Green Fundamentals: Community Solar Hopes are Clouded by California Regulators

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

New community solar rules in California benefit utilities over developers, likely slowing build-out

What Happened: On May 30th, California Public Utilities Commission (CPUC) rejected a proposed new plan to build 8 GW of community solar. The new plan (“Net Value Billing Tariff”) would provide more generous incentives to build and adopt community solar, including a 20% electricity bill subsidy to community solar subscribers. The plan was backed by a coalition of developers, activists, and unions. The CPUC argued that benefits community solar subscribers would harm non-community solar residents and increase energy costs overall.

Instead, the CPUC adopted a plan that only makes small changes. They revamped two existing programs, but without significant changes to incentives it is unlikely to meaningfully increase build-out. They also added a third new program, which enables investor-owned utilities to manage customers subscribing to new community solar. On the back of this news, utility stocks are up (Sempra +3.5%, Edison +2.9%, PG&E +1.4%).

Background: Community solar falls between rooftop and utility-scale solar. Community solar projects are typically 1-5 MW, larger than rooftop solar (3-10 kW and not everyone can do it) and smaller than utility-scale (10-100+ MW and face transmission challenges). Community solar is located in the community it serves (imagine an unused lot down the street). Residents ‘sign-up’ to a project and their electricity consumption is offset by the solar electricity produced (without needing to change anything about the customer’s connection to the grid). The benefits are:

Residents get access to low cost solar power when they weren’t able to otherwise (i.e., they are renters or have roofs not suitable for solar), reducing their power bill

Community solar does not require transmission (since it is close to residents it uses existing distribution lines), saving costs and avoiding a key bottleneck

Developers receive state-passed incentives for community solar, generating outsized returns once residents ‘sign up’

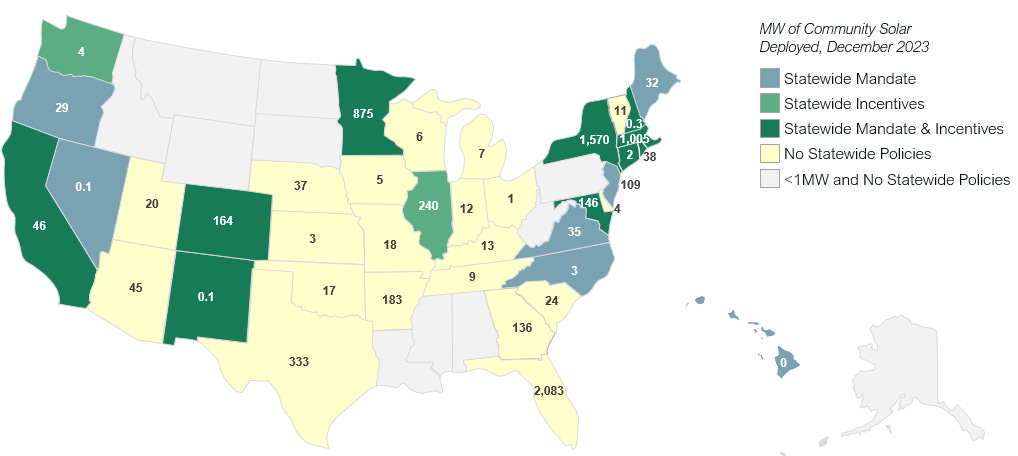

17 States and Washington, D.C. have passed state-level incentives or mandates. States mandate their utilities provide some community solar program to customer (which may include capacity targets, participation requirements, and regulatory frameworks). States can also offer additional incentives to improve the economics (which may include tax credits and exemptions, rebates, performance based incentives, and renewable energy credits). Community solar bills have been introduced and failed in Wisconsin, Pennsylvania, Alaska, Montana, and most recently Michigan.

