Green Fundamentals: The Path to Commercial Fusion

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

I will be taking a brief break for Christmas and New Years, and then will be back in January with more!

The Fusion Dream Takes Shape in Virginia with Commonwealth Fusion Systems’ ARC Reactor Site

On Wednesday, Commonwealth Fusion Systems (CFS) announced that its first commercial-scale ARC reactor will be built in Chesterfield County, Virginia, in partnership with Dominion Energy. Targeting grid connection in the early 2030s, this milestone marks a major step in the commercialization of fusion energy.

Fusion aims to achieve “Q > 1,” where the energy output exceeds the input—a critical milestone across fusion approaches. CFS is building a Tokamak reactor, which uses powerful magnetic fields to confine plasma at extreme temperatures and enable sustained fusion reactions. While fusion holds immense promise, significant challenges remain, including stable plasma confinement, materials durability under extreme conditions, and efficient energy conversion.

See my previous post for more on the fusion landscape in addition to Tokamaks, especially as it relates to inertial confinement which achieved Q>1 last year:

The Fusion Journey: Always 30 Years Away?

Skeptics often argue that fusion has perpetually been “30 years away.” Historical progress has been punctuated by breakthroughs followed by setbacks:

1958: Los Alamos National Laboratory achieved the first laboratory thermonuclear fusion, but magnetic field technologies were insufficient to sustain stable energy production.

1982: The ASDEX Tokamak demonstrated high-confinement mode (H-mode), improving plasma stability, but edge instabilities risked damaging reactor walls.

1991: The Joint European Torus (JET) released fusion power but fell short of producing net-positive energy (Q > 1).

In the 1990s, Scientists stood at a crossroad. To sustain controlled fusion in a Tokamak reactor, more powerful magnets were needed. The scientific community faced two options:

Make a bigger magnet. These scientists pursued building ITER to make more powerful magnets by increasing its scale (i.e., several football fields).

Make smaller magnets more powerful. These scientists pursued using High-Temperature Superconducting (HTS) Tape to fit more powerful magnets in a reactor that could fit within the footprint of existing power plants.

In September 2021, CFS successfully built and tested one of these HTS magnets. Shortly thereafter, they raised a $1.8B Series B to build its first reactor.

CFS’s Path to Commercialization

CFS’s strategy emphasizes practicality and scalability:

SPARC Reactor: A 40%-scale demonstration plant targeting Q > 10, validated by peer-reviewed research, to prove commercial viability.

ARC Reactor: A 400 MW reactor designed to provide clean, firm power directly to the grid, operating continuously with minimal downtime.

Scalable Business Model: Mass production of HTS-powered reactors, akin to GE’s model for combined-cycle turbines, to supply power projects worldwide.

Justified Skepticism: Challenges to the ARC Reactor

While the progress is impressive, fusion must overcome several hurdles to become commercially viable:

Tritium Management: Tritium, critical for D-T fusion, is scarce and must be bred in the reactor using lithium-based blankets. Developing efficient systems to breed, capture, and recycle tritium while ensuring safety is a key focus, with advanced materials like ceramics and alloys showing promise.

Energy Conversion: Fusion energy, released as fast-moving neutrons, must be converted to heat via fusion blankets (e.g., molten salts). This heat powers turbines, with supercritical CO2 offering efficiency advantages. The challenge lies in developing materials, like tungsten or silicon carbide, that can withstand neutron bombardment and extreme temperatures without degrading.

Integration with Power Systems: Translating fusion heat into grid-compatible electricity requires modular heat exchangers, high-efficiency turbines, and energy storage systems to manage intermittency. These solutions are under development, but scalability remains a hurdle.

Despite these challenges, none require “new physics.” The recent success at Lawrence Livermore National Laboratory in achieving net energy gain has validated current theories and de-risked ignition. Remaining barriers are primarily engineering and economic.

Unit Economics: Fusion vs. Solar PV and Fission

Some skeptics argue that the Sun is a fusion reactor in the sky, so solar PVs are much better and less risky. The table below provides illustrative ranges for key parameters for solar, fission, and fusion, as well as resulting LCOEs. The ranges reflect possible variations due to site conditions, technology maturity, financing terms, and other uncertainties.

Source: Lazard LCOE Report, illustrative estimated for Fusion plant

Solar’s major advantage is its “$0 fuel costs,” as sunlight is free. However, solar’s efficiency is limited by module efficiency and capacity factor, capturing only a fraction of the sun’s energy and operating only during daylight hours. Fusion, by contrast, operates continuously (with some downtime) and achieves much higher thermal efficiency due to controlled reactions.

