Green Fundamentals: Industrial Heat is Catching Fire

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

The Industrial Heat Revolution is Already Underway with Cutting-Edge Pilot Projects, Bankability is Not Far Off

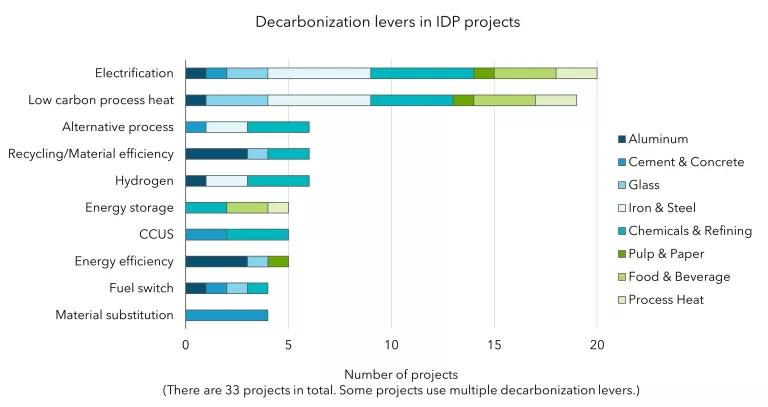

What Happened: On August 13, Echogen Power Systems announced a pilot High Temperature Heat Pump system with $3M funding from the DOE Industrial Efficiency and Decarbonization Office. Several other major pilots have already been announced, including Rondo, Antora, Brenmiller, Johnson Controls, AtmosZero, and Siemens. This DOE grant is further expanding on the Industrial Demonstration Program (IDP), with $6.3B in funding announced on March 25, 2024. This larger program is funding 33 projects focused on industrial decarbonization (which this newsletter previously discussed).

Source: NRDC

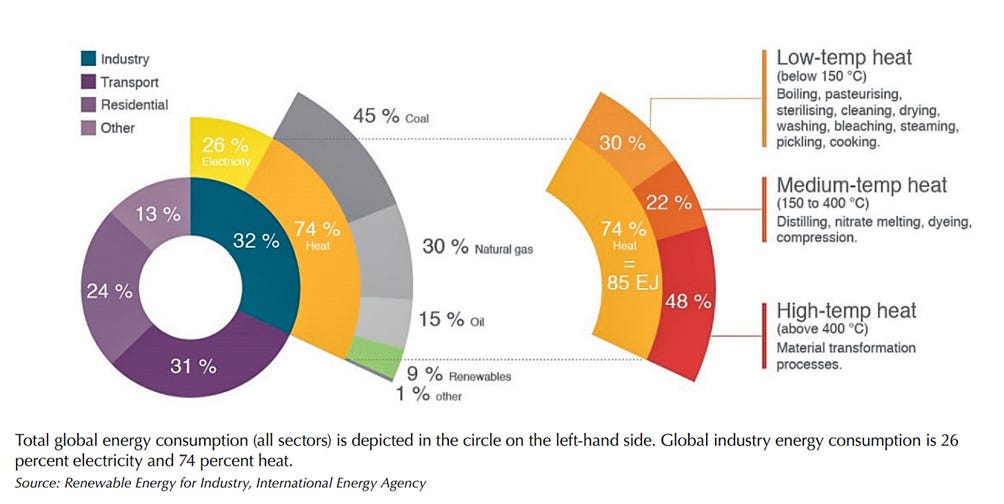

Background: Industrial heat accounts for 74% of industrial emissions, contributing ~10% of global GhG emissions. Key industrial sectors (i.e., steel, cement, chemicals processing, manufacturing, petroleum refining) require temperatures ranging from 150°C to over 1,500°C. Today, that heat is created by burning fossil fuels (i.e., natural gas, coal, oil). Additional emissions can come from the chemical reactions inherent to these processes (i.e., the calcination of limestone to produce cement).

