Green Fundamentals: Stars Align for Constellation (Despite DeepSeek)

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Constellation’s $16.4B Calpine Acquisition Is A Bold Bet on Nuclear and Gas for 24x7 Power

On January 10, Constellation Energy announced a $16.4 billion acquisition of Calpine, positioning itself as the largest independent power producer in the U.S. Constellation’s stock surged ~30% in the following week as investors reacted to the deal’s financial and strategic upside.

By integrating Calpine's low-carbon-intensity gas and geothermal portfolio with Constellation’s dominant nuclear fleet, this deal allows the company to offer an unmatched combination of clean, reliable, and dispatchable power—a crucial value proposition as hyperscalers, AI data centers, and electrification efforts drive demand for 24/7 energy.

However, on January 27, DeepSeek’s more capital- and energy-efficient AI model release sent shockwaves through energy markets. Investors questioned whether AI power demand would be as high as expected, triggering a 13% decline in Constellation’s stock over five days, alongside similar declines for other baseload power players like Vistra Corp (-13%), NRG (-7%), NuScale (-19%) and Cameco (-11%).

Now, investors are left asking:

Does AI still drive an exponential power demand curve, or is that thesis in question?

If AI demand softens, does Constellation’s strategic bet on 24/7 power still hold up?

How defensible is this deal against competitors like Vistra and NRG?

Market Context: Rising Demand and the Role of Gas in Decarbonization

The acquisition occurs amidst unprecedented growth in electricity demand. Peak load forecasts from ERCOT project an 80% increase between 2024 and 2034, while PJM anticipates a 30% rise in peak demand over the same period. Data centers alone could account for 9% of U.S. power demand by 2030, up from 4% today

The Role of Natural Gas

Despite aggressive renewable energy deployment, natural gas remains critical for grid reliability, as battery storage and renewables cannot yet fully replace firm generation. The intermittency of solar and wind requires flexible capacity that can ramp up quickly—Calpine’s fleet provides exactly that.

Constellation’s nuclear assets already supply zero-carbon baseload power, but nuclear alone cannot meet peak loads, nor can it provide fast-ramping flexibility. By adding Calpine’s 26 GW of natural gas generation, the combined entity ensures it can deliver both clean and dispatchable energy at a national scale.

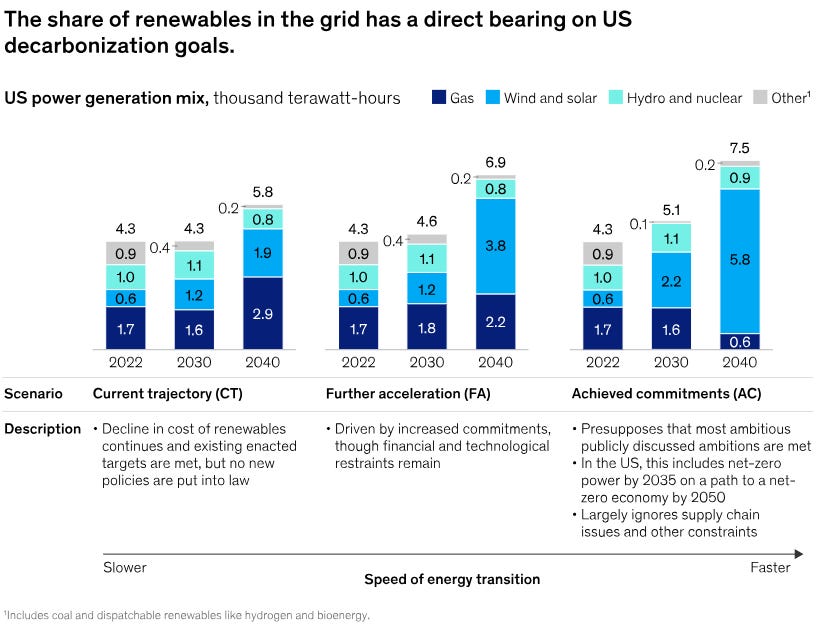

This strategy aligns with McKinsey’s energy transition analysis, which underscores that while renewables will dominate new capacity additions, low-carbon gas remains essential for ensuring grid stability and preventing price volatility during peak demand periods.

Source: McKinsey & Company

Regional Opportunities:

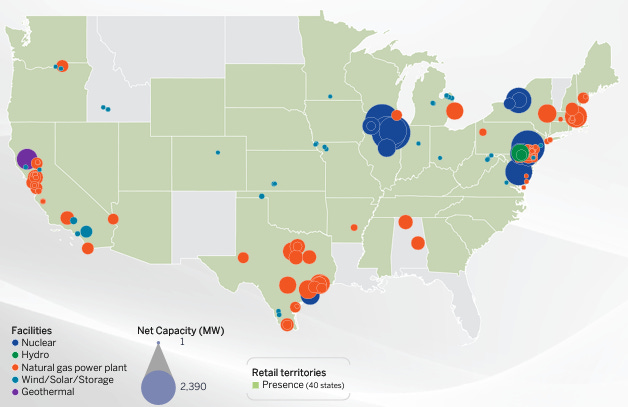

The acquisition expands Constellation’s geographic reach, increasing its presence in two of the most energy-intensive U.S. markets:

Texas (ERCOT): Constellation's Texas market share grows from 15% to 25%, increasing exposure to one of the fastest-growing power demand regions, driven by both industrial expansion and AI/data center investments.

