Green Fundamentals: Will Sunnova Burn Out Like SunPower?

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Sunnova is more diversified than SunPower, but analysts will be listening closely to the Oct 31 earnings call

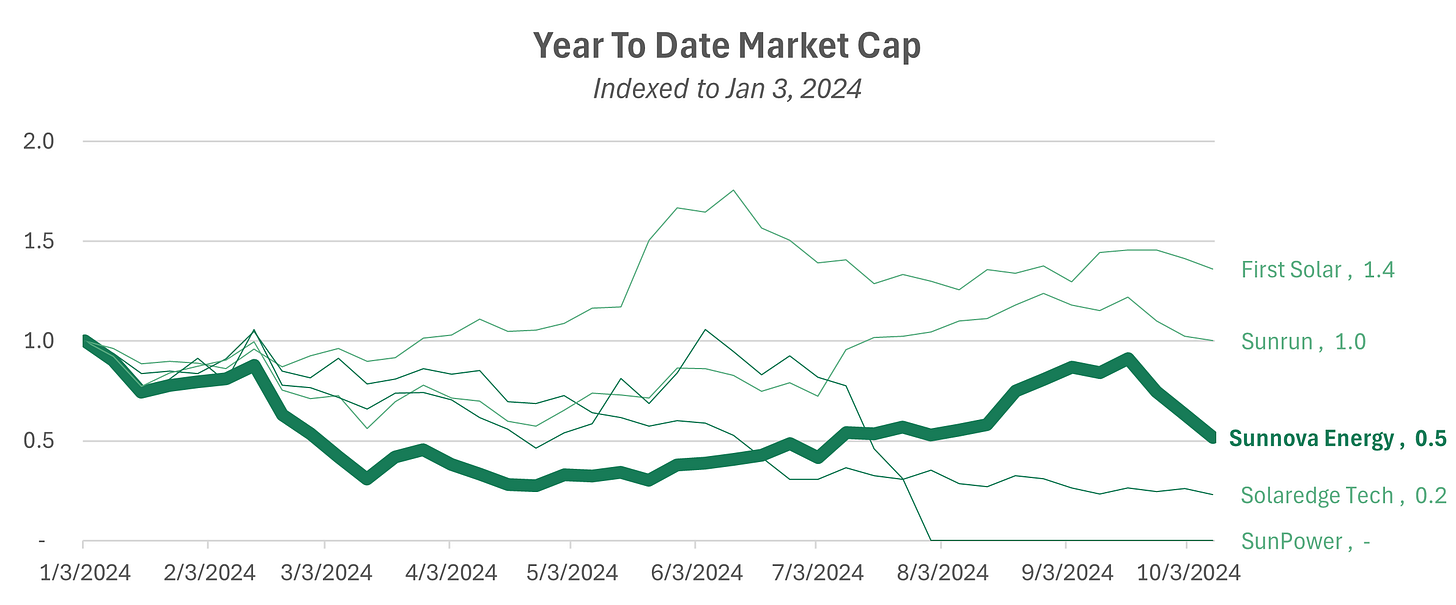

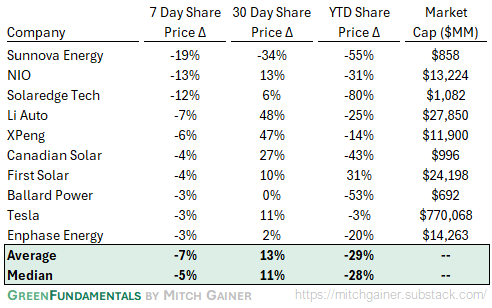

What Happened: Sunnova Energy (NOVA), a leading provider of residential and commercial solar and energy storage services, has seen its stock decline by 19% in the last 7 days and 55% year-to-date. This sharp decrease contrasts with First Solar (+36% YTD), which has thrived, and Sunrun (flat YTD). However, Sunnova's performance is better than SolarEdge (-77% YTD), which has faced significant challenges, and SunPower (which filed for bankruptcy in August).

Source: CapitalIQ

Background: The solar energy industry is undergoing a transformative period. While the global push for renewable energy sources continues, the residential and commercial sectors face distinct headwinds and tailwinds.

Residential Solar Headwinds:

Regulatory Changes: In California, a major market for residential solar, recent adjustments to Net Energy Metering (NEM) policies have reduced the financial incentives for homeowners to install solar panels. NEM 3.0, implemented by the California Public Utilities Commission, lowers the compensation rates for excess energy sent back to the grid, impacting the return on investment for residential solar customers.

Market Saturation and Competition: Increased competition among solar providers has led to thinner margins and intensified the battle for market share.

Financing Challenges: Rising interest rates have made financing solar installations more expensive for both consumers and companies like Sunnova, which rely on debt financing to support growth.