Source: CleanTech for Europe

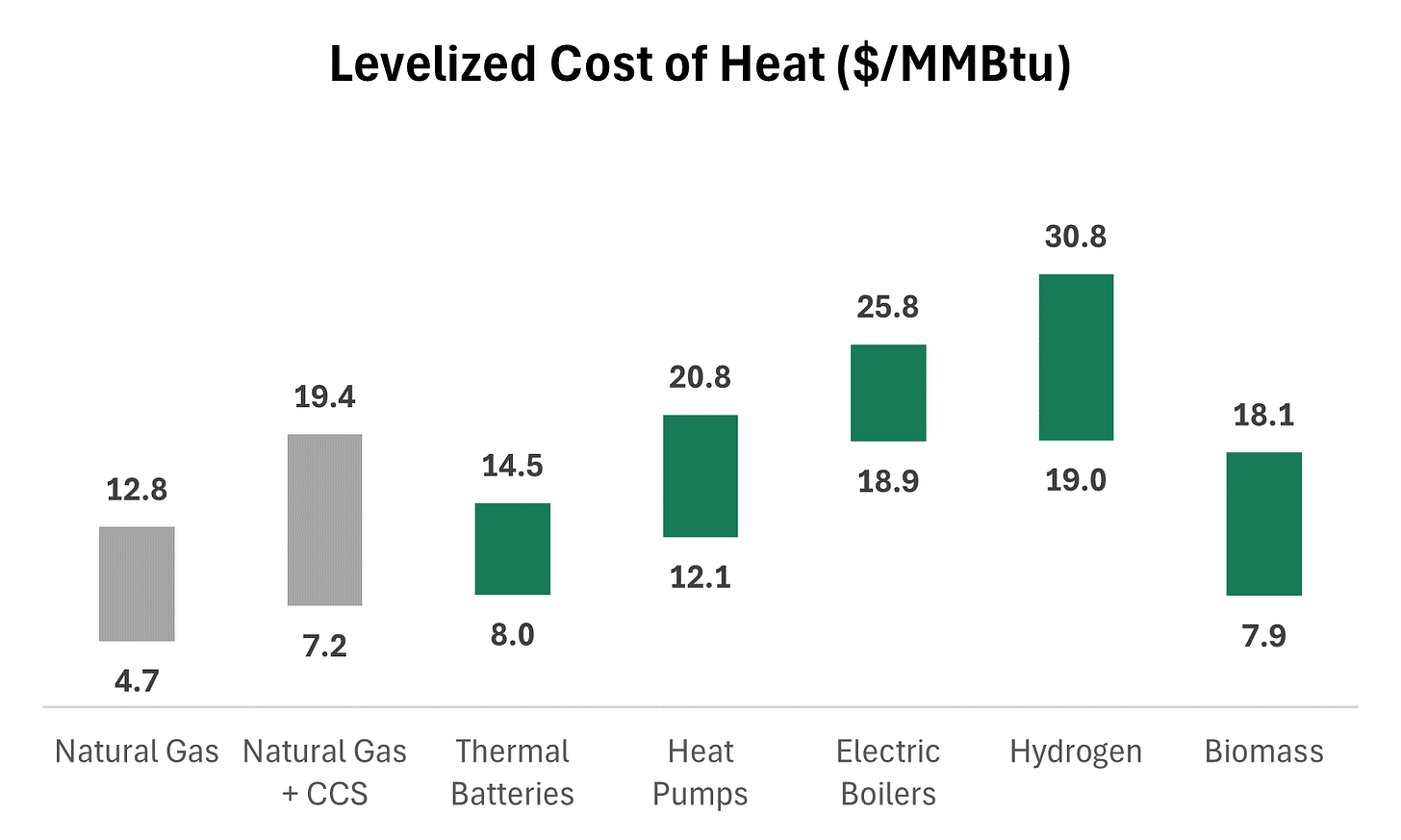

Technologies are emerging to decarbonize industrial heat. They are still early and require additional scale to improve the unit economics. Further, each have their own outstanding questions and challenges that determine which part of the market they can best address.

Thermal Batteries store renewable electricity as heat, which can be released as needed for industrial processes. These systems can reach high temperatures (>1,400°C), making them suitable for a range of applications, including those that require continuous heat supply. This technology is particularly valuable for bridging the gap between intermittent renewable energy sources and constant industrial heat demand. Leaders include Rondo Energy, Antora Energy, KraftBlock, MGA Thermal, EnergyNest, and Brenmiller.

Heat Pumps can upgrade low-temperature waste heat to higher temperatures, reducing the need for additional fuel consumption. These systems are highly efficient and can be powered by electricity, making them a low-carbon solution when combined with renewable energy. However, their application is limited to processes requiring temperatures below 200°C, and the integration into existing systems can be complex. Leaders include Climeon, Heatrix, Echogen, GEA Group, and Johnson Controls.

Electric Boilers can replace fossil-fuel-based heat sources as a ‘drop-in’ replacement. This technology is particularly effective for low to medium-temperature processes. When powered by renewable electricity, electrification can result in zero-carbon industrial heat. However, the challenge lies in the high energy demand and the need for substantial upgrades to electrical infrastructure. Leaders include AtmosZero, HeatX, and Siemens Energy.

Hydrogen produced through the electrolysis of water using renewable energy is another promising solution for decarbonizing industrial heat. Hydrogen can be burned directly or used in fuel cells to generate high-temperature heat for processes like steelmaking. The main challenges are the current high cost of green hydrogen production and the need for significant infrastructure investment. Leaders include H2Pro, Electric Hydrogen, H2 Green Steel, Thyssenkrupp, and ArcelorMittal.

Biomass, such as wood pellets, agricultural waste, or biogas, can be used as a renewable alternative to fossil fuels for generating industrial heat. Biomass combustion is carbon-neutral if sourced sustainably, as the CO2 released is balanced by the CO2 absorbed during the growth of the biomass. However, biomass availability and sustainability concerns, such as land use and biodiversity impacts, limit its widespread adoption. Leaders include Renmatix, Terviva, Drax, and Ørsted.

