Green Fundamentals: The IRA on Ice

Data-driven discussion of climate technology, finance, and policy

I provide data-driven climate tech market analysis. Follow along to stay up to date!

This post and the information presented are intended for informational purposes only. They reflect solely the personal opinions of the author in his individual capacity. They do not reflect the views or opinions of any current, past, or future employer, organization, or affiliate.

The House bill doesn’t just cut IRA spending — it reintroduces capital scarcity by gutting transferability while subsidizing incumbents

This week, House Republicans launched their opening salvo in the reconciliation fight—targeting the Inflation Reduction Act with a mix of credit phaseouts and structural rollbacks. In November, I laid out what to expect in Climate Policy Under Trump. I expected rollback efforts to target EVs, residential upgrades, GGRF, and hydrogen hubs; that held. What I underestimated was just how strategic the attack on transferability would be.

See below the risk I assigned to each provision last year:

I underestimated the strategic importance of transferability. The House reconciliation bill doesn’t just phase out specific credits. It strips away the mechanism that democratized clean energy finance. Without transferability, many credits become inaccessible. Without accessibility, the IRA’s headline ambition becomes paper policy.

This edition walks through the bill as it stands—line by line, category by category. Transferability remains the pivotal fight. But it’s not the only one investors should watch.

Transferability: The Quiet Engine, Now Targeted

As I wrote in Giving Credit Where Taxes Are Due, this provision let developers without tax appetite monetize credits—bypassing slow, expensive tax equity markets. It unlocked over $500B in private capital since 2022 across solar, storage, hydrogen, and manufacturing.

The House bill would repeal transferability after 2027 for most energy credits. That would send us back to a pre-IRA world where only large developers with bespoke legal teams and bank relationships can build at scale. It’s not just repeal—it’s repeal-by-stealth. And it may matter more than any single credit phaseout.

This isn’t a technical fix. It’s repeal-by-stealth. And if it holds, it will reshape project finance more than any headline credit elimination.

Clean Electricity (45Y / 48E)

What I expected: I anticipated that the clean electricity tax credits (45Y and 48E) might revert to pre-IRA levels, with a particular risk to bonus incentives tied to prevailing wage, apprenticeship, and domestic content. I expected the credits themselves would remain but return to short-term Congressional renewals—introducing periodic uncertainty. The bonus incentives could be weakened or stripped altogether, and the shift from “bonus” to “requirement” was seen as a possibility.

What we got: The bill proposes a five-year runway before full repeal. Credits begin to phase out starting in 2029—dropping to 80%, 60%, and 40% by 2031, then disappearing entirely in 2032. In a major shift, the eligibility threshold changes from “start of construction” to “placed in service,” placing far more risk on long-lead-time projects. Transferability of the credits is repealed after 2027. Most significantly, the FEOC provision effectively blocks any project with upstream components linked to China—including minerals, designs, or manufacturing IP—from eligibility.