Source: NREL

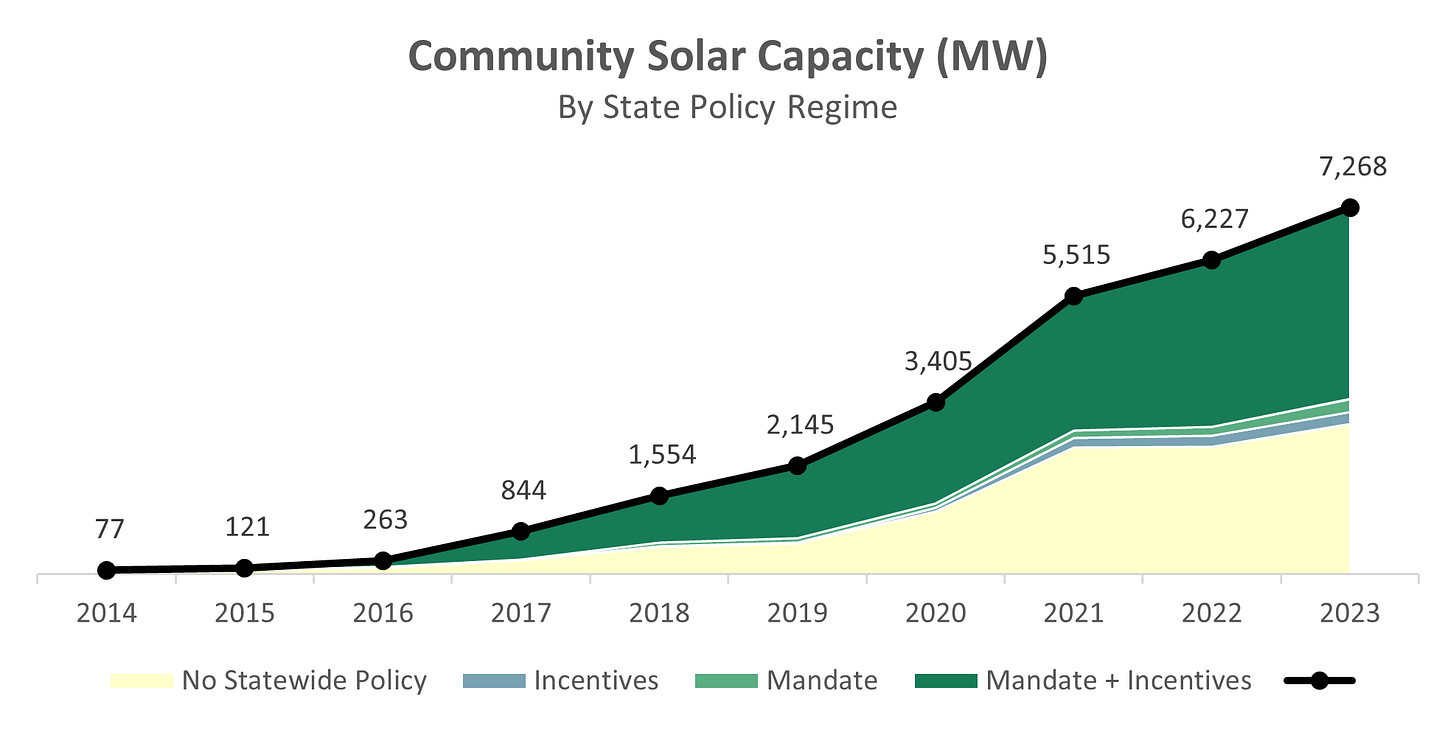

Community solar growth has slowed. While rising interest rates and less ‘low hanging fruit’ contribute to the national slowdown, policy plays a role. Between 2021 and 2023, community solar (MW) in states with no statewide policy increased 18% while in states with mandates or incentives increased 43% (driven mainly by New York and Massachusetts).

Source: NREL

In 2022, California passed a law to accelerate community solar in the state. On September 16, 2022, California signed into law AB 2316 which orders the CPUC to create an equitable and affordable community-solar program. The intent of the law was to accelerate community solar deployment. At the time, this was a major win for community solar advocates, opening one of the largest potential markets in the U.S.

California regulators have made a series of decisions to favor utility-scale solar. In December 2022, California regulators cut compensation for rooftop solar, slowing installations. In December 2023, California regulators overhauled incentives for owners of apartment buildings, schools, and businesses. And now, regulators rejected the more aggressive plan to accelerate community solar. Regulators argue that this ensures the costs of solar are distributed fairly (making solar consumers pay for the cost). Chris Ward, the California assemblymember who wrote the 2022 law, called this “wholly inconsistent” with his legislation.

Take-Away: Community solar is ‘dead on arrival’ in California. California’s regulatory regime favors large utilities and ensures solar development costs are incurred by solar community participants.

What Comes Next: California will likely not see much new community solar this year or next. In April, California secured $250 million in federal IRA funds, some of which will go toward community solar. These funds could make up for weak state incentives.