Source: Renewable Thermal Collaborative

Take-Away: Significant resources are being mobilized to address the challenge of decarbonizing industrial heat. There are an increasing number of pilot projects announced as projects are identified that have superior unit economics to natural gas and garner significant government subsidies. This will be a major opportunity for project finance investors in the near future.

What Comes Next: Investors should closely monitor the outcomes of ongoing pilot projects. They will serve as critical proof points for the viability and scalability of decarbonization technologies in industrial heat. Key areas to watch include:

Commercial Viability: Look for successful pilot projects that demonstrate cost-effective, scalable technologies like thermal batteries and heat pumps. These will be strong indicators that the market is ready for larger investments.

Policy and Regulatory Support: Monitor government actions—expanding subsidies, tax credits, and carbon pricing—that could accelerate technology adoption and create favorable investment conditions.

Technology Integration: Watch for breakthroughs in how these technologies integrate with existing industrial processes. Seamless integration will be a critical proof point for widespread deployment.

Partnerships and Collaborations: Strategic partnerships between tech developers and industrial giants can fast-track innovation and market entry, signaling strong investment potential.

Breakthrough Innovations: Pay close attention to advances in green hydrogen production, thermal battery efficiency, and electric boilers. These could dramatically lower costs and unlock massive opportunities.

When these milestones are reached, it will be time to start investing big in the industrial heat sector. The industrial heat sector is on the cusp of transformation, and early movers could be well-positioned to capitalize on the growing demand for low-carbon industrial solutions.

Further Reading

Technology (Deep Tech, Materials Science, Emissions)

Solar: China humbles us and presents this to the world: We thought perovskite solar panels were the future (EcoNews)

Insurance: The uninsurable world: rethinking how to cover for climate damage (FT)

Solar: New solar cell design offers over 90% efficiency, boosts durability (Interesting Engineering)

Private Markets (PE / VC / Real Estate / Infra)

Venture: Climate Tech Is No Longer Weathering Venture’s Slump (WSJ)

Hydrogen: Blue hydrogen joint venture withdraws from US H2 hub, despite promise of near-billion-dollar federal funding pot (Hydrogen Insight)

Hydrogen: Pacific Northwest Hydrogen Hub becomes second cluster to be awarded US government funding under $7bn programme (Hydrogen Insight)

Solar: New Mexico just announced a nearly $1 billion solar cell factory (Electrek)

Batteries: Batteries step in as coal plant trips amid heatwave and near record demand in Texas (Renew Economy)

Data Centers: How data centers are being used to bypass clean energy goals (Utility Dive)

Public Markets (Stocks, Bonds)

Solar: The solar sector vultures circling over SunPower’s remains (FT)

Coal: ‘Cash is king’: Why Glencore kept faith with coal (FT)

Hydrogen: Hydrogen specialist Bloom Energy delivers record revenues in second quarter, but still registers $62m net loss (Hydrogen Insight)

Government & Policy

Sweden: Can Sweden deliver its much hyped green energy boom? (FT)

Biofuels: Are tariffs enough to save Europe’s biofuels sector? (FT)

LPO: LPO Announces Conditional Commitment to Clean Flexible Energy to Build Utility-Scale Solar Generation and Storage in Puerto Rico (DOE)

IRA: Delays hit 40% of Biden’s major IRA manufacturing projects (FT)