Commercial Solar Tailwinds:

Behind-the-Meter Solar + Storage Opportunities: Businesses are increasingly adopting behind-the-meter solar installations combined with energy storage solutions. This setup allows them to generate and consume their own energy, reducing dependence on the grid and cutting operational costs.

Incentives and Tax Credits: Government incentives, such as the Investment Tax Credit (ITC) for commercial solar projects, continue to bolster the sector.

At the beginning of 2024, a few companies looked to navigate these changing market dynamics. They aren’t all still with us today:

Sunnova Energy (NOVA): Offers residential and commercial solar and energy storage services across the U.S., providing flexible financing options to make clean energy accessible.

Sunrun (RUN): The largest residential solar and energy storage company in the U.S., specializing in solar-as-a-service solutions, including installation, financing, and maintenance.

SolarEdge Technologies (SEDG): Develops inverter systems, power optimizers, and energy management solutions for solar installations, serving both residential and commercial markets globally.

First Solar (FSLR): A leading manufacturer of thin-film photovoltaic (PV) solar modules and developer of utility-scale solar projects, focusing on large-scale installations with innovative technology.

SunPower Corporation (SPWR): Provides high-efficiency solar panels and comprehensive energy solutions for residential and commercial customers, emphasizing advanced technology for maximum energy output.

Take-Away: Companies focused on the commercial sector, like First Solar, have outperformed this year, benefiting from policy support and robust demand. First Solar, in particular, has thrived due to:

Government Incentives: The U.S. Inflation Reduction Act (IRA) offers substantial tax credits for domestically produced solar panels, directly benefiting First Solar's U.S.-based manufacturing operations.

Technological Advantages: Proprietary thin-film technology provides cost and efficiency benefits, appealing to large-scale energy producers.

Conversely, companies heavily invested in the residential sector, such as Sunnova, Sunrun, and SolarEdge, face significant headwinds:

Supply Chain Issues: SolarEdge has grappled with supply chain disruptions and increased costs for components like semiconductors, affecting production and profitability.

Rising Interest Rates: Sunrun and Sunnova face increased financing costs, which can reduce margins and make solar offerings less attractive to consumers.

Regulatory Uncertainty: California's NEM 3.0 law decreases the financial benefits of residential solar, impacting growth prospects in a key market.

What Comes Next: As Sunnova prepares for its October 31 earnings call, analysts and investors will be keenly focused on the company's strategies to navigate these challenges:

Mitigating Regulatory Impacts:

Adaptation to NEM 3.0: How does Sunnova plan to adjust its business model in California? Are there new value propositions or technologies to enhance customer ROI?

Market Diversification: Initiatives to expand into states with more favorable policies or to advocate for supportive legislation.

Expanding Commercial Opportunities:

Expansion Plans: Is Sunnova increasing its focus on the commercial sector to capitalize on current tailwinds?

Partnerships and Projects: Potential collaborations with businesses seeking behind-the-meter solutions.

Financial Strategy Amidst Higher Interest Rates:

Debt Management: Strategies to manage existing debt and reduce exposure to interest rate fluctuations.

Financing Models: Adjustments to customer financing options to maintain attractiveness and profitability.

Portfolio Diversification:

Product and Service Innovation: Development of new offerings, such as energy management systems or community solar projects, to diversify revenue streams.

Despite the challenges, some analysts remain optimistic about Sunnova's potential. Jefferies recently upgraded Sunnova to a BUY rating following the stock's decline, citing the company's potential to adapt and grow. Their reasons for optimism include (1) Sunnova's mix of residential and commercial services may provide resilience and (2) the overall demand for renewable energy solutions is expected to grow, offering opportunities for well-positioned companies.

The upcoming earnings call is an opportunity for the company to articulate its strategic vision and reassure investors of its ability to navigate the current headwinds. By addressing regulatory challenges, leveraging commercial sector opportunities, and optimizing its financial strategies, Sunnova can position itself for sustained growth in the evolving solar industry.

