Green Fundamentals: Biden's Big Green Goodbye

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Biden’s IRA Regulations Go Out The Door, But Investors Should Not Expect For All ‘Winners’ To See The Cash

As the Biden administration wraps up with landmark energy regulations and tax credit announcements, the incoming Trump administration promises significant shifts in energy policy, manufacturing, and fiscal strategy. Below is a streamlined analysis of recent announcements from the departing Biden administration as they race to cement their legacy before time runs out.

Technology-Neutral Clean Electricity Tax Credits (45Y, 48E)

Announcement: On January 7, 2025, the Treasury and IRS finalized guidance for the 45Y and 48E tax credits.

Technology Neutrality: Open to any technology achieving net-zero lifecycle emissions, including wind, solar, nuclear, geothermal, marine, and emerging innovations like wave energy. RNG and hydrogen fuel cells require lifecycle emissions verification.

Phase-Out Schedule: Credits are available through 2032 or until grid emissions fall 75% below 2022 levels, phasing out over three years thereafter.

Investor Insight: Expected to add 146–308 GW of clean energy by 2030, these credits anchor the U.S. clean energy economy. Their longevity and flexibility make them a cornerstone for decarbonization-focused investments. There is possible risk for the benefit to be reduced in a future Trump Tax Bill in 2025.

Source: Rhodium Group

Hydrogen Tax Credit (45V)

Announcement: On January 3, 2025, the Treasury and IRS issued final 45V rules, addressing deployment barriers while maintaining emissions rigor.

Incrementality: Expanded pathways for qualifying clean electricity, including nuclear plants at risk of retirement, CCS-equipped generators, and state policies like those in California and Washington.

Temporal Matching: Annual electricity-hydrogen matching allowed until 2030 (a slight extension over previous guidance), then hourly matching required.

Methane-Based Hydrogen: Improved methane leakage accounting; RNG and coal mine methane sources gain expanded eligibility.

Investor Insight: The rules provide greater flexibility for hydrogen producers while preserving environmental rigor. The phase-in of hourly matching and broader pathways for incrementality address industry concerns about investment viability. However, compliance complexities, particularly for green hydrogen, could hinder rapid deployment.

Green hydrogen projects face compliance challenges, while blue hydrogen gains a competitive edge from lenient methane rules. California and Washington projects are well-positioned, but U.S. hydrogen remains globally uncompetitive.

Advanced Manufacturing (48C) Round 2 Allocations

Announcement: On January 10, 2025, $6 billion was allocated to 50 clean energy manufacturing and decarbonization projects.

$3.8 billion for clean energy technologies like EV components, electrolyzers, and wind/solar components.

$1.5 billion for recycling and refining critical materials such as lithium and rare earth elements.

$700 million for industrial decarbonization projects, including heat pumps and electric boilers.

Investor Insight: Many awarded projects may never materialize. Significant project changes can disqualify them from the 48C credits. Be cautious of companies taking costly or impractical steps to retain eligibility or raising funds on awards that may ultimately be forfeited.

Clean Commercial Vehicle Credit (45W)

Announcement: On January 10, 2025, the Treasury and IRS released final guidance on the 45W credit for commercial clean vehicles.

Credit Value: Up to $40,000 per vehicle or 30% of the cost, depending on vehicle size and emissions.

Eligibility: Vehicles must meet specific emissions and battery content standards, with phased domestic content requirements for critical minerals and battery components.

Investor Insight: Fleet operators with scalable EV deployment plans stand to benefit most. Watch for innovation in meeting domestic content standards, a key to maximizing credit value.

Clean Fuel Production Credit (45Z)

Announcement: On January 10, 2025, the IRS issued final regulations for the 45Z credit, offering $1 per gallon for clean fuel production with lifecycle GHG emissions reductions of 50% or more.

Eligibility: Biofuels, renewable natural gas (RNG), and hydrogen-derived fuels qualify, subject to GHG lifecycle analysis.

Sliding Scale: Credit value is proportional to emissions reductions compared to a petroleum baseline.

Investor Insight: Developers targeting aviation and maritime biofuels could see outsized benefits. Ensure alignment with stringent emissions verification standards.