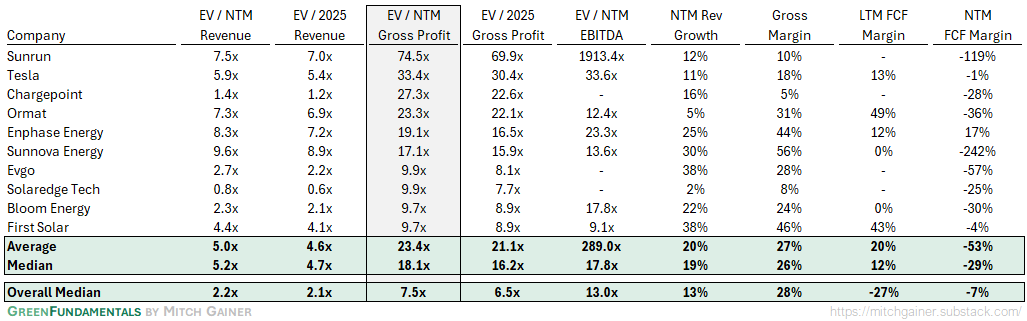

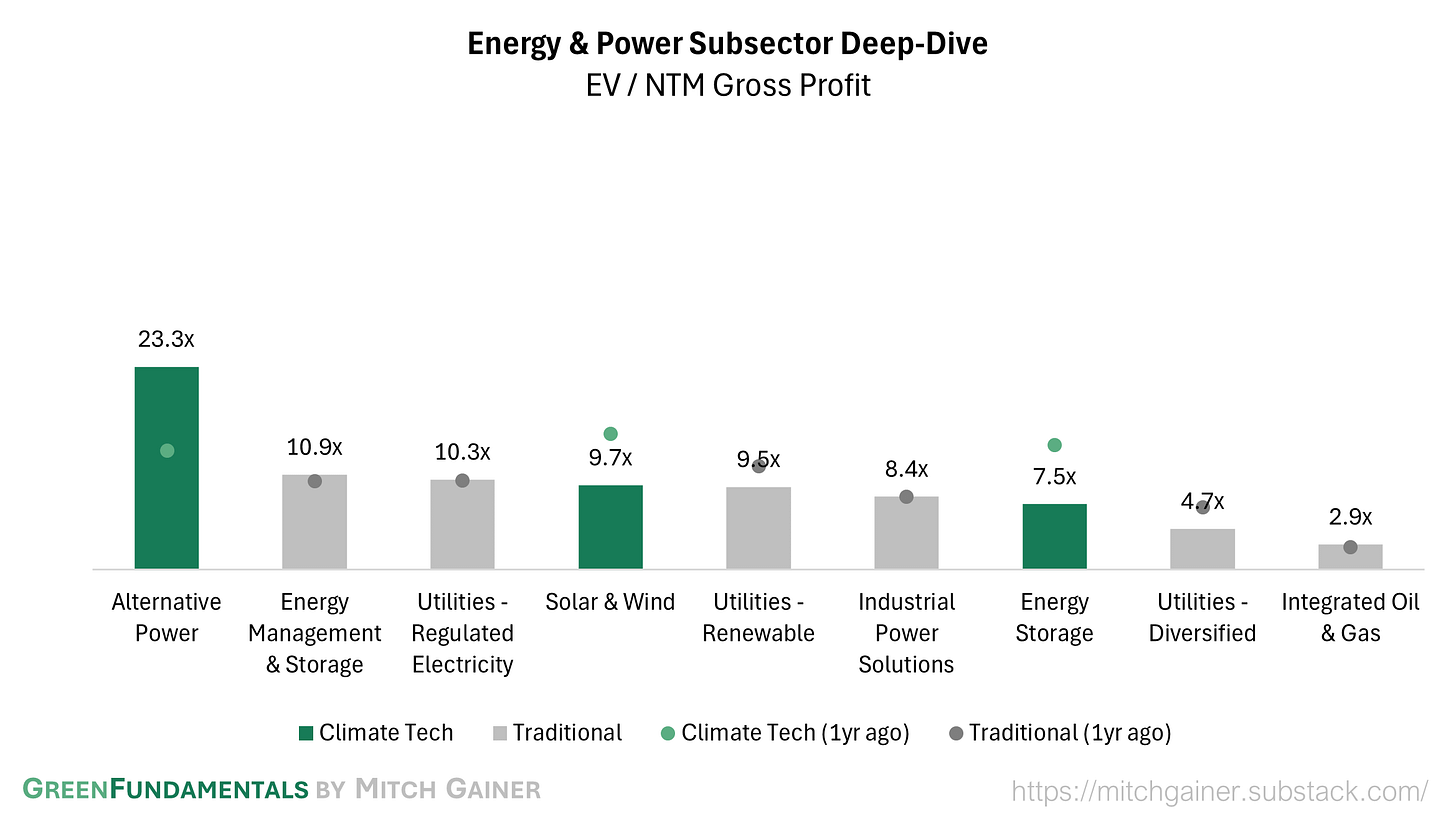

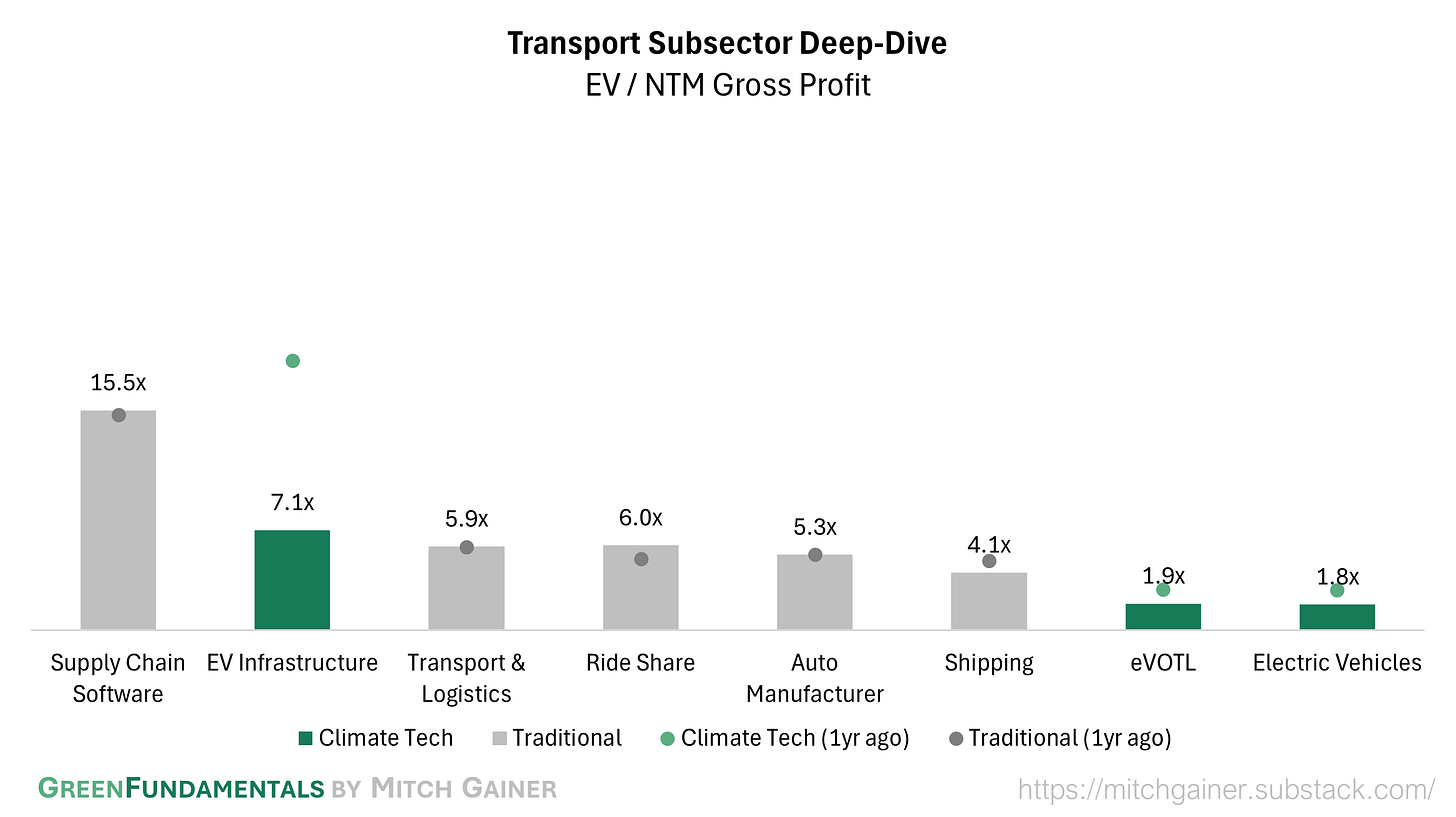