California (CAISO): The company’s negligible exposure to California prior to this deal now expands to 10% of its portfolio, positioning it to benefit from the state’s continued investment in decarbonization and reliability-focused energy policies.

PJM Diversification: The deal reduces Constellation’s reliance on PJM from 65% to 45%, reducing regulatory and market concentration risk in a region that has increasingly constrained capacity market revenues.

Source: Constellation

The Uncertainty of AI: Is the Market Overreacting?

DeepSeek’s AI model efficiency breakthrough caused an immediate selloff in energy stocks, as investors reassessed the scale of future AI-driven electricity demand. DeepSeek-V3 achieved a massive reduction in training costs, reportedly training a GPT-4o-equivalent model for just $5.6 million, an order of magnitude lower than industry expectations.

At issue is whether DeepSeek’s innovations will reduce overall AI power consumption, or if they simply make AI more efficient while still driving exponential growth. The key considerations:

If AI compute needs become more efficient, total electricity demand growth may slow, undermining the investment thesis for 24/7 baseload power.

However, AI models are increasingly shifting workloads to inference rather than training, which could still drive sustained data center power demand growth despite training efficiencies.

Despite market concerns, the structural long-term data center power demand remains robust. Over 80% of projected data center electricity growth by 2030 comes from traditional enterprise cloud and SaaS, not AI. While AI growth is a factor, data centers remain a core driver of power demand regardless of AI volatility.

Source: Goldman Sachs

Competitive Positioning: How Constellation Wins

While investors are questioning the AI power demand thesis, the Constellation-Calpine deal still offers a unique competitive edge over rivals like Vistra and NRG.

Nuclear + Gas = The Only Scalable 24/7 Clean Solution by 2030: Nuclear provides true baseload power, but lacks flexibility. Gas can ramp up quickly but isn’t carbon-free. By integrating both, Constellation becomes the only U.S. IPP capable of delivering 24/7 carbon-free energy at scale—a key differentiator for hyperscalers facing ESG pressures.

Locking in Long-Term Power Contracts with Hyperscalers: Microsoft, Google, and Amazon are prioritizing long-term clean power procurement. Constellation’s expanded portfolio allows it to offer a diversified mix of nuclear, gas, and geothermal, giving it an advantage over competitors reliant on just gas or renewables.

Regulatory and Policy Tailwinds: The 45V tax credit for clean hydrogen could enable some Calpine gas plants to convert to hydrogen co-firing, improving ESG positioning. Nuclear power continues to receive federal support, with the recent $1 billion nuclear supply contract reinforcing long-term demand for Constellation’s assets.

Investor Takeaways: What Comes Next

The Constellation-Calpine deal is a long-term play on power demand diversification—but recent market jitters over AI power efficiency should be understood in context.

Short-Term Overreaction? AI power demand growth may not be as steep as investors thought, but it still represents a major demand driver. Data center and SaaS-driven electricity growth remains strong and is independent of AI volatility.

Regulatory Approvals & Execution Risks: Investors should monitor potential FERC/DOJ-required divestitures, which could affect final deal economics. Successfully integrating Calpine’s assets will be critical to delivering the expected $2 billion in additional free cash flow annually.

A More Resilient, Diversified IPP Model: By blending nuclear, natural gas, and geothermal assets, Constellation secures a long-term advantage in a decarbonizing but reliability-constrained power market.

While AI-related power demand uncertainty may continue to create short-term volatility, Constellation’s fundamental investment thesis remains intact—this deal cements its leadership in a future where both scale and flexibility will define the winners in energy markets.