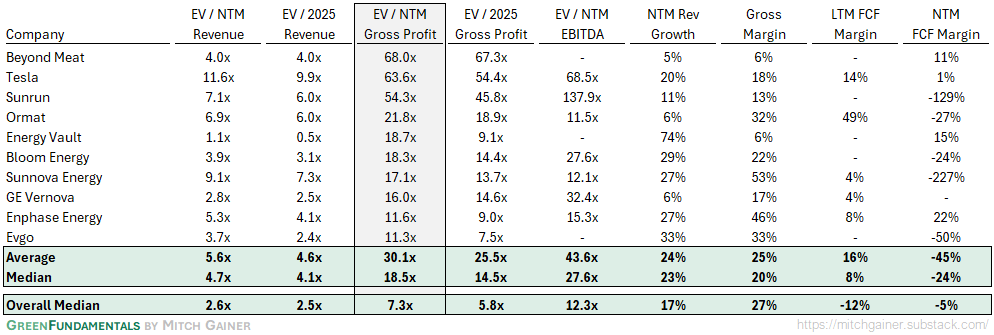

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

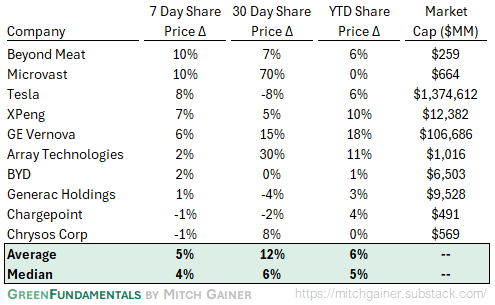

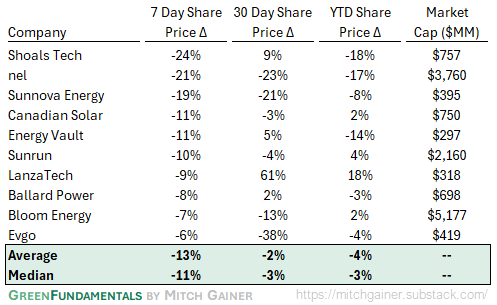