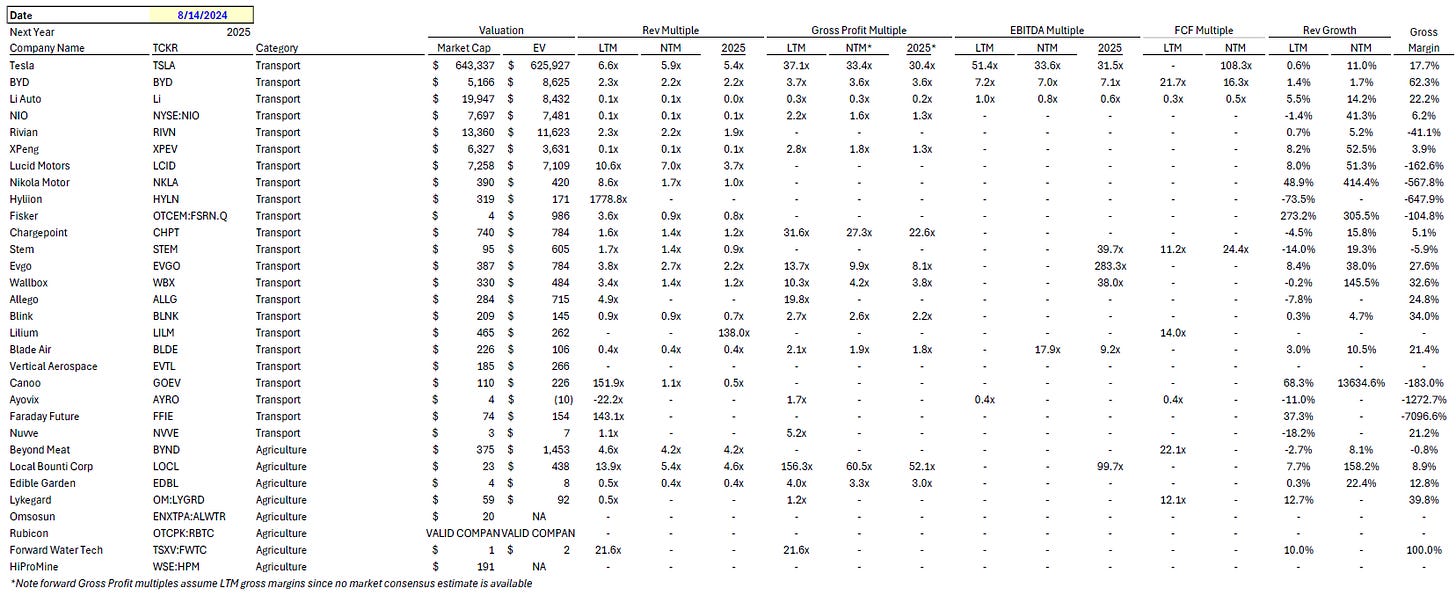

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

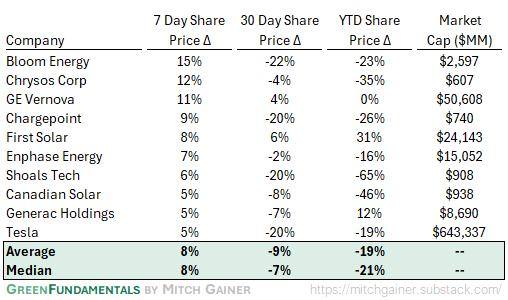