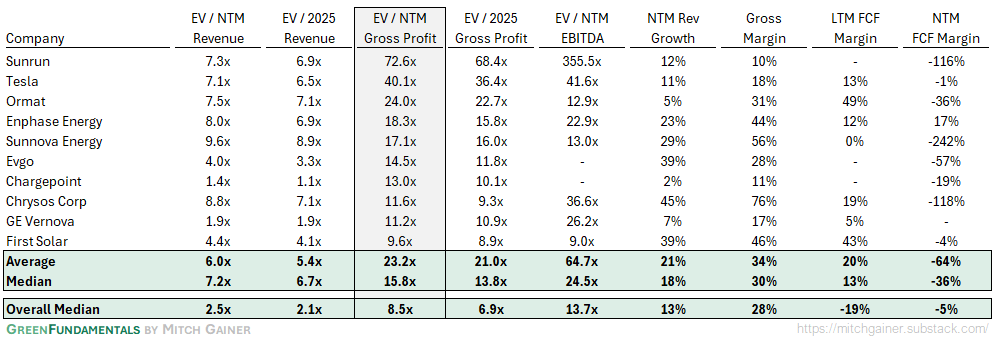

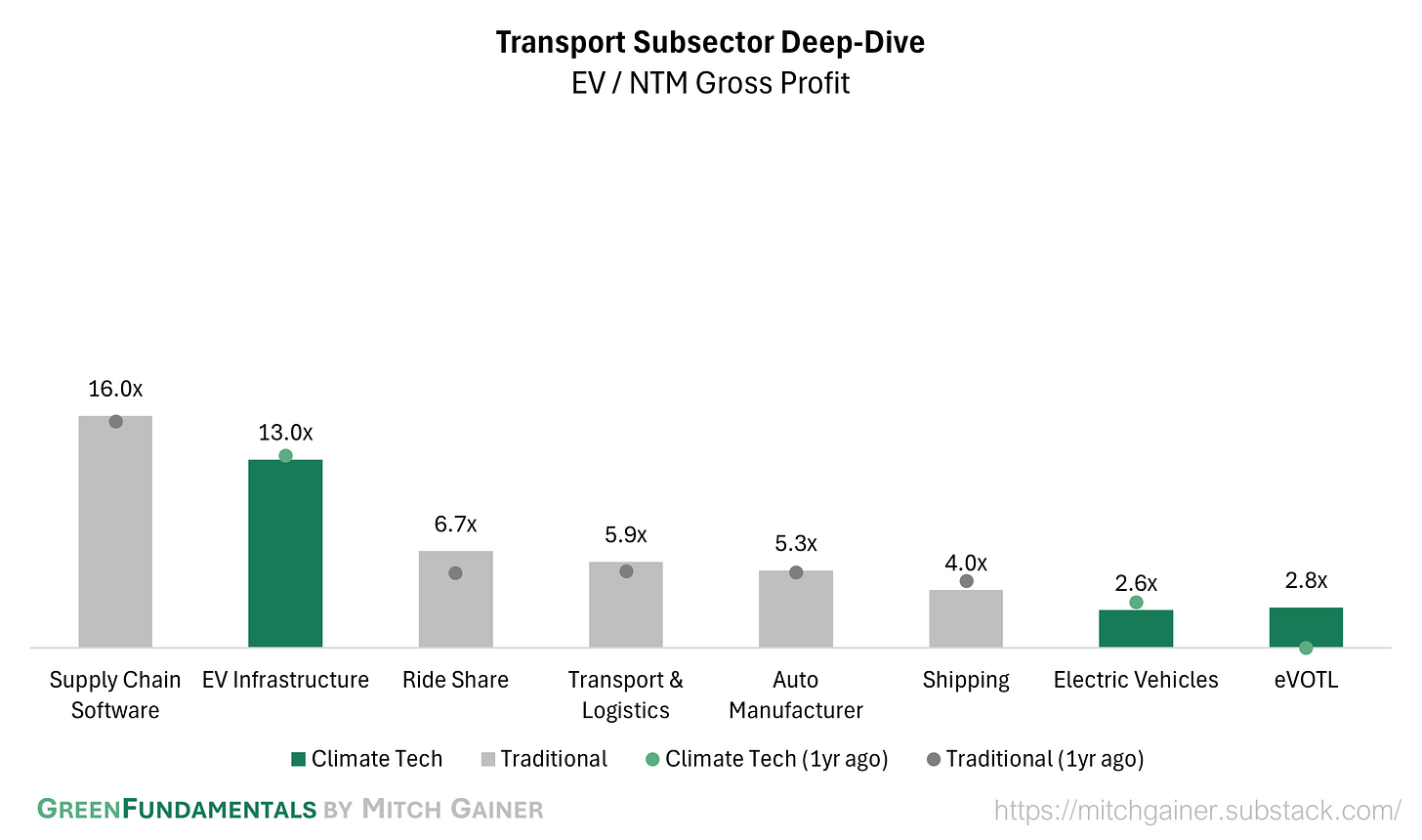

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