Top 10 and Bottom 10 Weekly Share Price Movement

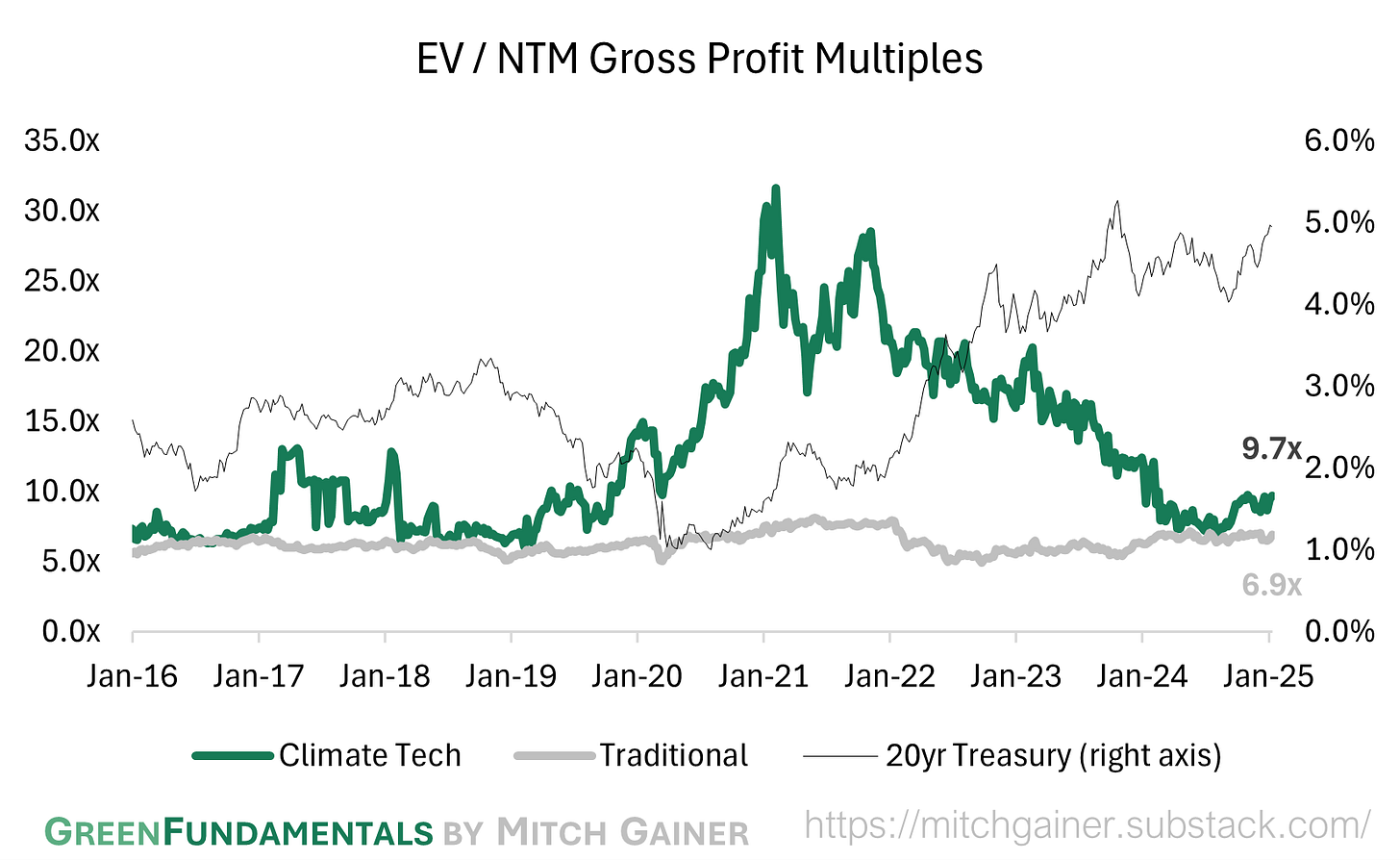