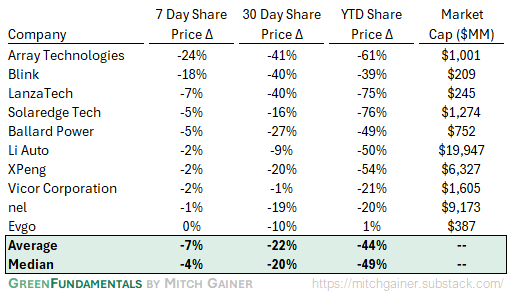

Top 10 and Bottom 10 Weekly Share Price Movement

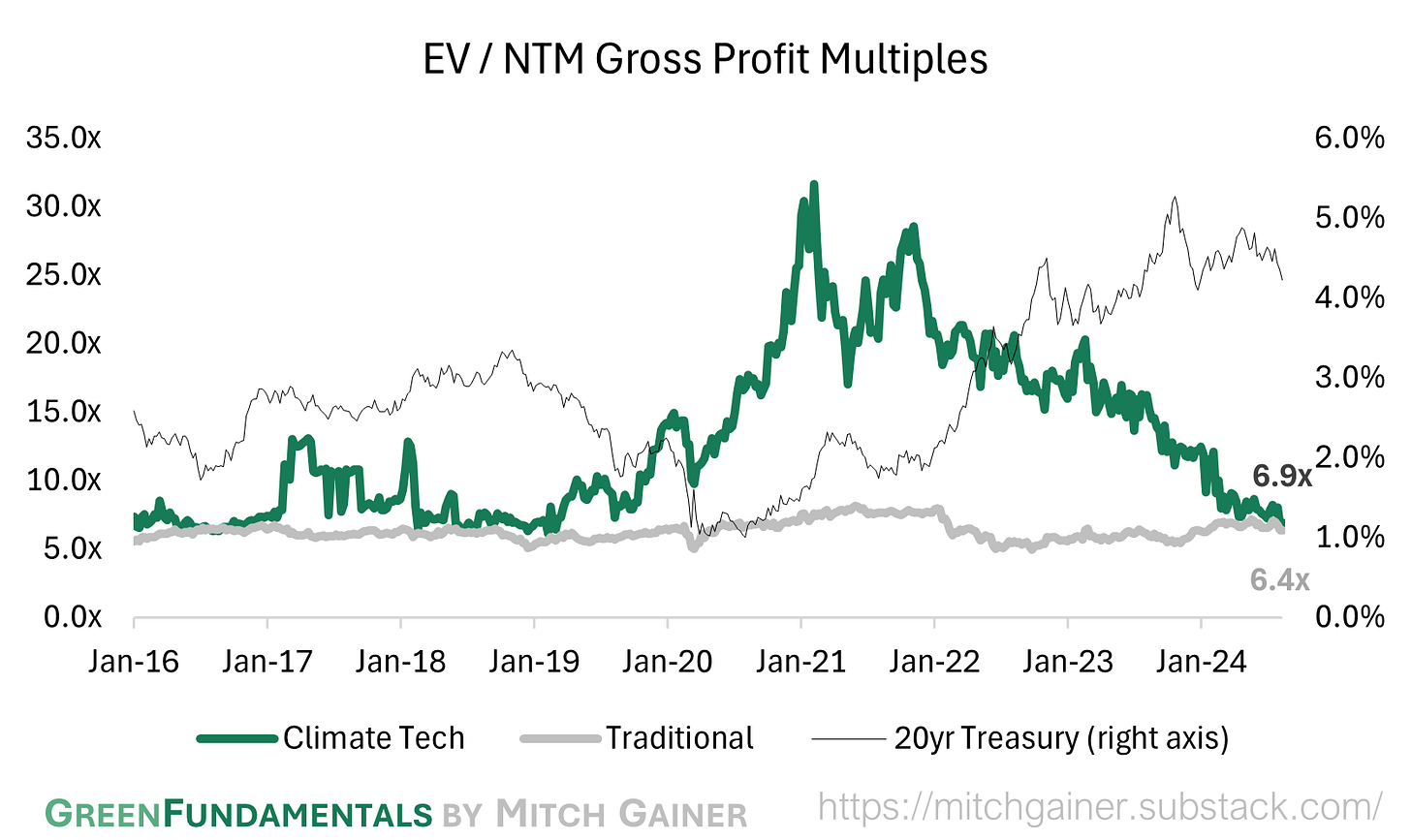

