Green Fundamentals: Trump's Energy Dominance Vision Comes Into Focus

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Investors Focus on Permitting, Tax Reforms, and Interest Rates as Trump Freezes $300B in Climate Funds

Trump’s "energy dominance" policy revival prioritizes fossil fuels and critical minerals while pausing $300 billion in federal climate funding. Fossil fuel and critical mineral sectors are poised to benefit from deregulation and federal incentives, while renewables face significant risks due to permitting challenges and funding freezes. The success of Trump’s 2025 tax plan in managing deficits will shape borrowing costs and infrastructure investments.

Day One Executive Orders

President Trump’s executive orders revive the "energy dominance" policy, with major implications for energy markets. Day One actions include:

Fossil Fuels: Federal leasing resumes for oil and gas exploration, with expedited approvals for pipelines and refineries. Arctic National Wildlife Refuge and Gulf Coast drilling are prioritized. Methane regulations are rolled back, EV subsidies are cut, and state-level emissions waivers for gas-powered vehicles are rescinded. Expect a surge in upstream activity, especially in Alaska and Gulf Coast regions.

Critical Minerals: To reduce reliance on China, the U.S. fast-tracks domestic mining and processing of lithium, cobalt, and rare earths. Public lands reopen for mining, and the U.S. Geological Survey updates critical mineral reserves. Federal loan guarantees and incentives are prioritized for processing facilities, signaling long-term opportunities in critical mineral supply chains.

Offshore Wind Halt: Offshore wind development is frozen, with new and renewed permits and loans suspended pending federal review. This creates uncertainty for developers in the sector.

Energy Diplomacy and Trade: LNG exports are positioned as a geopolitical tool, targeting markets in Europe and Asia. Trade policies restrict imports of Chinese solar panels and wind components, incentivizing domestic manufacturing and reshaping global supply chains.

$300B Funding Freeze: Federal funding under the Inflation Reduction Act (IRA) and infrastructure law is paused. Key projects at risk include $50 billion in Department of Energy loans already agreed to, such as $9 billion for DTE Energy and $3.5 billion for PacifiCorp. Also at risk are another $280 billion in loan requests under review.

Source: Financial Times

Investor Takeaways: Fossil fuel and critical mineral sectors are positioned for gains from deregulation and incentives, while renewable energy developers face delays, funding gaps, and increased legal risks.

Permitting Reform Under Trump

Investors look to a major permitting bill to potentially pass later this year. Building on his 2017 "One Federal Decision," Trump’s renewed focus on permitting reform aims to accelerate energy and infrastructure projects.

Scope Expansion: Trump’s reforms target fossil fuels and clean energy infrastructure, including transmission lines and utility-scale solar. Bipartisan support for grid modernization could mitigate bottlenecks and improve energy reliability.

NEPA Rollbacks: Anticipated changes include shorter public comment periods, reduced cumulative impact analyses, and tighter judicial review thresholds. These reforms promise faster approvals but heighten legal risks for controversial projects.

State-Level Preemption: Federal overrides may address state-level permitting delays, facilitating interstate pipelines and transmission projects.

Investor Insight: While faster permitting lowers upfront costs and mitigates delays, reduced scrutiny increases reputational and legal risks. Prioritize projects with clear paths to market under the new regulatory landscape.

Trump’s 2025 Tax Bill

The upcoming tax overhaul aims to sustain energy dominance and manufacturing competitiveness while addressing deficit concerns. Early indications suggest:

Corporate Tax Cuts: Trump seeks to make 2017 tax cuts permanent, targeting energy-intensive industries with streamlined deductions and credits.

IRA Rollbacks: Potential cuts to 45Y/48E bonuses, stricter oversight of LPO loans, and potential claw backs of EPA grants. Nuclear (45J/45U) and carbon capture (45Q) are likely to expand (see detailed analysis link below).

Domestic Content and Manufacturing: Bonuses for domestic content may become mandatory, particularly for credits like 45X. Semiconductor manufacturing and other critical sectors are expected to retain strong incentives due to national security and economic priorities.

Investor Insight: Advanced nuclear and carbon capture projects are likely winners, but IRA-dependent renewable developers face headwinds. Deficit neutrality will influence bond market reactions and borrowing costs. Early projections estimate a $660 billion to $1 trillion budget impact, necessitating significant IRA rollbacks to balance the books.

Interest Rate and Bond Market Implications

The bond market’s response to fiscal policy will shape U.S. borrowing costs. Despite recent Fed cuts, 10-year Treasury yields have risen to 4.8%, reflecting concerns over deficits and the persistence of inflation.

If Trump’s tax bill is paired with credible spending cuts, it could ease pressure on the bond market. Lower yields would reduce borrowing costs for infrastructure and renewable energy projects, making long-term investments more attractive.

If the tax bill exacerbates the deficit, bond markets could react sharply. Rising yields would increase borrowing costs for government and private borrowers, stalling investment in infrastructure and clean energy.

Source: MacroMicro

Source: Wallstreet Journal

Investor Insight: Elevated Treasury yields risk squeezing private investment in renewables and infrastructure. A fiscally disciplined tax plan could stabilize rates, while deficit-driven policies may stall project momentum and erode investor confidence.

The Long View

The climate tech revolution marches on, driven by macro forces like falling costs of new technologies and the structural shifts they enable. Interest rates and the underlying unit economics of clean energy, advanced storage, and innovative manufacturing will remain the ultimate determinants of long-term growth.

While Trump’s policies create clear winners—fossil fuels, LNG, critical minerals, and advanced nuclear—and losers—renewables, EVs, and offshore wind—these shifts are more about influencing the margins. Policy changes may accelerate or stall certain investments in the short term, but the broader energy transition is powered by unstoppable economic and technological trends.

For investors, understanding where macro forces, technology breakthroughs, and policy align will be key to navigating the opportunities and risks in this evolving landscape.

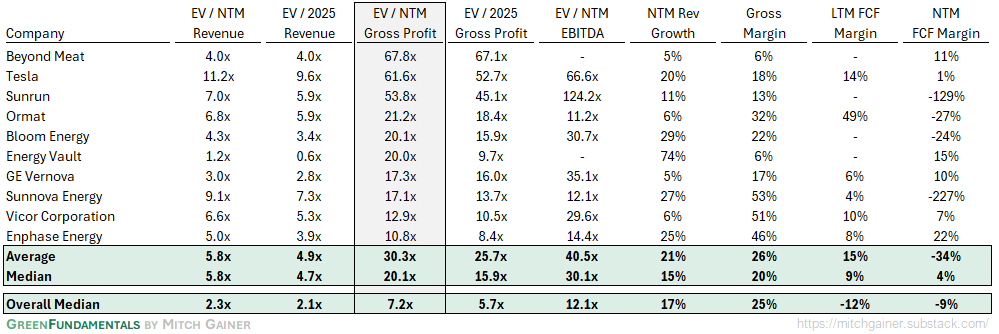

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

Top 10 and Bottom 10 Weekly Share Price Movement

Valuation Multiples over Time

Deep-Dive by Subsector

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

New subscriber here, Mitch. I am enjoying your perspective. One quick question: you posit that winners under President Trump’s policies include advanced nuclear and carbon capture bets. I understand carbon capture potentially being helped, but how do you see advanced nuclear benefitting? Thanks…