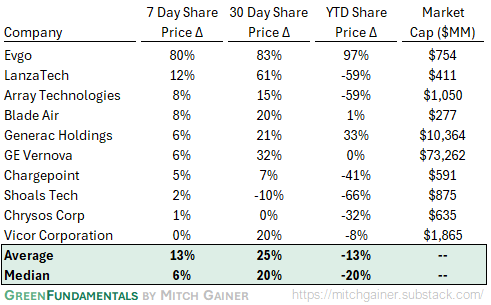

Top 10 and Bottom 10 Weekly Share Price Movement

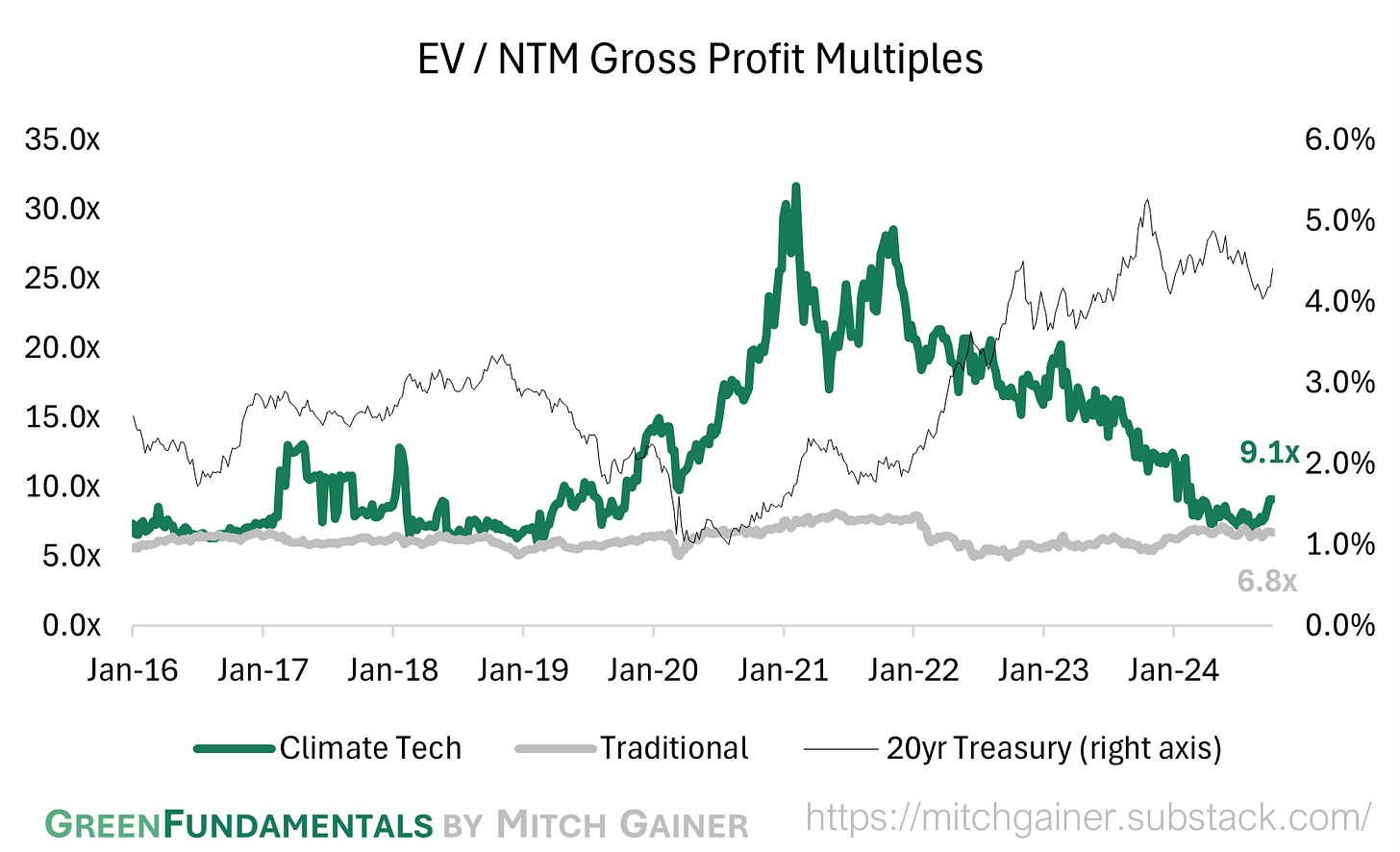

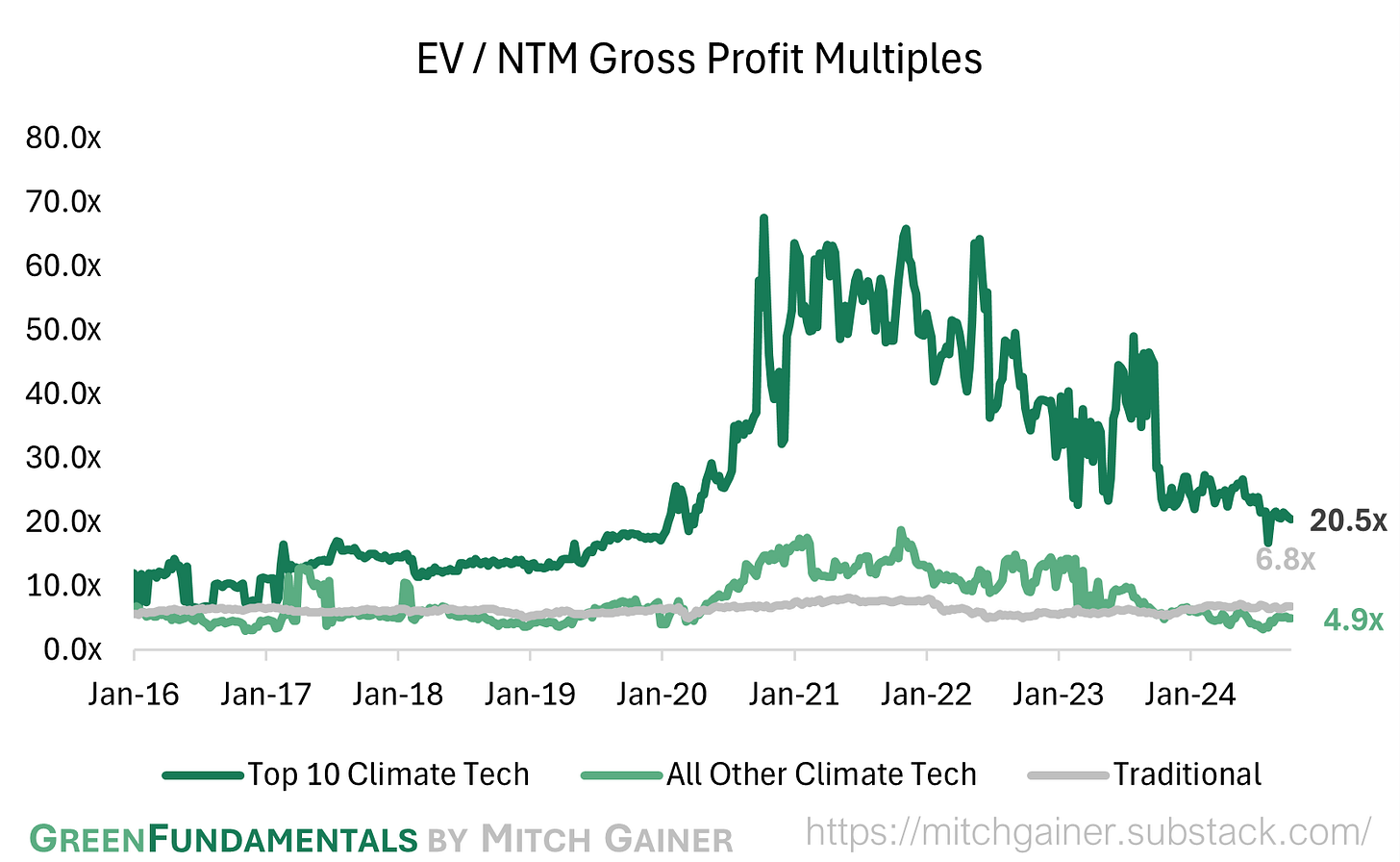

Valuation Multiples over Time