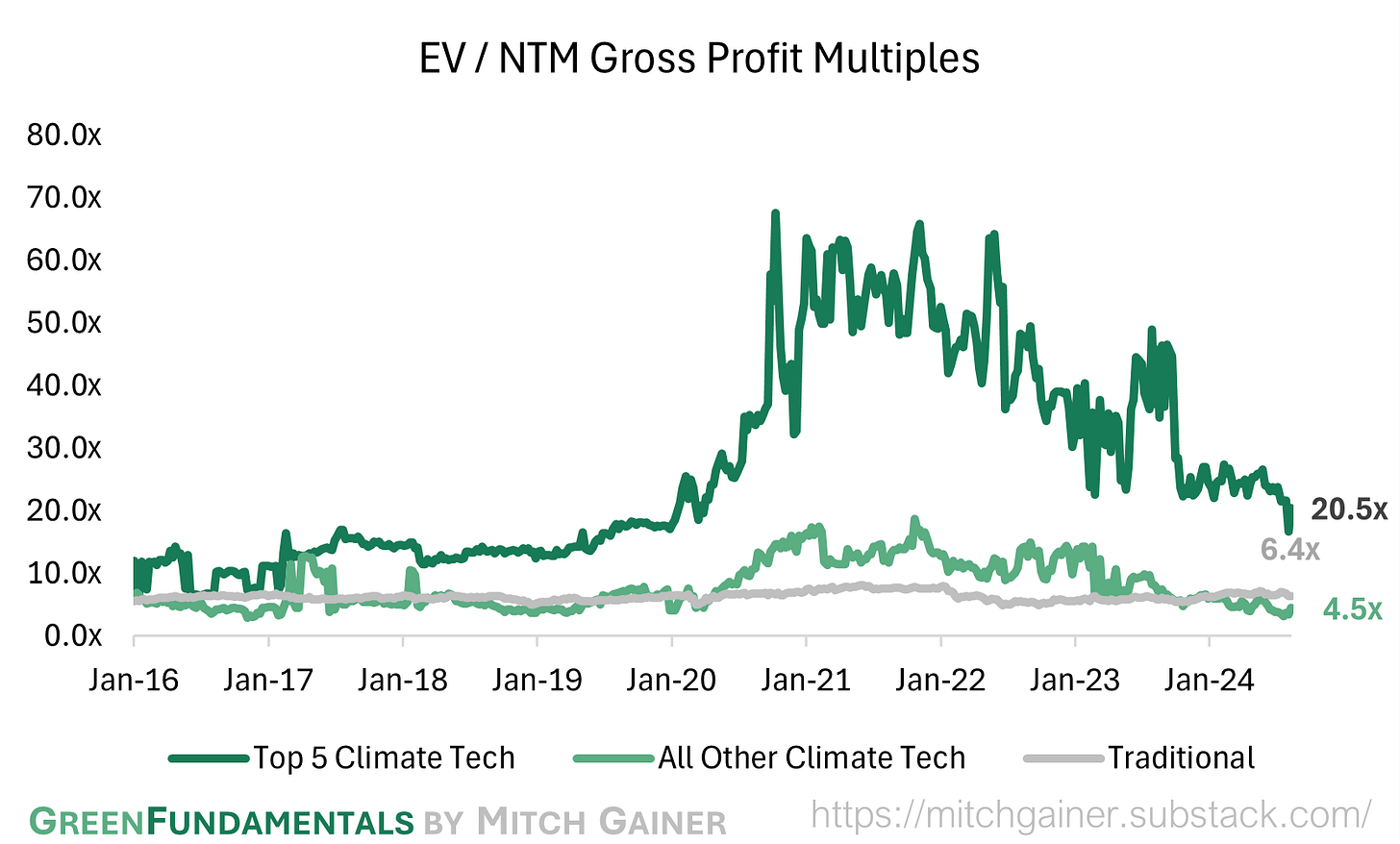

Valuation Multiples over Time

Deep-Dive by Subsector