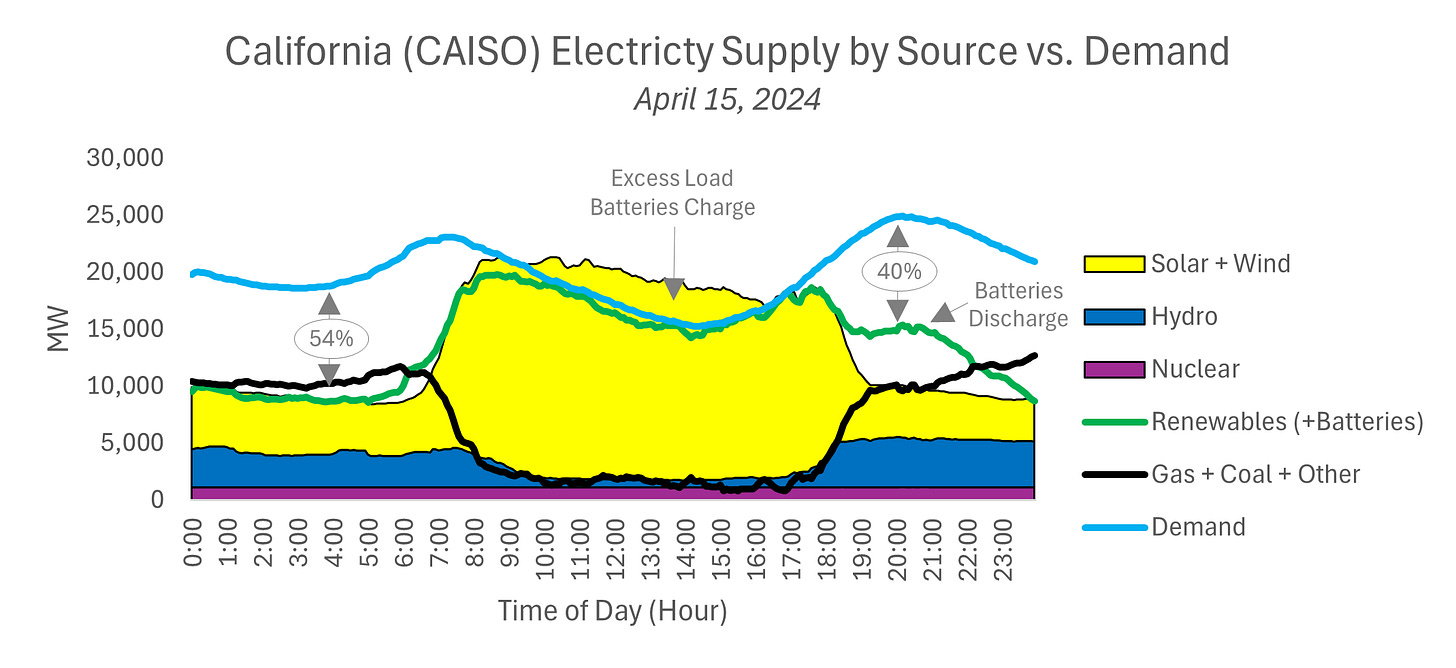

As this newsletter has said before, in California, solar is now supplying more power than demand. Much of the ‘low hanging fruit’ has been built. California will have to address excess production without harming renewable project attractiveness. Storage will be key for continued renewables deployment as will grid control (and possible forced curtailment of solar assets). It’s possible regulators are favoring utility-scale solar over rooftop and community to better navigate the impending challenges and build a more financially sustainable grid.

Source: Green Fundamentals, CAISO data

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

EV Charging: Can streetlights unlock big city EV charging? This startup thinks so (Canary Media)

Aviation Fuel: Swiss Startup Bets on Clean-Fuel Tech to Cut Costs for Airlines (Bloomberg)

Alternative Foods: There’s No Alternative to Alternative Protein (Bezos Earth Fund)

Geothermal: New map shows vast potential for geothermal energy beneath entire US (The Hill)

Private Markets (PE / VC / Real Estate / Infra)

Nuclear: Nuclear politics: Kemp, Granholm host dueling Vogtle victory parties (Atlantic Journal-Constitution)

Wind: As Solar Power Surges, U.S. Wind Is in Trouble (NY Times)

Grid: Who gets to profit from a bigger grid? Ask the states (E&E News)

Heat Pumps: Northvolt founder’s heat pump startup Aira secures €200m in debt (Sifted)

Public Markets (Stocks, Bonds)

Inflation: The Fed Might Soon Have to Worry About More Than Just Inflation (WSJ)

European Central Bank: ECB rate cut to breathe life into Eurozone economy (FT)

Solar: Schneider Electric’s Deal Is Big News for Solar-Power Projects. Why You Should Care. (Barrons)

Solar: SunPower Announces $50 Million Draw on Previously Announced Second Lien Term Loan to Further Business Operations as Company Executes Business Plan (PR Newswire)

Solar: First Solar, Qcells to be US government's preferred green-label panel vendors (Reuters)

Electric Vehicles: China’s plan to sell cheap EVs to the rest of the world (FT)

Electric Vehicles: BYD Launches Hybrids With 1,300-Mile Driving Range (WSJ)

Electric Vehicles: Electric Cars Are Suddenly Becoming Affordable (NY Times)

Government & Policy

Vermont: Vermont becomes first US state to make Big Oil pay for climate damages (FT)

Massachusetts: The emerging world leader in climate tech could soon be Massachusetts, experts say (ABC)

Virginia: Virginia Passed a Law Adopting California’s EV Standards. Now It Wants Out. (WSJ)

Trade: US set to impose 100% tariff on Chinese electric vehicle imports (FT)

Trade: How America Inadvertently Created an ‘Axis of Evasion’ Led by China (WSJ)

