Green Fundamentals: Are Data Centers Gaslighting Us?

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

Nuclear and Geothermal make headlines but Natural Gas is likely to fuel data center growth through 2030

What Happened: In the past week, two major tech companies made significant investments in nuclear power to support their energy-intensive data centers. Amazon announced a $500 million investment in X-Energy to develop small modular reactors (SMRs), while Google partnered with Kairos Power to explore advanced nuclear reactors for powering its data centers. These moves highlight the growing energy demand from AI-driven data centers and the need for reliable, clean energy sources.

Check out past articles on data centers and:

Background: While AI is a key driver of long-term demand, most of the projected energy growth through 2030 is coming from existing cloud applications. Over the past decade, data centers have made significant efficiency gains by improving chips and operations, but those efficiency gains are now hitting a wall, with diminishing returns driving a new spike in projected power needs.

Source: Goldman Sachs

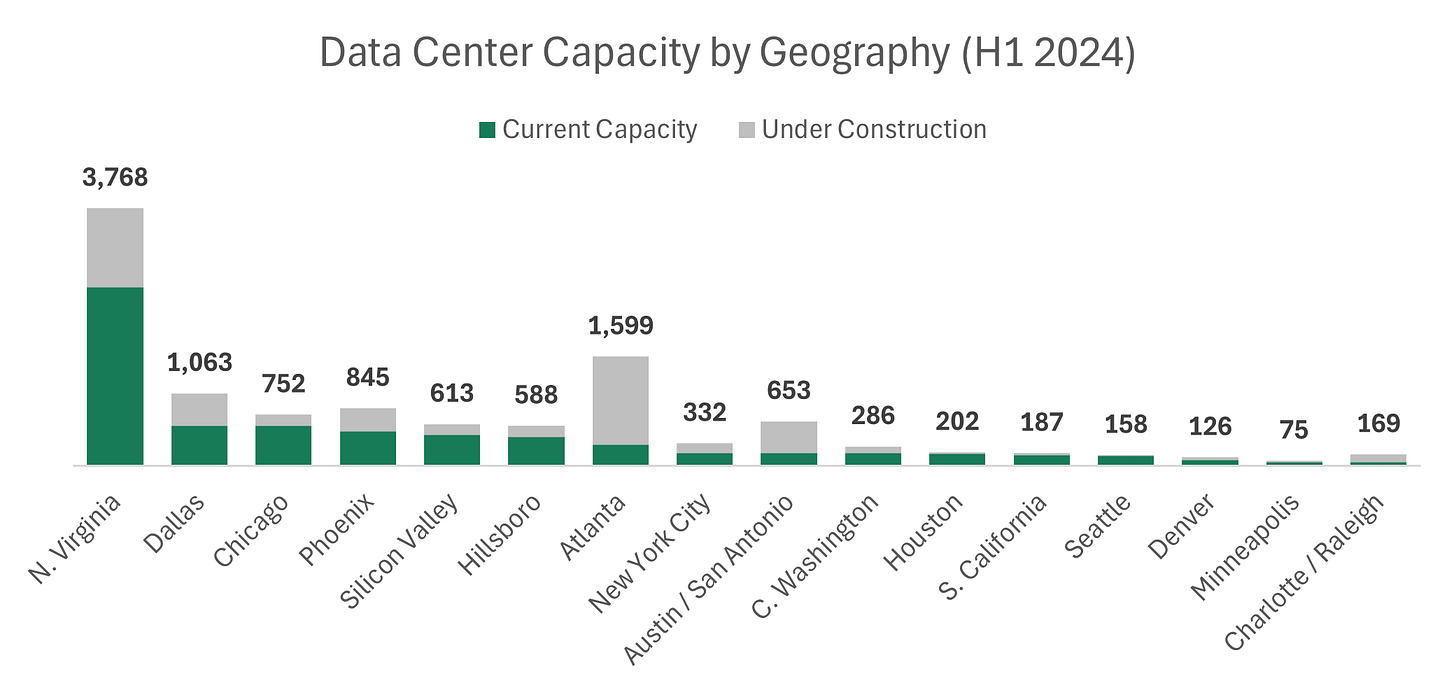

Data centers thrive in regions where energy is abundant, costs are manageable, and connectivity to major tech hubs is strong.