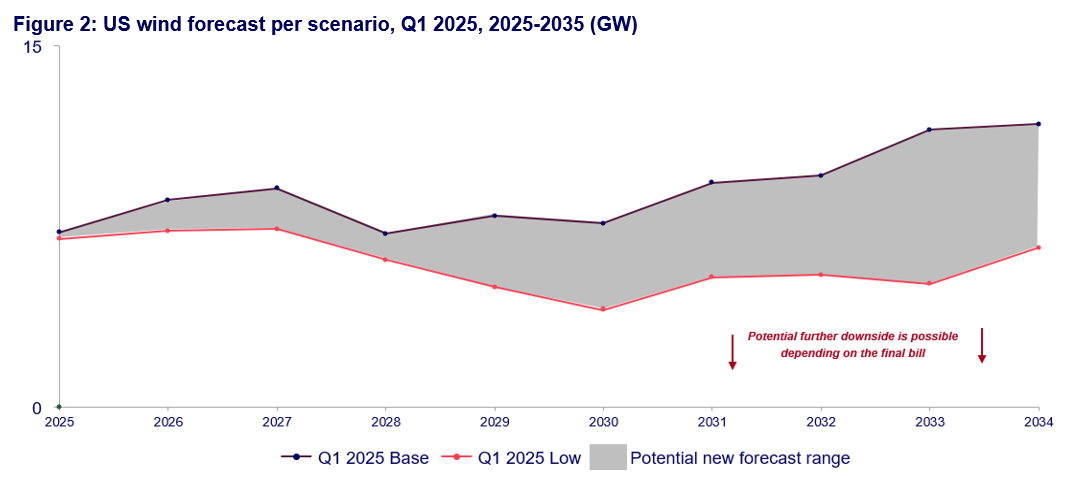

Commentary: Before the IRA, wind and solar lived on annual extensions—and it looks like we’re headed back there. Starting in 2029, the industry may be right back to lobbying for one-year renewals… just in time for the next presidential term.

Investor impact: Developers like NextEra (NEE) and AES face timeline risk. IPPs like Brookfield Renewable (BEPC) may struggle to monetize credits. Equipment suppliers including Enphase (ENPH) and Shoals (SHLS) face demand compression.

Source: Wood Mackenzie

Electric Vehicles (30D, 45W, 25E, 30C)

What I expected: EV tax credits were always at high risk. I expected the 30D consumer credit and 45W commercial credit could be repealed or significantly narrowed. However, Tesla’s position as the dominant U.S. EV producer meant they could benefit from reduced competition and fewer eligibility restrictions under a revised regime.

What we got: The bill proposes full repeal of all EV-related credits after 2025, including the consumer ($7,500) and used ($4,000) EV credits, as well as the commercial vehicle and charging infrastructure credits. A limited exception allows 45W credits for vehicles under binding contracts prior to May 2025, but this applies to a narrow slice of the market.

Investor impact: Demand hit to Rivian (RIVN), Lucid (LCID), Ford (F), GM. Charging networks like ChargePoint (CHPT) and EVgo (EVGO) exposed. Tesla (TSLA) holds relative advantage, but TAM shrinks.

Manufacturing (45X)

What I expected: I expected the 45X credit to survive, given its popularity in Republican districts and its role in reshoring critical supply chains.

What we got: The bill proposes a phaseout beginning in 2029, with the credit reduced to 75% in 2030, 50% in 2031, and eliminated by 2032. Wind energy components are specifically carved out and will no longer be eligible after 2027. FEOC restrictions apply here as well, effectively shutting out firms using Chinese inputs or technology licenses.

Commentary: It’s hard to see how manufacturing projects could absorb the complex flip structures that wind and solar used pre-IRA. That said, some lawyers will find a way—and get paid well to do it.

Investor impact: First Solar (FSLR) and Maxeon (MAXN) face sourcing risk. Freyr (FREY) and others must rework feedstock flows. Short-term equipment spikes possible pre-2028.

Residential Energy (25D, 25C, 45L)

What I expected: I flagged these credits as among the most vulnerable, given their limited political constituency and the direct consumer benefits they offered. I expected potential elimination at the federal level with state-level continuity in some regions.

What we got: All three residential credits are slated for repeal after 2025. The clean energy credit for rooftop solar (25D), the efficiency credit for HVAC and weatherization (25C), and the builder credit for efficient homes (45L) all sunset without phaseout or grandfathering provisions.

Investor impact: Installers like Sunrun (RUN), Sunnova (NOVA), SunPower (SPWR) lose customer economics. Downstream pain for Enphase (ENPH), SolarEdge (SEDG), Generac (GNRC) through installer volume reductions.

Hydrogen (45V)

What I expected: I assumed the credit could survive in a modified form—perhaps with loosened eligibility rules favoring blue hydrogen or politically aligned fossil pathways. Repeal was viewed as less likely due to bipartisan fossil support.

What we got: The 45V hydrogen production credit is eliminated after 2025. Only projects that start construction by December 31, 2025, are eligible. This puts roughly 95% of green hydrogen capacity under development in jeopardy.

Commentary: Green Hydrogen was already on life support (see our previous article Hydrogen Tax Credit - Dead or Alive). This bill pulls the plug.

Investor impact: Plug Power (PLUG) and Bloom Energy (BE)—two of the most exposed names—face the collapse of their development pipelines. Cummins (CMI), which supplies electrolyzers, also faces headwinds. By contrast, ExxonMobil (XOM), Chevron (CVX), and Air Liquide stand to benefit from a blue hydrogen pivot, supported by the surviving 45Q credit.