Fusion’s fuel costs are uncertain but likely low given the abundance of deuterium and tritium, provided tritium can be effectively bred and recycled. Unlike solar, fusion is not constrained by geography, time of day, or time of year, making it a strong candidate for firm, clean power to complement renewables.

Fission is another source of firm power but has been hampered by high costs, largely driven by regulatory and construction challenges rather than technological fundamentals. Fusion, with no meltdown risk or long-lived waste, may avoid similar regulatory hurdles. In 2023, the NRC issued preliminary proposed rule language for Fusion that was much less burdensome than fission. However, its capital and operational costs remain uncertain and need de-risking.

A 24x7 alternative to intermittent renewables is essential for 100% decarbonization, especially as electricity demand grows. While solar and wind are critical, storage limitations and deployment bottlenecks mean firm power sources are vital. Fusion, receiving ~0.7% of venture dollars in the last five years, represents an appropriately modest share of innovation investment but may require increased focus as the technology advances.

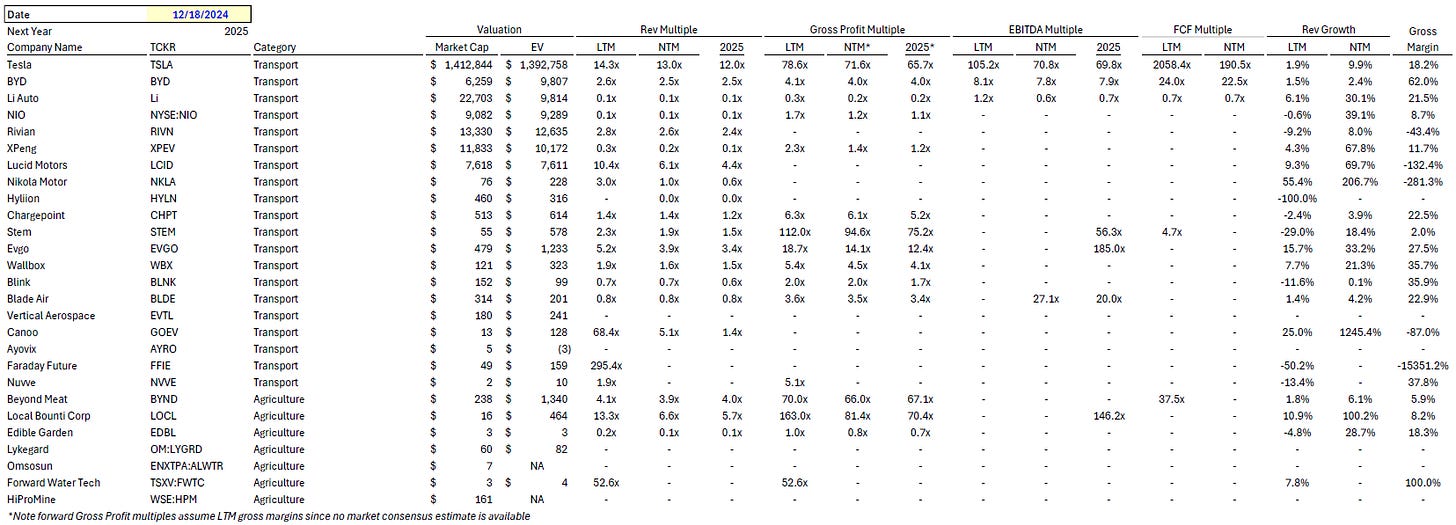

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

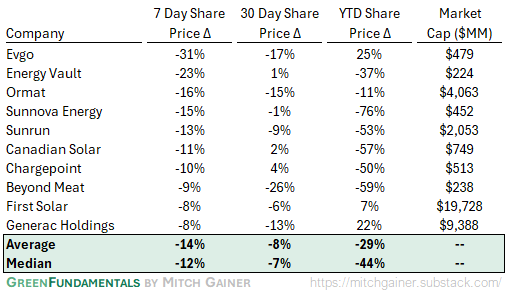

Top 10 and Bottom 10 Weekly Share Price Movement

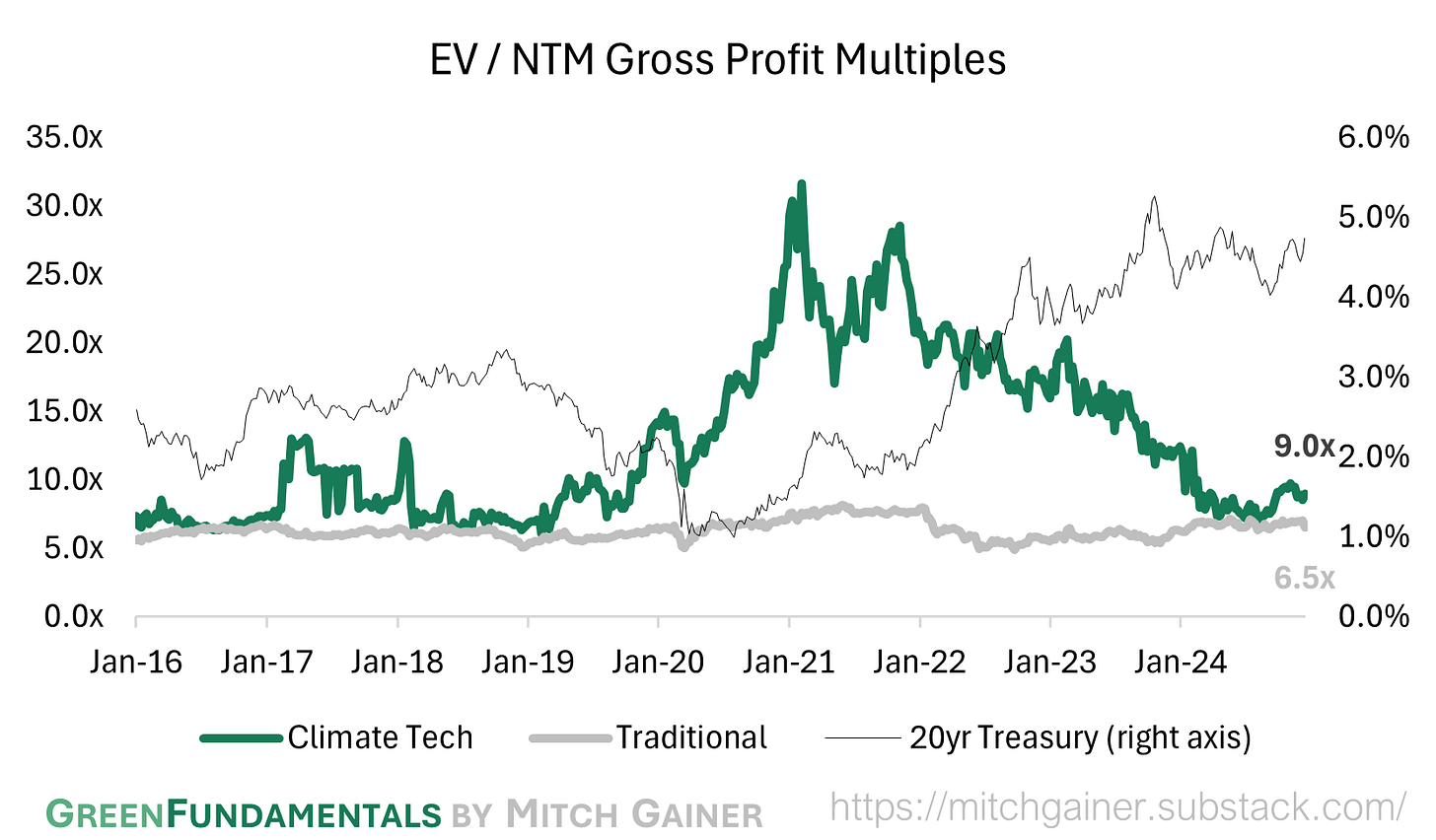

Valuation Multiples over Time

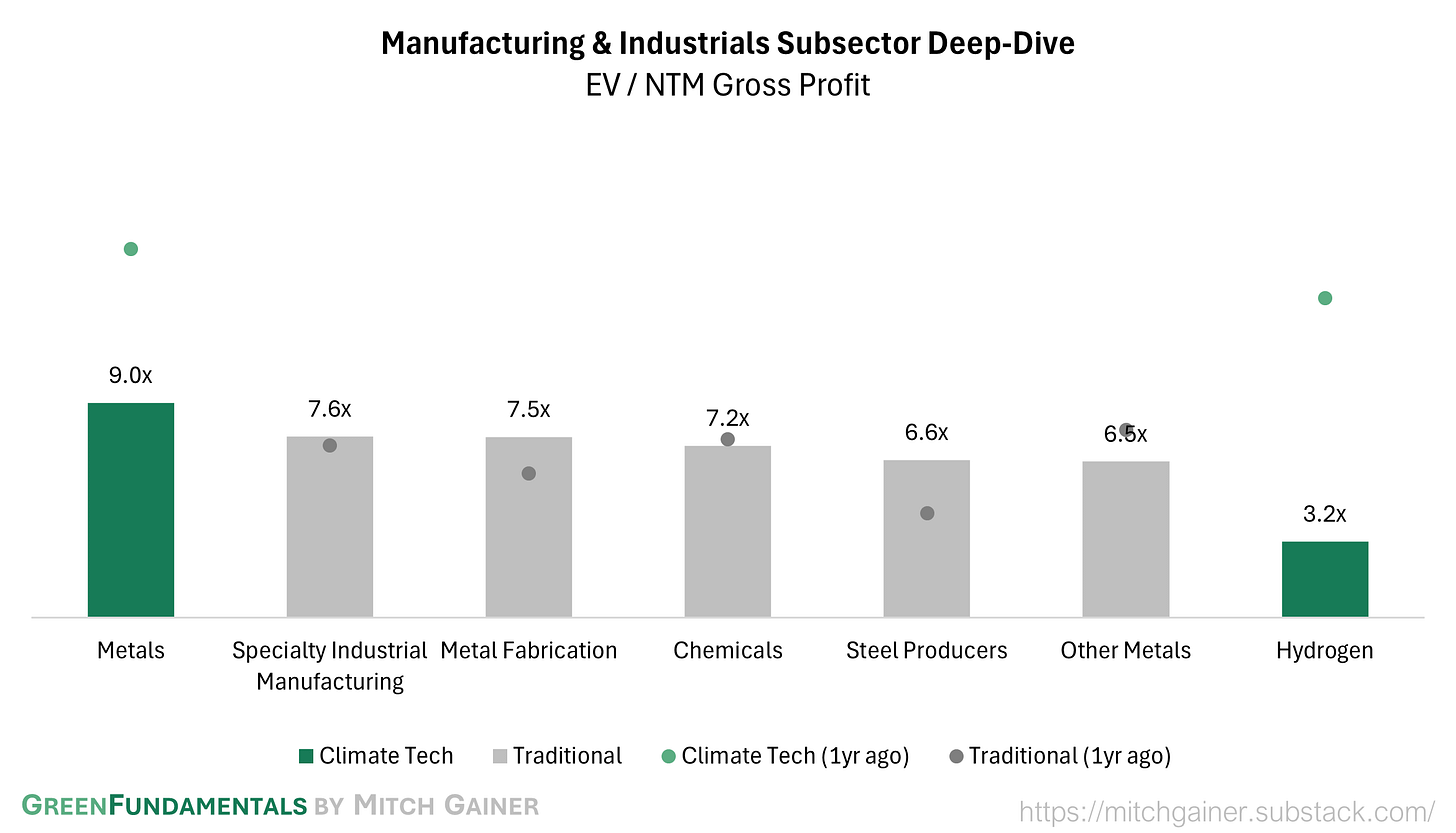

Deep-Dive by Subsector

Months of Cash

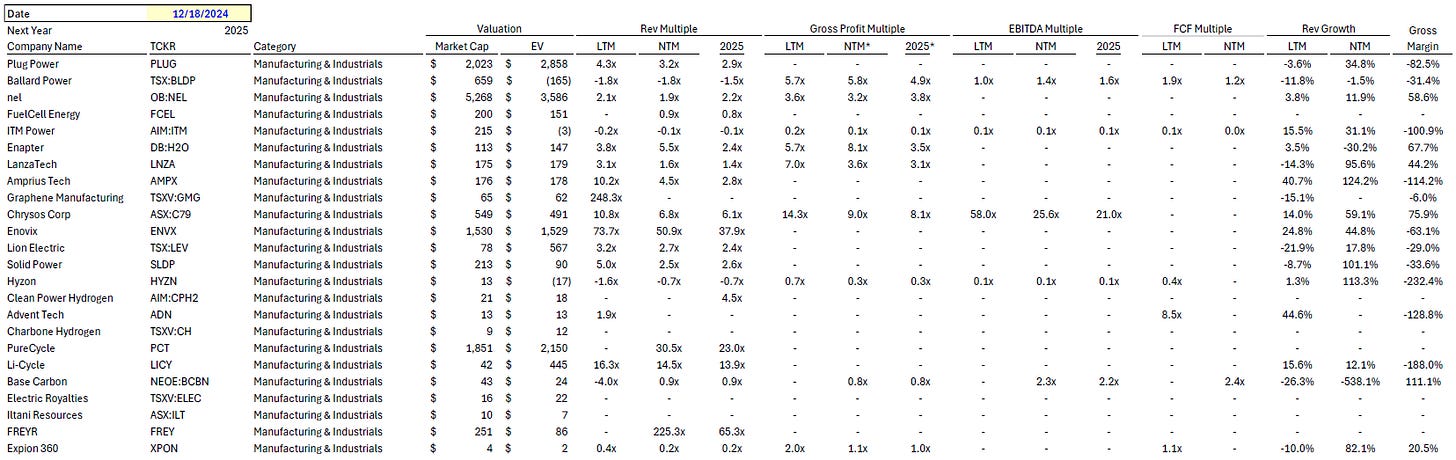

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.