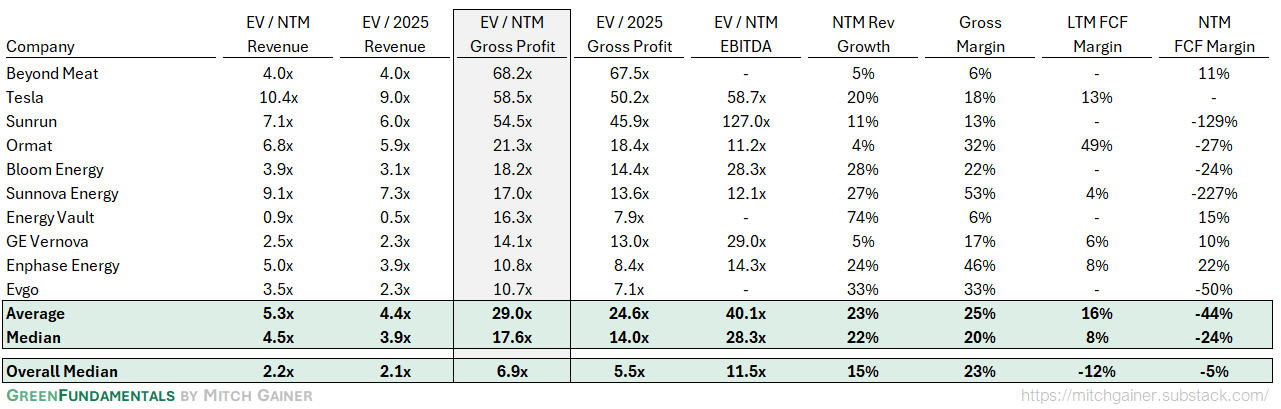

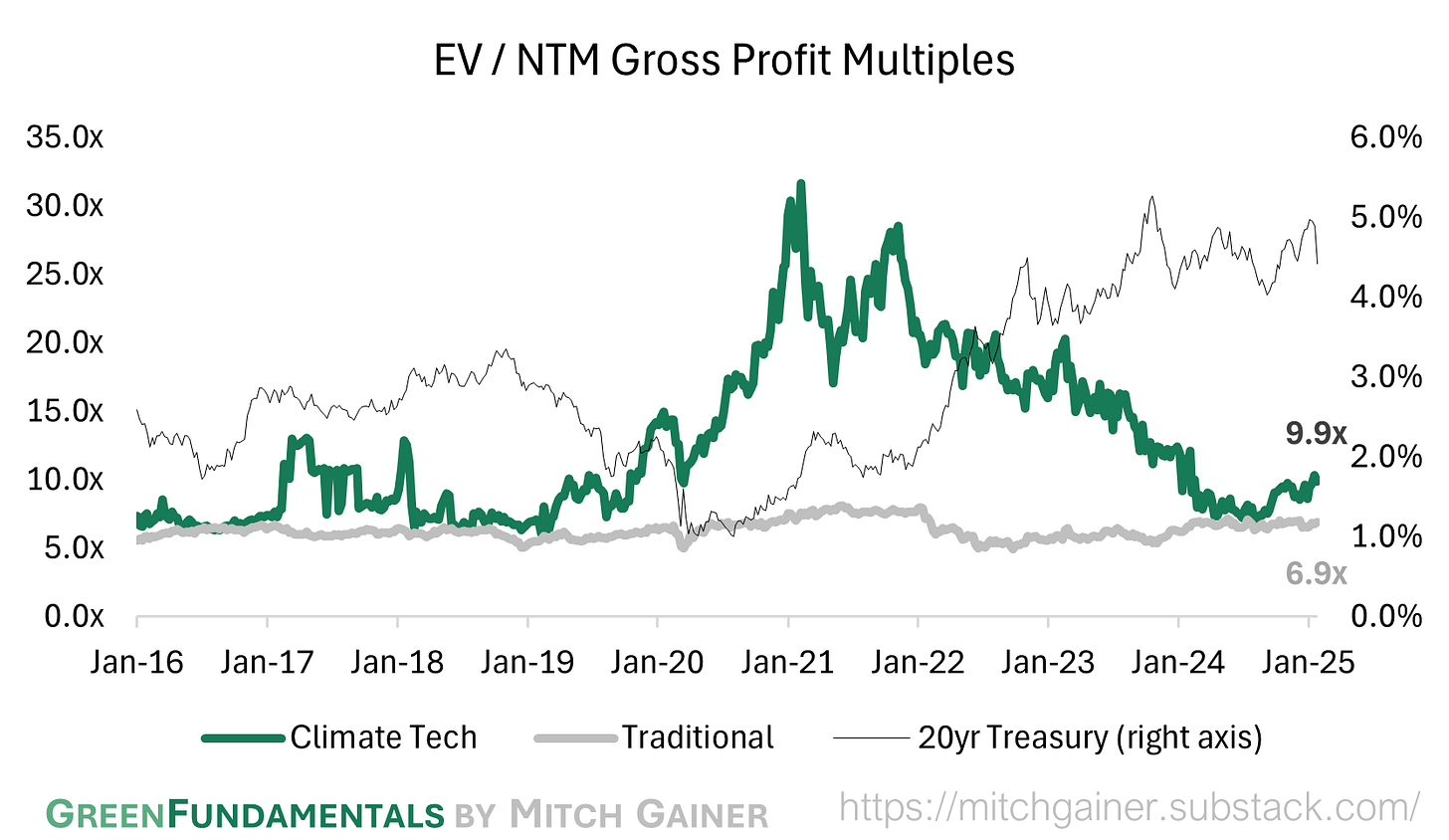

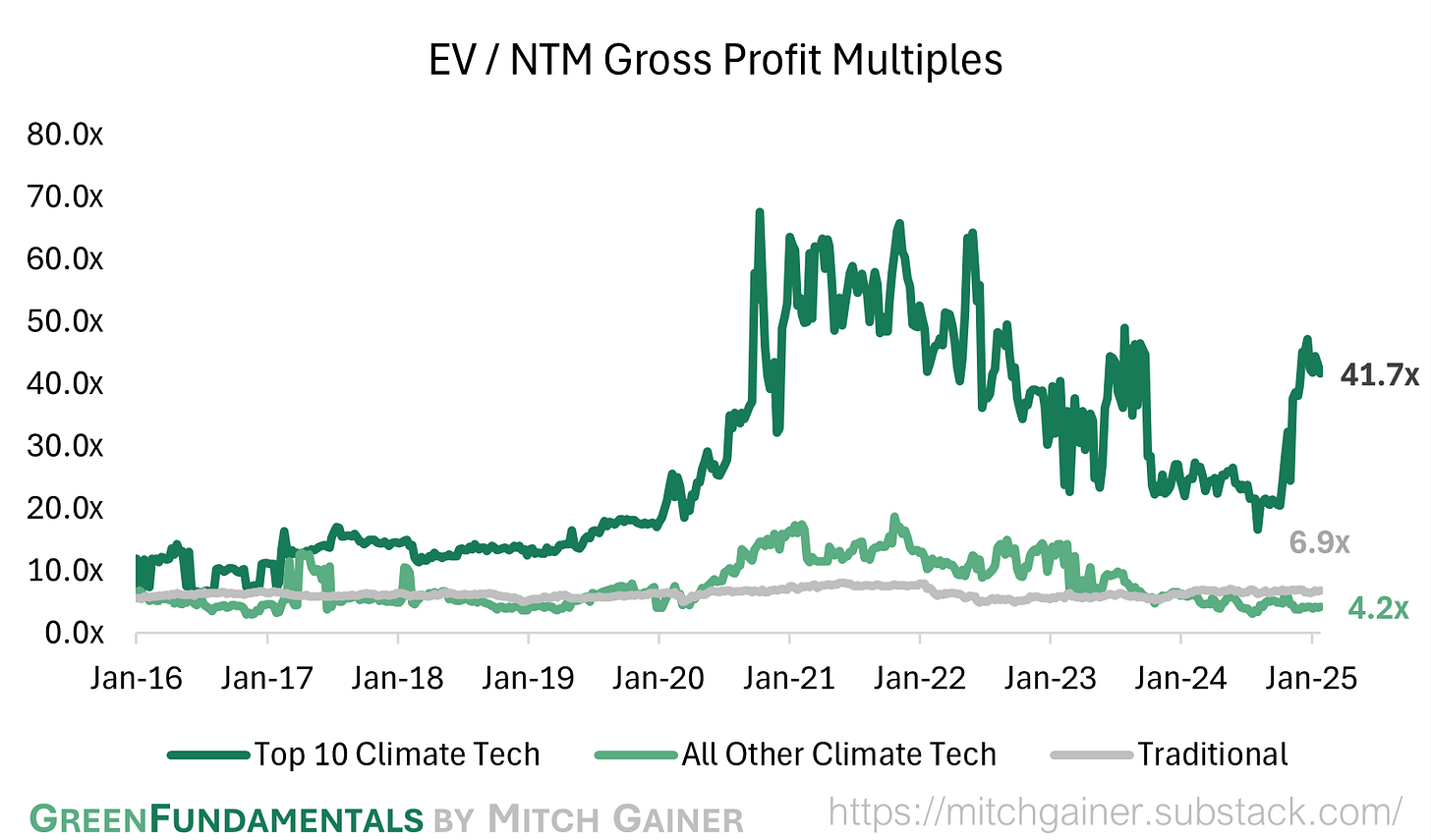

