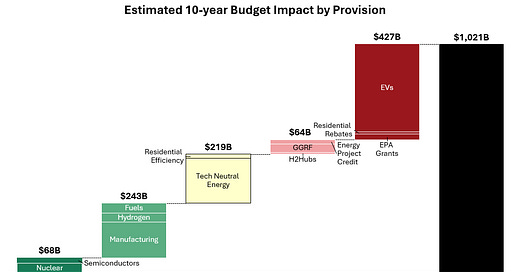

Source: Wharton Budget Model, analysis below

Note: Estimates above are based on expected deficit impact; as a result, some ‘money earning’ programs like the Loan Programs Office are not included. Because many of the benefits are uncapped, the true 10-year spend is uncertain. The Wharton Budget Model estimates a higher budget impact (~$1 trillion) than the most recent CBO estimates ($660B).

SAFE: Most likely safe (or even accelerated) under the new administration

Nuclear (45J Advanced Nuclear Power Facility Production Credit)

Nuclear (45U Zero-Emission Nuclear Power Production Credit)

Carbon Capture Utilization and Sequestration (45Q CCUS Credit)

Semiconductors (48D Advanced Manufacturing Investment Credit)

Domestic content requirements

Transferability rules

Interest rate cuts from the Fed

CCUS (45Q) could see a CO2 parity bill passing. Republicans have long wanted to deliver similarly valued credits for enhanced oil recovery (EOR), sequestration, and utilization. This would put all three on equal footing, largely benefiting oil and gas.

Domestic content requirements won’t get eliminated but could shift from a credit bonus to a requirement. Today, it is a bonus on the tax credit - if the applicant meets the domestic qualifications requirements they get additional credits. Trump could change this to be a requirement (and eliminate the bonus).

The rules released by the Treasury governing how tax credits are transferred is unlikely to change. While the low-income community bonuses, wage and apprenticeship requirements, and energy community bonuses may change, they will likely be transferred in the same way.

Federal Reserve rate cuts are more probable. Despite concerns about the Fed's independence, Trump previously expedited rate reductions and may do so again. Notably, even with recent cuts and the election, the 10-year Treasury yield has risen, not declined.

Source: Publicly available data on the fed funds rate and 10 year treasuries

LIKELY SAFE: Uncertain under the new administration, requires an act of Congress

Manufacturing (45X Advanced Manufacturing Production Credit)

Clean Fuels (45Z Clean Fuel Production Credit)

Sustainable Aviation Fuel (40B Sustainable Aviation Fuel Credit)

Hydrogen (45V Clean Hydrogen Production Tax Credit)

Methane Reduction

Grid build-out and permitting

The clean fuels credit (45Z) is very pro-farmer. It will likely get extended from 3 years to 10 years (accompanied with a ban on foreign feedstocks). The SAF credit (40B) sunsets at the end of this year anyway.

The hydrogen credit could thrive under Trump. While repeal is possible to fund tax cuts, key Republican-aligned industries (oil, gas, industrial gas) are heavily investing in hydrogen. Biden's strict three-pillars framework limits eligibility, but Trump may loosen these rules, expanding project access and boosting investment opportunities.

There is bipartisan support for the oil and gas industry’s commitment to curb methane emissions to demonstrate natural gas can be cleaner. A new administration may help accelerate this commitment.

Grid permitting has bipartisan support and is likely to continue. While the Energy Permitting Reform Act (EPRA) may face revisions under the new Senate Energy Committee, its passage remains possible. Bipartisan efforts to expand transmission and boost clean energy with government purchasing may see delays or lower priority under the new administration.

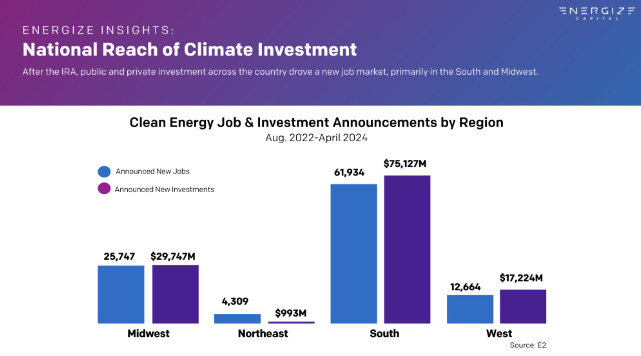

Many of these tax credits, especially the manufacturing tax credits, benefit Republican districts. A critical question is whether this will protect key manufacturing provisions like 45X and 48C.

Source: Energize

POSSIBLE RISK: Disliked by the new administration, requires an act of Congress

Residential Efficiency (25C Energy Efficient Home Improvement Credit)

Residential Energy (25D Residential Clean Energy Credit)

Technology-Neutral Energy (48E Clean Electricity Investment Tax Credit)

Energy (45Y Clean Electricity Production Tax Credit)

Paris Climate Agreement

Technology-neutral credits (i.e., wind solar) could revert to pre-IRA levels. Congress may retain standard credits, eliminate bonus incentives (e.g., fair wage), and make domestic content mandatory. Credits might also return to two-year renewals, reintroducing opportunities for congressional amendments.