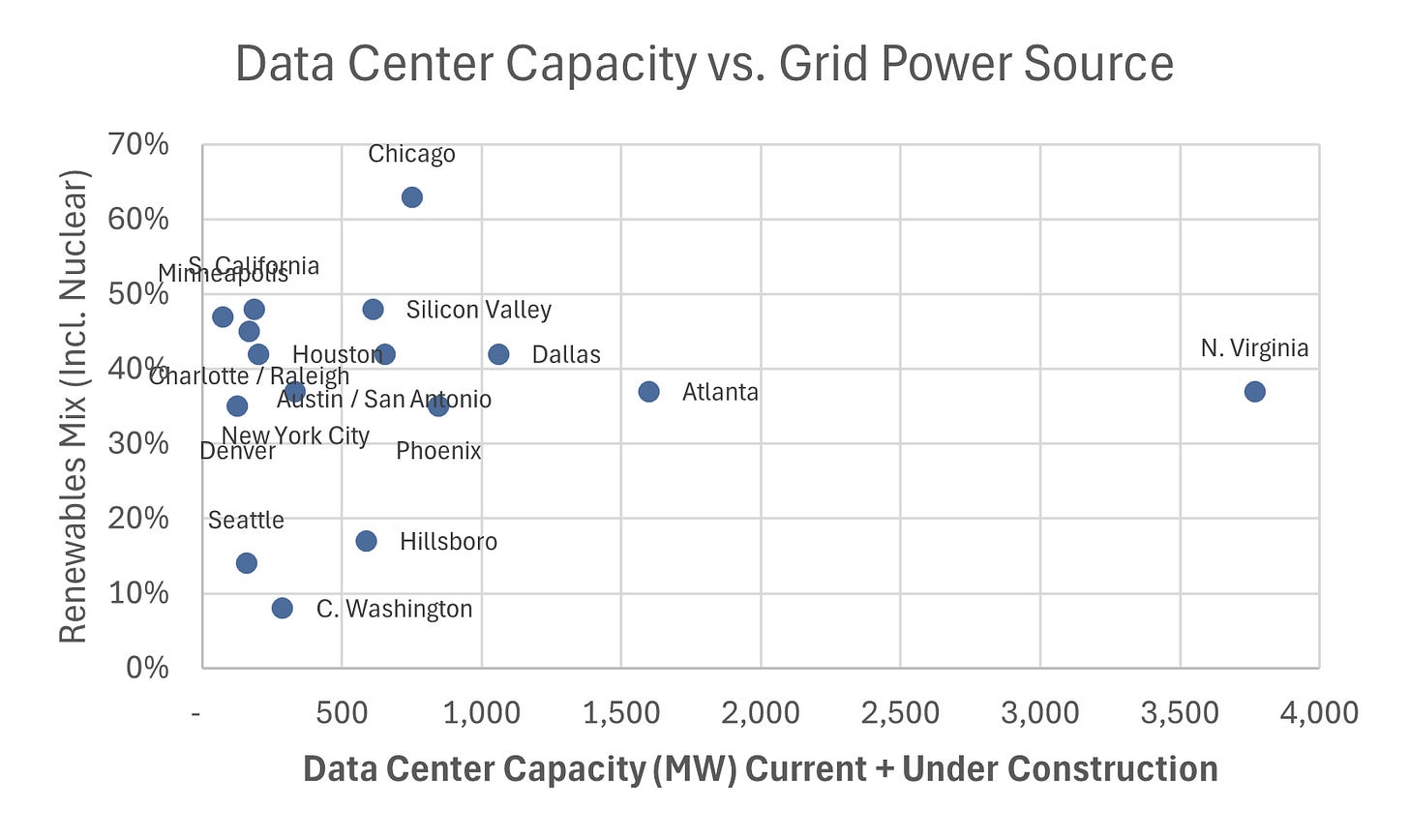

Northern Virginia, the world’s largest data center market, relies primarily on natural gas (54%) for power, with nuclear energy providing a significant 31% share. Renewable energy, such as solar and hydropower, is gradually being integrated, but it accounts for just 11% of the region’s energy mix.

Texas markets like Dallas, Austin, and San Antonio benefit from the state’s diverse energy sources. Wind power dominates (~30%) due to the extensive wind farms in West Texas, but natural gas remains the primary fallback, ensuring consistent energy supply during peak demands. The deregulated energy market in Texas allows greater flexibility in integrating renewable power, but natural gas and on-site backup generators remain essential for reliability.

Phoenix and Atlanta are attractive data center markets thanks to low costs and available land. However, both cities still rely on natural gas for over 60% of their energy needs, with renewables contributing less than 20%. Tech companies are increasingly seeking renewable power agreements in these regions as part of their decarbonization strategies.

Source: CBRE

Take-Away: Don’t be swayed by the high-profile press releases focused on nuclear and geothermal investments—while the intentions are real, the challenges are immense.

Nuclear: Expect long timelines (i.e., 10+ years). The Nuclear Regulatory Commission’s (NRC) approval process is notoriously slow, making it likely that SMRs won’t be operational for at least a decade. Even after approval, construction can take another 7-10 years—Vogtle 3 took 14 years to complete. Currently, only three SMR designs are under review by the NRC, meaning the majority of projects are still years away from starting the regulatory process.

Geothermal: A promising but geographically limited solution. Markets like Utah, Nevada, and possibly Colorado may benefit—Google’s deal with Fervo Energy or Blackstone’s investment in Utah are examples—but the majority of markets won’t be able to tap into geothermal power due to geographical constraints.

Natural Gas: The go-to option for immediate reliability. Despite its environmental impact, natural gas offers the firm, 24/7 power that data centers need to keep operations running without interruption. As a result, it remains the default choice for many operators in the near term. Dominion Energy in Virginia has already applied for an expansion of natural gas capacity to meet data center demands.

Behind-the-Meter backup should be a growing concern for sustainability: Data centers cannot afford even brief outages, as they typically guarantee 99.7% uptime in their service level agreements (SLAs). As a result, reliable backup power is critical.