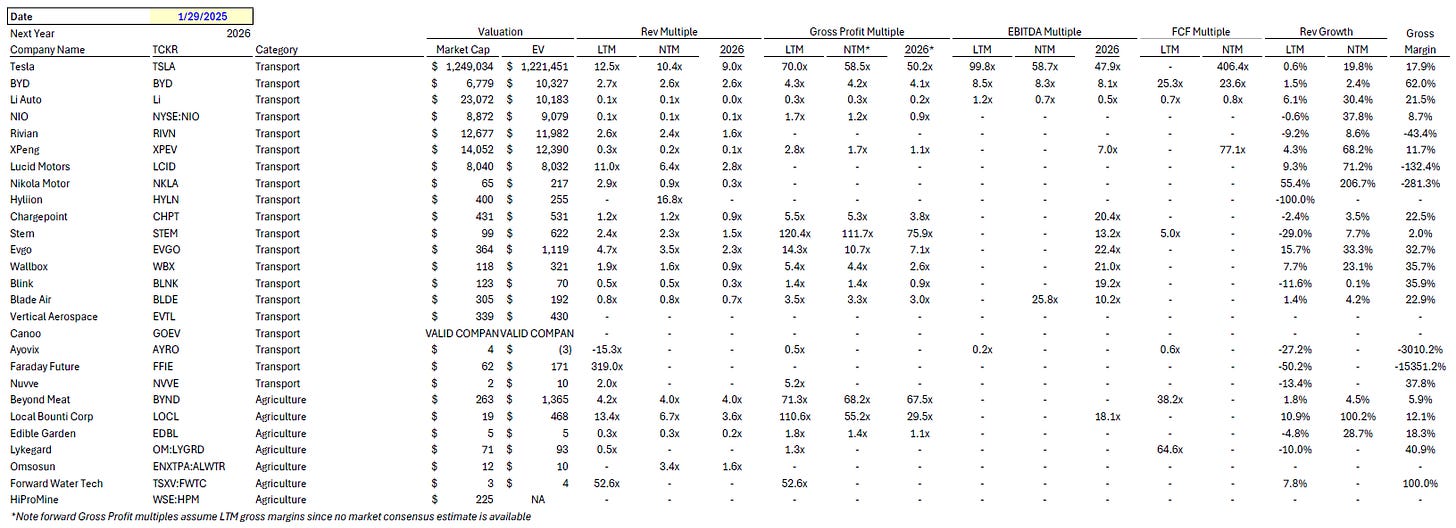

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