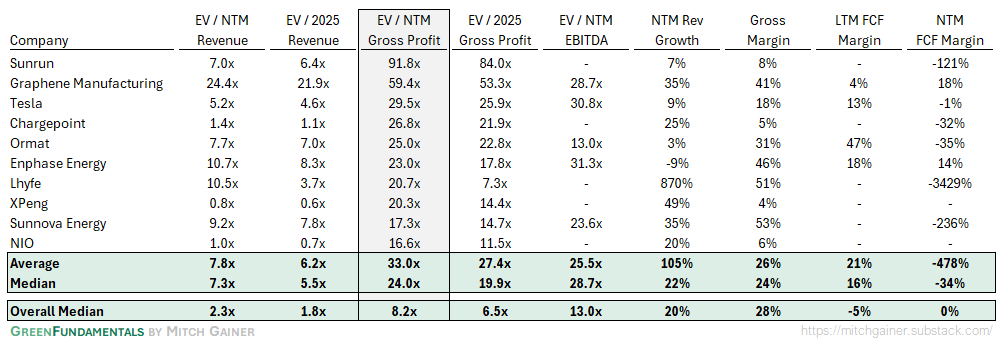

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

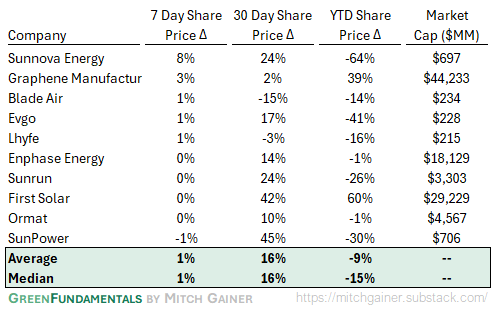

Top 10 Weekly Share Price Movement

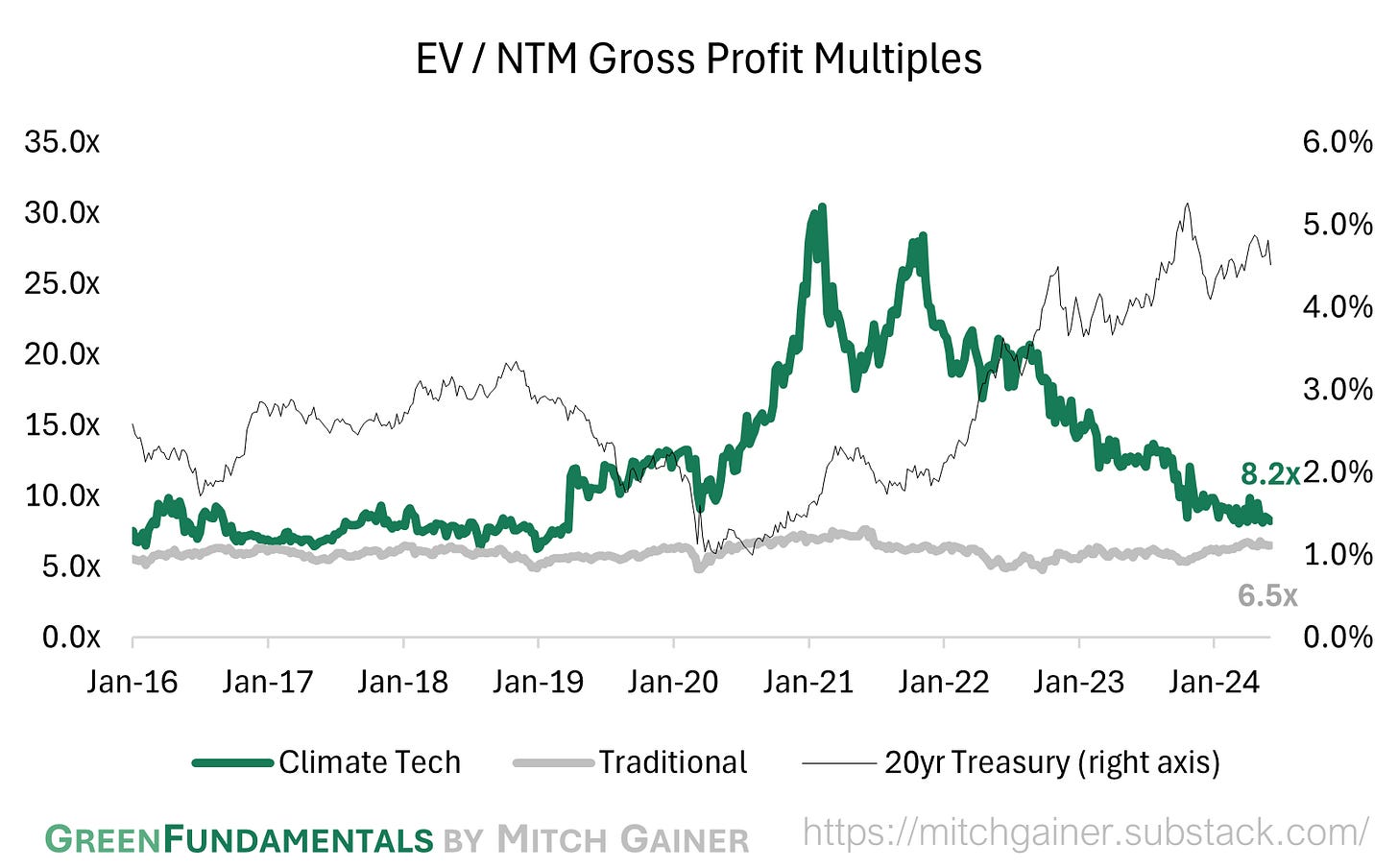

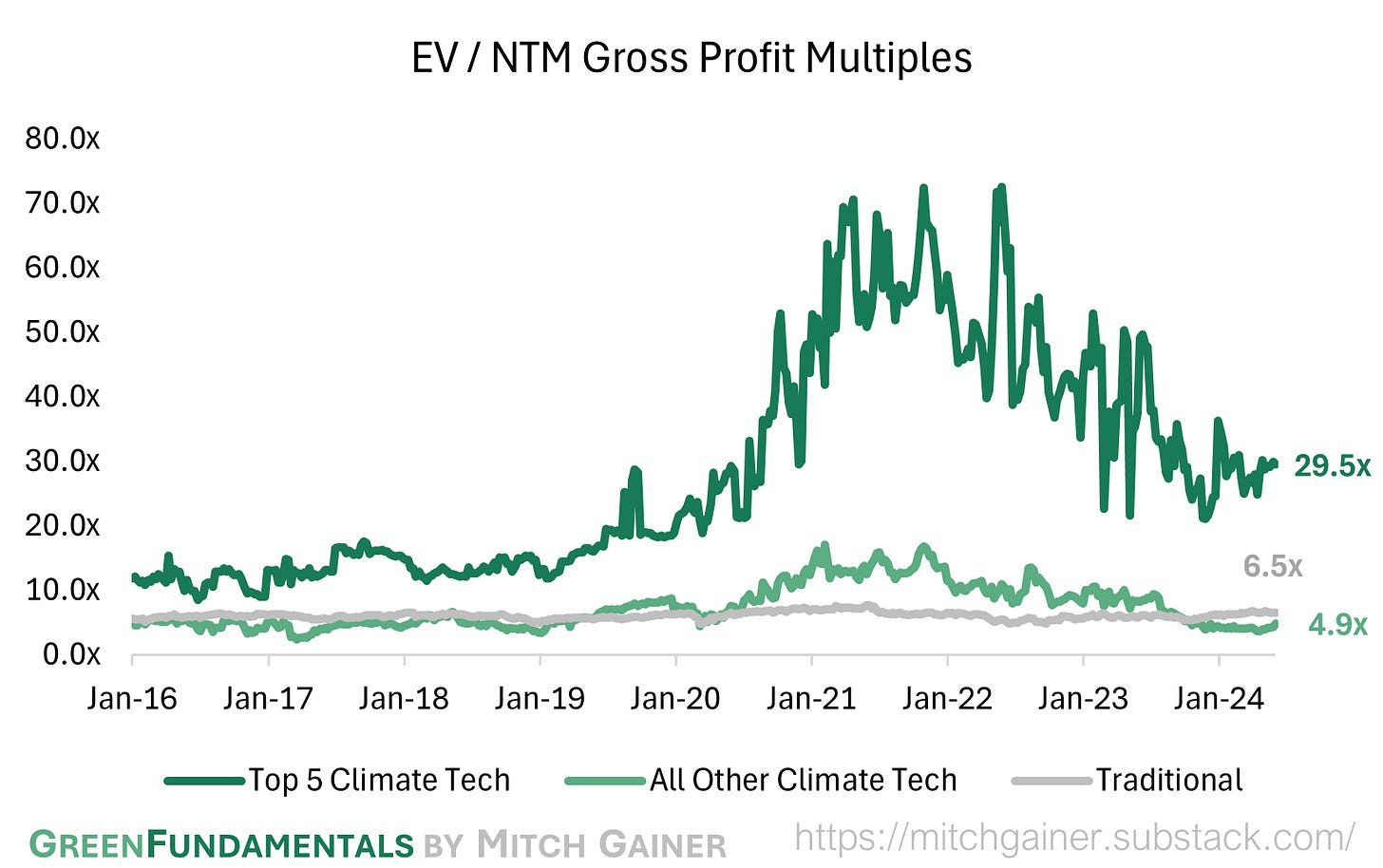

Valuation Multiples over Time

Take-Away: As interest rates have increased, valuations of growth-focused climate tech have declined (similar to other growth-focused industries like cloud software), reducing the premium to their near-term focused, traditional industry peers.

Take-Away: The Top 5 Climate Tech companies account for all of the premium Climate Tech has over Traditional Industries.