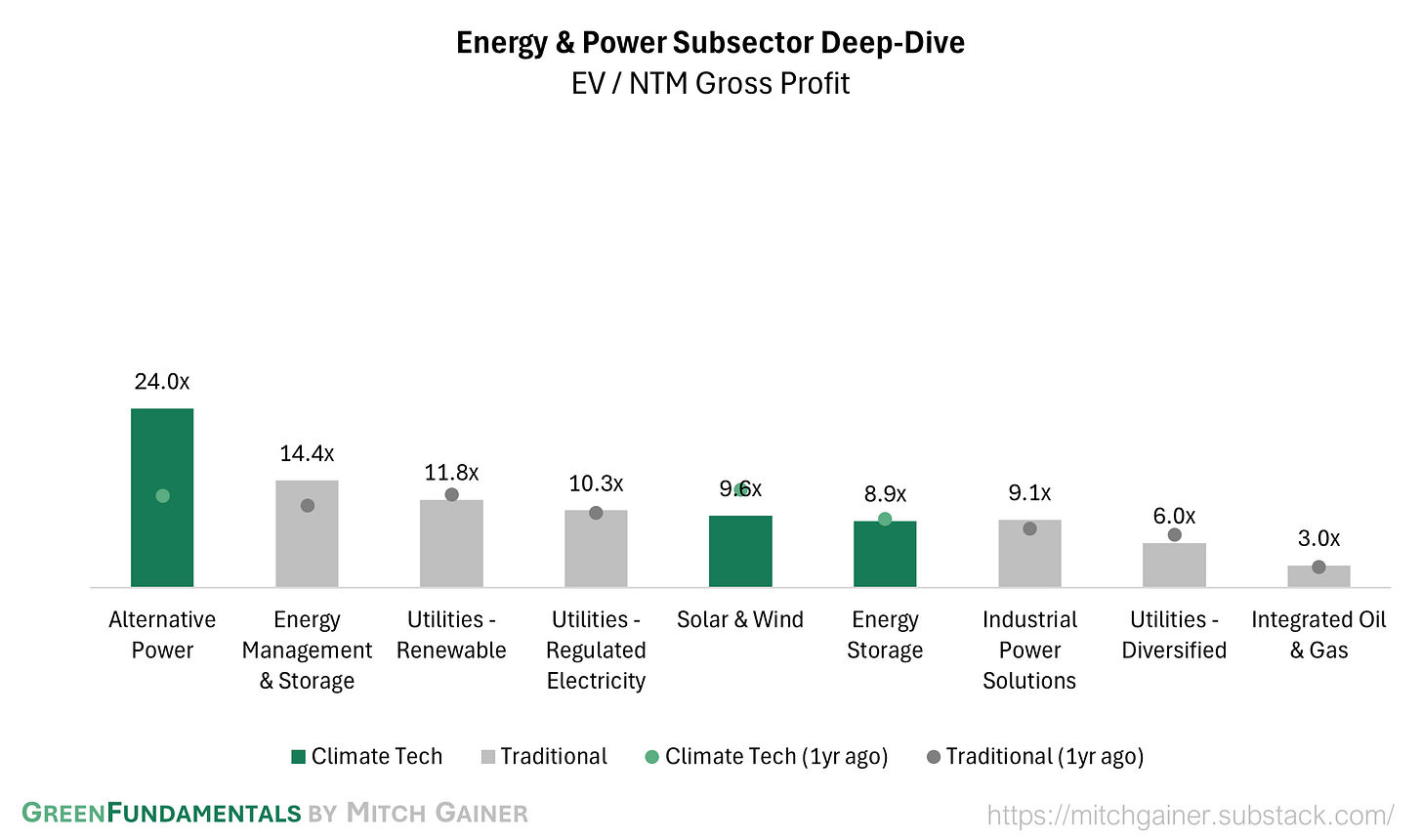

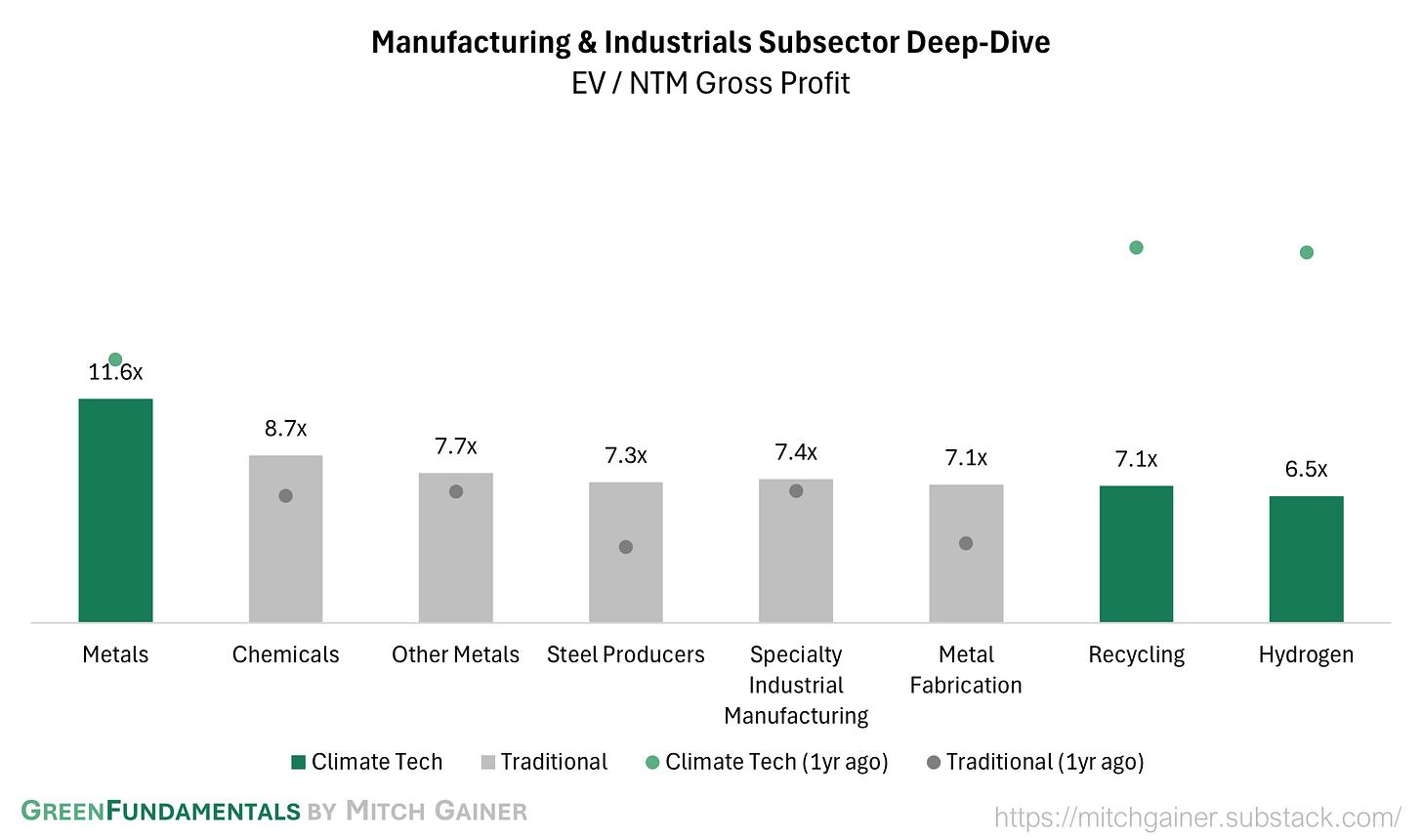

Deep-Dive by Subsector