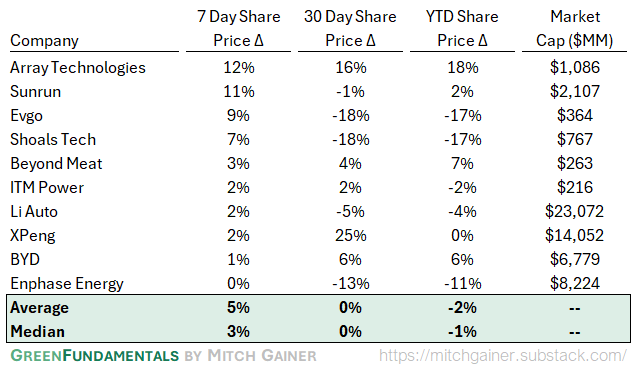

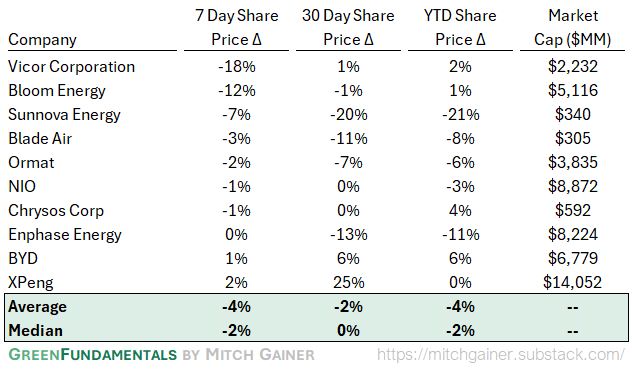

Top 10 and Bottom 10 Weekly