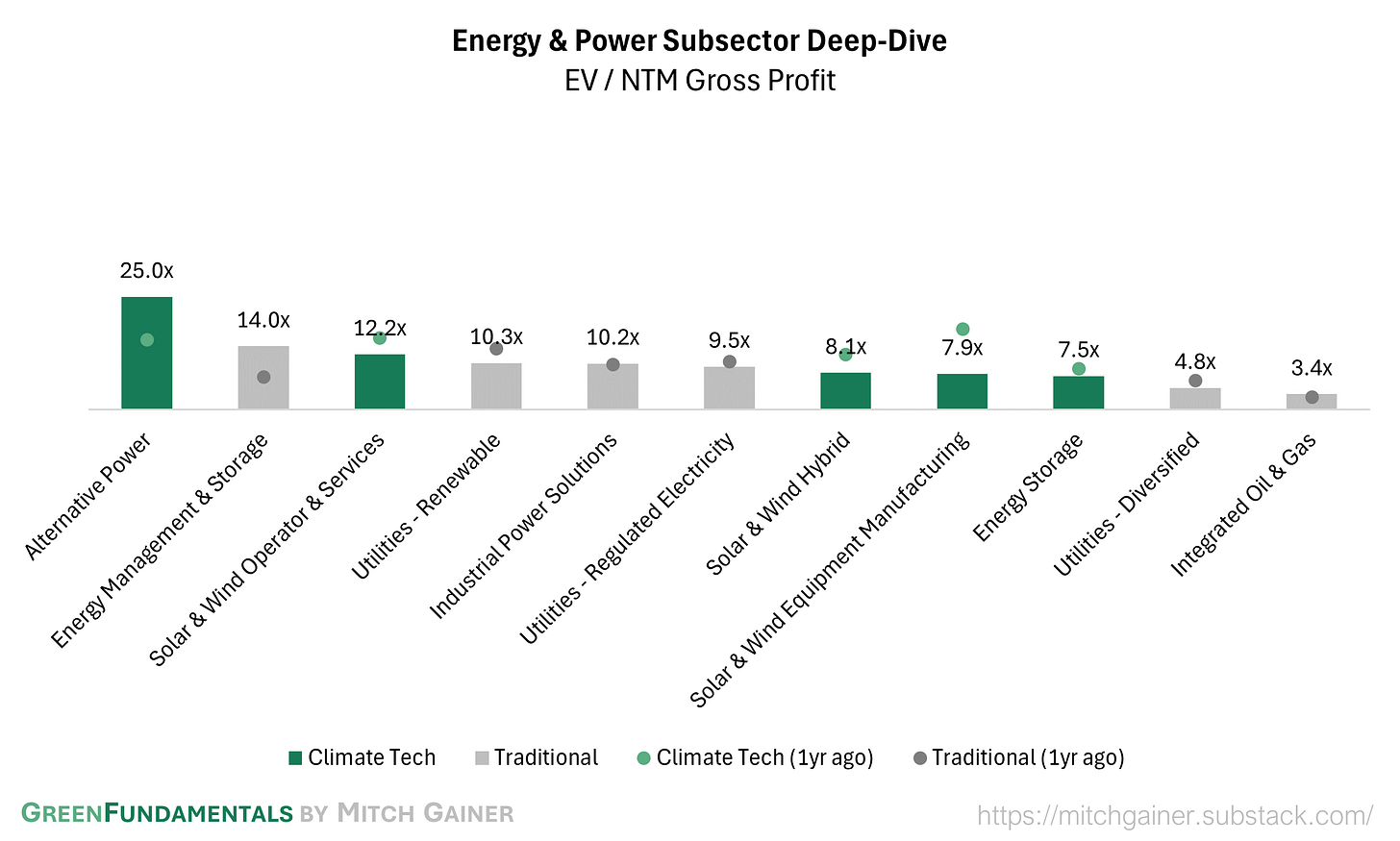

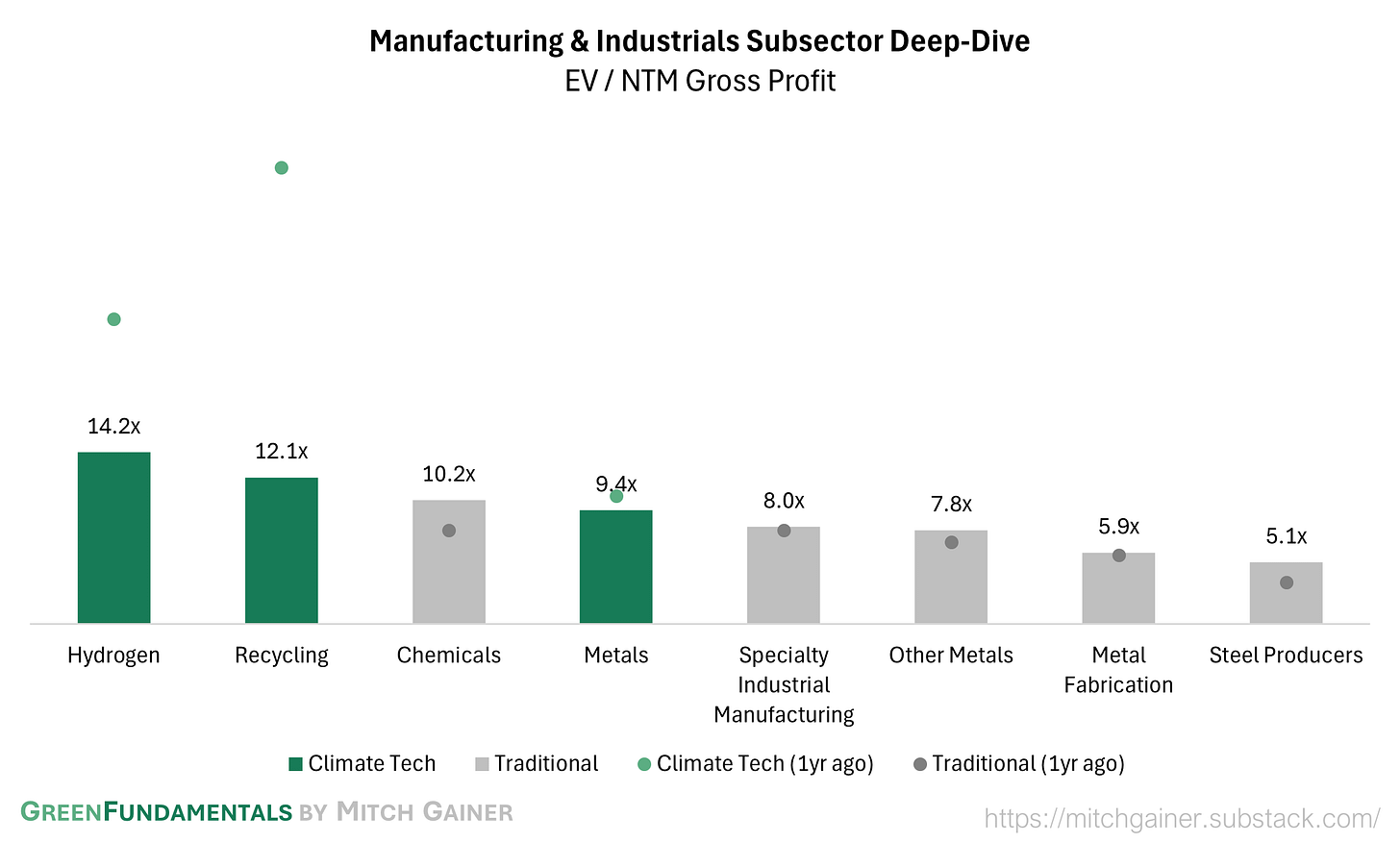

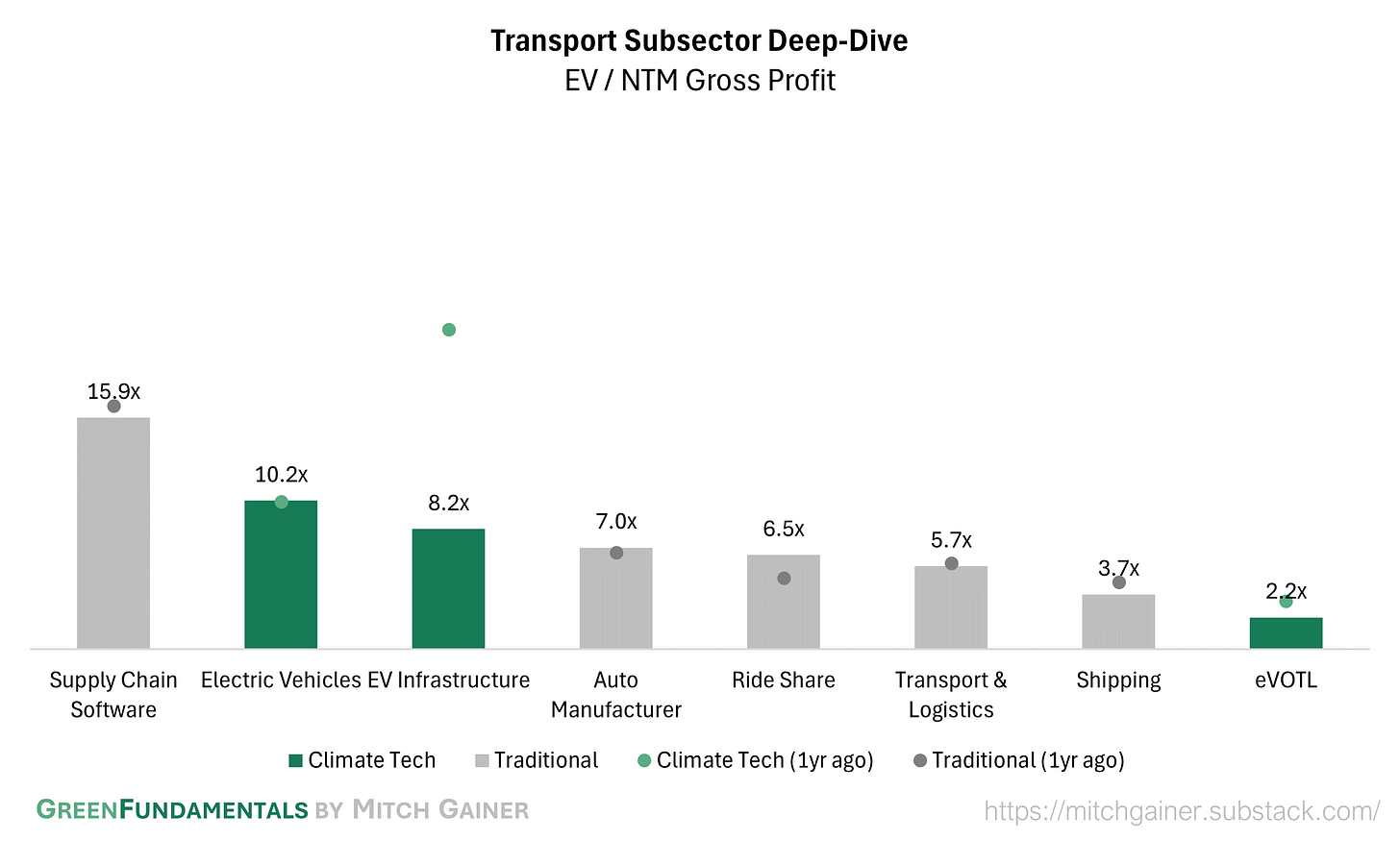

Deep-Dive by Subsector

Energy & Power: Mature and bankable climate tech (pure-play solar & wind services, alt. power) commands a higher premium, while more speculative (storage) has less; the market is more skeptical on hybrid solar & wind business models (combining manufacturing with services or operations).

Manufacturing & Industrials: Both traditional and emerging companies around critical minerals supply command a premium. Hydrogen valuations are improving, but still down over the previous year.

Transport: EV growth is priced in to climate tech and traditional companies; the market is skeptical on eVOTL.