Diesel Generators: Historically, the most dependable backup option. Diesel generators provide consistent, reliable power during emergencies. Data center operators favor them because they offer peace of mind, though they come with high costs and significant carbon emissions.

Lithium-Ion Batteries: Cleaner but with limitations. Many companies under pressure to decarbonize are exploring lithium-ion batteries as an alternative for short-term backup. While they offer cleaner emissions than diesel, they are typically insufficient for extended outages and are more complex to manage at scale.

Natural Gas Turbines: Gaining traction behind the meter. Many data centers are considering installing their own natural gas turbines to ensure longer-duration backup power. Though natural gas turbines provide reliability, they also contribute to increased carbon emissions, making them a controversial choice for operators aiming to decarbonize.

What Comes Next: Data centers will get the power they need, but the path forward may not be green. As demand for data center energy rises, the industry faces tough choices. Natural gas and coal, while dependable, are under growing environmental scrutiny, and renewables like geothermal are limited by scalability and geography. Nuclear presents a long-term solution, but regulatory and construction timelines mean it won’t meet near-term demand. For investors, the opportunity lies in finding technologies that strike the right balance between reliability and sustainability, as the data center energy market evolves.

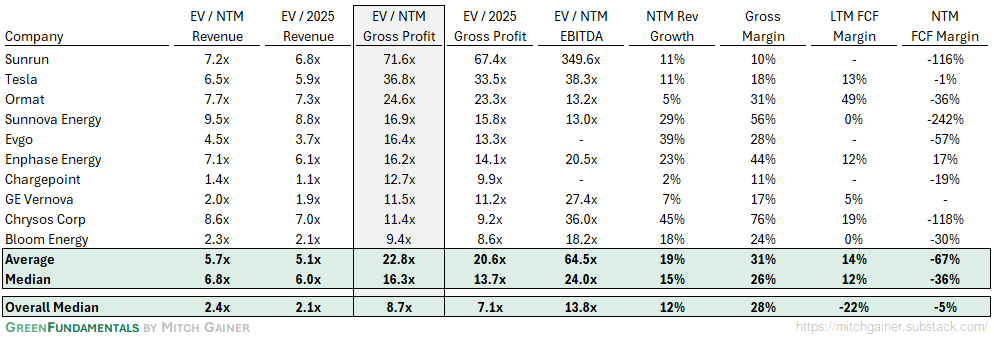

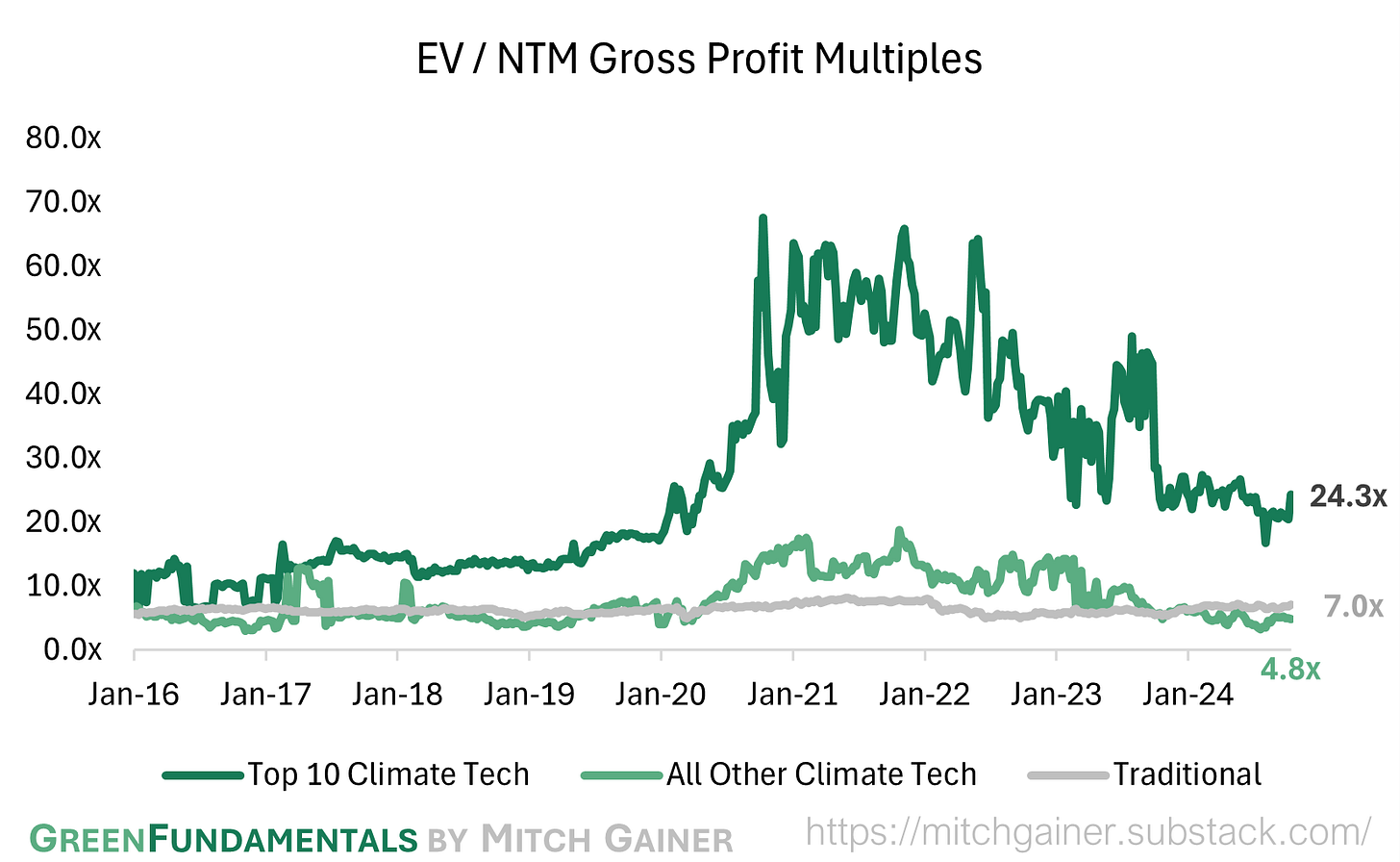

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

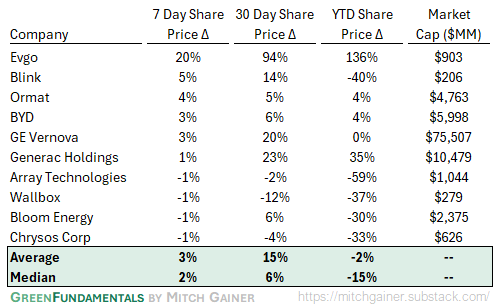

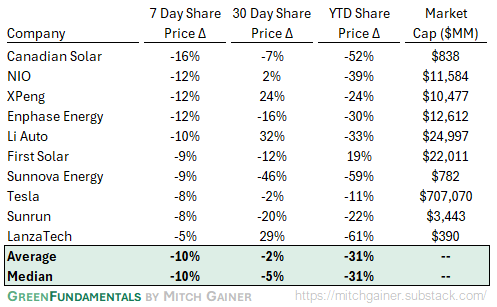

Top 10 and Bottom 10 Weekly Share Price Movement

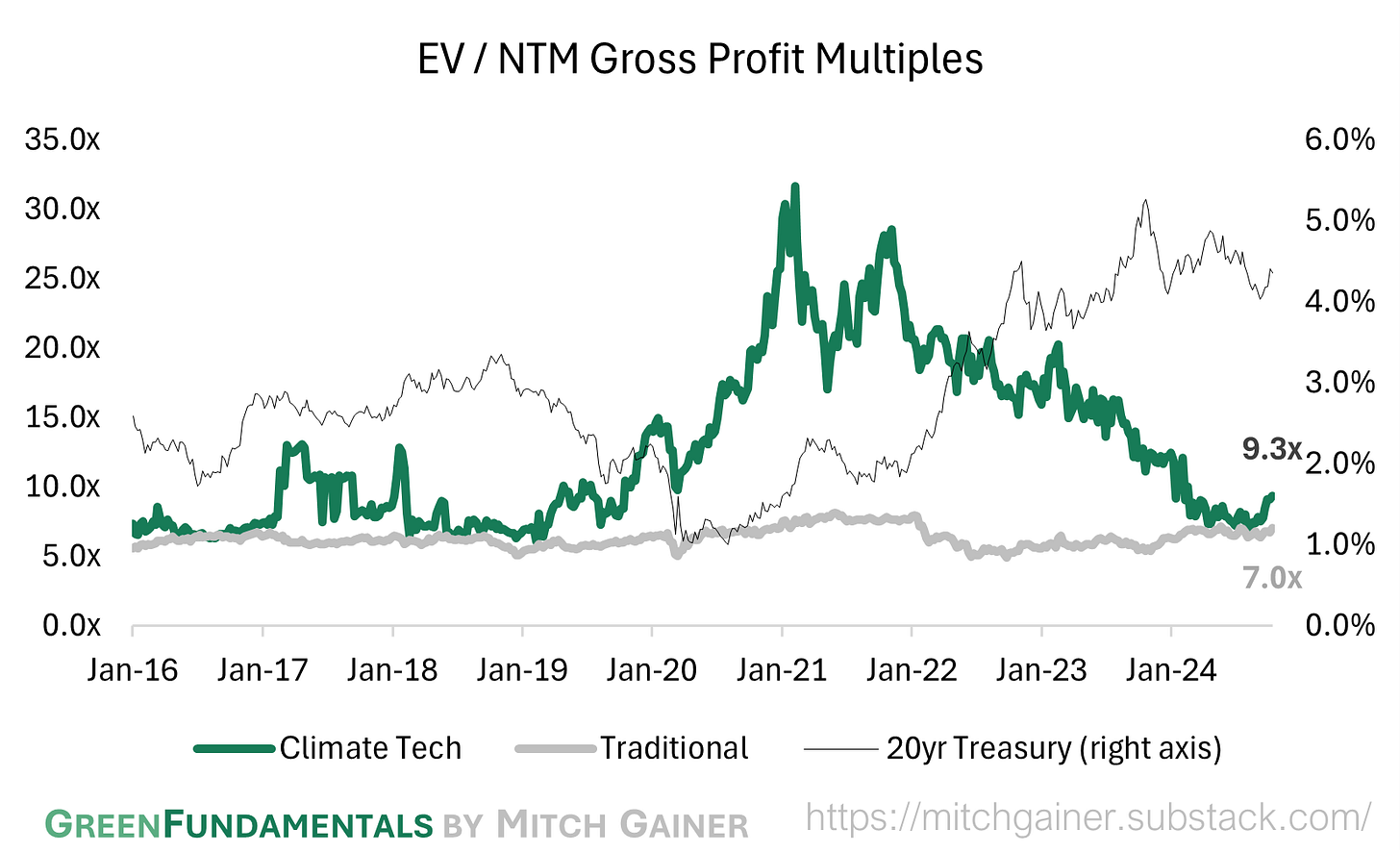

Valuation Multiples over Time