Share Price Movement

Valuation Multiples over Time

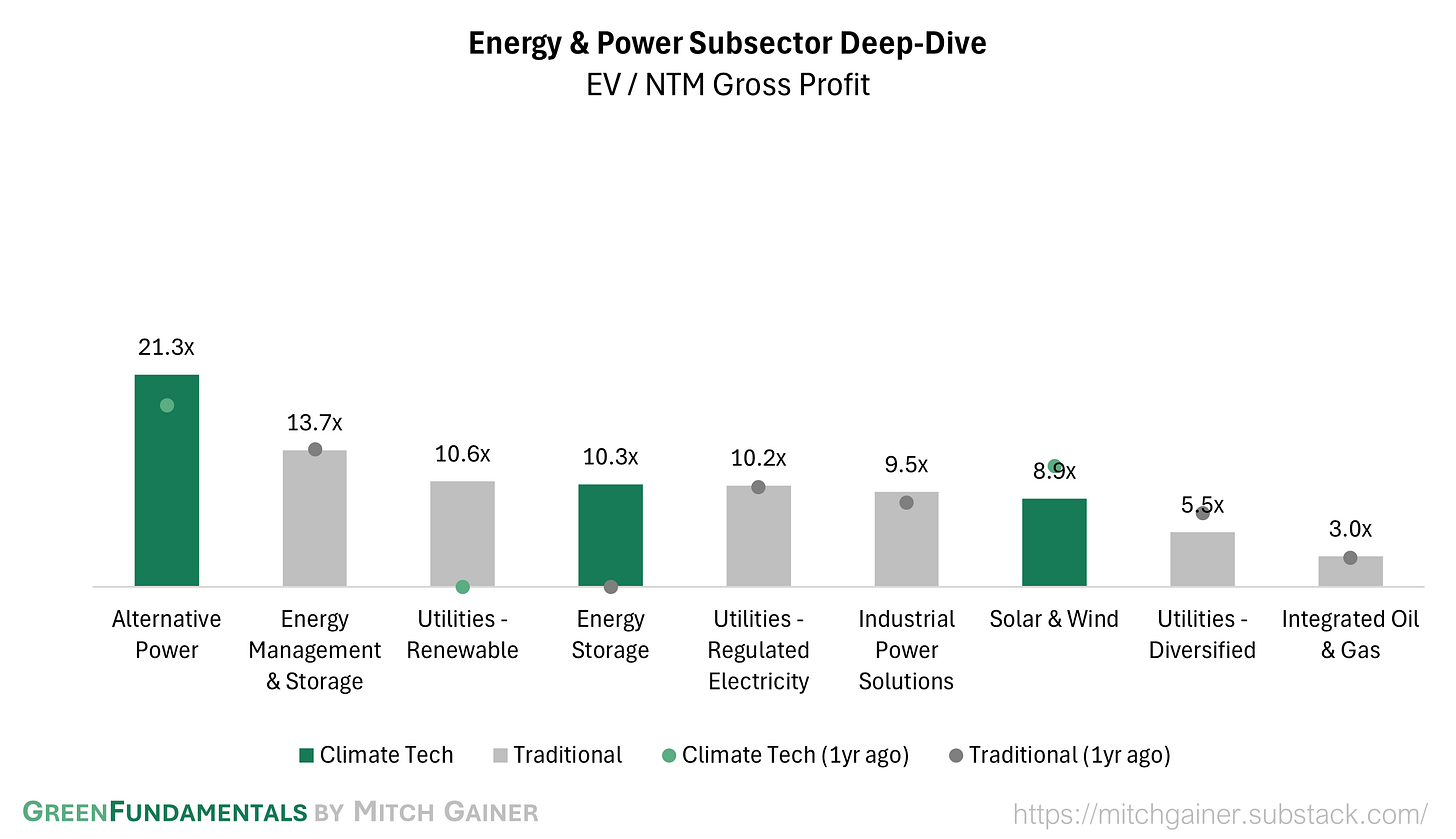

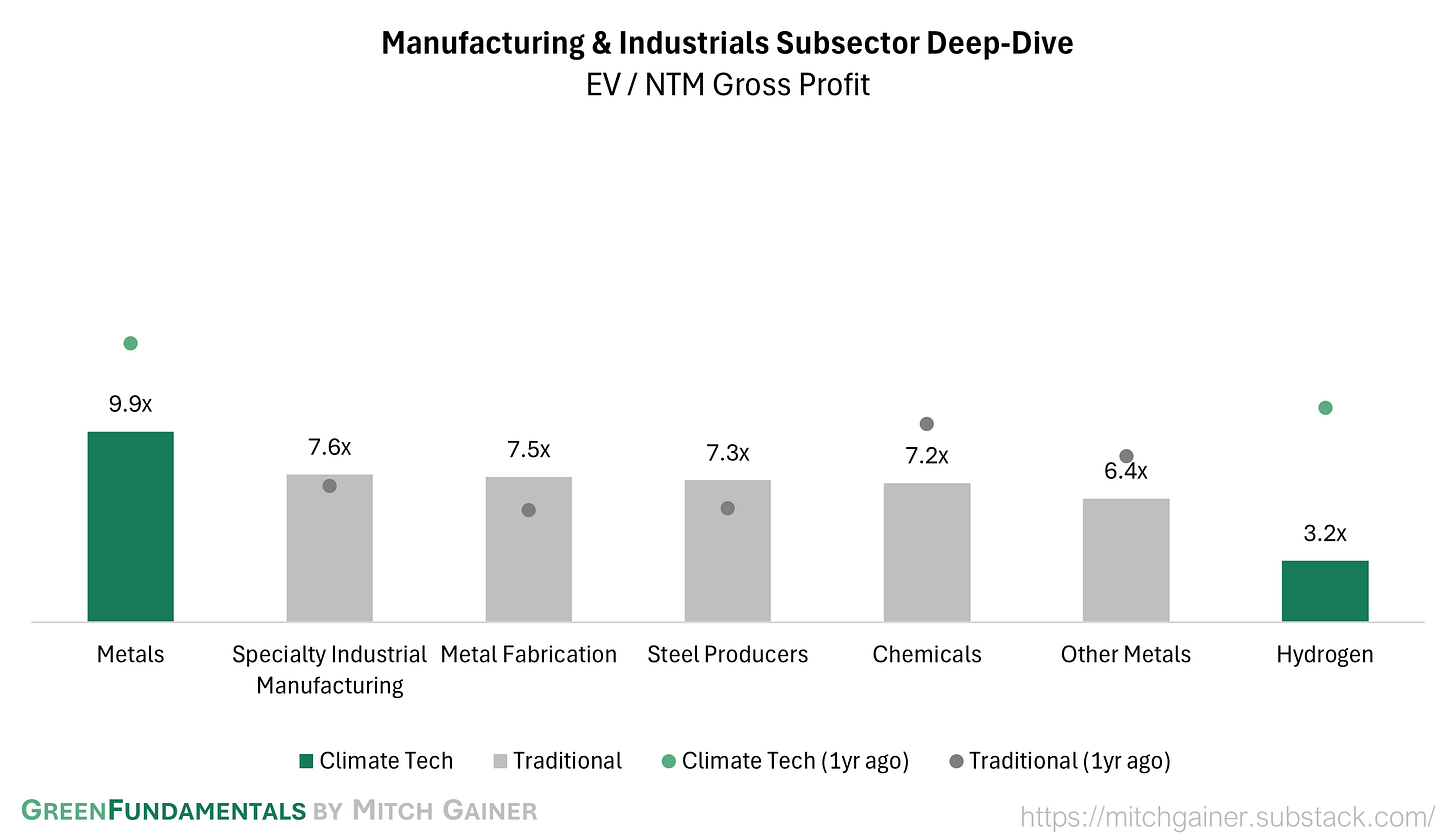