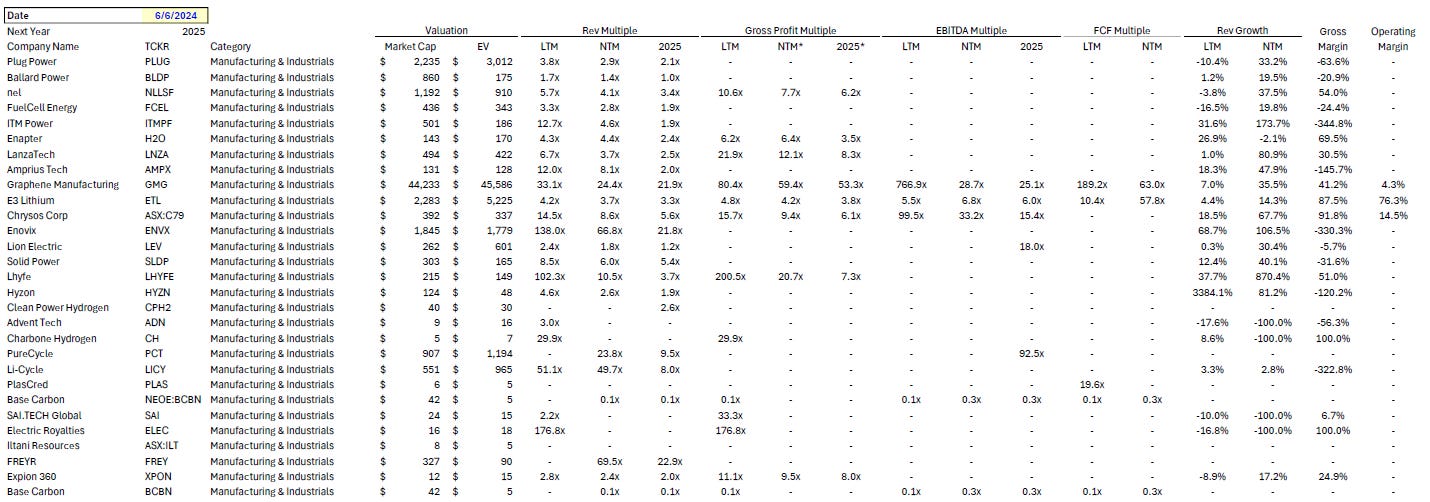

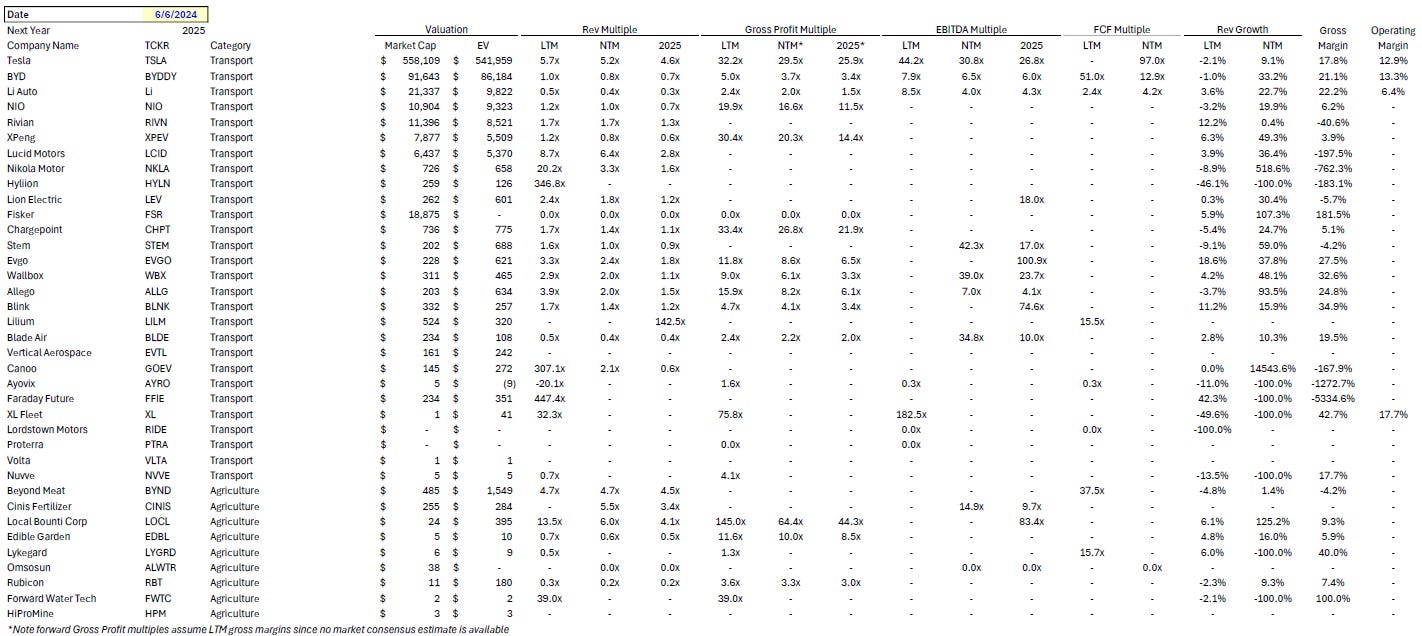

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.