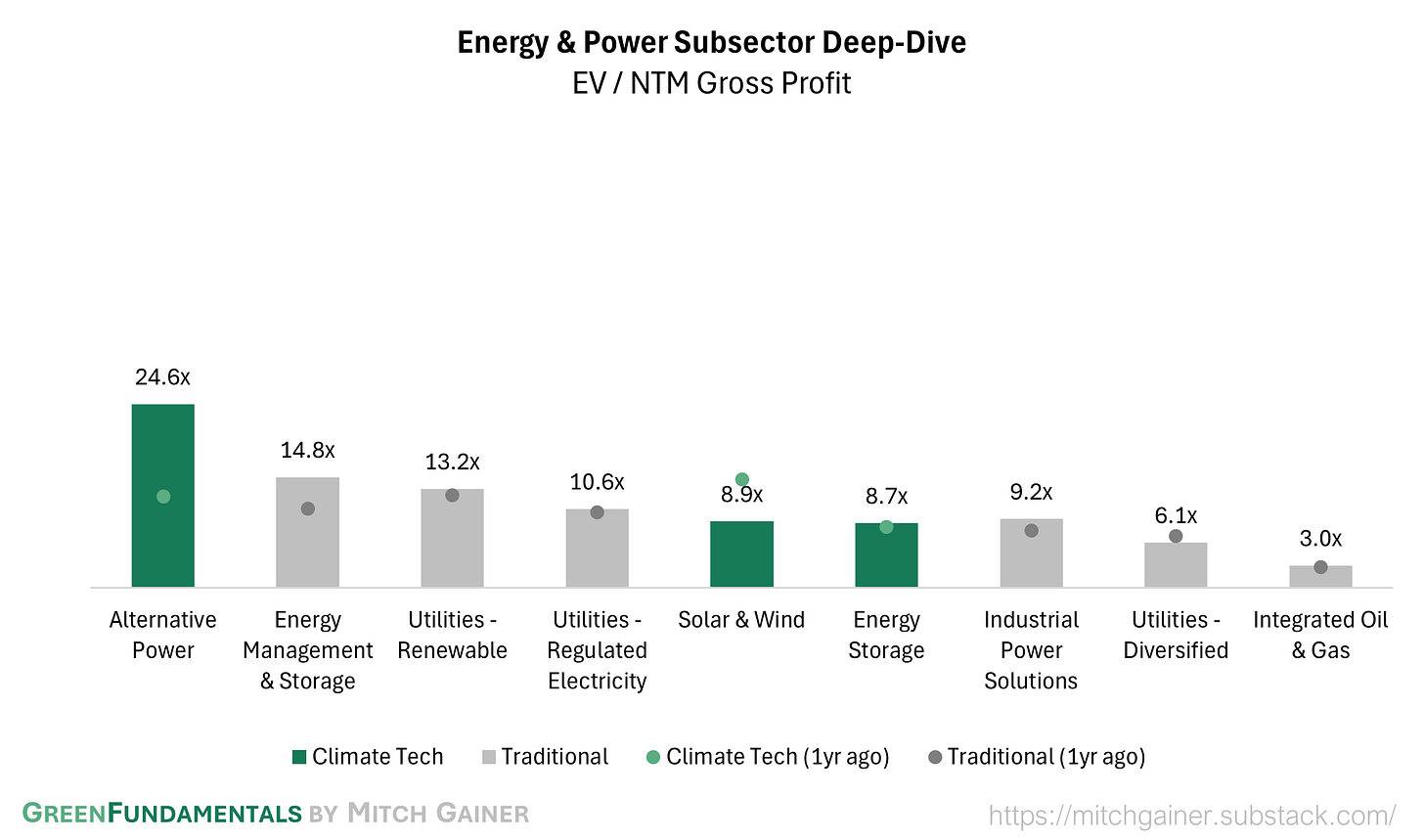

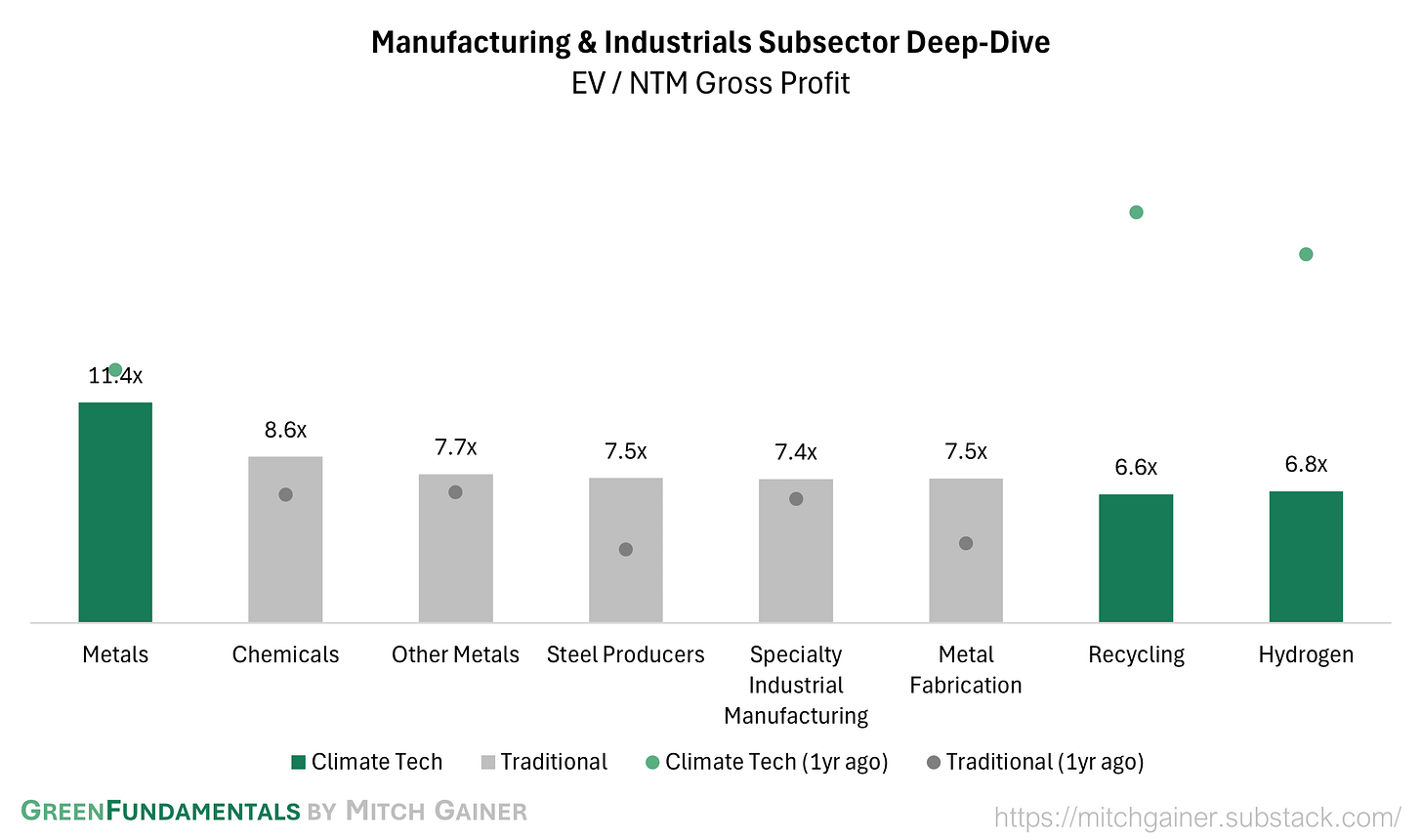

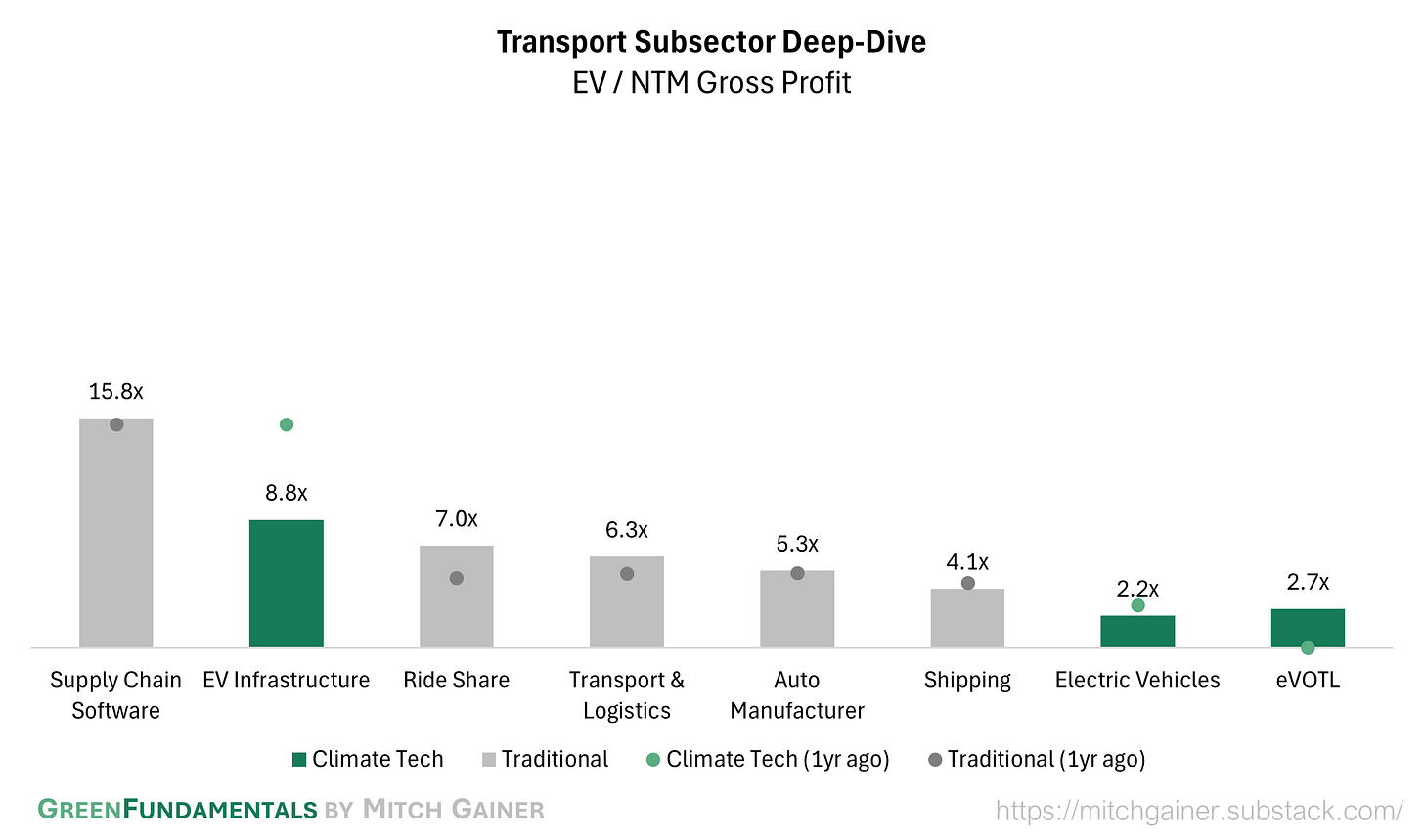

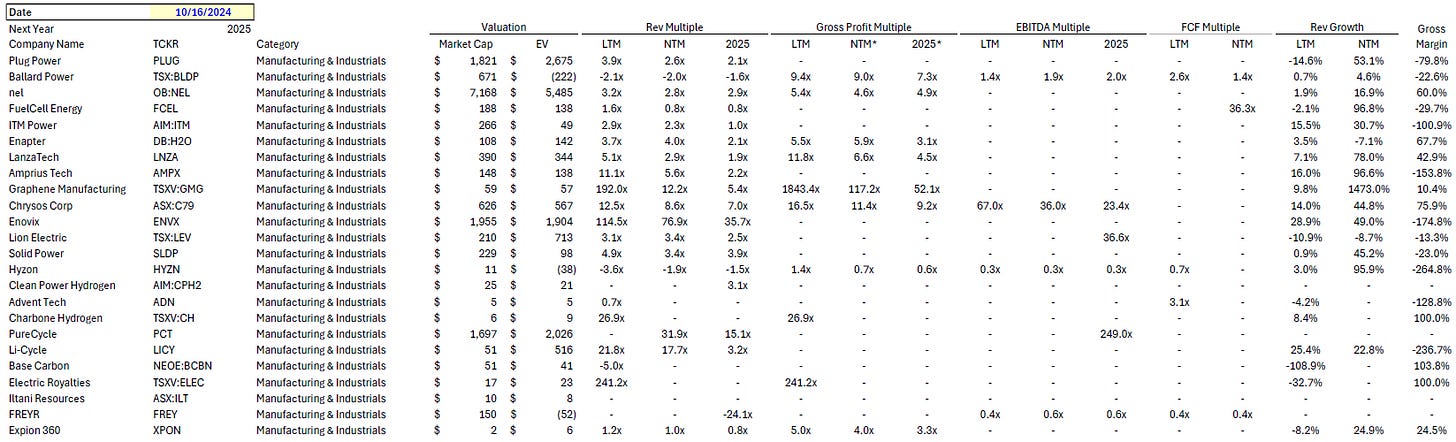

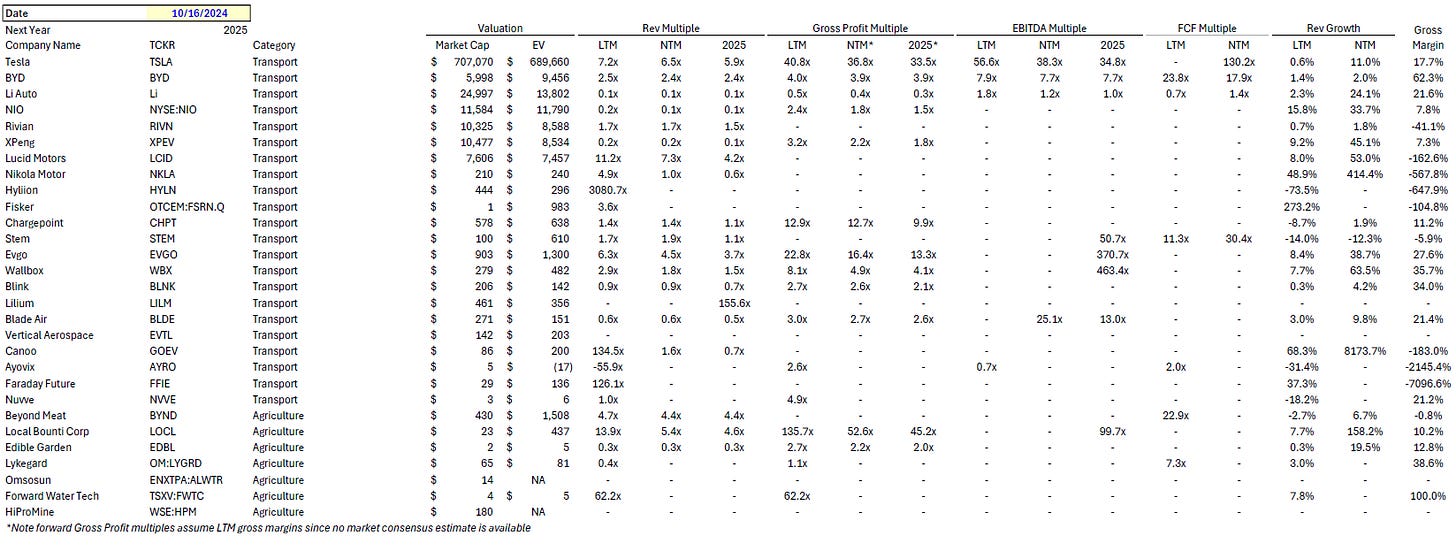

Deep-Dive by Subsector

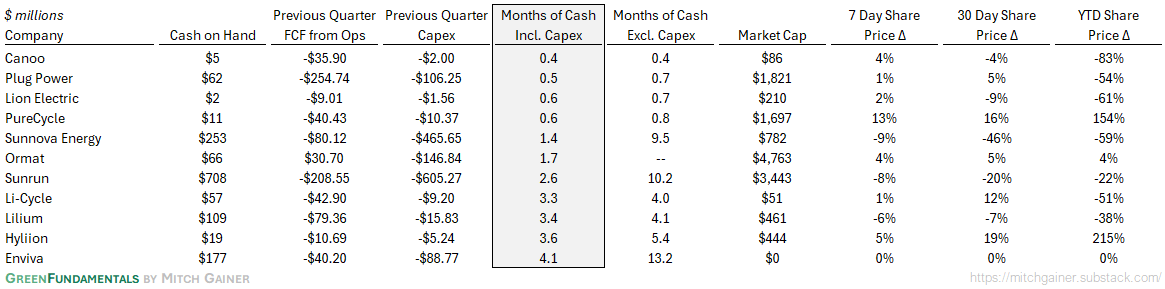

Months of Cash

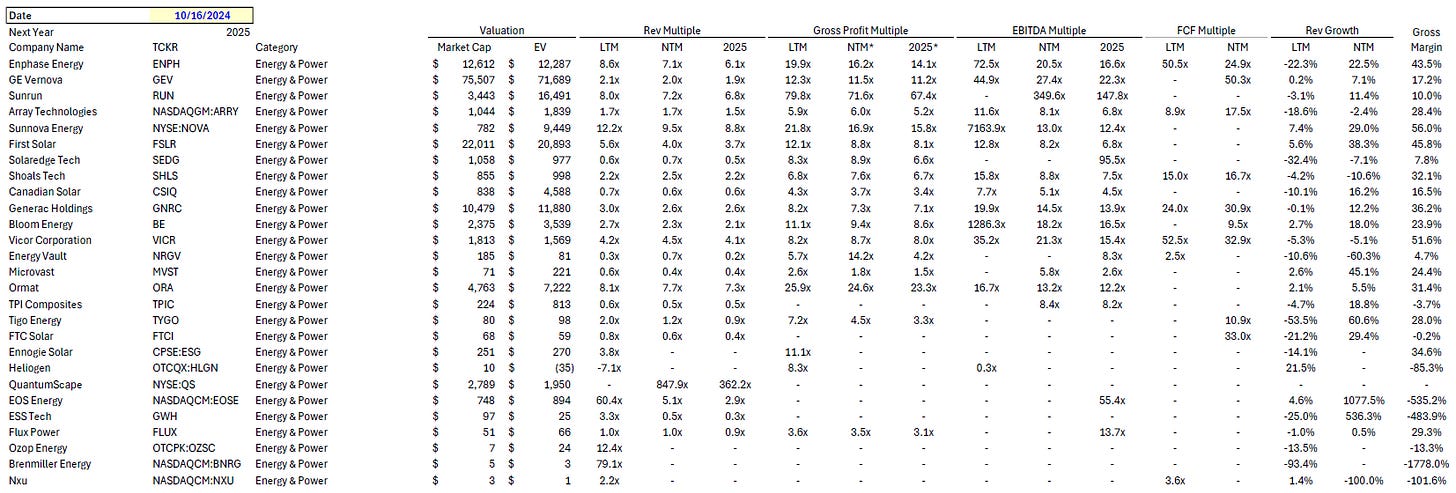

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.