Trump may be less likely to withdraw from the Paris Agreement again. Oil and gas advocates support staying in. Notably, during his first term, U.S. emissions fell close to Paris targets due to market-driven shifts from coal to natural gas.

IMPLEMENTATION RISK: Disliked by new administration, punitive implementation possible

Energy (48C Advanced Energy Project Credit)

Greenhouse Gas Reduction Fund (GGRF)

Loan Programs Office (existing loan applications)

Hydrogen Hubs

The Greenhouse Gas Reduction Funds may get clawed back. Technically, the Impoundment Act forbids this, but there is a gray area on whether it is technically considered ‘obligated’. Recipients of these funds are hoping for the best and preparing for the worst.

Loans closed by the LPO will be honored, but conditional commitments are likely to be suspended. Deals not reaching financial close by inauguration may be delayed until the new administration sets its LPO strategy, as disbursed funds are legally protected once milestones are met.

Hydrogen hubs face challenges, even without a new administration. Three of seven hubs are set to receive funding (all three of which are more ‘green’ focused), while the remaining four fossil-fuel-focused hubs may gain political support but face viability concerns.

If the energy tax credits are repealed, project investment is expected to fall by 17%. While this isn’t a death knell, it is a setback for the industry.

Source: BloombergNEF

SIGNIFICANT RISK: Disliked by the new administration, executive actions can alter these

Electric Vehicles (30D Clean Vehicle Tax Credit)

Residential Rebates (Home Energy Rebate Programs)

Fuel economy regulations

EPA Grants

Loan Programs Office (new loans)

Elon Musk is a wild card for the EV tax credits. Trump ran on abolishing the EV tax credits. But Tesla could stand to gain from changes in the rules governing these credits.

Some states are still negotiating the home energy rebate programs. Some states have already launched. They received have their money and the remaining half is likely safe (AZ, CA, CO, DC, ME, MI, NM, NY, RI, WI). Other states are under negotiation and though 25% of the funds have been received, the remaining is at risk (GA, IN, MA, MN, NC, NH, OR, VT, WA).

Trump may roll back fuel economy standards again. In his first term, Trump rolled back Obama-era fuel economy standards by freezing annual efficiency improvements at 1.5% through 2026 (down from 5%) and revoking California's waiver to set stricter emissions rules, limiting state-level regulations.

The LPO has a $250B pipeline; anything that isn’t closed by inauguration is on pause. There are some rumors of a plan to redirect LPO funds to nuclear and other industry-friendly projects (chemicals, utility projects). On the other hand, it may go into hibernation as it did in the first Trump term.

WHAT’S NEXT: Legislation to watch

The Tax Superbowl is coming in 2025. The Tax Cuts and Jobs Act of 2017 is set to sunset at the end of 2025. If Congress does nothing, there will be a significant tax increase under Trump. Up for negotiation are individual and corporate tax rates, the child tax credit, business income deduction, and any IRA provisions Republicans would want to repeal.

A major tax bill is likely to move through sequestration, and repealing climate policy that requires an act of Congress could be part of this. Think tanks believe these could include proposals to make previous tax cuts permanent and add further cuts. Since the Trump administration also wants to reduce the deficit, they may look to cutting spending from the Inflation Reduction Act to do this.

If federal climate action stalls, states like New York and California, and initiatives like the Northeast's RGGI, can fill the gap. Look to those states to strengthen renewable standards, clean energy incentives, and emissions caps. While states and cities are at a much smaller scale than the federal government, their market influence and regional cooperation can drive innovation, attract investment, and sustain emissions reductions despite federal rollbacks.

While climate investment may decline, the 10-year horizon is bright. Investment was increasing before the IRA and it will continue to do so if parts or all of it are repealed. The market has taken hold of this trend. Clean energy and advanced manufacturing have superior unit economics. Politics be damned.

Source: Rhodium Group Clean Investment Monitor

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

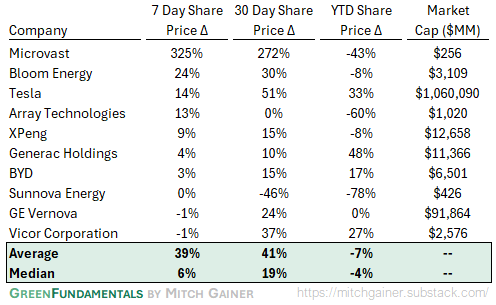

Top 10 and Bottom 10 Weekly Share Price Movement

Valuation Multiples over Time

Deep-Dive by Subsector

Months of Cash

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

•• An Open Letter to Trump Voters ••

The True Cost of Your Ignorance and Idolatry

https://open.substack.com/pub/patricemersault/p/an-open-letter-to-trump-voters?r=4d7sow&utm_campaign=post&utm_medium=web