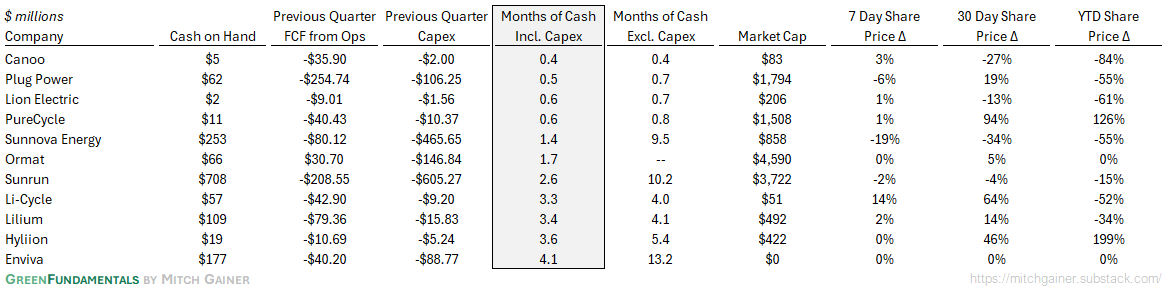

Months of Cash

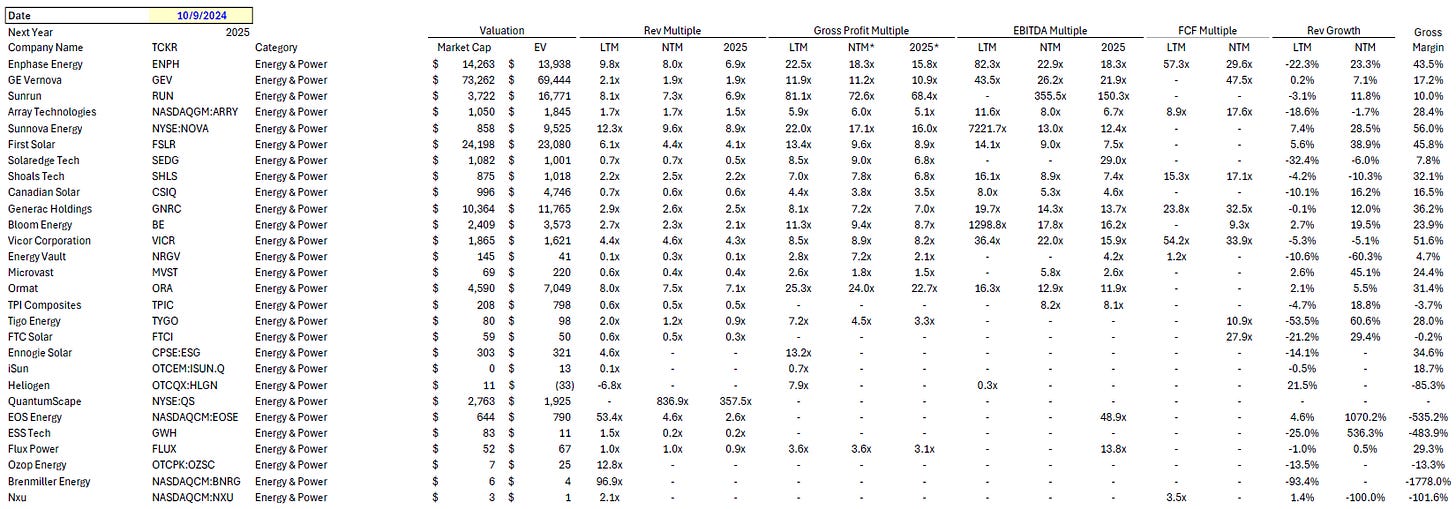

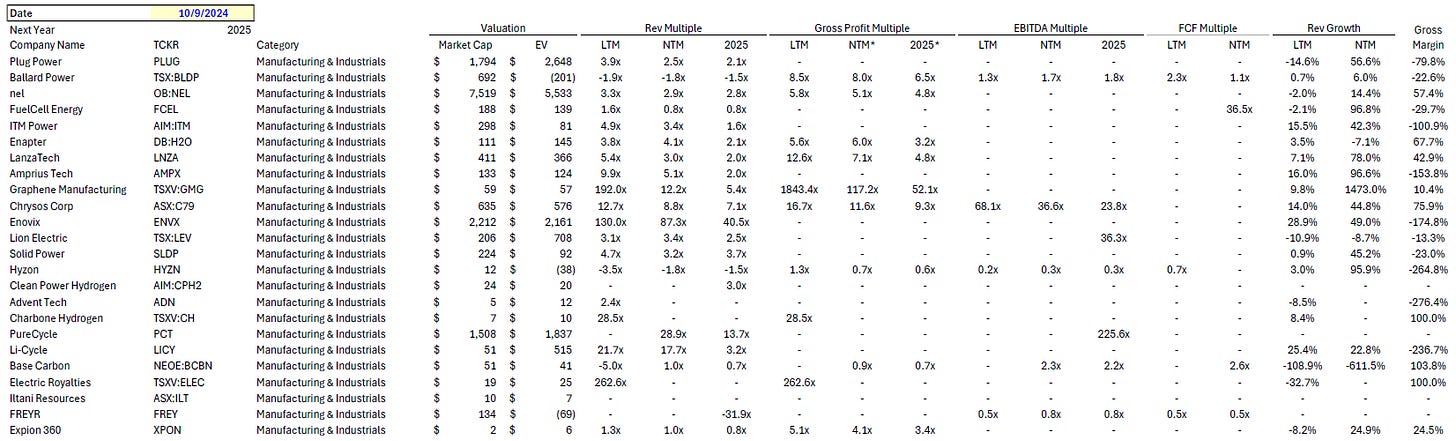