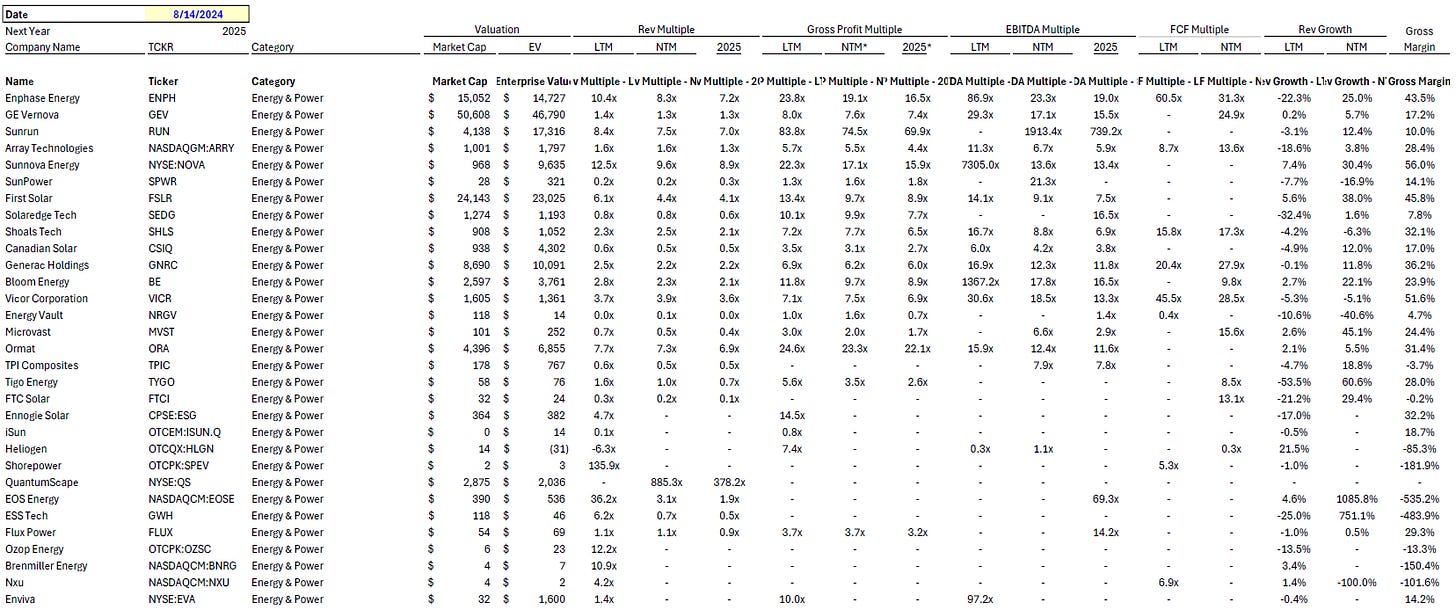

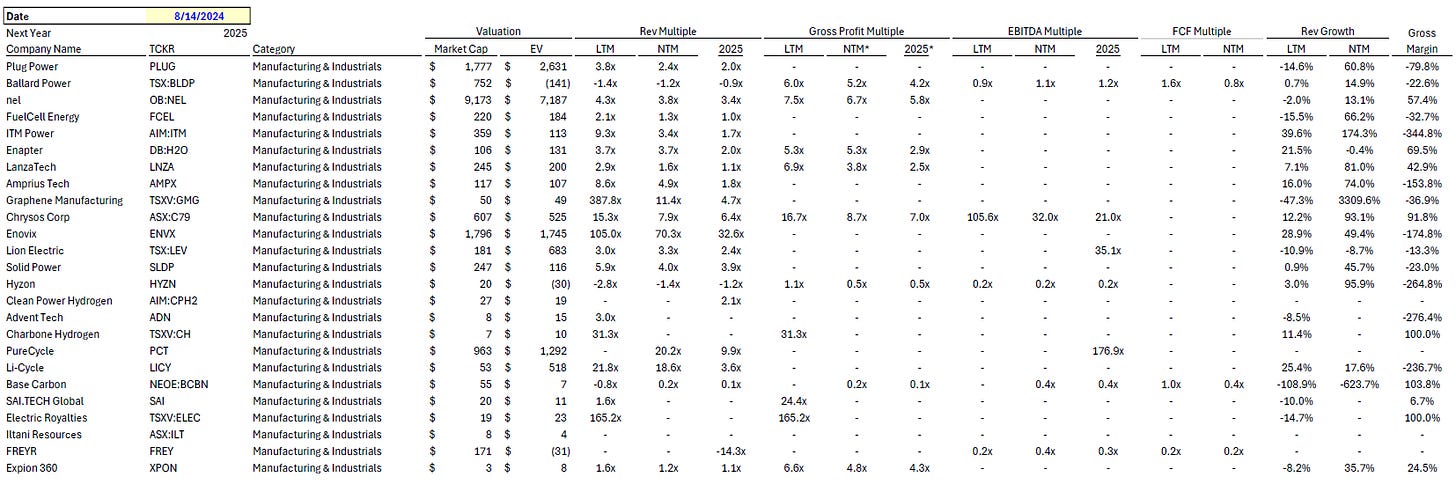

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.