Carbon Capture and Sequestration (45Q)

What I expected: I viewed carbon capture as one of the most politically durable IRA provisions, especially with oil and gas support and a growing consensus around firm power.

What we got: The 45Q credit remains intact in structure, value, and duration. The bill adds FEOC restrictions and repeals transferability, but neither provision significantly affects project viability today.

Investor impact: This is a clear win for CCUS players. Occidental Petroleum (OXY), ExxonMobil (XOM), and Denbury (now part of ExxonMobil) benefit from clarity and continuity. Smaller developers without tax liability or access to capital may struggle more in a post-transferability world, but the macro outlook remains favorable.

Energy Storage (48E)

What I expected: I expected the standalone storage Investment Tax Credit (ITC) to face pressure if tied to broader IRA repeal efforts. Given storage’s reliance on Chinese battery components and the growing scrutiny around foreign supply chains, FEOC restrictions were also seen as a potential but unresolved risk. I flagged storage developers’ heavy reliance on transferability as a structural vulnerability.

What we got: Storage credits are phased out alongside 48E, ending in 2032. Crucially, the FEOC provision disqualifies most battery projects that source from Chinese entities, including LFP and NMC chemistries used in the majority of U.S. grid-scale systems. The repeal of transferability after 2027 adds a financing hurdle, particularly for smaller developers without access to tax equity. There is no carve-out for standalone storage or batteries paired with solar.

Investor impact: The combined loss of transferability and FEOC eligibility significantly constrains project development. Fluence (FLNC) and Stem (STEM)—both of which depend on LFP chemistries—are exposed to material revenue downside. Tesla’s Megapack division (TSLA) could see deployment slow as capital becomes scarcer. U.S.-based cell manufacturers like KORE Power (private) may benefit if they can qualify under revised sourcing rules, but market uptake will hinge on guidance and carve-outs that don’t yet exist.

DOE Loans, GGRF, CPRG, Ports, and Industrial Programs

What we expected: We anticipated that grant-funded programs like the Greenhouse Gas Reduction Fund (GGRF) and deployment initiatives for clean ports and industrial decarbonization could be targeted. Legal challenges to GGRF clawbacks were expected, but we assumed LPO loans already committed would remain safe and remaining funds would be repurposed for nuclear and manufacturing.

What we got: The bill rescinds all unobligated funding from a wide array of programs: GGRF, LPO, CPRG, Clean Ports, and the Advanced Industrial Facilities Deployment Program. While obligated dollars are technically shielded, administrative capacity to execute on existing awards is also reduced. Legal challenges to the GGRF clawbacks are ongoing, particularly around the Solar for All and Clean Communities Investment Accelerator programs.

Investor impact: High-capital developers pursuing first-of-a-kind infrastructure—like Redwood Materials, Fervo Energy, Form Energy, and Eos Energy (EOSE)—now face financing gaps as LPO loan access tightens. Repeal of GGRF, CPRG, and port-related grants undermines community-scale and environmental justice investments, destabilizing green bank networks and nonprofit lenders that had emerged as critical capital bridges. The result is a slower pace of deployment for emerging technologies and constrained deal flow in underserved markets.

Permitting and Fossil Infrastructure

What we expected: We expected permitting reform to advance—potentially in exchange for some Democratic concessions—and flagged the possibility of fast-tracked fossil approvals, particularly for LNG. The risk was less about outright policy repeal and more about creating structural advantages for fossil developers.

What we got: The bill introduces a “pay-to-play” model for fossil infrastructure: LNG export permits can be rubber-stamped by DOE for a $1 million fee, and natural gas pipelines can bypass environmental review for $10 million. Simultaneously, judicial review of these approvals is curtailed, limiting legal standing and recourse for community challengers. Clean energy permitting and interconnection support, by contrast, is defunded through the repeal of transmission planning and siting grants.

Investor impact: This is a clear win for fossil fuel infrastructure developers. Companies like Cheniere Energy (LNG) and Tellurian (TELL) benefit from accelerated project timelines and reduced permitting risk. Clean power developers face longer queues and no help from repealed transmission programs. Some are still hopeful for permitting reform later this year.