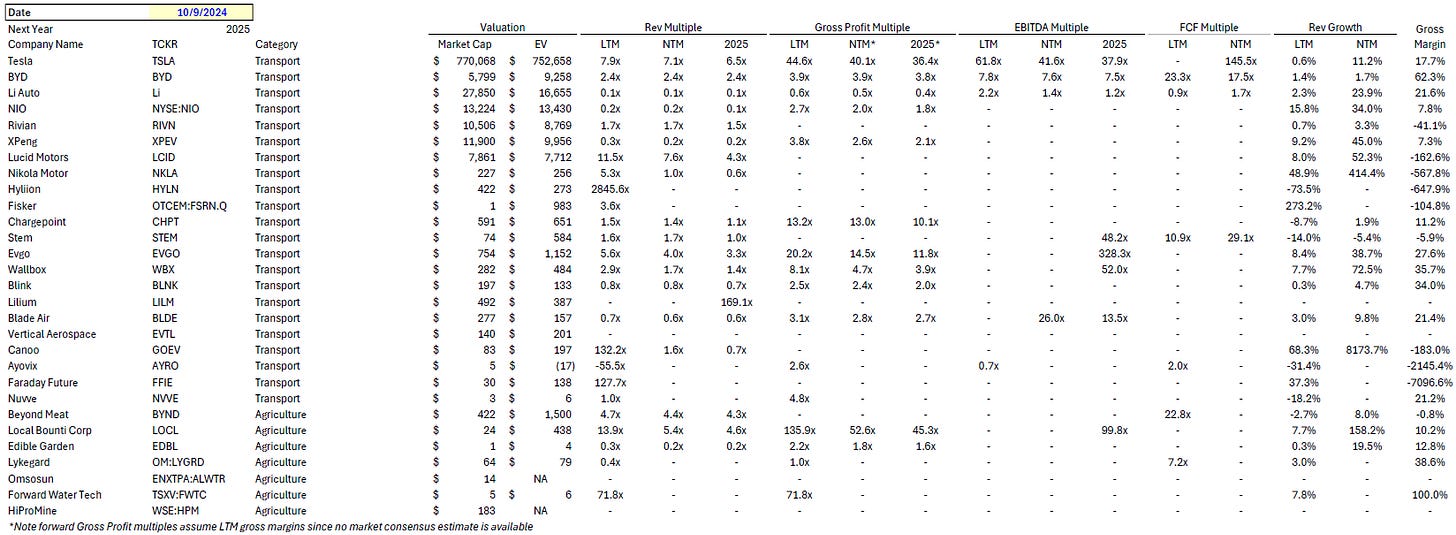

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.