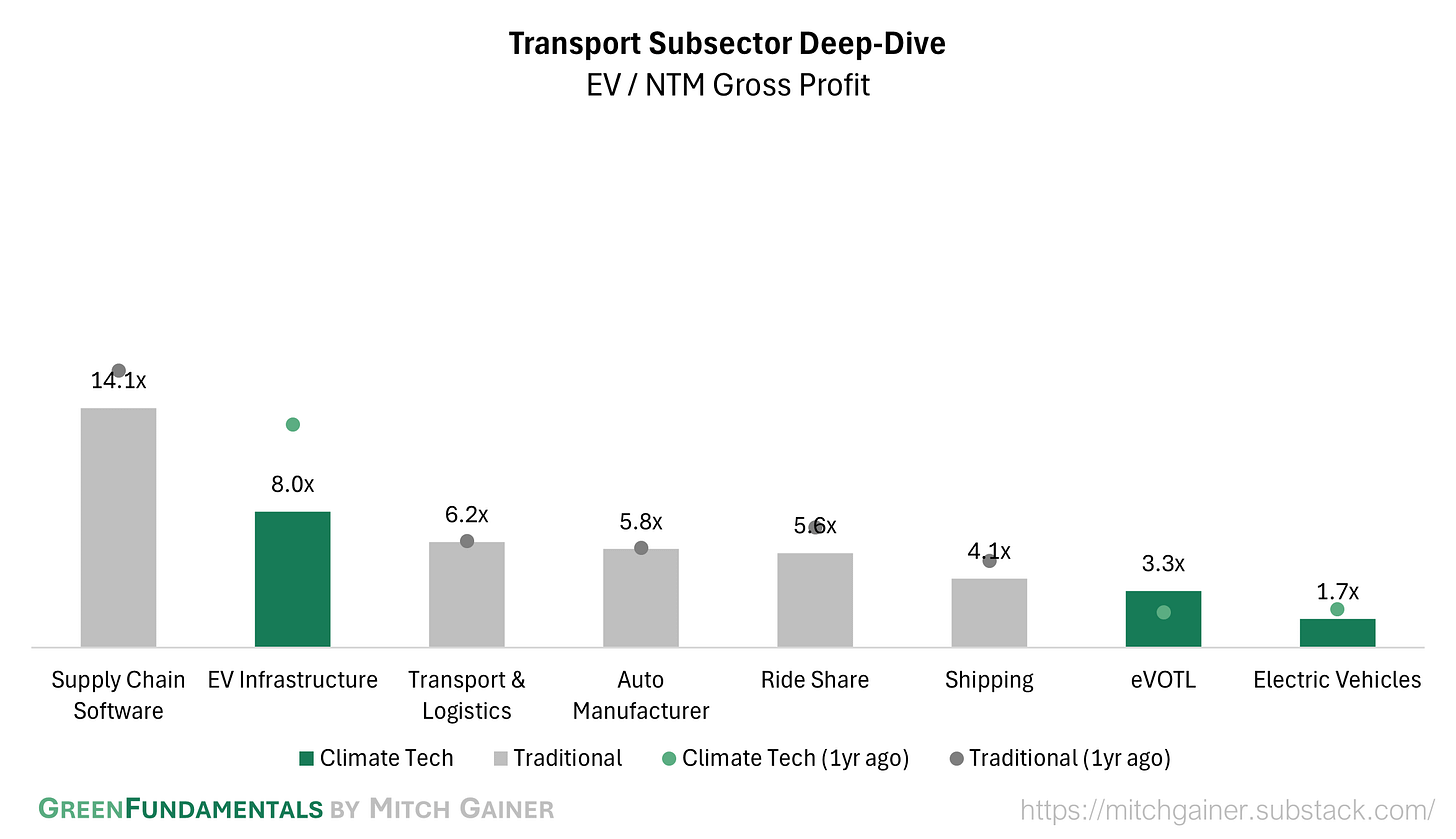

Deep-Dive by Subsector

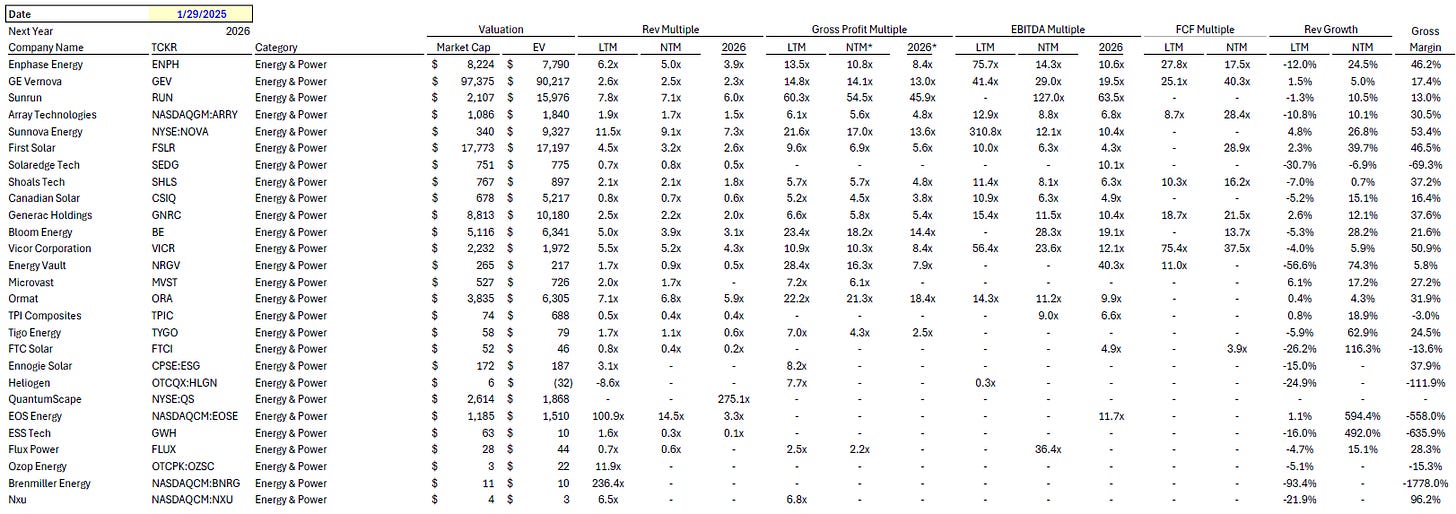