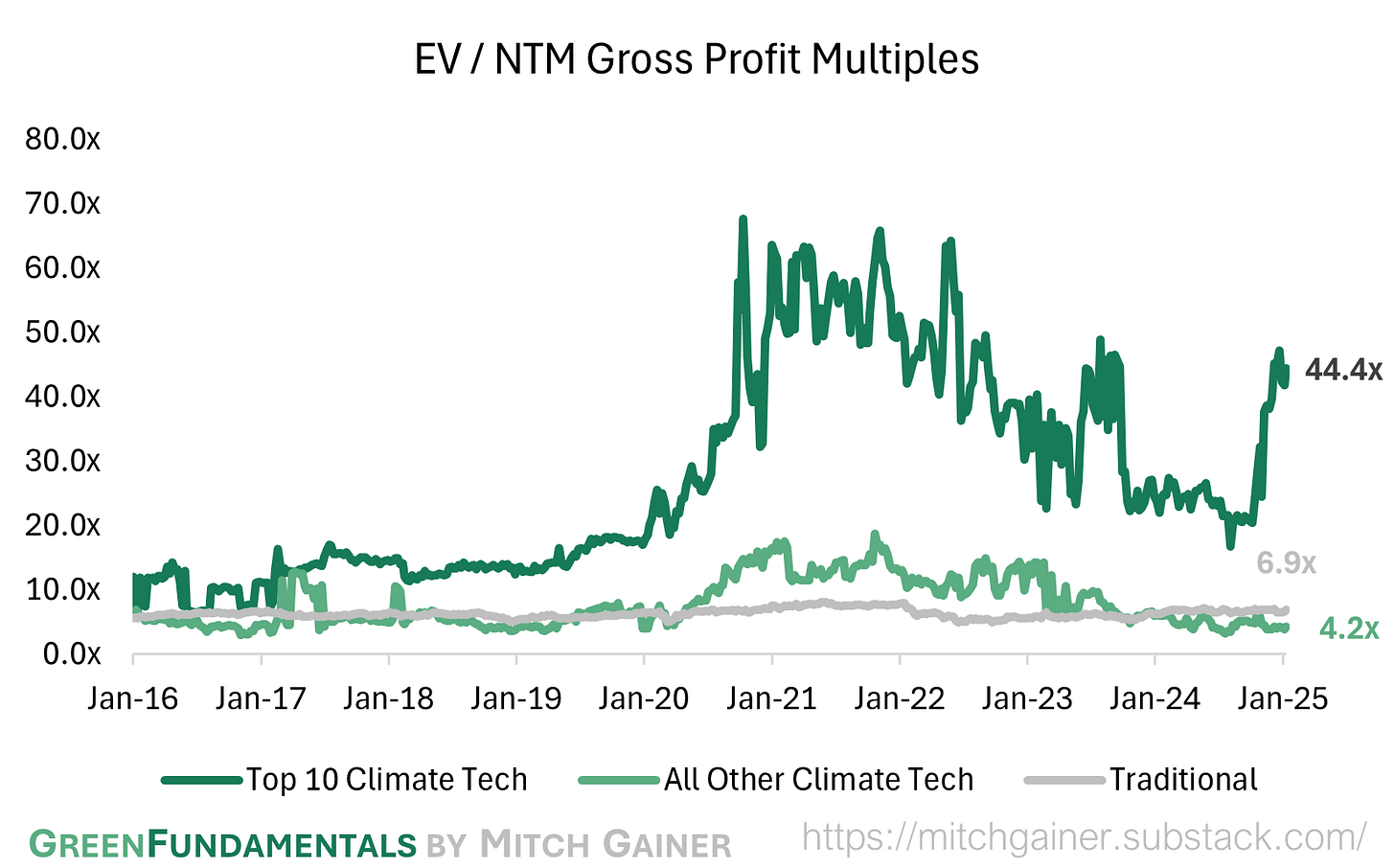

Valuation Multiples over Time

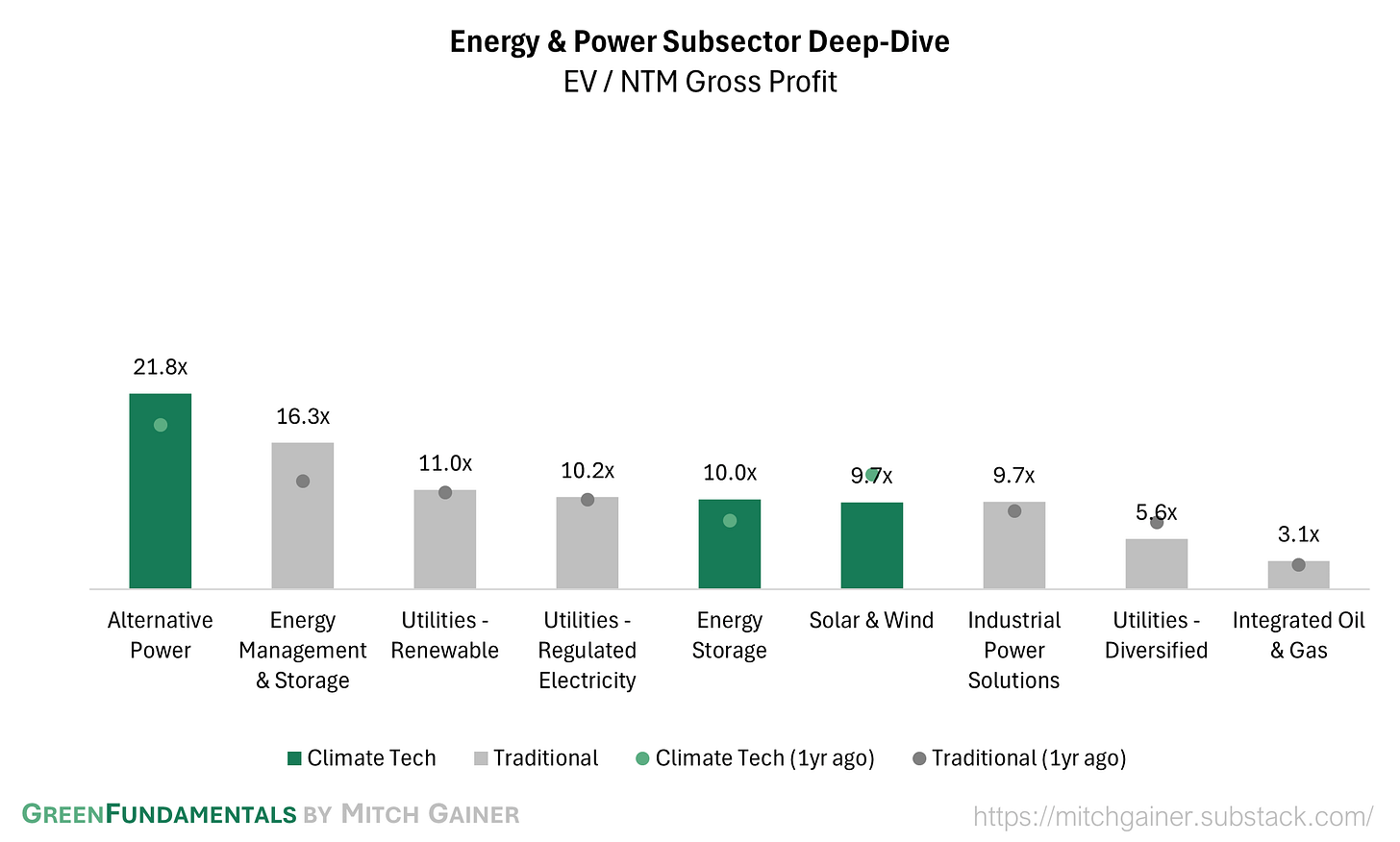