What This Means for Investors

If the House bill becomes law, we’re headed back to a world of safe harbor deadlines, opaque tax equity, and zero policy certainty. Capital formation will tilt toward the largest incumbents. Credits will be harder to monetize, and project risk will rise materially.

But that doesn’t mean there won’t be winners. This environment favors:

Developers with low cost of capital and balance sheet tax appetite

Technologies that don’t rely on tax credit arbitrage

U.S.-based manufacturers with clean supply chains

Projects that can lock in credits before the sunset clock runs out

The reconciliation bill still has a narrow path. Senate moderates are balking at FEOC enforcement and GGRF clawbacks. But for investors, the real market mispricing may be the assumption that tax credits still drive growth—even as their liquidity and eligibility are quietly eroded.

We'll be watching:

Senate Finance markups on FEOC carveouts

Legal action against GGRF clawbacks and LPO rescissions

Market reaction from high-exposure names like ENPH, FLNC, RUN, PLUG, and SPWR

Whatever ultimately sunsets, the fight will go on. Before the IRA, wind and solar credits lived on year-to-year extensions—and we may be headed back to that world. It’s a nightmare for capital planning, but all too familiar to climate investors.

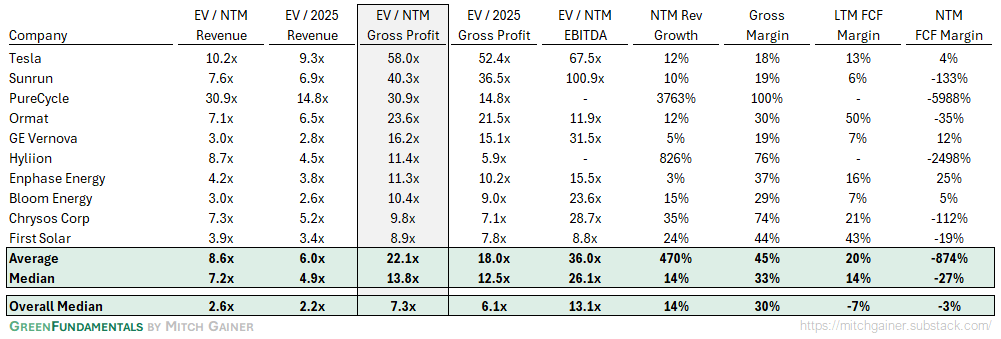

Top 10 EV / NTM Gross Profit Multiples

See footnote for detailed valuation methodology and explanation.1

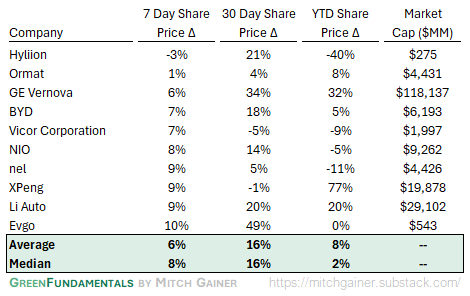

Top 10 and Bottom 10 Weekly Share Price Movement

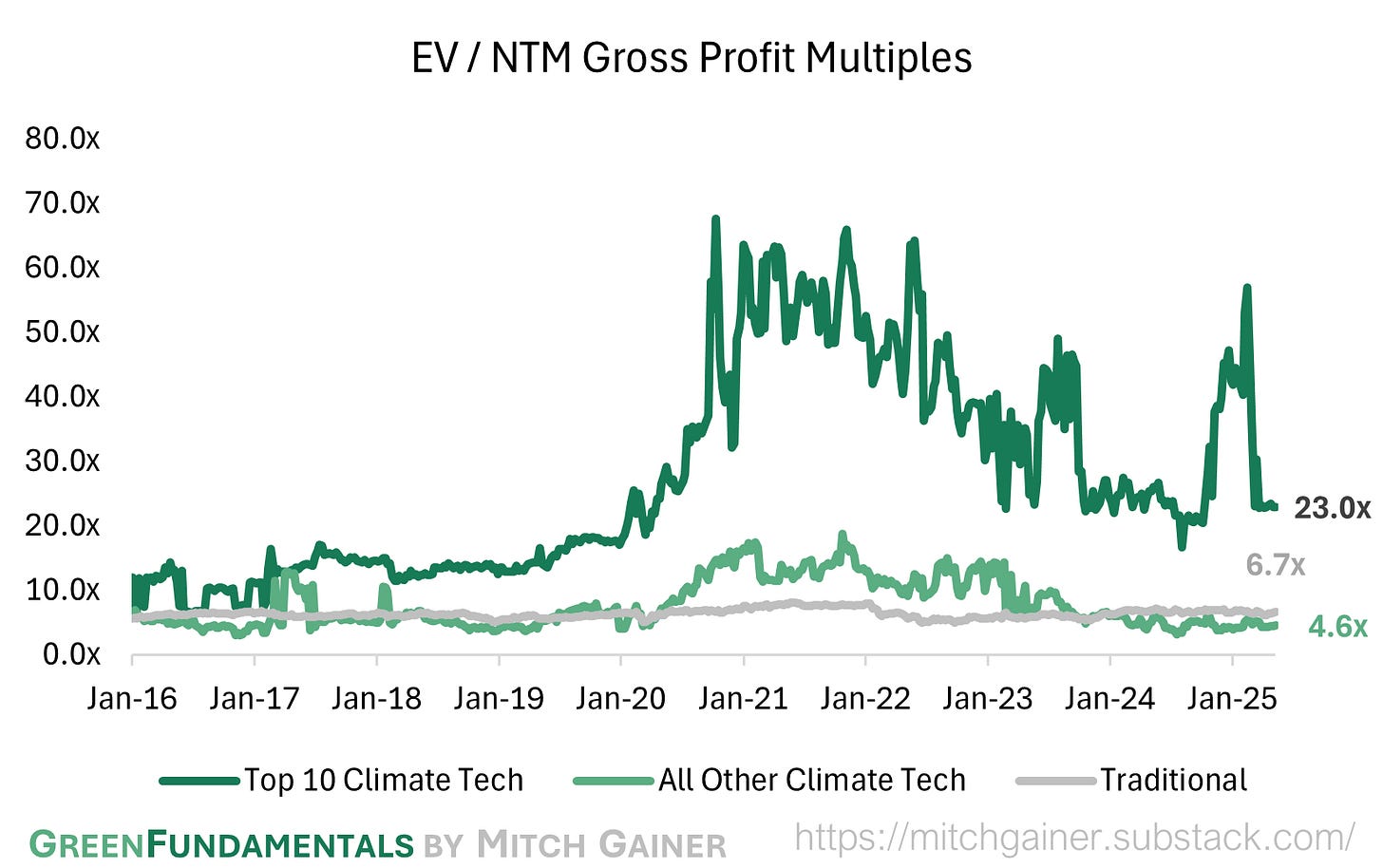

Valuation Multiples over Time

Detailed Comparison Set Data

Sources include news articles cited (above) and publicly available SEC filings.

While technology companies are typically valued on Next Twelve Months (NTM) Revenue, traditional industrial businesses are often valued on Last Twelve Months (LTM) EBITDA. Due to the varied business models across climate tech (and the fact that many of the companies are not yet EBITDA positive) valuation multiples here are calculated based on Next Twelve Months (NTM) Gross Profit.

‘Climate Tech’ includes (1) any pure-play climate technology company that (2) has more than $200M market cap and (3) has positive revenue as well as gross profit (see sector deep dives for full list). ‘Traditional’ includes legacy market participants in relevant sectors (see sector deep dives for full list).

This post and the information presented are intended for informational purposes only. They reflect solely the personal opinions of the author in his individual capacity. They do not reflect the views or opinions of any current, past, or future employer, organization, or affiliate. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

What do you make of investor’s reaction to this bill? I was surprised how many of these companies saw their stock go up. I know part of that was the tariff news on Monday. But it seems like investors either:

1/ don’t appreciate how bad some of these provisions truly are (e.g. foreign entity poison pill)

2/ don’t think they will survive House negotiations and the Senate.

3/ think the bill was much better than initial expectations.