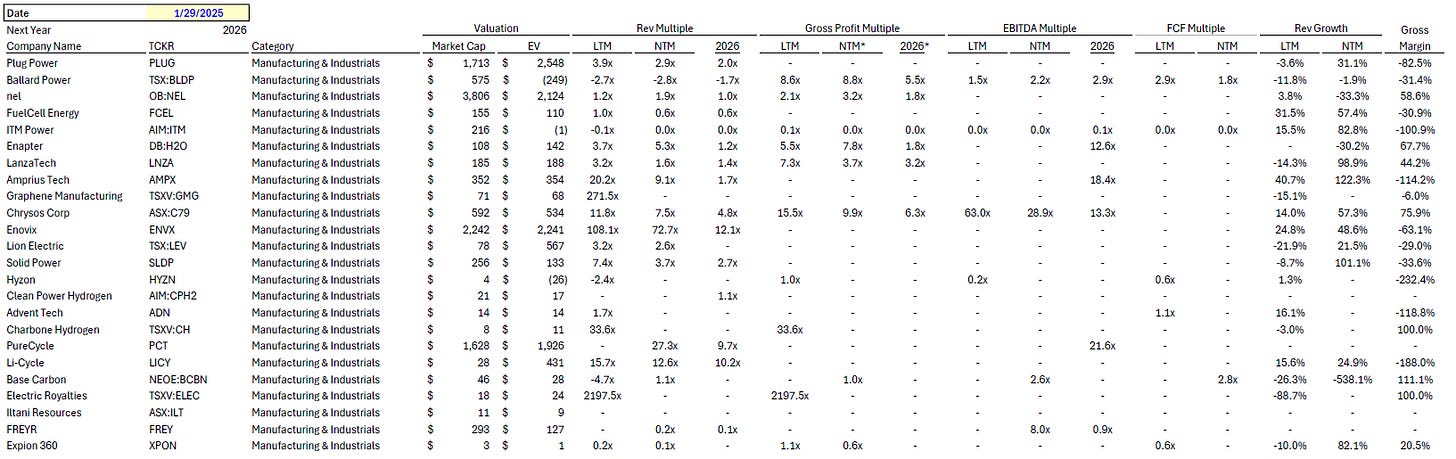

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.