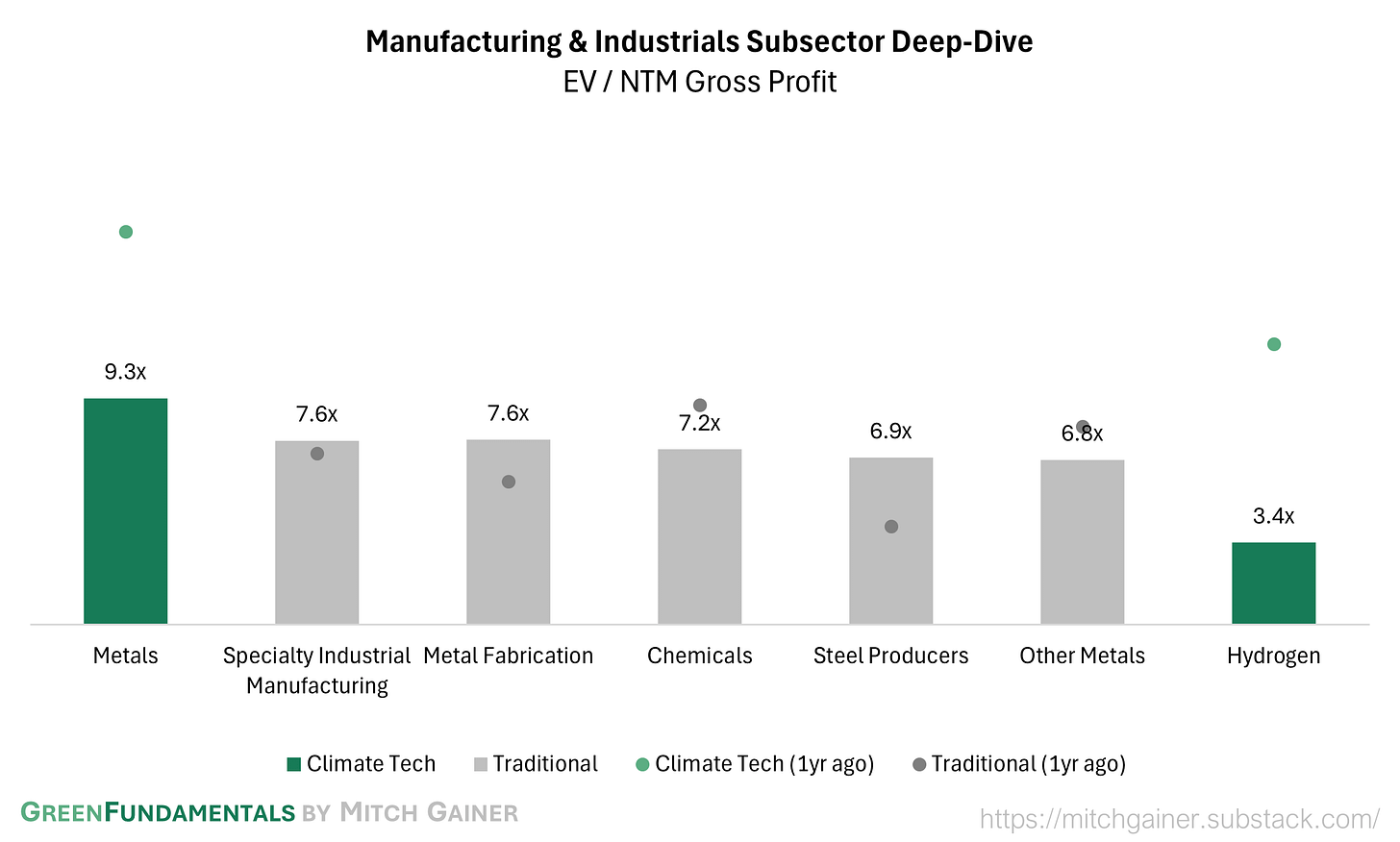

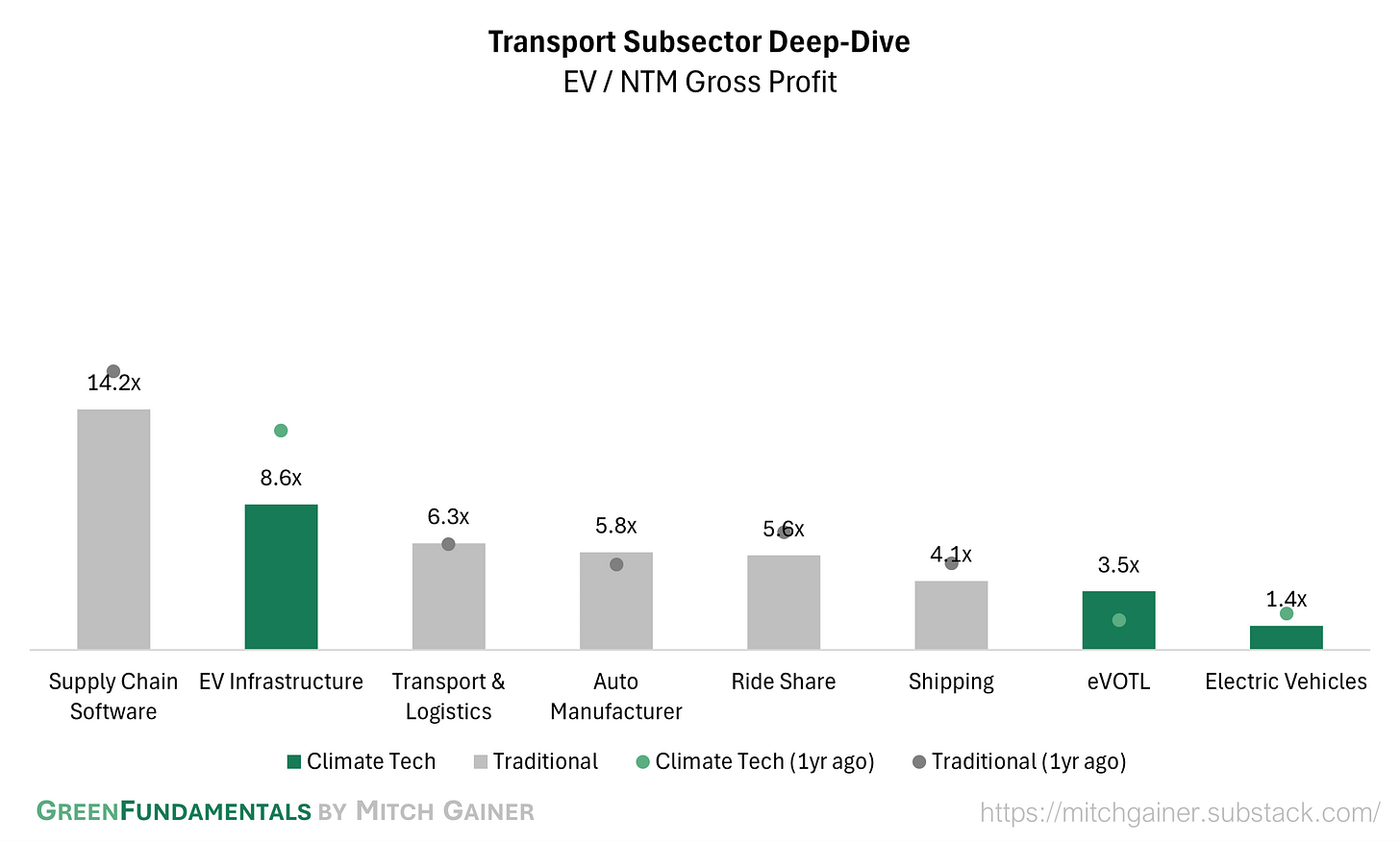

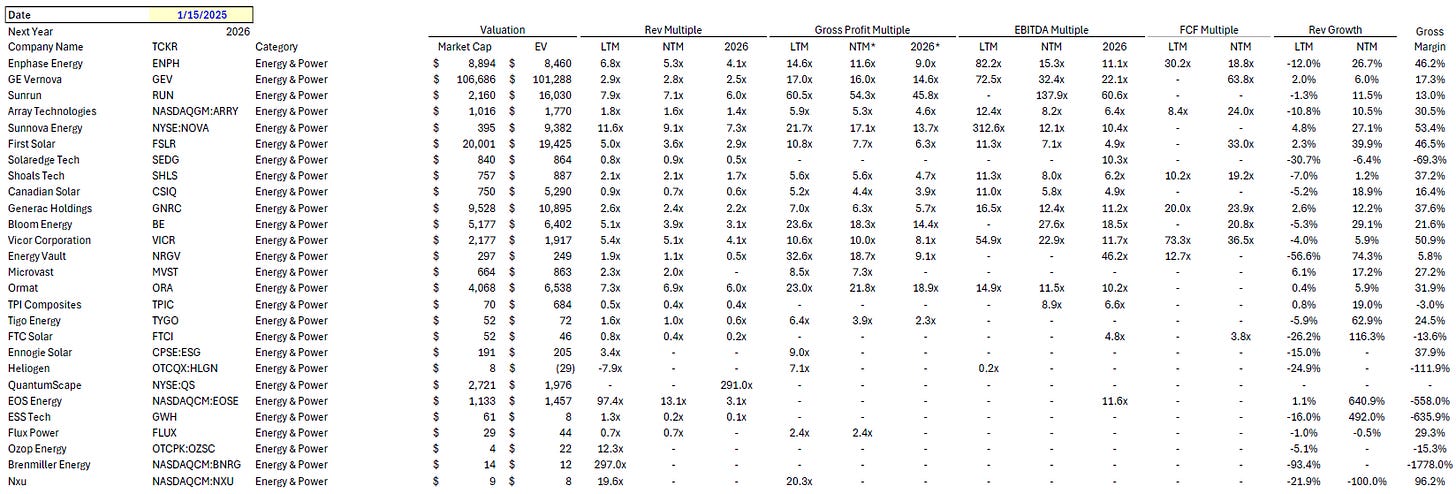

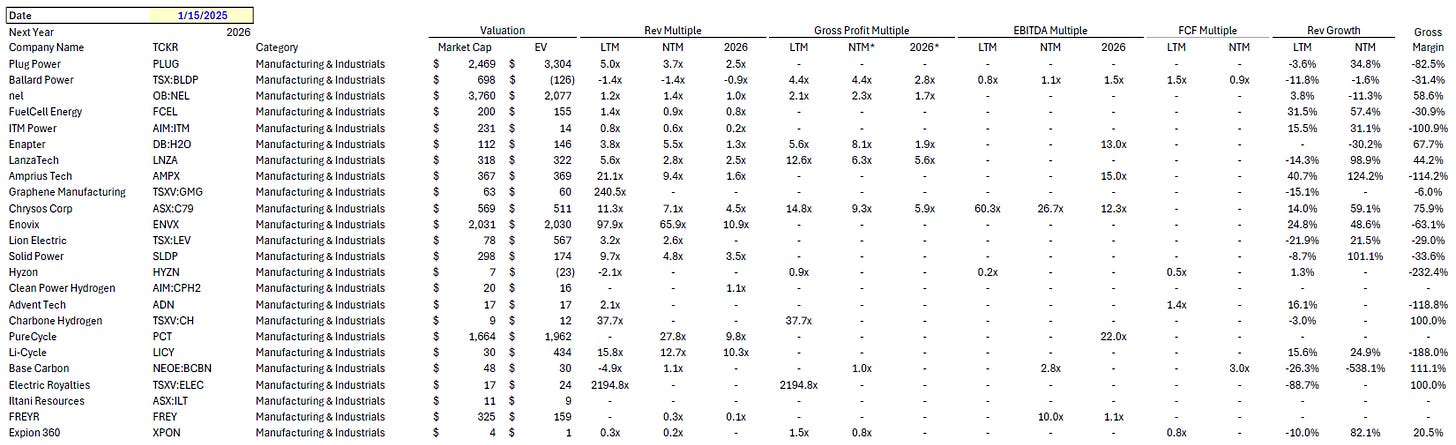

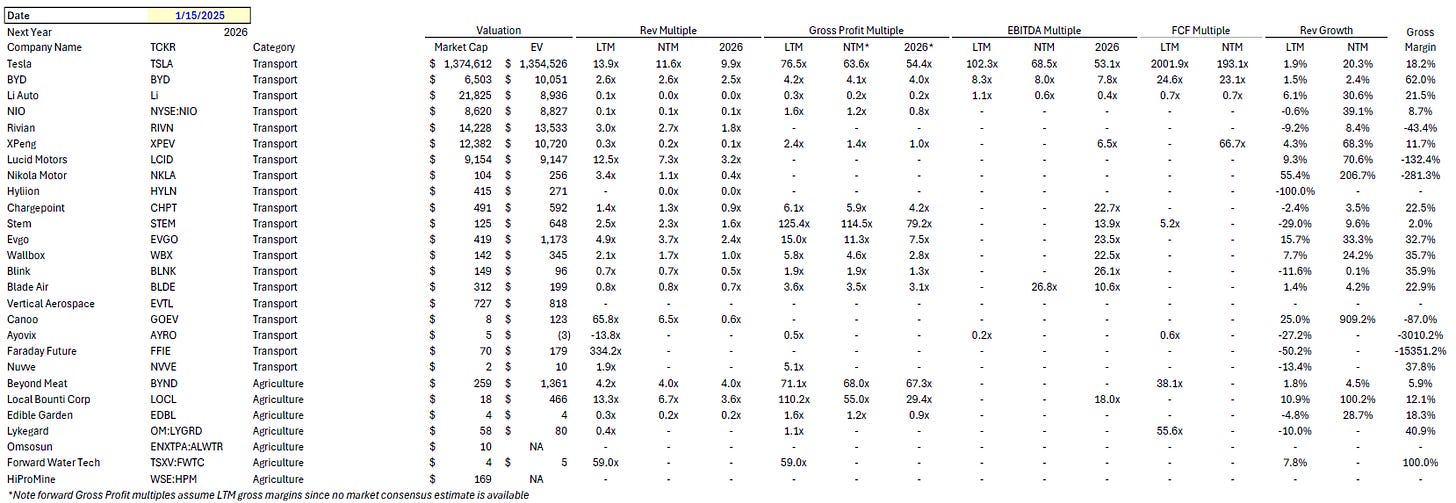

Deep-Dive by Subsector

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.